Avalanche

AVAX To Soar 1,200%, Beat Bitcoin By 2029: Standard Chartered

Published

3 days agoon

By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Global banking giant Standard Chartered published new five-year price projections for three leading cryptocurrencies: Avalanche (AVAX), Bitcoin (BTC), and Ethereum (ETH). According to these forecasts, Avalanche is poised to gain significant ground on both Bitcoin and Ethereum by 2029.

Ryan Rasmussen, Head of Research at Bitwise, drew attention to these ambitious targets via X. “Global banking giant Standard Chartered just published 5yr price targets for Bitcoin, Ethereum, and Avalanche,” Rasmussen wrote, pointing to a chart that outlined the bank’s estimates.

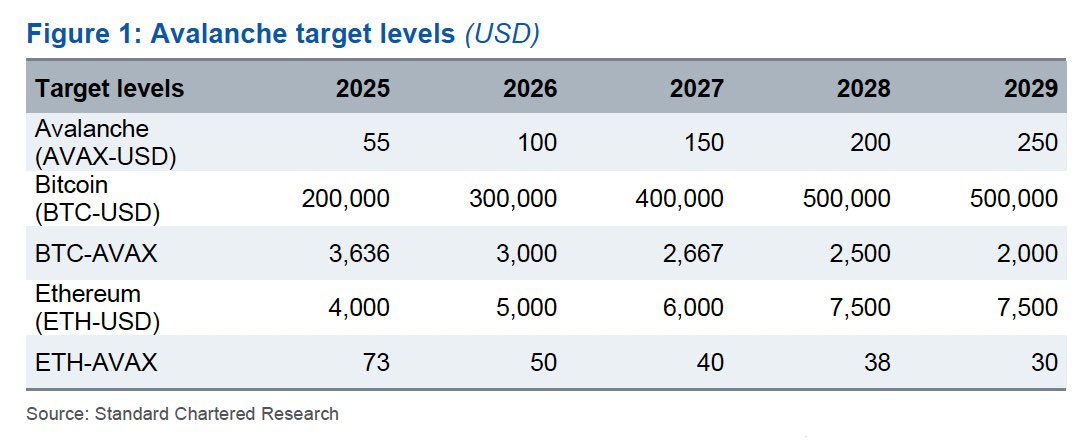

Standard Chartered expects Avalanche (AVAX) to reach $55 by the end of 2025, $100 by 2026, $150 by 2027, $200 by 2028, and ultimately $250 by the end of 2029. This projected growth represents a more than 1,200% increase from its current trading level of around $20.

Meanwhile, Bitcoin (BTC) updated its forecast and now projects BTC to appreciate from $200,000 in 2025 to $300,000 in 2026, followed by $400,000 in 2027, and finally hitting $500,000 in 2028—a level it is expected to maintain through 2029.

For Ethereum (ETH), Standard Chartered projects the token to hit $4,000 in 2025, $5,000 in 2026, $6,000 in 2027, and $7,500 by 2028, with no change anticipated in 2029. The forecast indicates steady but less dramatic growth relative to Avalanche.

Related Reading

In terms of comparative valuation, the bank provided ratio metrics to show how AVAX might perform against BTC and ETH. The BTC-to-AVAX ratio, which measures how many AVAX tokens equal one BTC, is expected to drop from 3,636 in 2025 to 2,000 in 2029.

This decreasing trend implies that AVAX will appreciate faster than Bitcoin over the period. Similarly, the ETH-to-AVAX ratio is projected to decline from 73 to 30 during the same timeframe, pointing to a similar outperformance against Ethereum.

Standard Chartered’s Bullish Case For Avalanche

Standard Chartered has initiated coverage of Avalanche, stating it expects AVAX to rise from its current price of roughly $20 to $250 by the end of 2029. “One positive of the tariff noise is that it gives us a chance to re-set and pick winners for the next upswing in digital asset prices,” said Geoffrey Kendrick, the bank’s global head of digital assets research, in an email to The Block on Wednesday, referencing his latest report. “And I think Avalanche will be another winner, perhaps the winner in EVM [Ethereum Virtual Machine] chains.”

Related Reading

Kendrick emphasized that Avalanche’s approach to scaling—particularly after its Etna upgrade, also known as Avalanche9000—positions the network for long-term success. Activated in December 2024, the Etna upgrade dramatically reduced the cost of launching subnets (which Avalanche now calls Layer 1 blockchains), slashing setup expenses from up to $450,000 to nearly zero.

Kendrick noted that these changes appear to be attracting new developer activity: “A quarter of Avalanche’s active subnets are now Etna-compatible, and developer numbers have jumped 40% since the upgrade.”

He also mentioned that some developers are migrating from Ethereum Layer 2 solutions to Avalanche due to its compatibility with Ethereum code and the lower overhead for launching new subnets or L1 chains. While fees on Avalanche can still run higher than certain Ethereum L2s like Arbitrum, Kendrick believes attracting completely new applications—especially in fields such as gaming and consumer-focused tools—will be critical to Avalanche’s growth.

“As a result, we see AVAX outperforming both Bitcoin and Ethereum in terms of relative price gains in the coming years,” Kendrick remarked, while noting Avalanche’s higher volatility levels compared to BTC.

At press time, BTC traded at $83,334.

Featured image created with DALL.E, chart from TradingView.com

Source link

You may like

Bitcoin Trades Above $79K as Asia Markets React to Trump Tariffs

Memecoin platform Pump.fun brings livestream feature back to 5% of users

Bitcoin Price On The Verge Of Explosive 15% Breakout As Analyst Spots Triangle Formation

Strategy CEO Makes The Case For Corporate Bitcoin Adoption In MIT Keynote

Hackers Hammer Android and iPhone Users As Bank Account Attacks Surge 258% in One Year: Kaspersky

Cryptocurrencies to watch this week: Aptos, XRP, Solana

Avalanche

Crypto Trader Says Dogecoin Is at a Critical ‘Make-or-Break’ Level, Updates Outlook on Solana and Avalanche

Published

3 days agoon

April 4, 2025By

admin

Cryptocurrency trader Ali Martinez believes Dogecoin (DOGE) is at a critical level that could determine its price direction over the near term.

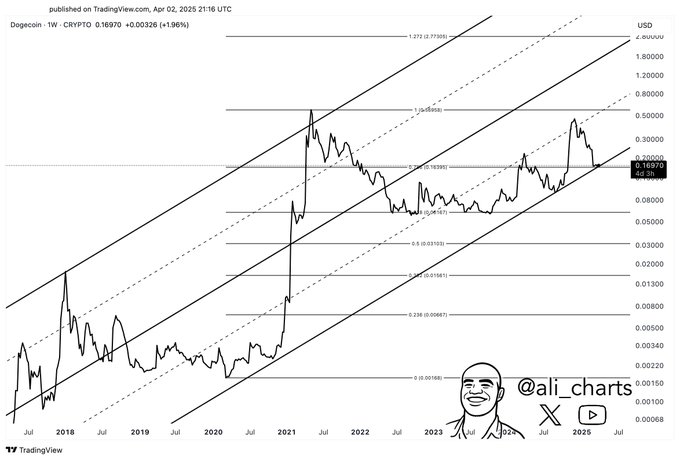

Martinez tells his 134,800 followers on the social media platform X that Dogecoin is at a “make-or-break level” of around $0.16.

According to Martinez, Dogecoin could either go up substantially by up to 256% from the support zone if the critical level holds as support or fall precipitously by around 60% if the critical level fails as support.

Based on a chart by the crypto trader, it appears he’s suggesting that Dogecoin is in an ascending channel on the weekly time frame and the make-or-break level is the lower boundary of the pattern.

“If $0.16 holds, a rally to $0.57 could follow. If it fails, a drop to $0.06 becomes likely.”

Dogecoin is trading at $0.158 at time of writing.

Next up is Solana (SOL). Martinez says the seventh-largest crypto asset by market cap is primed to go lower after breaking down below a descending triangle pattern on the daily time frame. Based on Martinez’s chart, it appears he is suggesting that Solana could plummet to around $60, about 47% from the current level.

Solana is trading at $114 at time of writing.

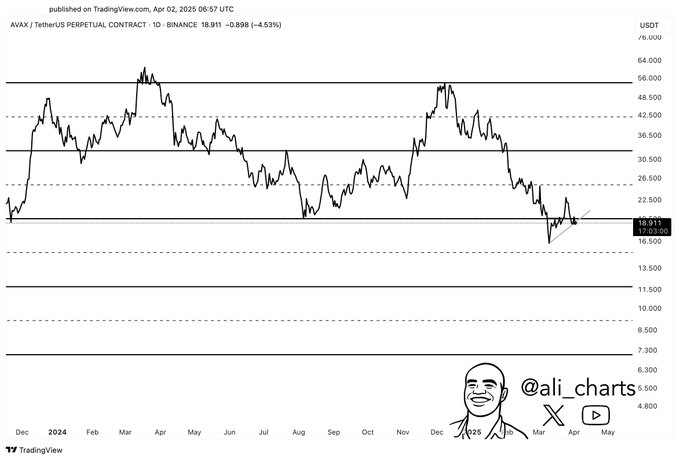

Turning to Avalanche (AVAX), Martinez says that the utility token of the layer-one blockchain is primed to break down from the lower boundary of a rectangle pattern that has formed on the daily time frame. According to Martinez, Avalanche could fall by up to 61% from the current level.

Avalanche is trading at $18 at time of writing.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoins

Nasdaq Files To Launch a New Grayscale Avalanche (AVAX) Exchange-Traded Fund

Published

1 week agoon

March 30, 2025By

admin

Digital asset management giant Grayscale hopes to launch an Avalanche (AVAX) exchange-traded fund (ETF) in the US.

The Nasdaq Stock Market submitted a proposal this week to the U.S. Securities and Exchange Commission (SEC) to list and trade shares of Grayscale Avalanche Trust, which would be entirely tied to the price of the layer-1 project’s native asset, AVAX.

Grayscale isn’t the first financial giant to file for an Avalanche ETF. Documents submitted to the state of Delaware earlier this month suggest VanEck also hopes to launch a fund tied to the Ethereum (ETH) rival.

Coinbase Custody will serve as the custodian for Grayscale’s Avalanche ETF if it’s approved. The crypto asset manager also hopes to launch funds tied to Cardano (ADA), Solana (SOL), XRP and Hedera (HBAR).

The SEC greenlit the first spot market Bitcoin (BTC) ETFs in January 2024, bringing in billions of dollars worth of inflows to the top digital asset by market cap. The regulator subsequently approved Ethereum ETFs for trading last July.

Two financial firms, Franklin Templeton and Hashdex, also launched joint BTC-ETH ETFs earlier this year.

AVAX is trading at $20.36 at time of writing. The 17th-ranked crypto asset by market cap is down nearly 8% in the past 24 hours.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

VanEck has registered an Avalanche exchange-traded fund (ETF) in the U.S. state of Delaware as investment manager continue to apply for various altcoin-based product despite the clawback in the crypto market.

The New York-headquartered company registered the “VanEck Avalanche ETF” on March 10, according to a filing on Delaware’s Department of State website.

The registration comes amid an ongoing sell-off in the crypto market, which has seen Avalanche’s native token (AVAX) fall to a one-year low of $16.27.

Avalanche becomes the fourth crypto asset VanEck has registered an ETF for, following its filing for a spot Solana fund last June. VanEck was among the first issuers of bitcoin (BTC) and ether(ETH) ETFs after they were approved in January and July respectively.

Issuers are seemingly branching out across the altcoin market to develop new ETFs. Investment managers Rex Shares and Osprey Fund filed to list a MOVE fund on Monday.

Source link

Bitcoin Trades Above $79K as Asia Markets React to Trump Tariffs

Memecoin platform Pump.fun brings livestream feature back to 5% of users

Bitcoin Price On The Verge Of Explosive 15% Breakout As Analyst Spots Triangle Formation

Strategy CEO Makes The Case For Corporate Bitcoin Adoption In MIT Keynote

Hackers Hammer Android and iPhone Users As Bank Account Attacks Surge 258% in One Year: Kaspersky

Cryptocurrencies to watch this week: Aptos, XRP, Solana

This Week in Crypto Games: ‘Off the Grid’ Token Live, Logan Paul ‘CryptoZoo’ Lawsuit Continues

Crypto Liquidations hit $600M as BTC Plunges Below $80K First Time in 25-days

Bitcoin (BTC) Price Posts Worst Q1 in a Decade, Raising Questions About Where the Cycle Stands

Stablecoins are the best way to ensure US dollar dominance — Web3 CEO

Chainlink (LINK) Targets Rebound To $19 — But Only If This Key Support Holds

NFT industry in trouble as activity slows, market collapses

US Tech Sector About To Witness ‘Economic Armageddon’ Amid Trump’s Tariffs, According to Wealth Management Exec

XRP’s Open Interest Surges Above $3 Billion, Will Price Follow?

This Week in Bitcoin: BTC Holds Steady as Trump’s Trade War Wrecks Stocks

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x