Bitcoin

Net Taker Volume on Binance Hits Yearly High Amid Bitcoin Price Consolidation

Published

4 days agoon

By

admin

Bitcoin continues to trade just below the $84,000 mark, reflecting a broader slowdown in upward momentum. Despite attempts to reclaim higher levels, the cryptocurrency has remained under the $90,000 mark for over two weeks.

This current range-bound activity comes nearly two months after Bitcoin touched its all-time high in January, indicating a period of uncertainty as traders assess macroeconomic conditions and upcoming Federal Reserve policy decisions.

In the midst of the stagnation from BTC’s price, on-chain data is offering contrasting signals on where the market might be headed next. Analysts have pointed to fluctuations in buying and selling pressure on major exchanges, particularly Binance, as key indicators of short-term market sentiment.

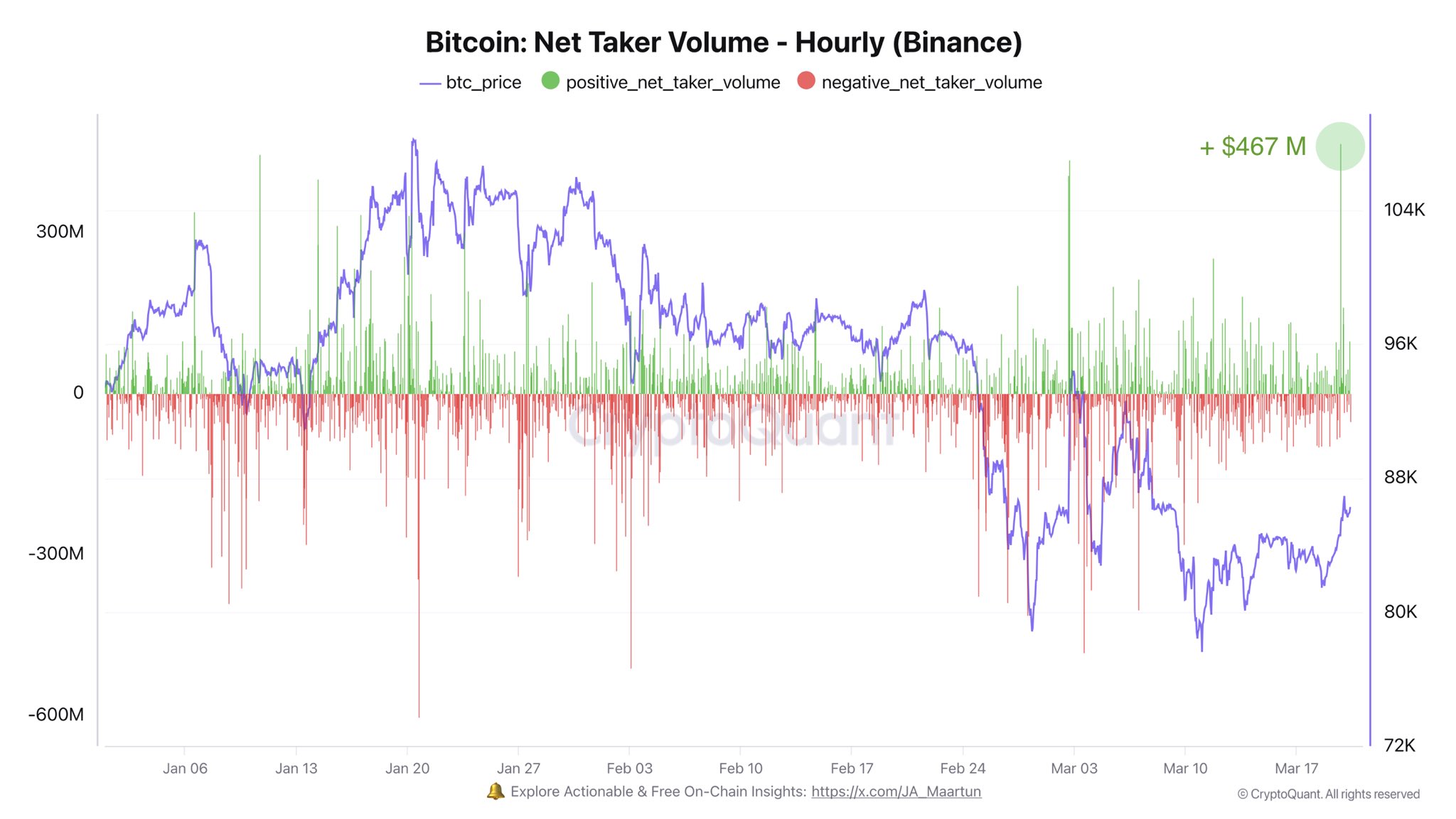

Surge in Binance Net Taker Volume

CryptoQuant analyst Darkfost recently highlighted a notable spike in net taker volume on Binance, the world’s largest centralized crypto exchange. According to Darkfost, net taker volume surged by $467 million in a single hour—marking the highest level recorded in 2025 so far.

This metric, which measures the difference between aggressive market buys and sells, is often used to gauge the immediate sentiment of active traders. A positive value indicates stronger buying activity and has historically signaled short-term bullishness.

Darkfost emphasized that this uptick in taker volume occurred just prior to the recent FOMC meeting, suggesting that some traders may be positioning for favorable policy outcomes.

While the data only reflects an hourly time frame and may not imply long-term directional change, the movement could signal a broader shift in sentiment among active participants, especially given Binance’s influential position in global crypto markets.

Buying pressure from Binance traders might be back.

— Binance is the CeX with the highest trading volume, making it particularly relevant for data analysis. —

The net taker volume is a powerful metric for gauging trader sentiment, as it measures the volume of market buys and… pic.twitter.com/enI1VMAixf

— Darkfost (@Darkfost_Coc) March 20, 2025

Bitcoin Whale Activity Returns as Exchange Ratios Spike

Meanwhile, another CryptoQuant analyst, EgyHash, provided a more cautious interpretation of recent activity. According to his analysis, the Bitcoin Exchange Whale Ratio—defined as the share of total exchange inflows coming from the top 10 largest addresses—has surged to its highest point in over a year.

This ratio is closely monitored because spikes often precede increased selling pressure, especially when large holders move funds to exchanges. While not a definitive indicator of immediate liquidation, the rise in whale-driven deposits suggests that some major players may be preparing for reallocation or profit-taking.

Combined with stagnant price action, this metric implies that Bitcoin’s current price level may be approaching a decision point, where the market direction will be determined by the balance between new demand and potential supply from large holders.

Featured image created with DALL-E, Chart from TradingView

Source link

You may like

Analyst Unveils Extended XRP Price Target To $44, Reveals When To Take Profits

Would GameStop buying Bitcoin help BTC price hit $200K?

New SEC Chair Paul Atkins Holds $6,000,000 in Crypto-Related Investments – Here’s His Portfolio: Report

We’ve Turned A Generation Of Bitcoiners Into Digital Goldbugs

Solana DEX Raydium’s Pump.fun Alternative Is Going Live ‘Within a Week’

Google Cloud joins Injective as validator, expands Web3 tools

Bitcoin

Bitcoin Rally To $95K? Market Greed Suggests It’s Possible

Published

10 hours agoon

March 26, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is on everyone’s crosshairs once more. The cryptocurrency shot up to $88,500 today, exciting traders who think the price will rise to $95,000 in the near term. But while optimism is high, so is caution. Some analysts are warning that a retreat back to $80,000 may occur before the next major rally starts.

Related Reading

Traders Show Signs Of Greed

Market intelligence platform Santiment reports that greed is building among crypto investors. References of Bitcoin reaching $100,000 or even as high as $159,000 have surged through social media platforms. While hope is generating all the excitement, Santiment reminds that such peaks in greed generally precede an imminent price adjustment.

As crypto has bounced nicely in the second half of March, traders have swung the pendulum back toward mild greed. After showing major fear in late February and early March following two stints of Bitcoin dipping as low as $78K, it appears that this rebound to $88.5K has… pic.twitter.com/WGvmvKSv2X

— Santiment (@santimentfeed) March 25, 2025

Traders had also been holding back earlier in the year when Bitcoin fell to a low of $78,000. But that recent spike back to $88,500 does appear to have changed the general sentiment. Santiment suggests this might be an ideal time for traders to consider taking profits.

Miners Hold Onto Bitcoin Reserves

Bitcoin miners appear to be confident about the future. According to data from CryptoQuant, miners have not been selling much of their Bitcoin recently. In fact, miner reserves now total 1.81 million BTC, which is worth around $159 billion.

Ali Martinez, a crypto analyst, confirmed in a comment on X that no significant selling activity has been recorded among miners over the past 24 hours. This behavior could be a sign that miners are expecting higher prices and prefer to hold onto their earnings for now.

Institutional Interest Grows With ETF Inflows

Institutional investors are also playing a big role in the market’s momentum. On March 25, Bitcoin spot ETFs in the US recorded a total daily inflow of $27 million. BlackRock, one of the largest asset management firms, led the way with $42 million in inflows that day.

Whereas some other funds such as Bitwise and WisdomTree experienced $10 million and $5 million outflows respectively, the robust demand for BlackRock helped in nudging the general trend into positive direction. BlackRock’s net assets in its Bitcoin spot ETF are currently at a little over $50 billion, demonstrating that institutional investors still have a passion for Bitcoin.

Related Reading

Analysts Expect Short-Term Fall Before Rally

Technical analysis is indicating Bitcoin might experience a temporary decline before the next peak. On its 4-hour chart, Bitcoin is having a difficult time surpassing a trendline of resistance, creating what experts refer to as a “double top” formation. The pattern suggests the potential for a price drop towards $85,000.

Meanwhile, the most important support level is at $86,146, according to the 61.80% Fibonacci retracement level. If Bitcoin manages to stay above this level, analysts indicate that the price may rebound and move towards $95,000.

Featured image from Gemini Imagen, chart from TradingView

Source link

Bitcoin

Crusoe Energy sells Bitcoin mining arm to NYDIG, turns focus to AI

Published

14 hours agoon

March 26, 2025By

admin

United States-based Bitcoin miner Crusoe Energy is wrapping up its Bitcoin mining business as it plans to shift focus towards the artificial intelligence sector.

According to a recent press release, Crusoe will sell 425 of its modular data centers— spanning sites across Colorado, North Dakota, Montana, Wyoming, New Mexico, Utah, Texas, and Argentina — with a combined 270 megawatts of power generation capacity, to the New York Digital Investment Group.

The deal also includes its Digital Flare Mitigation business, and around 135 employees will transition to NYDIG.

“Our innovative approach to energy utilized for mining is uniquely complementary to NYDIG’s bitcoin custody, institutional trading and mining businesses, creating a consolidated business that is more valuable than the sum of its parts,” Chase Lochmiller, CEO and co-founder of Crusoe, said regarding the acquisition.

NYDIG, which already has a strong presence in Bitcoin custody, trading, and mining, plans to continue operating and investing in the newly acquired business. In a separate announcement, the firm said the move will help support Bitcoin’s proof-of-work mechanism and contribute to the network’s long-term security.

Founded in 2018, Crusoe Energy was among the first U.S. Bitcoin mining firms to harness wasted natural gas to fuel the high-performance computing needed for both crypto mining and AI workloads.

Now, the company says it’s ready to shift gears and focus on scaling its AI infrastructure.

“We will continue to channel the same energy-first mentality towards scaling AI infrastructure and accelerating the adoption and proliferation of AI in our everyday lives,” Lochmiller added.

Signs of a transition to AI had already emerged in 2024, when Crusoe announced a multibillion-dollar deal with energy tech firm Lancium to build a 200-megawatt AI data center in Abilene, Texas.

Touted as the “first phase” of a larger expansion, the facility was set to tap into up to 1.2 gigawatts of clean power and support GPU clusters designed for AI training and inference at scale.

At the time, Lochmiller called the project a unique opportunity to “sustainably power the future of AI.” Although a specific launch date wasn’t confirmed, the facility was expected to go live in 2025.

Crusoe’s transition to AI comes at a time when the U.S. government is also turning its attention to the sector. Since returning to office in 2025, President Donald Trump has signed an executive order aimed at encouraging American leadership in artificial intelligence.

Source link

Bitcoin

What Next For XRP, DOGE as Bitcoin Price Action Shows Bearish Double Top Formation

Published

16 hours agoon

March 26, 2025By

admin

Bitcoin’s (BTC) recovery looks to have run out of steam with an emergence of a double top bearish reversal pattern on the short duration price charts.

BTC peaked near $87,400 last week, with prices pulling back to around $84,000 on Friday and staging a recovery to above $87,000 before stalling again. This sequence of two prominent peaks at roughly the same level, separated by a trough, hints at a classic double top formation. This bearish pattern often signals the end of an uptrend.

The double top pattern typically requires confirmation through a decisive drop below the “neckline,” the support level between the two peaks, which lies at around $86,000.

Should this occur, BTC could decline toward $75,000 or lower in the short term. However, long-term charts continue to indicate the asset remains in an ascending range.

Traders reacted positively to the U.S. Federal Reserve’s dovish stance on inflation and a cooldown in concerns around the upcoming U.S. tariffs, which have supported gains in the past week.

However, the lack of altcoin correlation with BTC’s recent moves hints that the current price action might lack broad market support, raising the possibility of a “fakeout” rally.

A potential drop in BTC will likely spread over to major tokens, denting recent gains and hopes of a lasting rally. Dogecoin (DOGE), heavily influenced by market sentiment and speculative trading, could see amplified losses if bitcoin’s bearish pattern plays out, while XRP might see reduced momentum, especially given its sensitivity to market sentiment and regulatory developments.

Solana could be particularly sensitive due to its recent volatility and technical indicators — with it coming close to forming a “death cross” (a bearish signal where the 50-day moving average crosses below the 200-day) in mid-April, a pattern that historically leads to deeper losses.

For now, bitcoin hovers in a critical zone. A weekly close below $84,000 could confirm the bearish double top scenario, while a push above $87,500 might invalidate it, potentially reigniting bullish momentum.

Source link

Analyst Unveils Extended XRP Price Target To $44, Reveals When To Take Profits

Would GameStop buying Bitcoin help BTC price hit $200K?

New SEC Chair Paul Atkins Holds $6,000,000 in Crypto-Related Investments – Here’s His Portfolio: Report

We’ve Turned A Generation Of Bitcoiners Into Digital Goldbugs

Solana DEX Raydium’s Pump.fun Alternative Is Going Live ‘Within a Week’

Google Cloud joins Injective as validator, expands Web3 tools

U.S. House Stablecoin Bill Poised to Go Public, Lawmaker Atop Crypto Panel Says

South Korea Urges Google To Block 17 Unregistered Crypto Exchanges

Bitcoin Rally To $95K? Market Greed Suggests It’s Possible

Polymarket faces scrutiny over $7M Ukraine mineral deal bet

Morgan Stanley Warns of Short-Lived Stock Market Rally, Says Equities To Print ‘Durable’ Low Later in the Year

Stablecoins Are The CBDCs

Ethereum Volatility Set to Surge in April as Derive Flags Bearish Sentiment Shift

Crusoe Energy sells Bitcoin mining arm to NYDIG, turns focus to AI

What Next For XRP, DOGE as Bitcoin Price Action Shows Bearish Double Top Formation

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x