Mining

Bitfarms stock dips despite $110m acquisition

Published

3 days agoon

By

admin

Canadian Bitcoin miner Bitfarms has finalized the acquisition of Stronghold Digital Mining, marking the largest-ever merger between two publicly listed Bitcoin mining companies.

According to a press release published on March 17, Bitfarms has completed the all-stock acquisition of Stronghold Digital Mining. The merger was approved on Feb. 28, with 99.6% of votes cast voting in favor, representing about 54.5% of Stronghold’s outstanding shares.

Bitfarms acquired Stronghold through a stock-for-stock merger, with Stronghold shareholders receiving 2.52 Bitfarms shares for each Stronghold share they owned. Nearly 60 million Bitfarms shares and over 10.5 million warrants were issued as part of the deal. Stronghold’s stock was removed from Nasdaq and stopped trading.

Bitfarms’ stock opened higher Monday morning but lost any buying momentum and was trading lower by around 1% during the early afternoon session.

Details of the acquisition

With Stronghold now fully integrated into Bitfarms, the mining giant has expanded its energy capacity to 623 megawatts — including existing power generation and grid import capacity in Pennsylvania.

Additionally, Bitfarms now manages nearly 1 more Exahash of computing power, bringing its total to 18 Exahash. A previous agreement where Stronghold hosted miners for others is now being used for Bitfarms’ direct mining operations.

Bitfarms also sees potential to convert two Stronghold power sites into large-scale AI and computing hubs, with plans to partner with industry players to develop these facilities.

“With Stronghold’s portfolio of power assets, combined with our operational expertise and balance sheet strength, we are well positioned to create long-term value for our shareholders by executing on our US strategy and developing an HPC/AI business geared for scale, ” said Ben Gagnon, Chief Executive Officer of Bitfarms.

In addition to increasing its power assets, the acquisition has boosted Bitfarms’ share of the North American energy market from 6% to 80%.

Source link

You may like

Tether’s US treasury holdings surpass Canada, Taiwan, ranks 7th globally

Here’s Where Support & Resistance Lies For Solana, Based On On-Chain Data

President Trump To Address The Digital Assets Summit Tomorrow

Analyst Says Bitcoin Primed for ‘Party Time’ if BTC Breaks Above Critical Level, Updates Outlook on Chainlink

Binance adds a new EUR market tier to its fiat liquidity provider program

Authorities Target Crypto Scammers Posing as Binance in Australia

Bitcoin ETF

How Bitcoin ETFs And Mining Innovations Are Reshaping BTC Price Cycles

Published

18 hours agoon

March 19, 2025By

admin

Bitcoin’s market structure is evolving, and its once-predictable four-year cycles may no longer hold the same relevance. In a recent conversation with Matt Crosby, lead analyst at Bitcoin Magazine Pro, Mitchell Askew, Head Analyst at Blockware Solutions, shared his perspective on how Bitcoin ETFs, mining advancements, and institutional adoption are reshaping the asset’s price behavior.

According to Askew, Bitcoin’s historical pattern of parabolic price increases followed by steep drawdowns is changing as institutional investors enter the market. At the same time, the mining industry is becoming more efficient and stable, creating new dynamics that affect Bitcoin’s supply and price trends.

Bitcoin’s Market Cycles Are Fading

Askew suggests that Bitcoin may no longer experience the extreme cycles of past bull and bear markets. Historically, halving events reduced miner rewards, triggered supply shocks, and fueled rapid price increases, often followed by corrections of 70% or more. However, the increasing presence of institutional investors is leading to a more structured, macro-driven market.

He explains that Spot Bitcoin ETFs and corporate treasury allocations are bringing consistent demand into Bitcoin, reducing the likelihood of extreme boom-and-bust price movements. Unlike retail traders, who tend to buy in euphoria and panic-sell during downturns, institutions are more likely to sell into strength and accumulate Bitcoin on dips.

Askew also notes that since Bitcoin ETFs launched in January 2024, price movements have become more measured, with longer consolidation periods before continued growth. This suggests Bitcoin is beginning to behave more like a traditional financial asset, rather than a speculative high-volatility market.

The Role of Bitcoin Mining in Price Stability

As a mining analyst at Blockware Solutions, Askew provides insight into how Bitcoin mining dynamics influence price trends. He notes that while many assume a rising hash rate is always bullish, the reality is more complex.

In the short term, increasing hash rate can be bearish, as it leads to higher competition among miners and more Bitcoin being sold to cover electricity costs. However, over the long term, a rising hash rate reflects greater investment in Bitcoin infrastructure and network security.

Another key observation from Askew is that Bitcoin’s hash rate growth lags behind price growth by 3-12 months. When Bitcoin’s price rises sharply, mining profitability increases, prompting more capital to flow into mining infrastructure. However, deploying new mining rigs and setting up facilities takes time, leading to a delayed impact on hash rate expansion.

Why Mining Profitability Is Stabilizing

Askew also highlights that mining hardware efficiency is reaching a plateau, which has significant implications for miners and Bitcoin’s supply structure.

If you’re thinking about Bitcoin mining, you MUST watch this clip.

There’s a trend developing in mining hardware that will bode extremely well for miners:

– Longer machine lifespans

– Slowing hashrate growth

– Increased lag between price growth and hashrate growthBitcoin… pic.twitter.com/H0ZjsCm7Rc

— Mitchell

(@MitchellHODL) March 19, 2025

In Bitcoin’s early years, new mining machines offered dramatic efficiency improvements, forcing miners to upgrade hardware every 1-2 years to remain competitive. Today, however, new models are only about 10% more efficient than the previous generation. As a result, mining rigs can now remain profitable for 4-8 years, reducing the pressure on miners to continuously reinvest in new equipment.

Electricity costs remain the biggest factor in mining profitability, and Askew explains that miners are increasingly seeking low-cost power sources to maintain long-term sustainability. Many companies, including Blockware Solutions, operate in rural U.S. locations with stable energy prices, ensuring better profitability even during market downturns.

Could the U.S. Government Start Accumulating Bitcoin?

Another important discussion point raised by Askew is the potential for a U.S. Strategic Bitcoin Reserve (SBR). Some policymakers have proposed that the U.S. government accumulate Bitcoin in the same way it holds gold reserves, recognizing its potential as a global store of value.

Askew explains that if such a reserve were implemented, it could create a massive supply shock, pushing Bitcoin’s price significantly higher. However, he cautions that government action is slow and would likely involve gradual accumulation rather than sudden large-scale purchases.

Even if implemented over several years, such a program could further reinforce Bitcoin’s long-term bullish trajectory by removing available supply from the market.

Bitcoin Price Predictions & Long-Term Outlook

Based on current trends, Askew remains bullish on Bitcoin’s long-term price trajectory, though he believes the market’s behavior is shifting toward more gradual, sustained growth rather than extreme speculative cycles.

- Base Case: $150K – $200K

- Bull Case: $250K+

- Base Case: $500K – $1M

- Bull Case: Bitcoin flips gold’s $20T market cap → $1M+ per BTC

Askew sees several key factors driving Bitcoin’s price over the next decade, including:

He emphasizes that as Bitcoin’s market structure matures, it may become less susceptible to sharp price swings, making it a more attractive long-term asset for institutions.

Conclusion: A More Mature Bitcoin Market

According to Askew, Bitcoin is undergoing a structural shift that will shape its price trends for years to come. With institutional investors reducing market volatility, mining innovations improving efficiency, and potential government adoption, Bitcoin’s market behavior is beginning to resemble that of gold or other long-term financial assets.

While dramatic parabolic runs may become less frequent, Bitcoin’s long-term trajectory appears stronger and more sustainable than ever. Askew’s perspective reinforces the idea that Bitcoin is no longer just a speculative asset—it is evolving into a key financial instrument with increasing global adoption.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

bill

Kentucky Senate Passes Bill Protecting Bitcoin Self-Custody Rights

Published

6 days agoon

March 14, 2025By

admin

Yesterday evening, the Kentucky Senate unanimously passed a bill aimed at protecting Bitcoin self-custody rights and digital asset mining operations. With a decisive 37-0 vote, the legislation, titled AN ACT relating to blockchain digital assets (HB 701), now moves to the Governor’s desk for final approval.

NEW:

Kentucky Senate passes bill that will protect Bitcoin self custody rights with 0 votes against it.

