Bitcoin

Bitcoin Layer 2 Foundations Should Buy Bitcoin For Their Treasuries

Published

2 months agoon

By

admin

I’ve been thinking about this a lot lately: Bitcoin Layer 2 foundations need to start holding bitcoin in their treasuries. It makes too much sense for them not to.

And apparently I’m not the only one.

As someone who’s watched this space evolve, let me explain why Bitcoin Layer 2 foundations should listen to Molly and I.

For years, bitcoin was known as “digital rock”—a solid store of value but not much else. But now with the explosion of Bitcoin Layer 2s, bitcoin is becoming a “programmable rock.” These layers are adding functionalities like smart contracts and scaling solutions, making bitcoin more versatile than ever.

But here’s the thing: these projects raise millions of dollars from VCs and investors, and most of that money ends up sitting in fiat currencies like USD. That’s a huge mistake.

Why? Because fiat is a melting ice cube. Every year, it loses 5-10% of its value due to inflation. The longer you hold it, the less it’s worth. On the other hand, bitcoin has a Compound Annual Growth Rate (CAGR) of around 70%. If these foundations held their treasury in bitcoin instead of fiat, their runway wouldn’t just stay the same—it would grow.

Imagine having 70% more resources each year to fund developers, grants, and projects. That’s the kind of edge that could make or break a Layer 2 ecosystem.

Okay, okay, I get it — Bitcoin is volatile, and these foundations need some stability. Because of this, keeping 3 to 4 years of runway in fiat makes sense. It would help to cover short-term needs. But the rest? It should be in bitcoin. Over the long run, this strategy could double or even triple the runway of these foundations, giving them the time and resources they need to succeed.

There’s a precedent for this too. Remember EOS? They raised $4.2 billion in 2018 and reportedly bought 164,000 bitcoin with it. Today, that bitcoin is worth around $16 billion—even though EOS itself fell off the map. Now, imagine if Bitcoin Layer 2 foundations did the same but actually used their bitcoin to grow and sustain their ecosystem. The potential is massive.

At the end of the day, these foundations are building on Bitcoin. They believe in its future, so why not hold it in their treasuries? Bitcoin is the best store of value out there. If you’re running a Bitcoin Layer 2 foundation, stop holding depreciating fiat, and start holding bitcoin. It’s not just a smart move—it’s the move.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

This Week in Bitcoin: Volatility Rises as ETFs Rebound and SEC Gives OK to Mining

Will ETH ETF Net Outflow Exceed $20 Million?

Will new US SEC rules bring crypto companies onshore?

Net Taker Volume on Binance Hits Yearly High Amid Bitcoin Price Consolidation

Eric Trump Joins Metaplanet’s Board Of Advisers

Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

Bitcoin

Net Taker Volume on Binance Hits Yearly High Amid Bitcoin Price Consolidation

Published

5 hours agoon

March 22, 2025By

admin

Bitcoin continues to trade just below the $84,000 mark, reflecting a broader slowdown in upward momentum. Despite attempts to reclaim higher levels, the cryptocurrency has remained under the $90,000 mark for over two weeks.

This current range-bound activity comes nearly two months after Bitcoin touched its all-time high in January, indicating a period of uncertainty as traders assess macroeconomic conditions and upcoming Federal Reserve policy decisions.

In the midst of the stagnation from BTC’s price, on-chain data is offering contrasting signals on where the market might be headed next. Analysts have pointed to fluctuations in buying and selling pressure on major exchanges, particularly Binance, as key indicators of short-term market sentiment.

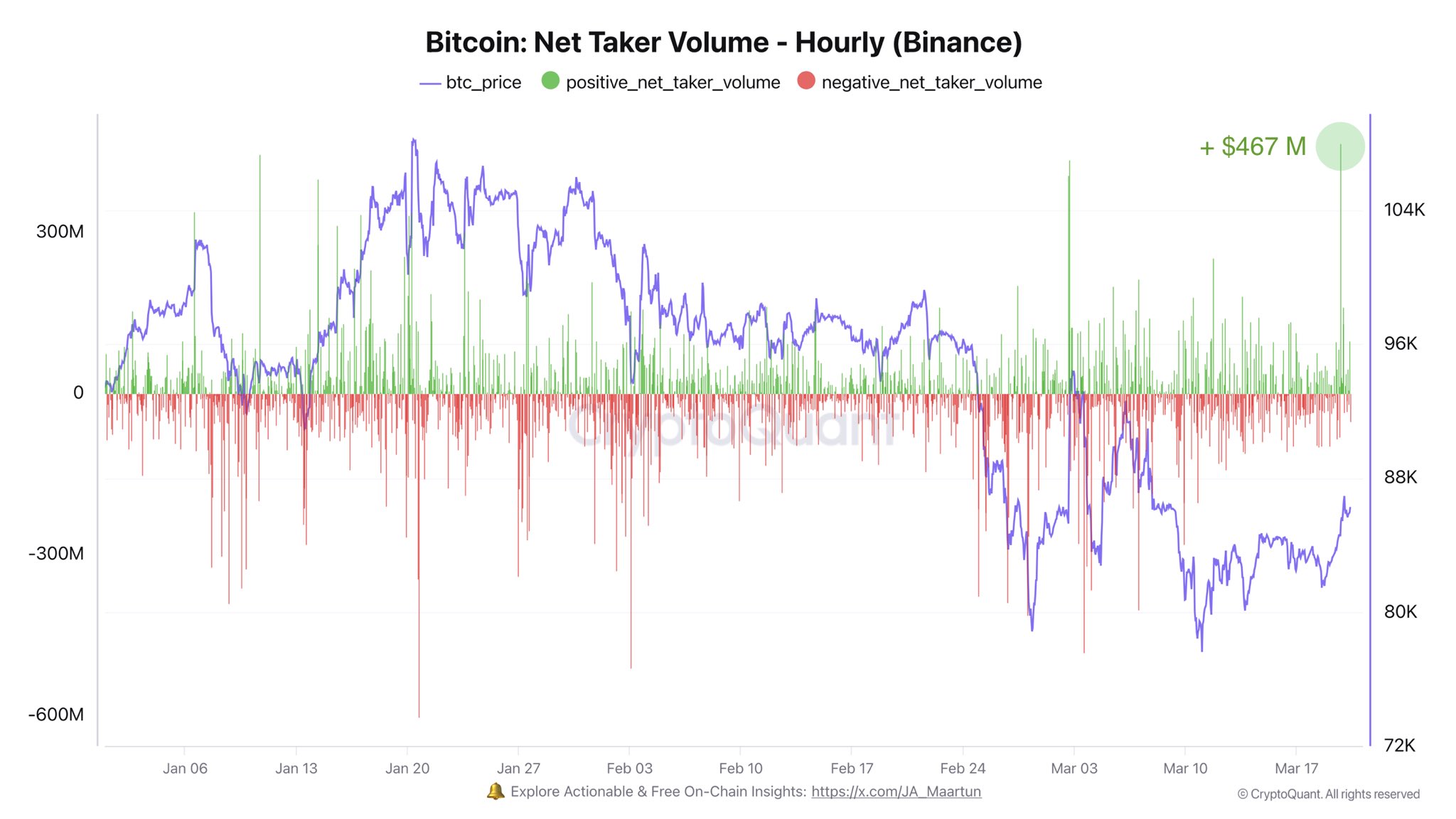

Surge in Binance Net Taker Volume

CryptoQuant analyst Darkfost recently highlighted a notable spike in net taker volume on Binance, the world’s largest centralized crypto exchange. According to Darkfost, net taker volume surged by $467 million in a single hour—marking the highest level recorded in 2025 so far.

This metric, which measures the difference between aggressive market buys and sells, is often used to gauge the immediate sentiment of active traders. A positive value indicates stronger buying activity and has historically signaled short-term bullishness.

Darkfost emphasized that this uptick in taker volume occurred just prior to the recent FOMC meeting, suggesting that some traders may be positioning for favorable policy outcomes.

While the data only reflects an hourly time frame and may not imply long-term directional change, the movement could signal a broader shift in sentiment among active participants, especially given Binance’s influential position in global crypto markets.

Buying pressure from Binance traders might be back.

— Binance is the CeX with the highest trading volume, making it particularly relevant for data analysis. —

The net taker volume is a powerful metric for gauging trader sentiment, as it measures the volume of market buys and… pic.twitter.com/enI1VMAixf

— Darkfost (@Darkfost_Coc) March 20, 2025

Bitcoin Whale Activity Returns as Exchange Ratios Spike

Meanwhile, another CryptoQuant analyst, EgyHash, provided a more cautious interpretation of recent activity. According to his analysis, the Bitcoin Exchange Whale Ratio—defined as the share of total exchange inflows coming from the top 10 largest addresses—has surged to its highest point in over a year.

This ratio is closely monitored because spikes often precede increased selling pressure, especially when large holders move funds to exchanges. While not a definitive indicator of immediate liquidation, the rise in whale-driven deposits suggests that some major players may be preparing for reallocation or profit-taking.

Combined with stagnant price action, this metric implies that Bitcoin’s current price level may be approaching a decision point, where the market direction will be determined by the balance between new demand and potential supply from large holders.

Featured image created with DALL-E, Chart from TradingView

Source link

Bitcoin

Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

Published

7 hours agoon

March 22, 2025By

admin

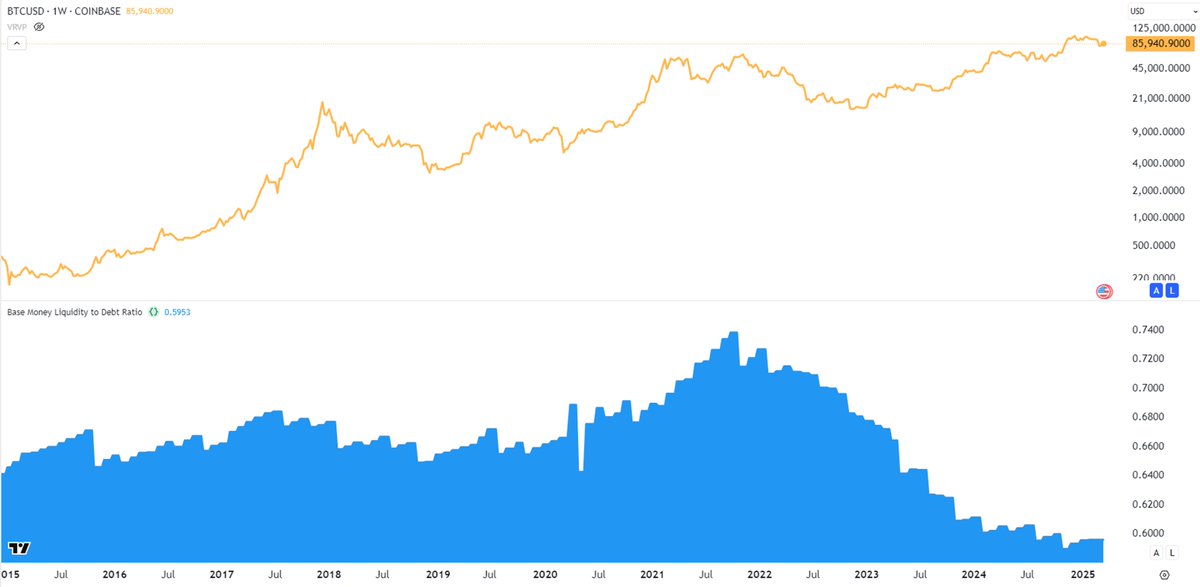

Real Vision’s chief crypto analyst says that Bitcoin (BTC) may soon print a series of rallies as macroeconomic conditions could ease later this year.

In a new thread, crypto strategist Jamie Coutts tells his 37,300 followers on the social media platform X that market liquidity is expected to increase in the second half of 2025, which may pump Bitcoin.

“The bottom line, though, is that if Bitcoin can rally through the worst liquidity withdrawal in decades, it’s primed for more significant moves as conditions ease through the rest of the year. Watch the blue line [Base Money Liquidity to Debt Ratio] begin to tick higher in 2H (second half) of the year.”

In addition to predicting money supply will increase faster than US debt, he also predicts that Bitcoin adoption will increase among US banks and sovereign wealth funds, helping to increase the value of the flagship crypto asset.

“More likely, base money outpaces government debt growth. What happens if base money expands faster than U.S. debt growth? In some reality, that might steady the ship and dampen the fear fueling Bitcoin adoption. But, in my view, that only hits the margins.

Meanwhile, deeper Bitcoin integration at both sovereign and banking levels is inevitable. Ultimately, US structural deficits are not changing. The US government will need to find new and inventive ways to ensure there is a bid for their debt.”

Bitcoin is trading for $84,090 at time of writing, flat on the day.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

24/7 Cryptocurrency News

Is Bitcoin Price Bottom In? Key Metrics Show rally Is Likely

Published

17 hours agoon

March 21, 2025By

admin

Bitcoin (BTC) price volatility is slowing down as the coin’s capitulation continues. At the time of writing, Bitcoin’s price was changing hands for $84,278.83 as it pared off the losses accrued in earlier trading. At this pace, the question now hinges on whether BTC can form sustainable support at the $84,000 price mark or whether further drawdown lies ahead.

Core Bitcoin Price Metric to Watch

According to Glassnode data, BTC Short-Term Holders (STH) are under increasing pressure. This group’s unrealized losses have surged, pushing many STH coins into losses. As revealed, their holdings are now nearing the two-standard deviation threshold.

Despite this outlook, the data platform hinted that losses remain within historical bull market bounds. Specifically, it noted that these losses are less severe than the May 2021 sell-off from the all-time high. Glassnode said the rolling 30-day losses for STH have topped $7 billion. It confirmed that “this remains well below prior capitulation events, such as the $19.8B and $20.7B losses in 2021-22.”

BTC price jumped to an ATH above $109,000 in January but has since dropped by 22.79%. While experts predicted a drop of over 35%, the limited loss from holders can form a good rebound basis.

BTC Price Bottom In, Here Are Triggers for Rally

Over the past week, Bitcoin has rallied within very tight price ranges, from a low of $81,300 to a high of $87,320. Some market observers believe the coin has attained its floor price and might be set for a rebound.

While firms like Strategy have kept Bitcoin purchase plans alive with Strife’s perpetual stock offering, the Global Money Supply M2 also lays a positive basis for growth. With the current outlook, the projection that the $83,00 level is the BTC price floor is resounding among analysts.

The shift in regulation and the backing of Bitcoin by President Donald Trump creates a tailwind for the coin’s proponents. At the Digital Asset Summit earlier this week, President Trump reiterated the plan to make the US the crypto capital of the world.

Several government agencies have shifted their policies in this regard, which might attract investors in the long term.

How High Can Bitcoin Valuation Rise?

Despite the slowdown in growth in recent weeks, many market leaders are still confident in the coin’s prospects. As reported earlier by CoinGape, Bitwise CIO Matt Hougan maintained the price target of $1 million by 2029. He cited a longer-term reaction to macroeconomic uncertainties as the basis for his prediction.

While this Bitcoin price prediction appears lofty, others believe Bitcoin may cross $200,000 once the bull rally returns. With spot Bitcoin ETF hype and other growing institutional adoption, BTC price has an arguably bright future.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

This Week in Bitcoin: Volatility Rises as ETFs Rebound and SEC Gives OK to Mining

Will ETH ETF Net Outflow Exceed $20 Million?

The SEC Resets Its Crypto Relationship

Will new US SEC rules bring crypto companies onshore?

Net Taker Volume on Binance Hits Yearly High Amid Bitcoin Price Consolidation

Eric Trump Joins Metaplanet’s Board Of Advisers

Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

Themes ETFs exec on new 2X Coinbase fund: ‘We believe as the Bitcoin tide rises, it will lift all crypto boats’

Ethena’s USDe Stablecoin Sales Blocked by German Regulator Over ‘Serious Deficiencies’

Is Ethena Price At Risk? Market Maker Offloads $10M ENA Raising Concerns

Coinbase Could Be Near Multi-Billion Dollar Deal for Deribit: Bloomberg

Tether eyes Big Four firm for its first full financial audit: Report

Why Current ‘Boredom Phase’ Could Trigger Epic Rally

US Treasury Removes Tornado Cash From OFAC Sanctions List

21,899 Bank Customers Affected As US Lender Suffers Cybersecurity Breach, Hacker Taps Social Security Numbers and Other Sensitive Information

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: