24/7 Cryptocurrency News

Analyst Reveals Timeline When Bitcoin Price Could Jump To $140,000

Published

3 months agoon

By

admin

Crypto analyst Jelle has provided a bullish outlook for the Bitcoin price for the remainder of this market cycle. The analyst predicted that the flagship crypto will reach $140,000 and revealed when this price surge could likely happen.

When The Bitcoin Price Will Jump To $140,000

In an X post, Crypto Jelle predicted that the Bitcoin price could rally to $140,000 in the next three months. This came as the analyst highlighted a cup and handle pattern, which put BTC’s price target at this level.

Crypto analyst Titan of Crypto also suggested that Bitcoin could rally to $140,000 in the next three months. In an X post, the analyst shared an accompanying chart, which he tagged as the ‘Bitcoin 2025 Roadmap.’

The accompanying chart showed that the Bitcoin price could reach $140,000 at the start of the new year. However, this price is unlikely to mark the top for Bitcoin, as it could still surge to $150,000.

Other market experts have even provided a more bullish outlook for the flagship crypto. Engineer Ted Boydston predicted that BTC could hit $225,000, the biggest bull run for the flagship crypto.

Meanwhile, renowned finance author Robert Kiyosaki predicted that the flagship crypto will hit $350,000 in 2025. While it remains to be seen if the flagship crypto could reach such heights, fundamentals such as Donald Trump’s inauguration support a bullish continuation.

A Price Rebound Is Imminent

In an X post, crypto analyst Ali Martinez stated that the Bitcoin price could be preparing for a rebound. The analyst mentioned that Bitcoin is showing a bullish divergence on the hourly chart against the Relative Strength Index (RSI).

The analyst added that the percentage of Binance traders going long on BTC has increased from 53.12% to 64%. These traders are said to have a solid record of being right.

Martinez further stated that the Bitcoin price needs to break above $94,800 to confirm this rebound. A break above this level could send BTC to $95,300 or even $96,000.

On the flip side, the analyst warned that if Bitcoin drops below $93,600, the bull case is off the table as the flagship crypto could drop to $84,000 or even $70,000.

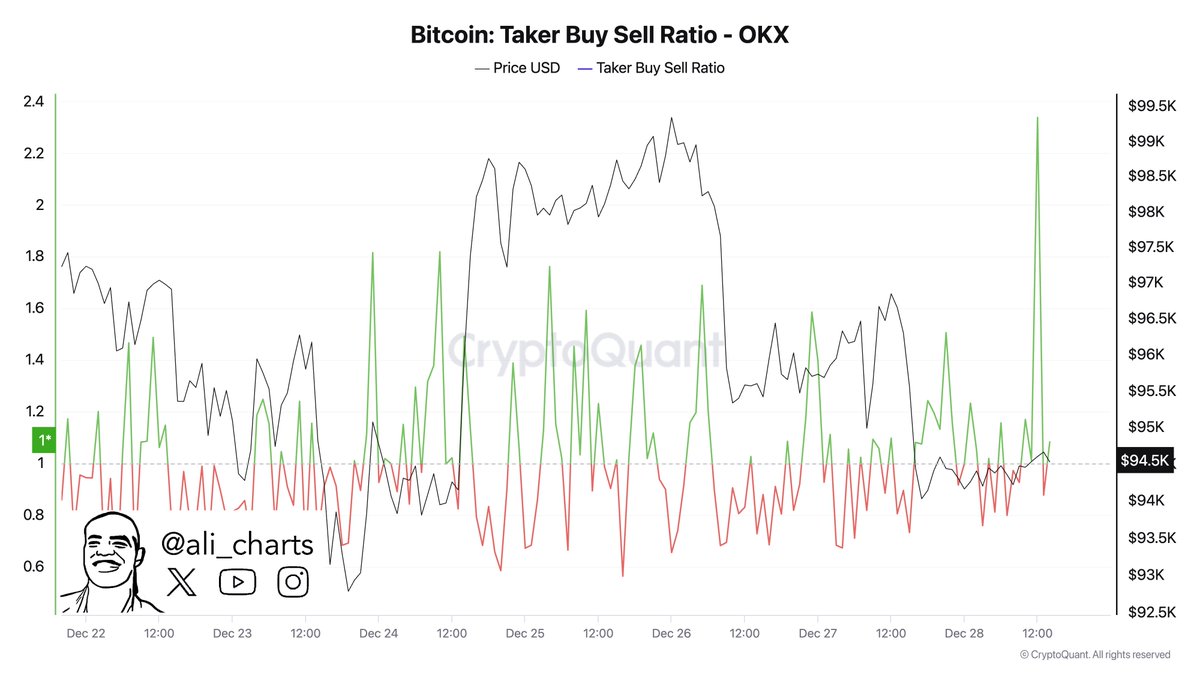

However, the bullish case is looking more likely. In another X post, the analyst revealed that there was a spike in Bitcoin’s Taker Buy/Sell ratio on the top crypto exchange OKX. This indicates a surge in aggressive buying, which is a sign of upward momentum ahead.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across DeFi, NFTs, smart contracts, and blockchain interoperability, among others. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Bitcoin Futures Data Shows Bullish Long/Short Ratio – Details

TRUMP, PI Network, Wormhole Analysis

Insider at Major US Bank Quietly Drains $180,000 From Two Customers’ Accounts, Alleges Department of Justice

Bitcoin ‘in position’ for first key RSI breakout in 6 months at $85K

Beyond Strategy: 11 More Publicly Traded Companies That Are Stockpiling Bitcoin

Crypto stocks mirror market-wide slump in Bitcoin, altcoins

24/7 Cryptocurrency News

Analyst Predict XRP Price Could Hit $77 in This Bull Cycle

Published

7 hours agoon

March 23, 2025By

admin

A market analyst has presented a bold projection for XRP price movement, suggesting it could reach as high as $77.7 during the ongoing bull market cycle. This prediction is based on the application of advanced technical tools, including Exponential Fibonacci models and Elliott Wave theory, which are often used to forecast long-term price trends in financial markets.

According to the analyst, conventional linear models fail to capture the compounding nature of crypto price movements, especially during the upcoming altcoin rally.

XRP Price Prediction: Analyst Says $77 Target Possible in Current Bull Cycle

Crypto analyst Dark Defender revealed XRP price could climb to $77.7 during the current market cycle. The forecast is based on the use of Exponential Fibonacci levels, a method he claims is underused in crypto market analysis. He explains that standard linear projections do not reflect the actual growth patterns often observed during accelerated market conditions.

Dark Defender outlines a five-wave impulse structure based on Elliott Wave theory. In his analysis, Wave 3 is positioned as the most explosive part of the cycle. He suggests that the top altcoin rally may first move between $5 and $8 during this wave. A further push toward $18 to $23 is anticipated before the final wave.

Wave 5, the final leg in the structure, is projected to carry XRP price into three-digit levels. His analysis sets the upper range at approximately $77.7, based on the extended Fibonacci measurements. This would mark a substantial increase from current levels and surpass previous highs.

Technical Indicators and Chart Patterns Supporting the Outlook

Dark Defender’s projection includes a review of multiple technical indicators. He references Relative Strength Index (RSI) trends and momentum indicators as supporting factors in his analysis. These tools suggest continued bullish pressure, especially on higher time frames like the monthly chart.

Volume clusters are another factor he incorporates. According to the chart data, strong accumulation zones have formed, typically supporting future crypto rallies. He also notes that current price movements mirror those of previous bull runs, reinforcing the idea of an upcoming altcoin rally.

Chart structures from earlier cycles show similar formations that preceded large price expansions. These historical similarities, momentum signals, and volume behavior form the basis of his extended projection for the XRP price.

Meanwhile, another more bullish analysis projects the Ripple token could cross $1,000 if the partnership with SWIFT leads to the global adoption of XRP for real-time liquidity in cross-border payments. Analysts suggest that such integration would require massive XRP reserves and institutional demand, which could drive the altcoin rally.

Impact of Ripple Lawsuit and Legal Developments

Additionally, analyst Egrag Crypto has also shared a bullish forecast for XRP price earlier on. He places initial targets between $5 and $6, with a possibility of reaching $10. His prediction is partly tied to the recent resolution of the Ripple lawsuit by the U.S. Securities and Exchange Commission, which some believe could act as a catalyst for further gains.

Egrag Crypto’s analysis also uses Fibonacci levels, identifying consistent full-body monthly candle closings above Fib 1.0. He states that this chart’s behavior reflects price strength and momentum. A potential altcoin rally to the Fib 1.618 level, targeting up to $10, remains a possibility according to his analysis.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. With over 4000 published articles across various media outlets, he aims to inform, educate and introduce more people to the Blockchain and DeFi world. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

US FOMC, XRP Lawsuit, & Pi Network In Spotlight

Published

13 hours agoon

March 23, 2025By

admin

The crypto market concluded another week, primarily witnessing major developments surrounding the U.S. FOMC, XRP lawsuit, and Pi Network. While the Ripple community rejoiced in light of the U.S. SEC lawsuit end, the Fed Reserve kept interest rates unchanged. Simultaneously, Pi Network fluxed around the $1 mark this week, triggering a wave of speculation among investors.

Other developments like a SUI ETF filing followed, stirring market optimism globally. Mentioned below are some of the top market updates reported by CoinGape over the past week.

US FOMC Sparks Crypto Market Speculations With Unchanged Interest Rates

The crypto market saw the latest US FOMC in play, with the Federal Reserve deciding to keep interest rates unchanged at 4.25 to 4.5% this week. Nevertheless, speculations of a dovish stance as the year longs persist across the market.

Fed Chair Jerome Powell stated that the inflation outlook is transitory with the Donald Trump-induced tariff in North America. Notably, the Fed appears to be gauging the impact of recent macro dynamics before making a rate cut decision.

BitMex CEO Arthur Hayes further took the stage amid the FOMC decision, stating he believes a rate cut is looming for April 1. In turn, the CEO also anticipated a BTC rally to follow, given that the feat happens. Bitcoin closed the week at the $84K price level, whereas major altcoins mainly prevented downturns.

XRP Lawsuit End: Affirms Ripple CEO

Simultaneously, Ripple’s CEO Brad Garlinghouse proclaimed that the U.S. SEC has agreed to drop the XRP lawsuit this week. While this news offered the Ripple community immense relief, a butterfly effect occurred in the crypto market. The SEC’s stance on cryptocurrencies saw a loosened grip under Trump’s presidency.

Meanwhile, CLO Stuart Alderoty revealed the next steps following the U.S. SEC’s declaration of an appeal drop in the lawsuit. In the interim, XRP price closed this week considerably above the $2 level, although the weekly chart showed a dip of 2%.

Pi Network: What’s The Buzz?

Pi Network stole the broader market’s attention, showcasing a highly fluxing action over the past week. CoinGape reported that this volatility came attributed to nearly 129 million Pi Coins ready for an unlock, worth about $175 million, set to be added to the supply this month.

On the other hand, the crypto saw rising adoption in the Asian landscape this week. Vietnam-based Pi enthusiast Cryptoleakvn recently shared an update on X, highlighting a surge in Pi-accepting regions across the country.

However, the Pi token faced investor selloff concerns amid its turbulent price action this week. The lack of major announcements by the crypto team has added to market concerns about future movements.

In conclusion, mentioned above were some of the top crypto market updates reported by CoinGape over the past week. It’s also worth mentioning that Canary Capital filed for SUI ETF approval with the U.S. SEC this week.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Ethereum Price Eyes Key Resistance as Analysts Warn of Drop to $1,700

Published

21 hours agoon

March 22, 2025By

admin

Ethereum price is approaching a key technical level that has historically acted as a barrier to upward price movement. According to recent technical analysis, this resistance zone has triggered past reversals, and analysts caution that another failure to break above could lead to a downward correction. The altcoin is trading within a descending channel, a pattern typically associated with bearish trends. While some analysts remain optimistic about a potential rebound, others warn that the next move could push ETH price lower, targeting a key support of $1,700.

Analysts Warn of Ethereum Price Potential Fall to $1,700

According to a recent analysis, Ethereum price is nearing a resistance zone at $2,200. This level coincides with the upper boundary of a Descending Channel. Technical analysts consider this pattern bearish. Price movements within the channel have shown lower highs and lower lows, indicating downward pressure.

Crypto analyst MadWhale shared a chart showing Ethereum trading close to this critical resistance. Previous interactions with this level have led to downward reversals. The analyst suggests that failure to break this zone may trigger a 13% decline. The projected target is $1,700, a level that has previously served as support.

More so, another recent analysis shows that ETH/BTC is currently testing a critical support zone last seen in late 2020, raising the possibility of a trend reversal after years of decline. This technical setup, combined with record-high futures open interest of 10.23M ETH, signals a rising potential for a rebound.

Technical Indicators Support a Bearish Outlook

The Ethereum price chart also shows weakening bullish momentum. A rounded top pattern is forming near the resistance. This technical formation suggests that buying pressure is declining. Volume analysis reveals that trading activity is inconsistent, with low participation during recent gains and higher volume during declines.

Lower highs on the daily chart further support a potential downward continuation. These are typical in bearish trends. Traders are advised to monitor for signs of increased selling pressure. Confirmation of a rejection, such as a bearish candlestick pattern or rising sell volume, could strengthen the case for a decline toward $1,700.

According to the Moving Average Convergence Divergence (MACD), ETH is currently showing signs of waning bearish momentum as the MACD line is approaching a bullish crossover with the signal line. If this crossover occurs and is supported by increasing histogram bars, it could indicate a potential price rebound for the top altcoin.

Alternate Scenario: Analyst Forecasts Bullish Targets

While bearish indicators persist, some market observers maintain a positive view. Analyst Patron has outlined three possible bullish price targets. According to his analysis, if the top altcoin holds support near $1,980, a short-term rally could occur. His initial target is $2,296, reflecting a potential increase of over 15%.

Further upside targets include $2,913 and $4,000. These projections assume that current support holds and momentum shifts in favor of buyers. The analyst’s outlook is based on Ethereum price recovering from recent lows and reclaiming previous highs. This scenario would challenge the bearish narrative if confirmed by increased volume.

At press time, the crypto is trading at $1,999.75, marking a 1.20% gain over the past 24 hours. Despite the price uptick, trading volume has dropped sharply by 37.37%, indicating a possible divergence.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. With over 4000 published articles across various media outlets, he aims to inform, educate and introduce more people to the Blockchain and DeFi world. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin Futures Data Shows Bullish Long/Short Ratio – Details

TRUMP, PI Network, Wormhole Analysis

Insider at Major US Bank Quietly Drains $180,000 From Two Customers’ Accounts, Alleges Department of Justice

Bitcoin ‘in position’ for first key RSI breakout in 6 months at $85K

Beyond Strategy: 11 More Publicly Traded Companies That Are Stockpiling Bitcoin

Crypto stocks mirror market-wide slump in Bitcoin, altcoins

Fidelity Files for OnChain U.S. Treasury Fund, Joining the Asset Tokenization Race

Analyst Predict XRP Price Could Hit $77 in This Bull Cycle

Jupiter Price Action Signals Breakdown—$0.41 Target In Play

Sonic unveils high-yield algorithmic stablecoin, reigniting Terra-Luna ‘PTSD’

Ethereum Altcoin Explodes 68% After Korea’s Second-Biggest Crypto Exchange Announces Trading Support

Time for XRP to hit new highs after SEC case over? IntelMarkets could rattle the market

Swedish Film ‘Watch the Skies’ Set for US Release With AI ‘Visual Dubbing’

US FOMC, XRP Lawsuit, & Pi Network In Spotlight

Now Is the Time to Rally to Web3 Gaming

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: