Bitcoin ETF

Bitcoin ETF options coming ‘soon’ following CFTC clearance

Published

5 months agoon

By

admin

The U.S. Commodity Futures Trading Commission issued an advisory through its Division of Clearing and Risk stating it would no longer have a role in clearing Bitcoin ETF options.

The agency is transferring this responsibility to the Options Clearing Corporation, according to a prepared statement.

“[..] In light of relevant precedents in the courts, it is substantially likely these spot commodity ETF shares would be held to be securities. Therefore, DCR’s position is the listing of these shares on SEC-registered national securities exchanges does not implicate the CFTC’s jurisdiction.”

CFTC staff advisory.

According to the commission, the OCC, which serves as the “sole issuer of all equity options” in the U.S., now holds the final authority to decide whether these options will be listed.

Experts believe the OCC’s approval could be imminent, with ETF analyst Eric Balchunas predicting it will come “very soon.”

Meanwhile, market commentator Andrew said the CFTC’s move came much quicker than expected, as approval was initially anticipated by late Q1 2025, but this decision could speed things up.

Bitwise Invest’s Jeff Park suggested that while he was optimistic about the chances of a year-end approval, he wouldn’t “short the odd.”

The advisory follows the SEC’s approval last month, which cleared applications from the New York Stock Exchange and the Chicago Board Options Exchange to list and trade Bitcoin ETF options.

Options contracts give investors the right, but not the obligation, to buy or sell an underlying asset at a specified price before a set date. The SEC believes options trading could bring “better price efficiency” and “less volatility” to Bitcoin ETFs, helping to stabilize the market while making it more transparent and efficient overall.

Bitcoin advocates view the approval of Bitcoin ETF options as a game-changer, bringing more liquidity to the market. See below.

Earlier this year, Grayscale CEO Michael Sonnenshein advocated for the swift approval of Bitcoin ETF options, saying that these offerings could pull in more players, like broker-dealers, and deepen Bitcoin’s ties with traditional finance.

Crypto influencer Mario Nawfal, in a recent social media post, highlighted the buzz around Bitcoin ETF options, saying institutional investors are “drooling” over the opportunities.

BITCOIN SPOT ETF OPTIONS GET THE GREEN LIGHT

The CFTC approved Bitcoin spot ETF options, and institutional investors are drooling.

⁰BlackRock’s Bitcoin ETF will trade as “IBIT,” and everyone’s hyped about more “big fish” jumping in.BTC spiked to $91,000 after a dip to $87,100… pic.twitter.com/qJCtH7hJpm

— Mario Nawfal’s Roundtable (@RoundtableSpace) November 16, 2024

“This is your mainstream finance world, now featuring Bitcoin,” he wrote.

Bitcoin reacted positively to the development, breaking past the $91,000 resistance level it struggled with over the past two days. At press time, the flagship cryptocurrency was trading at $91,293, up 2.4%.

Source link

You may like

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Bitcoin

Bitcoin ETFs post $172m in weekly outflows amid market bloodbath

Published

1 week agoon

April 7, 2025By

admin

Spot Bitcoin exchange-traded funds in the U.S. recorded a negative week once again amid escalating trade tensions following President Donald Trump’s announcement of new tariffs, dubbed ‘Liberation Day’ duties.

According to data from SoSoValue, the 12 spot Bitcoin ETFs reported $172.89 million in net outflows over the past week, snapping a two-week inflow streak that drew in nearly $941 million into the funds.

Notably, these ETFs experienced outflows on four of the five days between March 31 and April 4. Monday saw $71.07 million in outflows, followed by $157.64 million on Tuesday, $99.86 million on Thursday, and $64.88 million on Friday. The only positive day was Wednesday, with $220.76 million in inflows.

The majority of outflows came from Grayscale GBTC, which lost $95.5 million over last week, followed by WisdomTree’s BTCW with $44.6 million per Faside data. Additionally, outflows came from IBIT, BITB, ARKB, and HODL funds that saw $35.5 million, $24.1 million, $22.2 million, and $4.9 million in net redemption, respectively.

