Altcoins

Analyst Outlines Massive Price Targets for Dogecoin, Predicts Parabolic Rally for Ethereum-Based Altcoin

Published

5 months agoon

By

admin

A closely followed crypto strategist believes that top memecoin Dogecoin (DOGE) is poised to spark massive rallies, en route to astronomical fresh all-time high levels.

Analyst Ali Martinez tells his 80,000 followers on the social media platform X that DOGE appears to be trading in a large ascending channel on the weekly chart.

An ascending channel is typically seen as a bullish structure as it suggests that an asset is printing higher highs and higher lows.

According to Martinez, Dogecoin looks to be gearing up for fireworks after respecting the diagonal support of the channel.

“A test of the middle or upper boundary of the channel puts Dogecoin DOGE at $2.40 or $18!”

At time of writing, DOGE is trading for $0.383, suggesting a potential rise of 526% if the coin hits the trader’s first target and about 6,000% if it reaches Martinez’s second target.

Next up, the trader has his radar locked on the native asset of the Ethereum (ETH) scaling solution Optimism (OP). According to Martinez, OP appears to be mirroring a pattern that led to parabolic rallies last year.

“Optimism OP has a history of forming market bottoms with ascending triangles, often followed by rallies to the 1.618 Fibonacci retracement level. Today, we’re seeing a similar setup, pointing to a bullish target of $7.20 for OP – a potential 340% gain.”

At time of writing, OP is worth $1.68.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Now On Sale For $70,000: The World’s First Factory Ready Open-Source Humanoid Robot

What Next for ETH as Traders Swap $86M into Solana DeFi protocols ?

Why Did Bitcoin Price (BTC) Fall on Wednesday Afternoon

Solana price is up 36% from its crypto market crash lows — Is $180 SOL the next stop?

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Altcoins

Analyst Says Solana Flashing Biggest Bear Trap, Predicts New All-Time High for SOL by End of 2025

Published

2 days agoon

April 15, 2025By

admin

A closely followed trader believes that the layer-1 protocol Solana (SOL) may have just flashed a strong bullish reversal signal.

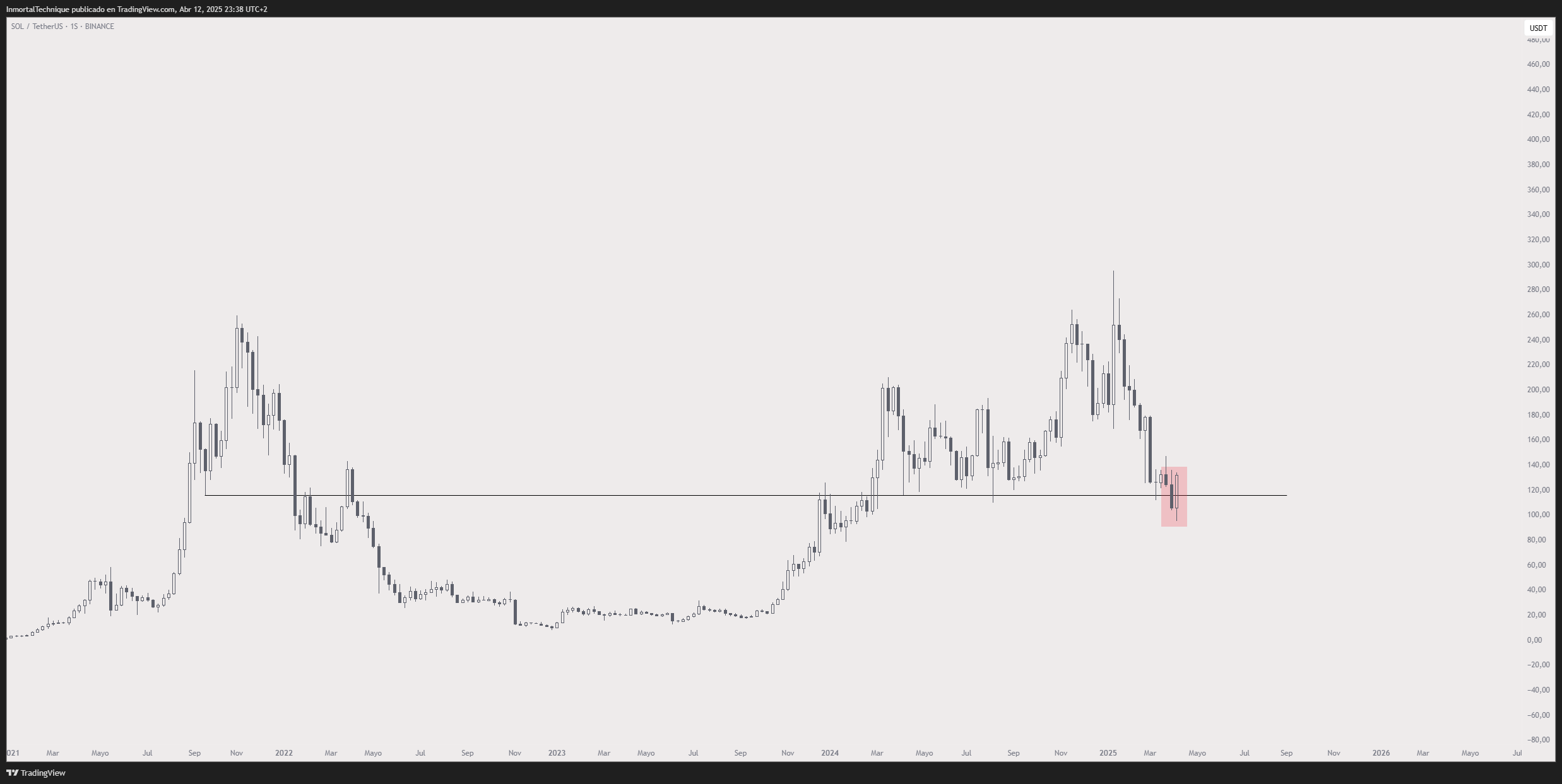

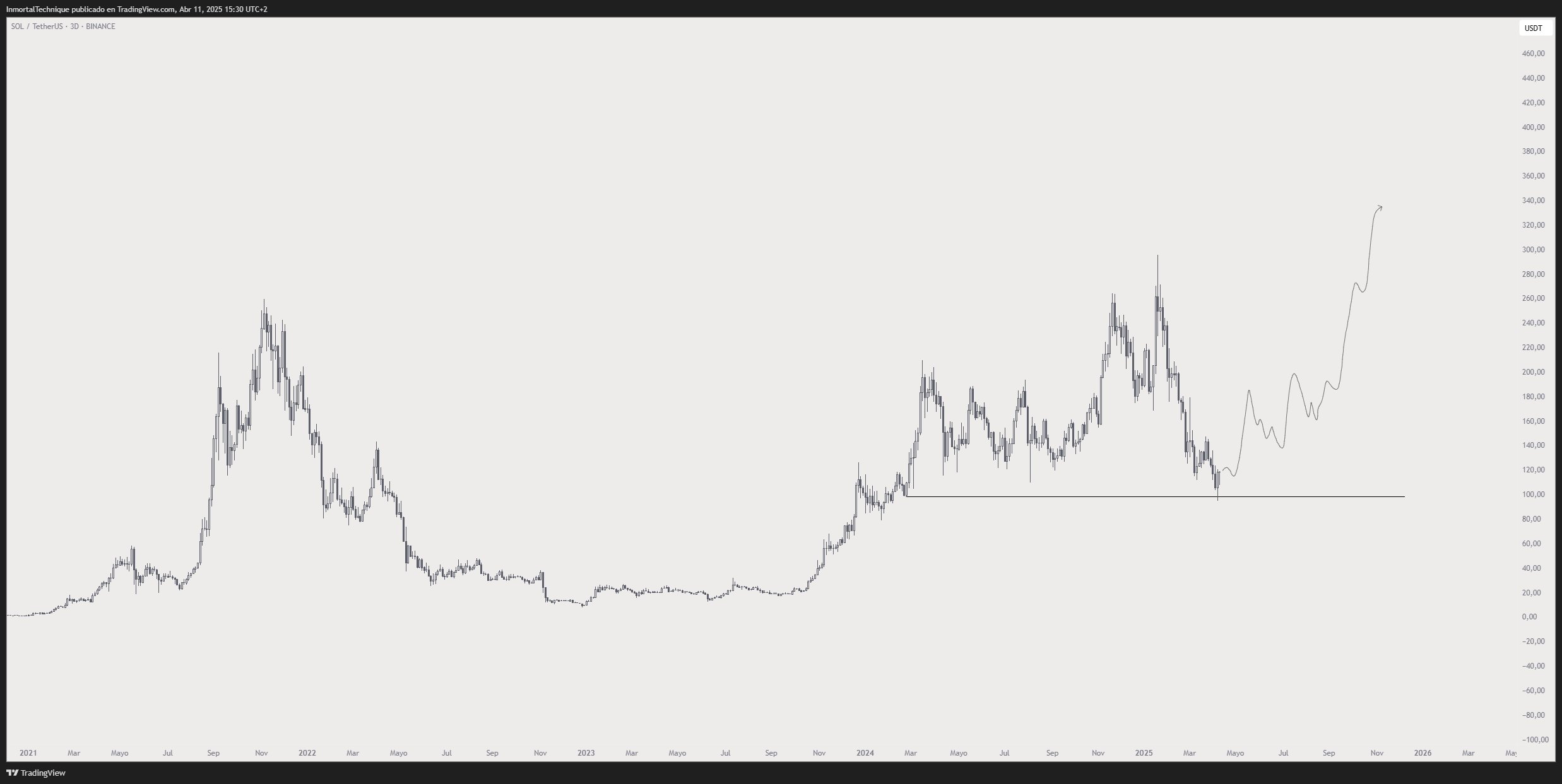

Pseudonymous trader Inmortal tells his 231,500 followers on the social media platform X that Solana appears to have set a massive bear trap earlier this month when the price of SOL briefly dropped below $100.

A bear trap is a false signal that makes it appear that the price of an asset is heading to much lower levels, but instead, the price abruptly reverses and rallies, leaving short-sellers trapped.

Says Inmortal,

“That weekly candle is maybe the biggest bear trap I’ve ever seen, SOL.”

The analyst now believes that SOL is setting the stage for strong rallies en route to a new all-time high of $340 by December 2025.

“In retrospect, it will be so obvious, SOL.”

At time of writing, Solana is trading for $128.19, down over 3% on the day.

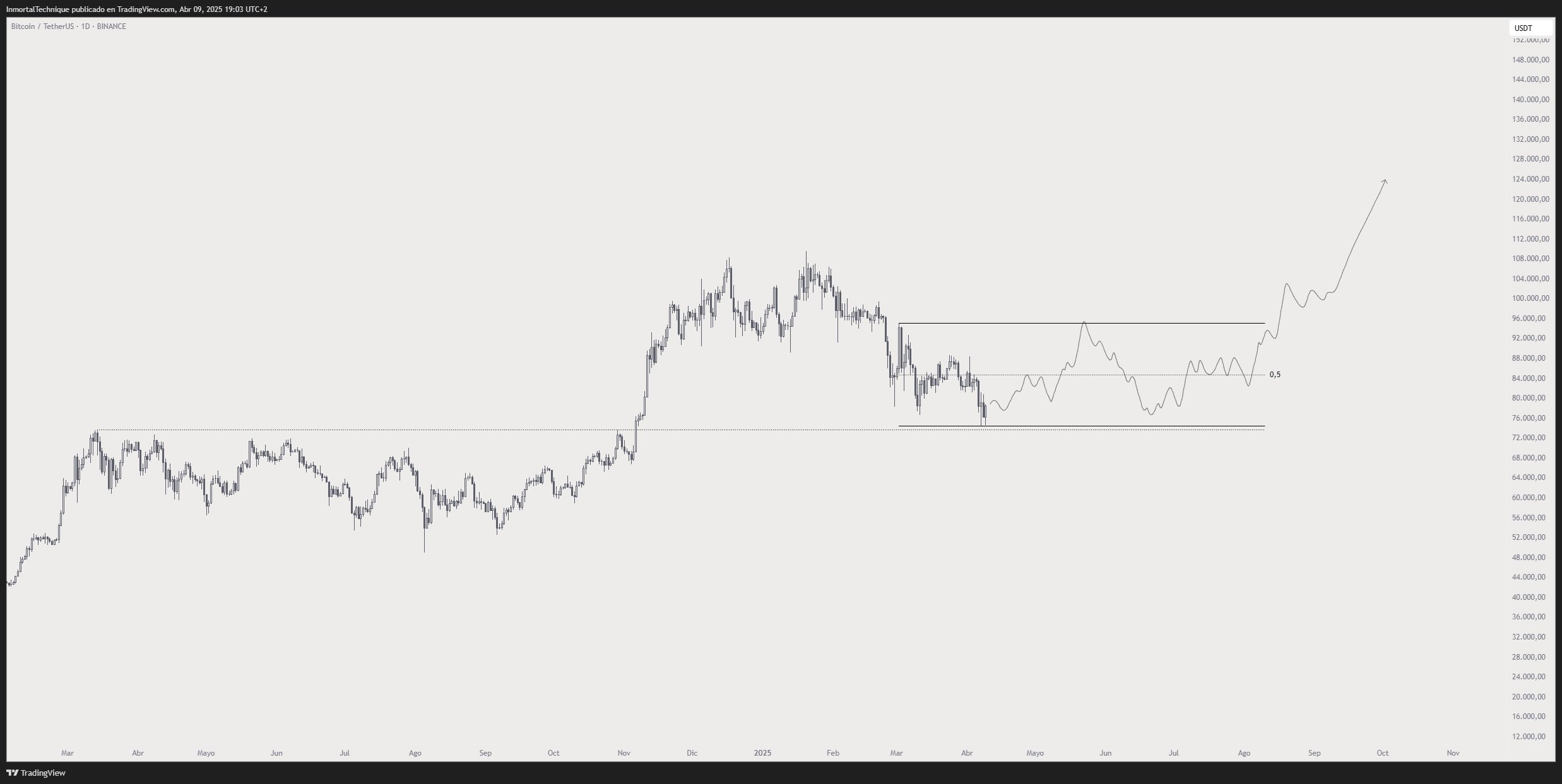

Looking at Bitcoin, Inmortal thinks that BTC will trade between $74,000 and $95,000 in the coming months before sparking a breakout rally toward the end of the year.

“Expecting something like this:

> Bounce to $90,000

> More chop/ranging ($67,000 maybe)

> Uptrend in the second half of this year

Maybe not in this exact order.

BTC.”

Based on the trader’s chart, he appears to suggest that Bitcoin will soar close to $130,000 by the end of 2025. At time of writing, Bitcoin is worth $84,943.

Turning to the memecoin Floki (FLOKI), Inmortal thinks the altcoin is at a price level where it can potentially carve a major cycle bottom.

“Accumulating more FLOKI at these levels.

RSI (relative strength index) is at the same levels it was 700 days ago, and price at pre-bullrun levels.”

The RSI is a momentum indicator that can help traders spot levels where an asset is oversold or overbought. At time of writing, FLOKI is worth $0.000057.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoins

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

Published

3 days agoon

April 14, 2025By

admin

They say journalists never truly clock out. But for Christian, that’s not just a metaphor, it’s a lifestyle. By day, he navigates the ever-shifting tides of the cryptocurrency market, wielding words like a seasoned editor and crafting articles that decipher the jargon for the masses. When the PC goes on hibernate mode, however, his pursuits take a more mechanical (and sometimes philosophical) turn.

Christian’s journey with the written word began long before the age of Bitcoin. In the hallowed halls of academia, he honed his craft as a feature writer for his college paper. This early love for storytelling paved the way for a successful stint as an editor at a data engineering firm, where his first-month essay win funded a months-long supply of doggie and kitty treats – a testament to his dedication to his furry companions (more on that later).

Christian then roamed the world of journalism, working at newspapers in Canada and even South Korea. He finally settled down at a local news giant in his hometown in the Philippines for a decade, becoming a total news junkie. But then, something new caught his eye: cryptocurrency. It was like a treasure hunt mixed with storytelling – right up his alley!

So, he landed a killer gig at NewsBTC, where he’s one of the go-to guys for all things crypto. He breaks down this confusing stuff into bite-sized pieces, making it easy for anyone to understand (he salutes his management team for teaching him this skill).

Think Christian’s all work and no play? Not a chance! When he’s not at his computer, you’ll find him indulging his passion for motorbikes. A true gearhead, Christian loves tinkering with his bike and savoring the joy of the open road on his 320-cc Yamaha R3. Once a speed demon who hit 120mph (a feat he vowed never to repeat), he now prefers leisurely rides along the coast, enjoying the wind in his thinning hair.

Speaking of chill, Christian’s got a crew of furry friends waiting for him at home. Two cats and a dog. He swears cats are way smarter than dogs (sorry, Grizzly), but he adores them all anyway. Apparently, watching his pets just chillin’ helps him analyze and write meticulously formatted articles even better.

Here’s the thing about this guy: He works a lot, but he keeps himself fueled by enough coffee to make it through the day – and some seriously delicious (Filipino) food. He says a delectable meal is the secret ingredient to a killer article. And after a long day of crypto crusading, he unwinds with some rum (mixed with milk) while watching slapstick movies.

Looking ahead, Christian sees a bright future with NewsBTC. He says he sees himself privileged to be part of an awesome organization, sharing his expertise and passion with a community he values, and fellow editors – and bosses – he deeply respects.

So, the next time you tread into the world of cryptocurrency, remember the man behind the words – the crypto crusader, the grease monkey, and the feline philosopher, all rolled into one.

Source link

ALCH

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Published

3 days agoon

April 14, 2025By

admin

A closely followed crypto analyst believes one meme token operating on Solana (SOL) is in the early stages of a market recovery.

Pseudonymous analyst Altcoin Sherpa tells his 243,800 followers on the social media platform X that he’s bullish on the memecoin Bonk (BONK).

The trader shares a chart suggesting that BONK will face resistance at the $0.000012 level before printing a bullish higher low setup and rallying to his target above $0.0000145.

“BONK is looking strong in the short term, and should go higher. Should be a pullback around the 200 EMA (exponential moving average) on the four-hour chart but still, I think this has pulled back enough to where any buying down here is probably reasonable.”

At time of writing, BONK is worth $0.00001376.

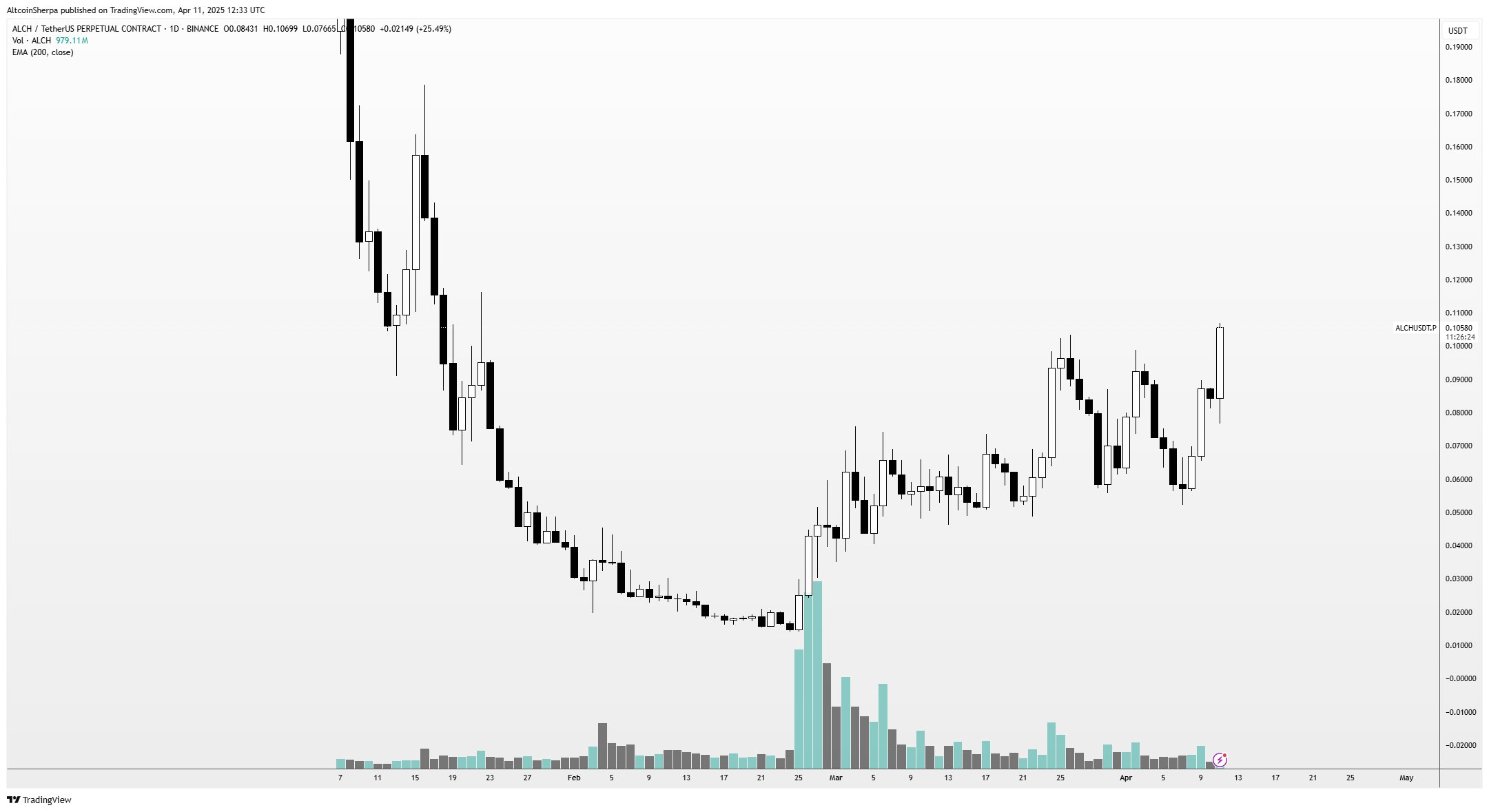

Turning to the low-cap altcoin Alchemist AI (ALCH), the analyst says the coin appears to be in an uptrend and that he’s waiting for potential dips to accumulate the asset.

ALCH is an artificial intelligence (AI)-based crypto project that allows users with no coding skills to generate codes by providing natural language descriptions.

Says Altcoin Sherpa,

“ALCH still seems like a really strong chart, don’t see it being mentioned much. I think it’s basically taken the place of ARC; a super volatile AI coin that moves 20% a day. Not in it but traded it a lot before; will look to buy dips.”

At time of writing, ALCH is the 431st-largest crypto asset by market cap, trading at $0.109.

Looking at Bitcoin, Altcoin Sherpa thinks that BTC will continue to consolidate within a large trading range in the short to mid-term.

“Expecting there is some sort of chop between $70,000-$90,000 over the next several weeks for BTC. Relative bottom probably in, but still some more consolidation to come.”

At time of writing, Bitcoin is trading for $85,366.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Now On Sale For $70,000: The World’s First Factory Ready Open-Source Humanoid Robot

What Next for ETH as Traders Swap $86M into Solana DeFi protocols ?

Why Did Bitcoin Price (BTC) Fall on Wednesday Afternoon

Solana price is up 36% from its crypto market crash lows — Is $180 SOL the next stop?

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x