Bitcoin

President Trump To Address The Digital Assets Summit Tomorrow

Published

4 days agoon

By

admin

President Donald Trump is expected to deliver a speech tomorrow via a recording at Blockworks’ Digital Asset Summit (DAS) in New York City. This will be the first time a sitting U.S. president has addressed a Bitcoin and crypto conference, highlighting the growing influence of digital assets in mainstream financial policy.

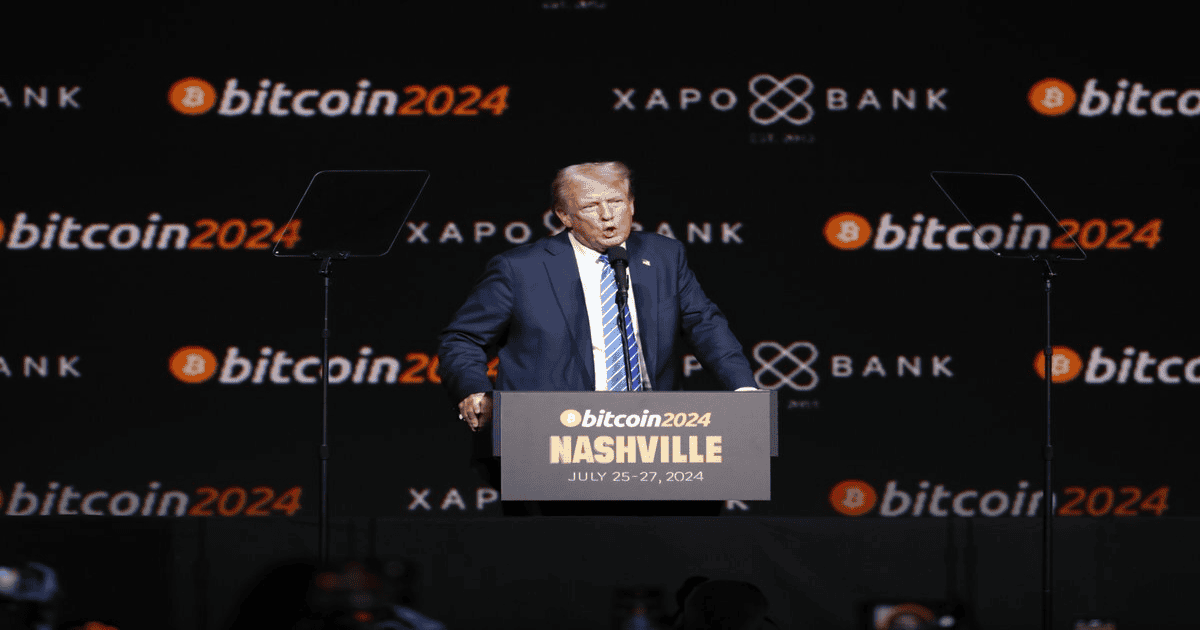

Trump has previously engaged with the Bitcoin community, having spoken in person at the world’s largest Bitcoin conference in Nashville last summer while on the campaign trail. His return to the stage now as president further highlights the continued support from the U.S. government on Bitcoin.

Trump’s upcoming address at DAS comes only a couple weeks after moving forward with officially integrating Bitcoin into his national strategy, when he signed an executive order establishing the U.S. Strategic Bitcoin Reserve, positioning BTC as a key asset for the country’s financial future.

Joining the lineup tomorrow at DAS is Strategy’s Michael Saylor, who will deliver a keynote speech and engage in a fireside chat with Bitcoin historian Pete Rizzo. Additionally, Bloomberg ETF analyst James Seyffart will host a panel discussion with BlackRock’s Head of Digital Assets Robbie Mitchnick and Nasdaq’s Head of U.S. Equities & Exchange-Traded Products Giang Bui, where they will delve into the evolving landscape of Bitcoin ETFs and institutional adoption.

The announcement of Trump’s participation follows remarks from Bo Hines, Executive Director on Digital Assets for President Trump, who spoke earlier this week at DAS. Hines reaffirmed the administration’s commitment to accumulating Bitcoin for the Strategic Bitcoin Reserve, stating:

“I think it’s high time that our President started accumulating assets for the American people, which is what President Trump is doing rather than taking it away.”

He also emphasized the administration’s approach to acquiring Bitcoin in budget-neutral ways, likening BTC accumulation to gold reserves:

“You know, I’ve been asked all the time, it’s like how much do you want? Well, that’s like asking a country how much gold do you want – as much as we can get.”

JUST IN –

President Trump’s Executive Director on digital assets: “We talked about ways of acquiring more Bitcoin in budget neutral ways.”

We want “as much as we can get.”

pic.twitter.com/zK8PyQK1Rw

— Bitcoin Magazine (@BitcoinMagazine) March 18, 2025

Trump’s executive order has already sparked legislative action aiming to build on this momentum. Senator Cynthia Lummis and Congressman Nick Begich have each proposed plans for the U.S. to acquire 1 million BTC over the next five years, ensuring a long-term reserve of the scarce asset. Earlier today at DAS, House Majority Whip and Congressman Tom Emmer stated that he believes this legislation will be enacted “before this congress is done.”

JUST IN:

Congressmen Tom Emmer said he believes Strategic Bitcoin Reserve bill to buy 1 million BTC will be enacted. pic.twitter.com/DlfuArq1rr

— Bitcoin Magazine (@BitcoinMagazine) March 19, 2025

Source link

You may like

XRP Price Reclaims Ground—Is a Bigger Push Just Getting Started?

First meta-DEX aggregator Titan launches on Solana

Crypto Trader Sees Memecoin Resurgence After Sector Got ‘Smashed’ – Here Are His Top Picks

$90K Target Ahead as BTC Options Volume nears $800M

This Week in Crypto Games: Jurassic World in ‘The Sandbox’, Telegram Gets ‘Not Games’

Fidelity files for Ethereum-based US Treasury fund ‘OnChain’

Bitcoin

$90K Target Ahead as BTC Options Volume nears $800M

Published

3 hours agoon

March 24, 2025By

admin

Bitcoin’s price rose 2.6% on Sunday, March 23, crossing the $86,000 mark after a three-day consolidation around $84,000. With growing market optimism following the recent Fed rate pause, speculative BTC traders deployed increased leverage over the weekend. Will BTC advance above $90,000, or will it reverse to $80,000 in the week ahead?

Bitcoin (BTC) Retakes $85,500 After Three-Day Consolidation

After a prolonged consolidation phase, Bitcoin (BTC) made a major recovery bounce on Sunday. Following Trump’s appearance at Blockworks’ Digital Asset Summit, many short-term traders opted to take profits on their BTC holdings.

Despite the decline, Bitcoin continues to find buyers, as the recent U.S. Fed rate pause announced on Wednesday prompted macro-sensitive capital to flow toward risky assets.

Bullish tailwinds from the Fed rate pause counteracted the downward pressure from profit-taking, leading to a three-day stalemate at the $84,000 level since Thursday.

However, as sell-side pressure subsided, BTC price recorded a major breakout above $86,000 on Sunday, March 23. The chart above shows how BTC rose 2.6%, hitting a daily peak of $85,600.

BTC Options Volume nears $800M as Whales Return After Fed Rate Pause

Bitcoin price demonstrated remarkable resilience consolidating around $84,000 over the past three days, as macro-sensitive institutional investors reassess their stance on U.S. economic policies.

Earlier this month, fears of inflationary pressure from Trump’s proposed tariffs triggered a cautious retreat from risk assets, including Bitcoin. However, with recent CPI and PPI reports showing inflation cooling and the Federal Reserve opting to pause rate hikes, large investors appear to be re-entering the market.

This shift in sentiment is reflected in broader financial markets. The S&P 500 surged by 32 points following the Fed rate pause, signalling renewed risk appetite. As Bitcoin mirrors this trend, it has seen a sharp uptick in speculative trading activity from large investors.

Validating this stance, Coinglass derivatives market data shows BTC’s options trading volume skyrocketed 24% in the last 24 hours, pushing total volume above $793 million.

What Does 24% Options Trading Surge Mean for Bitcoin Price Action This Week?

Options trading is a derivatives market strategy that allows traders to bet on the future price movements of an asset without directly purchasing it. This technique is particularly popular among institutional investors and whales because leverage enables traders to control large positions with relatively small capital, amplifying returns, especially during periods of market volatility.

Given that options trading volume surged 24% over the last day, it suggests that whales and institutional investors are taking bullish positions on BTC’s near-term price movements.

Why is BTC Options Volume Rising?

The renewed interest in BTC options trading aligns with key macroeconomic narratives:

- Fed Rate Pause Fuels Risk Appetite – With the Fed pausing rate hikes, liquidity-sensitive assets like Bitcoin become more attractive.

- S&P 500 Rally Indicates Broader Market Confidence – TradFi investors reallocating capital to stocks may also be expanding exposure to BTC.

- Altcoin Season Rotation – With BTC holding steady above $85,000, traders are betting on volatility to capture short-term gains.

Bitcoin Price Forecast: Data Supports Bullish Outlook, But $90K Flip Unlikely

Beyond options trading, other key metrics reinforce a positive BTC outlook for the week ahead:

- Open Interest Rose 3.88% to $54.04B – A sign that new capital is entering the derivatives market.

- Long/Short Ratio at 1.28 on OKX & 1.2217 on Binance – Indicates more traders are placing long bets.

- Liquidations Favor Shorts – Over the last 12 hours, $14.2M in short positions were wiped out, compared to just $2.82M in longs.

With Bitcoin showing strong demand above $86,000 and institutional investors actively positioning through options, a bullish breakout toward $90,000 remains a distinct possibility. However, signals on the daily Bitcoin price forecast charts below suggest the rally could face significant resistance below the $90,000 mark.

Despite these bullish signals, the technical chart presents a nuanced picture. While Bitcoin has reclaimed $85,600, the looming death cross—where the 50-day moving average trends below the 200-day moving average—remains a cause for concern. This bearish formation suggests that unless BTC can decisively break above $87,200, a retracement toward the $80,000 region remains plausible.

Bulls must clear this key resistance zone to sustain momentum toward $90,000. If BTC fails to establish support above $87,200, bears could regain control, triggering a potential pullback.

Frequently Asked Questions (FAQs)

Bitcoin’s bullish momentum suggests it could approach $90,000, but resistance around $87,200 and technical signals indicate potential pullbacks.

Institutional investors and whales are increasing leverage after the Fed rate pause, betting on Bitcoin’s near-term price movement.

The Fed rate pause, stock market trends, and increased institutional activity in options trading are driving Bitcoin’s recent price movements.

ibrahim

Crypto analyst covering derivatives markets, macro trends, technical analysis, and DeFi. His works feature in-depth market insights, price forecasts, and institutional-grade research on digital assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin

Bitcoin Futures Data Shows Bullish Long/Short Ratio – Details

Published

9 hours agoon

March 23, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin continues to trade within a tight range, consolidating below the $85,000 mark and holding above the $81,000 support zone. Bulls are making efforts to reclaim higher levels and spark a recovery rally, but persistent macroeconomic uncertainty and growing concerns over global trade tensions continue to weigh on market sentiment.

Related Reading

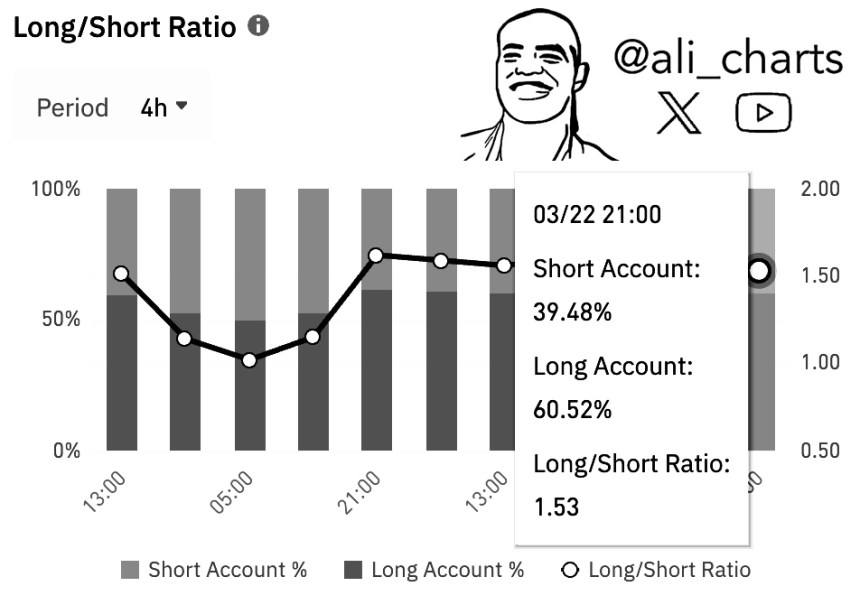

The lack of momentum in either direction has left Bitcoin range-bound for the past several sessions. However, optimism remains among futures traders. According to recent data, 60.52% of traders with open Bitcoin positions on Binance Futures are currently holding long positions, suggesting a majority still believe in an upside breakout.

This bullish leaning among leveraged traders highlights growing expectations that Bitcoin could recover once broader market sentiment improves. Still, the consolidation pattern remains in place until BTC can break decisively above the $85K level and target $88K or higher.

If bulls fail to reclaim resistance soon, the risk of a breakdown below $81K increases, potentially triggering a deeper correction. As uncertainty dominates headlines, Bitcoin remains at a crossroads, and traders continue to watch closely for a catalyst to drive the next major move.

Bitcoin Investors Split On Market Direction As Long Positions Dominate Futures

After months of volatility and a sharp correction from Bitcoin’s January all-time high, some market participants are preparing for a prolonged bear market. Sentiment among this group is driven by persistent macroeconomic uncertainty, erratic global policy shifts, and rising concerns of recession, all of which have shaken confidence across both crypto and traditional markets.

However, a more optimistic view persists among analysts who argue that the current price action is simply a healthy correction within a larger bull cycle. They believe that Bitcoin is undergoing a standard consolidation phase following its parabolic move in late 2024. The structural fundamentals supporting Bitcoin—including growing institutional interest and broader adoption—remain intact.

Supporting this view, top analyst Ali Martinez shared a key metric on X: the Bitcoin Long/Short Ratio on Binance Futures. Martinez revealed that 60.52% of traders with open BTC positions are currently leaning long, signaling a bullish sentiment among futures traders.

This bullish skew in leveraged positions suggests that a potential breakout may be on the horizon. If bulls can reclaim resistance levels near $88K and push above the $90K mark, it could confirm the start of a recovery rally and help restore confidence.

Related Reading

Until then, indecision continues to dominate the market, and Bitcoin remains trapped in a tight range where both scenarios—a deeper correction or a bullish breakout—remain on the table.

BTC Price Range Narrows As Key Resistance Holds Strong

Bitcoin (BTC) is trading at $84,200 after several days of tight consolidation between the $87,000 resistance and the $81,000 support level. Despite recent attempts to push higher, bulls have struggled to break through key resistance, leaving the price range bound and vulnerable to sudden volatility.

Currently, BTC sits approximately 4% below the 4-hour 200-day Moving Average (MA) and Exponential Moving Average (EMA). These indicators, now acting as dynamic resistance around $87,300, are widely watched by traders as crucial short-term trend signals. Reclaiming this zone as support could be the catalyst for a recovery rally toward the $90,000 mark, helping shift sentiment back in favor of the bulls.

Related Reading: Investors Withdraw 360,000 Ethereum From Exchanges In Just 48 Hours – Accumulation Trend?

However, the failure to break above this technical ceiling raises concerns. If price action remains weak and fails to retake the 200 MA and EMA in the coming sessions, the likelihood of a drop below the $81,000 support increases. Such a move would not only trigger fresh selling pressure but could also send BTC into deeper correction territory.

Featured image from Dall-E, chart from TradingView

Source link

Bitcoin

Crypto stocks mirror market-wide slump in Bitcoin, altcoins

Published

13 hours agoon

March 23, 2025By

admin

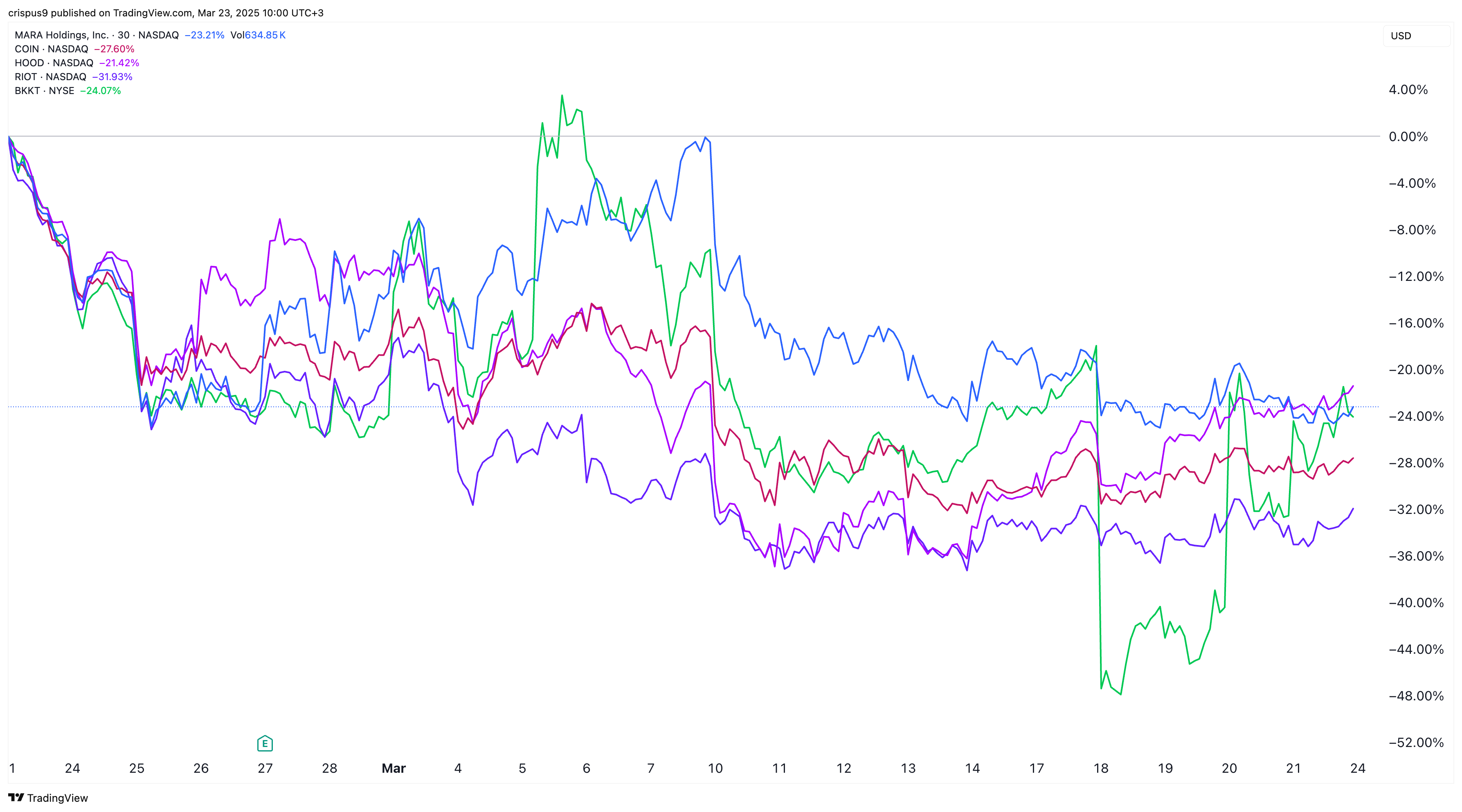

Crypto stocks are caught in a brutal free fall, mirroring the market-wide slump in Bitcoin and altcoins.

Coinbase, the biggest crypto exchange in the U.S., has crashed from nearly $350 per share in November to $190. This decline has brought its market cap from $86 billion to $48 billion—a $38 billion wipe out.

Michael Saylor’s Strategy, has also shed billions of dollars in value. Its market cap dipped from a high of $106 billion last year to $79 billion today. The company, formerly known as MicroStrategy, has continued to accumulate Bitcoin and now holds 499,226 Bitcoins in its balance sheet.

Robinhood stock crashed from $66.85 earlier this year to $45, erasing $18 billion in value. While Robinhood is known for providing retail trading, it has become a major player in the crypto market. It hopes to play a bigger role in the sector when it completes its BitStamp acquisition later this year.

Bitcoin (BTC) mining stocks have also plunged as the struggling BTC price hurts margins. Mara Holdings, formerly known as Marathon Digital, has lost over $4.6 billion in valuation. Other similar companies like Riot Blockchain, Core Scientific, CleanSpark, Hut 8 Mining, and TeraWulf have also shed billions in valuation.

Bitcoin, altcoin prices plummet

These crypto stocks have dropped because of the ongoing decline of Bitcoin and other altcoins. According to CoinMarketCap, the market cap of all cryptocurrencies has dropped from over $3.7 trillion in 2024 to $2.7 trillion today.

Bitcoin has dropped from $109,300 in January to $85,000 at last check. Most altcoins have done worse. For example, Solana meme coins have shed over $18 billion in value as their combined market cap sank.

Crypto prices and crypto stocks have dropped despite the Trump administration’s pledge to be highly supportive of the sector via initiatives like a Strategic Bitcoin Reserve.

The Securities and Exchange Commission has also enacted some friendly policies and ended most of the lawsuits in the industry. It has ended lawsuits brought on companies like Coinbase, Ripple Labs, and Kraken.

Whether these crypto stocks bounce back remains to be seen. Crypto analysts have a mixed outlook on the industry. Some observers expect Bitcoin’s price to recover, with Standard Chartered predicting it will hit $500,000 over time.

Ki Young Ju, CryptoQuant’s founder, estimates that the crypto bull run has ended, noting that all indicators were bearish.

Source link

XRP Price Reclaims Ground—Is a Bigger Push Just Getting Started?

First meta-DEX aggregator Titan launches on Solana

Crypto Trader Sees Memecoin Resurgence After Sector Got ‘Smashed’ – Here Are His Top Picks

$90K Target Ahead as BTC Options Volume nears $800M

This Week in Crypto Games: Jurassic World in ‘The Sandbox’, Telegram Gets ‘Not Games’

Fidelity files for Ethereum-based US Treasury fund ‘OnChain’

German Regulator BaFin Identifies ‘Deficiencies’ in Ethena’s USDe Stablecoin, Orders Immediate Issuance Halt

Q&A with DELV’s Charles St. Louis

Bitcoin Futures Data Shows Bullish Long/Short Ratio – Details

TRUMP, PI Network, Wormhole Analysis

Insider at Major US Bank Quietly Drains $180,000 From Two Customers’ Accounts, Alleges Department of Justice

Bitcoin ‘in position’ for first key RSI breakout in 6 months at $85K

Beyond Strategy: 11 More Publicly Traded Companies That Are Stockpiling Bitcoin

Crypto stocks mirror market-wide slump in Bitcoin, altcoins

Fidelity Files for OnChain U.S. Treasury Fund, Joining the Asset Tokenization Race

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: