active realized price

Analyst Identifies Key Bitcoin Demand Zone For ‘Substantial Gains’ – Details

Published

4 days agoon

By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

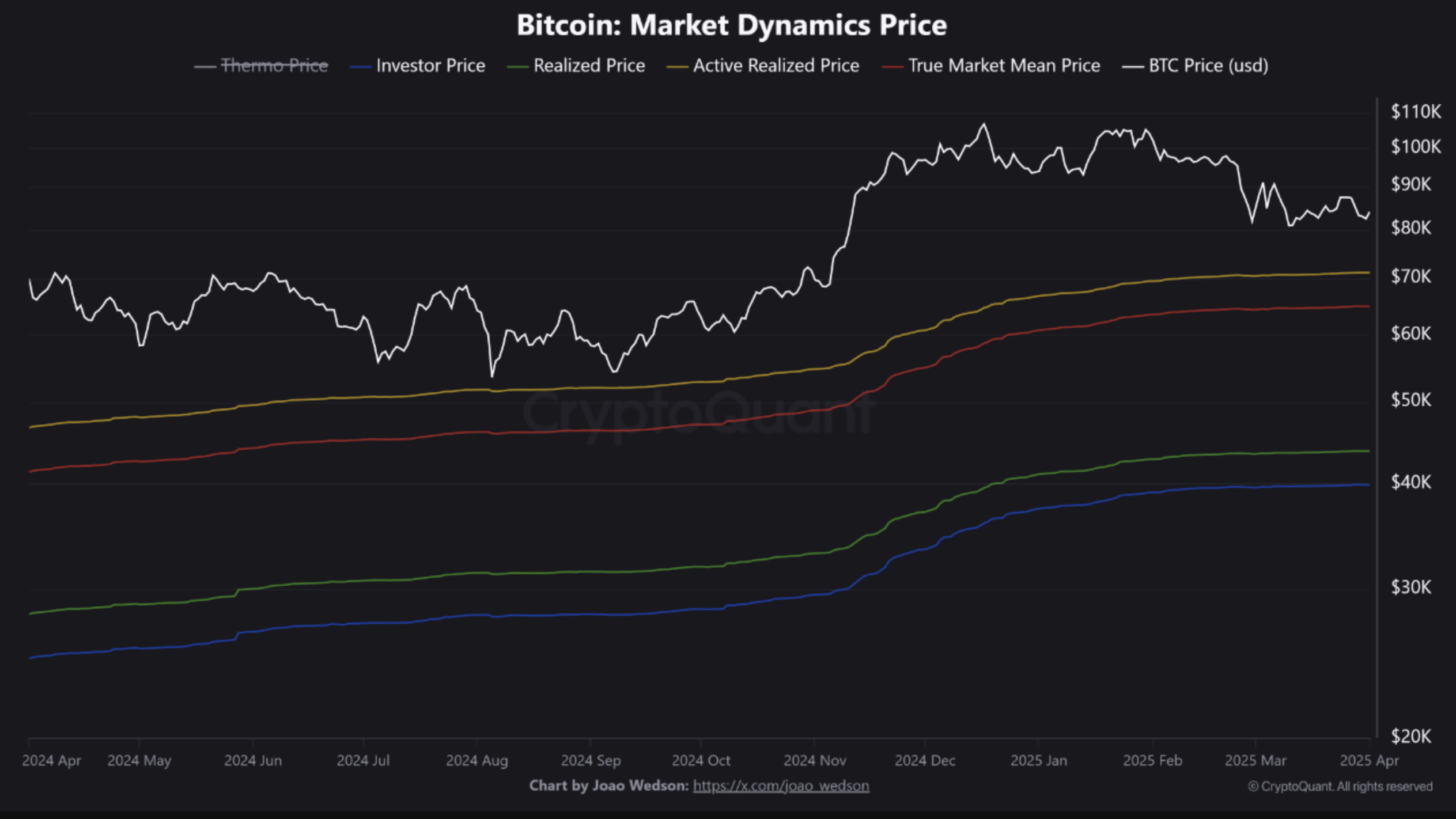

In a CryptoQuant Quicktake post published today, contributor BorisVest highlighted a key demand zone for Bitcoin (BTC) that could offer investors an opportunity for ‘substantial gains.’ The analyst used the Active Realized Price (ARP) and the True Market Mean Price (TMMP) to identify this critical zone.

Buying Bitcoin Here Could Be Profitable

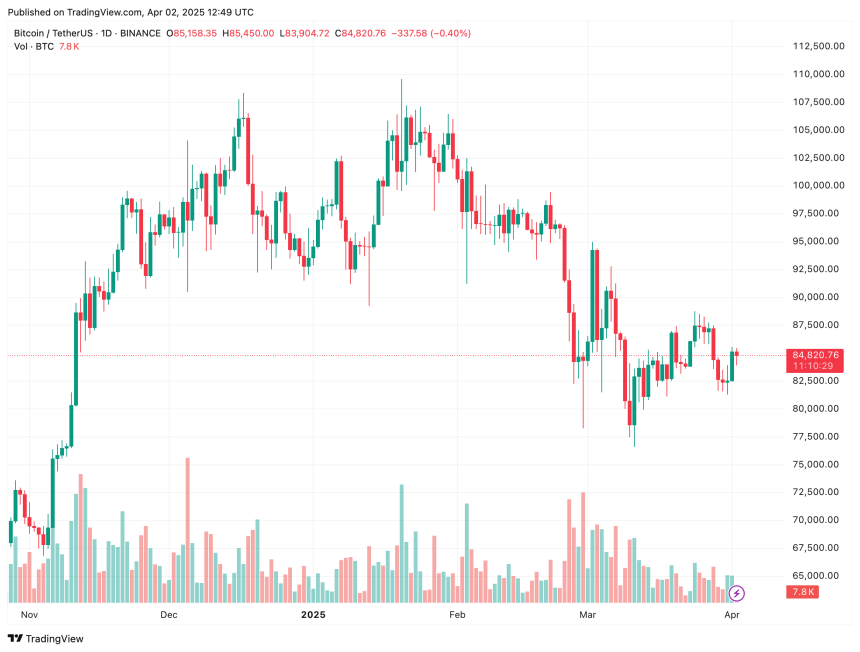

Bitcoin is currently trading approximately 10% higher than its recent local bottom of nearly $77,000, recorded on March 10. However, uncertainty in the market has increased due to US President Donald Trump’s looming trade tariffs, with some analysts predicting that the top cryptocurrency could experience further downside before a trend reversal occurs.

Related Reading

Amid this backdrop, CryptoQuant contributor BorisVest noted that, based on market dynamics, BTC’s ARP is currently hovering around $71,000 – representing almost a 20% pullback from its current price in the mid-$80,000 range.

For the uninitiated, Bitcoin’s ARP is a metric that calculates the average acquisition price of all actively traded BTC, filtering out dormant coins. It helps identify market sentiment by showing the cost basis of active investors, providing insights into potential support or resistance levels.

Additionally, BorisVest pointed out that BTC’s TMMP currently has a key support level at $65,000. The analyst stated:

If we define the area between the Active Realized Price and the True Market Mean Price as a zone, we can expect that in the near future, if the price declines, it should meet significant demand in this range.

In essence, BTC’s current major demand zone lies between $71,000 and $65,000. Purchasing BTC within this range could provide investors with a favorable risk-reward ratio, potentially leading to substantial gains.

Analyst Points Out Key Resistance Levels

In contrast to BorisVest’s analysis, prominent crypto analyst Ali Martinez identified two key resistance levels for Bitcoin. Martinez stated:

Bitcoin BTC faces the 200-day MA at $86,200 and the 50-day MA at $88,300 as key resistance ahead! A break above these levels could shift momentum back to the bulls.

Moving-average (MA) based resistance levels often function as key psychological and technical price barriers. Market traders typically place their sell orders around these levels, leading to price reversal or consolidation.

Related Reading

Martinez’s analysis aligns with that of fellow crypto analyst Rekt Capital, who noted that despite BTC breaking its daily Relative Strength Index (RSI) downtrend, it may still face significant resistance ahead.

That said, a bullish trend reversal may be on the horizon for BTC. Recent reports suggest that Trump may soften his stance on reciprocal tariffs, potentially enabling a relief rally for risk-on assets like BTC. At press time, BTC is trading at $84,820, up 1.5% in the past 24 hours.

Featured image from Unsplash, Charts from CryptoQuant, X, and TradingView.com

Source link

You may like

Bitcoin Trades Above $79K as Asia Markets React to Trump Tariffs

Memecoin platform Pump.fun brings livestream feature back to 5% of users

Bitcoin Price On The Verge Of Explosive 15% Breakout As Analyst Spots Triangle Formation

Strategy CEO Makes The Case For Corporate Bitcoin Adoption In MIT Keynote

Hackers Hammer Android and iPhone Users As Bank Account Attacks Surge 258% in One Year: Kaspersky

Cryptocurrencies to watch this week: Aptos, XRP, Solana

Bitcoin Trades Above $79K as Asia Markets React to Trump Tariffs

Memecoin platform Pump.fun brings livestream feature back to 5% of users

Bitcoin Price On The Verge Of Explosive 15% Breakout As Analyst Spots Triangle Formation

Strategy CEO Makes The Case For Corporate Bitcoin Adoption In MIT Keynote

Hackers Hammer Android and iPhone Users As Bank Account Attacks Surge 258% in One Year: Kaspersky

Cryptocurrencies to watch this week: Aptos, XRP, Solana

This Week in Crypto Games: ‘Off the Grid’ Token Live, Logan Paul ‘CryptoZoo’ Lawsuit Continues

Crypto Liquidations hit $600M as BTC Plunges Below $80K First Time in 25-days

Bitcoin (BTC) Price Posts Worst Q1 in a Decade, Raising Questions About Where the Cycle Stands

Stablecoins are the best way to ensure US dollar dominance — Web3 CEO

Chainlink (LINK) Targets Rebound To $19 — But Only If This Key Support Holds

NFT industry in trouble as activity slows, market collapses

US Tech Sector About To Witness ‘Economic Armageddon’ Amid Trump’s Tariffs, According to Wealth Management Exec

XRP’s Open Interest Surges Above $3 Billion, Will Price Follow?

This Week in Bitcoin: BTC Holds Steady as Trump’s Trade War Wrecks Stocks

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x