Altcoins

Why Current ‘Boredom Phase’ Could Trigger Epic Rally

Published

4 days agoon

By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

A crypto analyst has predicted that the XRP price could hit $27 soon. He describes the cryptocurrency’s current price action as a “ Bermuda Triangle or boredom phase” — a period where the market moves slowly or sideways, fuelling doubt and uncertainty among traders and investors before a price rally.

XRP Price Boredom Phase To Trigger $27 Surge

Crypto analyst Egrag Crypto has warned that the XRP price is in a Bermuda Triangle, a boredom phase characterized by price stagnation and market uncertainty designed to shake out weak hands before a significant price move. According to his prediction, while traders and investors are growing impatient and questioning why XRP has not experienced any notable price increases, this phase is merely a set-up for a strong rally toward $27.

Related Reading

Following a predicted downturn in mid-March, XRP has struggled to recover its bullish momentum. The cryptocurrency was one of the top-performing altcoins in this bull cycle, jumping from a $0.5 low to over $3 for the first time in seven years.

Due to the current market decline, Egrag Crypto revealed that many traders are now wondering why “XRP hasn’t mooned.” The analyst explained that this price decline was intentional, forcing investors to second-guess themselves and make emotional trading decisions.

He also disclosed that the XRP market is now filled with ‘What ifs’, as Fear, Uncertainty, and Doubt (FUD) cloud traders’ minds. Moreover, concerns over potential dips to $1.60 or $1.30 could push investors to panic-sell or attempt risky trades.

The analyst also revealed that the XRP market is currently controlled by sharks and larger players, also called Whales. These large holders tend to influence price movements, triggering stop-losses and shaking out weak hands before a major rally.

Egrag Crypto warns that new investors and traders are especially vulnerable, as frustration and boredom can lead to making financial mistakes. He disclosed that the best strategy to implement during this current market phase is to do nothing. He suggested investors stay disciplined and patient, recognizing that boredom phases are normal in crypto market cycles.

The analyst also urged investors to remain vigilant and hold their positions while accumulating at ideal prices rather than react impulsively to rapid changes in the market.

XRP Breakout Point Hints At New ATH

In other analyses, market expert ‘Steph Is Crypto’ has announced that XRP is currently retesting breakout levels to trigger a surge to a fresh ATH. The analyst’s price chart shows a Falling Wedge pattern which has been broken above the resistance at the upper trend line.

Related Reading

After breaking out, XRP now retests this level to confirm a larger upward move. The large green arrow on the chart points to the cryptocurrency’s projected price target, suggesting a bullish continuation if the Falling Wedge breakout holds.

XRP’s upside potential is predicted to be $4 or higher if its bullish momentum is maintained. As of writing, the cryptocurrency is trading at $2.4, reflecting a 3.5% decline in the last 24 hours, according to CoinMarketCap. If its price rises to $4, it would represent a significant 66.7% increase from current levels.

Featured image from Unsplash, chart from Tradingview.com

Source link

You may like

Altcoins

Solana Rises As BlackRock Brings Its $1,700,000,000 Tokenized Treasury Fund to Ethereum Rival’s Chain

Published

9 hours agoon

March 25, 2025By

admin

Solana (SOL) is green on the day on reports that BlackRock is moving its blockchain-based money market fund onto the Ethereum (ETH) competitor’s network.

Fortune reports that the world’s largest asset manager is adding its $1.7 billion BlackRock USD Institutional Digital Liquidity Fund (BUIDL) to the Solana blockchain.

Solana is trading for $145 at time of writing, up nearly 19% in the last week.

Launched a year ago, BUIDL uses traditional money market funds, which investors use to store cash in the near term and earn yield on it, combined with blockchain payment properties.

Solana is now the seventh blockchain compatible with the tokenized money market fund BUIDL, after its initial launch on Ethereum.

BlackRock’s technology partner, Securitize, says the fund is expected to exceed $2 billion in cash and Treasury bills by early April.

Says Michael Sonnenshein, COO at Securitize,

“We’re making [money market funds] unboring. We are advancing and leapfrogging some of the quote-unquote deficiencies that money markets may have in their traditional formats.”

One benefit BUIDL offers over traditional money market funds is 24/7 trading.

Says Lily Liu, president of the Solana Foundation,

“Our vision for why on-chain finance adds more value is because you can do more things with those assets on chain than you could if [they’re] sitting in your brokerage account.”

BUIDL is part of BlackRock’s long-term digital asset strategy, which includes its spot-Bitcoin (BTC) exchange-traded fund (ETF).

According to BlackRock CEO Larry Fink, the future of finance includes the “tokenization of every financial asset.”

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Altcoin

XRP Breakout On Hold? Financial Expert Reveals What’s Missing

Published

15 hours agoon

March 25, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP remains stuck around the $2 level, with experts issuing warnings of restricted near-term growth prospects. According to recent analysis, the digital currency is going through a phase of uncommon stability that has investors speculating about its next step.

Related Reading

Investor Sentiment Dampens Market Momentum

According to financial commentator Austin Hilton, millions of crypto traders have withdrawn from active participation. The market is stuck in neutral, as traders are simply waiting for a big event to set things into motion. The volumes of trade have been above $4 billion at peak levels, but the price itself remains virtually unchanged.

Summer Slowdown Impacts Crypto Trading

Analysts cite seasonal patterns as the major reason for XRP’s current behavior. Hilton describes how summer months usually experience lower trading volumes, with investors more inclined to engage in private activities than respond to market activity. This pattern might continue until July, possibly maintaining XRP’s price relatively stable.

A realistic XRP price prediction!

– Lets talk about the resistance levels for $XRP

– Also, discussed are the support levels that you need to know about

– What you need to know about your XRP holdings – so that you can navigate what is going on right now pic.twitter.com/h9kxG3a0Ex— Austin Hilton (@austinahilton) March 23, 2025

Price Barriers Create Market Challenges

Technical analysis indicates key price levels for XRP. Resistance levels are found at $2.61 and $2.81, while support levels are at $2.22 and $2.31. Experts caution that in the absence of heavy buy pressure, the cryptocurrency might not be able to overcome these levels. Currently, XRP is trading at $2.44, with a modest 0.04% gain over the last 24 hours.

XRP market cap currently at $141 billion. Chart: TradingView.com

Long-Term Outlook Remains Hopeful

Despite current market challenges, some experts remain optimistic. Market analyst Dom suggests the current price consolidation might indicate a strong foundation for future growth. Unlike previous market cycles where XRP experienced rapid price spikes and drops, the current stability suggests a more measured approach.

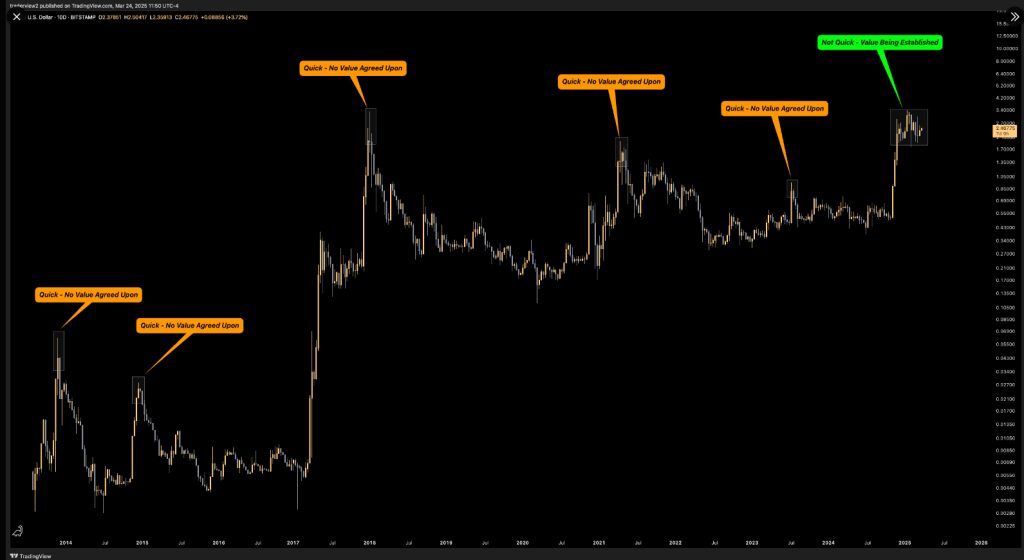

There’s one reason I will be pretty surprised if $XRP does not go higher this year, read along –

Every time $XRP has historically put in a multi month or year top, it did it quickly (as shown below)

Essentially, it never showed any mid term acceptance at those higher… pic.twitter.com/RahjM2xHwz

— Dom (@traderview2) March 24, 2025

A number of possible catalysts are on the horizon, such as developments in XRP ETF products, continued action in the SEC vs. Ripple case, and possible reserve disclosures. As of yet, however, none of these events have caused major market activity.

Related Reading

Institutional investors remain quietly accumulating digital assets, creating yet another level of sophistication to the current market dynamics. Hilton advises not to anticipate extreme price increases in the near term, highlighting that there needs to be a major positive event for drastic change.

As the cryptocurrency market keeps growing, XRP investors are warned to keep close watch on the market conditions. The fourth quarter could see things pick up once again, but for the meantime, patience seems to be the main approach for those who possess the cryptocurrency.

Featured image from Gemini Imagen, chart from TradingView

Source link

Altcoins

Whales Abruptly Deposit Ethereum Altcoin to Binance and OKX, Causing Price To Plummet 50%: On-Chain Data

Published

1 day agoon

March 25, 2025By

admin

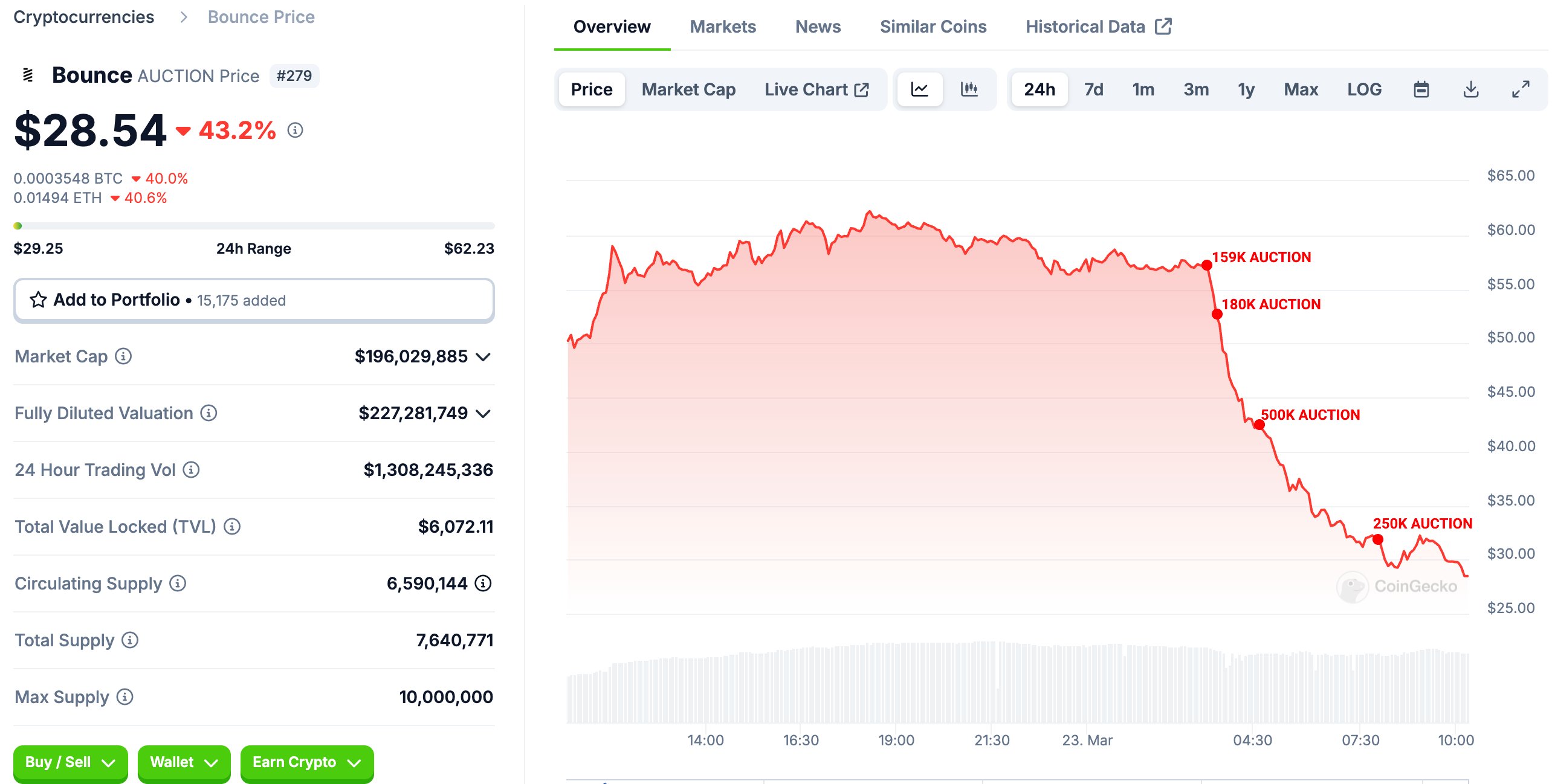

Deep-pocketed traders triggered a price crash over the weekend after depositing a huge chunk of an altcoin’s supply to digital asset exchanges.

According to blockchain tracking firm Lookonchain, whales in the Bounce (AUCTION) market have been greatly influencing the altcoin’s price action for the past week, causing massive swings in both directions.

Bounce Finance is a decentralized auction platform enabling auctions for various assets, such as physical assets tokenized on the blockchain and non-fungible tokens (NFTs).

AUCTION tokens are used for governance, staking, and fees for participating in auctions or creating NFTs on the platform.

Lookonchain says that in the last several days, whales sent over 14% of the circulating supply of AUCTION to Binance, the largest crypto exchange in the world by volume, and OKX. Those deposits presumably led to coins being sold on the open market, which ultimately caused prices to plummet.

Says Lookonchain,

“AUCTION Whales deposited 1.08 million AUCTION ($48.6 million, 14.26% of the total supply) into Binance and OKX again, causing the price to plummet by 50%.

Pay attention to price changes.”

At time of writing, AUCTION has not recovered, currently trading at $20.93 with a market cap of $137 million. AUCTION is ranked as the 363rd-largest crypto asset by market cap.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin Correction to $76,000 Likely a Downside Deviation, According to Crypto Analyst – Here’s Why

GameStop Approves Adding Bitcoin To Treasury Reserves

Cboe Exchange Submits Filing to List Fidelity Solana ETF

How Strategy is Redefining Corporate Leverage?

Tokenized Treasuries Hit $5B Milestone as Fidelity Investments Touts RWA Potential as Collateral

Cardano Price Eyes $0.85 as Whales Scoop Up 240 Million ADA

Dogecoin Price Mirroring This 2017 Pattern Suggests That A Rise To $4 Could Happen

SEC closes investigation into Immutable nearly 5 months after Wells notice

Solana Rises As BlackRock Brings Its $1,700,000,000 Tokenized Treasury Fund to Ethereum Rival’s Chain

BlackRock Launches Bitcoin ETP In Europe

Crypto holds on to Gains, US may reverse Biden BTC sales, Tesla leads bounce

Cardano price could surge to $2 as whale purchases rise

Bitcoin Cash (BCH) Falls 1.9%, Leading Index Lower

Analyst Sets ‘Conservative’ XRP Price Target At $15, What’s Next?

XRP Breakout On Hold? Financial Expert Reveals What’s Missing

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x