However, it wasn’t entirely a bearish week across the board, as Grayscale’s spot Bitcoin Trust, Franklin Templeton’s EZBC, and Fidelity’s FBTC still saw combined inflows of $61.8 million. The remaining BTC ETFs remained flat over the five days.

The drop in investor demand wasn’t limited to Bitcoin ETFs. Ethereum ETFs recorded $49.93 million in outflows last week, marking six straight weeks of withdrawals totaling over $795 million.

These outflows come as Bitcoin posted its worst first-quarter performance since 2018, and investor sentiment weakened due to Trump’s new tariff plans, starting with a flat 10% on all imports and higher rates for certain key trading partners, raising fears of a new global trade war.

At press time, the crypto market was down nearly 10% over the past day. Bitcoin had dropped 9.3%, falling below the $76,500 mark, a level BitMEX co-founder Arthur Hayes previously warned must be held to avoid deeper losses.

Source link

Bitcoin ETF

Bitwise Debuts Option Income ETFs On Bitcoin Treasury Stocks: MSTR, MARA, COIN

Published

2 weeks agoon

April 5, 2025By

admin

Bitwise has introduced three new ETFs that provide yield-seeking investors with exposure to leading Bitcoin treasury companies, using a covered call strategy designed to capitalize on equity volatility while preserving Bitcoin-linked upside.

The funds include:

- $IMST, tracking Strategy (formerly MicroStrategy, ticker: MSTR), which currently holds 528,185 BTC.

- $IMRA, focused on MARA Holdings (MARA), a top-tier Bitcoin miner with 47,600 BTC in treasury.

- $ICOI, offering exposure to Coinbase (COIN), which holds 9,480 BTC and serves as a key on-ramp for institutional and retail Bitcoin adoption.

Each ETF employs an actively managed options overlay, writing out-of-the-money calls on the underlying equity while maintaining a long position. This approach is designed to deliver monthly income distributions—particularly attractive in today’s high-volatility environment—while retaining meaningful upside exposure to Bitcoin-linked companies.

While none of the funds directly hold Bitcoin, all three underlying equities are deeply intertwined with Bitcoin’s performance and trajectory. Strategy and Marathon are among the most prominent corporate holders of BTC, while Coinbase continues to serve as critical infrastructure for the broader ecosystem.

New Tools for Bitcoin-Aligned Capital Allocation

For corporate treasurers and institutional allocators who view Bitcoin as a long-term strategic asset, these new products represent a compelling way to gain indirect exposure while generating yield—especially in balance sheets that can’t yet directly hold BTC.

The rise of equity-based strategies like this is part of a broader shift. More public companies are actively integrating Bitcoin into their financial models, whether through direct holdings or through services and operations tied to Bitcoin mining, custody, or exchange infrastructure.

What Bitwise is offering is not just exposure, but a way to monetize volatility—something that Bitcoin-native companies experience more than most. Whether it’s MSTR stock reacting to Bitcoin’s price swings, MARA stock tracking mining difficulty and rewards, or Coinbase stock responding to changes in trading volume and regulatory sentiment, these equities are increasingly used as BTC proxies by sophisticated investors.

In recent months, institutional interest in Bitcoin ETFs, mining stocks, and companies with Bitcoin treasuries has intensified, and tools like IMST, IMRA, and ICOI provide a new angle on that demand. For companies already on a Bitcoin treasury path—or considering one—this evolution in capital markets infrastructure is notable.

What This Signals for Bitcoin Treasury Strategy

The launch of these ETFs reflects how Bitcoin is no longer just a spot asset—it’s now embedded in public equity strategy, yield generation, and portfolio construction.

Covered call structures won’t be right for every investor or treasury, but the signal is clear: the market is maturing around the idea that Bitcoin isn’t just to be held—it can be actively managed, structured, and monetized in new ways.

These new ETFs won’t replace direct holdings on a corporate balance sheet. But they may complement them—or offer a first step for firms exploring how to position around Bitcoin while still meeting traditional risk, yield, and reporting mandates.

Disclaimer: This content was written on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be interpreted as an invitation or solicitation to acquire, purchase, or subscribe for securities.

Source link

Bitcoin

This Easy Bitcoin ETF Flow Strategy Beats Buy And Hold By 40%

Published

2 weeks agoon

April 5, 2025By

admin

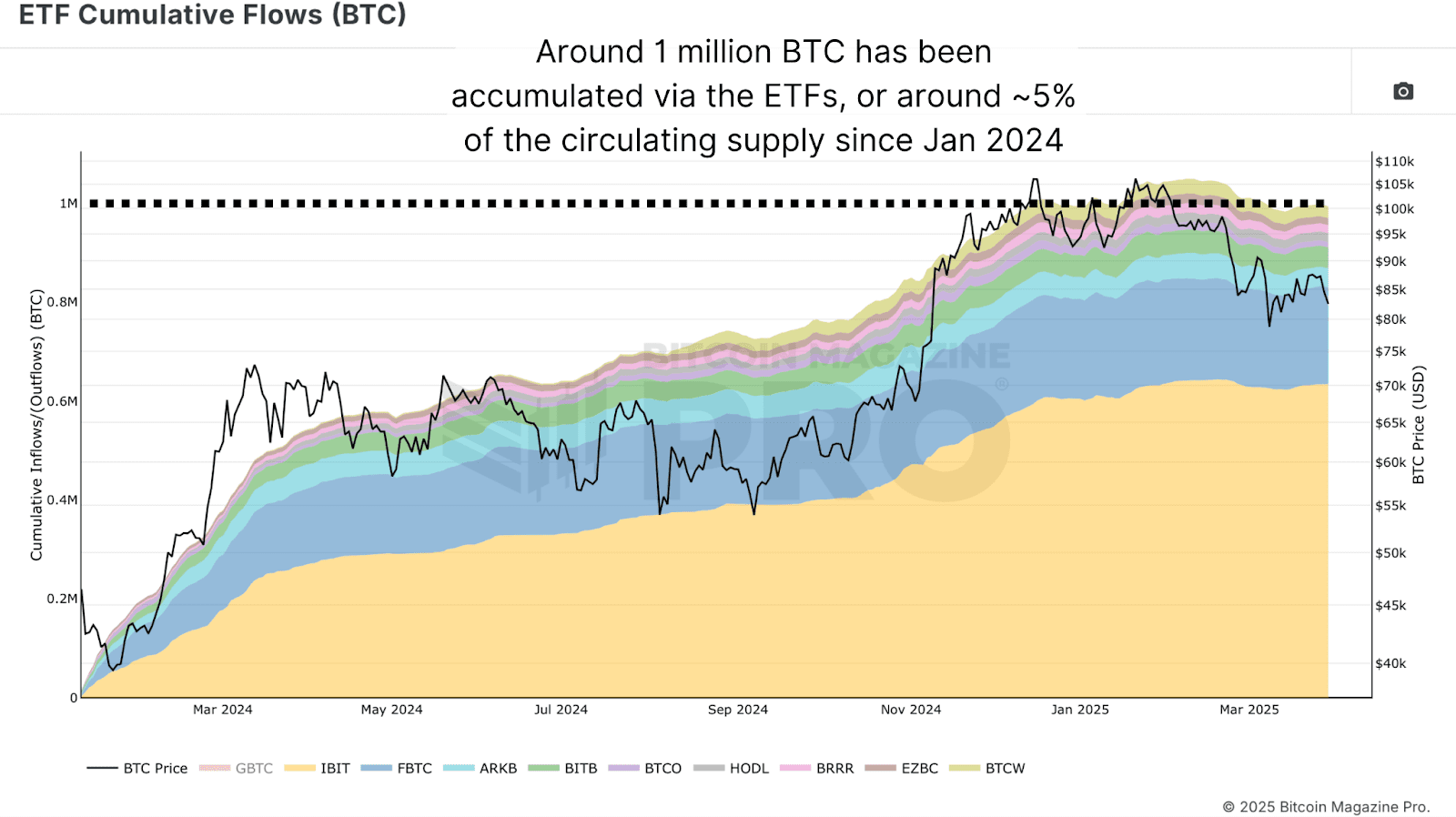

Bitcoin has seen an institutional capital influx on a scale previously unfathomable. Billions of dollars are flowing into Bitcoin ETFs, reshaping the liquidity landscape, inflow-outflow dynamics, and investor psychology. While many interpret this movement as smart money executing complex strategies backed by proprietary analytics, a surprising reality surfaces: outperforming the institutions might not be as difficult as it seems.

For a more in-depth look into this topic, check out a recent YouTube video here:

Outperforming Bitcoin – Invest Like Institutions

Canary In The Bitcoin Coal Mine

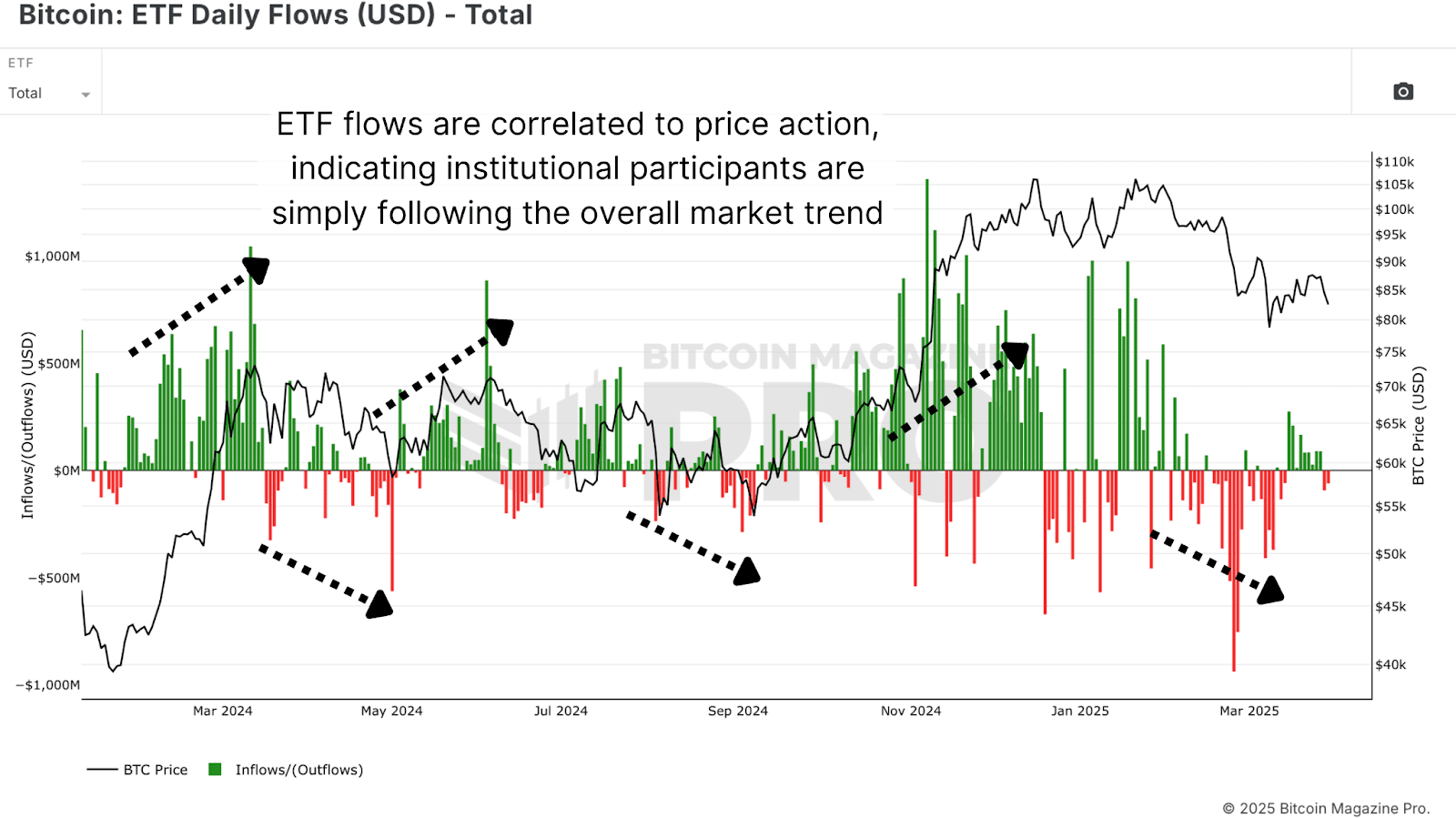

One of the most revealing datasets available today is daily Bitcoin ETF flow data. These flows, denoted in USD, offer direct insight into how much capital is entering or exiting the Bitcoin ETF ecosystem on any given day. This data has a startlingly consistent relationship with short to mid-term price action.

Importantly, while these flows do impact price, they are not the primary movers of a multi-trillion-dollar market. Instead, ETF activity functions more like a mirror for broad market sentiment, especially as retail traders dominate volume during trend inflections.

Surprisingly Simple

The average retail investor often feels outmatched, overwhelmed by the data, and disconnected from the tactical finesse institutions supposedly wield. But institutional strategies are often simple trend-following mechanisms that can be emulated and even surpassed with disciplined execution and proper risk framing:

Strategy Rules:

- Buy when ETF flows are positive for the day.

- Sell when ETF flows turn negative.

- Execute each trade at daily close, using 100% portfolio allocation for clarity.

- No complex TA, no trendlines, just follow the flows.

This system was tested using Bitcoin Magazine Pro’s ETF data starting from January 2024. The base assumption was a first entry on Jan 11, 2024, at ~$46,434 with subsequent trades dictated by flow changes.

Performance vs. Buy-and-Hold

Backtesting this basic ruleset yielded a return of 118.5% as of the end of March 2025. By contrast, a pure buy-and-hold position over the same period yielded 81.7%, a respectable return, but a near 40% underperformance relative to this proposed Bitcoin ETF strategy.

Importantly, this strategy limits drawdowns by reducing exposure during downtrends, days marked by institutional exits. The compounding benefit of avoiding steep losses, more than catching absolute tops or bottoms, is what drives outperformance.

Institutional Behavior

The prevailing myth is that institutional players operate on superior insight. In reality, the majority of Bitcoin ETF inflows and outflows are trend-confirming, not predictive. Institutions are risk-managed, highly regulated entities; they’re often the last to enter and the first to exit based on trend and compliance cycles.

What this means is that institutional trades tend to reinforce existing price momentum, not lead it. This reinforces the validity of using ETF flows as a proxy signal. When ETFs buy, they’re confirming a directional shift that is already unfolding, allowing the retail investor to “surf the wave” of their capital inflow.

Conclusion

The past year has proven that beating Bitcoin’s buy-and-hold strategy, one of the toughest benchmarks in financial history, is not impossible. It requires neither leverage nor complex modeling. Instead, by aligning oneself with institutional positioning, retail investors can benefit from market structure shifts without the burden of prediction.

This doesn’t mean the strategy will work forever. But as long as institutions continue to influence price through these large, visible flow mechanics, there is an edge to be gained in simply following the money.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Coinbase Urges Australia to Vote for Crypto Progress in May

How High Would Pi Network Price Go If Pi Coin Adopts Transparency to Avoid Mantra Pitfalls

XRP’s ‘Rising Wedge’ Breakdown Puts Focus on $1.6 Price Support

China selling seized crypto to top up coffers as economy slows: Report

Ethereum Price Dips Again—Time to Panic or Opportunity to Buy?

The Inverse Of Clown World”

Bitcoin Indicator Flashing Bullish for First Time in 18 Weeks, Says Analyst Who Called May 2021 Crypto Collapse

3iQ and Figment to launch North America’s first Solana staking ETF

Bitcoin Miners Are Selling More BTC to Make Ends Meet: CryptoQuant

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x