Blockchain

Crypto Fintech Giant MoonPay Continues Acquisition Spree With Purchase of Stablecoin Infrastructure Platform

Published

2 days agoon

By

admin

The web3 infrastructure provider MoonPay just announced its acquisition of the stablecoin infrastructure developer Iron just months after purchasing crypto payments platform Helio.

In a statement, MoonPay says its new acquisition significantly expands its offerings with solutions that allow businesses to manage multi-currency treasuries, facilitate instant cross-border payments and generate new revenue through yield-bearing assets.

Says MoonPay’s co-founder and CEO, Ivan Soto-Wright,

“This acquisition is a strategic step forward, positioning MoonPay at the forefront of enterprise-grade stablecoin solutions. With Iron’s technology, we’re putting the power of instant, programmable payments into the hands of enterprises, fintechs, and global merchants.”

Iron co-founder and CTO Omid Aladini says that joining forces with MoonPay is also beneficial to the platform.

“Since we rolled out the Iron stablecoin API the interest has been absolutely phenomenal! But once part of MoonPay, we’ll be able to scale exponentially faster.

We’ve built a developer-first API experience to power apps, exchanges, institutions, DEXs, and PSPs around the world to move stablecoins across crypto ecosystems and fiat rails. It’s the foundational infrastructure for the future of money.”

MoonPay also acquired Helio in January. The Solana (SOL) crypto payment processor enables merchants and creators to accept cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH) and SOL.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/duangphorn wiriya/INelson

Source link

You may like

Ethereum Cost Basis Data Signals Strong Support At $1,886

Solana Cofounder Advocates For Decisive Governance As SIMD-228 Proposal Fails

Layer-1 Project MultiversX Continues To Top the Crypto Gaming Sector in Terms of Development Activity: Santiment

Kaito AI and founder Yu Hu’s X social media accounts hacked

Which AI Actually Is the Best at ‘Being Human?’

21Shares To Liquidate Bitcoin and Ethereum Futures ETFs, Here’s All

Altcoins

Layer-1 Project MultiversX Continues To Top the Crypto Gaming Sector in Terms of Development Activity: Santiment

Published

4 hours agoon

March 16, 2025By

admin

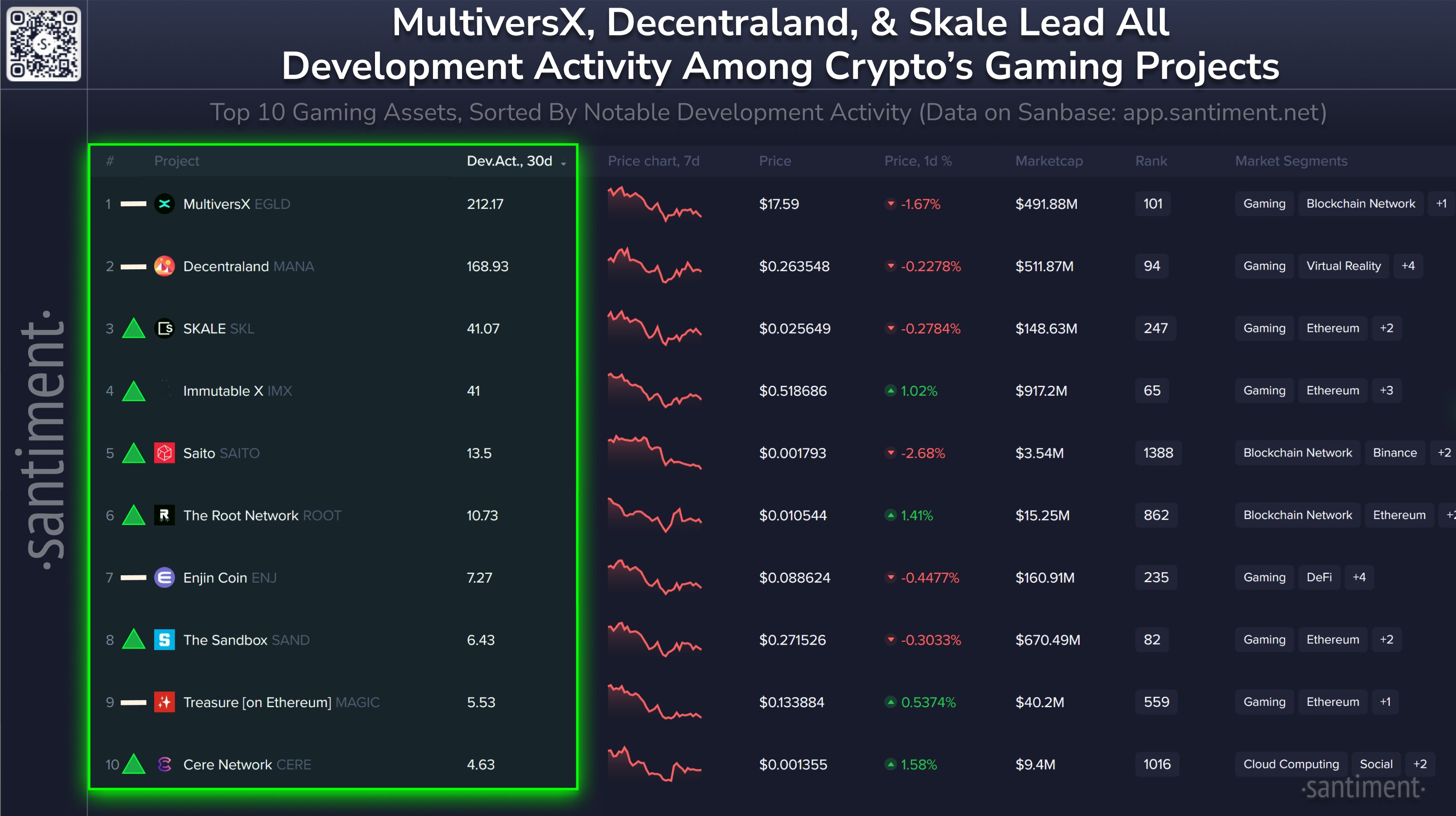

The layer-1 blockchain MultiversX (EGLD) continues to lead the digital asset gaming sector in the realm of development activity, according to the crypto analytics firm Santiment.

Santiment notes on the social media platform X that MultiversX, formerly known as Elrond, registered 212.17 notable GitHub events in the past 30 days.

The Ethereum (ETH)-based virtual reality platform Decentraland (MANA) ranks second, clocking 168.93 events, and the Ethereum layer-2 protocol Skale Network (SKL) is a distant third with 41.07.

MultiversX and Decentraland have occupied the number one and two spots in previous months as well, according to Santiment.

Santiment notes that it doesn’t count routine updates and uses a “better methodology” to collect data for GitHub events based on a “backtested process.”

The analytics firm has previously said that heavy development activity centered around a crypto project is a positive indication that could mean that the developers believe the protocol will be successful. It also indicates that the project is less likely to be an exit scam.

MultiversX is a distributed, proof-of-stake blockchain network that is decentralized via more than 3,500 nodes. The project aims to help developers build next-gen applications.

The project’s native token, EGLD, is trading at $18.10 at time of writing. The 139th-ranked crypto asset by market cap is up more than 3% in the past 24 hours.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Blockchain

Brazil’s Postal Service Seeks Blockchain, AI Solutions for Operations

Published

7 days agoon

March 9, 2025By

admin

Brazil’s state-owned postal service, Empresa Brasileira de Correios e Telégrafos, has launched a pre-selection process for companies and specialists in blockchain and artificial intelligence (AI) to develop solutions for its logistics and operational management.

The tender, published in the country’s official journal Diário Oficial da União on Friday, seeks proposals that support the digital transformation of the agency’s services. The initiative, called Licitação Seleção Prévia e Diálogo nº 25000001/2025 CS, is focused on finding advanced technological solutions to modernize business processes, operations, and internal supply management.

“We want to promote a collaborative and dynamic process to find artificial intelligence and blockchain solutions for our business, operations, and hiring challenges,” the company announced.

The organization did not specify the exact use cases it is targeting, but blockchain technology has been widely adopted for supply chain tracking, document authentication, and transaction security. The use of artificial intelligence is likely linked to logistics optimization and enhanced data analysis.

Source link

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

One of the most intriguing aspects of crypto is its sense of anonymity. Bitcoin (BTC), for example, was created in 2008 by an unknown figure using the pseudonym Satoshi Nakamoto, and to this day, the true identity of its inventor remains unknown. The veil of anonymity has allowed users to create distinct identities through wallet addresses, adding an extra layer of privacy and discretion to transactions.

This concept of openness and universal access is one of the core promises of digital currencies, allowing anyone with internet access to engage, regardless of their financial history or background. However, even though the ethos of crypto promotes inclusivity, the reality hasn’t always reflected this.

The early days of crypto were defined by the archetype “crypto bros,” referring to a specific demographic of young, tech-savvy men who influenced the industry’s direction. Their influence extended to the design of projects, development of key protocols, and framing of the culture surrounding digital assets.

However, as the industry matured and evolved, efforts were made to reflect and include more female voices. This shift helped address the imbalance between gender representation, bringing new perspectives into the industry.

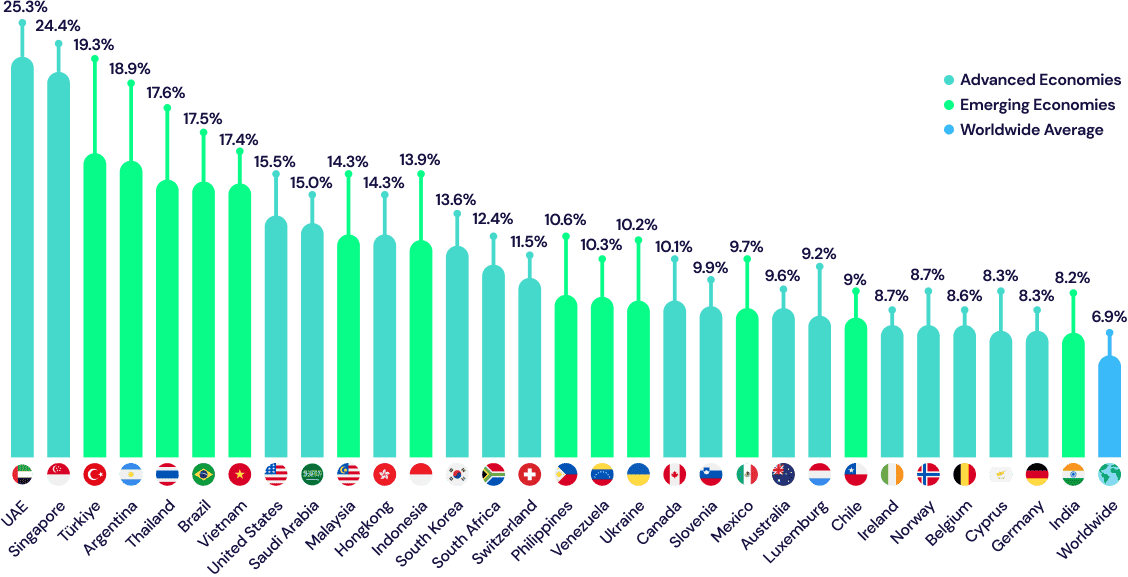

A 2024 study revealed that over 560 million cryptocurrency owners exist globally, with 61 percent identifying as male and 39 percent as female. This marks an increase from the previous year, when the global total was 420 million, with 37 percent of owners being female, signaling a positive shift.

In response to this trend, organizations have emerged to address crypto’s gender imbalances. Conferences and events once primarily targeted toward the male-dominated demographic have changed to allow women to step into the space and take the lead.

The Association for Women in Cryptocurrency, or AWC, for example, was founded in 2022 as a platform for women looking to enhance their knowledge and education in crypto. Led by Amanda Wick, AWC hosts various events, like webinars and in-person meetups, where women can learn from industry experts and connect with mentors who can guide them and help them discover new career opportunities.

Recently, Binance shared that it will offer global programs exclusively for women through its Binance Academy platform in honor of International Women’s Day. The events will be held across five continents at 11 venues to help women ease their way into the industry.

While women have made significant strides in the DeFi space, now accounting for 40 percent of Binance’s workforce, leadership positions have been predominantly held by men. Despite this, several women have established themselves as leaders in the space.

Perianne Boring, for instance, is the founder and CEO of the blockchain advocacy group The Digital Chamber, working alongside Congress and the government to promote and regulate blockchain technology. Her leadership role has made her an advocate for adopting blockchain technologies, as she has become a well-known voice in the space discussing the future of finance. In December, President Trump also considered Boring as a potential CFTC chair.

Another established female leader in the space is Joanna Liang, the founding partner of Jsquare, a tech-focused investment firm specializing in blockchain and web3. With a previous background as CIO at Digital Finance Group (DFG), a global Venture Capital firm focusing on crypto projects, Liang recently launched Jsquare’s latest fund, the Pioneer Fund. The fund has successfully raised $50 million in capital, making its first investment in the startup MinionLabs. The fund will focus on emerging technologies in the crypto space, including PayFi, real-world assets (RWAs), and consumer apps.

Laura Shin is also a prominent name in crypto and is recognized as one of the first mainstream media reporters to cover cryptocurrency full-time. She is the author of the book, ‘The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze,’ and the host of the podcast Unchained. Laura has shared her expertise at events such as TEDx San Francisco and the International Monetary Fund.

Over the past 16 years, women have been instrumental in helping legitimize crypto assets throughout the financial landscape. Their contributions have spanned various sectors in the ecosystem, helping shift the narrative around crypto from a niche, speculative asset to a more widely recognized and accepted financial tool.

Source link

Ethereum Cost Basis Data Signals Strong Support At $1,886

Solana Cofounder Advocates For Decisive Governance As SIMD-228 Proposal Fails

Layer-1 Project MultiversX Continues To Top the Crypto Gaming Sector in Terms of Development Activity: Santiment

Kaito AI and founder Yu Hu’s X social media accounts hacked

Which AI Actually Is the Best at ‘Being Human?’

21Shares To Liquidate Bitcoin and Ethereum Futures ETFs, Here’s All

21Shares to Liquidate Active Bitcoin and Ether Futures ETFs Amid Market Downturn

TON Society celebrates Pavel Durov leaving France as free speech win

Best New Presales to Buy as Bullish Bitcoin Signal Promises Upcoming Bull Run

Russia Is Using Bitcoin And Crypto For Its Oil Trades With China And India

‘Be on Guard’: Trader Says Altcoin Bounce May Be Temporary, Tracks Bitcoin’s Next Targets

Sacks purges crypto, but Trump? His digital empire continues

This Week in Bitcoin: Strategy Stalls, But White House Plans to Buy More BTC

Layer3 (L3) Price Prediction March 2025, 2026, 2030, 2040

Ripple Token Zooms 5% Higher as Bitcoin Grapples With $84K Level

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins1 month ago

Altcoins1 month agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x