The bill now heads to the Governors desk. pic.twitter.com/HPciWIgpZO

— Bitcoin Magazine (@BitcoinMagazine) March 14, 2025

Sponsored by Representatives Adam Bowling and T.J. Roberts, the bill affirms the right of individuals to self-custody digital assets through self-hosted wallets. Additionally, it prevents local zoning laws from discriminating against digital asset mining businesses, ensuring that Bitcoin miners can operate freely within the state.

The bill outlines several key provisions, including:

- Protection for Bitcoin self-custody: Individuals have the legal right to use and store digital assets in self-hosted wallets.

- Prohibition of discriminatory zoning laws: Local governments cannot impose zoning changes that unfairly target digital asset mining businesses.

- Exemptions from money transmitter licensing: Home Bitcoin miners and digital asset mining businesses are exempt from Kentucky’s money transmitter requirements.

- Clarification of securities laws: Digital asset mining and staking as a service are explicitly not classified as securities under Kentucky law.

@Rawlings4Ky is carrying HB 701 which protects the use of digital assets and self-hosted wallets, prevents local zoning discrimination against digital asset mining businesses, and establishes guidelines for blockchain node operations. It shields node operators and staking… pic.twitter.com/1crnd8mqQS

— KY Senate Majority (@KYSenateGOP) March 13, 2025

After passing through the Kentucky House with a 91-0 vote on February 28, 2025, the bill moved swiftly through the Senate. The March 13 vote saw full bipartisan support, with 37 senators voting in favor, zero opposed, and one not voting.

The legislation now awaits the Governor’s signature, which would officially enshrine Bitcoin self-custody protections and digital asset mining rights into Kentucky law. If signed, Kentucky will become one of the more Bitcoin-friendly states in the country, setting a precedent for other states to follow.

Source link

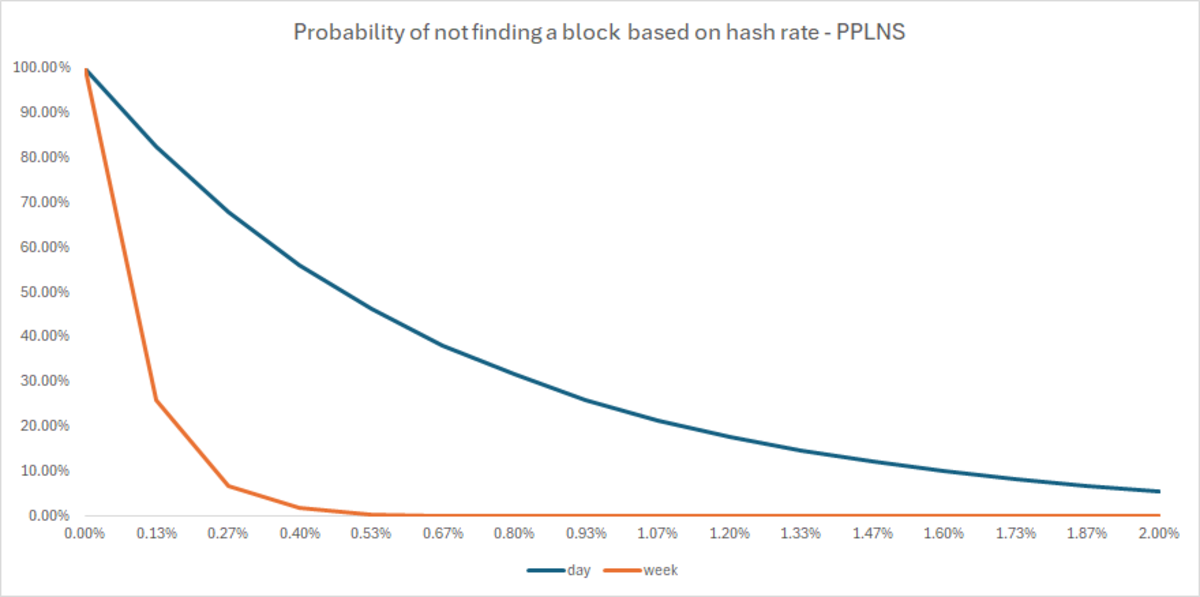

Bitcoin mining is a tough business. When one considers deploying economic resources to mine traditional commodities such as gold, copper or oil, prospecting for those resources in the field is always done beforehand, to ensure that any capital invested in a mining project will not be in vain. But due to the very nature of Bitcoin’s security protocol, miners are not able to prospect for anything, since finding a block is a purely statistical and random event. Since there are only 144 blocks to be found per day, there is no way to ensure that a miner’s work will be rewarded in a timely fashion without significant variability, unless the miner has a considerable amount of hash rate. A miner needs roughly 1.2% of the total hashrate (approximately 10 Exahashes per second at the time of writing) to guarantee consistent payouts and significantly diminish its revenue variance. The CAPEX required to achieve such an amount of hashrate is in order of hundreds of millions of dollars. Unless a miner is a gigantic enterprise that has an enormous flock of ASICS, he will have a problem in his hands.

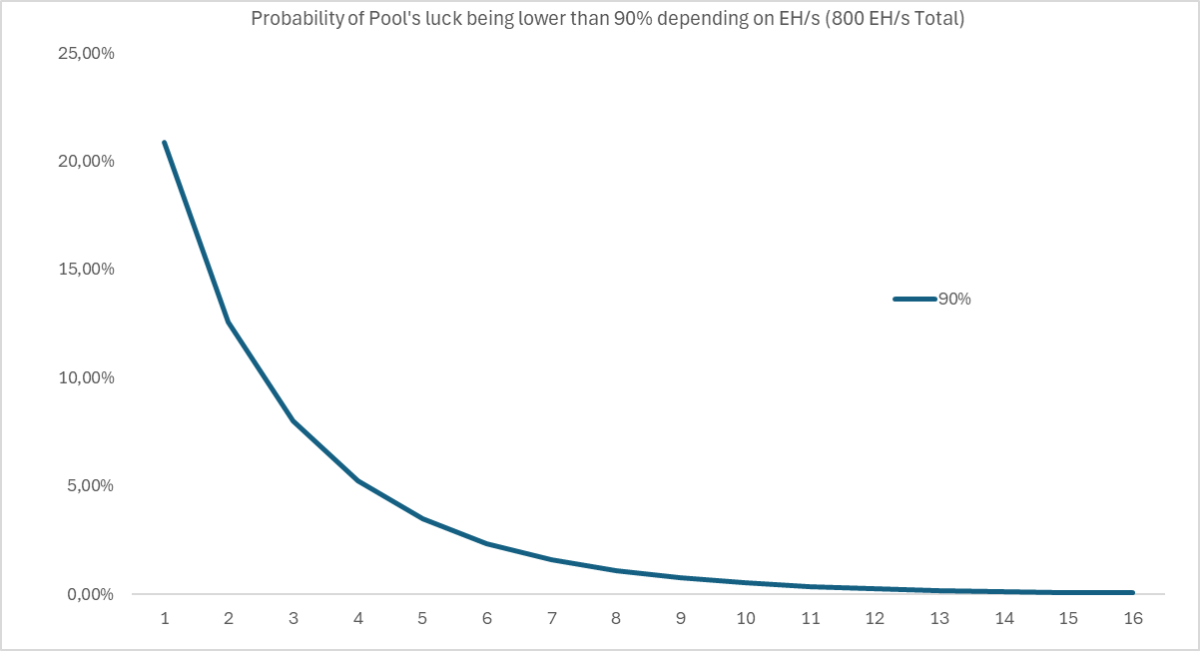

Pool mining was created to address and solve this issue. Let’s take a single miner, with a small but considerable mining operation. Out of the 52560 yearly blocks, he’s expected to find one, since he has 1/52560th of all the hashrate of the network. In other words, he’s expected to find one block every 12 months. But his electricity bill comes due every 4 weeks, and if he was to wait for a whole year paying bills before getting some revenue through the door, he’d go bankrupt. Given this discrepancy between its ongoing costs and its revenues, an idea comes to his mind. He sets out to find 499 other people with a similar sized operation, and they strike a deal. Instead of everyone mining on their own, the miner proposes to the others that they all mine collectively as if they are part of the same entity, splitting the mining rewards according to each miner’s work every time someone finds a block. If every miner has 1/52560th of all the hashrate of the network, the 500 miners collectively are expected to find a block approximately two times per week. With a pool mining approach, every miner guarantees that all the effort and hard work they put in will be rewarded much more frequently. This way everyone gets to pay their bills every month, and by the end of the year, they have all effectively managed to avoid bankruptcy. Nevertheless, there are still sources of variance within those same payouts.

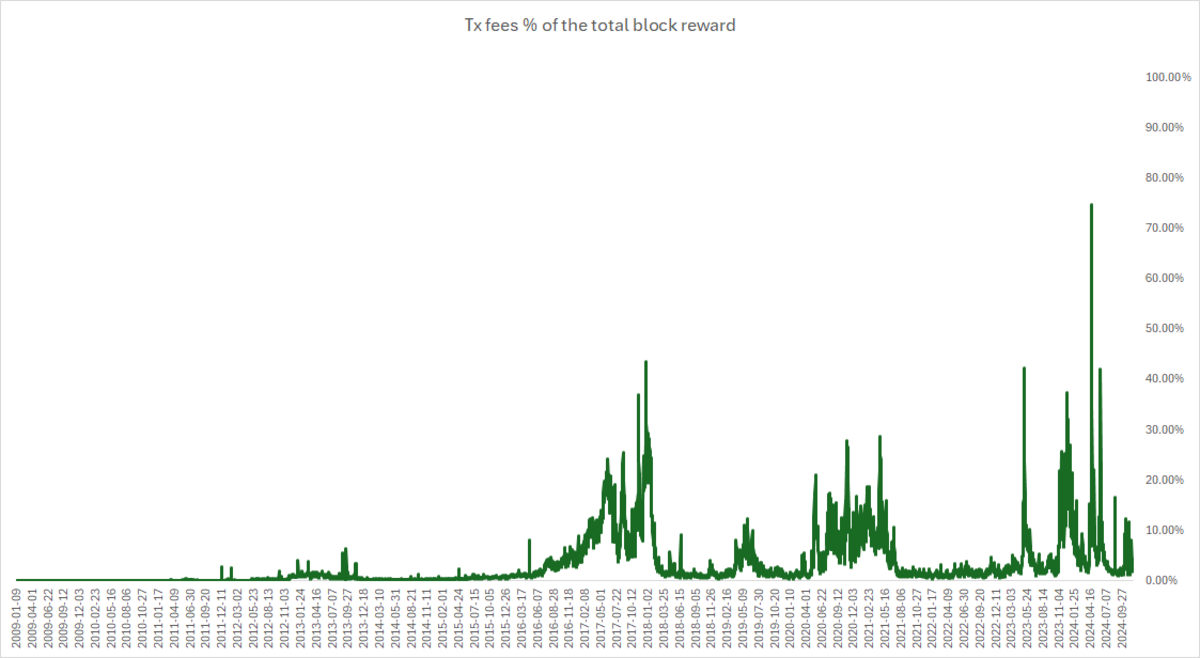

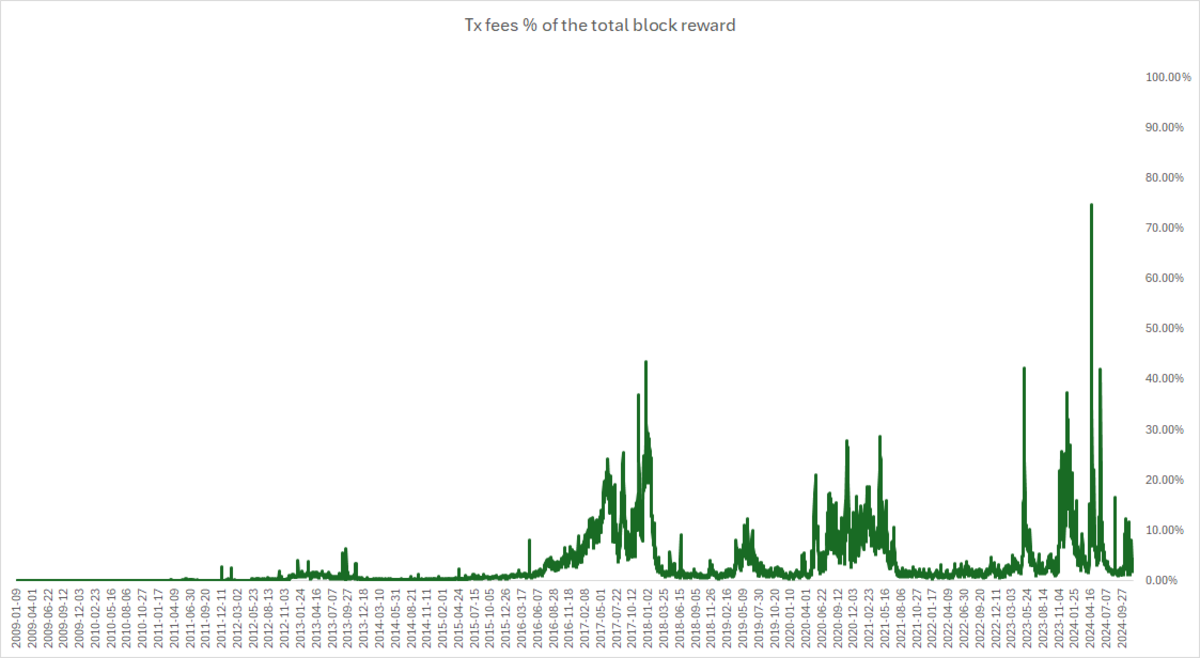

Pool mining makes sure miners get paid much more frequently compared to solo mining. However, it doesn’t guarantee predictable payouts based on the hashing power that each miner has. This problem is commonly known as the pool’s luck risk. Let´s go back to the previous example. 500 miners with 1/52560th of the total hashrate of the network each are expected to find 500 blocks in a year. Nevertheless, they may find 480. Or 497. Or 520. There is no assurance that the pool will mine exactly 500 blocks in a year. A Pool’s luck is calculated by dividing the number of blocks found by the number of blocks that was expected to be found based on the total hashrate of the pool. If a pool mines 480 blocks when they were expected to mine 500, the pool’s luck was 95%. Pool luck can cause significant fluctuations in earnings over short periods. However, luck tends to even out over time, and payouts will eventually align with the expected distribution based on the pool’s hash rate. Two additional factors contribute to the overall variance in miners’ payment rewards, with the first factor being more significant than the second. The first is transaction fees. These tend to vary considerably as witnessed in the last few years. Transactions fees from the blocks that were mined right after the last halving represented more than 50% of the total block reward for the first time in Bitcoin’s history. As of the writing date of this article, (block height 883208), there were several non-full blocks mined in the past week, since the mempool cleared for several occasions during these past days. Quite a jump in such a short amount of time. The second factor is related to the variance associated with the time between blocks found by the network. When a block is found right after another, there is less time for transactions to build up in the mempool, which leads to lower transaction fees in that block. Conversely, if a more extended period elapses between blocks, more transactions will be broadcast, driving up transaction fees in the process.

Uncertainty is painful. Especially where there is substantial capital at risk. Thus, most miners find value in having more predictable, stable and less volatile payouts to recoup the significant amount of capital deployed. This is where a Full Pay Per Share payout scheme paid by pools comes into play. FPPS works as a traditional insurance product. A pure risk transfer. Regardless of how many blocks the miners of the pool collectively find and what the transaction fees paid on them are, miners get paid by the pool based on the expected value of their hashing power. The pool assumes all that risk. The predictability that FPPS provides to miners is unrivaled by any other method. Hence, no one should be surprised to learn that FPPS is pretty much the standard nowadays when it comes to pool payouts, although not without a significant cost.

FPPS is not a free lunch. To withstand any bad luck period and all the risks associated with a FPPS payout scheme, pools need to have big fat pockets. These high capital requirements cost money. And pools are not charitable organizations. These high costs end up being paid by miners through higher pool fees. Like previously mentioned, miners need to keep in mind the fact that an FPPS payout scheme works as an insurance policy. And insurance policies rely on counterparties. And sometimes, counterparties fail to honor their commitments when they are most needed, as witnessed back in the 2008 Global Financial Crisis. The miner must trust that the pool will fulfill their insurance contract obligations. Sure, if the pool is very big in size, that risk is very small indeed. Pools can also develop ways to offload this risk from their operations. But isn’t Bitcoin all about minimizing trust, counter-party risk and eliminating it if possible? Looks like the Bitcoin ethos hasn’t arrived yet at the pool mining side of the protocol.

Furthermore, any miner that receives FPPS rewards for their work must necessarily forfeit any revenue related to transaction fee spikes. The FPPS payout formula determines miner rewards by analyzing transaction fees from the previous n blocks and calculating an “expected value” for transaction fees. The pool then uses this calculation to decide how much to pay miners for the transaction fee portion of their shares. As a result, when transaction fees surge, the payout is made according to what happened in the past, where there is no transaction fees spike whatsoever. No need to be a PhD in mathematics to understand that all those rewards end up in the pool’s pockets rather than the miners’ in this scenario. Moreover, even if there was a recent spike in transactions, pools cannot factor this into payout calculations. The probability of such a spike not being an outlier is almost negligible. In other words, pools have no guarantee that the fee spikes will be consistent and frequent in the future. Therefore, they cannot include it in miner payouts without risking bankruptcy.

The unsustainability of the FPPS payout scheme

Having a closer look at how the FPPS payout scheme is built, we can easily see that it is like the modern pension systems of many governments, unsustainable by design. FPPS as it stands today, will collapse under its own weight soon. As time goes by, transaction fees will represent a bigger percentage of the total payout to miners. This dynamic, alongside their inherent variability, will lead to a significant increase of the total payout variance, thus increasing the insurance costs of FPPS pools to infinity. In other words, as the Coinbase reward keeps halving, the variance of the rewards in the block will increase significantly. If the variance increases, so does the associated risk of providing this insurance product for miners. Thus, premiums for the insured will have to increase as well. This means that FFPS pools will be taking additional risk when compromising themselves to a fixed payment to miners. With more risks comes higher capital costs. The extent to which pool fees will have to rise for pools to continue providing a FPPS insurance product remains to be seen. Only insurance actuaries can determine the precise amount. One thing we already know for sure. It won’t be cheap, because it already isn’t.

A much higher pool fee for stable predictable payouts offered by FPPS will make a PPLNS method reward method much more attractive for any miners that are looking to maximize their profitability, as the previously described dynamic of the changing composition of blocks is played out. Under this scheme, miners are paid once a block is found by the pool. When a block is found, the pool assesses how many valid shares each miner contributed during a period comprised of the last N blocks found by the pool and distributes payouts accordingly. This time window is commonly referred to as the PPLNS window. The biggest setback with this payment method is of course the risk associated with the pool’s luck being under 100% and the risk that there might be periods when the pool doesn’t find any block and as a result, miners don’t get paid. However, a pool with only 1% of the hash rate has only a 0.0042% chance of not finding a block within a week, while the odds of the pool’s luck being lower than 90% in a year are approximately 1.09%.

Will there be a market soon for FPPS pool services at a high enough price that compensates the pool for all the variance associated with the total block rewards? No one can know for sure. One thing we know. Pool fees will have to be enormous. The revenue that miners will have to forfeit will just be too big to be worth it to get rid of the risk associated with not getting paid consistently in a timely manner. And as other more mature players enter the bitcoin mining industry, such as energy companies, one should expect other risk management tools to be readily available in the market for miners to hedge all types of risks. New innovative pool payment schemes will probably surface as these instruments become more available to everyone.

Miners’ revenue and profitability will be significantly impacted by the dynamics described in this article. Exploring alternative pool payment schemes and risk hedging strategies will be required for any miner that looks to maximize the profitability of their operation. The FPPS payout method might still be helpful for miners as of today. But as was previously explained, FPPS will soon be buried in bitcoin’s history.

This is a guest post by Francisco Quadrio Monteiro. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Tether’s US treasury holdings surpass Canada, Taiwan, ranks 7th globally

Here’s Where Support & Resistance Lies For Solana, Based On On-Chain Data

President Trump To Address The Digital Assets Summit Tomorrow

Analyst Says Bitcoin Primed for ‘Party Time’ if BTC Breaks Above Critical Level, Updates Outlook on Chainlink

Binance adds a new EUR market tier to its fiat liquidity provider program

Authorities Target Crypto Scammers Posing as Binance in Australia

Why Is Solana Price Up 6% Today?

Ripple CEO Confident of XRP Being Included in U.S. Strategic Reserve, Says IPO is 'Possible'

Bitnomial drops SEC lawsuit ahead of XRP futures launch in the US

Bitcoin Long-Term Holder Net Position Turns Green For The First Time In 2025

BIGGER THAN ORDINALS. MORE THAN ART

Leading Shiba Inu Rival Flashing Bullish Signals Hinting at Price Reversal, According to Santiment

Binance’s USDT pair with Turkish lira sees largest amplitude since 2024 after key Erdogan rival detained

Treasury Expands Financial Surveillance of Cash Transactions—What About Crypto?

Bitcoin Price Eyes 90K rally at Blackrock-led ETFs Buy $512M BTC 3-Days before US Fed Decision

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x