Altcoins

Bears aim at $2.20 Reversal as Profit-taking begins

Published

3 months agoon

By

admin

XRP price fell as low as $2.30 on Sunday, January 5, down 7% within the 24-hour timeframe. Recent trading data shows that XRP is witnessing intense sell-side pressure. Is Ripple price at risk of double-digit losses in the week ahead?

XRP Price Retraces 7% as Profit-Taking Begins

XRP price action has experienced downward volatility in the last 24 hours, after a remarkable start to 2025. As the global crypto market rally entered its 5th day, investors began to reshuffle capital across the markets, with the likes of XRP and Shiba Inu (SHIB) witnessing bearish tailwinds.

The TradingView chart above illustrates how XRP prices climbed 25% between December 30 and January 4. But after a 5-day winning streak, early profit-taking signals have emerged as XRP price retraced 7% from $2.50 to $2.33 in the last 24 hours.

With the broader crypto market sentiment still largely positive, recent declines in XRP transaction volumes suggest traders could be rotating gains towards other assets.

CryptoQuant Data Signals Growing Sell-Side Pressure

Failure to breach the $2.50 resistance on January 4 has dampened bullish momentum within the XRP markets over the last 24 hours. However, derivatives markets data show active holders ramped up sell-side pressure since January 2.

Indicatively, CryptoQuant’s Taker Buy/Sell ratio tracks and compares the volume of buy orders to sell orders executed at current market rates. Taker Buy/Sell ratio values below 1 signal bearish dominance, where sellers exiting at current prices outpace willing buyers.

The chart above shows that XRP Taker Buy/Sell ratio fell as low as 0.93 on Sunday, January 5, signaling that sell order volumes have outpaced demand in each of the 3 previous trading days. This evidently set the stage for the 7% price dip experienced in the last 24 hours.

If this shortfall in market demand persists relative to supply, XRP prices could face additional downside risks in the week ahead.

XRP Price Forecast: Bulls Could Regroup at $2.20 Support Level

XRP’s recent 7% price dip has been driven by a rapid profit-taking frenzy, with the Taker Buy/Sell ratio dropping to 0.93 as of January 5. This indicates a consistent dominance of sell-orders over buy-orders in the past three trading days, leading to intensified downward pressure.

If this imbalance between supply and demand persists, XRP could face further declines in the short term.

Trading volumes have been gradually decreasing, signaling weak participation from both buyers and sellers.

The Relative Strength Index (RSI) is trending downward at 53.69, suggesting more downside potential before approaching oversold territories.

In terms of short-term XRP price forecasts, immediate support lies at $2.27, which aligns with the lower Bollinger Band. A breach below that key XRP support level could extend the reversal toward $1.85.

On the upside, the recent peak at $2.50, which aligns with the middle Bollinger Band, acts as immediate resistance.

A sustained recovery above this level could pave the way for XRP to retake the $3 mark.

If XRP rebounds from $2.20 and buyers regain dominance, the price could climb back toward $2.35, and a breakout above $2.52 would invalidate the bearish outlook. However, if selling pressure continues and XRP loses $2.20 support, the next leg down to $1.85 could materialize quickly.

Frequently Asked Questions (FAQs)

XRP’s price drop is linked to profit-taking, with sell orders outpacing buys as indicated by a Taker Buy/Sell ratio of 0.93.

Immediate support lies at $2.20, with critical resistance at $2.50. Breaching $2.50 could open the door to a rally toward $3.

Yes, if selling pressure persists and $2.20 support fails, XRP could decline further to $1.85. However, a rebound above $2.50 could spark recovery.

ibrahim

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

Themes ETFs exec on new 2X Coinbase fund: ‘We believe as the Bitcoin tide rises, it will lift all crypto boats’

Ethena’s USDe Stablecoin Sales Blocked by German Regulator Over ‘Serious Deficiencies’

Is Ethena Price At Risk? Market Maker Offloads $10M ENA Raising Concerns

Tether eyes Big Four firm for its first full financial audit: Report

US Treasury Removes Tornado Cash From OFAC Sanctions List

Altcoins

Why Current ‘Boredom Phase’ Could Trigger Epic Rally

Published

7 hours agoon

March 22, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

A crypto analyst has predicted that the XRP price could hit $27 soon. He describes the cryptocurrency’s current price action as a “ Bermuda Triangle or boredom phase” — a period where the market moves slowly or sideways, fuelling doubt and uncertainty among traders and investors before a price rally.

XRP Price Boredom Phase To Trigger $27 Surge

Crypto analyst Egrag Crypto has warned that the XRP price is in a Bermuda Triangle, a boredom phase characterized by price stagnation and market uncertainty designed to shake out weak hands before a significant price move. According to his prediction, while traders and investors are growing impatient and questioning why XRP has not experienced any notable price increases, this phase is merely a set-up for a strong rally toward $27.

Related Reading

Following a predicted downturn in mid-March, XRP has struggled to recover its bullish momentum. The cryptocurrency was one of the top-performing altcoins in this bull cycle, jumping from a $0.5 low to over $3 for the first time in seven years.

Due to the current market decline, Egrag Crypto revealed that many traders are now wondering why “XRP hasn’t mooned.” The analyst explained that this price decline was intentional, forcing investors to second-guess themselves and make emotional trading decisions.

He also disclosed that the XRP market is now filled with ‘What ifs’, as Fear, Uncertainty, and Doubt (FUD) cloud traders’ minds. Moreover, concerns over potential dips to $1.60 or $1.30 could push investors to panic-sell or attempt risky trades.

The analyst also revealed that the XRP market is currently controlled by sharks and larger players, also called Whales. These large holders tend to influence price movements, triggering stop-losses and shaking out weak hands before a major rally.

Egrag Crypto warns that new investors and traders are especially vulnerable, as frustration and boredom can lead to making financial mistakes. He disclosed that the best strategy to implement during this current market phase is to do nothing. He suggested investors stay disciplined and patient, recognizing that boredom phases are normal in crypto market cycles.

The analyst also urged investors to remain vigilant and hold their positions while accumulating at ideal prices rather than react impulsively to rapid changes in the market.

XRP Breakout Point Hints At New ATH

In other analyses, market expert ‘Steph Is Crypto’ has announced that XRP is currently retesting breakout levels to trigger a surge to a fresh ATH. The analyst’s price chart shows a Falling Wedge pattern which has been broken above the resistance at the upper trend line.

Related Reading

After breaking out, XRP now retests this level to confirm a larger upward move. The large green arrow on the chart points to the cryptocurrency’s projected price target, suggesting a bullish continuation if the Falling Wedge breakout holds.

XRP’s upside potential is predicted to be $4 or higher if its bullish momentum is maintained. As of writing, the cryptocurrency is trading at $2.4, reflecting a 3.5% decline in the last 24 hours, according to CoinMarketCap. If its price rises to $4, it would represent a significant 66.7% increase from current levels.

Featured image from Unsplash, chart from Tradingview.com

Source link

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

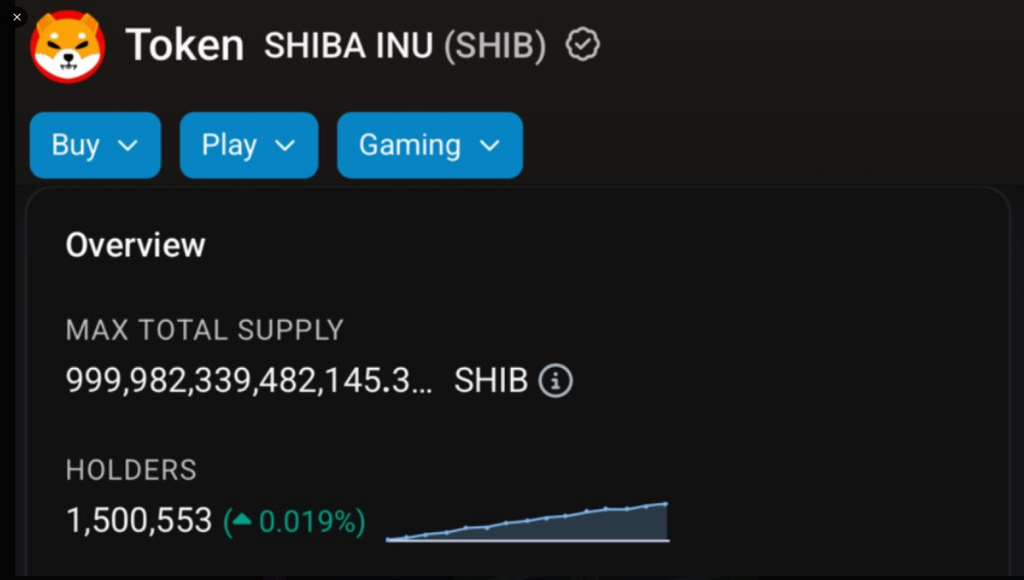

The ecosystem of a popular meme coin has attained two major milestones, showing the continued interest in the token that could lead to a bullish scenario. Analysts reported that Shiba Inu recently reached 1.5 million holders while its Shibarium recorded 10 million blocks, an indicator that the SHIB ecosystem could attract new users.

Related Reading

1.5 Million SHIB Holders

Crypto analysts revealed Shiba Inu successfully achieved a major milestone, offering a bright spot for the broader cryptocurrency market which has faced some challenges recently.

The project’s marketing lead, LUCIE noted that the meme coin hit 1.5 million holders on March 18, reaching such a milestone is an important achievement for any crypto.

As of writing, about 843 new holders have joined the Shiba Inu ecosystem, indicating that the token remained attractive to traders.

SHIB has reached 1.5 million on-chain holders!

pic.twitter.com/sKaAO57R6I

— 𝐋𝐔𝐂𝐈𝐄 (@LucieSHIB) March 18, 2025

Analysts believe that Shiba Inu’s milestone suggests continued interest in the meme coin, fueling the token’s significant growth. It also showed a bullish outlook on the meme coin.

Market observers said that the milestone might signify the unwavering belief of its community in the token.

10 Million Blocks For Shibarium

Meanwhile, Shiba Inu’s Ethereum Layer 2 network, Shibarium also recorded a win after surpassing 10 million blocks with an estimated 10,010,974 blocks as of press time.

Crypto analysts said that this achievement is proof of the network’s longevity and reliability, adding that it could entice more new users.

Market observers noted that the network has experienced exponential growth in total addresses in the last few weeks as it now tallies almost 175 million.

Shibarium’s growth is crucial in burning SHIB tokens and a major price control mechanism. Many investors are optimistic that diminishing supply and solid demand might send the token to surge. Shibarium played an essential role in burning around 713 million SHIB.

Unmoved By The Crypto Downturn

Many analysts say that milestones achieved by Shiba Inu and Shibarium offer a great deal of hope to investors, considering the ongoing downtrend in the cryptocurrency market.

For instance, Shiba Inu tanked by about 68% in the last four months, dipping from a high of $0.00003343 in December 2024 to a low of $0.00001082 in March 2025.

On the other hand, some analysts raised their concern about Shiba Inu underperforming the competition, noting that the token only increased by 98% following the US presidential election, while the Dogecoin skyrocketed by 200%.

Related Reading

Currently, Shiba Inu is traded at $0.00001288 per token, down by 0.2% in the past 24 hours with a total market cap of over $7.5 billion.

Featured image from Getty Images, chart from TradingView

Source link

Altcoins

Justin Sun Stakes $100,000,000 Worth of Ethereum Amid Calls for ‘Tron Meme Season’

Published

2 days agoon

March 20, 2025By

admin

Tron (TRX) founder Justin Sun has staked $100 million worth of Ethereum (ETH), according to the blockchain analytics platform Arkham.

Arkham notes that Sun’s staked ETH will yield $3 million worth of Ethereum per year in passive income.

In addition to staking ETH, Sun also teased that Tron’s native asset, TRX, would soon be available on the Ethereum competitor Solana (SOL).

Sun, a polarizing figure in the crypto community, says it is currently “Tron meme szn [season].” He also notes that the issuance of top stablecoin USDT on Tron recently reached a new all-time high of $64.7 billion.

The U.S. Securities and Exchange Commission (SEC) recently paused its civil case against Sun. According to recent court filings, the Tron founder and the regulatory agency jointly asked United States District Judge Edgardo Ramos if they could “move to stay [the] case to allow the parties to explore a potential resolution.” Ramos granted the application a day later.

In 2023, the SEC accused Sun – who went on to invest millions of dollars into President Donald Trump’s decentralized finance platform World Liberty Financial – and his crypto firms of fraud, selling unregistered securities and manipulating the price of the digital asset TRX via wash trading.

TRX, a layer-1 asset, is trading at $0.23 at time of writing. The 10th-ranked crypto asset by market cap is down nearly 1% in the past day but up nearly 3% in the past week.

ETH is trading at $2,033 at time of writing. The second-ranked crypto asset by market cap is up nearly 7% in the past 24 hours and more than 8% in the past seven days.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Design Projects

Source link

Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

Themes ETFs exec on new 2X Coinbase fund: ‘We believe as the Bitcoin tide rises, it will lift all crypto boats’

Ethena’s USDe Stablecoin Sales Blocked by German Regulator Over ‘Serious Deficiencies’

Is Ethena Price At Risk? Market Maker Offloads $10M ENA Raising Concerns

Coinbase Could Be Near Multi-Billion Dollar Deal for Deribit: Bloomberg

Tether eyes Big Four firm for its first full financial audit: Report

Why Current ‘Boredom Phase’ Could Trigger Epic Rally

US Treasury Removes Tornado Cash From OFAC Sanctions List

21,899 Bank Customers Affected As US Lender Suffers Cybersecurity Breach, Hacker Taps Social Security Numbers and Other Sensitive Information

Tether eyeing ‘Big Four’ firm for reserve audit: CEO

Solo Bitcoin Miner Hits the Jackpot, Scoring $266K Reward

Is Bitcoin Price Bottom In? Key Metrics Show rally Is Likely

SEC ‘Earnest’ About Finding Workable Crypto Policy, Commissioners Say at Roundtable

John Reed Stark opposes regulatory reform at SEC crypto roundtable

Investors Withdraw 360,000 Ethereum From Exchanges In Just 48 Hours – Accumulation Trend?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: