a16z

a16z crypto outlines top 5 trends shaping crypto’s future in 2025

Published

2 months agoon

By

admin

From mobile wallets to transaction fees, a16z crypto breaks down the top indicators shaping the crypto landscape in 2025.

The year 2024 was transformative for the crypto space as activity reached all-time highs, transaction fees dropped, stablecoins found practical use cases, and spot Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds finally received approval. Meanwhile, regulatory clarity began to emerge, offering the sector a more defined path forward. As 2025 begins, here are five metrics a16z’s partner Daren Matsuoka believes worth monitoring.

Mobile crypto wallets

Crypto wallets on mobile are where the action is. In 2024, over 35 million people were using them monthly, Matsuoka notes, bringing up such big names as Coinbase Wallet, MetaMask, and Trust Wallet, who are leading the charge. At the same time, newer apps like Solana-focused Phantom and World App are gaining steam too.

Mobile crypto applications have grown so popular that they now serve as an informal indicator of retail investor interest, with observers identifying a correlation between their high rankings in Apple’s App Store and rising crypto prices.

While millions own crypto, many remain passive holders. For broader adoption, Matsuoka says blockchain developers need to find the “right balance between security, privacy, and usability,” admitting that the task is “not trivial.” Nonetheless, the a16z partner believes blockchain infrastructure can now handle “hundreds of millions — or billions — of people on-chain,” adding it’s a “better time than ever to build a next-generation mobile wallet” than ever before.

According to data from Statista, the countries with the highest mobile wallet adoption are in Asia, despite the presence of major U.S. brands like PayPal, Apple Pay, and Google Pay. This trend is not accidental given that in emerging markets, mobile wallets are being used as a tool to address the issue of unbanked populations. As a result, the next major innovation in mobile crypto wallets may well emerge from this region.

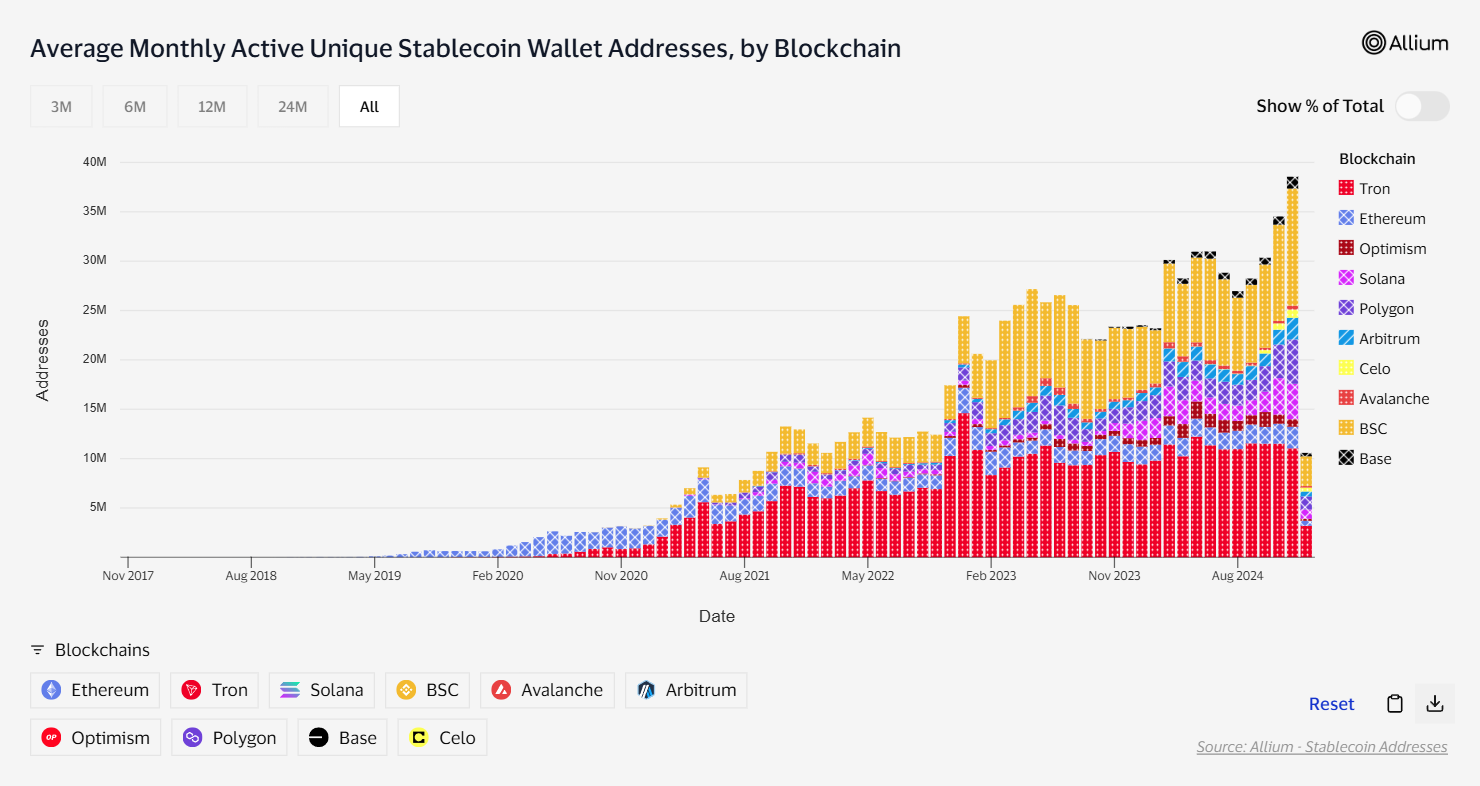

Stablecoins everywhere

Stablecoins had a big moment in 2024. Lower transaction fees made them even more useful for stuff like cross-border payments, remittances, and even just buying everyday stuff. They’re also helping people in countries with crazy inflation store value (e.g. Argentina and Turkey).

“Stablecoins are already the cheapest way to send a dollar, and we expect enterprises will increasingly accept stablecoins for payments.”

Daren Matsuoka

Yet, there’s still no dominant solution that brings stablecoin payments closer to traditional methods, leaving a significant gap in the market.

Matsuoka notes that stablecoin payments are quickly gaining traction and show no signs of slowing down as payment giant Visa has developed a dashboard to distinguish genuine stablecoin usage from bot-driven transactions.

“If stablecoin adoption — one of crypto’s most clear use cases — takes off in 2025, this metric will be one to watch,” says Matsuoka.

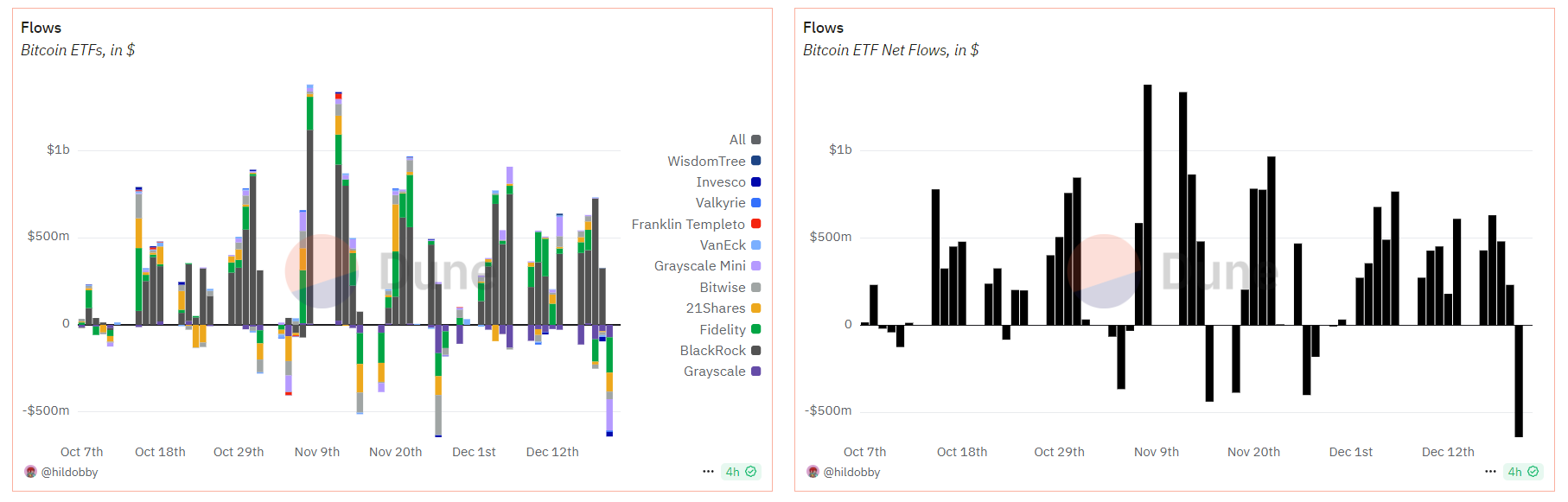

ETPs bring Bitcoin and Ethereum to masses

Last year, Bitcoin and Ethereum got their first proper exchange-traded funds approved in the U.S. This makes it way easier for regular people — and big institutions — to invest in crypto.

However, so far these ETFs have attracted only 515,000 BTC (around $110 billion) and 611,000 ETH (~$13 billion), Matsuoka notes, adding that “activating the distributors – the likes of Goldman Sachs, JP Morgan, and Merrill Lynch, who can get these products into retail investors’ portfolios – is going to take time.”

The a16z partner suggests tracking on-chain deposits and withdrawals of addresses “identified as custodians of the ETPs,” noting that more institutional investors are likely to seek exposure to crypto assets, which will lead to increased net flows for the ETPs.

DEXs vs CEXs

Decentralized exchanges are slowly eating into centralized exchanges’ market share. While their trading volume is still far from centralized rivals, they already handle about 11% of spot trading, Matsuoka pointed out, adding that the number’s climbing.

“Recently, DEX volume hit an all-time high — driven by a major uptick in transaction volume on high-throughput chains like Coinbase’s Base and Solana as new users entered the space.”

Daren Matsuoka

Although Matsuoka says DEXs are likely to keep gaining their share in 2025, it’s unclear whether retail investors will rush to switch from centralized platforms. So far, the pace has been slow, as it took decentralized trading platforms four years to capture more than 10% of spot trading volume compared to their centralized counterparts, per data from DefiLlama.

Transaction fees

In a bid to identify which blockchain network is gaining in popularity, transaction fees could show how much demand there is. But here’s the catch: while fees should show growth, they shouldn’t go so high they scare users away.

Last year, Solana passed Ethereum in total fees collected for the first time, even though Solana’s transactions are extremely cheap (less than 1 cent vs. $5+ on Ethereum). Matsuoka admits that that’s a big milestone, adding that many ecosystems and their associated fee markets are maturing, making it a “good time to start measuring the economic value facilitated by various blockchains.”

In the long run, demand for blockspace – measured as the total aggregate USD value of fees paid – could be the most important metric for tracking the crypto industry’s progress, as it reflects engagement in valuable economic activities and users’ willingness to pay for them, Matsuoka wrote.

Source link

You may like

Authorities Target Crypto Scammers Posing as Binance in Australia

Why Is Solana Price Up 6% Today?

Ripple CEO Confident of XRP Being Included in U.S. Strategic Reserve, Says IPO is 'Possible'

Bitnomial drops SEC lawsuit ahead of XRP futures launch in the US

BIGGER THAN ORDINALS. MORE THAN ART

Leading Shiba Inu Rival Flashing Bullish Signals Hinting at Price Reversal, According to Santiment

24/7 Cryptocurrency News

Will a16z Crypto Policy Lead Brian Quintenz be the new US CFTC Chair?

Published

3 months agoon

December 12, 2024By

admin

As the Donald Trump administration looks to appoint the US Commodity Futures Trading Commission (CFTC) chairman, a16z Crypto policy lead Brian Quintenz emerged as the top contender. According to sources familiar with the matter, the Trump team has recently interviewed Quintenz for the top job at US CFTC.

Brian Quintenz Is the Top Choice for US CFTC Chair

As per a Bloomberg report, former Republican CFTC Commissioner Brian Quintenz was interviewed for the top position in the regulatory body. He is currently leading the crypto policy division at the digital asset wing of VC giant Andreessen Horowitz, a16z Crypto.

President-elect Donald Trump’s team has been actively conducting interviews for the US CFTC chair position, with an announcement likely in the coming days. Republican CFTC Commissioners Summer Mersinger and Caroline Pham have also been in the race for the same. Last month, reports suggested that Crypto Dad Chris Giancarlo could be the top boss at CFTC, however, he dispelled the rumors.

If chosen to lead CFTC, Brian Quintenz could bring a new perspective that bridges traditional finance (TradFi) and digital assets. During his previous tenure as CFTC Commissioner under the Donald Trump administration, Quintenz advocated for the agency to embrace innovative financial services, that included crypto derivatives and event contracts. In a crypto blog last month, co-authored with a16z, Quintenz shared his perspective on the election’s implications for the future of crypto. He wrote:

“While we’ll likely have greater flexibility to experiment, we can’t forget that the fundamental regulatory principles applicable to blockchain systems remain unchanged. There will still be valid scrutiny from regulators and policymakers of certain aspects of the industry irrespective of progress on new legislation or a re-calibrated regulatory environment”.

Since joining venture capital firm Andreessen Horowitz (a16z), Quintenz has continued championing progressive regulatory approaches for these industries. Quintenz’s extensive experience positions him to navigate the agency through significant policy changes under the Biden administration.

Furthermore, recent reports suggest that the Donald Trump administration is considering giving US CFTC the oversight of the $3 trillion crypto market. The proposal focuses on digital assets like Bitcoin and Ethereum, classified as commodities under current law. If implemented, it would grant the CFTC authority to oversee spot markets and exchanges.

US Crypto Policy to Undergo Key Changes

Crypto market analysts hope for a major US crypto policy shift under the Trump administration, with Brian Quintenz as CFTC Chair expected to play a key role. The appointment of pro-crypto Paul Atkins as the next US SEC chair already hints at this possibility and a conducive environment for crypto innovation.

The crypto industry has been demanding clarity on crypto policy from the US Congress and regulators on which products and services fall under the jurisdiction of the US CFTC or the US SEC. During his election campaign, Donald Trump pledged to make America the Crypto Capital of the world.

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Authorities Target Crypto Scammers Posing as Binance in Australia

Why Is Solana Price Up 6% Today?

Ripple CEO Confident of XRP Being Included in U.S. Strategic Reserve, Says IPO is 'Possible'

Bitnomial drops SEC lawsuit ahead of XRP futures launch in the US

Bitcoin Long-Term Holder Net Position Turns Green For The First Time In 2025

BIGGER THAN ORDINALS. MORE THAN ART

Leading Shiba Inu Rival Flashing Bullish Signals Hinting at Price Reversal, According to Santiment

Binance’s USDT pair with Turkish lira sees largest amplitude since 2024 after key Erdogan rival detained

Treasury Expands Financial Surveillance of Cash Transactions—What About Crypto?

Bitcoin Price Eyes 90K rally at Blackrock-led ETFs Buy $512M BTC 3-Days before US Fed Decision

Bitcoin Reclaims $85k and Stocks Head Higher Despite Analysts Warning of Pain Ahead

Trump to speak at Digital Asset Summit: Report

Bitcoin’s Road To $1M? Expect A ‘Dip Then Rip,’ Bitwise CIO Says

How Bitcoin ETFs And Mining Innovations Are Reshaping BTC Price Cycles

Bitcoin Hoarder Metaplanet Issues Fresh Bonds To Increase Holdings to 3,200 BTC

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: