AI

Arbitrum Awards Biggest-Ever Foundation Grant to Lotte, the South Korean Megacorp

Published

4 months agoon

By

admin

Arbitrum, the largest layer-2 network on top of Ethereum, has awarded its biggest-ever developer grant to Lotte Group, the multibillion-dollar South Korean conglomerate known for its vast portfolio of shopping malls, media companies and entertainment properties. According to Offchain Labs, the developer behind Arbitrum, the grant cements Arbitrum as the main blockchain infrastructure provider for Caliverse, Lotte’s metaverse gaming platform.

Offchain Labs shared the news at CES 2025, the technology tradeshow happening this week in Las Vegas, Nevada. A representative for the company declined to disclose the exact size of the grant “at this stage.” It was technically awarded by the non-profit Arbitrum Foundation, which periodically doles out grants in $ARB tokens to help spur development in the Arbitrum ecosystem.

“Lotte is Arbitrum Foundation’s largest grant recipient to date. And we’re proud to be working with partners so closely aligned with our vision,” said John Park, Head of Korea at The Arbitrum Foundation.

Lotte’s Arbitrum integration could signal renewed interest from traditional companies in building blockchain-based virtual worlds—the “metaverse” concept that earned mainstream buzz a few years ago but has since become less top-of-mind for many technologists and investors. Lotte first showed interest in releasing metaverse-related products in 2022 and announced that it was entering a “strategic partnership” with Arbitrum last year.

Caliverse is mainly a venue where the South Korean megacompany experiments with emerging tech trends like artificial intelligence, virtual reality and crypto. Caliverse users can explore virtual worlds featuring differing kinds of media content and futuristic shopping experiences. The app currently features content from a grab-bag of big brands, ranging from 7-Eleven to the Tomorrowland music festival. Much of the content on Caliverse comes from fashion and beauty companies like Givenchy, MCM, and L’Occitane.

Users can currently shop for those brands or experience concerts and other kinds of media within the Caliverse app. The new integration with Arbitrum means that blockchain users will be able to pay for certain services using crypto, and systems like in-game transactions could start running on-chain.

The Arbitrum blockchain has become a popular choice among gaming platforms, with the network experiencing a 72% year-over-year growth in 2024 for gaming, according to Offchain Labs. According to a press release the company shared with CoinDesk, Arbitrum currently hosts 119 game titles and 23 gaming-focused blockchains through its Arbitrum Orbit stack, a customizable toolkit that lets developers create their own blockchains based on Arbitrum’s technology.

“Arbitrum’s blockchain is the ideal home ground for Lotte Caliverse, delivering industry-leading 250ms block times that ensure high-quality performance within virtual worlds and gaming experiences,” said Steven Goldfeder, the co-founder and CEO of Offchain Labs. “With Arbitrum now powering Lotte Caliverse, in-game transactions will be seamlessly integrated on-chain and will eliminate transaction latency, providing users with a smooth, consumer-friendly experience that sets a new standard for Arbitrum-based interactions in virtual worlds.”

Read more: Trading Platform Robinhood, Layer-2 Arbitrum Team Up To Offer Swaps To Users

Source link

You may like

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

AI

Canada’s securities regulator flags rise in crypto scams amid ‘geopolitical unpredictability’

Published

3 days agoon

April 25, 2025By

admin

Crypto-related fraud is booming in Canada as scammers increasingly use AI tools to target investors, the Ontario Securities Commission says.

Canada‘s top securities watchdog is sounding the alarm on a wave of crypto scams, saying fraudsters are now using slick artificial intelligence deepfakes and fake trading platforms to fool investors and steal their money.

During the annual event on Thursday, Grant Vingoe, the chief executive officer of the Ontario Securities Commission, said the country is now in an environment “where there’s more scams, more fraud, more insider trading, more corruption, enabled by an atmosphere in which anything goes and the traditional norms are not being observed as they have in the past,” The Globe and Mail reports.

Vingoe linked the rise in fraud to wider instability as the “unpredictability of the geopolitical environment leads to an environment where people who are interested in doing wrong will find a place.” In 2024 alone, victims reported nearly $640 million in losses, per data from the Canadian Anti-Fraud Centre.

Now, Bonnie Lysyk, the OSC’s executive vice-president of enforcement, says the Commission wants to focus on “high-impact cases,” adding the the Commission wants to “put in place additional strategies to disrupt those who harm investors earlier” as the crypto space “is ripe for fraud.”

Canada began tightening crypto-related regulations in February 2023 when the Canadian Securities Administrators required all crypto trading platforms operating in the country to sign legally binding pre-registration undertakings. This came on top of existing restrictions, including the prohibition on offering margin trading to Canadian users.

Since the CSA considers some stablecoins to be securities or derivatives, exchanges were also prohibited from offering stablecoins or value-referenced crypto through contracts without prior approval, making it challenging for many crypto platforms to comply.

Source link

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Crypto is out of narratives, out of patience, and running out of time to matter. The only way out is forward—by building products people actually use and don’t have to think about. For the past several months, AI agents have been pitched as that future, but most of them are just noise: flashy wrappers that don’t actually do anything.

In the middle of a macro meltdown, with Ethereum’s (ETH) value against Bitcoin (BTC) hitting five-year lows and Bitcoin trading like a high-beta tech stock, no one is begging for another DEX, bridge, or wallet extension. The problem isn’t discoverability. It is a utility. We’ve built an industry optimized for speculation, not service. A financial arcade, not a functioning economy. Most crypto apps don’t have users because they don’t solve anything real.

Volatility is the tell. If crypto were used at scale, real demand would anchor the price. But when macro conditions shift, the whole sector moves in lockstep—because actual usage doesn’t matter. That’s not a UX issue. That’s a product problem.

If crypto wants to survive this phase—let alone escape the echo chamber in the next cycle—we need to stop building abstractions for each other and start building real products for real people.

Why it keeps happening

Crypto has never grown out of its builder-for-builder roots. Success is defined by shipping, not retention. We reward composability over usability. Launches over DAUs. TVL over usefulness.

That’s how we ended up with a wave of AI agents that look good in demos but fall apart in practice—built to impress, not to endure. Builders build for other builders. Teams optimize for token launches, not long-term users. Most roadmaps are driven by narrative timing, not customer feedback. The result? Products that impress on crypto Twitter but don’t matter to anyone outside of it.

User experience is still considered surface-level polish when it should be foundational. We talk about onboarding like it’s a marketing problem, not an architectural one. And we wonder why users churn faster than altcoins collapse.

Not all AI agents are the answer

Take a look at what’s been happening with AI agents in crypto. We’re pretending automation means intelligence. But users don’t need agents that talk. They need agents that do.

And they need agents that can operate with intent: taking autonomous action, interacting onchain, and accruing value, not just information. If this is going to be the narrative of the next cycle—and it might be—we need to raise the bar. What’s missing isn’t another chatbot. It’s autonomy, action, and economic alignment.

The next generation of agents must be onchain actors—agents with memory, incentives, and agency. Not just slick AI interfaces, but participants in the network itself.

What a real product looks like

A real product solves a real problem—clearly, quickly, and without friction. It doesn’t need an explainer thread. It feels like magic, not a UI puzzle. In crypto, the magic moment happens when a product abstracts away the protocol, when it does something for the user without making them think about networks, wallets, or bridges.

Imagine an AI agent that quietly monitors your wallet, and the moment your airdrop unlocks, it claims it and sells at optimal execution—no prompts, no extra steps. At the same time, it watches gas prices and dips into stable-yield reserves you forgot you had, automatically buying the dip without you lifting a finger. When you need to bridge funds or execute a transaction, it instinctively reroutes you through the cheapest and fastest network available, all without asking which chain you’re on or forcing you to approve a dozen steps. That kind of seamless automation isn’t a feature. It’s the foundation of a real product.

These aren’t features. They’re outcomes. And they’re the foundation of actual adoption.

And so these are the kinds of applications crypto needs to hone in on and devote resources to. Real consumer AI agents are a breakthrough here. They act on behalf of users, claiming, trading, and coordinating. They reduce surface area. They make infrastructure invisible. They don’t rely on speculative hype to attain value; they provide an actual service.

That’s how we get crypto out of the power user corn maze and into everyday relevance.

What needs to change (and why now)

This isn’t just about good design. It’s about product discipline. And the timing has never been better. We’re not just in a bear market. We’re in a trust correction. Retail is gone. The ETF narrative is priced in. Altcoins are bleeding out. The Fed and fiscal policy are driving every headline.

This is the best possible time to build—because no one’s watching. There’s no pressure to chase yield or force hype. There’s room to build quiet conviction around something real. So what should builders actually do?

First, they need to design for behavior, not just composability. It’s not enough that components can plug into one another—what matters is whether people actually use them. Real product design starts with the user’s motivation and workflow, not with modularity.

Second, builders should use automation and agents to reduce decision fatigue. Most crypto products overwhelm users with options. The goal should be to eliminate choices, not add more. A great product handles complexity behind the scenes so the user doesn’t have to think.

Third, it’s time to prioritize retention over liquidity mining. If your product only works because there’s a token incentive attached to it, it’s not a product—it’s a promotion. Focus on building something people come back to without needing a bribe.

Finally, usability should be treated as infrastructure, not decoration. The interface is not the cherry on top—it’s the bridge between function and experience. If it’s not intuitive, it’s broken.

AI agents for consumers aren’t a gimmick. They’re the best shot we have at building something people actually return to. Not because they believe in your token. But because the product does something for them.

Stop building for nobody

We don’t need more tokenized interfaces. We don’t need more demos that explain themselves better than they perform. And we definitely don’t need another yield mechanic disguised as a product.

We need software that helps people get something done. That they come back to because it works, not because they’re speculating. Consumer AI agents are the clearest path to that future. Stop building apps no one uses. Start building ones that people don’t even have to think about.

Garrison Yang

Garrison Yang is the co-founder of Mirai Labs, a web3 development studio building intuitive consumer applications that make crypto usable—and useful—for everyone. With over 15 years of experience across engineering, strategy, growth, and product, Garrison blends technical depth with a marketer’s eye for impact. A former professional gamer, he brings a competitive edge and a deep understanding of user behavior to everything he builds. At Mirai, he’s focused on turning blockchain into something people actually use—without even realizing it.

Source link

AI

Here’s why AI tokens FET, AIC, Render, WLD, TAI are soaring

Published

1 week agoon

April 20, 2025By

admin

Top artificial intelligence tokens were among the best performers this weekend, as investors bought the dip following a key report from CoinGecko.

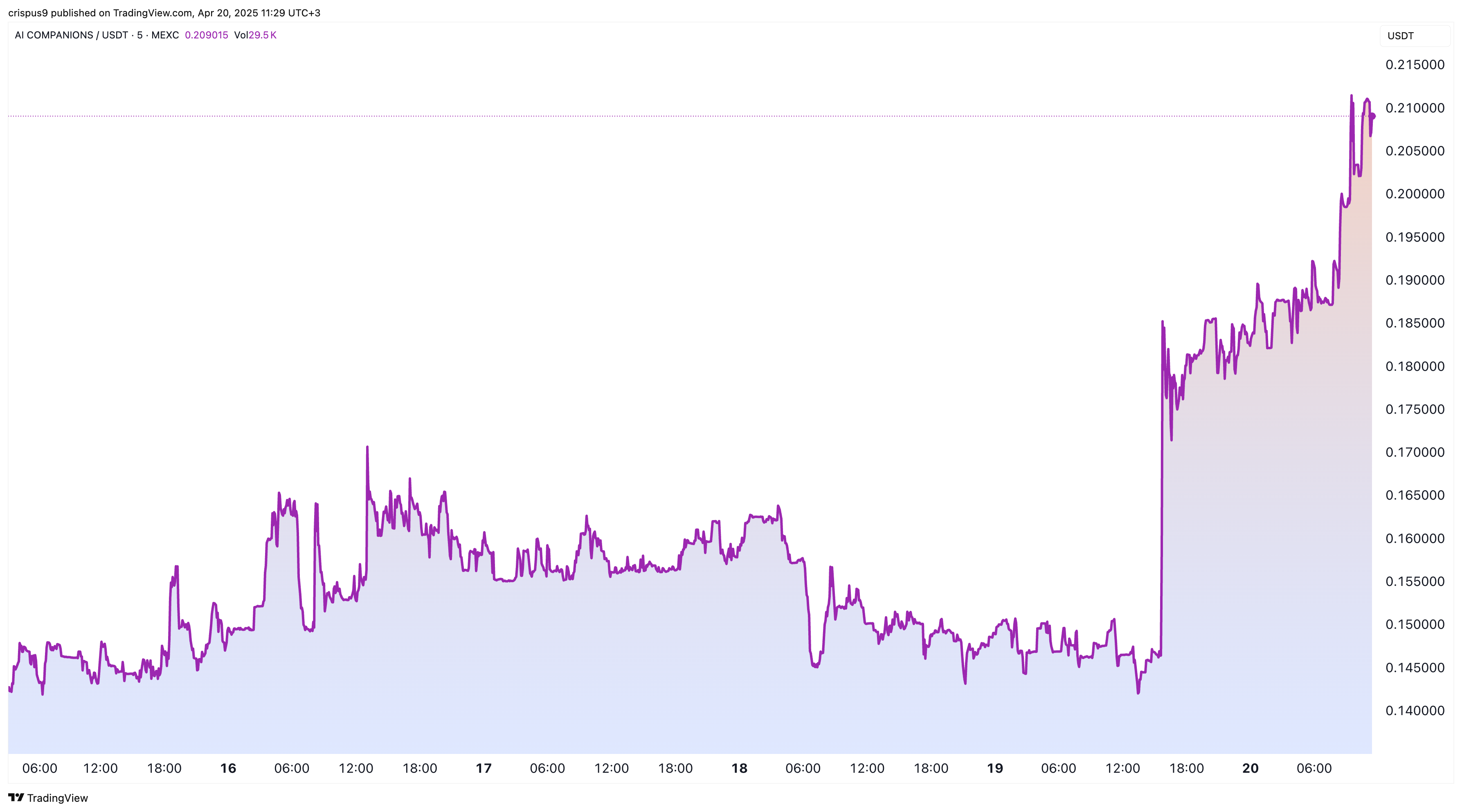

AI Companions (AIC) tokens jumped by over 40% to $0.2120, its highest point since March 30 and 70% above its lowest point this month.

Artificial Superintelligence Alliance (FET) price rose for four consecutive weeks, reaching a high of $0.5730, its highest swing since March 26.

Render (RNDR) token jumped to $4.32, also up by double digits from the year-to-date low. Worldcoin (WLD) price rose by 7%, while Tars AI jumped by about 60%. The total market cap of all AI tokens tracked by CoinGecko has jumped by 5.6% in the last 24 hours to $22.20 billion.

These AI tokens jumped after a CoinGecko report showed that AI was one of the most popular themes in the crypto market. The Artificial Intelligence theme had a 14.4% share, while AI agents had 10.1%. Combined, the figure was higher than the meme coin interest of 16.5%.

AI tokens and stocks are losing traction

Recently, however, there are signs that the AI theme is losing traction in the stock and crypto market. Popular AI stocks like NVIDIA, AMD, SoundHound, and Bigbear AI have all plunged by over 20% from their peak levels.

Similarly, AI tokens like Render, AIC, TAI, WLD, and FET have all plunged by over 50% from their highest points this year. Their decline has mirrored the performance of the broader crypto market.

There are concerns that the AI bubble that has been inflating in the past few years is about to deflate. One possible sign for this is that Microsoft has started pausing its data center expansion in places like the United States, India, and Indonesia.

Another concern is the oversupply of AI models. While US AI models like Claude, ChatGPT, and Grok are the most popular, China has many more, including DeepSeek, Baidu Ernie, Alibaba Qwen, and ByteDance’s Doubao.

It is unclear whether these AI tokens like AI Companions, Tars AI, Worldcoin, and FET will continue rising since this rebound may be part of a dead cat bounce. A sustained recovery will depend on the performance of the crypto market. A strong Bitcoin (BTC) rebound, as we predicted, will point to more gains for most altcoins.

Source link

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin6 months ago

Bitcoin6 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines