Bitcoin

Leaders In Adoption And Innovation

Published

2 days agoon

By

admin

As bitcoin moves into the mainstream of American life, people from every background and corner of the planet are contributing to its historic rise. In the spirit of the age, the bitcoin industry is largely a meritocracy. It is the quality of contributions—rather than any singular identity—that drives bitcoin forward.

March is recognized as International Women’s Month, a tradition rooted in early-20th century labor and suffrage movements. It provides an occasion to reflect on the role of women in bitcoin. Rather than focusing on the experience of being a woman in a technical field, this article spotlights the real contributions and leadership from individuals who happen to be women but who have each, in their own right, helped shape the bitcoin ecosystem.

Whether they come from legal, financial, or technical backgrounds, individuals with strong foundational skills often transition naturally into the bitcoin industry. Much of bitcoin’s growth can be credited to those able to distill complex technical concepts into accessible language. Women are excelling in this role, using skills in marketing, community organizing, and storytelling to broaden understanding and trust in bitcoin. It’s one thing to code or invest in bitcoin, but quite another to convey its principles effectively to the uninitiated. As more people demonstrate real skill in bridging that knowledge gap—through podcasts, workshops, or online content—bitcoin’s base of educated users expands exponentially.

“Women can be powerful communicators and community builders, finding ways to distill complex topics into easily understandable and relatable bites,” says Kelley Weaver, CEO of Melrose PR & Founder of Bitwire. “Since bitcoin fundamentally grows through network effects, this is essential! I’ve seen firsthand how women’s approaches to explaining bitcoin can reach people who might otherwise be intimidated. Approachability is essential for bitcoin’s long-term success.”

In recent years, bitcoin ownership among women has risen significantly. One survey showed that women’s share of digital asset ownership jumped from 29% to 34% in a single quarter. While these numbers vary depending on the source, there’s a clear upward trend. If finance was once perceived as a male-dominated space, that narrative is shifting—particularly for a technology-driven asset like bitcoin, which democratizes participation by removing traditional gatekeepers.

“Across ‘Main Street’ America and the world… decentralized networks of female leaders can be a catalyst for financial education and increasing understanding about the transformative nature of bitcoin,” says Cleve Mesidor, Executive Director of Blockchain Foundation. “Particularly because of scarcity, most individuals will never own even a fraction of bitcoin, which is why women cannot afford to be late adopters.”

Mesidor points to a key dynamic: informal, community-driven networks excel at spreading education. Because bitcoin can be learned and shared peer-to-peer, it finds fertile ground in the natural social structures that women have historically led, such as book clubs, parent associations, and charitable groups. Such networks become informal “nodes” of adoption, where knowledge flows more freely than it might in a top-down environment.

In the past, popular culture often portrayed men as the family financiers while women managed daily household tasks. Yet a recent study revealed that about 84% of women say they are responsible for their family’s finances, from paying bills to setting budgets to overseeing savings and debt obligations. Perhaps more remarkable is that almost all women in couples (94%) report being actively involved in shaping household financial decisions. Many women effectively act as Chief Financial Officers for their families, handling budgeting, strategic planning, and long-term goal setting.

As bitcoin continues to gain traction worldwide, it is increasingly one of the tools under consideration, especially for those who like to plan with a low-time-preference mindset. Bitcoin’s design fits neatly with the mindset that prudent financial planners rely upon. Its limited supply and disinflationary monetary policy reward disciplined saving. As families look for ways to preserve purchasing power, it is natural to add bitcoin in the mix. Whether it’s a small allocation every month or a larger diversification strategy, bitcoin attracts those seeking reliability over the long run.

“For long-term investments, bitcoin is a top choice. While short-term fluctuations are inevitable, its overall trajectory shows a clear path toward growth and stability.” says Frieda Bobay, co-founder of Bitcoin Sports Network. “I never plan to sell my bitcoin; instead, I view it like real estate—an asset I can borrow against while it continues to grow in value.”

While it’s easy to over-generalize, data does suggest that women, on average, tend to adopt disciplined approaches to money management. They trade less frequently in stock markets, are more likely to stick to a plan, and often do deeper research before making an investment. One of bitcoin’s most emblematic qualities is its alignment with low-time-preference thinking: favoring long-term wealth building over short-term speculation. Studies have shown that women are often methodical, patient, and focus on fundamentals rather than jumping in and out of markets. This mindset leads to outperformance in traditional investment contexts.

“A common misconception is that bitcoin is ‘too expensive’—in reality, this is a matter of unit bias,” says Hailey Lennon, General Counsel at Fold. “Many people don’t realize you can own fractions of a bitcoin, and by that measure, it’s still incredibly early and relatively cheap when you compare it to traditional assets. If women empower themselves with the basic knowledge of how bitcoin works, they’ll see that we’re just at the beginning of its potential, making it a compelling opportunity rather than an exclusive, high-priced investment.”

Lennon’s perspective highlights a key barrier for new entrants: bitcoin’s per-coin price might intimidate some, but the option to purchase fractions (satoshis) lowers that barrier significantly. That’s often an eye-opener for people new to bitcoin—especially those who excel in careful, long-term budget allocation. By embracing the possibility of stacking small amounts, methodically and regularly, one can build a meaningful position over time.

Weaver agrees: “Slow and steady wins the race! My personal strategy is to DCA, or “dollar cost average” meaning that I purchase small amounts daily. This spreads out risk. I ultimately think it’s more risky to NOT own bitcoin in the long term, but I also recognize that it’s incredibly volatile. I always say in the short term it may never be a good time to buy bitcoin but in the long term it’s ALWAYS a good idea to buy bitcoin.”

Another reason for the surge in interest among women is that bitcoin, as a universal asset, offers financial independence and sovereignty. This resonates strongly with individuals who value autonomy. “Bitcoin is the pathway to financial sovereignty. It removes traditional gatekeepers and allows for independent wealth management without intermediaries,” says Evie Phillips, Founder of Creeds Collective & Founding Board Member of Crypto Connect, now Eve Wealth. “The blockchain’s immutability means assets can’t be frozen or seized—this is specifically valuable in relational situations and regions where women face financial restrictions. Bitcoin doesn’t have geographic limitations, making global transactions seamless, and that opens up a flood of opportunities that aren’t available through centralized financial systems.” Phillips’s point highlights bitcoin’s advantages in personal control over assets. The economy is fundamentally transforming, and many are drawn to the reliability of an asset that exists beyond the reach of institutions.

The novelty of bitcoin can be intimidating, especially because the mainstream media frequently associates it with scams and hype-driven speculative bubbles. Thought leaders in bitcoin address this by pointing to the facts of the technology. “The more I learn about bitcoin, the more I trust this trustless financial system,” says Weaver. “The network has had zero downtime since it launched in 2009 and has never been hacked. Over the course of bitcoin’s history, the price has risen and fallen, but consistently trends upward in the long term.”

Bitcoin is a protocol, and using it does not require trust in any central authority. Yet it thrives on trust, education, and consensus among people. This is why communicators matter so much. “I often see women’s entire perspective shift when they recognize bitcoin’s potential—not just as an investment, but as a vehicle for financial empowerment,” says Megan Nilsson, host of the Crypto Megan Podcast. “By leveraging their ability to build networks, drive education, and advocate for broader adoption, women can play a leading role in shaping the future of bitcoin and decentralized finance… Bitcoin has fundamentally redefined the concept of financial independence. It has leveled the playing field, offering financial tools that were once only available to accredited investors. It eliminates reliance on centralized systems, providing individuals with true ownership and control over their wealth.”

In the coming years, the world economy, and society itself, will be reshaped by the convergence of transformative technologies including AI, robotics, and space travel, all underwritten and financed with bitcoin. It’s no wonder that as families, institutions, and communities discover bitcoin’s utility, so many of those leading the charge are women. They do so not because they want to check a box, but because the technology itself demands the best talent available. In celebrating the achievements of women this month, we also celebrate bitcoin’s potential to reshape our collective future. It is a global experiment buoyed by those who see beyond the hype and dedicate themselves to building, teaching, and expanding the Bitcoin Network for future generations.

This is a guest post by Dave Birnbaum. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Binance Launchpool To Roll Out Support for New Native Token of Private Data ‘Blind Computer’ Project

Bitcoin race intensifies as leaders address reserve urgency

Ripple, Mt. Gox Founder Bets $1 Billion That He Can Replace the International Space Station

Ethereum Price Eyes Key Resistance as Analysts Warn of Drop to $1,700

South Korea Plans Sanctions Against BitMEX, KuCoin, Others: Report

Gold-backed stablecoins will outcompete USD stablecoins — Max Keiser

Bitcoin

Bitcoin race intensifies as leaders address reserve urgency

Published

53 minutes agoon

March 23, 2025By

admin

On March 20, investor and entrepreneur Anthony Pompliano stated on Fox News, “There’s a global race going on–Russia, Abu Dhabi, El Salvador, Bhutan–all these other countries are trying to buy Bitcoin… the same way that there was a space race there’s now a Bitcoin race.”

The idea of a Bitcoin “race” is now a reality as world leaders actively discuss the urgency of either establishing digital asset reserves or embracing cryptocurrency as legal tender.

El Salvador, in 2021, became the first country to make Bitcoin legal tender, purchasing over 2,000 Bitcoin as part of a national reserve to foster financial inclusion and economic growth. The move has been both celebrated and criticized due to Bitcoin’s volatility. Similarly, in 2022, the Central African Republic became the second country to adopt Bitcoin, viewing the cryptocurrency as a tool to improve economic development and financial inclusion in one of the world’s least developed nations.

Both countries’ actions reflect growing interest in Bitcoin as an alternative financial strategy. It’s hard-capped at 21 million, and in 10 years, most of it will be mined.

The theory is that the countries considering Bitcoin a valuable reserve asset will strive to establish as much ownership of the total BTC supply as possible.

Proponents believe scarcity and growing demand will drive Bitcoin’s value, making large BTC holders influential.

What Saylor says…

One of the most prominent Bitcoin evangelists, Michael Saylor, said that 78% of the U.S. was bought for $40 million at some point. The former CEO of MicroStrategy referred to various land acquisitions, such as the Louisiana Purchase of 1803 to illustrate why the U.S. government should buy Bitcoin now when it’s “cheap.”

In a recent speech, Saylor called the next decade “a digital gold rush” and compared Bitcoin to the Manhattan Project, dubbing it “digital energy.”

“Today, Bitcoin represents the digital capital network, controlling 99% of power within the cryptocurrency ecosystem,” he said. “The U.S. government recognizes only Bitcoin as legitimate digital capital. To secure the future of cyberspace and maintain global financial dominance, America must adopt Bitcoin strategically. Only Bitcoin—and U.S. Treasuries—have the liquidity and global trust required to serve as reliable reserve assets worldwide.”

No wonder Saylor has been vocally supportive of government officials pushing to increase the U.S.’s BTC stockpile.

President Donald Trump, Republican Sen. Cynthia Lummis, and Bo Hines, the Executive Director of the President’s Council of Advisors on Digital Assets, have all expressed a desire to increase the U.S.’s Bitcoin reserve.

Like Saylor, Pompliano (among the most vocal crypto advocates in the U.S.) considers the Trump administration’s focus on Bitcoin dominance important.

Speaking about the future price of Bitcoin, Pompliano said during a Fox News appearance that he doesn’t know when BTC will hit one million. However, he is seemingly confident that, like gold, its value will increase from where it currently is today.

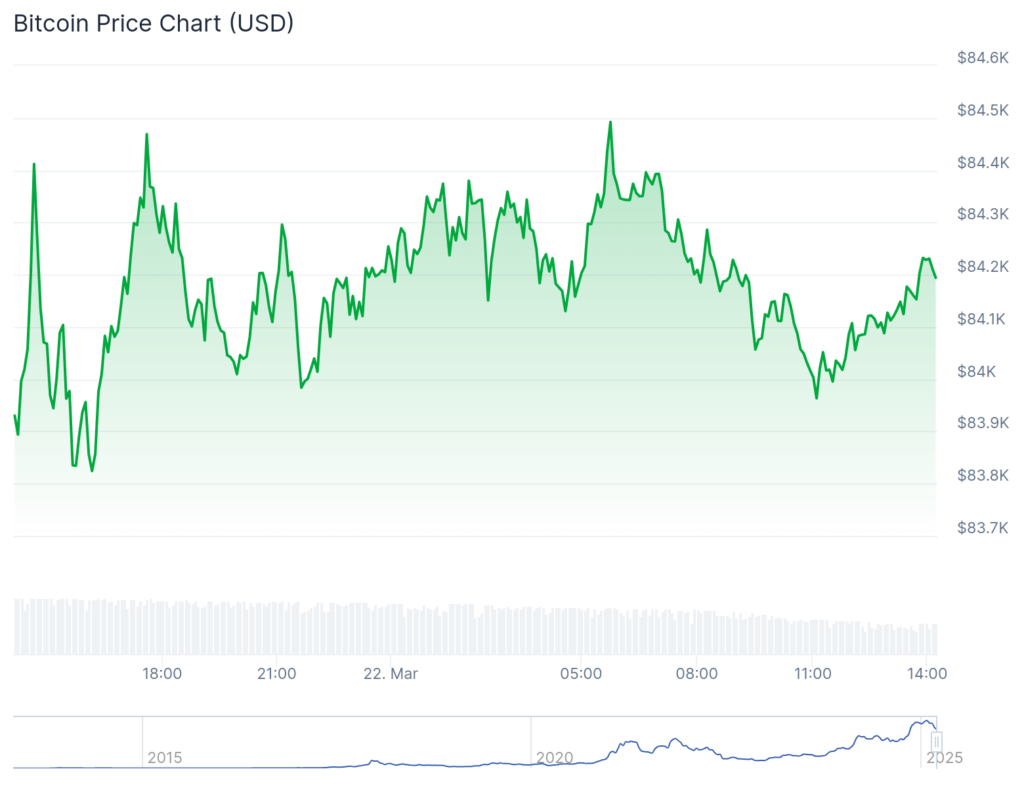

At last check, Bitcoin is trading at just above $84,000.

“I think people are drastically underestimating how maniacal they are going to be about buying Bitcoin,” Pompliano said. “Everyone thinks it’s cute that they put 200,000 Bitcoin over here and now we have this reserve — they are going to continue to buy Bitcoin.”

Who participates in the Bitcoin race?

Apart from the U.S., Pompliano named Russia, El Salvador, Bhutan, and the United Arab Emirates. Indeed, all of these countries reportedly have Bitcoin holdings, but not necessarily all of them explicitly expressed their desire to buy more.

It is not quite clear how much crypto Russia holds. However, it is known that Russia has large-scale mining operations while local companies use crypto for international trade and dodging Western sanctions.

Pompliano neglected to mention several leading Bitcoin holders, including China, which is the second biggest BTC owner after the U.S.

The United Kingdom and Ukraine currently follow China, according to BitBo’s Bitcoin Treasuries page.

All these countries have different strategies:

- North Korea’s hackers steal hundreds of millions of dollars worth of crypto from crypto exchanges.

- The UK holds crypto, seized while dismantling a high-scale money-laundering operation.

- Ukraine became a notable Bitcoin holder through donations made after the intensification of the Russian-Ukrainian conflict in 2022.

- The U.S. intends to confiscate Bitcoin and crypto assets from criminal cases. It’s worth noting that many individual states are exploring the creation of local-level reserves.

More than that, some corporations, most notably Strategy (previously MicroStrategy) and asset manager BlackRock, are among the world’s biggest Bitcoin holders, capable of competing with leading nations in terms of Bitcoin dominance. Both firms own or manage around 500,000 Bitcoins (over 2% of the total supply). As of March 2025, no country holds even half that amount.

Many countries are opting out

European countries have been cautious and innovative in their interactions with blockchain solutions. For instance, Estonia is one of the world’s pioneers in adopting blockchain for elections and healthcare data management. However, the EU countries take a conservative stance when it comes to crypto reserves. High volatility and low liquidity are the main reasons for rejecting Bitcoin’s reserve establishment.

Similar reasons are cited by Switzerland, South Korea, Japan, and other countries that seem unbothered by America’s passion for winning in the Bitcoin musical chairs game. Germany went so far to sell thousands of Bitcoin.

Germany sold all their #Bitcoin at $54,000.

If they had waited, they could have made an extra $990 million.

Losers

pic.twitter.com/2G8iRFhzn9

— Crypto Rover (@rovercrc) November 6, 2024

Crypto.news asked Genius Group, a company using Bitcoin as a corporate reserve, how they time the market.

“As fundamental believers in the long-term potential of Bitcoin, we don’t try to time the market, but rather buy and hold with the intention of never selling,” a spokesperson responded.

Let’s assume the so-called Bitcoin race exists, as Pompliano described it. If we compare it to space or the Manhattan Project, we must ask ourselves: Were the countries that didn’t have spacecraft or atomic weapons in the 20th century left with nothing?

Source link

Bitcoin

Bitcoin Exchange Whale Ratio Hits New 2025 High — BTC Price At Risk?

Published

7 hours agoon

March 22, 2025By

admin

Opeyemi is a proficient writer and enthusiast in the exciting and unique cryptocurrency realm. While the digital asset industry was not his first choice, he has remained absolutely drawn since making a foray into the space over two years. Now, Opeyemi takes pride in creating unique pieces unraveling the complexities of blockchain technology and sharing insights on the latest trends in the world of cryptocurrencies.

Opeyemi savors his attraction to the crypto market, which explains why he spends the better parts of his day looking through different price charts. “Looking” is a rather simple way to describe analyzing and interpreting various price patterns and chart formations. However, it appears that is not Opeyemi’s favorite part – in fact, far from it.

Being able to connect what happens on a price chart to on-chain movements and blockchain activities is what keeps Opeyemi ticking. “This emphasizes the intricacies of blockchain technology and the cryptocurrency market,” he would say. Most importantly, Opeyemi thinks of any market insights as the gospel, while recognizing that he is only a messenger.

When he is not clicking away at his keyboard, Opeyemi is most definitely listening to music, playing games, reading a book, or scrolling through X. He likes to think he is not loyal to a particular genre of music, which can be true on many days. However, the fast-rising Afrobeats genre is a staple in Opeyemi’s Spotify Daily Mix.

Meanwhile, Opeyemi is a voracious reader who enjoys a wide category of books – ranging from science fiction, fantasy, and historical, to even romance. He believes that authors like George R. R. Martin and J. K.

Rowling are the greatest of all time when it comes to putting pen to paper. Opeyemi believes his reading of the Harry Potter series twice is proof of that.

Indeed, Opeyemi enjoys spending most of his time within the four walls of his home. However, he also sometimes finds solace in the company of his friends at a bar, a restaurant, or even on a stroll. In essence, Opeyemi’s ambivert (haha! been searching for an opportunity to use the word to describe myself) nature makes him a social chameleon who is able to quickly adapt to different settings.

Opeyemi recognizes the need to constantly develop oneself in order to stay afloat in a competitive and ever-evolving market like crypto. For this reason, he is always in learning mode, ready to pick up the slightest lesson from every situation. Opeyemi is efficient and likes to deliver all that is required of him in time – he believes that “whatever is worth doing at all is worth doing well.” Hence, you will always find him striving to be better.

Ultimately, Opeyemi is a good writer and an even better person who is trying to shed light on an exciting world phenomenon – cryptocurrency. He goes to bed every day with a smile of satisfaction on his face, knowing that he has done his bit of the holy assignment – spreading the crypto gospel to the rest of the world.

Source link

Bitcoin

Net Taker Volume on Binance Hits Yearly High Amid Bitcoin Price Consolidation

Published

15 hours agoon

March 22, 2025By

admin

Bitcoin continues to trade just below the $84,000 mark, reflecting a broader slowdown in upward momentum. Despite attempts to reclaim higher levels, the cryptocurrency has remained under the $90,000 mark for over two weeks.

This current range-bound activity comes nearly two months after Bitcoin touched its all-time high in January, indicating a period of uncertainty as traders assess macroeconomic conditions and upcoming Federal Reserve policy decisions.

In the midst of the stagnation from BTC’s price, on-chain data is offering contrasting signals on where the market might be headed next. Analysts have pointed to fluctuations in buying and selling pressure on major exchanges, particularly Binance, as key indicators of short-term market sentiment.

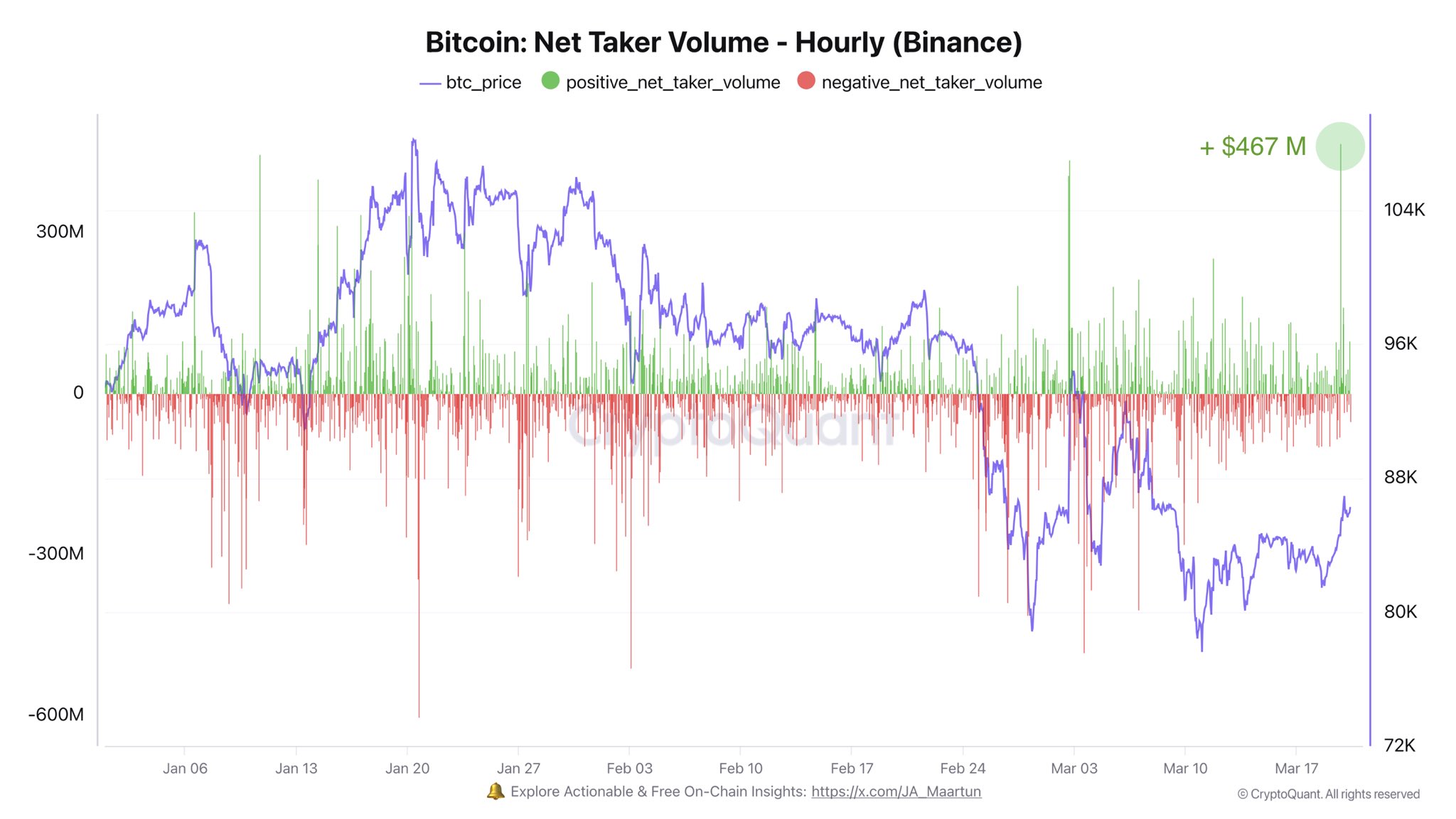

Surge in Binance Net Taker Volume

CryptoQuant analyst Darkfost recently highlighted a notable spike in net taker volume on Binance, the world’s largest centralized crypto exchange. According to Darkfost, net taker volume surged by $467 million in a single hour—marking the highest level recorded in 2025 so far.

This metric, which measures the difference between aggressive market buys and sells, is often used to gauge the immediate sentiment of active traders. A positive value indicates stronger buying activity and has historically signaled short-term bullishness.

Darkfost emphasized that this uptick in taker volume occurred just prior to the recent FOMC meeting, suggesting that some traders may be positioning for favorable policy outcomes.

While the data only reflects an hourly time frame and may not imply long-term directional change, the movement could signal a broader shift in sentiment among active participants, especially given Binance’s influential position in global crypto markets.

Buying pressure from Binance traders might be back.

— Binance is the CeX with the highest trading volume, making it particularly relevant for data analysis. —

The net taker volume is a powerful metric for gauging trader sentiment, as it measures the volume of market buys and… pic.twitter.com/enI1VMAixf

— Darkfost (@Darkfost_Coc) March 20, 2025

Bitcoin Whale Activity Returns as Exchange Ratios Spike

Meanwhile, another CryptoQuant analyst, EgyHash, provided a more cautious interpretation of recent activity. According to his analysis, the Bitcoin Exchange Whale Ratio—defined as the share of total exchange inflows coming from the top 10 largest addresses—has surged to its highest point in over a year.

This ratio is closely monitored because spikes often precede increased selling pressure, especially when large holders move funds to exchanges. While not a definitive indicator of immediate liquidation, the rise in whale-driven deposits suggests that some major players may be preparing for reallocation or profit-taking.

Combined with stagnant price action, this metric implies that Bitcoin’s current price level may be approaching a decision point, where the market direction will be determined by the balance between new demand and potential supply from large holders.

Featured image created with DALL-E, Chart from TradingView

Source link

Binance Launchpool To Roll Out Support for New Native Token of Private Data ‘Blind Computer’ Project

Bitcoin race intensifies as leaders address reserve urgency

Ripple, Mt. Gox Founder Bets $1 Billion That He Can Replace the International Space Station

Ethereum Price Eyes Key Resistance as Analysts Warn of Drop to $1,700

South Korea Plans Sanctions Against BitMEX, KuCoin, Others: Report

Gold-backed stablecoins will outcompete USD stablecoins — Max Keiser

Bitcoin Exchange Whale Ratio Hits New 2025 High — BTC Price At Risk?

Having The Bitcoin Privacy Discussion With Politicians Will Be Difficult — Please Help

$4,750,000 Guaranteed Income Program To Distribute Cash to Citizens Across One US State

Key factors why Ripple could soon skyrocket like it did in 2024

This Week in Bitcoin: Volatility Rises as ETFs Rebound and SEC Gives OK to Mining

Will ETH ETF Net Outflow Exceed $20 Million?

The SEC Resets Its Crypto Relationship

Will new US SEC rules bring crypto companies onshore?

Net Taker Volume on Binance Hits Yearly High Amid Bitcoin Price Consolidation

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x