Bitcoin

Bitcoin Crashes Under $93,000: What’s Behind It?

Published

5 months agoon

By

admin

Bitcoin has observed a plunge under the $93,000 level during the past day. Here’s what the trend in an indicator suggests about what could be behind this downturn.

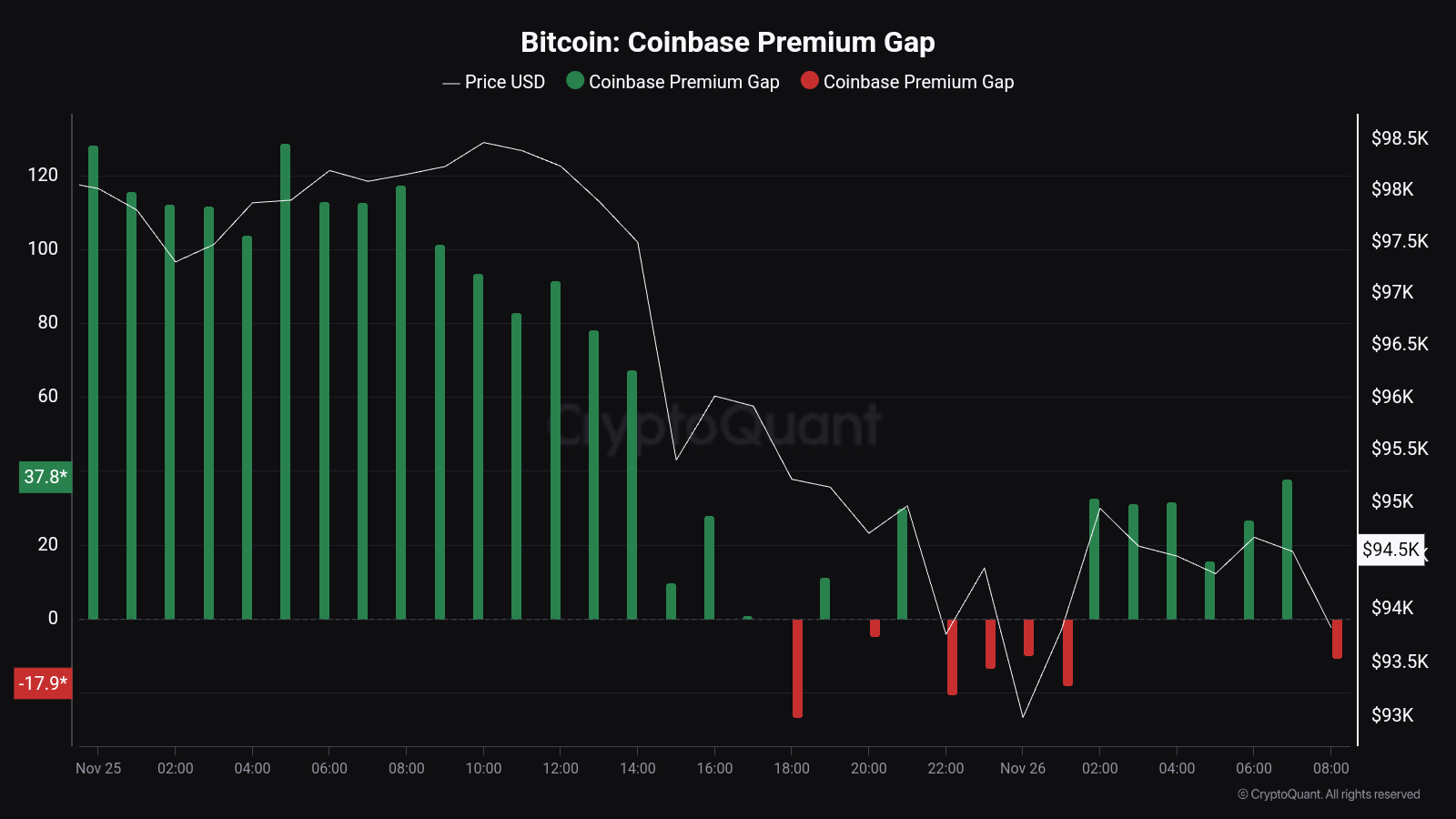

Bitcoin Coinbase Premium Gap Has Gone Cold

As pointed out by CryptoQuant community analyst Maartunn in a new post on X, the Coinbase Premium Gap has returned to neutral levels recently. The “Coinbase Premium Gap” here refers to an indicator that keeps track of the difference between the Bitcoin price listed on Coinbase (USD pair) and that on Binance (USDT pair).

This metric essentially tells us about how the buying or selling behaviours differ between the user bases of the two cryptocurrency exchanges. Coinbase’s main traffic is made up of American investors, especially large institutional entities, while Binance serves investors around the world.

When the Coinbase Premium Gap has a positive value, it means the US-based whales are participating in a higher amount of buying or a lower amount of selling than the Binance users, which is why the asset is more expensive on Coinbase. Similarly, it being negative implies a net higher buying pressure on Binance.

Now, here is a chart that shows the trend in the Bitcoin Coinbase Premium Gap over the past couple of days:

As displayed in the above graph, the Bitcoin Coinbase Premium Gap had been at notable positive levels earlier, but during the past day, its value has declined to the neutral zero mark.

According to Maartunn, the source of the positive premium was Microstrategy’s latest buying spree. Indeed, the cooldown in the indicator matches up with the timing of the completion of the $5.4 billion purchase by Michael Saylor’s firm. The significant accumulation from the company had helped the cryptocurrency maintain its recent highs, but with the buying pressure depleted, Bitcoin has retraced to price levels under $93,000.

BTC and the Coinbase Premium Gap have held a close relationship throughout 2024, so the metric could be to keep an eye on in the near future, as where it goes next may once again foreshadow the asset’s next destination. Naturally, a decline into the negative region could spell further bearish action for its price.

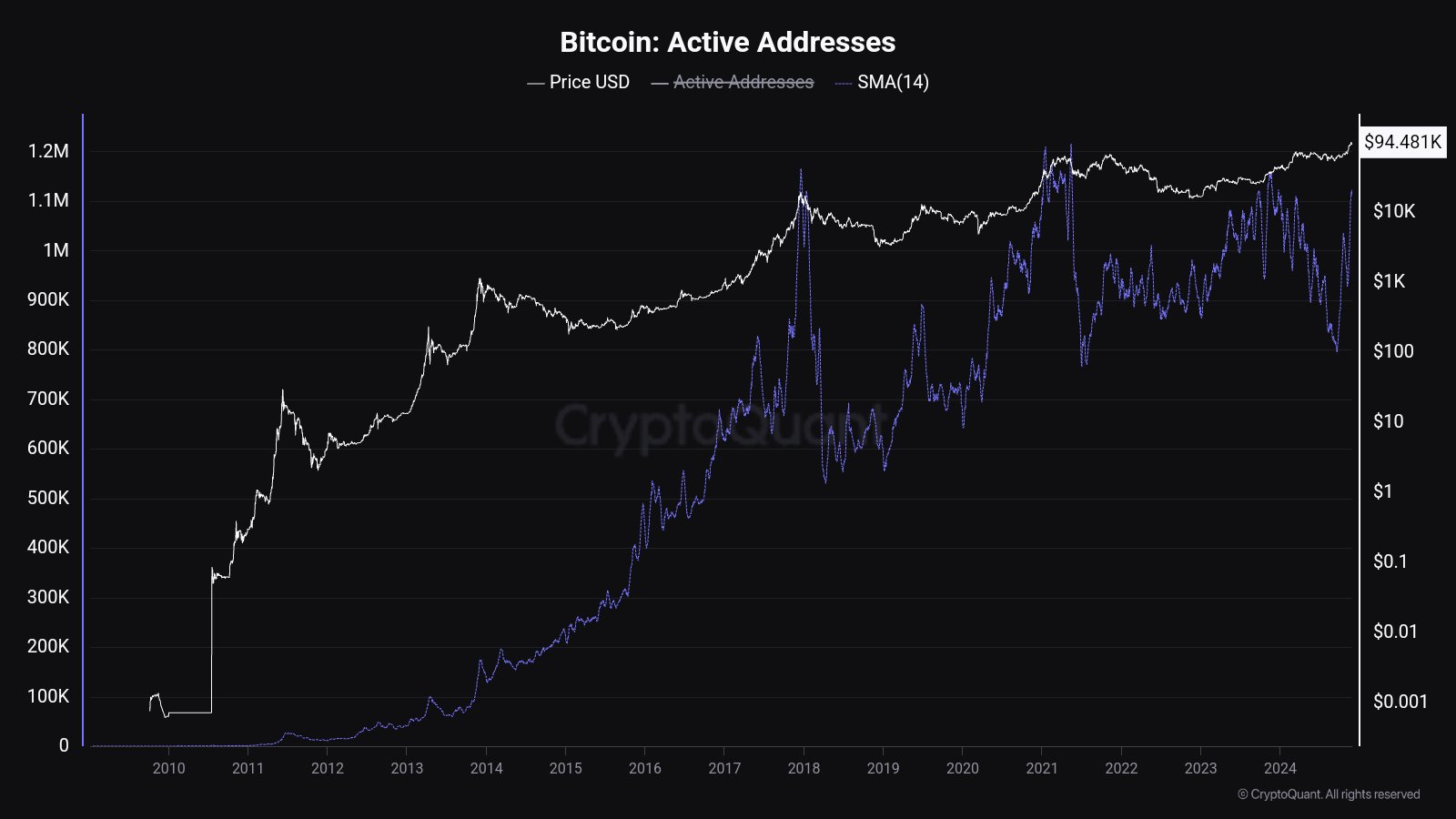

In some other news, the Bitcoin Active Addresses indicator has observed a sharp jump recently, as Maartunn has shared in another X post. This metric keeps track of the daily number of addresses that are participating in some kind of transaction activity on the network.

Below is the chart shared by the CryptoQuant analyst for the 14-day simple moving average (SMA) of the Active Addresses:

With this latest surge, the 14-day SMA of the Bitcoin Active Addresses has reached its highest point in eleven months. This suggests that a lot of activity has recently occurred on the network. Given that the asset has gone down in the past day, though, the most recent user interest has certainly not come for buying.

BTC Price

At the time of writing, Bitcoin is floating around $92,400, down almost 6% over the last 24 hours.

Source link

You may like

From Booze to Barbells: Exercise May Offset Risks of College Partying

Ethereum Foundation shuffles leadership, splits board and management

Bitcoin Price (BTC) Retakes $95K Level After Early U.S. Decline

A New Risk For The Industry?

Justin Sun Bets Big On JUST Token, Sees 100x Potential

Worldcoin price prediction | What’s next for WLD price?

Bitcoin

Bitcoin Price (BTC) Retakes $95K Level After Early U.S. Decline

Published

3 hours agoon

April 29, 2025By

admin

Bitcoin (BTC) fell early in the U.S. trading session, but mostly held firm as poor macroeconomic news rolled in.

The top cryptocurrency late in the day was trading just below $95,000, up 0.5% over the past 24 hours. The CoinDesk 20 — an index of the top 20 largest cryptocurrencies by market capitalization excluding memecoins, exchange coins and stablecoins — was roughly flat over the same time frame.

Crypto stocks like Coinbase (COIN), Strategy (MSTR) and the miners were losing modest ground after big gains last week. Notable exceptions included Janover (JNVR) and DeFi Technologies (DFTF), ahead 24% and 6.5%, respectively even as SOL — the token which both companies are aggressively accumulating — fell about 3% during the U.S. day.

Meanwhile, gold rose almost 1% and the dollar index fell 0.6%. The S&P 500 and Nasdaq each peaked into the green late in the session after earlier dipping more than 1%.

The Dallas Fed Manufacturing Index, a typically little-noticed economic data point, plunged to -35.8 from -16.3 last month — much worse than analysts’ expectations of a -14.1 print and the worst performance since COVID upended the world economy.

“Pretty horrible Dallas Fed Manufacturing Survey. Level hits the lowest since May 2020,” Joe Weisenthal, co-host of the Odd Lots podcast, posted on X. “All the comments are about tariffs and policy uncertainty. Add it to the list of bad soft/survey data.”

Hostilities between India and Pakistan might also have added to market jitters, with Pakistani Defense Minister Khawaja Muhammad Asif claiming that an Indian military incursion into Pakistan was imminent. Last week 26 people were killed in a terrorist attack in Pahalgam, a popular tourist destination in Indian-controlled Kashmir. The two countries have exchanged fire since.

Source link

Bitcoin

Bitcoin Is About To Begin Outperforming Gold, Says InvestAnswers – Here’s His Timeline

Published

7 hours agoon

April 28, 2025By

admin

A widely followed crypto analyst and trader is forecasting that Bitcoin (BTC) will start outperforming gold.

In a new video update, the host of InvestAnswers tells his 565,000 YouTube subscribers that the top crypto asset by market cap should outpace gold over the coming months, as he says the precious metal looks overextended following its parabolic rally to $3,500.

“If you look at the steady correlation between Bitcoin and Nasdaq, it is extremely tight because Bitcoin is considered a risk asset, [while] gold is considered a risk-off asset. But here, if you look at the Bitcoin/gold correlation, it fluctuates very heavily. Half the time, not correlated; half the time, it is correlated.

So there’s no signal of direct correlation and Bitcoin has already had a great post-halving, and in fact, we had hit a new all-time high before the halving, which has never happened before with Bitcoin. But its correlation with gold remains low.

Now, if I look at this chart and just like a caveman would, what do I interpret? I expect the correlation to increase with gold as the broader dynamics of the market will shift as well. I also believe gold is overbought, so I see gold mean-reverting and I see Bitcoin going up versus gold over the next six months.”

InvestAnswers says a summarized interpretation of his analysis would be that the flagship digital asset is lagging behind gold and will start to outpace the precious metal during the next six months.

BTC is trading for $93,870 at time of writing, a fractional decrease during the last 24 hours while gold is valued at $3,283 per ounce, a marginal decrease on the day.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Published

15 hours agoon

April 28, 2025By

admin

Veteran macro investor Luke Gromen says he likes Bitcoin (BTC) due to its potential to influence demand for US Treasuries.

In a new video update, the founder of the macroeconomic research firm Forest for the Trees (FFTT) says the Trump administration is in a position to boost demand for US bonds after the president signed an executive order creating a Strategic Bitcoin Reserve.

A Bitcoin bull market typically increases demand for dollar-pegged crypto assets, and according to Gromen, could ultimately drive demand for US Treasuries.

“Note that the Trump administration is still talking about putting T-bills (Treasury bills) into stablecoins, using stablecoins as a means to drive demand for T-bills. And obviously, they’ve talked about the Strategic Bitcoin Reserve.

Left unsaid in all of that is that the higher the Bitcoin price, the more stablecoin demand, the more T-bill demand there is…

I think the underlying theme of [the] US government desperately needs balance sheet and stablecoins and therefore Bitcoin can help the US government find balance sheet. I think that is absolutely still in play.

It’s one of the reasons why we still like Bitcoin over the intermediate longer term.”

Stablecoin issuers such as Tether and Circle predominantly rely on Treasury bills to back their coins on a 1:1 basis. As of December 2024, Tether has invested over $94.47 billion in T-bills to back USDT. Meanwhile, Circle owns $22.047 billion worth of T-bills as of February of this year to back USDC.

Additionally, two stablecoin bills that are progressing through Congress, the STABLE Act of 2025 and the GENIUS Act of 2025, require issuers to invest in T-bills and other real-world assets to back their coins.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

From Booze to Barbells: Exercise May Offset Risks of College Partying

Ethereum Foundation shuffles leadership, splits board and management

Bitcoin Price (BTC) Retakes $95K Level After Early U.S. Decline

A New Risk For The Industry?

Justin Sun Bets Big On JUST Token, Sees 100x Potential

Worldcoin price prediction | What’s next for WLD price?

Bitcoin Is About To Begin Outperforming Gold, Says InvestAnswers – Here’s His Timeline

Bloomberg Analyst Confirms No Set Launch Date for ProShares XRP ETFs

What is Base? The Ethereum Layer-2 Network Launched by Coinbase

Loopscale hacker in talks to return stolen crypto

Bitcoin (BTC) Yield Platform Coming From Coinbase (COIN), Aspen Digital

The Emerging Market For State Services Via Citizen X

XRP Price Shoots For 20% Surge To $2.51 Amid Pullback To Breakout Zone

Stocks edge higher ahead of big earnings week

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin6 months ago

Bitcoin6 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines