Bitcoin

Bitcoin Loses $93K as Goldman Trims Fed Rate Cut Expectations, BofA Sees Potential Hike After Blowout Jobs Report

Published

2 months agoon

By

admin

Bitcoin (BTC) started the new week on a negative note as major investment banks reassessed their expectations for Federal Reserve (Fed) rate cuts following Friday’s strong jobs report.

The leading cryptocurrency by market value dipped below $93,000 during the European hours, representing a 1.6% drop on the day, according to data source CoinDesk. Prices looked set to test the support zone near $92,000, which has consistently acted as a floor since late November.

The CoinDesk 20 Index, a broader market gauge, was down over 3%, with major coins like XRP, ADA, and DOGE posting bigger losses.

In traditional markets, futures tied to the S&P 500 traded 0.3% lower, pointing to an extension of Friday’s 1.5% drop that pushed the index to the lowest since early November. The dollar index (DXY) neared 110 for the first time since late 2022, with elevated Treasury yields supporting further gains.

Data released Friday showed nonfarm payrolls increased by 256,000 in December, the most since March, surpassing expectations for 160,000 job additions and the previous figure of 212,000 by a big margin. The jobless rate declined to 4.1% from 4.2%, and the average hourly earnings came in slightly lower than expected at 0.3% month-on-month and 3.9% year-on-year.

That prompted Goldman Sachs to push out the next interest rate cut to June from March.

“Our economists now expect the Fed to cut just twice in 2025 (Jun/Dec vs Mar/Jun/Dec previously), with another rate cut in June 2026, Goldman’s Economic Research note to clients on Jan. 10 said.

“If December’s FOMC decision marked a significant shift back towards inflation in the Fed’s relative weighting of risks, the December jobs report may have completed the pendulum swing. The soft average hourly earnings figure kept the print from sending a more alarming re-heating signal, but the case for cutting to mitigate risks to the labor market has faded into the background,” the note explained.

The Fed’s rate-cutting cycle began in September when the official reduced the benchmark borrowing cost by 50 basis points. The bank delivered quarter-point rate cuts in the following months before pausing in December to signal fewer rate cuts in 2025. BTC has surged over 50% since the first rate cut on Sept. 18, hitting record highs above $108,000 at one point.

While Goldman and JPMorgan still expect rate cuts, Bank of America (BofA) fears an extended pause, with risks skewed in favor of a rate hike or renewed tightening. Note that the U.S. 10-year Treasury note yield, which is sensitive to interest rate, growth and inflation expectations, has already surged by 100 basis points since the Sept. 18 rate cut.

“We think the cutting cycle is over … Our base case has the Fed on an extended hold. But we think the risks for the next move are skewed toward a hike,” BofA analysts said in a note, according to Reuters.

ING said, “The market is right to see the risk of an extended pause from the Fed” in the light of the recent economic reports.

“That view will only increase if core inflation comes in at 0.3% month-on-month for a fifth consecutive month next week,” ING said in a note to clients over the weekend.

The December consumer price index report is scheduled for release on Jan. 15. Some observers are worried that base effects could accelerate the headline CPI and the core CPI, adding to the hawkish Fed narrative.

Source link

You may like

CryptoQuant CEO Sounds The Alarm

South Korea Dismisses Establishing Strategic Bitcoin Reserve

TokenPicks Launches Reward System to Incentivize Crypto Education

Ethereum leadership now eyes Solana-style growth, Dragonfly’s Qureshi says

SEC’s Uyeda Signals Possible Revisions to Crypto Custody Rule

Mubarak Meme Coin Trader Turns $232 Into $1.1 Million, Here’s How

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

CryptoQuant CEO Ki Young Ju announced today that Bitcoin’s bull cycle “is over” and warned investors to brace for “6–12 months of bearish or sideways price action.” This development comes after the on-chain analytics veteran had previously urged caution but maintained a measured outlook on the market as recently as two weeks ago.

Is The Bitcoin Bull Run Over?

In a post shared today via X, Ki stated:“Bitcoin bull cycle is over, expecting 6–12 months of bearish or sideways price action.”

Related Reading

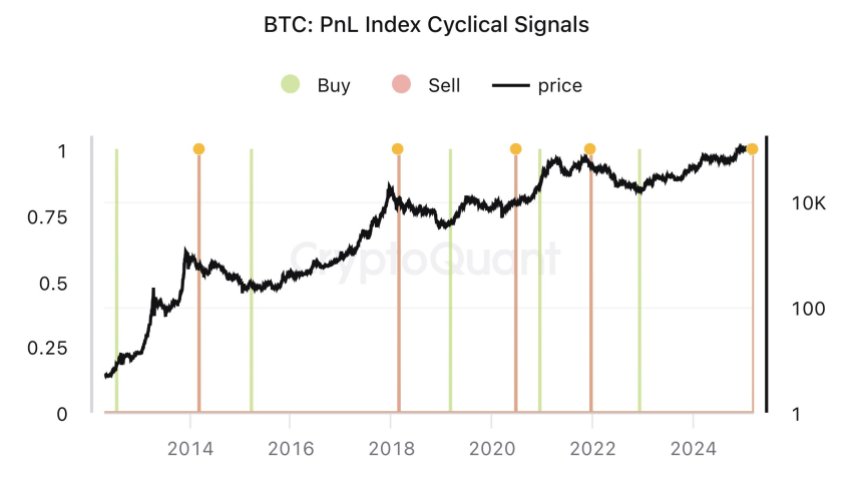

Along with the comment, the CEO highlighted the Bitcoin PnL Index Cyclical Signals—an index that aggregates multiple on-chain metrics, such as MVRV, SOPR, and NUPL, to pinpoint market tops, bottoms, and cyclical turning points in Bitcoin’s price. According to Ki, this indicator has historically offered reliable buy and sell signals.

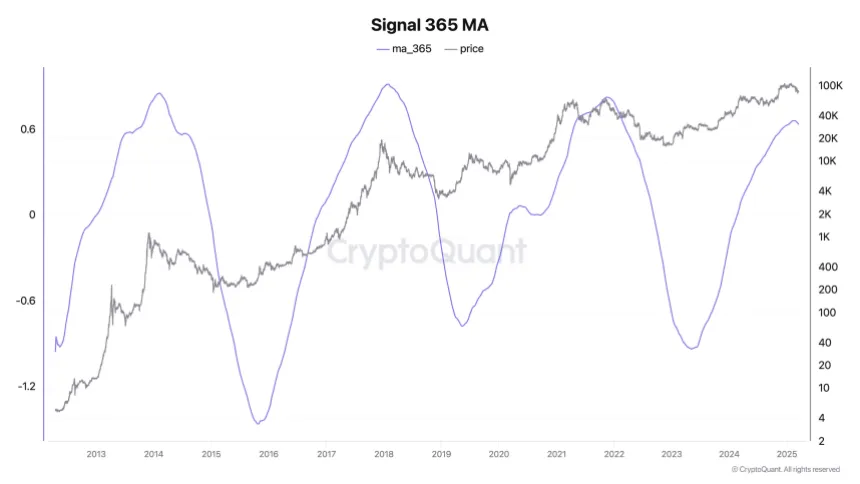

He further explained how an automated alert, previously sent to his subscribers, combined these metrics into a 365-day moving average. Once the trend in this 1-year moving average changes, it often signals a significant market inflection point. As proof, Ki also shared a chart: “This alert applies PCA to on-chain indicators like MVRV, SOPR, and NUPL to compute a 365-day moving average. This signal identifies inflection points where the trend of the 1-year moving average changes.”

Ki pointed to drying liquidity and fresh selling pressure by “new whales” who, he said, are unloading Bitcoin at lower prices. Notably, he revealed that CryptoQuant users who subscribed to his alerts received this signal before today’s public announcement. “With fresh liquidity drying up, new whales are selling Bitcoin at lower prices. Cryptoquant users who subscribed to my alerts received this signal a few days ago. I assume they’ve already adjusted their positions, so I’m posting this now.”

Related Reading

This latest declaration contrasts remarks from just four days ago, on March 14, when Ki struck a more cautious tone, stating: “Bitcoin demand seems stuck, but it’s too early to call it a bear market.”

At that time, he shared a chart of the Bitcoin Apparent Demand (30-day sum) indicator, which had turned slightly negative—an early signal that demand might be tapering off. Although Ki pointed out that demand could still rebound (as it has in past sideways phases), he acknowledged the possibility of Bitcoin teetering on the edge of a bear market.

The pivot in sentiment is especially notable given Ki’s stance from two weeks ago. In that earlier post, he opined that the “bull cycle is still intact,” crediting strong fundamentals and growing mining capacity: “There’s no significant on-chain activity, and key indicators are neutral, suggesting the bull cycle is still intact. Fundamentals remain strong, with more mining rigs coming online.”

However, he also cautioned that the market could turn if sentiment did not improve, particularly in the United States. With today’s announcement, the warning has evidently crystallized. Reflecting on the potential downside scenario, Ki said at the time: “If the cycle ends here, it’s an outcome no one wanted—not old whales, mining companies, TradFi, or even Trump. (FYI, the market doesn’t care about retail.)”

At press time, BTC traded at $83,059.

Featured image created with DALL.E, chart from TradingView.com

Source link

Bitcoin

Trader Predicts Crypto Rallies Amid Expectations of Fed Monetary Policy Shift – But There’s a Catch

Published

12 hours agoon

March 18, 2025By

admin

A widely followed crypto analyst is predicting higher prices for crypto assets as he expects the Federal Reserve to end its anti-inflation monetary policies.

In a new thread, the pseudonymous crypto analyst Pentoshi tells his 861,300 followers on the social media platform X that we are close to seeing the end of quantitative tightening (QT), which are policies that reduce the Fed’s balance sheet and lowers the supply of money in circulation.

The trader cites data from the decentralized prediction platform Polymarket, which shows that 100% of users believe that the Fed will end QT by May of this year.

The cessation of QT is typically seen as bullish for risk assets like Bitcoin (BTC) and altcoins as the move signals the end of tight monetary conditions.

However, Pentoshi warns investors to be “cautiously optimistic” as both the S&P 500 and top crypto assets have seen growth over the last few years that appears unsustainable.

“I think we are getting close to [the] end of QT with Polymarket now pricing in odds as a sure thing whereas before they were much lower odds. As previously stated, it does seem Trump would end up forcing it. I don’t think QT automatically means it’s easy mode.

I think that mode is clearly gone overall in the way people think about it (2017/2021). While prices are much lower, I think it’s best to be cautiously optimistic. Many things are down significantly and there hopefully will be some decent mean reversion. Markets in general have rallied hard. And assets were likely a bit overvalued before.

SPX going 25% back to back years was going to have low growth or negative this year as it wasn’t a sustainable pace. BTC went from $16,000 to $108,000, SOL [from] $8 to $300. Cautiously optimistic. [Be] patient for any time capitulation, as often, following big trends, we eventually get longer sideways periods and less volatility as the market finds balance.”

While Pentoshi is flipping tactically bullish on stocks and crypto, he warns investors that any rally will likely be short-lived.

“I think any up currently will be a lower high. People underestimate the time aspect.”

At time of writing, Bitcoin is trading for $83,248.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

24/7 Cryptocurrency News

Bitcoin Price Eyes $200,000 Breakout If This History Aligns

Published

14 hours agoon

March 17, 2025By

admin

The price of Bitcoin (BTC) is undergoing bullish consolidation at the moment after the intense selloff in the broader market cooled off. The current outlook shows relief for a coin that dropped as low as $76,624.25 in the past week. Per the historical trend of BTC prices, this consolidation might be a buildup to a massive rally for the top coin.

Bitcoin Price and Potential $200,000 Play

When writing, the BTC price changed hands for $83,927.24, up by 1.38% in 24 hours. The coin has jumped from a low of $82,017.90 to a high of $84,725.32, a show of brewing breakout.

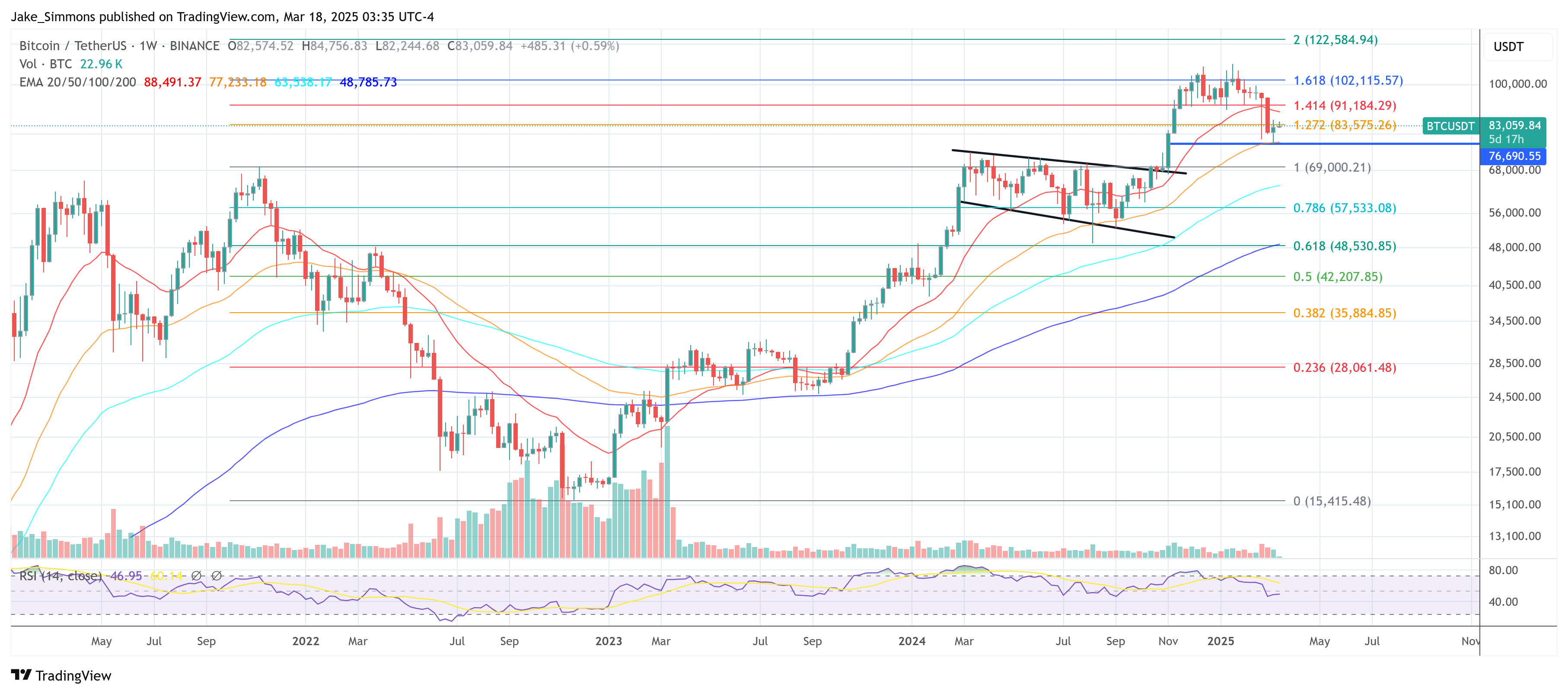

Market analyst Rekt Capital analyzed whether this current price is a short-term relief. He spotlighted a trend from June 2021, when the price of Bitcoin was consolidating between the 21-week EMA and the 50-week EMA. The consolidation came just after a crash.

About a week ago, the BTC price crashed, triggering millions in liquidation across the market. Following this price slump, the coin is consolidating between the same EMA showcased by Rekt Capital.

In June 2021, Bitcoin prices increased from $33,000 to $42,000. This gives an average price of $37,500. From here, the coin jumped by over 123.95% to its current price of $83,927.24. If history repeats, Bitcoin Bitcoin may soar to almost $187,280 or approximately $200,000.

BTC Price and Accumulation Trend

According to market data from Glassnode, Bitcoin currently has a high of 0.1. According to the market analytics platform, this figure indicates sustained buying pressure despite the market selloff.

Rather than steer clear of the market, Glassnode hinted that the coin’s distribution remains dominant overall. Other onchain indications also point to reboot from BTC proponents. IntoTheBlock data points to a 5.34% surge in large transactions to $34.7 billion.

This whale transaction is important as it shows a trend shift among market players that can impact prices. It is also complemented by the 24% surge in BTC trading volume of crypto exchanges, a sign of sustained positive sentiment.

What Next for the Crypto Market?

The growth or fall in the price of Bitcoin has a way of impacting the broader market. In an earlier cryptocurrency price prediction, the impact of Trump and Putin’s peace deal over Ukraine was considered. Experts are convinced the broader market may ignite a bullish rally if the conversations turn positive.

Although spot Bitcoin ETF market has been showcasing outflows over the past week, the coin is positioned to be the biggest beneficiary in this shift. While the Rekt Capital historic forecast teases $200,000, experts like Cathie Wood predict deflationary boom for the market, riding on massive BTC adoption rate by institutions and governments.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

CryptoQuant CEO Sounds The Alarm

South Korea Dismisses Establishing Strategic Bitcoin Reserve

TokenPicks Launches Reward System to Incentivize Crypto Education

Ethereum leadership now eyes Solana-style growth, Dragonfly’s Qureshi says

SEC’s Uyeda Signals Possible Revisions to Crypto Custody Rule

Mubarak Meme Coin Trader Turns $232 Into $1.1 Million, Here’s How

Solana Protected Gender Identity Before Panning It in Anti-Queer Ad

Musk says he found ‘magic money computers’ printing money ‘out of thin air’

XRP To Triple Digits? Analyst Confident In $100 Price Goal

What Are They And What Do They Do?

Trader Predicts Crypto Rallies Amid Expectations of Fed Monetary Policy Shift – But There’s a Catch

Solana’s 5th birthday highlights explosive growth and trading activity: Mercuryo

Trump, Associates Net $390 Million Payday From World Liberty Token Sale

Bitcoin Price Eyes $200,000 Breakout If This History Aligns

Gold-Backed Tokens Outperform as ‘Bond King’ Gundlach Sees Precious Metal Hit $4,000

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: