Binance

Binance confirms FDUSD reserves are accurate after depegging

Published

4 days agoon

By

admin

Binance has reaffirmed the accuracy of FDUSD’s reserve attestation for February, following concerns sparked by a brief de-pegging event.

In an Apr. 3 update on the company’s blog, Binance stated it had reviewed First Digital USD’s (FDUSD) reserve data twice, once after the February attestation report was released and again recently to ensure accuracy.

As of Mar. 1, FDUSD had $2.05 billion in reserves, according to the audit, which was carried out by Prescient Assurance. These reserves, which are kept in fixed deposits and U.S. Treasuries, are greater than the amount of stablecoin in circulation and guarantee a 1:1 redemption with USD.

The update comes after Tron (TRX) founder Justin Sun accused the stablecoin’s issuer, First Digital Trust, of being insolvent, causing FDUSD to momentarily lose its peg and drop by 5%. Sun called for regulatory action, criticized Hong Kong’s financial system, and advised investors to withdraw their funds.

Protect users and protect HK

First Digital Trust (FDT) is effectively insolvent and unable to fulfill client fund redemptions. I strongly recommend that users take immediate action to secure their assets. There are significant loopholes in both the trust licensing process in…

— H.E. Justin Sun

(@justinsuntron) April 2, 2025

His claims caused panic selling, which led to FDUSD’s price dropping as low as $0.87 before recovering. In response, FDT refuted the claims, claiming that Sun’s remarks were deceptive and that FDUSD is fully backed.

The company insisted the issue was unrelated to FDUSD and instead linked to a dispute involving TrueUSD (TUSD), another stablecoin it manages. FDT also accused Sun of launching a smear campaign against its business and has threatened to take legal action against him.

Given that Binance owns roughly 94% of the supply of FDUSD, the situation has sparked worries about the exchange’s exposure. Some industry analysts have pointed out the risks of relying on a single stablecoin for key trading pairs.

As of the time of press, FDUSD seems to have stabilized, trading at $0.99 despite market volatility. Binance intends to carry out another review after the next attestation report is published in two weeks and has reiterated its commitment to keeping an eye on the FDUSD’s stability.

Source link

You may like

Bitcoin Trades Above $79K as Asia Markets React to Trump Tariffs

Memecoin platform Pump.fun brings livestream feature back to 5% of users

Bitcoin Price On The Verge Of Explosive 15% Breakout As Analyst Spots Triangle Formation

Strategy CEO Makes The Case For Corporate Bitcoin Adoption In MIT Keynote

Hackers Hammer Android and iPhone Users As Bank Account Attacks Surge 258% in One Year: Kaspersky

Cryptocurrencies to watch this week: Aptos, XRP, Solana

24/7 Cryptocurrency News

Binance Founder CZ Signs MoU With Kyrgyzstan For Web 3 Development

Published

3 days agoon

April 3, 2025By

admin

Binance founder Changpeng Zhao (CZ) has inked a deal with Kyrgyzstan’s National Investment Agency to trigger Web 3 adoption metrics. Both parties have reiterated a commitment to integrate Web 3 technologies into every facet of the local economy leaning on CZ’s expertise.

Kyrgyzstan Turns To Binance Founder CZ For Web 3 Direction

According to an X post by Kyrgyzstan President Sadyr Zhaparov, the Central Asian country has inked a deal with CZ. The Binance founder and the National Investment Agency signed a Memorandum of Understanding (MoU) to develop the local Web 3 ecosystem.

Signed with the consent of the president, parties will commit to building out a thriving cryptocurrency ecosystem for residents. To achieve this, the National Investment Agency will lean on Zhao’s expertise as the Binance founder takes on an advisory role.

“The signing of the Memorandum opens new horizons for the development of digital technologies and the blockchain ecosystem in the country,” said President Zhaparov.

Furthermore, CZ says the MoU will extend to distributed ledger technology (DLT) and real-world application of blockchain outside of speculation. However, while not expressly stated, pundits theorize that the founder of the top cryptocurrency exchange will explore cross-border use cases and other financial utility for cryptocurrencies.

There are plans to train residents on blockchain, cybersecurity, virtual asset management, and other emerging technologies. The economic impact of the Web 3 initiative is far-reaching and will contribute a chunk to Kyrgyzstan’s GDP by 2030.

CZ Excited To Take On The Advisory Role

CZ has expressed his commitment to the advisory role, noting that Kyrgyzstan is the latest in a line of MoUs. The Binance founder has previously provided advisory services in both official and unofficial capacities on cryptocurrency regulatory frameworks and real-world DLT applications.

“I find this work extremely meaningful,” said CZ.

Amid reciprocal tariffs affecting crypto prices, CZ disclosed that his advisory services to countries do not extend to geopolitics.

Apart from his advisory role, Zhao has donated a portion of his wealth to disaster relief in affected regions. The latest is a hefty donation of over $1 million to earthquake relief efforts in Myanmar and Thailand. Beyond charitable donations, the Binance founder has downplayed the impact of exchange listing on token prices.

Aliyu Pokima

Aliyu Pokima is a seasoned cryptocurrency and emerging technologies journalist with a knack for covering needle-moving stories in the space. Aliyu delivers breaking news stories, regulatory updates, and insightful analysis with depth and precision. When he’s not poring over charts or following leads, Aliyu enjoys playing the bass guitar, lifting weights and running marathons.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Binance Sidelines Pi Network Again In Vote To List Initiative, Here’s All

Published

4 days agoon

April 3, 2025By

admin

As Binance’s Vote to List initiative kicks off, the exchange has turned its back on Pi Network for the second time. Binance is proceeding with the decentralized listing program but Pi Network is noticeably absent from the raft of cryptocurrencies.

Pi Network Fails To Make Binance List

Pi Network enthusiasts are in limbo following the absence of the token in Binance’s Vote to List initiative. According to a press release, Binance has opened voting for its second Vote to List initiative.

This time, 12 tokens are up for community voting, with Binance proceeding to spot-list successful tokens. Apart from vote count, Binance says it will consider trading demand, a risk assessment, and a compliance check to decide on tokens that will make the listing.

The selected tokens include VIRTUAL, BIGTIME, UXLINK, MORPHO, GRASS, ATH, WAL, SAFE, ZETA, IP, ONDO, and PLUME. While the first focused on memecoin, the second iteration beams a searchlight on utility tokens cutting across several verticals.

Back in March, Binance excluded Pi Network from its first edition of the Vote to List initiative. Binance has clarified that only BNB-based projects will be allowed to participate in the Vote to List initiative, dousing optimism for Pi Network enthusiasts.

When Will Binance List The Asset?

Despite Pi missing out on the Vote to List program, there is still a ray of hope for community members. Binance can list Pi via a direct listing in the future but a timeline is unavailable.

Experts say a lack of transparency by The PiCoreTeam (PCT) is a reason why Binance has not listed Pi Network. Particularly, the exchange took swipes at the PCT for failing to give proper disclosures on the Pi Network’s locking and burning mechanism.

Pi Network secured a major listing on the BTCC Exchange, bringing the token closer to being listed on mainstream exchanges. While a listing hovers on the horizon for Pi, the PCT’s domain auction is gathering steam with over 200,000 bids.

Pi price has been largely underwhelming over the last day, losing nearly 5%. Pi trades at $0.6646 to drop below the $0.7 mark for the first time in over a month.

Aliyu Pokima

Aliyu Pokima is a seasoned cryptocurrency and emerging technologies journalist with a knack for covering needle-moving stories in the space. Aliyu delivers breaking news stories, regulatory updates, and insightful analysis with depth and precision. When he’s not poring over charts or following leads, Aliyu enjoys playing the bass guitar, lifting weights and running marathons.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Altcoins

Whales Abruptly Deposit Ethereum Altcoin to Binance and OKX, Causing Price To Plummet 50%: On-Chain Data

Published

2 weeks agoon

March 25, 2025By

admin

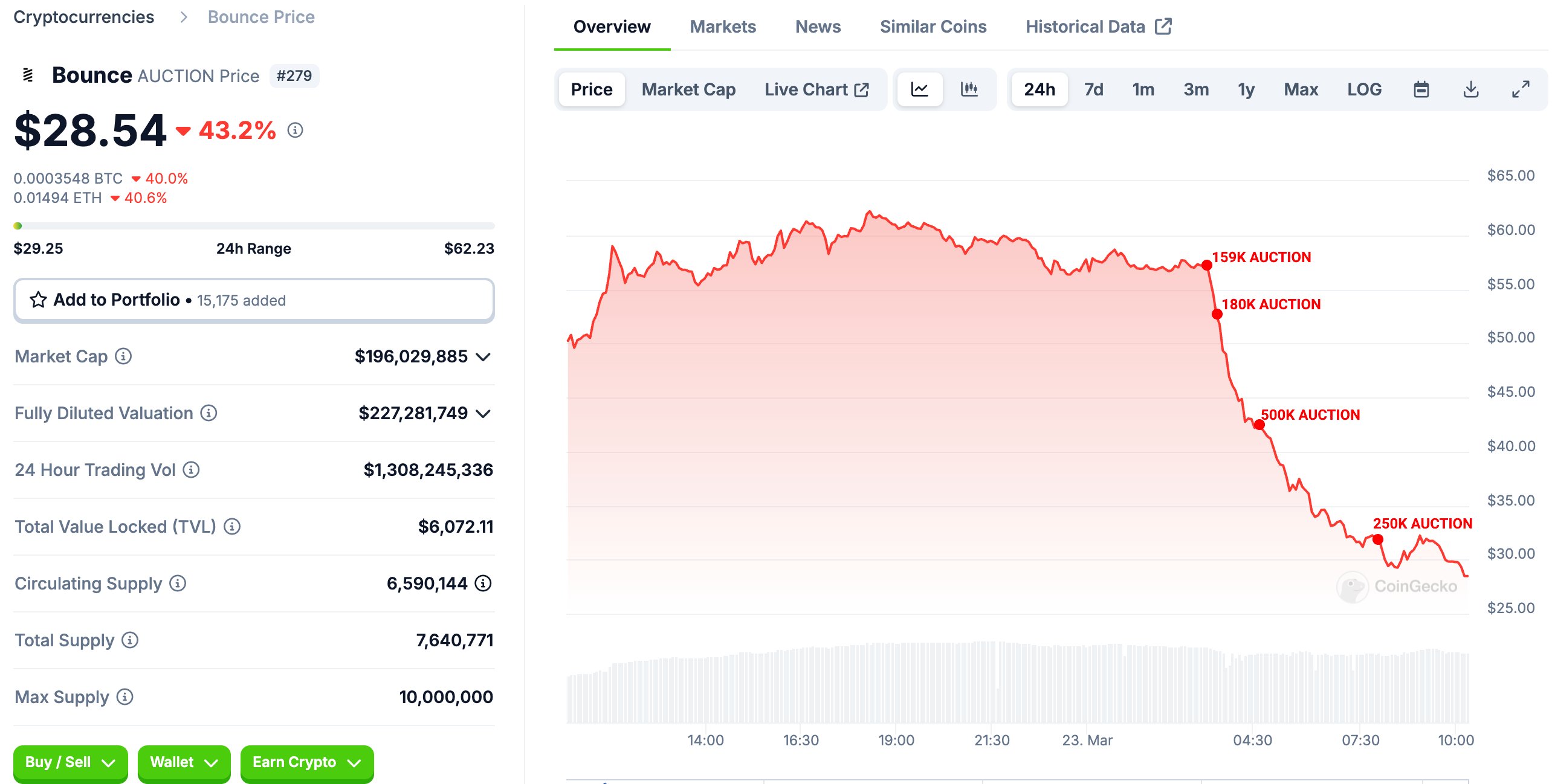

Deep-pocketed traders triggered a price crash over the weekend after depositing a huge chunk of an altcoin’s supply to digital asset exchanges.

According to blockchain tracking firm Lookonchain, whales in the Bounce (AUCTION) market have been greatly influencing the altcoin’s price action for the past week, causing massive swings in both directions.

Bounce Finance is a decentralized auction platform enabling auctions for various assets, such as physical assets tokenized on the blockchain and non-fungible tokens (NFTs).

AUCTION tokens are used for governance, staking, and fees for participating in auctions or creating NFTs on the platform.

Lookonchain says that in the last several days, whales sent over 14% of the circulating supply of AUCTION to Binance, the largest crypto exchange in the world by volume, and OKX. Those deposits presumably led to coins being sold on the open market, which ultimately caused prices to plummet.

Says Lookonchain,

“AUCTION Whales deposited 1.08 million AUCTION ($48.6 million, 14.26% of the total supply) into Binance and OKX again, causing the price to plummet by 50%.

Pay attention to price changes.”

At time of writing, AUCTION has not recovered, currently trading at $20.93 with a market cap of $137 million. AUCTION is ranked as the 363rd-largest crypto asset by market cap.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin Trades Above $79K as Asia Markets React to Trump Tariffs

Memecoin platform Pump.fun brings livestream feature back to 5% of users

Bitcoin Price On The Verge Of Explosive 15% Breakout As Analyst Spots Triangle Formation

Strategy CEO Makes The Case For Corporate Bitcoin Adoption In MIT Keynote

Hackers Hammer Android and iPhone Users As Bank Account Attacks Surge 258% in One Year: Kaspersky

Cryptocurrencies to watch this week: Aptos, XRP, Solana

This Week in Crypto Games: ‘Off the Grid’ Token Live, Logan Paul ‘CryptoZoo’ Lawsuit Continues

Crypto Liquidations hit $600M as BTC Plunges Below $80K First Time in 25-days

Bitcoin (BTC) Price Posts Worst Q1 in a Decade, Raising Questions About Where the Cycle Stands

Stablecoins are the best way to ensure US dollar dominance — Web3 CEO

Chainlink (LINK) Targets Rebound To $19 — But Only If This Key Support Holds

NFT industry in trouble as activity slows, market collapses

US Tech Sector About To Witness ‘Economic Armageddon’ Amid Trump’s Tariffs, According to Wealth Management Exec

XRP’s Open Interest Surges Above $3 Billion, Will Price Follow?

This Week in Bitcoin: BTC Holds Steady as Trump’s Trade War Wrecks Stocks

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: