Cryptocurrency Market News

Best New Presales to Buy as Bullish Bitcoin Signal Promises Upcoming Bull Run

Published

2 weeks agoon

By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin’s recent performance has sent shockwaves through the crypto market, with retail investors who bought the token at its peak particularly bearing the brunt of this downward push.

However, as we’ve mentioned time and time again, corrections in the market – any market – are healthy.

Even better, we’ve noticed a rare bullish signal in Bitcoin. Spoiler alert: it’s one of the strongest (because it’s pretty much worked every single time) technical patterns as far as $BTC is concerned.

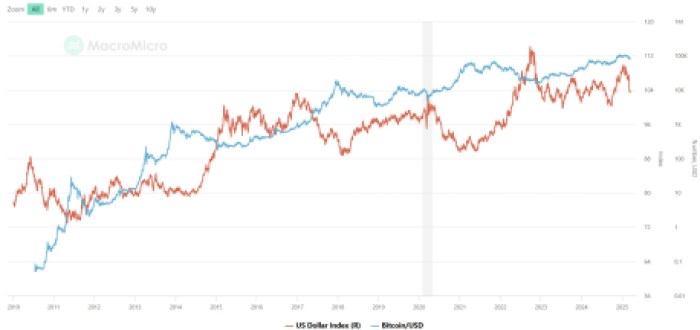

US Dollar Strength Index (DXY) Hints at Bitcoin Reversal

First things first, it’s important to understand that Bitcoin has an inverse correlation with the US Dollar Strength Index (DXY).

Simply put, Bitcoin’s price increases whenever DXY is sloping downwards and vice versa.

The DXY decreased by over 3.4% in a single week recently. Such a rapid fall in the DXY has only occurred thrice before, and each of those instances saw $BTC shed its sluggishness and rally violently to new highs.

To further understand just how prominent this bullish signal is, let’s take an in-depth look at what happened in the past – seeing as in the markets, past action is a strong predictor of future prices.

- In 2015, DXY fell sharply, and Bitcoin climbed by over 200% in just a few months.

- The first few months of 2020 saw the exact same thing unfold, i.e., DXY sloped downwards and BTC sloped upwards simultaneously.

- The latest and greatest instance was during the 2022 bear market recovery, when a decline in DXY was followed by a long-drawn consolidation in $BTC – and then a sharp move upwards.

Bitcoin’s Chart Also Screams Bullishness

In addition to an inverse relationship with DXY, Bitcoin’s chart is also showing a handful of positive signs.

On the weekly chart, $BTC is taking support on the 50 EMA (Exponential Moving Average). Furthermore, it has formed a pretty neat hammer candle, which is a classic buy signal.

On the 4-hour and 1-hour timeframes, Bitcoin is hovering over the 10 & 20 EMAs, which are both sloping upwards. This is a strong indicator of an upcoming price explosion towards the upside.

If you’re looking to make the most of the forthcoming Bitcoin (and crypto) rally, here are the best new presales to buy. Since these are tokens that haven’t yet been listed, you can grab them for astonishingly cheap prices.

1. BTC Bull Token ($BTCBULL) – Best New Presale to Buy to Get Behind Bitcoin’s Growth

With Bitcoin finally showing some serious intentions to rally upwards, it’s worth backing a project like BTC Bull Token ($BTCBULL).

It is, after all, a meme coin that can help you maximize your earnings from Bitcoin’s growth. Here’s how:

- As a token holder, you’ll receive free $BTC via airdrops. Just make sure you buy and hold $BTCBULL in Best Wallet.

- Secondly, because these $BTC airdrops are slated to take place every time Bitcoin reaches a new milestone ($150K, $200K, $250K, and so on), the price of the $BTCBULL token, too, will rise by leaps and bounds.

Also, given that BTC Bull Token works on meme coin fundamentals, it’s expected to generate better returns than Bitcoin.

Expert BTC Bull Token price predictions suggest the token could reach $0.0084 by the end of 2025.

That’s a nearly 3.5x return on your investment – provided that you get in now when the token is in presale ($3.6M+ raised) and available at some of its lowest ever prices. 1 $BTCBULL is currently selling for just $0.00241.

2. Solaxy ($SOLX) – First-Ever Solana Layer-2 Currently in Presale

Bitcoin might be the biggest cryptocurrency out there, but blockchain networks like Solana have occupied a significant place in the crypto economy, too.

And with Bitcoin to pull the entire crypto market along with it, an altcoin with real utility like Solaxy ($SOLX) is in a pole position to skyrocket.

Solaxy will build the first-ever Layer 2 scaling protocol on Solana. It will provide a much-needed boost to the Solana network, which has recently been struggling with scalability issues and failed transactions.

Essentially, the abundance of meme coin launches in the last few months has overwhelmed Solana, and its mainnet is in dire need of some relief.

Solaxy will do so by processing transactions away from the network’s primary chain, i.e., on a sidechain.

Additionally, since it’s a multi-chain token (works on both Ethereum and Solana), it will leverage Ethereum’s liquidity while providing the same top-notch security and affordability that Solana is known for.

It’s also among the hottest presales of 2025, having already amassed over $26.4M. You can join the hype by shelling out just $0.001664 per token.

Check out our guide on how to buy Solaxy for more info.

3. Bitcoin Pepe ($BPEP) – Fascinating New Project Aiming to Create Bitcoin L2

Bitcoin Pepe calls itself the ‘World’s ONLY Bitcoin Meme ICO.’

Although we still believe BTC Bull Token to be the king of all Bitcoin meme coins, it’s worth noting that $BPEP, unlike $BTCBULL, is actually based on the Bitcoin blockchain.

$BPEP’s aim is simple. It wants to combine Bitcoin’s class-leading liquidity and security with Solana’s speed and low fees and use that to create a meme layer-2 network on Bitcoin.

By becoming a hub for meme coin activities within the Bitcoin ecosystem, Bitcoin Pepe plans to kickstart a new era of DeFi and meme coin trading on the world’s most popular blockchain.

The project, which is currently in its presale, has witnessed significant investor interest.

It has managed to raise a whopping $4.8M so far, and you can currently buy one token for an extremely low price of $0.0281.

Bottom Line

To conclude, Bitcoin has by no means fallen out of favor in the market.

With a rare and extremely strong buy signal in DXY divergence and several other technical analysis confluences in play, the OG crypto is highly likely to start an upmove sooner rather than later.

Although $BTC itself as well as the other top cryptos mentioned in this guide can easily make you a crypto millionaire in 2025, it’s important to not go into overdrive.

That means only investing a sum that’s small enough for you and doing your own research before diving in. Remember, none of the above is a substitute for professional financial advice.

Source link

You may like

BTC in Stasis Below $88K as Trump Suggests Bigger Tariffs on EU, Canada

Dogecoin Price Eyes 10x Breakout After Elon Musk Ghibli Anime

XRP Price Rejected at Resistance—Are Bears Taking Control?

OpenAI expects to 3X revenue in 2025 but Chinese AI firms are heating up

‘Chart Is Still Broken’ – Crypto Analyst Predicts Sustained Downtrend for Altcoins Until This Takes Place

GameStop Announces $1.3 Billion Fundraising Plan To Purchase Bitcoin

crypto

Crypto Braces For April 2 — The Most Crucial Day Of The Year

Published

3 days agoon

March 24, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The crypto market is on high alert ahead of April 2, a date some analysts are calling “the biggest event of the year by an order of magnitude.” Macro economist Alex Krüger (@krugermacro), warns that President Donald Trump’s upcoming announcement of new reciprocal tariffs could deliver a seismic jolt to global markets — including crypto.

Why April 2 Is Massive For Crypto

In a post shared on X, Krüger describes the looming announcement, which the president has dubbed “Liberation Day,” as “10x more important than any FOMC” meeting: “April 2nd is similar to election night. It is the biggest event of the year by an order of magnitude. 10x more important than any FOMC, which is a lot. And anything can happen.”

According to Krüger, Trump might choose one of several paths: “Trump could go soft, in which case markets would rally fast and furiously. Or could go half-way, adding uncertainty on timelines, in which case markets would take out the stops of all longs and shorts. Or go all out, in which case markets could easily crash another 10% to 15%, fast.“

Related Reading

Krüger also suggests that “the US economy is still strong, but will highly likely slow down due to tariffs regardless of the path Trump chooses.” Nevertheless, he notes that many economists have already factored in a sharp year-end slowdown. He stresses that April 2 could mark the peak of market anxiety, aligning with the arrival of US Tax Day just two weeks later. “Either way, you all want to be prepared and ready to act on ‘Liberation Day.’ It will be big.”

Trump’s “Liberation Day” announcement will reportedly focus on “reciprocal tariffs” targeting specific countries or blocs deemed to maintain unfair trade barriers. Although this strategy appears “more targeted than the barrage he has occasionally threatened,” officials familiar with the matter believe it could still prove far-reaching.

President Trump has repeatedly signaled that these tariffs would be significant. Citing trade disparities with nations such as the European Union, Mexico, Japan, South Korea, Canada, India, and China, he asserts the US has been treated unfairly for too long. In remarks from the Oval Office, he declared: “April 2nd is going to be liberation day for America. We’ve been ripped off by every country in the world, friend and foe.”

Worst Case Scenario

Aides and allies suggest that while some countries may be excluded, Trump is looking for immediate impact. Tariff rates could take effect right away, adding to market fears of spiraling retaliation. In this case, Krüger says: “In worst case scenario sh*t would hit the fan then tariffs would start coming off as Trump negotiates hard in the following month, in which case peak negativity would hit around week 2 of April, which would coincide with US Tax Day.”

Related Reading

Senior officials, including National Economic Council Director Kevin Hassett and Treasury Secretary Scott Bessent, have indicated that the administration is focusing on a “dirty 15” group of countries where tariff and non-tariff barriers are allegedly most egregious. Hassett recently remarked, “It’s not everybody that cheats us on trade, it’s just a few countries, and those countries are going to be seeing some tariffs.”

For the crypto market, global macroeconomic events have increasingly played a pivotal role in price action in recent weeks. The April 2 “Liberation Day” announcement arrives at a time when digital asset traders already face headwinds from monetary policy shifts and a slowing global economy. Krüger believes that if the tariffs come in softer than expected, “markets would rally fast and furiously.” On the other hand, a maximalist tariff approach could deliver a significant shock, potentially denting cryptocurrencies.

At press time, the total crypto market cap stood at $2.81 trillion.

Featured image from iStock, chart from TradingView.com

Source link

Bitcoin

Top 6 Important Fed Decisions To Know After SEC Drops Ripple Lawsuit Appeal

Published

6 days agoon

March 21, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The crypto industry received a significant legal victory as Ripple CEO Brad Garlinghouse announced on March 19 that the U.S. Securities and Exchange Commission (SEC) had officially dropped its appeal against the company. The announcement came in a video posted on social media platform X, where Garlinghouse noted the regulatory agency’s decision to end its pursuit of further litigation.

Besides this interesting development, another major financial development has taken center stage in the crypto market in the past 24 hours; the outcome of the Federal Reserve’s latest meeting.

Fed Keeps Interest Rates Steady Amid Uncertainty

The outcome of the latest Fed meeting can be divided into six key decisions. First, the Federal Reserve opted to maintain interest rates at their current level, keeping the borrowing rate in a range between 4.25% and 4.5% for the second consecutive meeting. This decision is part of a continued pause in the Fed’s tightening cycle.

Related Reading

Secondly, the Fed noted that uncertainty surrounding the economy has increased, and third, the Fed’s updated projections were the shift in expectations for rate cuts in 2025. The median forecast suggests 50 basis points of cuts for the year, but a growing number of Fed officials are less convinced that rate reductions will be necessary. In December, only one official anticipated no rate cuts in 2025. However, there’s now a more divided outlook, and that number has now risen to four, as noted in a post on social media platform X by analysts at The Kobeissi Letter.

Beyond interest rates, the Fed revised its economic growth projections downward for 2025, suggesting that policymakers see slower expansion ahead. This adjustment comes alongside an increase in the Fed’s inflation forecast for the same period, reflecting concerns about price pressures persisting longer than previously anticipated. With inflation remaining a key focus, the central bank is treading carefully as it evaluates the right time to pivot toward a looser monetary stance.

Fourthly, the Fed announced that it would slow the pace of its balance sheet runoff beginning in April. This is alongside a sharp reduction in the Fed’s 2025 growth projections and a markup in their 2025 inflation forecast.

Implications For Crypto Markets And Digital Assets

For the crypto industry, the Fed’s decision to hold rates steady and its mixed messaging on future cuts introduce a dynamic situation to Bitcoin and others. The fact that the Fed is still concerned about inflation and economic uncertainty shows that the path to more accommodative policies regarding the crypto industry may not be as smooth.

Related Reading

However, if the Fed stays hesitant to cut rates and economic growth slows as projected, digital assets may face headwinds later in the year, which may slow down the predicted growth by crypto analysts.

Featured image from Unsplash, chart from Tradingview.com

Source link

Bitcoin

Crypto Faces Uncertainty As Trump’s ‘Short-Term Pain’ Unfolds

Published

2 weeks agoon

March 14, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

US President Trump’s outspoken acceptance of near-term economic hardship has placed risk assets—including Bitcoin (BTC) and the broader crypto market—under mounting pressure. According to a thread by The Kobeissi Letter on X, President Trump’s strategy revolves around tolerating significant “short term pain” in order to drive down inflation and facilitate the refinancing of over $9 trillion in US debt.

Will Crypto Survive Trump’s ‘Short-Term Pain’ Strategy?

The impact on cryptocurrencies has been immediate and pronounced. While US equities have shed an estimated $5 trillion in market value this year, digital assets have also suffered steep losses. Since President Trump’s inauguration on January 21, Bitcoin (BTC) has declined by approximately -23%, Ethereum (ETH) has tumbled by roughly -43% and the broader crypto market has experienced even more dramatic price drops.

Related Reading

Although high volatility is nothing new in crypto, the synchronized downturn suggests that crypto assets are not immune to macroeconomic forces. The Kobeissi Letter adds, “Based on our research, President Trump made this conclusion BEFORE inauguration. However, he began formally articulating it on March 6th. Below is the headline that destroyed investor confidence in 2025. President Trump is no longer the ‘stock market’s President’ (for now).”

The Kobeissi Letter points to March 9 as the date President Trump further confirmed his stance by noting that America is in a “period of transition” and that it will “take a little time,” implying a willingness to tolerate near-term market turbulence. During this period, Commerce Secretary Lutnick’s statement on March 6—“Stock market not driving outcomes for this admin”—was followed by Treasury Secretary Bessent’s remark, “Not concerned about a little volatility.”

Although The Kobeissi Letter’s analysis notes that the administration’s viewpoint solidified before inauguration, it cites President Trump’s urgent focus on the year 2025, when $9.2 trillion in US debt will either mature or need to be refinanced. The thread states, “First, as we have previously noted, the US is facing a massive refinancing task. In 2025, $9.2 TRILLION of US debt will either mature or need to be refinanced. The quickest way to LOWER rates ahead of this colossal refinancing would be a recession.”

Related Reading

Beyond debt concerns, The Kobeissi Letter also highlights the administration’s drive to reduce oil prices and the US trade deficit as part of the same economic calculation. Since President Trump took office, oil has fallen by over 20%. “Furthermore, a clearly defined part of President Trump’s strategy has been to LOWER oil prices. Oil prices are down 20%+ since Trump took office. This morning, Citigroup said oil prices falling to $53 would lower inflation to 2%. What would lower oil prices? A recession.”

Meanwhile, the administration’s extensive use of tariffs, which The Kobeissi Letter describes as “levying tariffs on almost ALL US trade partners,” is chipping away at GDP growth estimates, further hinting that a deliberate slowdown is in motion.

The Kobeissi Letter also notes, “On top of this, DOGE and Trump are attempting to cut TONS of government jobs. These are the same jobs that have accounted for much of the recent job ‘growth’ in the US. Government jobs have risen by 2 million over the last 4.5 years. Cutting these jobs will spur a recession.” DOGE leader Elon Musk appears resigned to short-term declines. Even after Tesla (TSLA) recorded its seventh-largest historical drop on March 10, Musk posted that “It will be fine long-term.”

For crypto traders and investors, the “short term pain” scenario by Trump is currently dictating the price action. The question, the analysts from The Kobeissi Letter posit, is whether this will lead to a more favorable economic landscape in the long run. “Is the ‘short term pain’ worth the ‘long term gain’ in President Trump’s economic strategy?”.

At press time, the BTC price remained under heavy downward pressure and traded at $82,000.

Featured image from Shutterstock, chart from TradingView.com

Source link

BTC in Stasis Below $88K as Trump Suggests Bigger Tariffs on EU, Canada

Dogecoin Price Eyes 10x Breakout After Elon Musk Ghibli Anime

XRP Price Rejected at Resistance—Are Bears Taking Control?

OpenAI expects to 3X revenue in 2025 but Chinese AI firms are heating up

‘Chart Is Still Broken’ – Crypto Analyst Predicts Sustained Downtrend for Altcoins Until This Takes Place

GameStop Announces $1.3 Billion Fundraising Plan To Purchase Bitcoin

Wyoming Governor Backs Away From State’s Failed Bitcoin Reserve Push

Priced at $0.20, this Solana competitor could be the next crypto to 20x

Why Are We Still Under the SEC’s Gun?

Expert Predicts XRP ETF Approval Is Only A ‘Matter Of Time’ As Approval Odds Soar

Analyst Unveils Extended XRP Price Target To $44, Reveals When To Take Profits

Would GameStop buying Bitcoin help BTC price hit $200K?

New SEC Chair Paul Atkins Holds $6,000,000 in Crypto-Related Investments – Here’s His Portfolio: Report

We’ve Turned A Generation Of Bitcoiners Into Digital Goldbugs

Solana DEX Raydium’s Pump.fun Alternative Is Going Live ‘Within a Week’

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x