cryptocurrency

AMP surged 60% amid increased whale interest

Published

4 months agoon

By

admin

Ampera’s AMP rose 62% in the last 24 hours and continued its rally as on-chain metrics indicated whales have begun accumulating the altcoin, driven by its increasing utility.

AMP (AMP) soared to a high of $0.0133 on Wednesday morning, marking a jump of over 330% from its lowest point this year. The surge in price pushed its market cap over $1 billion for the first time in 29 months before settling at $978 million when writing.

The altcoin’s rally coincided with a 750% surge in daily trading volume, which reached over $601 million, while AMP also trended on Google on the back of heightened retail interest.

Why is AMP price rising?

There are three potential catalysts driving AMP’s recent rally.

Firstly, AMP’s surge coincided with a broader rally in the altcoin market, as major cryptocurrencies like Binance Coin (BNB) and Tron (TRX) posted significantly higher daily gains of 17.6% and 68.8%, respectively, compared to Bitcoin’s modest 1.4% rise during the same period.

Second, Flexa, a digital payments platform that uses AMP as collateral, recently announced its integration with the Zcash wallet app ‘Zashi.’ The integration allows users to make purchases at Flexa-enabled U.S. stores without revealing their wallet or currency details.

As more transactions occur on the platform, the demand for AMP to serve as collateral naturally increases. This reduces the token’s available supply, creating upward pressure on its price, which is potentially fueling growth for the altcoin.

Third, AMP’s rally has been bolstered by a surge in whale activity over the past 24 hours. Data from IntoTheBlock shows that whale holder netflow jumped over 150%, shifting from a $186K outflow on Dec. 2 to $473K in inflows on Dec. 3, signaling renewed interest from large investors.

Meanwhile, on the daily chart, AMP has risen above both the 50-day and 200-day Simple Moving Averages, indicating bulls are still in control. Further, the 50-day SMA has crossed over the 200-day SMA, forming a golden cross, a major bullish sign in technical analysis.

Further, the MACD line (blue) and the signal line (orange) on the Moving Average Convergence Divergence indicator have been moving higher above the zero mark, which means the rally still holds significant momentum.

Considering these signals, AMP could potentially continue its rally, a sentiment also echoed by analyst Javon Marks, who projected that AMP could climb to $0.07048—a potential increase of over 470% from its current price.

Source link

You may like

Kyrgyzstan President Brings CBDC a Step Closer to Reality

Manta founder details attempted Zoom hack by Lazarus that used very real ‘legit faces’

Ethereum Price Fights for Momentum—Traders Watch Key Resistance

Corporate Bitcoin Holdings Hit Record High In Q1 2025 As Public Companies Accelerate Accumulation

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

cryptocurrency

Solana’s Raydium rolls out LaunchLab after split with Pump.fun

Published

22 hours agoon

April 17, 2025By

admin

Raydium, a Solana-based DeFi platform, has launched its own memecoin launchpad after Pump.fun severed ties with the automated market maker last month.

Dubbed LaunchLab, the new memecoin-making protocol officially went live on April 16, giving users a simple way to create, customise, and trade their own tokens directly on the Solana blockchain, according to an X post from Raydium on the day.

The platform connects directly to Raydium’s liquidity pools, allowing new tokens to start trading instantly with minimal setup. Projects that raise at least 85 SOL, or about $11,150, are automatically added to Raydium’s AMM, giving them access to deeper liquidity from the start.

LaunchLab also offers flexible bonding curve options, 1% trading fees, and zero migration costs, a key change aimed at reducing friction for both developers and traders. Over 10 projects had already crossed the 85 SOL threshold at press time, suggesting early interest in the new tool.

Following the launch, Raydium’s native token RAY spiked roughly 13% to $2.41 before cooling off to around $2.32, at press time.

According to Raydium, 25% of all trading fees collected through LaunchLab will be used to buy back RAY tokens, potentially supporting its market value over time.

As previously reported by crypto.news, early signs of Raydium working on a new token launch platform emerged in March, shortly after Pump.fun revealed plans for its own automated market maker.

The announcement from Pump.fun, which had long used Raydium’s liquidity pools for its bonding curve launches, effectively ended what was seen as a key source of revenue and activity for Raydium.

On March 20, Pump.fun introduced PumpSwap, a Solana-based DEX that supports all launchpad coins completing their bonding curve, offering instant, fee-free migrations and full trading support.

At the time, an anonymous Raydium developer, LaunchLab, had already been in the works for several months. However, the team kept it shelved to avoid any perception that they were directly competing with Pump.fun or other launchpads.

According to the developer, LaunchLab wasn’t built to replace Pump.fun, but rather to offer teams a simpler way to create and manage tokens without starting from scratch.

That said, LaunchLab still lacks some community-driven features like Pump.fun’s live streaming option, which has become a popular tool for memecoin creators to engage directly with their audiences.

Due to widespread misuse, including extreme stunts and threats of self-harm, Pump.fun suspended the feature in November 2024 following community backlash. It has since been reinstated, with the platform fully restoring live streaming on April 11 under stricter moderation rules to curb abuse.

Source link

Bitcoin

Bitcoin Price Holds Steady, But Futures Sentiment Signals Caution

Published

1 day agoon

April 17, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

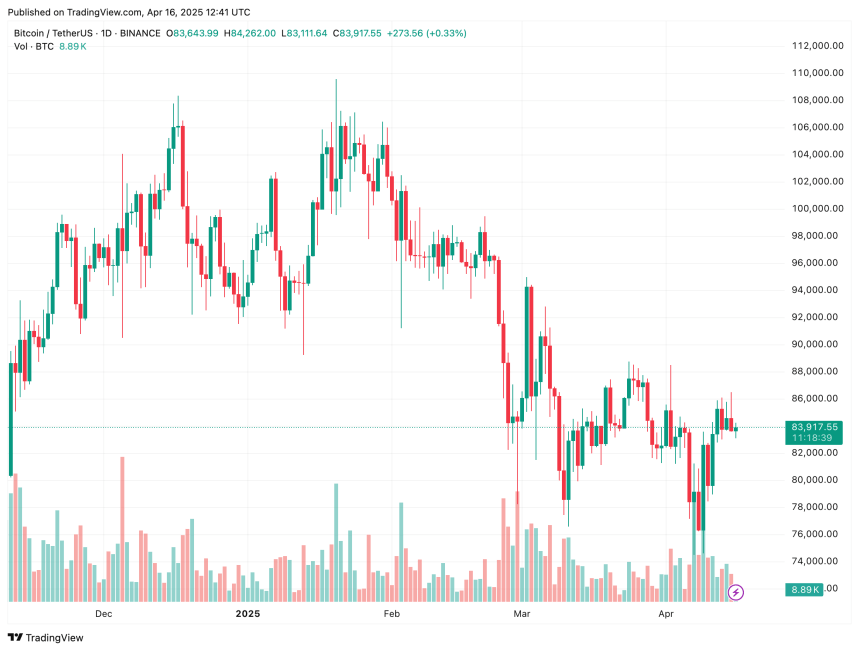

According to a recent CryptoQuant Quicktake post, while Bitcoin (BTC) has seen a steady rise in price from November 2024 to February 2025, sentiment in the cryptocurrency’s futures market has not shown a corresponding uptick.

Bitcoin Futures Sentiment Index Signals Caution

Bitcoin’s price surged from approximately $74,000 in November 2024 to a peak of $101,000 by early February 2025. However, following US President Donald Trump’s tariff announcements, risk-on assets – including BTC -have experienced a significant pullback.

Related Reading

After hitting a potential local bottom of $74,508 earlier this month on April 6, the apex cryptocurrency has recovered some of its recent losses. The top digital asset is trading in the mid $80,000 range at the time of writing.

Despite this recovery, BTC’s futures sentiment has continued to decline since February. Even as the price holds near local highs, sentiment in the futures market has notably cooled.

CryptoQuant contributor abramchart highlighted this divergence, noting that it could indicate increasing caution or profit-taking behavior despite the ongoing bullish trend. The analyst commented:

This indicates a cooling interest or increased fear in the futures market, possibly due to macroeconomic uncertainty, regulatory concerns, or expected corrections.

A look at the BTC futures sentiment index shows a resistance zone around 0.8 and a support level near 0.2. The index is currently hovering around 0.4, pointing to a predominantly bearish sentiment across futures markets.

Similarly, Bitcoin’s average price has steadily declined from its early 2025 highs. It is now ranging between $70,000 and $80,000, signalling possible market indecision amid heightened tariff tensions.

According to abramchart, if futures sentiment remains low, BTC could face extended price consolidation or even downward pressure in the near term. However, any emerging bullish catalyst could quickly shift the sentiment and renew upward momentum.

Is BTC Close To A Momentum Shift?

Some analysts believe Bitcoin may be nearing a breakout. After consolidating in the mid-$80,000s for several weeks, on-chain metrics suggest BTC may be undervalued at current levels. Indicators such as BTC exchange reserves and the Stablecoin Supply Ratio support this view.

Related Reading

In addition, momentum indicators like Bitcoin’s weekly Relative Strength Index have begun to break out of a long-standing downward trendline – raising hopes for a potential bullish rally back toward $100,000.

However, several risks still remain. The recent appearance of a ‘death cross’ on BTC’s price chart – combined with persistent macroeconomic concerns related to trade tariffs – could still weigh heavily on market sentiment. At press time, BTC trades at $83,917, down 1.8% over the past 24 hours.

Featured image from Unsplash, Charts from CryptoQuant and TradingView.com

Source link

Blockchain

Athens Exchange Group eyes first onchain order book via Sui

Published

2 days agoon

April 16, 2025By

admin

Greek exchange Athens Exchange Group has moved closer to adopting a Sui-based order book following its collaboration with Mysten Labs.

On April 16, the Sui (SUI) team announced that Athens Exchange Group, or ATHEX, had finalized the technical design for an onchain fundraising platform that will leverage zero-knowledge proofs on the Sui blockchain.

ATHEX’s ZK-powered fundraising platform will help the stock exchange enhance its offering with privacy and speed, bolstering its growth in traditional capital markets.

This nod to blockchain innovation and integration follows Sui contributor Mysten Labs’ partnership with the Athens Exchange Group in March 2024.

The collaboration between the two platforms aims to leverage their respective ecosystems to deliver the technical design for ATHEX’s Electronic Book Building (EBB), the exchange’s fundraising feature. By tapping into Sui’s technology and tooling, the company will be able to integrate zero-knowledge proofs into EBB’s bidding process.

Currently, Athens Exchange Group and Mysten Labs are eyeing a proof of concept, with this a key milestone towards building the first onchain order book for a stock exchange.

“The focus on privacy-preserving mechanisms, combined with Sui’s unparalleled speed and security, will enable us to build a state-of-the-art PoC that can evolve into a full-fledged onchain order book, setting a new benchmark for the industry,” said Dr. Kostas Kryptos Chalkios, Chief Cryptographer and Co-Founder of Mysten Labs

ATHEX will benefit from a platform that combines privacy-preserving mechanisms, speed and security.

Sui’s capacity to scale and handle transactions in parallel, with industry-leading throughput will be crucial to the stock exchange.

“By integrating zero-knowledge proofs, we aim to uphold the highest standards of compliance and data integrity while boosting operational efficiency for all market participants,” said Nikos Porfyris, chief operating officer at Athens Exchange Group.

Sui is the 10th largest blockchain by total value locked per DeFiLlama with over $1.18 billion in TVL.

Source link

Kyrgyzstan President Brings CBDC a Step Closer to Reality

Manta founder details attempted Zoom hack by Lazarus that used very real ‘legit faces’

Ethereum Price Fights for Momentum—Traders Watch Key Resistance

Corporate Bitcoin Holdings Hit Record High In Q1 2025 As Public Companies Accelerate Accumulation

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Ripple acquisition Hidden Road secures FINRA registration

Ethereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

How Do We Protect Bitcoin From Quantum Computers? Not With A Joke

OKX Goes Live In The US After Setting Up New Headquarters in San Jose, California

Stanford’s AI research lab to use Theta EdgeCloud for LLM model studies

Central African Republic Solana Meme Coin Jumps as President Fuels Rumors of Revival

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals