Canada

Kraken Secures Restricted Dealer Status in Canada Amid 'Turning Point' for Crypto in the Country

Published

2 weeks agoon

By

admin

Crypto exchange Kraken has registered as a restricted dealer in Canada, allowing the exchange to continue offering crypto trading services to Canadian users under the country’s evolving regulatory framework.

The registration, announced on Tuesday, comes after a multi-year process that required exchanges to meet higher standards for investor protection and governance. Kraken said it worked closely with Canadian regulators during this pre-registration phase, upgrading its compliance systems and internal controls to meet expectations set by the Ontario Securities Commission (OSC).

To lead its Canadian expansion, Kraken named Cynthia Del Pozo as general manager for North America. Del Pozo, a fintech and operations veteran, will oversee strategy, regulatory engagement and business development across the region.

“Canada is at a turning point for crypto adoption,” said Del Pozo in a statement, pointing to growing interest from both retail and institutional investors. A recent survey cited by Kraken found that 30% of Canadian investors currently hold crypto assets.

Kraken also announced it will offer free Interac e-Transfer deposits for Canadian users, a move aimed at reducing friction for newcomers to the platform. The exchange claims it doubled its team and user base in Canada over the last two years and now manages over $2 billion CAD in client assets.

Mayur Gupta, Kraken’s chief marketing officer and general manager of growth, will be speaking at CoinDesk’s Consensus 2025 in Toronto on May 14-15.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Source link

You may like

Bitcoin Price Holds Steady, But Futures Sentiment Signals Caution

Panama City Approves Bitcoin And Crypto Payments For Taxes, Fees, And Permits

Crypto Trader Says Solana Competitor Starting To Show Bullish Momentum, Updates Outlook on Bitcoin and Ethereum

weakness signals move toward lower support

Now On Sale For $70,000: The World’s First Factory Ready Open-Source Humanoid Robot

What Next for ETH as Traders Swap $86M into Solana DeFi protocols ?

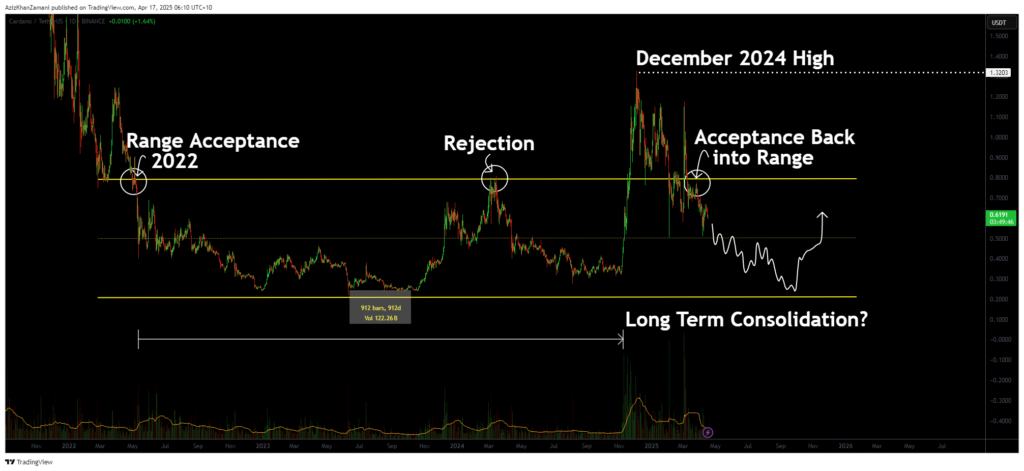

Cardano (ADA) has shown major structural developments as it re-enters a multi-year trading range. The recent price action suggests acceptance back within this long-term structure, with indicators pointing toward a potential move to the lower support region.

Cardano (ADA) has re-entered a significant trading range that has contained its price action for over three years. After a breakout in late 2024 that lacked volume strength, the asset has failed to sustain its highs and is now showing signs of weakness. For traders, this shift back into the range carries major implications for ADA’s medium- to long-term price trajectory.

Key points covered

- ADA has closed multiple candles back within a multi-year trading range, signaling true acceptance

- The 2024 breakout lacked volume confirmation, indicating a potential climactic top

- A move towards the lower support region is increasingly likely as ADA seeks true market value

After more than 912 days of trading within a well-defined range since 2022, ADA finally broke out in December 2024, setting a new high. However, this breakout lacked the critical component of follow-through volume. A sharp drop in volume immediately after the breakout signaled weakening momentum, suggesting a climactic top rather than a sustainable bullish trend.

Price action has since fallen back below the range high and closed multiple candles beneath it, a clear sign of acceptance back within the range. This is significant from a structural standpoint. Rather than consolidating above and building new support, ADA is now signaling a potential return to its value zone, likely toward the lower bound of the long-term range.

The volume profile reinforces this theory. The expansion to the December highs was not matched by sustained buyer interest. Instead, volume sharply tapered off, indicating that the breakout may have been speculative and not backed by conviction. In such cases, price often returns to equilibrium levels to reassess fair market value.

What to expect in the coming price action

With ADA now firmly back inside the long-term range, a slow grind toward the lower support region is increasingly probable. Traders should exercise patience, avoiding premature entries until there is either a confirmed trend reversal or a test of the lower boundary. The real opportunity may lie in ADA’s eventual consolidation and structure near the bottom of this historical range.

Source link

Bitcoin

Bitcoin slips another 4% after Trump targets Canadian steel, aluminum with tariffs

Published

1 month agoon

March 11, 2025By

admin

President Donald Trump spooked Bitcoin and other markets after announcing a tariff increase on Canadian steel and aluminum from 25% to 50%, citing Ontario’s 25% tariff on U.S. electricity.

According to Trump’s Truth Social post, the new tariffs will take effect on March 12. Trump also called on Canada to remove up to 390% dairy tariffs and warned of higher tariffs on Canadian cars by April 2.

In his statement, President Trump criticized Canada’s longstanding tariffs on U.S. dairy products, which range from 250% to 390%, labeling them as “outrageous.” He further threatened to declare a national emergency concerning electricity to counter what he described as an “abusive threat” from Canada.

‘Egregious’ tariffs

Additionally, Trump warned that if Canada does not eliminate other “egregious” tariffs, the U.S. will substantially increase tariffs on Canadian automobile imports starting April 2—a move he claims would effectively “shut down the automobile manufacturing business in Canada.”

Trump also said that “the only thing that makes sense is for Canada to become our cherished Fifty-First State. This would make all tariffs, and everything else, totally disappear.”

Markets reacted to the announcement. Bitcoin (BTC) fell 4.2%, dipping below $80,000 while The Dow Jones dropped nearly 600 points. Investors responded to both the trade tensions and the administration’s statement that no new Bitcoin purchases were planned for the national strategic reserve.

Bitcoin has rebounded to above $81,000 at the time of writing.

The tariff dispute follows Trump’s tariffs on Canadian and Mexican goods. Canada and Mexico have pushed back, citing trade agreement violations.

Source link

Canada

Polymarket Traders Bet on Canadian Tariff Cuts After Lutnick Hints at Negotiations

Published

1 month agoon

March 5, 2025By

admin

There’s a 70% chance that the trade war between Canada and the U.S. will be over by May, according to odds on a Polymarket contract on the topic, as Commerce Secretary Howard Lutnick told Fox Business that U.S. President Donald Trump was open to negotiation.

On Tuesday morning, Canada and Mexico faced the implementation of 25% tariffs on all products entering the U.S., with President Trump citing their failure to curb fentanyl trafficking and illegal immigration as a national security threat.

But later in the day, Lutnick appeared to offer a potential avenue for negotiation, with odds rising 20% in a few hours on Polymarket.

I think [Trump is] going to work something out with them,” Lutnick said on Fox Business. “It’s not going to be a pause, none of that pause stuff, but I think he’s going to figure out: you do more, and I’ll meet you in the middle someway and we’re going to probably announce that tomorrow.”

Lutnick’s comments also appeared to calm crypto markets on ‘Turnaround Tuesday’ with bitcoin (BTC) up 1.5% and trading comfortably above $87,000, according to CoinDesk Indices data.

The CoinDesk 20 (CD20), a measure of the performance of the world’s largest digital assets, is up 2% on the news.

Source link

Bitcoin Price Holds Steady, But Futures Sentiment Signals Caution

Panama City Approves Bitcoin And Crypto Payments For Taxes, Fees, And Permits

Crypto Trader Says Solana Competitor Starting To Show Bullish Momentum, Updates Outlook on Bitcoin and Ethereum

weakness signals move toward lower support

Now On Sale For $70,000: The World’s First Factory Ready Open-Source Humanoid Robot

What Next for ETH as Traders Swap $86M into Solana DeFi protocols ?

Why Did Bitcoin Price (BTC) Fall on Wednesday Afternoon

Solana price is up 36% from its crypto market crash lows — Is $180 SOL the next stop?

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon