Coins

Alabama, Minnesota Advance Bitcoin Reserve Plans With Companion Bills

Published

2 weeks agoon

By

admin

Bitcoin could soon find a place on state balance sheets, with Alabama and Minnesota both pressing ahead with legislative frameworks for state Bitcoin reserves.

In Minnesota, House File 2946, also called the Minnesota Bitcoin Act, introduced by Rep. B. Olson (R-MN) on Tuesday, would allow the state to invest in Bitcoin directly. Its Senate counterpart, SF 2661, was introduced earlier in March.

The identical bills seek to authorize the State Board of Investment to allocate public funds into Bitcoin, marking a direct acknowledgment of the digital asset’s long-term financial potential.

Meanwhile in Alabama, Senate Bill 283, filed this week by Sen. April Weaver (R-AL)is a companion to House Bill 482, introduced earlier in March.

Though neither bill explicitly names Bitcoin, the legislation limits eligibility to digital assets with a market capitalization of at least $750 billion.

Currently, only Bitcoin meets that threshold, effectively making it the sole qualifying asset under the proposed framework.

If the proposals pass, they would take effect on October 1, 2025 in Alabama and January 1, 2026 in Minnesota.

Both states are embracing a legislative tactic commonly used to fast-track approval: introducing identical bills in both chambers.

HF 2946/SF 2661 would allow the state to not only invest in Bitcoin but also accept it for tax payments and government transactions.

The bill amends more than a dozen statutes to incorporate crypto, including tax codes, pension plans, and investment rules.

The Alabama legislation also outlines digital assets must be held directly by the treasurer, by a qualified custodian, or via exchange-traded products, and cannot exceed 10% of any state fund.

U.S. state Bitcoin reserve proposals

The proposals follow a wider trend of state-level efforts across the U.S. to explore the world’s largest crypto as a strategic reserve asset.

While some states, including Wyoming, Montana, and Pennsylvania, have recently paused or withdrawn their Bitcoin reserve plans, the momentum remains strong elsewhere.

South Carolina recently introduced a bill to allow its treasurer to allocate up to 10% of certain state funds into digital assets—starting with Bitcoin.

Oklahoma’s House Bill 1203, which allows for crypto asset reserves, passed overwhelmingly and is pending Senate review. Texas passed Senate Bill 21 to establish a Bitcoin strategic reserve and is awaiting gubernatorial approval.

Arizona and Utah have introduced their own frameworks, although Utah’s reserve language was dropped during revisions.

Bitcoin reserve tracker Bitcoin Law’s data shows that 47 state-level Bitcoin reserve bills have been introduced in 26 states, 41 of which are currently live.

Sentiment around the passing of a state Bitcoin reserve proposal appears to have turned negative, however. Users of MYRIAD, the decentralized prediction market launched by Decrypt’s parent company DASTAN, overwhelmingly predicted that no state would implement such a reserve, in a market that closed at the end of March.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Ethereum fees drop to a 5-year low as transaction volumes lull

Bitcoin Price Holds Steady, But Futures Sentiment Signals Caution

Panama City Approves Bitcoin And Crypto Payments For Taxes, Fees, And Permits

Crypto Trader Says Solana Competitor Starting To Show Bullish Momentum, Updates Outlook on Bitcoin and Ethereum

weakness signals move toward lower support

Now On Sale For $70,000: The World’s First Factory Ready Open-Source Humanoid Robot

Coins

Bitcoin Miners Are Selling More BTC to Make Ends Meet: CryptoQuant

Published

1 day agoon

April 15, 2025By

admin

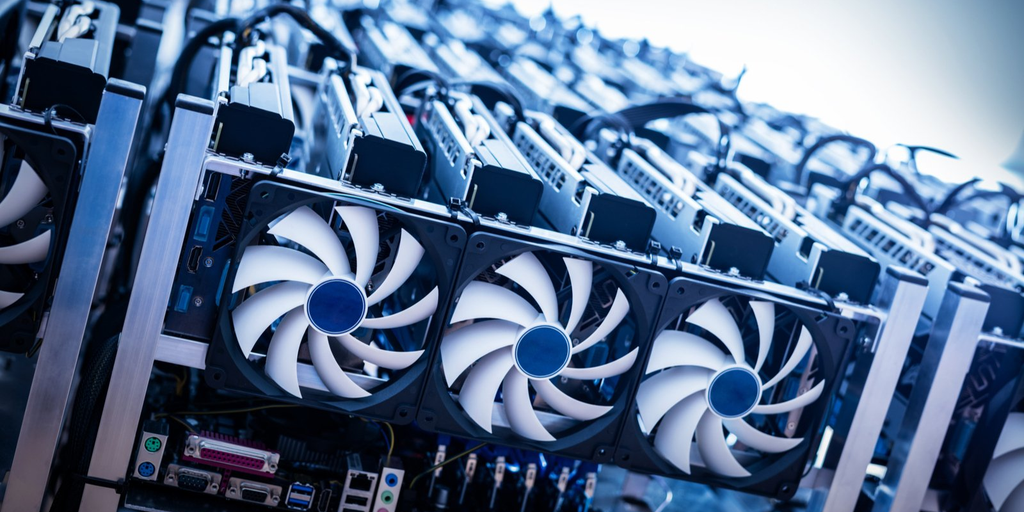

Bitcoin miners continue to feel the crunch, with firms in the space selling more coins than usual to make ends meet.

Data firm CryptoQuant said in a Tuesday report that miners last week stepped up their selling as the price of the biggest cryptocurrency dropped below $80,000.

The firm said that on April 7, miners sold a total of 15,000 BTC—the third-largest daily outflow this year. That’s at least $1.12 billion worth, based on the day’s low price of less than $75,000.

Increased market volatility—in both the stock market and crypto sphere—was mainly caused by President Trump’s erratic announcements on tariffs, leaving traders unsure of how to act.

Miners, which are typically large industrial operations of specialized computers processing transactions and minting new coins for the cryptocurrency’s network, are rewarded with new Bitcoin for their work.

But when the price of the coin takes a hit, they may struggle to cover costs—and be forced to sell more coins to keep their businesses running.

“Miner margins have been pressured by lower prices, but also with depressed transaction fees, and a record-high Bitcoin network hash rate, which implies higher mining costs, sending their average operating margins down from 53% in late January to 33% today,” CryptoQuant said.

The firm added that Bitcoin remains in one of its least bullish phases since November 2022. Bitcoin hit a new high of nearly $109,000 per coin ahead of President Trump’s inauguration, but has since struggled to rise above $90,000.

Bitcoin is now trading for nearly $83,800, a modest jump of just 1% over the past 30 days, CoinGecko shows. However, it’s up almost 9% over the last week after diving to nearly $75,000.

President Trump promised to help the crypto industry—especially Bitcoin miners. And while the new commander-in-chief has approved a national Bitcoin strategic reserve and his SEC has scrapped a number of high-profile lawsuits against crypto firms, mining is a tough business.

Miners at this year’s Mining Disrupt conference told Decrypt that the industry would continue to struggle as the mining difficulty and costs increase.

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Coins

Yen Surge, Soaring Bond Yields Could Threaten Bitcoin as BOJ Weighs Policy Shift

Published

2 days agoon

April 15, 2025By

admin

A rallying yen and the highest Japanese bond yields in 30 years are sending warning signals across global markets, and Bitcoin may not be spared.

This week, Japan’s 30-year bond yield jumped to 2.345%, its highest level since 1994, while the yen rallied to around 153 against the U.S. dollar.

Goldman Sachs analysts led by former Bank of Japan (BOJ) chief economist Akira Otani believe that the bank may be nearing a policy pivot amid the yen’s rally.

If the yen strengthens further toward 130/USD, the central bank could pause rate hikes and slash its inflation outlook for 2026. A weaker yen past 160, meanwhile, could force tighter policy, the analysts said in a Monday report.

Either way, global markets are watching closely, and crypto may be one of the first to feel the heat.

“Major shift” for risk assets

Bitcoin, which thrives in environments of excess liquidity, faces the risk of capital rotation as Japanese yields rise.

Higher fixed-income returns and tightening policy typically draw institutional money away from speculative assets, especially those like Bitcoin that rely heavily on liquidity conditions.

“The macroeconomic trends in Japan, signaled by the current surge in the 30-year bond yield, signal a major shift coming for risk assets,” said Agne Linge, Head of Growth at decentralized bank WeFi told Decrypt.

Beyond institutional rotation, Linge warned of a more structural consequence, “The yen carry trade thrives when investors borrow yen at a cheaper rate… With bond yield soaring, the need to take the yen to invest in other assets is limited.

Other analysts say Bitcoin’s recent stability, trading near $85,600, may not hold if Japan tightens further.

Aravanan Pandian, CEO and Founder of crypto exchage KoinBX, told Decrypt that the BOJ’s historically loose policy has been a key pillar of global risk appetite. That may be changing.

“If the BOJ ends or drastically tightens its yield curve control (YCC), there might be a significant repatriation of capital, particularly from crypto assets,” he said. “Historically, risk-off sentiment is indicated by a stronger yen, which tends to lower speculative exposure across portfolios.”

Yield curve control (YCC) is a policy tool where the central bank targets specific long-term interest rates by buying or selling government bonds.

Pandian also said that a Japanese policy shift could ripple far beyond crypto, and could “trigger a wider rethinking of central bank autonomy and global debt sustainability,” he said.

Still, not everyone sees doom for digital assets. The Federal Reserve is facing mounting pressure to cut rates amid cooling CPI and PPI growth, potentially offsetting Japan’s hawkish tone.

While speaking with Decrypt, Marcin Kazmierczak, co-founder and COO of modular oracle RedStone, pointed to historical precedent from 2016, when the Bank of Japan last pivoted to tightening, as a comparable moment, “Bitcoin initially dropped 15% before rebounding strongly within six months,” he said.

A temporary blip?

While Goldman Sachs analysts have warned that a stronger yen could lead to capital flight from digital assets, Kazmierczak argued that the crypto market is far more robust than in previous cycles.

“Bitcoin’s 21-million-coin supply cap continues to position it uniquely against these shifting monetary policies,” he added, suggesting that the current downturn may be “temporary rather than structural.”

While Japan’s policy path is in focus, U.S. economic signals also weighed on sentiment. Bitcoin saw an uptick on Monday, as investors digested rising inflation expectations and recession risks.

A Fed survey showed consumers expect 3.6% inflation over the next year, with 44% anticipating higher unemployment, marking the highest anxiety levels since April 2020.

As of now, Bitcoin is trading at around $85,210, up 0.6% over the past 24 hours, and 8.2% rise in the past week, per data from CoinGecko.

Predictors on MYRIAD, the decentralized prediction market launched by Decrypt’s parent company DASTAN, appeared cautiously optimistic Tuesday, with 55% expecting Bitcoin to hold $85,000 through Wednesday.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Coins

Professor Coin: What’s Driving Cryptocurrency Adoption Around the World

Published

4 days agoon

April 13, 2025By

admin

Professor Andrew Urquhart is Professor of Finance and Financial Technology and Head of the Department of Finance at Birmingham Business School (BBS).

This is the fifth instalment of the Professor Coin column, in which I bring important insights from published academic literature on cryptocurrencies to the Decrypt readership. In this article, we’ll investigate cryptocurrency adoption.

Cryptocurrencies are clearly growing in terms of size, scale and types of offerings, which altogether indicates the growing importance and influence they have on the traditional financial system.

They may have begun life being traded by only a select few computer programmers, but since the introduction of Bitcoin futures in 2017 and the subsequent introduction of other derivative products, culminating in the Bitcoin spot ETF launch in January 2024, more investors are taking notice of this innovative asset class.

At the core of the fourth industrial revolution is artificial intelligence, information communication and technology, the internet of things and blockchains—and PwC predicts that blockchains will boost global GDP by $1.76 trillion by 2030.

China places blockchain as one of its top five priorities, while other countries, including Germany, Japan, the UK and France, all see the potential benefits of over $50 billion. The increased investor interest in recent times may have changed the user base forever, and this adoption may differ across industries, territories, regulatory domains and political realms. In this column, I investigate what is driving cryptocurrency adoption across the globe.

Some recent work examines the relationship between certain macro-national developmental indicators and cryptocurrency deployment across 137 countries, and interestingly finds that the countries with higher education, human development, democracy, regulatory quality and gross domestic product (GDP) have higher adoption of cryptocurrencies.

However, countries with less economic freedom and more corruption have experienced less adoption, indicating that more open and free nation states have experienced adoption. This suggests that it isn’t corrupt, uneducated states that are adopting cryptocurrencies, but more open, democratic and free states.

Trust, but verify

Now that we know the economic and state variables affect adoption across different territories, but what about trust? Trust is a social construct and a belief, which fosters economic growth, financial development and financial inclusion.

Trust has fallen in recent decades—and as European Central Bank President Christine Lagarde remarked, “In this age of diminished trust, it is the financial sector that takes last place in opinion surveys.”

Work by Jalan et al (2023) supports the work by Bhimani et al (2022) in showing that countries with higher trust levels have a higher interest in, and adoption of, cryptocurrencies, confirming the importance of trust in the growth of financial markets.

In a more detailed study, Saeedi and Al-Fattal (2025) explore which aspects of trust are important for cryptocurrency adoption and they find that females place more weight on regulation trust than males, while social trust is more important for older participants.

DeFi adoption

What about the distinction between the adoption of cryptocurrencies and decentralized finance (DeFi)? Recent work by Nguyen and Nguyen (2024) suggests that high cryptocurrency adoption can arise from the combination of high population, high inflation, low social connectedness, democracy, and uncertainty avoidance, while high human development, high population, and high financial development seems to be the dominant configurations in explaining a country’s DeFi adoption.

But what impact does adoption, and different types of adoption, have on cryptocurrencies? Recent work by Rzayev et al (2025) document that early adopters of cryptocurrencies drive cryptocurrency returns and improve price efficiency, while late adopters contribute to noisier prices and efficiencies. Therefore, early adopters are key drivers for any cryptocurrencies.

Therefore, the academic literature suggests that adoption of cryptocurrencies varies widely across the world, but there are key economic and state indicators that explain adoption. Further, the type of adoption affects the performance of cryptocurrencies, indicating that not all attention is created equally.

For more information, see:

Bhimani, A., Hausken, K., Arif, S. (2022). Do national development factors affect cryptocurrency adoption? Technological Forecasting and Social Change, 181, 121739.

Jalan, A., Matkovskyy, R., Urquhart, A., Yarovaya, L. (2023). The role of interpersonal trust in cryptocurrency adoption. Journal of International Financial Markets, Institutions and Money, 83, 101715.

Nguyen, L. T. M., Nguyen, P. T. (2024). Determinants of cryptocurrency and decentralized finance adoption – A configurational exploration. Technological Forecasting and Social Chance, 201, 123244.

Rzayev, K., Sakkas, A., Urquhart, A. (2025). An adoption model of cryptocurrencies. European Journal of Operational Research, 323, 253-266.

Saeedi, A., Al-Fattal, A. (2025). Examining trust in cryptocurrency investment: Insights form the structural equation modelling. Technological Forecasting and Social Change, 210, 123882.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Republican States Pause Lawsuit Against SEC Over Crypto Authority

Ethereum fees drop to a 5-year low as transaction volumes lull

Bitcoin Price Holds Steady, But Futures Sentiment Signals Caution

Panama City Approves Bitcoin And Crypto Payments For Taxes, Fees, And Permits

Crypto Trader Says Solana Competitor Starting To Show Bullish Momentum, Updates Outlook on Bitcoin and Ethereum

weakness signals move toward lower support

Now On Sale For $70,000: The World’s First Factory Ready Open-Source Humanoid Robot

What Next for ETH as Traders Swap $86M into Solana DeFi protocols ?

Why Did Bitcoin Price (BTC) Fall on Wednesday Afternoon

Solana price is up 36% from its crypto market crash lows — Is $180 SOL the next stop?

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon