Markets

AI Agent Tokens Skyrocket as Franklin Templeton Highlights ‘Significant Promise’

Published

6 hours agoon

By

admin

Artificial intelligence cryptocurrencies are still making sizable gains—just as asset manager Franklin Templeton highlights how big AI and crypto could be together.

Franklin Templeton said in a Tuesday note that how AI agents interact on blockchains is “very exciting.” And it noted the current buzz surrounding AI16z and the Virtuals Protocol—two tokens that have made some of the biggest gains over the past 24 hours among the top 100 coins ranked by market cap.

AI16z is an investment DAO run by AI agents. CoinGecko data shows that over the past day, its native token has risen by over 18%—after slowing down last week—and is now trading hands for $1.30. It briefly fell out of the top 100 on Monday, but has recovered and bounced back into such valuable company.

The world’s biggest crypto exchange, Binance, announced earlier this month that it would launch perpetual futures contracts trading for AI16z. Even with today’s surge, however, AI16z is down 32% over the last week, and is 47% off its all-time high price of $2.47 set less than two weeks ago.

And Virtuals Protocol’s VIRTUAL—a token launched on Ethereum layer-2 network Base last year—is up by 15% over the past day. It’s now priced at $2.98. Virtuals is used to launch a variety of AI agents, including AiXBT—a token that nearly matched its own all-time high price on Tuesday.

Both tokens had slowed their rallies down in recent days after a white-hot start to the year, but are making a comeback as the broader crypto market recovers Tuesday.

AI agent software programs are designed to help humans by completing tasks on their own. As the hype around AI has grown, many in the field have made big promises on how much such agents will help humans complete tasks. And some of these agents have their own tokens, adding potential utility and speculation into the equation.

Franklin Templeton added that even if AI agents have some way to go to be as refined and useful as envision, the sector holds substantial promise.

“Although these agents are not yet fully autonomous, and have little utility in their current state, this emerging sector may hold significant promise and is worth watching closely as it evolves and matures,” the note said.

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

You Should Not Wear This Bitcoin Shirt — Here's Why

Four Under-the-Radar Altcoins Witnessing ~10x Surge in Number of New Wallets Created in One Week: Santiment

Satoshi Action Fund raises $300,000 as it advances Bitcoin advocacy

US SEC Delays Decision on Bitwise 10 Crypto Index Fund

Syria Exploring The Embrace of Bitcoin

Hashed’s Simon Kim Says AI Has a ‘Black Box’ Problem

Bitcoin

Bitcoin Loses $93K as Goldman Trims Fed Rate Cut Expectations, BofA Sees Potential Hike After Blowout Jobs Report

Published

2 days agoon

January 13, 2025By

admin

Bitcoin (BTC) started the new week on a negative note as major investment banks reassessed their expectations for Federal Reserve (Fed) rate cuts following Friday’s strong jobs report.

The leading cryptocurrency by market value dipped below $93,000 during the European hours, representing a 1.6% drop on the day, according to data source CoinDesk. Prices looked set to test the support zone near $92,000, which has consistently acted as a floor since late November.

The CoinDesk 20 Index, a broader market gauge, was down over 3%, with major coins like XRP, ADA, and DOGE posting bigger losses.

In traditional markets, futures tied to the S&P 500 traded 0.3% lower, pointing to an extension of Friday’s 1.5% drop that pushed the index to the lowest since early November. The dollar index (DXY) neared 110 for the first time since late 2022, with elevated Treasury yields supporting further gains.

Data released Friday showed nonfarm payrolls increased by 256,000 in December, the most since March, surpassing expectations for 160,000 job additions and the previous figure of 212,000 by a big margin. The jobless rate declined to 4.1% from 4.2%, and the average hourly earnings came in slightly lower than expected at 0.3% month-on-month and 3.9% year-on-year.

That prompted Goldman Sachs to push out the next interest rate cut to June from March.

“Our economists now expect the Fed to cut just twice in 2025 (Jun/Dec vs Mar/Jun/Dec previously), with another rate cut in June 2026, Goldman’s Economic Research note to clients on Jan. 10 said.

“If December’s FOMC decision marked a significant shift back towards inflation in the Fed’s relative weighting of risks, the December jobs report may have completed the pendulum swing. The soft average hourly earnings figure kept the print from sending a more alarming re-heating signal, but the case for cutting to mitigate risks to the labor market has faded into the background,” the note explained.

The Fed’s rate-cutting cycle began in September when the official reduced the benchmark borrowing cost by 50 basis points. The bank delivered quarter-point rate cuts in the following months before pausing in December to signal fewer rate cuts in 2025. BTC has surged over 50% since the first rate cut on Sept. 18, hitting record highs above $108,000 at one point.

While Goldman and JPMorgan still expect rate cuts, Bank of America (BofA) fears an extended pause, with risks skewed in favor of a rate hike or renewed tightening. Note that the U.S. 10-year Treasury note yield, which is sensitive to interest rate, growth and inflation expectations, has already surged by 100 basis points since the Sept. 18 rate cut.

“We think the cutting cycle is over … Our base case has the Fed on an extended hold. But we think the risks for the next move are skewed toward a hike,” BofA analysts said in a note, according to Reuters.

ING said, “The market is right to see the risk of an extended pause from the Fed” in the light of the recent economic reports.

“That view will only increase if core inflation comes in at 0.3% month-on-month for a fifth consecutive month next week,” ING said in a note to clients over the weekend.

The December consumer price index report is scheduled for release on Jan. 15. Some observers are worried that base effects could accelerate the headline CPI and the core CPI, adding to the hawkish Fed narrative.

Source link

Markets

XRP meme coin PHNIX pumps 50%; UFD shows a similar pump

Published

2 days agoon

January 12, 2025By

admin

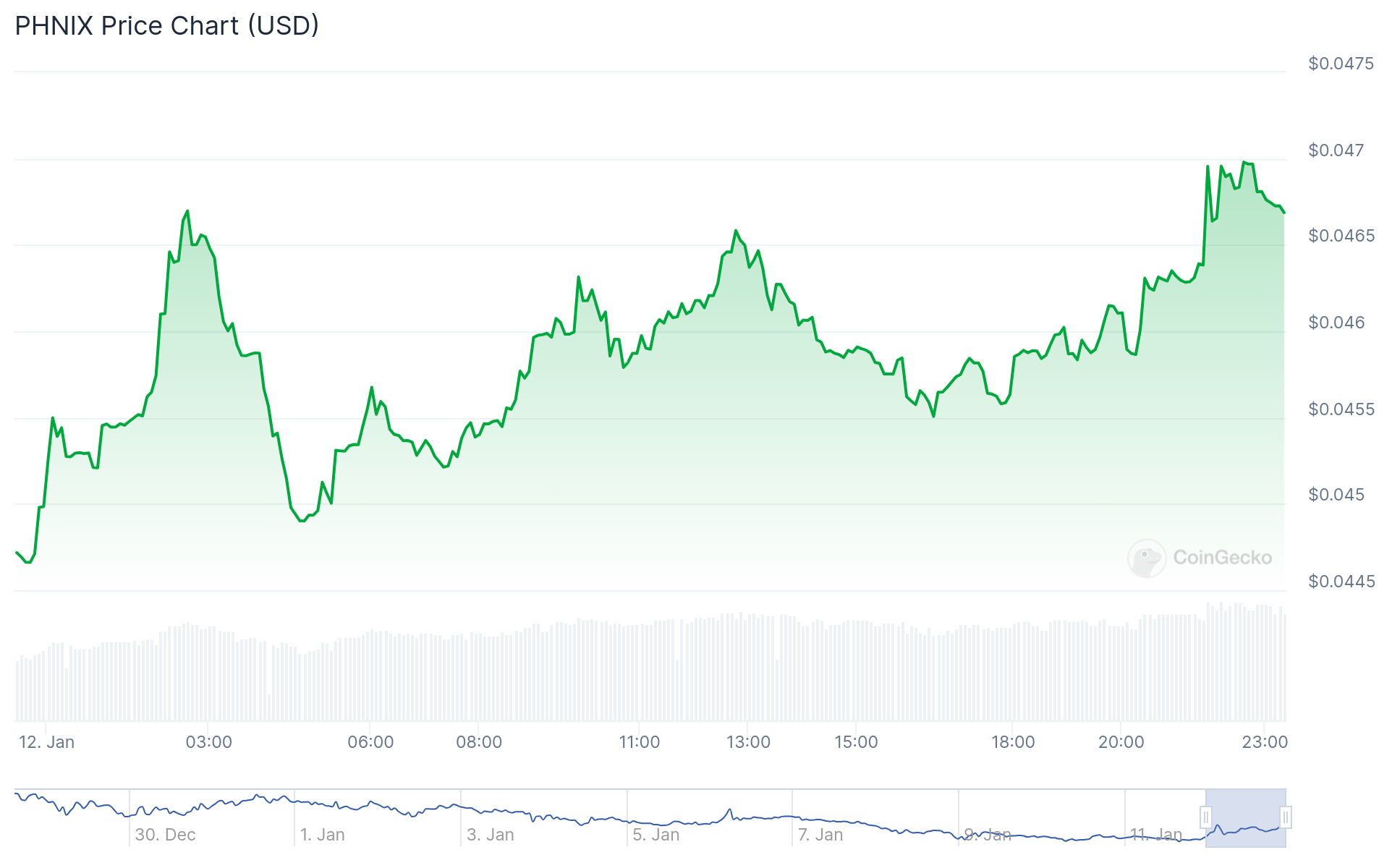

As the overall crypto market struggles to reclaim a bullish stance, XRP meme coin PHNIX has pumped over 50%.

In the last 24 hours, while Bitcoin (BTC) and Ethereum (ETH) have shown clear signs of struggle to reclaim a bullish stance, a few lesser-known coins have pumped double digits.

One of the top gainers, as per CoinGecko’s list, is Phoenix (PHNIX). PHNIX is an XRP (XRP) meme coin that has pumped from a 24-hour range of $0.00004662 to as high as $0.0000698.

Crypto analyst Gordon recently tweeted that meme coins on the XRP chain are exploding. He especially pointed out that PHNIX printed a massive God candle after a week of consolidation. Gordon also highlighted that it looks ready for its next rally.

MEMECOINS ON THE $XRP CHAIN ARE EXPLODING!$XRP is rising like a phoenix from the ashes, and its flagship meme, $PHNIX, just printed a massive god candle after a week of consolidation. It now looks ready for its next rally.

The most recognised mascot of the third-largest…

— Gordon (@AltcoinGordon) January 12, 2025

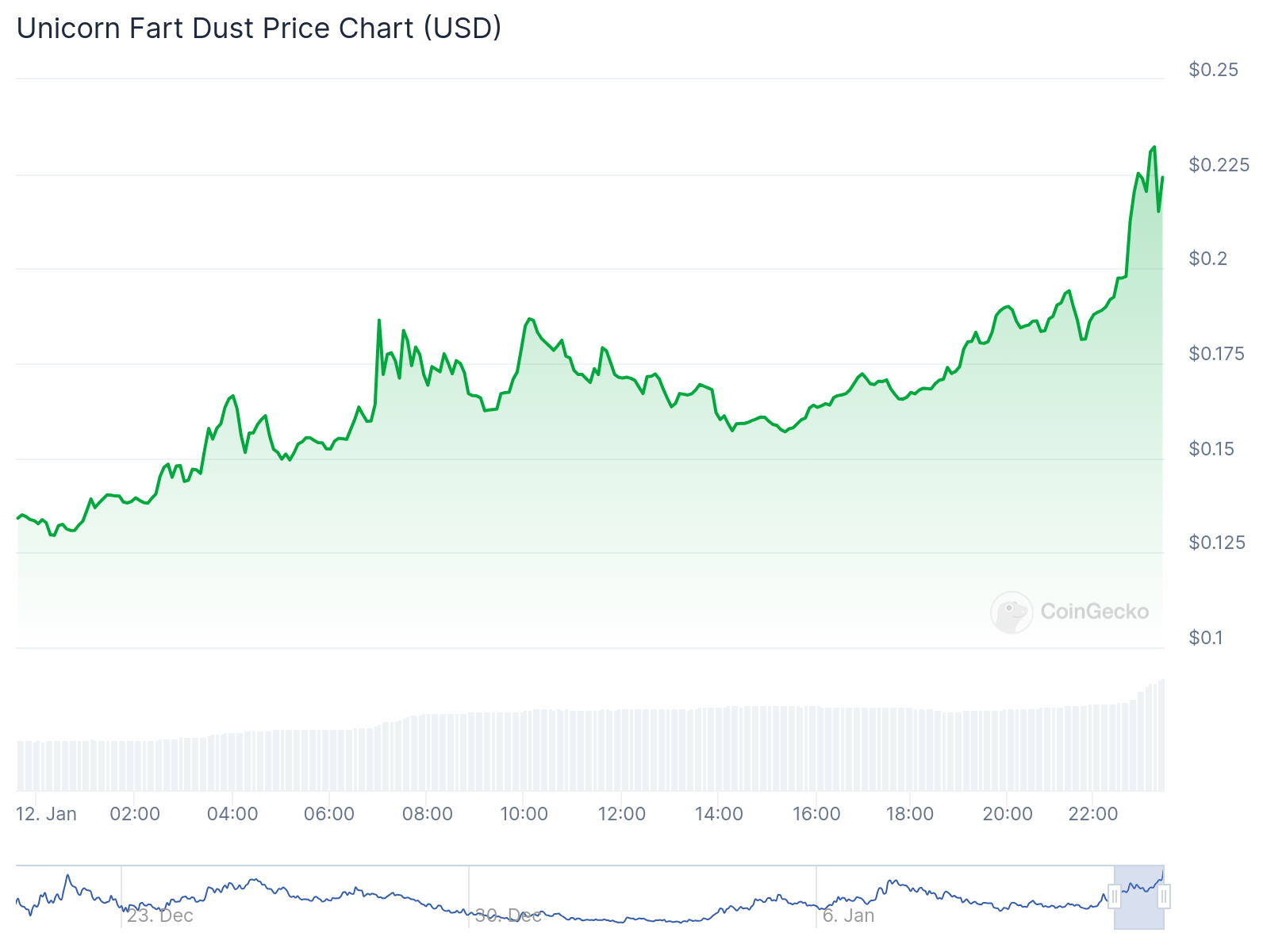

The second coin with almost a 70% pump is Unicorn Fart Dust (UFD). The UFD price has shot up close to 100% in the last seven days and is trading at $0.2274 at press time.

The meme coin was started by a 56-year-old YouTuber called Basement Ron, who creates videos about gold, silver, and now UFD. While the exact reason for the price surge is unclear, the coin has also bagged partnerships with companies like MoonPay.

Why is @MoonPay sponsoring Basement Ron? 🦄💨

I have never received so many texts and DMs so I wanted to answer publicly!

Ron’s journey, which he alludes to below, is something we all are incredibly proud of at MoonPay as we look to onboard the masses to crypto.

▶️ Ron is not… https://t.co/nPp0KAy6As

— Keith A. Grossman (@KeithGrossman) January 11, 2025

When we narrow it down to the top gainers of the top 300 coins by market cap, Theta Network (THETA) has spiked close to 14% from a 24-hour low of $0.06857 to as high as $0.09682 before retracing to its current price of $0.07854.

As per CoinMarketCap data, the global crypto market cap stands at $3.33 trillion, with a 1% surge in the last 24 hours. Alternative data also shows that the crypto Fear and Greed Index is now at 62, indicating greed. Greed usually indicates that the market is due for a correction.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Bitcoin

Why High Net-Worth Investors Are Super Bullish on Bitcoin Right Now

Published

3 days agoon

January 12, 2025By

admin

As bitcoin (BTC) wobbles around the $90,000-$95,000 area, down more than 10% from its all-time high touched a bit less than four weeks ago, a contrast is growing between traders — whose technical analysis tools show the top cryptocurrency may be due for another plunge — and long-term investors who believe the bull run is nowhere near done.

That’s according to David Siemer, CEO of Wave Digital Assets, a firm that provides asset management services to funds and high net-worth individuals in the crypto space. The company counts Charles Hoskinson, the CEO of the firm behind Cardano, as one of its clients.

“In 14 years of owning bitcoin, I’ve never seen a dichotomy like this,” Siemer told CoinDesk in an interview. “The traders are all worried and nervous and hedged, fully neutral or worse. And the long-term people are all super bullish.”

“There’s a really good chance we’ll go to $200,000 [per bitcoin] this year,” Siemer said. “Do I think we’ll see $1 million dollars per coin in my lifetime? Sure. Not soon, you know, not in the next year. … The smart, more connected people that I know are also really bullish. More is going to happen in the next six months than most people realize.”

Top of the list of developments for the year to come is that numerous jurisdictions — including the U.S., Russia, Singapore, the United Arab Emirates, South Korea, Japan, the Philippines and some European nations — are looking to take big steps in crypto’s favor, according to Siemer. (Wave runs crypto educational programs for various branches of the U.S. government, like the Internal Revenue Service or U.S. Marshals Service, as well as other executive bodies across the globe; in fact, government practices is the firm’s fastest growing business.)

These steps, whichever form they take, will likely have positive knock-on effects on some of these countries’ private sectors, Siemer said. “[Japan or Singapore], those are societies where they actually trust and rely on their governments. If their government says it’s okay, it’s actually really okay. It’s different from the U.S. where we think our guys are idiots.”

What is spurring such sudden interest in the crypto industry? The tremendous success of the U.S. spot bitcoin exchange-traded funds (ETFs), for one, is forcing financial institutions worldwide to think of ways to compete. That means spinning up exotic new products, like multi-token yield funds, to make up for the liquidity that was sucked away by BlackRock’s IBIT.

“The ETFs launched in America and they absolutely devastated all the bitcoin ETPs around the world,” Siemer said. “All of them had these terrible products, charging 1.5%. All of those guys got crushed.” Regulators, for their part, will tend to be supportive, Siemer said. For example, the European Union could end up producing a friendlier version of the Markets in Crypto-Assets Regulation (MiCA).

The chances of seeing new strategic bitcoin reserves is also high, Siemer said. “Even if the U.S. doesn’t do a reserve, at least several other countries probably will,” he added. Not that he’s bearish on prospects in the U.S. Wave, he said, is currently in talks with seven different states that are considering the matter of creating a reserve, Texas, Ohio and Wyoming among them.

What about the federal government? Siemer put the odds at slightly better than 50-50, in part thanks to the nearly $19 billion worth of bitcoin it already owns.

“That’s a decent start on a bitcoin reserve,” Siemer said. “All they have to do is not sell it. It’s a lot more palatable to the tax base than buying, you know, $10 billion worth of bitcoin.”

Source link

You Should Not Wear This Bitcoin Shirt — Here's Why

Four Under-the-Radar Altcoins Witnessing ~10x Surge in Number of New Wallets Created in One Week: Santiment

Satoshi Action Fund raises $300,000 as it advances Bitcoin advocacy

US SEC Delays Decision on Bitwise 10 Crypto Index Fund

AI Agent Tokens Skyrocket as Franklin Templeton Highlights ‘Significant Promise’

Syria Exploring The Embrace of Bitcoin

Hashed’s Simon Kim Says AI Has a ‘Black Box’ Problem

Expert who predicted Bitcoin’s 2017 surge says XYZVerse could be the next big thing

How Coinbase vs SEC Ruling Could Influence XRP Case

PEPE koers daalt ondanks toename whale interesse – wat gaat Pepe Coin doen?

BlackRock publishes 3 key takeaways to boost Bitcoin ETF adoption in 2025

One Factor Could Trigger ‘Larger’ Sell-Off in Cardano, Says Analyst Benjamin Cowen – Here’s His Outlook

Ancient8 (A8) Price Rockets 30% And Drift Token Up 7% Post Major Listing

US Tightens AI Chip Exports Restrictions Ahead of Trump’s Inauguration

ARKA NOEGO / NOAH’S ARK: On Solidarity and Bitcoin

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Telegram users can send gifts to friends, TON fails to pump

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

A16z-backed Espresso announces mainnet launch of core product

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x