Markets

Bitcoin Jumps to $105,000 as Fed Fears Fade

Published

3 weeks agoon

By

admin

Bitcoin (BTC) soared past the $105,000 mark on Wednesday as investor sentiment shifted following the Federal Reserve’s decision to pause its interest rate cuts.

The world’s largest crypto, which initially dipped to $101,800 after the announcement, quickly rebounded, marking its highest level in three days.

During the Federal Open Market Committee meeting, the Fed left its benchmark interest rate unchanged, keeping it within the target range of 4.25% to 4.50%.

Since President Donald Trump’s election victory in November, Bitcoin has gained over 50%, fueled partly by expectations of more crypto-friendly policies under his administration.

As the Federal Reserve continues to monitor economic data, traders remain cautious but optimistic about Bitcoin’s trajectory.

“Immediate growth, as we’ve seen in previous bull cycles, may not follow as much of the optimism surrounding Trump’s stance on crypto has already been priced in following recent bullish trends,” Gracy Chen, CEO of Bitget, told Decrypt.

The interest rate pause comes after three consecutive rate cuts since September, which slashed the federal funds rate by 100 basis points.

Fed Chair Jerome Powell said that continued economic strength and persistent inflation during a post-meeting press conference influenced the decision to hold rates steady.

Powell noted while inflation has eased significantly from its 2022 peak of 9.1%, it remains at 2.9% annually, making further rate adjustments uncertain.

The Fed chair’s remarks initially pushed Bitcoin and equities higher, with BTC crossing $103,000 before surging further.

Traditional markets showed a mixed response, with the Nasdaq falling 1.1% and the S&P 500 declining 0.9%. Gold remained in demand, holding steady above $2,750 in early Asian trading on Thursday.

Powell, when asked about digital assets, stated that U.S. banks are free to serve crypto customers as long as they manage associated risks.

The Fed chair also hinted at the need for clearer regulations from Congress, which many industry participants viewed as a positive development.

The broader crypto market responded positively to the Fed’s decision, with Ethereum (ETH) and Solana (SOL) trading in narrow ranges. ETH is up 2% to $3,184, while SOL has gained 4.1% to $239, CoinGecko data shows.

Despite recent gains, some analysts warn that Bitcoin’s rally could face resistance.

The world’s largest crypto briefly hit a record $109,241 before President Trump’s inauguration in January but has since retraced.

“While some believe the crypto market will get significant attention from the new administration, it’s important to temper price expectations,” Chen said.

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Bitcoin Price Set For Big Move As Volatility Drops

The United States Government Should Acquire 20% of the Bitcoin (BTC) Network, Says Michael Saylor – Here’s Why

SEC waves white flag on OpenSea probe, CEO says ‘this is a win’

How to Prepare for Monad: The High-Speed EVM Layer-1 Blockchain

US SEC Faces Backlash as Bybit Hack Highlights Lack of Oversight

Ether Price Spikes Further on Reports of Bybit Starting to Buy ETH

Bitcoin Magazine Pro

Bitcoin Price Set For Big Move As Volatility Drops

Published

47 minutes agoon

February 22, 2025By

admin

Bitcoin appears to be on the verge of a major price movement, and data suggests that volatility could return in a big way. With Bitcoin’s price action stagnating over the past few weeks, let’s analyze the key indicators to understand the potential scale and direction of the upcoming move.

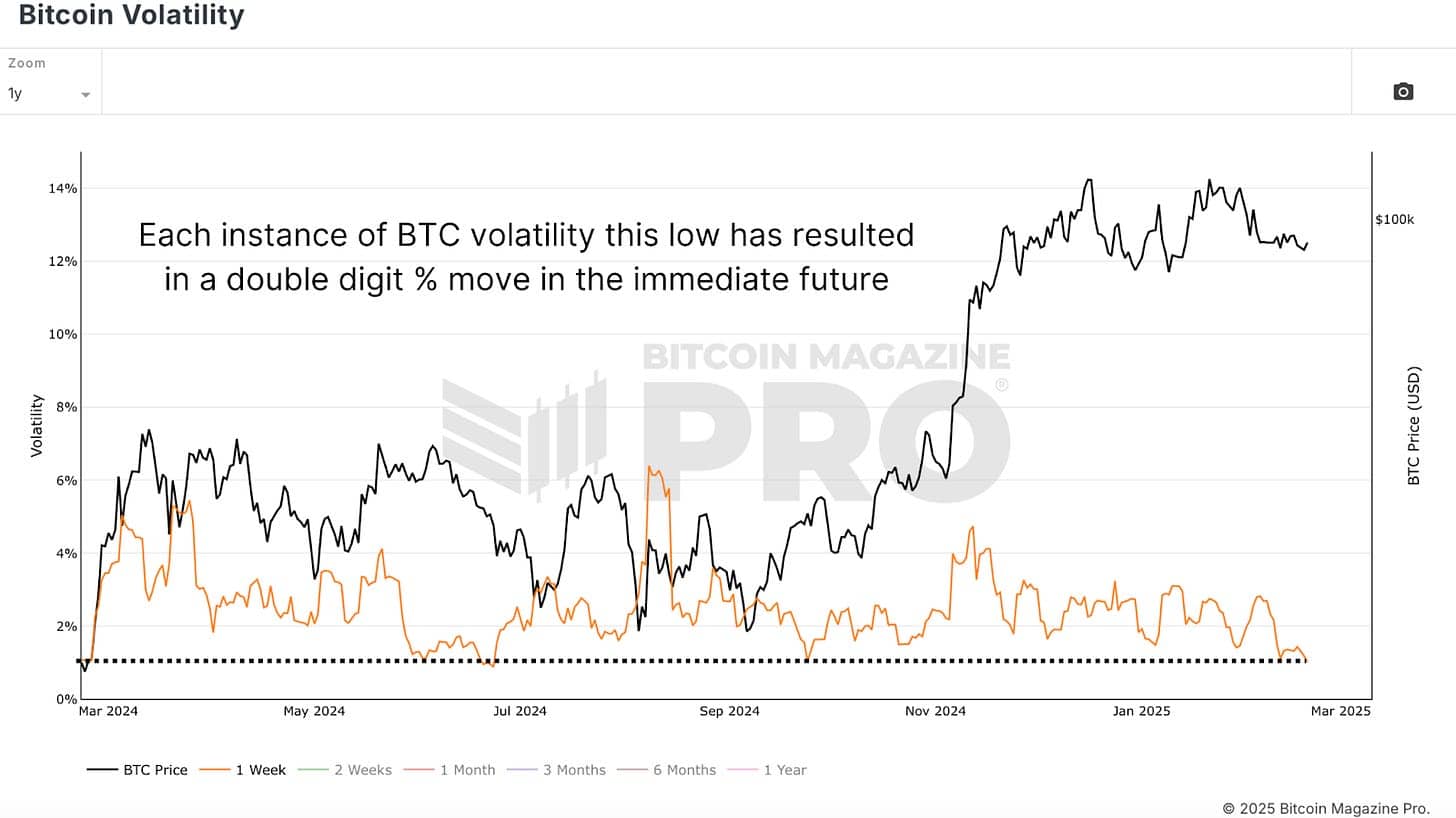

Volatility

A great place to start is Bitcoin Volatility, which tracks price action and volatility over time. By isolating the past year’s data and focusing on weekly volatility, we observe that Bitcoin’s price recently has been relatively flat, hovering in the $90,000 range. This prolonged sideways action has resulted in a dramatic drop in volatility, meaning Bitcoin is experiencing some of its most stable price behavior in recent history.

Historically, such low volatility levels are rare and tend to be short-lived. When looking at previous instances where volatility was this low, Bitcoin followed up with significant price movements:

A rally from $50,000 to a then all-time high of $74,000.

A drop from $66,000 to $55,000, followed by another surge to $68,000.

A period of stagnation around $60,000 before a surge to $100,000, its current all-time high.

Every time volatility dropped to this level, Bitcoin experienced a move of at least 20-30%, if not more, in the following weeks.

Bollinger Bands

To further confirm this, the Bollinger Bands Width indicator, a tool that measures volatility by tracking price deviation from a moving average, also signals that Bitcoin is coiled for a big move. The quarterly bands are currently at their tightest levels since 2012, meaning that price compression is at an extreme. The last time this happened, Bitcoin experienced a 200% price surge within weeks.

Examining previous occurrences of similar tight Bollinger Band setups, we find:

2018: A 50% drop from $6,000 to $3,000.

2020: A breakout from $9,000 to $12,000, setting up the eventual rally to $40,000.

2023: A slow accumulation phase around $25,000 before a rapid jump to $32,000.

Potential Direction

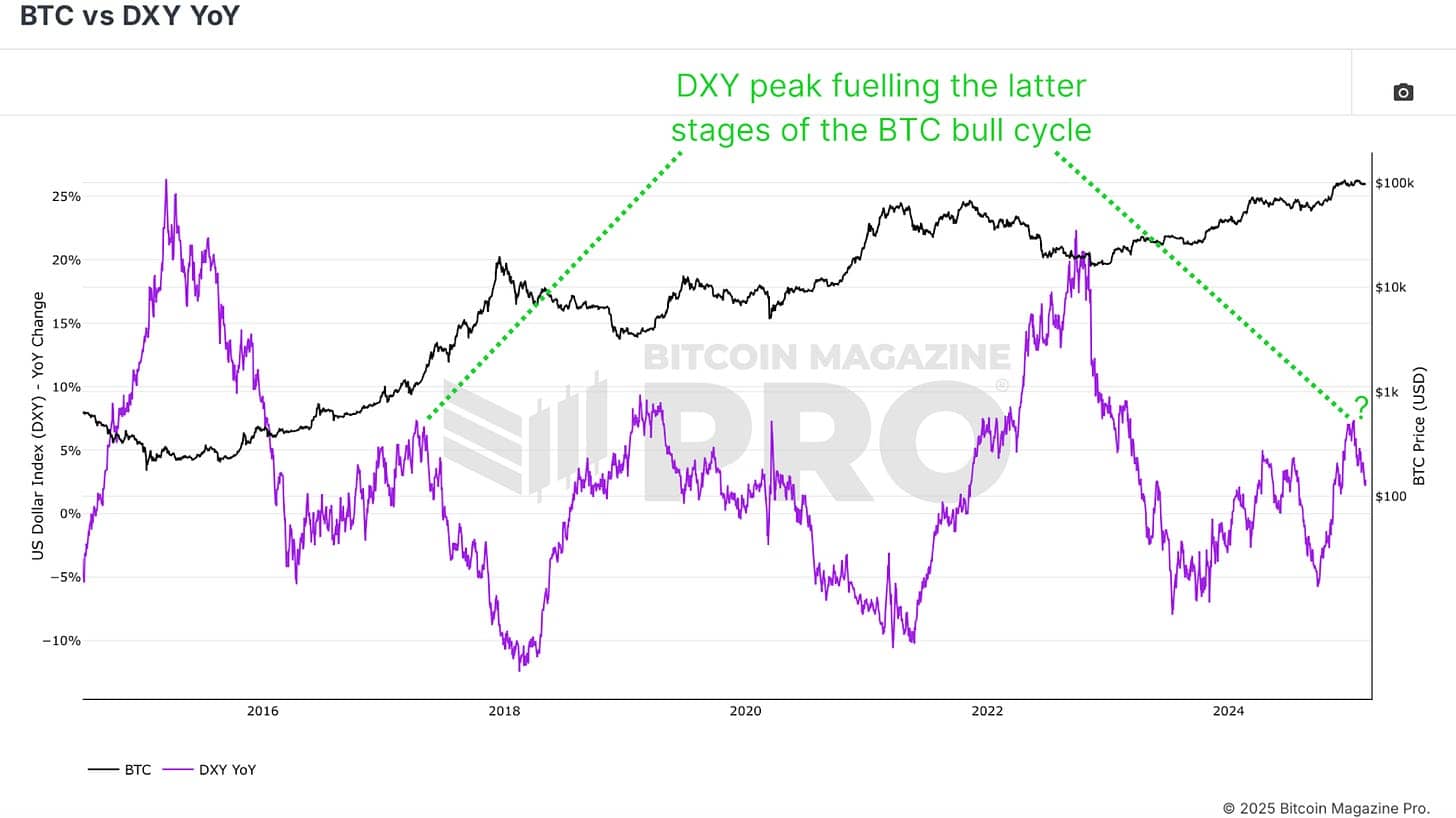

Understanding direction is harder than predicting volatility, but we have clues. One strong indicator is the US Dollar Strength Index (DXY) YoY, which has historically moved inversely to Bitcoin. Recently, the DXY has been rallying hard, yet Bitcoin has held its ground. This suggests Bitcoin has underlying strength, even in less favorable macro conditions.

Additionally, political factors may play a role. Historically, when Donald Trump took office in 2017, the DXY declined, and Bitcoin saw a massive bull run from $1,000 to $20,000. With a similar setup potentially unfolding in 2025, we may see a repeat of this dynamic.

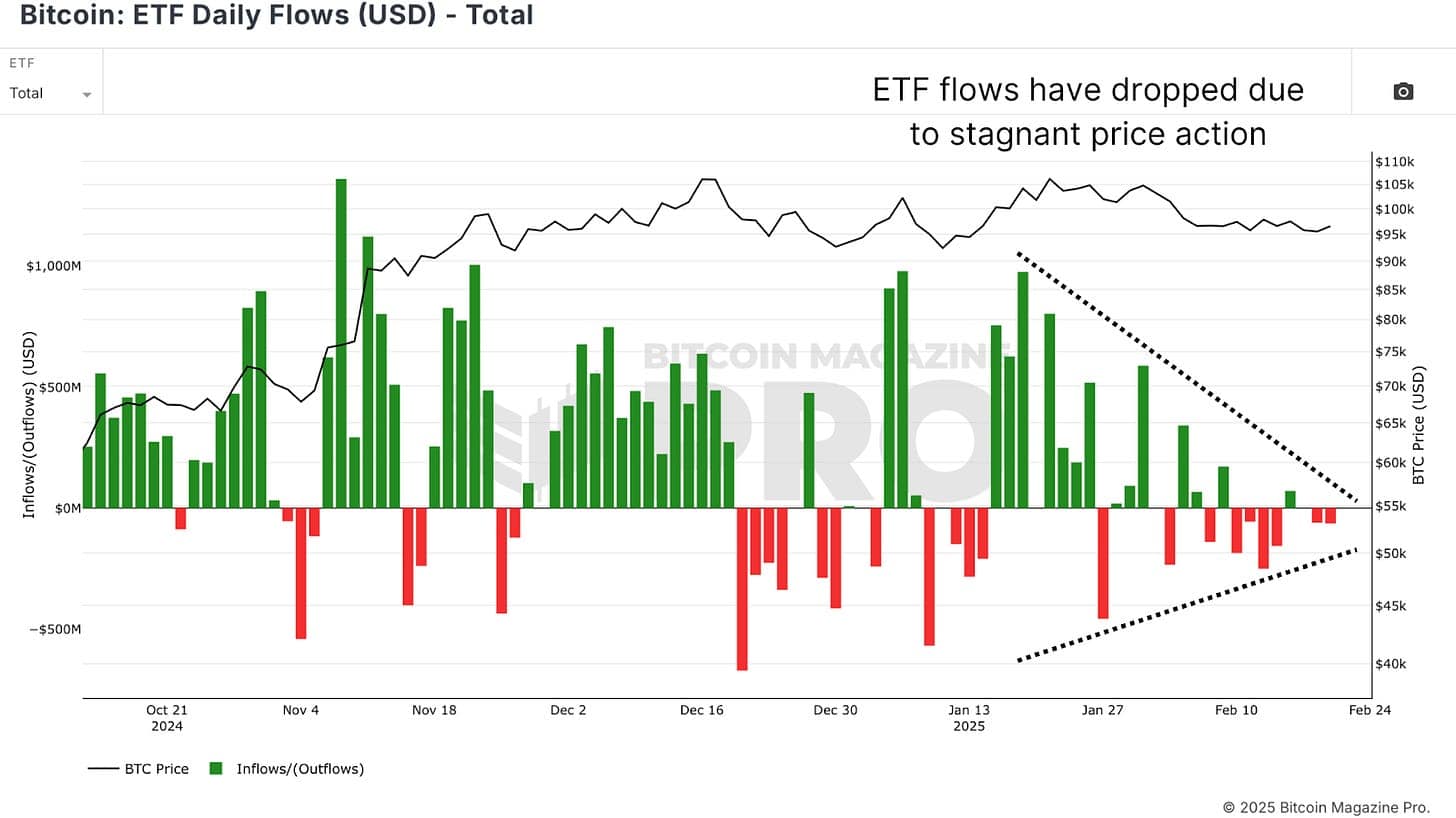

ETF Inflows

Furthermore, Bitcoin ETF inflows, a proxy for institutional demand, have slowed significantly during this period of low volatility. This suggests that major players are waiting for a confirmed breakout before adding to their positions. Once volatility returns, we could see renewed interest from institutions, driving Bitcoin even higher.

Conclusion

Bitcoin’s volatility is at one of its lowest levels in history, and such conditions have never lasted long. When volatility compresses this much, it sets the stage for an explosive move. The data suggests a breakout is imminent, but whether it leans bullish or bearish depends on macroeconomic conditions, investor sentiment, and institutional flows.

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

bybit

Ether Price Spikes Further on Reports of Bybit Starting to Buy ETH

Published

6 hours agoon

February 22, 2025By

admin

The price of the world’s second-largest cryptocurrency, ether (ETH), has risen by more than 2.3% in the last 24 hours, while the broader CoinDesk 20 Index has risen by just 0.76% during the same period. Bitcoin is down around 0.3%.

The rise comes amid reports that Bybit, the cryptocurrency exchange that was hacked for $1.5 billion worth of ether and staked ether by North Korean hacking group Lazarus, has moved 100 million USDT into new addresses and moved half of that into addresses to purchase 36,900 ETH over-the-counter.

The funds, worth around $101 million, were then moved to addresses tagged as belonging to the cryptocurrency exchange, crypto journalist Colin Wu reported, citing, Arkham Intelligence data.

Bybit’s CEO Ben Zhou reportedly said in an “ask me anything” session that the company’s assets are “far greater than $1.5 billion,” adding that “there is a cold wallet in safe with nearly 3 billion US dollars in USDT,” according to the same source.

Bybit’s hacker is now holdings an estimated 489,000 ETH valued at approximately $1.34 billion, around 0.4% of ether’s total supply, which makes it the 14th-largest holder of the cryptocurrency.

The addresses associated with the hacker are now closely monitored in the space and are blacklisted by major cryptocurrency exchanges.

“The stolen funds have already been marked, making it extremely difficult for the hacker to use them. Any attempt to transfer these funds to a major exchange would result in an immediate block,” StealthEX CEO Maria Carola told CoinDesk.

Since the hacker may not be able to use the funds in any way, some analysts are suggesting that the 0.4% of the ETH supply it holds is “essentially gone.”

Source link

Markets

Franklin Templeton Joins Growing Pile of Solana ETF Applicants

Published

12 hours agoon

February 22, 2025By

admin

Add Franklin Templeton to the list of asset managers seeking approval for exchange-traded funds tracking the ongoing price of Solana.

The issuer on Friday afternoon filed an S-1 registration statement with the Securities and Exchange Commission for a Franklin Solana ETF.

“The Fund seeks to reflect generally the performance of the price of Solana,” the firm said in its filing.

San Mateo, California-based Franklin follows multiple other issuing giants seeking an SEC nod for Solana-based funds. Grayscale, Bitwise, Canary, 21Shares, and VanEck have all submitted filings for ETFs based on the performance of the sixth-largest crypto by market capitalization.

Bloomberg Senior ETF Analyst Eric Balchunas has penciled in a 70% chance that Solana ETFs receive a green light this year, although he would not predict the timing. Issuers must still contend with regulatory review, ongoing enforcement actions, and public comment on the filings.

Solana’s price dip

Solana was recently trading at about $168, down slightly over the past 24 hours, according to crypto markets data provider CoinGecko. The token of the smart contracts blockchain has dropped more than 16% over the past week following its association with a scandal involving the Libra token, and wider slowing of meme coin projects that have favored the network.

Still, investor demand for crypto-focused assets remains strong, the continuing after-effects of spot Bitcoin funds’ dramatic success. The 11 Bitcoin funds have accumulated more than $40 billion in net inflows over the past year, ushering in the subsequent approval of ETFs tracking the price of Ethereum last July.

On Thursday, the issuer debuted the Templeton Crypto Index ETF (EZPZ) to track price movements for the two top cryptocurrencies by market value based on CF Benchmark’s Institutional Digital Asset Index.

The Franklin Bitcoin ETF’s (EZBC) $442 million in net inflows ranks just eighth among the Bitcoin funds, according to UK-based asset manager Farside Investors. The Franklin Ethereum ETF (EZET) has $34 million in AUM to rank sixth among eight funds in that group.

“This move reflects a growing interest among asset managers to offer investment products beyond Bitcoin, especially as regulatory conditions become more favorable,” Joe DiPasquale, CEO of crypto fund manager BitBull Capital, told Decrypt. “I am optimistic about the approval prospects for these ETFs, both because of the crypto-friendly regulatory environment and the recent success of Bitcoin ETFs.”

Franklin Templeton did not immediately respond to a request for comment.

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Bitcoin Price Set For Big Move As Volatility Drops

The United States Government Should Acquire 20% of the Bitcoin (BTC) Network, Says Michael Saylor – Here’s Why

SEC waves white flag on OpenSea probe, CEO says ‘this is a win’

How to Prepare for Monad: The High-Speed EVM Layer-1 Blockchain

US SEC Faces Backlash as Bybit Hack Highlights Lack of Oversight

Ether Price Spikes Further on Reports of Bybit Starting to Buy ETH

Bitcoin Faces Serious Price Compression – What Happened Last Time

FPPS Is Not A Free Lunch For Bitcoin Miners

One of the Most Reliable Indicators for Bitcoin Flashing Bullish Signal, Says Trader – Here Are His Targets

Expert reveals a shocking 10x contender

Franklin Templeton Joins Growing Pile of Solana ETF Applicants

Impact of Bybit’s $1.5B ETH Hack on ETH

Rollback Ethereum to Negate $1.4B Bybit Hack, Arthur Hayes Tells Vitalik Buterin

Altcoins Ready For Round 2? Expert Says Altseason ‘Has Begun’

Conference Bitcoin Afrique: A Bitcoin-Only Revolution in French-Speaking Africa

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

SAFE rallies 20% on Bithumb listing

Will Ethereum Price Fail $3,000 Breakout as Whale Selling Prolongs?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin1 month ago

Bitcoin1 month agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News1 month ago

24/7 Cryptocurrency News1 month agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin3 months ago

Bitcoin3 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Altcoins3 weeks ago

Altcoins3 weeks agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje