Altcoins

‘Be on Guard’: Trader Says Altcoin Bounce May Be Temporary, Tracks Bitcoin’s Next Targets

Published

1 month agoon

By

admin

A widely followed crypto analyst and trader is warning that an altcoin market bounce may end up being short-lived.

In a new post, pseudonymous crypto trader Altcoin Sherpa tells his 243,900 followers on the social media platform X that alts may give up gains after bouncing based on historical precedence.

He also says Bitcoin (BTC) may soon flip $84,000 into support and that the flagship crypto asset could maintain bullish momentum by breaking through the $89,000 level.

“BTC looks like $84,000 is the first test that is going to break (to the upside) and we’re ok in that department. $89,000 would be my next level of interest overall. Alts looking like they’ll give a temporary bounce but not sure how strong (yet). Be on guard.”

Looking at his chart, the analyst suggests that if Bitcoin can regain $98,703 as support, the flagship crypto asset may print new all-time highs.

However, he warns if $78,167 breaks down as support, Bitcoin may plummet into the $60,000 range.

Bitcoin is trading for $84,154 at time of writing, up 4.6% in the last 24 hours.

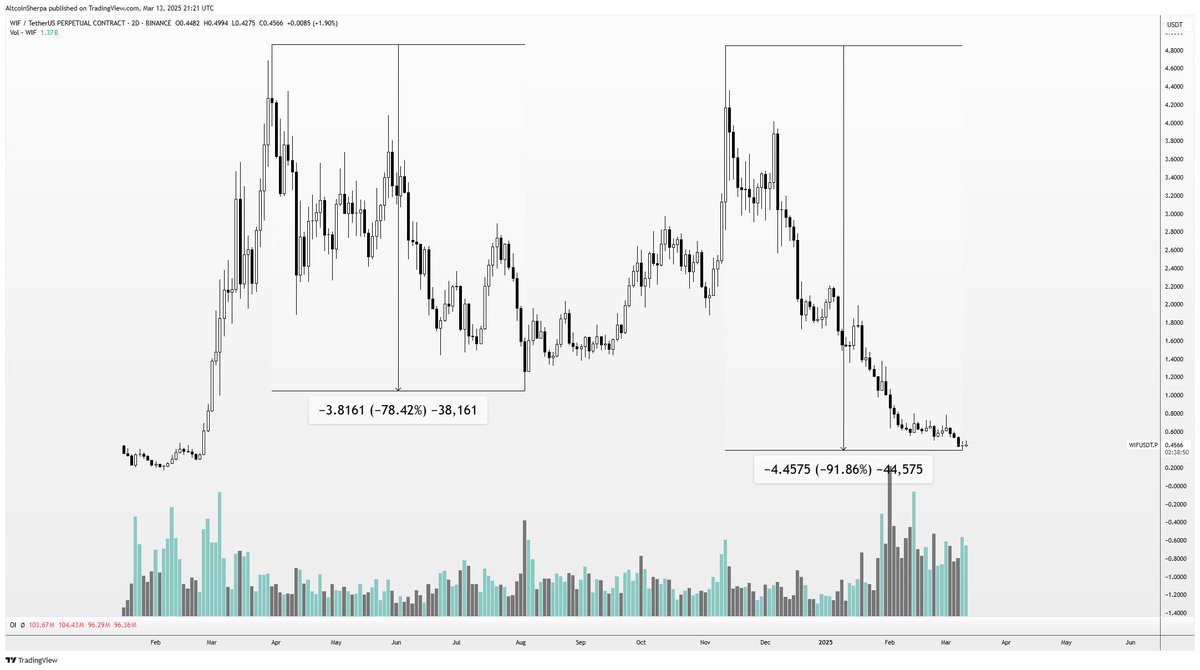

The analyst also warns that altcoins like the dogwifhat (WIF) memecoin may struggle for a long time to ever regain higher price targets if Bitcoin turns bearish.

“It’s a lot more concerning for sh**coins this go around because BTC might actually be dead for a bit. In the previous drawdown, we had a lot more hope because we assumed BTC still had more upside. If BTC dies to $50,000 or w/e (whatever), these aren’t coming back for a very long time. See WIF.”

WIF is trading for $0.50 at time of writing, up 9.7% in the last 24 hours.

He adds that altcoins may bounce even as they continue to print a bearish lower-high price structure.

“As much as everything is dead and we’re truly in a bear market for altcoins, it’s important to remember that a bounce will come and alts can still do a few x from current levels. Markets don’t move in a straight line down. Bounce coming within the next one to two months in my opinion.”

He shares the two-day chart of Ethereum (ETH) to illustrate the historical precedence of an altcoin bouncing amid a larger downtrend.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

XRP Price Shoots For 20% Surge To $2.51 Amid Pullback To Breakout Zone

Stocks edge higher ahead of big earnings week

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Altcoins

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Published

10 hours agoon

April 28, 2025By

admin

A closely followed crypto strategist believes one memecoin running on Solana (SOL) is not yet done rallying, even after posting over 60% gains this month.

Pseudonymous analyst Altcoin Sherpa tells his 245,000 followers on the social media platform X that he’s bullish on Bonk (BONK) following the altcoin’s breakout of an accumulation zone on the three-day chart.

The trader shares a chart suggesting that BONK can rally to as high as $0.0000262 after taking out its resistance at $0.0000142.

“BONK is going much higher (I have a bag). Looks good on the charts as well.

Think I’m going to add to my position if I get a small dip.”

At time of writing, BONK is trading for $0.0000182.

Turning to the native asset of the non-fungible token (NFT) project Pudgy Penguins (PENGU), the trader says the altcoin needs to print a bullish higher low setup at around $0.0065 to start reversing its multi-month downtrend. Otherwise, Altcoin Sherpa warns that PENGU may drop to as low as $0.004.

“Coins like PENGU got rekt the last several months but are showing some signs of life. The true test is going to be where the next low is and how the reaction is.

The trend is still bearish, so don’t be so quick to catch knives. That said, we could see some reversal if the environment continues to ease up.”

Based on the trader’s chart, he appears to suggest that PENGU may soar to as high as $0.014 if the altcoin manages to establish a higher low.

At time of writing, PENGU is worth $0.00985.

As for the broader altcoin market, the analyst warns that most coins are still in a high-time-frame downtrend and that the gains witnessed this month could be erased. However, Altcoin Sherpa notes that it is now within the realm of possibility for altcoins to start carving a major cycle bottom en route to a bullish reversal.

“To be clear, I’m pretty bullish overall and think that we’re going higher and the next major dip is a BUY THE DIP situation.

HOWEVER, most alts still are in bearish market structures (see TAO) and continuation of that trend is down. I think we go higher for everything, but just a careful reminder that these sh*tcoins are still in bearish trends and have made lower highs, lower lows.

I do think that we’re doing better, though.”

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Art Furnace/Natalia Siiatovskaia

Source link

Altcoin

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Published

16 hours agoon

April 27, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Dogecoin’s price is entering a new bullish phase after months of decline. Technical analysis of the daily candlestick timeframe chart shows that the popular meme cryptocurrency is flashing a trend reversal, hinting at a significant shift from bearish to bullish momentum.

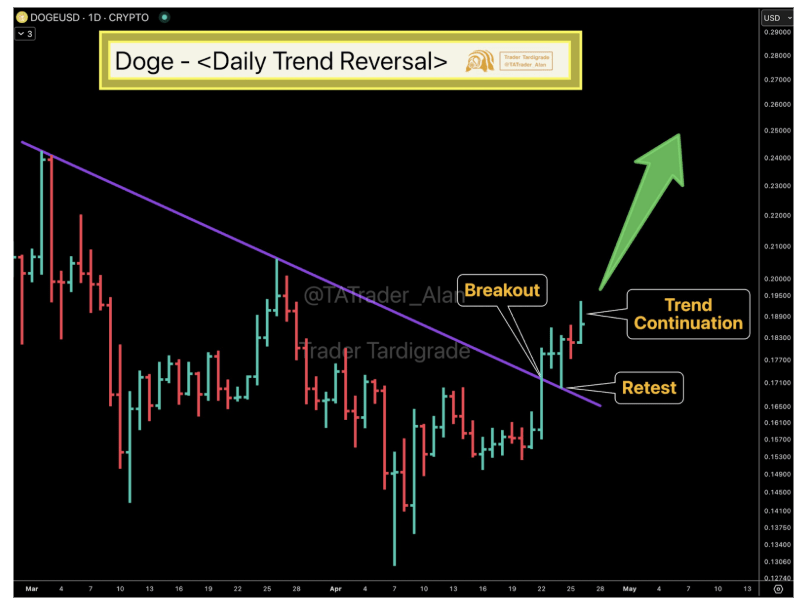

Analyst Flags Daily Trend Reversal On Dogecoin Chart

A prominent crypto analyst known as Trader Tardigrade has highlighted a confirmed trend reversal for Dogecoin. In a post on X (formerly Twitter) this week, he pointed out that DOGE’s daily chart has flipped from a downtrend to an uptrend. This claim is reinforced by a technical analysis of Dogecoin’s price action.

Related Reading

Dogecoin’s price recently broke above a descending trendline that had defined its downtrend for several weeks. This breakout occurred on April 22, when Dogecoin closed above $0.165 on the daily candlestick timeframe. This breakout was the first step indicating the coin was escaping its bearish trajectory.

Shortly after breaching the downward sloping resistance line, Dogecoin’s price pulled back between April 23 and April 24 to retest the same trendline, but this time from above. Importantly, the former resistance trendline held strong as a new support level during the retest. Following that successful test, Dogecoin resumed its upward climb, marking the continuation of the new uptrend.

This pattern of breakout, retest, continuation is a classic technical confirmation of a trend reversal. The successful retest of this trendline gives more confidence that the bullish shift is real and not a false signal.

Image From X: Trader Tardigrade

Bullish Target: $0.25 By Early May

With the daily trend now pointing upward, the focus is now on how far this new uptrend could carry Dogecoin. According to Trader Tardigrade’s analysis, Dogecoin could continue climbing in the coming days, potentially crossing the quarter-dollar mark very soon. As indicated on the chart he shared by Trader Tardigrade, the next Dogecoin price target is around $0.25 by the first week of May.

If achieved, a rise to $0.25 would be a significant milestone, considering Dogecoin has been stuck in a downtrend for over 10 weeks. As such, a break to $0.25 would mark Dogecoin’s highest price since late February and a robust recovery from its recent lows around the $0.14 to $0.15 range. Such a move would also represent roughly a 51% gain from the breakout level of $0.165.

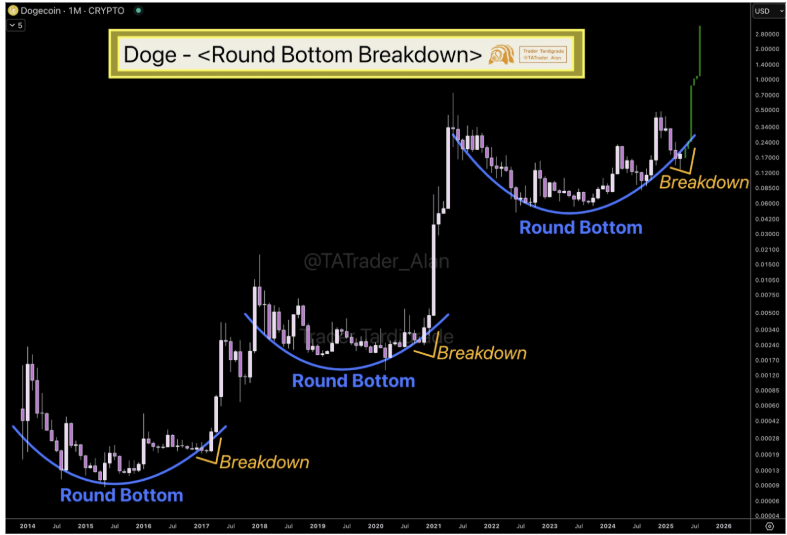

However, $0.25 is only the target in the short term. In a separate analysis, Trader Tardigrade pointed to Dogecoin’s long-term chart, highlighting a round bottom formation. The accompanying chart shows that in previous cycles, Dogecoin’s price formed a rounded bottom before entering explosive upward trends. This repeated pattern, now visible again on the monthly timeframe, signals that Dogecoin may be on the verge of another significant breakout. The long-term price target in this case is $2.8.

Image From X: Trader Tardigrade

Related Reading

At the time of writing, Dogecoin is trading at $0.18.

Featured image from Unsplash, chart from TradingView

Source link

Altcoins

DePIN Altcoin Outpaces Crypto Market and Skyrockets by Nearly 44% Following High-Profile Exchange Listing

Published

1 day agoon

April 27, 2025By

admin

An altcoin associated with a decentralized physical infrastructure network (DePIN) project surged by nearly 44% on Friday after receiving a prominent exchange listing.

On Thursday, the South Korean crypto exchange giant Bithumb announced it was listing XYO, the native token of the XYO Network.

The XYO Network aims to process any type of decentralized data.

Explains the project’s website,

“Encompassing both a network and protocol, XYO can be used for aggregating, verifying, organizing, and utilizing decentralized data from any hardware node capable of running XYO-enabled software or firmware.

XYO’s defining premise is decentralized verification, allowing network devices to verify the data flowing into the network’s databases by acting as witnesses for one another, strengthening the veracity of data received. Simple, accessible organization then allows this data to be put to use quickly and efficiently.”

Earlier this month, the project announced it would be migrating its network to a new layer-1 chain focused on DePIN. To help facilitate that move, the XYO Network is also rolling out a new layer-1 native token, XL1, and will operate with a dual-token model going forward.

The original XYO token will stay on Ethereum (ETH) and act “as an anchor to regulate the flow of XL1 into its native blockchain,” according to the project.

XYO is trading at $0.0154 at time of writing. The 278th-ranked crypto asset by market cap is also up by more than 71% in the past week.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

XRP Price Shoots For 20% Surge To $2.51 Amid Pullback To Breakout Zone

Stocks edge higher ahead of big earnings week

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin6 months ago

Bitcoin6 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines