24/7 Cryptocurrency News

Betting on FOMC Meeting Made This Investor $35,000

Published

2 months agoon

By

admin

Amid the odds and uncertainty, an investor bid on the FOMC meeting and made $35,000. Although this is nothing new in the crypto market, such milestones are remembered either due to them turning successful at odds or giving handsome returns, and this incident carries both things. Let’s discuss.

FOMC Meeting: No Rate Change Decision Made Investor $35K

The US FED decided to keep the interest rate study between $4.25% and $4.50, which most experts already anticipated. Jerome Powell’s speech mentioned that the economy is strong, but inflation is still above the central bank’s 2% targets. With the FOMC meeting on January 2, there’s a pause on the rate cuts after the three cuts happened in 2024.

“With the economy continuing to be robust, we don’t have to rush to change the policy direction,” said Powell.

Notably, an experienced trader made the best use of the opportunity, betting on the FOMC outcome and making $35,000 in just a few hours. Interestingly, the person took a risk, as they bet $1.86M. If the FED has opted for rate cuts, this investor would have lost $1.86M.

Some complimented this better’s trust and bold moves, while some criticized the madness, as the person bet millions of dollars for a mere profit. Regardless, the investor’s intuitions and research worked, making a $35,000 profit.

How is This FOMC Meeting Affecting the Crypto Market?

Along with the inflation discussion, Jerome Powell’s one specific statement has become the highlight of the Fed meeting. Powell stated that US banks are fully capable of managing any risks associated with crypto clients, which experts believe signals ‘no significant plans to restrict financial institutions from dealing with the crypto industry.’

Interestingly, before the FOMC meeting, a significant crypto crash took place, which impacted digital assets massively. However, past the meeting, bullish momentum has begun building. The Bitcoin price surged to $106.2k on January 30, and the rest of the altcoins followed up soon.

Investors’ trading activity and interest also grew in the market, especially in Bitcoin, XRP, VVV, and other tokens, per a santiment report. Considering that an earlier CoinGape report mentioned these as the cryptos to buy before January 31 for high returns.

However, with the upcoming U.S. economic data report, the crypto market is a bit turbulent today. Such macroeconomic events affect investors’ sentiments and interfere with the price trajectories of digital assets, so careful trading activities are mandatory at this point.

Key Things To Remember

The FED meeting positively affected the crypto market, especially the BTC token. Since then, the Bitcoin price surge has surged to $106.2k before declining again due to upcoming U.S. economic data. As a result, the entire crypto market is facing turbulence today. Interestingly, some investors consider it a buying opportunity, as the digital assets trade at a low. The aforementioned investor also identified a trading opportunity in the FOMC meeting, as they bet $1.86M on ‘no rate cuts,’ earning $35,000 in profits. With this, the person highlighted the earning potential of the market, but it is only possible with the proper research and skills.

Pooja Khardia

With a deep-seated passion for reading and five years of experience in content writing, Pooja is now focused on crafting trending content about cryptocurrency market.

As a dedicated crypto journalist, Pooja is constantly seeking out trending topics and informative statistics to create compelling pieces for crypto enthusiasts. Staying abreast of the latest trends and advancements in the field is an integral part of her daily routine, fueling a commitment to delivering timely and insightful coverage

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Slow-Moving Fed Should Cut Rates as There is ‘No Inflation’, Trump Says

Dogecoin Price Drops 19% In 24 Hours! But These Coins Can Earn You Profit

Bitcoin Dips Below $75K As Markets Tremble: What’s Goin On?

How to use Render Network for decentralized GPU rendering

Crypto Trader Unveils Best-Case Scenario for Bitcoin To Avoid 2021-Style Market Meltdown

Bitcoin ETFs post $172m in weekly outflows amid market bloodbath

24/7 Cryptocurrency News

XRP’s Open Interest Surges Above $3 Billion, Will Price Follow?

Published

21 hours agoon

April 6, 2025By

admin

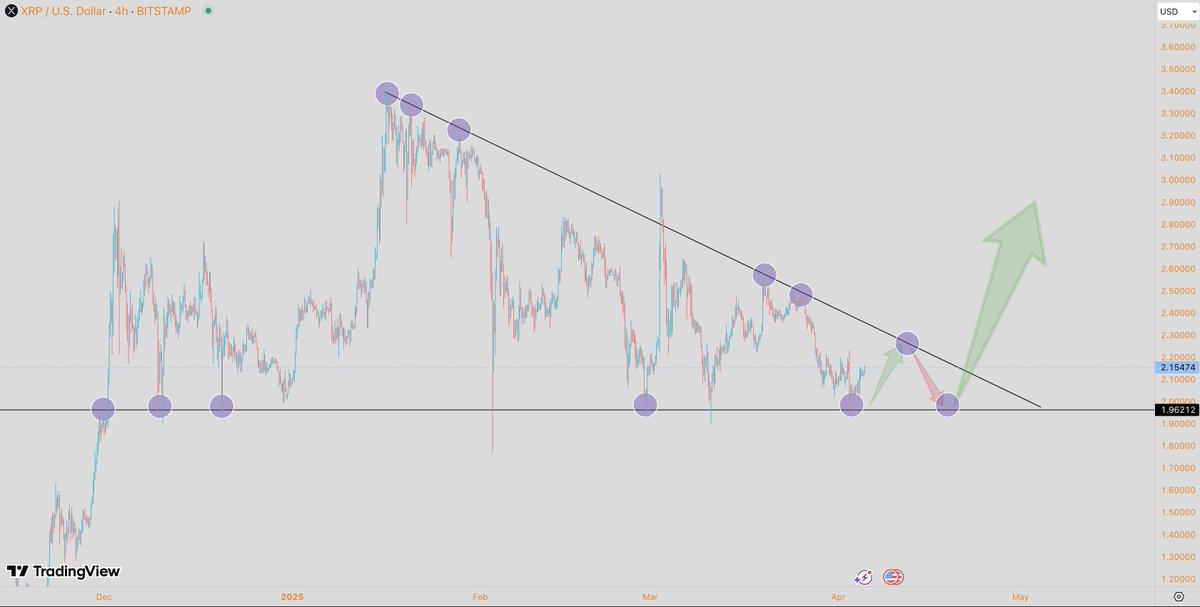

XRP’s interest has surged in the last 24 hours, providing a bullish outlook for the altcoin. Based on this, Ripple’s native crypto is eyeing a rebound, with crypto analyst Ali Martinez predicting that the XRP price could rebound to as high as $2.60 if it holds the $2 support.

XRP’s Open Interest Surges Above $3 Billion

CoinGlass data shows that XRP’s open interest has surged in the last 24 hours, rising to as high as $3.61 billion, indicating huge interest in the altcoin at the moment. This provides a bullish outlook for the altcoin, seeing as traders are heavily betting on it.

Crypto analyst Ali Martinez also suggested that Ripple’s native crypto could rebound soon. In an X post, he stated that if XRP can stay above the key $2 level, a 30% move toward the channel’s upper boundary at $2.60 could be next.

Crypto analyst CasiTrades’s prediction also showed that the altcoin could surge to $2.70 if it breaks above $2.24. This could eventually pave the way for Ripple’s native crypto to rally to a new all-time high (ATH).

However, there is still the possibility that the altcoin could also drop to new lows. A CoinGape market analysis revealed that Ripple’s price is at a crossroads, as a wedge pattern signals a 70% crash or 700% surge.

Crypto analyst Rex also predicted that XRP could soon witness a bullish reversal. He stated that a breakout is coming and that this is the most obvious play of the cycle. His accompanying chart showed that XRP could rally to as high as $2.9.

Two Paths For Ripple’s Native Crypto

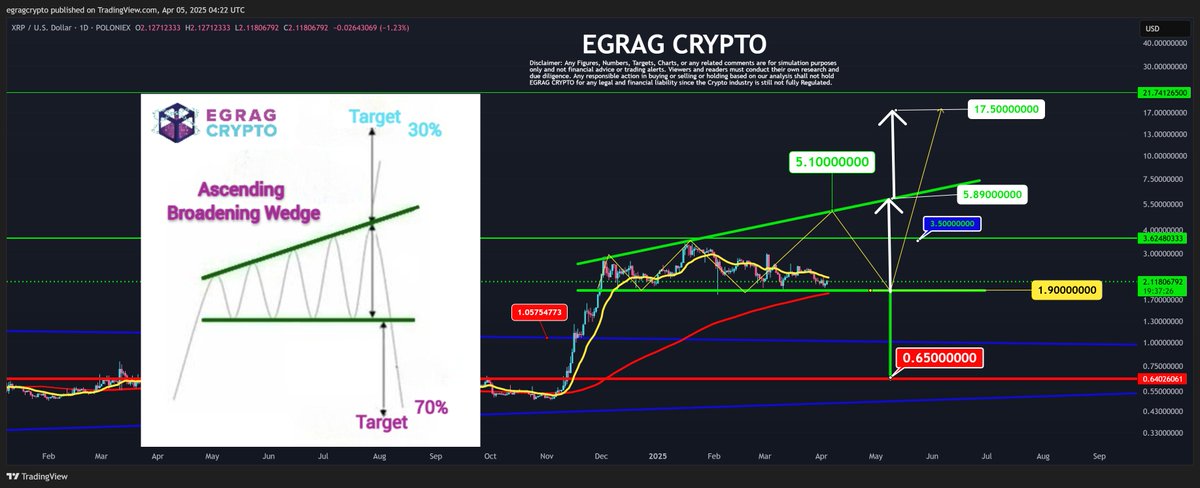

Crypto analyst Egrag Crypto stated that the XRP price could drop to $0.65 or rally to $17. This is based on an Ascending Broadening Wedge, which is currently forming for the altcoin. The analyst remarked that XRP first needs to close above $3.50 for a solid start.

He claimed that if the altcoin hits the $5 range but doesn’t close above it convincingly, this formation has a higher chance of playing out. Egrag Crypto asserted that XRP must retest $1.90 after being rejected from the $5 range.

Once that happens, the altcoin will need another attempt to close above $5, ideally hitting $6 and closing above that level. The analyst affirmed that XRP will likely blast to double digits within two to three weeks if that happens.

The target move for this Ascending Broadening Wedge is a potential $17.50. This aligns with another prediction in which he stated that the XRP price could rally to double digits by the July 21 cycle peak.

However, Egrag Crypto warned that there is still a 70% chance that XRP breaks to the downside and only a 30% chance for an upside breakout. If the altcoin breaks down, the analyst claims the measured move would take Ripple’s native crypto back to $0.65.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across several topics and niches. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover, a traveler and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Bitcoin Holds $83K Despite Macro Heat, What’s Happening?

Published

1 day agoon

April 6, 2025By

admin

The crypto market has closed yet another week, keeping traders and investors cautious with sluggish price performances. Bitcoin (BTC) price held the $83K level with no major gains in the past seven days. Whereas, Ethereum (ETH), Solana (SOL), and XRP prices mimicked a sluggish action.

Notably, the latest announcement by Donald Trump about reciprocal tariffs has rattled global markets, with even risk assets encountering some macro heat. Mentioned below are some of the top market updates reported by CoinGape Media over the past week.

Crypto Market Faces Macroeconomic Pressure

This week saw a couple of concerning macro developments that sparked a cautious sentiment among traders and investors. CoinGape reported that the manufacturing PMI and JOLTS data came in weaker than expected this week.

The March PMI data dropped to 49, below expectations of 49.5 and lower than the 50 recorded in February. Also, the U.S. JOLTS job openings for February stood at 7.568 million, coming short of the expected 7.690 million and lower than the 7.762 million recorded in January. This macro data pointed toward a bearish outlook for the broader market.

In turn, even the crypto market saw a stalled movement, with Bitcoin & Ether prices negating any major gains over the past seven days. In addition, Donald Trump’s Liberation Day, which is the tagline for his proposed reciprocal tariffs on other countries, has added to the pressure on broader markets.

Bitcoin, Ether, & Other Coin Prices Over The Week

BTC price witnessed a marginal 0.5% jump in the past seven days and closed in at the $83K level. In the past 7 days, the flagship crypto stooped as low as $81K whilst also touching a $87K high.

ETH price saw a drop of nearly 2% weekly and exchanged hands at the $1,800 level. Ethereum hit a bottom of $1,700 whilst also nearing a high of $2,000 this week

SOL price fell by roughly 5% over the week to reach $120. The crypto’s weekly high and low was $135 and $112, respectively.

XRP price mimicked the broader crypto market trend, dipping over 2% in seven days to $2.13. Ripple’s coin is consolidating despite speculations of an imminent settlement of the lawsuit against the U.S. SEC.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

CryptoQuant CEO Explains Why Bitcoin Bull Market is Over Now

Published

2 days agoon

April 5, 2025By

admin

CryptoQuant CEO Ki Young Ju avers that the Bitcoin bull market is over as prices hover around the $82K mark. The expert hinges his theory for Bitcoin price on key technicals, analyzing the relationship between Realized Cap, Market Cap, and selling pressure to reach his conclusions.

Expert Gives Reason Why The Bitcoin Bull Market Is Over

According to an analysis on X, Ki Young Ju reveals that Bitcoin is firmly in bear market territory to the dismay of investors. The CryptoQuant CEO surmised in his analysis that the curtain has fallen for the Bitcoin bull market giving reasons.

In his analysis, Ju bases his prediction on the interplay between Bitcoin’s Realized Cap and the asset’s market capitalization. Realized market cap measures Bitcoin’s value using the price at which each BTC held in wallets was transferred. On the other hand, the market cap measures value by multiplying the circulating BTC supply with current prices.

The CryptoQuant CEO notes that market capitalization alone is not the best way to track the Bitcoin Bull Market. According to Ju, when there is low selling pressure in the markets, small Bitcoin purchases often send the market capitalization to new highs. Ju notes that Strategy has ridden the tailwind of low selling pressure to grow the paper value of their BTC holdings.

Conversely, when sell pressure is high, sizeable purchases are unable to send Bitcoin price on a rally. Strategy’s purchase of 22,048 BTC for $1.92 billion did not trigger a rally like its previous acquisition.

Onchain data indicates that Bitcoin’s Realized Cap is rising but market capitalization continues its decline, an indicator of bearish sentiments. Ju notes that fresh capital is flooding the markets but prices are not responding, signaling the end of the bitcoin bull market.

“When even large capital can’t push prices upward, it’s a bear,” said Ju.

Bitcoin Price Flashes Bearish Signals

Despite glowing fundamentals and large acquisitions, on-chain indicators are underwhelming for the top cryptocurrency. Bitcoin price is consolidating within a bearish pennant, a signal for even lower prices. However, a small bump has triggered speculation of a potential Bitcoin price decoupling from S&P500.

Crypto Sat says a short-term drop to $80K is in play for Bitcoin with prices standing at $82,950. However, Ju has even grimmer predictions for BTC, noting that a near-term rally is unlikely for the asset. The CryptoQuant CEO notes that it will take the asset up to six months to drag itself out of the bear market.

“Sell pressure could ease anytime, but historically, real reversals take at least six months,” said Ju.

Despite the dour sentiments, US Treasury Secretary Scott Bessent has praised BTC as a store of value comparing it with gold.

Aliyu Pokima

Aliyu Pokima is a seasoned cryptocurrency and emerging technologies journalist with a knack for covering needle-moving stories in the space. Aliyu delivers breaking news stories, regulatory updates, and insightful analysis with depth and precision. When he’s not poring over charts or following leads, Aliyu enjoys playing the bass guitar, lifting weights and running marathons.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Slow-Moving Fed Should Cut Rates as There is ‘No Inflation’, Trump Says

Dogecoin Price Drops 19% In 24 Hours! But These Coins Can Earn You Profit

Bitcoin Dips Below $75K As Markets Tremble: What’s Goin On?

How to use Render Network for decentralized GPU rendering

Crypto Trader Unveils Best-Case Scenario for Bitcoin To Avoid 2021-Style Market Meltdown

Bitcoin ETFs post $172m in weekly outflows amid market bloodbath

Trump Ally Bill Ackman Calls for 90-Day Pause on US Tariffs as Crypto Sinks

Ethereum price Tags $1,500 As Global Stock Market Crash Triggers Circuit Breakers

Bitcoin Trades Above $79K as Asia Markets React to Trump Tariffs

Memecoin platform Pump.fun brings livestream feature back to 5% of users

Bitcoin Price On The Verge Of Explosive 15% Breakout As Analyst Spots Triangle Formation

Strategy CEO Makes The Case For Corporate Bitcoin Adoption In MIT Keynote

Hackers Hammer Android and iPhone Users As Bank Account Attacks Surge 258% in One Year: Kaspersky

Cryptocurrencies to watch this week: Aptos, XRP, Solana

This Week in Crypto Games: ‘Off the Grid’ Token Live, Logan Paul ‘CryptoZoo’ Lawsuit Continues

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

I’m Grateful for Trump’s Embrace of Bitcoin

Trump’s Coin Is About As Revolutionary As OneCoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: