ADA

Bitcoin, Ethereum, XRP, Solana and Cardano Surge As President Trump Announces US Will Establish ‘Crypto Strategic Reserve’

Published

1 month agoon

By

admin

Bitcoin and the crypto market at large are surging as President Trump announces that the US will establish a “crypto strategic reserve.”

On Truth Social, Trump says the reserve will include Bitcoin (BTC), Ethereum (ETH), XRP (XRP), Solana (SOL) and Cardano (ADA).

This announcement triggered a $100 billion surge in the global crypto market, with XRP soaring 37%, SOL 24%, and ADA over 70%, while BTC and ETH rose by 10% and 13%, respectively.

Trump framed the reserve as a response to what he called “corrupt attacks” on the crypto industry by the Biden administration, emphasizing his goal to make the U.S. the “crypto capital of the world.”

Trump hasn’t confirmed exactly how he will the reserve.

He established a Presidential Working Group in a January executive order to explore the creation of a national digital asset stockpile, giving 30 days to identify regulations, 60 days for recommendations and 180 days for a full report.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Trump Ally Bill Ackman Calls for 90-Day Pause on US Tariffs as Crypto Sinks

Ethereum price Tags $1,500 As Global Stock Market Crash Triggers Circuit Breakers

Bitcoin Trades Above $79K as Asia Markets React to Trump Tariffs

Memecoin platform Pump.fun brings livestream feature back to 5% of users

Bitcoin Price On The Verge Of Explosive 15% Breakout As Analyst Spots Triangle Formation

Strategy CEO Makes The Case For Corporate Bitcoin Adoption In MIT Keynote

ADA

Cardano Founder Reveals What Will Onboard 3 Billion New Users Into Crypto

Published

5 days agoon

April 2, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The crypto market spent most of March on a steady downtrend. Cryptocurrency prices across the board struggled on a downfall as investor caution and a lack of momentum suppressed the bullish narrative that dominated January and early February. With April just beginning, attention has turned to what lies ahead.

Technical indicators are pointing to both uptrends and downtrends, but a major conversation is taking shape off the charts that could reset the trajectory of the entire crypto space. According to Cardano founder Charles Hoskinson, there are two key regulatory developments that could mark a turning point for crypto adoption and open the door for billions of new users almost overnight.

Hoskinson Predicts Tech Giants Will Adopt Cryptocurrency

In a recent episode of the “The Wolf Of All Streets” podcast hosted by Scott Melker, Charles Hoskinson outlined a scenario where two bills currently being debated in the U.S. Senate, one on stablecoins and the other on market structure, could change the crypto industries. He argued that once these frameworks are passed, major tech companies like Apple, Facebook, Google, and Microsoft will have the legal clarity and infrastructure to integrate crypto wallets directly into their platforms. “Once those two bills pass, Apple, Microsoft, Google, Facebook, are going to say hey, we’re crypto people now,” Hoskinson said.

These companies already possess the infrastructure to onboard new crypto users: massive user bases, global infrastructure, payment processing tools, and familiarity with digital wallets. Once regulations provide a clear path forward, these tech companies will easily allow their users to buy and sell cryptocurrencies without leaving their ecosystems. This move wouldn’t be a gradual progress but a sudden leap into mass adoption that would unlock access to a userbase of over 3 billion users around the world.

The 3 Billion User Effect: What Will This Mean For The Crypto Industry?

The stablecoin legislation, formally titled the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act of 2025, is a proposal aimed at establishing clear rules for how stablecoins are issued and backed. It also seeks to amend existing federal securities laws to clarify that payment stablecoins should not be treated as securities. Although the exact timeline for when the bill will be passed is uncertain, Charles Hoskinson believes it will be passed within the next 60 to 90 days.

Once passed, the STABLE Act, alongside the market structure bill, will form the regulatory groundwork for widespread crypto adoption. On a basic level, it would allow major tech companies to integrate stablecoin payments into their platforms, letting users easily pay for services or products using stablecoins. On the higher end, these tech companies could eventually serve as intermediaries between users and crypto exchanges or even take on roles similar to exchanges themselves.

A user base of 3 billion users will bring with it not only increased trading volume but also growth in use cases, liquidity, and investment interest. It would shift crypto from a smaller sector into mainstream financial infrastructure.

Featured image from LinkedIn, chart from Tradingview.com

Source link

ADA

Analyst Says Crypto Whales Loading Up on Ethereum, Accumulating $815,514,345 in ETH in Just Five Days

Published

3 weeks agoon

March 17, 2025By

admin

A crypto analyst says deep-pocketed investors are snapping up the top layer-1 platform Ethereum (ETH) amid the marketwide digital asset correction.

Trader Ali Martinez tells his 132,900 followers on the social media platform X that whales gobbled up more than $815.514 million worth of ETH in less than a week.

“Whales have bought more than 420,000 Ethereum ETH in [five days]!”

Martinez is also keeping a close watch on Ethereum’s In/Out of the Money Around Price (IOMAP) metric – which classifies crypto addresses as either profiting, breaking even, or losing money – to determine support and resistance levels for ETH.

According to Martinez, ETH is currently trading in a narrow range between stiff support and resistance zones.

“Ethereum ETH key levels to watch! On-chain data reveals $1,870 as the strongest support and $2,050 as its toughest resistance!”

At time of writing, ETH is trading for $1,941.

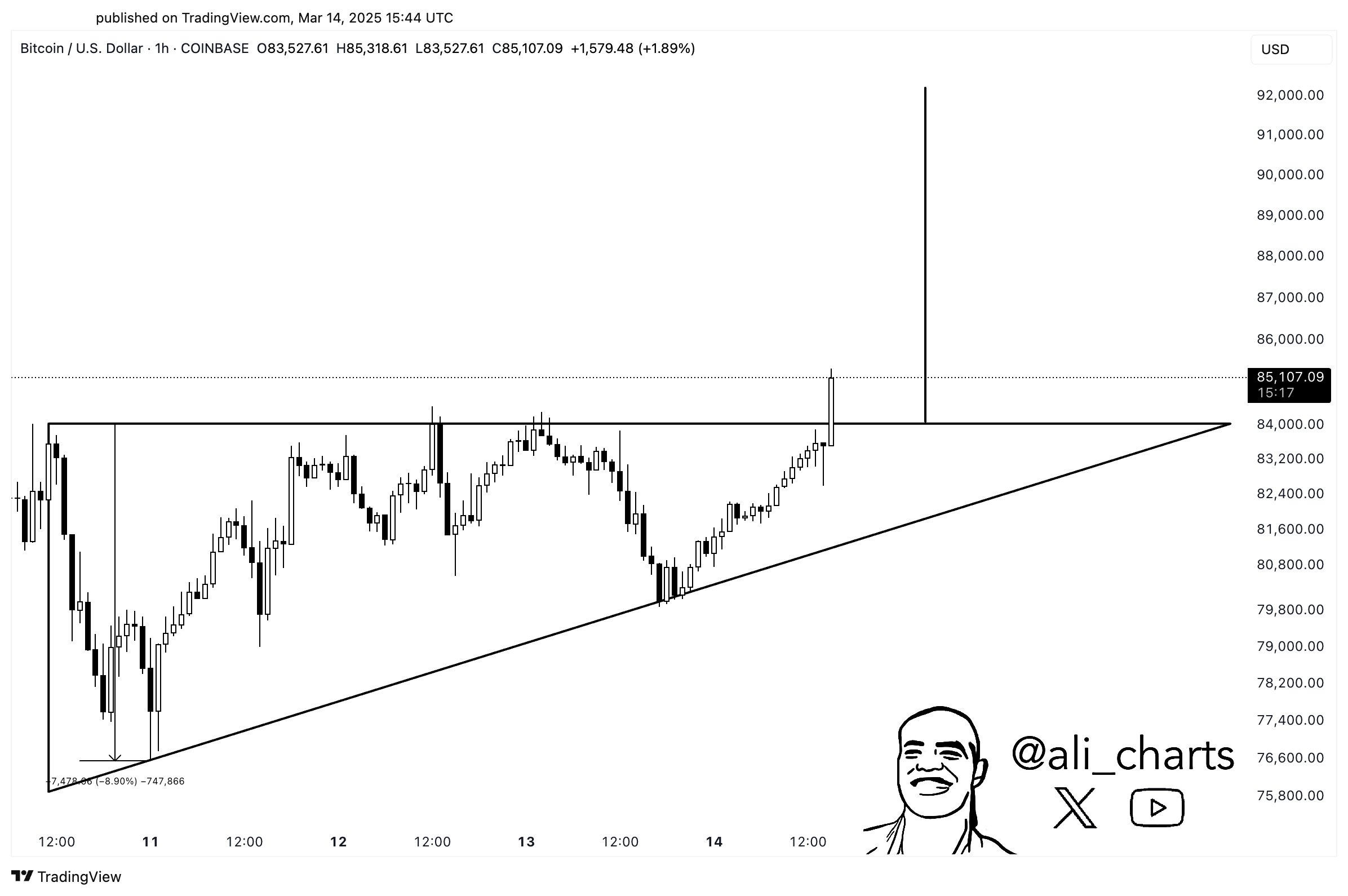

Turning to Bitcoin (BTC), the trader believes that the crypto king is poised to witness tactical rallies after breaching the horizontal resistance of an ascending triangle pattern.

“Bitcoin BTC is breaking out! The target is $90,000 as long as the $84,000 support holds.”

An ascending triangle pattern may be considered a bullish reversal structure if the asset soars above its horizontal resistance.

At time of writing, Bitcoin is trading for $84,288.

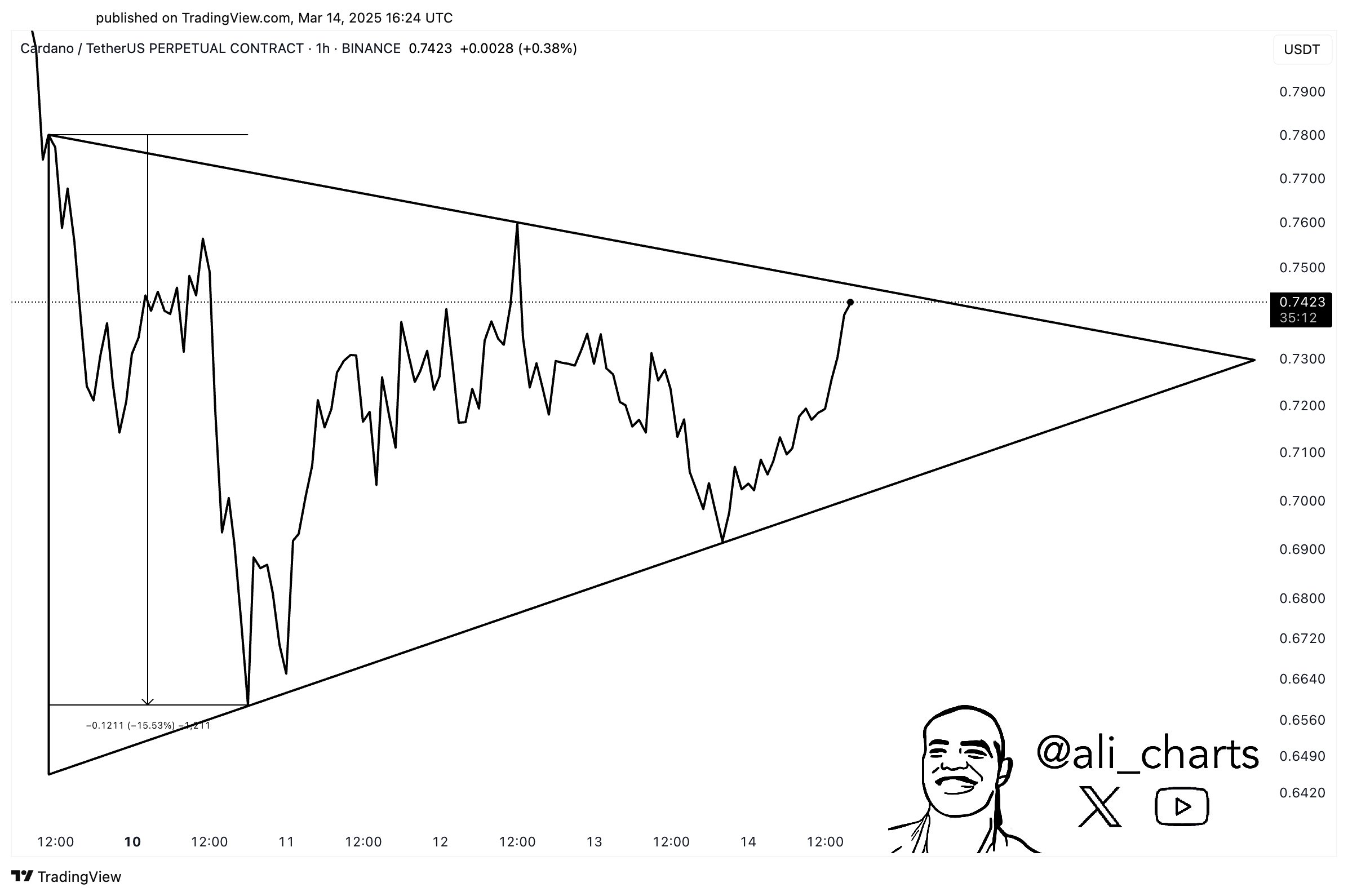

Turning to Ethereum rival Cardano, the analyst predicts rallies for ADA if the altcoin takes out the diagonal resistance of a triangle pattern at around $0.75.

“Cardano ADA is about to break free! Busting out of this triangle will trigger a 15% price move.”

A triangle is typically viewed as a consolidation pattern as it signals a potential breakout in either direction. The asset is considered bullish if the price moves above the diagonal resistance and bearish if it tumbles below the diagonal trend line.

At time of writing, ADA is worth $0.744.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

ADA

Cardano Bulls Eye $10 Target – Analyst Reveals Key Levels To Break

Published

4 weeks agoon

March 9, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Cardano (ADA) has been caught in massive volatility and extreme price swings, making it one of the most unpredictable assets in the crypto market. Following US President Donald Trump’s announcement of a US Strategic Crypto Reserve, which included Cardano, ADA’s price skyrocketed over 80% in less than a day, fueling speculation about its long-term role in institutional adoption.

Related Reading

However, the excitement was short-lived, as negative macroeconomic sentiment and fears surrounding global trade wars triggered a sharp 35% decline within just two days. As uncertainty grips the financial markets, traders remain cautious about whether ADA can regain momentum or if more downside is ahead.

Despite the recent sell-off, top analyst Ali Martinez shared a technical analysis suggesting that Cardano remains positioned for a potential surge toward $10. According to his insights, bulls must reclaim key technical levels for a strong recovery, with ADA still showing bullish potential despite short-term weakness.

With Cardano’s price action at a critical point, the coming days will be crucial in determining its next move. If bulls can stabilize ADA above key support, the potential for another explosive rally remains on the table.

Cardano Could Start A Massive Move

Cardano (ADA) has been overperforming compared to the broader crypto market over the past week, showing relative strength despite ongoing volatility. However, price action remains confined within a range that first began forming in November 2024, preventing a clear breakout in either direction.

Related Reading

If bulls can hold the current levels, ADA could soon attempt a push above multi-year highs, setting the stage for a significant bullish move. However, analysts remain cautious as prices are still low, and investor sentiment remains fearful amid macroeconomic uncertainty and trade war tensions. Many traders are waiting for confirmation of a breakout, as momentum has yet to fully shift in favor of the bulls.

Martinez’s technical analysis on X reveals that Cardano is still positioned for a potential surge toward $10. According to Martinez, for this bullish scenario to unfold, ADA must maintain support above $0.80 while successfully breaking through the key $1.20 resistance level. These price points serve as crucial pivot zones, and their validation or failure will likely determine Cardano’s short-term trend.

The next trading sessions will be crucial, as a break above $1.20 could trigger a strong upward move, while failure to hold above $0.80 could lead to further downside risk. With ADA currently at a pivotal moment, traders are closely monitoring price action to gauge whether bulls can regain control or if continued consolidation is ahead.

Price Action Details: Technical Analysis

Cardano (ADA) is currently trading at $0.80 after failing to hold above the key $1 level. Despite recent strong performance compared to the broader market, ADA has struggled to maintain bullish momentum, leaving traders uncertain about its next move.

For bulls to regain control, ADA must reclaim the $1 mark and push above the critical $1.17 resistance level. A break and hold above this zone could trigger a massive rally, potentially sending Cardano to multi-year highs. Such a move would signal renewed buying interest, boosting confidence among investors and traders who are watching ADA’s long-term potential.

Related Reading

However, failure to break above $1 and hold the crucial $0.80 support level could expose Cardano to further downside risk. A breakdown below $0.80 would likely send ADA into lower demand zones, extending its consolidation phase and delaying any significant recovery.

Featured image from Dall-E, chart from TradingView

Source link

Trump Ally Bill Ackman Calls for 90-Day Pause on US Tariffs as Crypto Sinks

Ethereum price Tags $1,500 As Global Stock Market Crash Triggers Circuit Breakers

Bitcoin Trades Above $79K as Asia Markets React to Trump Tariffs

Memecoin platform Pump.fun brings livestream feature back to 5% of users

Bitcoin Price On The Verge Of Explosive 15% Breakout As Analyst Spots Triangle Formation

Strategy CEO Makes The Case For Corporate Bitcoin Adoption In MIT Keynote

Hackers Hammer Android and iPhone Users As Bank Account Attacks Surge 258% in One Year: Kaspersky

Cryptocurrencies to watch this week: Aptos, XRP, Solana

This Week in Crypto Games: ‘Off the Grid’ Token Live, Logan Paul ‘CryptoZoo’ Lawsuit Continues

Crypto Liquidations hit $600M as BTC Plunges Below $80K First Time in 25-days

Bitcoin (BTC) Price Posts Worst Q1 in a Decade, Raising Questions About Where the Cycle Stands

Stablecoins are the best way to ensure US dollar dominance — Web3 CEO

Chainlink (LINK) Targets Rebound To $19 — But Only If This Key Support Holds

NFT industry in trouble as activity slows, market collapses

US Tech Sector About To Witness ‘Economic Armageddon’ Amid Trump’s Tariffs, According to Wealth Management Exec

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x