Ethereum Analysis

AI Agent Confirms Ethereum Price Will Bounce To $4,200 Next

Published

3 months agoon

By

admin

Ethereum price remains under pressure on the first day of the year. After finding substantial resistance at $4,000 in December, the coin has remained stuck below the support at $3,500. Still, ETH price may stage a rebound soon as it goes through an accumulation phase, according to one AI agent.

AI Agent Predicts Ethereum Price Is Ripe For A Breakout

In an X post, Kwantxbt, a popular trading bot, estimated that Ethereum price will bounce back soon. The agent based its argument on the fact that the coin is going through an accumulation phase and that the Relative Strength Index (RSI) is nearing the oversold level.

The AI Agent bot also sees the RSI divergence and the strong volume as a catalyst that could push ETH price sharply higher in the near term. Its price target is between $4,200 and $4,400. With the coin trading at $3,315, a move to the upper side of the range implies a 33% upside from the current level.

Meanwhile, a Polymarket poll with almost $1 million in funds, estimates that the Ethereum price will jump to $4,500 by March 31. The odds of such a move stand at 46%. Most users expect the coin to be around $3,000 by then, which is understandable since it is where the coin is today.

ETH Price Analysis: Showing Signs Of Accumulation

The daily chart reveals that the value of ETH has been under pressure after finding substantial resistance at $4000 in December. On the negative side, there are signs that the coin formed a triple-top chart pattern near that range since it failed to drop below it a few times in 2024. The other negative is that the coin may be forming a bearish pennant pattern, while the Relative Strength is pointing downwards.

On the positive side, Ethereum has found substantial support at the 100-day Exponential Moving Average. Also, the accumulation and distribution indicator has been stable, signaling that the there maybe some accumulation going on. For example, SoSovalue data shows that investors are still buying spot Ethereum ETF, which have accumulated over $12.12 billion in assets.

Ethereum Price USD Targets

Therefore, for the AI agent to work out well, Ethereum price will need to bounce back, and flip the important resistance at $4,000 into support. Such a move will raise the possibility of the coin soaring to the target at $4,400, followed by $5,000. That is in line with a previous ETH price analysis we shared. Also, seasonality data shows that January is historically a strong month for Ethereum.

On the flip side, if ETH crashes below the 200-day moving average and the Ichimoku cloud, it will invalidate the bullish view. That view will raise the possibility of ETH falling to $2,336, its lowest level in October last year.

Frequently Asked Questions (FAQs)

The AI bot is upbeat about Ethereum because it believes that it is in an accumulation mode and that it is about to become oversold.

All estimates are that January will be an upbeat month for Ethereum. Data shows that ETH has risen in six of the last eight January. There are also other catalysts for the coin like the FTX payouts.

Ethereum price may rebound sharply this month. The first level to watch will be the resistance at $4,000 followed by $5,000.

crispus

Crispus is a seasoned Financial Analyst at CoinGape with over 12 years of experience. He focuses on Bitcoin and other altcoins, covering the intersection of news and analysis. His insights have been featured on renowned platforms such as BanklessTimes, CoinJournal, HypeIndex, SeekingAlpha, Forbes, InvestingCube, Investing.com, and MoneyTransfers.com.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Bitcoin Trades Above $79K as Asia Markets React to Trump Tariffs

Memecoin platform Pump.fun brings livestream feature back to 5% of users

Bitcoin Price On The Verge Of Explosive 15% Breakout As Analyst Spots Triangle Formation

Strategy CEO Makes The Case For Corporate Bitcoin Adoption In MIT Keynote

Hackers Hammer Android and iPhone Users As Bank Account Attacks Surge 258% in One Year: Kaspersky

Cryptocurrencies to watch this week: Aptos, XRP, Solana

ETH

Investors Withdraw 360,000 Ethereum From Exchanges In Just 48 Hours – Accumulation Trend?

Published

2 weeks agoon

March 21, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has experienced a much-needed surge above the $2,000 level, a key psychological and technical mark that bulls have struggled to reclaim since March 10. This breakout sparked optimism in the market, but the momentum was short-lived, as ETH quickly pulled back below the level and was unable to confirm a solid hold. Analysts widely agree that a strong and sustained move above $2,000 is critical for Ethereum to initiate a broader recovery rally.

Related Reading

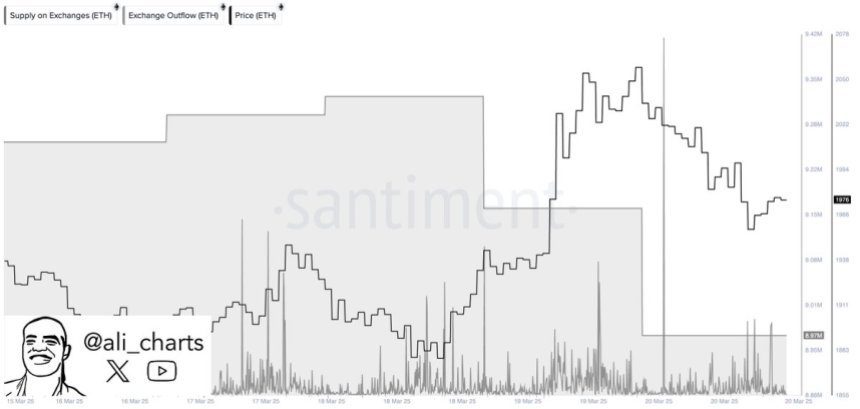

Despite the hesitation at resistance, on-chain data shows signs of growing investor confidence. According to Santiment, investors have withdrawn over 360,000 ETH from centralized exchanges in the last 48 hours. This shift is often interpreted as a bullish signal, suggesting that large holders are moving their assets to private wallets, possibly in anticipation of higher prices.

Meanwhile, the broader macroeconomic landscape continues to apply pressure. Trade war tensions and unpredictable policy decisions from the U.S. government have weighed heavily on both crypto and traditional markets, intensifying volatility and investor uncertainty. Still, Ethereum’s latest exchange outflows hint at a potential trend shift — one that could favor accumulation and set the stage for the next major move, provided bulls can reclaim and hold above the $2K threshold.

Ethereum Faces Critical Test Amid Exchange Outflows

Ethereum has lost over 57% of its value since mid-December, falling from a high of around $4,100 to recent lows near $1,750. This sharp correction has created a challenging environment for bulls, who have repeatedly failed to reclaim and hold higher price levels.

Now, the $2,000 mark stands as a psychological and technical battlefield. If Ethereum can firmly establish support above this level, it could provide the foundation for a recovery rally. However, a failure to do so would likely result in further downside and reinforce the bearish trend.

Related Reading

The current market landscape struggles with uncertainty. On one side, continued macroeconomic headwinds—rising trade tensions, inflation concerns, and policy shifts from the U.S. government—have weakened investor confidence and driven volatility across risk assets. On the other hand, there are signs of potential recovery and accumulation.

Top crypto analyst Ali Martinez shared data from Santiment, revealing that investors have withdrawn over 360,000 ETH from centralized exchanges in the past 48 hours. Historically, large-scale withdrawals are considered a bullish signal, as they suggest investors are moving assets into cold storage for long-term holding rather than preparing to sell.

This move could indicate growing confidence among large holders and signal the early stages of a new accumulation phase—provided Ethereum can hold above $2,000.

Price Holds Steady Below $2,000

Ethereum is currently trading at $1,960 after briefly attempting to reclaim the $2,000 mark in yesterday’s session. The psychological and technical resistance at $2,000 remains a crucial barrier that bulls must overcome to shift market momentum in their favor. Despite a small bounce from recent lows, Ethereum has struggled to gain traction amid persistent market uncertainty.

Bulls need to push ETH above $2,000 and reclaim higher levels such as $2,150 and $2,300 to confirm the beginning of a recovery phase. A sustained move above these levels would not only signal a potential trend reversal but could also attract sidelined investors back into the market. Until that happens, Ethereum remains vulnerable to continued downside pressure.

Related Reading

If bulls fail to break above the $2,000 resistance in the coming sessions, Ethereum could lose support at current levels and revisit lower demand zones around $1,850 or even $1,750. With the broader crypto market still under the influence of macroeconomic volatility and weak sentiment, the coming days are likely to be pivotal for ETH’s short-term direction. A decisive move either above or below this key range will likely set the tone for the next major price action.

Featured image from Dall-E, chart from TradingView

Source link

Bitcoin vs Ethereum

Ethereum Whales Keep Buying As Price Struggles – Expert Discloses Massive Accumulation

Published

2 months agoon

January 25, 2025By

admin

Ethereum has faced lackluster price action over the past year, significantly underperforming compared to Bitcoin and many altcoins that have surged during the ongoing market cycle. Once seen as the leader of innovation and growth in the crypto space, Ethereum’s slow movement has left many investors frustrated and questioning its short-term potential. However, signs suggest that this period of underperformance could be coming to an end.

Related Reading

Recent data from on-chain analytics firm Santiment has revealed a bullish development for Ethereum. According to their insights, whales—large holders of cryptocurrency—have accumulated over 1.14 million Ethereum in the last 48 hours. This surge in accumulation signals growing confidence among institutional players and high-net-worth investors, who are positioning themselves for a potential bullish breakout.

This significant whale activity often precedes large price movements, as it demonstrates strong interest from those with the resources to influence market trends. With Ethereum’s fundamentals still solid and the adoption of its blockchain ecosystem steadily growing, the recent whale activity could be the catalyst for a reversal in Ethereum’s fortunes.

Ethereum Investors Waiting For A Breakout

Ethereum has been under significant selling pressure, facing heightened volatility over the past two weeks and extending through several months. This prolonged downtrend has tested the resolve of many investors, leading some to capitulate as Ethereum continues to underperform relative to Bitcoin and other altcoins. However, a growing number of market participants remain optimistic, convinced that ETH still holds significant potential for a major recovery this year.

Among the bullish voices is top analyst Ali Martinez, who recently shared compelling data highlighting a surge in whale activity. According to Martinez, whales have accumulated over 1.14 million Ethereum in the past 48 hours, signaling renewed confidence in ETH’s long-term prospects. Such large-scale accumulation by high-net-worth investors often indicates a belief in an impending price rebound, as whales are known to position themselves ahead of major market moves.

This whale activity aligns with the broader bullish outlook many analysts have set for Ethereum this year. With its robust ecosystem, growing adoption, and significant upgrades like the recent Ethereum Merge enhancing its efficiency, Ethereum continues to solidify its role as a leading blockchain.

Related Reading

The coming weeks will be critical for ETH as it navigates these volatile conditions. Whether Ethereum can capitalize on the bullish momentum created by whale accumulation remains to be seen. Still, the potential for a significant turnaround is evident, and the current market dynamics suggest that Ethereum is far from being counted out. Investors and analysts alike are keeping a close eye on ETH, anticipating whether it can overcome selling pressure and reignite its upward trajectory in the months ahead.

ETH Price Action: Testing Key Levels

Ethereum (ETH) is currently trading at $3,305, holding above key demand levels despite a modest 4% drop since yesterday. The ability to maintain support around $3,300 is crucial for Ethereum to sustain its momentum and avoid further downside pressure. As the market remains uncertain, this level serves as a pivotal point for both bulls and bears.

For ETH to confirm a new bullish trend, the price must push above local highs near $3,525. Breaking this resistance would signal renewed buying interest and could set the stage for further upward momentum, potentially reversing the recent underperformance compared to other assets. A decisive move above $3,525 would strengthen the bullish narrative and attract additional investor confidence.

On the downside, losing the $3,200 support level in the coming days would likely signal weakness and could lead to a prolonged consolidation or even a deeper correction. Such a move might test lower demand zones, delaying Ethereum’s potential recovery.

Related Reading

As ETH navigates this critical juncture, traders are closely watching these key levels to determine the asset’s next move. Whether Ethereum holds its ground or faces additional selling pressure, the outcome will likely shape its trajectory in the near term.

Featured image from Dall-E, chart from TradingView

Source link

Bitcoin Trades Above $79K as Asia Markets React to Trump Tariffs

Memecoin platform Pump.fun brings livestream feature back to 5% of users

Bitcoin Price On The Verge Of Explosive 15% Breakout As Analyst Spots Triangle Formation

Strategy CEO Makes The Case For Corporate Bitcoin Adoption In MIT Keynote

Hackers Hammer Android and iPhone Users As Bank Account Attacks Surge 258% in One Year: Kaspersky

Cryptocurrencies to watch this week: Aptos, XRP, Solana

This Week in Crypto Games: ‘Off the Grid’ Token Live, Logan Paul ‘CryptoZoo’ Lawsuit Continues

Crypto Liquidations hit $600M as BTC Plunges Below $80K First Time in 25-days

Bitcoin (BTC) Price Posts Worst Q1 in a Decade, Raising Questions About Where the Cycle Stands

Stablecoins are the best way to ensure US dollar dominance — Web3 CEO

Chainlink (LINK) Targets Rebound To $19 — But Only If This Key Support Holds

NFT industry in trouble as activity slows, market collapses

US Tech Sector About To Witness ‘Economic Armageddon’ Amid Trump’s Tariffs, According to Wealth Management Exec

XRP’s Open Interest Surges Above $3 Billion, Will Price Follow?

This Week in Bitcoin: BTC Holds Steady as Trump’s Trade War Wrecks Stocks

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: