Bitcoin mining

Bitcoin Miners Near $40B Market Cap as Mining Difficulty Set for Fifth Straight Increase

Published

5 months agoon

By

admin

Publicly traded bitcoin (BTC) miners are approaching the milestone of an aggregated $40 billion market cap, according to Farside data, doubling in seven months as bitcoin’s price rocketed through multiple record highs to approach six figures for the first time.

Miners’ biggest challenge is revenue. The reward they receive for confirming blocks on the Bitcoin blockchain was cut 50% in April, when their combined market cap was about $20 billion. In this current epoch, only 450 bitcoin are mined a day and fees paid to miners remain at cycle lows, just 10 BTC ($946,000) on Nov. 27 according to Glassnode data.

That means they either have to diversify revenue streams or produce bitcoin at a cheaper cost than the spot price, currently about $96,000.

That’s a challenge that is about to become more difficult. The mining difficulty, which measures how hard it is to produce the blockchain’s blocks, is expected to increase by a further 3% at some point in the next few days.

Mining difficulty, already firmly above 1 trillion, automatically adjusts every 2016 blocks or roughly every two weeks. The higher the difficulty, the harder — and costlier — for miners to produce a new block.

The heart of the issue is the soaring hashrate, which has held above 700 exahash per second (EH/s) for more than a month. The hashrate is the computational power required to mine and process transactions on a proof-of-work blockchain like Bitcoin.

On a seven-day moving average, the hashrate is currently at 726 EH/s, continuing to put in higher highs and higher lows since mid-year, according to Glassnode data.

In 2024, many miners have diversified their revenue streams by pivoting into the AI and high-performance computing (HPC) industries, where there is soaring demand for locations that can host the computing power they need.

One example is IREN (IREN), whose shares surged 30% on Wednesday on renewed AI interest.

Other, such as MARA Holdings (MARA), are leveraging their bitcoin stashes and bumping up their bitcoin balance sheet holdings. As of Nov. 27, MARA added a further 703 BTC after selling a 0% $1 billion convertible note to raise the funds. The company now owns a total 34,794 BTC.

The CoinShares Valkyrie Bitcoin Miners ETF is a proxy for publicly traded miners. Its share price is up 60% year-to-date, which is underperforming bitcoin’s 113%.

Source link

You may like

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

With all the current bearish sentiment and macroeconomic uncertainty swirling around both Bitcoin and the broader global economy, it might come as a surprise to see miners as bullish as ever. In this article, we’ll unpack the data that suggests Bitcoin miners are not just staying the course, they’re accelerating, doubling down at a time when many are pulling back. What exactly do they know that the broader market might be missing?

For a more in-depth look into this topic, check out a recent YouTube video here:

Why Bitcoin Miners Are Doubling Down Right Now

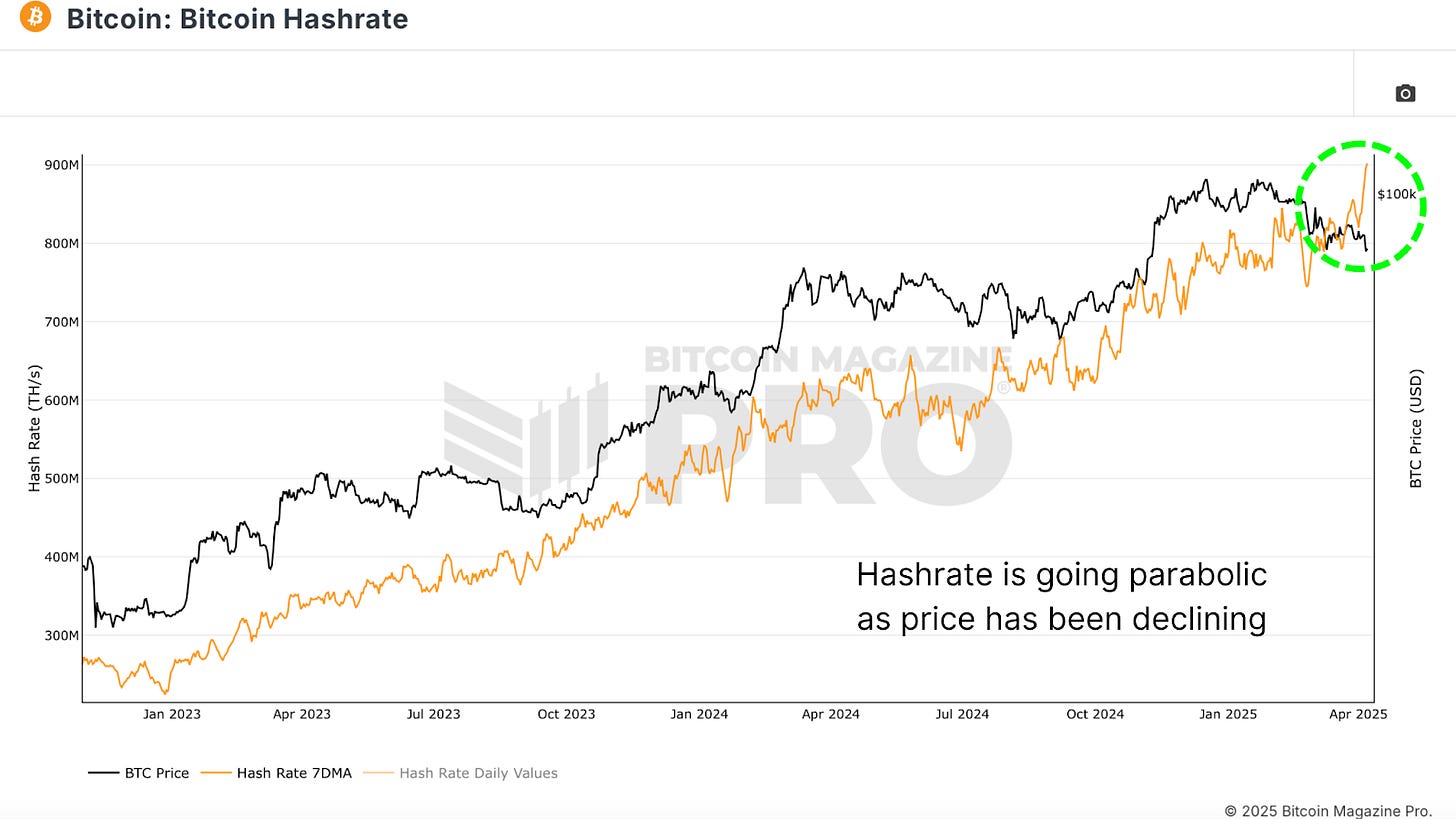

Bitcoin Hash Rate Going Parabolic

Despite Bitcoin’s recent price underperformance, the Bitcoin Hashrate has been going absolutely vertical, breaking all-time highs with seemingly no regard for macro headwinds or sluggish price action. Typically, hash rate is tightly correlated with BTC price; when price drops sharply or remains stagnant, hash rate tends to plateau or decline due to economic pressure on miners.

Yet now, in the face of heightened global tariffs, economic slowdown, and a consolidating BTC price, hash rate is accelerating. Historically, this level of divergence between hash rate and price has been rare and often significant.

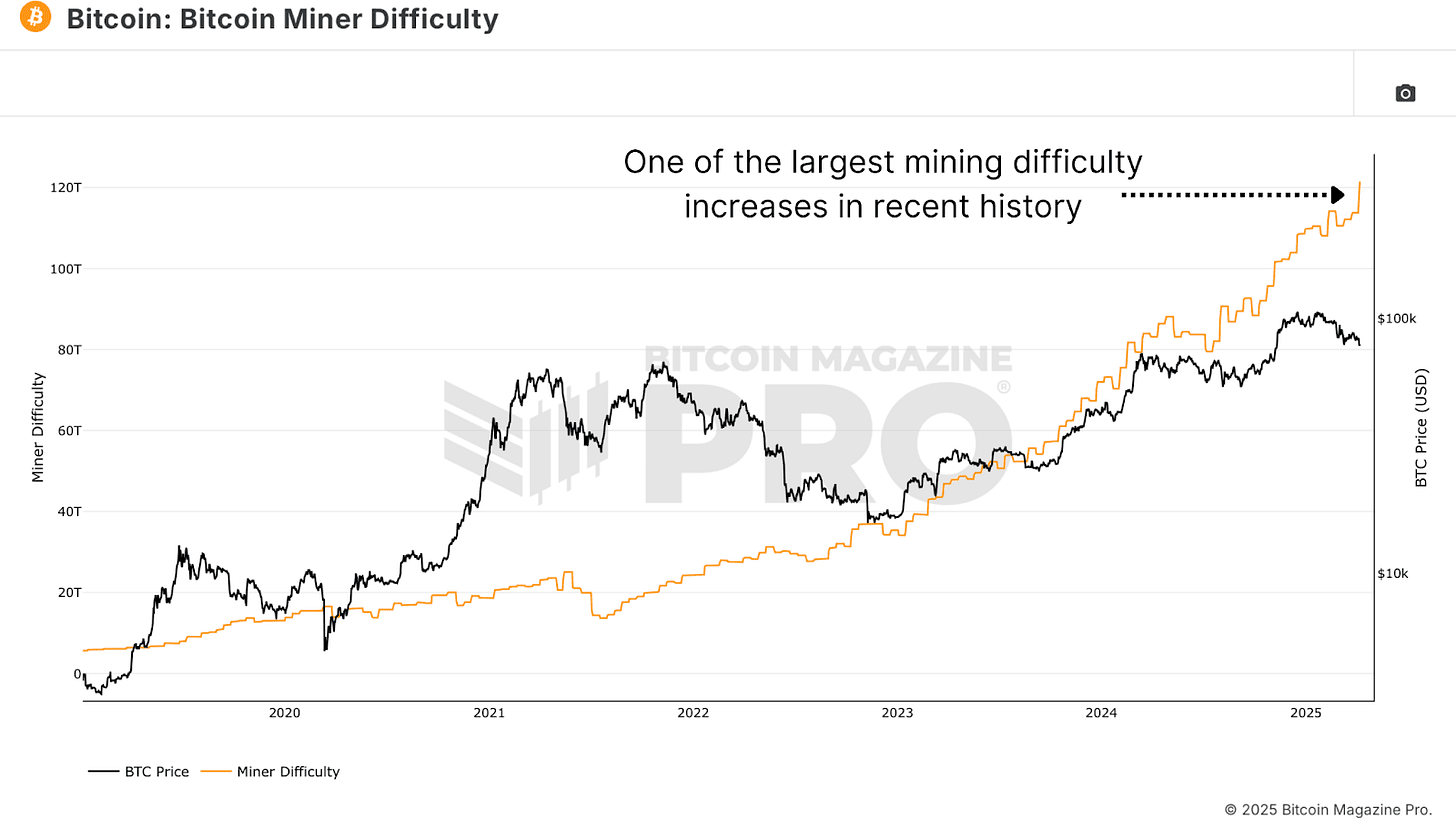

Bitcoin Miner Difficulty, a close cousin to hash rate, just saw one of its largest single adjustments upward in history. This metric, which auto-adjusts to keep Bitcoin’s block timing consistent, only increases when more computational power floods the network. A difficulty spike of this magnitude, especially when paired with poor price performance, is nearly unprecedented.

Again, this suggests that miners are investing heavily in infrastructure and resources, even when BTC price does not appear to support the decision in the short term.

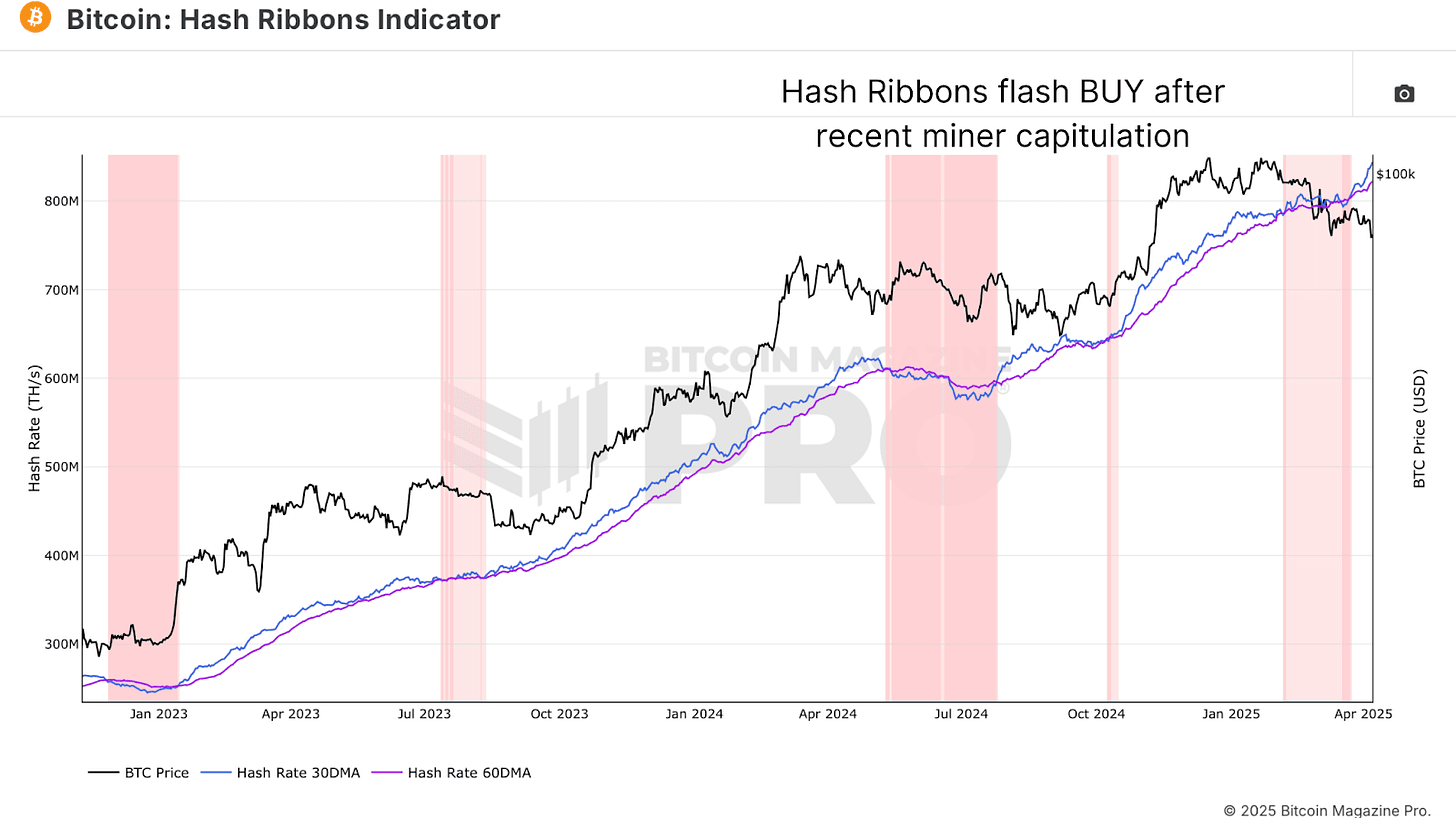

Adding further intrigue, the Hash Ribbons Indicator, a blend of short and long-term hash rate moving averages, recently flashed a classic Bitcoin buy signal.

When the 30-day moving average (blue line) crosses back above the 60-day (purple line), it signals the end of miner capitulation and the beginning of renewed miner strength. Visually, the background of the chart shifts from red to white when this crossover occurs. This has often marked powerful inflection points for BTC price.

What’s striking this time around is how aggressively the 30-day moving average is surging away from the 60-day. This is not just a modest recovery, it’s a statement from miners that they are betting heavily on the future.

The Tariff Factor

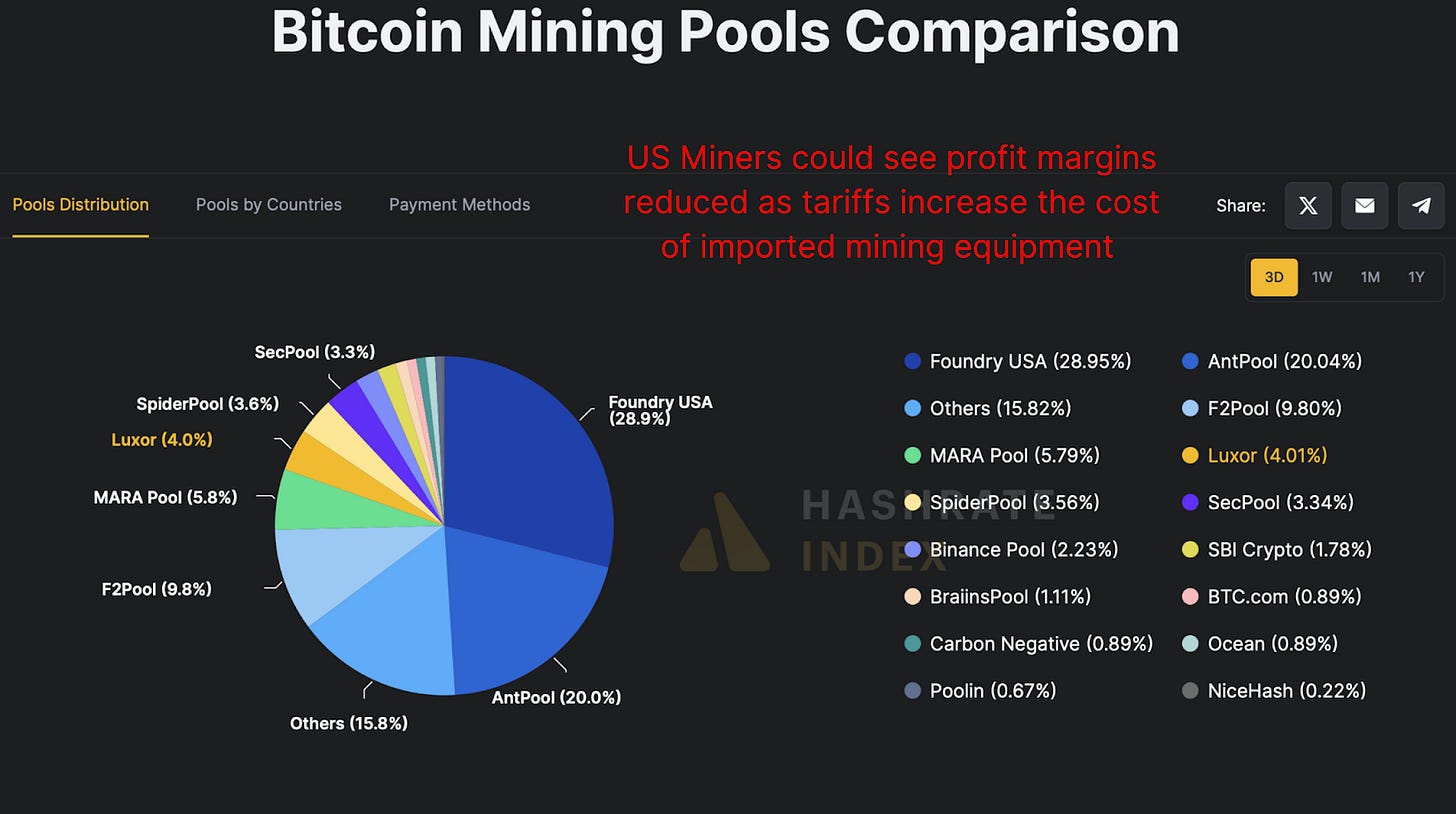

So, what’s fueling this miner frenzy? One plausible explanation is that miners, especially U.S.-based ones, are trying to front-run the impact of looming tariffs. Bitmain, the dominant producer of mining equipment, is now in the crosshairs of trade policies that could see equipment prices surge by 30–50%, potentially to even over 100%!

Given that over 40% of Bitcoin’s hash rate is controlled by U.S.-based pools like Foundry USA, Mara Pool, and Luxor, any cost increase would drastically reduce profit margins. Miners may be aggressively scaling now while hardware is still (relatively) cheap and available.

Bitcoin Miners Keep Mining

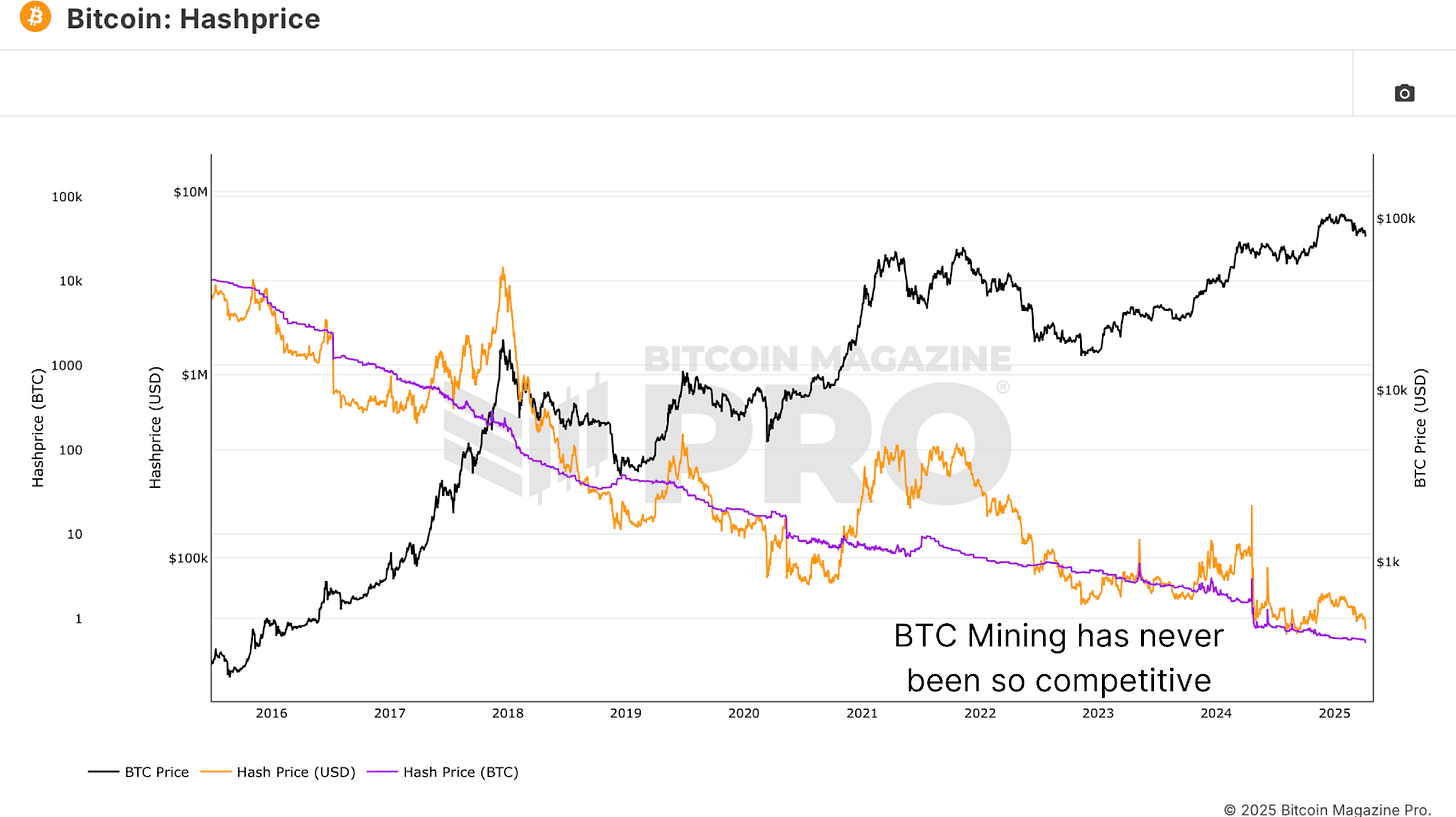

Hashprice, the BTC-denominated revenue per terahash of computational power, is at historical lows. In other words, it’s never been less profitable in BTC terms to operate a Bitcoin miner on a per-terahash basis. Typically, we see hash price increase toward the tail-end of bear markets, as competition fades and weaker players exit the space.

But that’s not happening here. Despite terrible profitability, miners are not only staying online, they’re deploying more hash power. This could imply one of two things; either miners are racing against deteriorating margins to front-load BTC accumulation, or, more optimistically, they have strong conviction in Bitcoin’s future profitability and are buying the dip aggressively.

Bitcoin Miners Conclusion

So, what’s really happening? Either miners are desperately front-running hardware costs, or, more likely, they’re signaling one of the strongest collective votes of confidence in the future of Bitcoin we’ve seen in recent memory. We’ll continue tracking these metrics in future updates to see whether this miner conviction is proven right.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Bitcoin mining

Luxor’s Aaron Foster on Bitcoin Mining’s Growing Sophistication

Published

4 days agoon

April 12, 2025By

admin

Luxor Technology wants to make bitcoin mining easier. That’s why the firm has rolled out a panoply of products (mining pools, hashrate derivatives, data analytics, ASIC brokerage) to help bitcoin miners, large and small, develop their operations.

Aaron Forster, the company’s director of business development, joined in October 2021, and has seen the team grow from roughly 15 to 85 people in the span of three and a half years.

Forster worked a decade in the Canadian energy sector before coming to bitcoin mining, which is one of the reasons why he’ll be speaking about the future of mining in Canada and the U.S. at the BTC & Mining Summit at Consensus this year.

Follow full coverage of Consensus 2025 in Toronto May 14-16.

In the leadup to the event, Forster shared with CoinDesk his thoughts on bitcoin miners turning to artificial intelligence, the growing sophistication of the mining industry, and how Luxor’s products enable miners to hedge various forms of risk.

This interview has been condensed and edited for clarity.

CoinDesk: Mining pools allow miners to combine their computational resources to have higher chances of receiving bitcoin block rewards. Can you explain to us how Luxor’s mining pools work?

Aaron Forster: Mining pools are basically aggregators that reduce the variance of solo mining. When you look at solo mining, it’s very lottery-esque, meaning that you could be plugging your machines in and you might hit block rewards tomorrow — or you might hit it 100 years from now. But you’re still paying for energy during that time. At a small scale, it’s not a big deal, as you scale that up and create a business around it.

The most common kind of mining pool is PPLNS, which means Pay-Per-Last-N-Shares. Basically, that means the miner does not get paid unless that mining pool hits the block. That’s also due to luck variance, so it’s no different from that solo miner’s situation. However, that creates revenue volatility for those large industrial miners.

So we’re seeing the emergence of what we call Full-Pay-Per-Share, or FPPS, and that’s Luxor is operating for our bitcoin pool. With FPPS, regardless of whether we find a block or not, we’re still paying our miners their revenue based on the number of shares they’ve submitted to the pool. That gives revenue certainty to miners, assuming hashprice stays the same. We’ve effectively become an insurance provider.

The problem is that you need a very deep and strong balance sheet to support that model, because while we’ve reduced the variance for miners, that risk is now put on us. So we need to plan for that. But it can be calculated over a long enough period of time. We have different partners in that regard, so that we don’t bear the full risk from our balance sheet.

Tell me about your ASIC brokerage business.

We’ve become one of the leading hardware suppliers on the secondary market. Primarily within North America, but we’ve shipped to 35+ countries. We deal with everybody from public companies to private companies, institutions to retail.

We’re primarily a broker, meaning we match buyer and seller, mostly on the secondary market. Sometimes we do interact with ASIC manufacturers, and in certain cases we do take principal positions, meaning we use money from our balance sheet to purchase ASICs and then resell them on the secondary market. But the majority of our volume comes from matching buyers and sellers.

Luxor also launched the first hashrate futures contracts.

We’re trying to push the Bitcoin mining space forward. We’re a hashrate marketplace, depending on how you look at our mining pools, and we wanted to take a big leap and take hashrate to the TradFi world.

We wanted to create a tool that allows investors to take a position on hashprice without effectively owning mining equipment. Hashprice is, you know, the hourly or daily revenue that miners get, and that fluctuates a lot. For some people it’s about hedging, for others it’s speculation. We’re creating a tool for miners to sell their hashrate forward and use it as a basic collateral or a way to finance growth.

We said, ‘Let’s allow miners to basically sell forward hashrate, receive bitcoin upfront, and then they can take that and do whatever they need to do with it, whether it’s purchase ASICs or expand their mining operations.’ It’s basically the collateralization of hashrate. So they’re obligated to send us X amount of hashrate per month for the length of the contract. Before that, they’ll receive a certain amount of bitcoin upfront.

There’s a market imbalance between buyers and sellers. We have a lot of buyers, meaning people and institutions wanting to earn yield on their bitcoin. What you’re lending your bitcoin at is effectively your interest rate. However, you could also look at it like you’re purchasing that hashrate at a discount. That’s important for institutions or folks that don’t want physical exposure to bitcoin mining, but want exposure to hash price or hashrate. They can do that synthetically through purchasing bitcoin and putting it into our market, effectively lending that out, earning a yield, and purchasing that hashrate at a discount.

What do you find most exciting about bitcoin mining at the moment?

The acceptance and natural progression of our industry into other markets. We can’t ignore the AI HPC transition. Instead of building these mega mines that are just massive buildings with power-dense bitcoin mining operations, you’re starting to see large miners turning into power infrastructure providers for artificial intelligence.

Using bitcoin mining as a stepping stone to a larger, more capital intensive industry like AI is exciting to me, because it kind of gives us a bit more acceptance, because we’re coming at it from a completely different angle. I think the biggest example is the Core Scientific / CoreWeave deal structure, how they’ve kind of merged those two businesses together. They’re complimentary to each other. And that’s really exciting.

When you look at our own product roadmap, we have no choice but to follow a similar roadmap to bitcoin miners. A lot of the products that we built for the mining industry are analogous to what is needed at a different level for AI. Mind you, it’s a lot simpler in our industry than in AI. We’re our first step into the HPC space, and it’s still very early days there.

Source link

Bitcoin mining

The U.S. Tariff War With China Is Good For Bitcoin Mining

Published

6 days agoon

April 10, 2025By

admin

Today, China announced that it will increase tariffs on the goods it ships to the United States from 34% to 84% in response to President Trump stating that he will raise tariffs on the goods the U.S. ships to China to 104%.

The increased Chinese tariffs on the U.S. will make it more costly for U.S.-based public Bitcoin mining companies to purchase ASICs (the premier machines used to mine bitcoin), the majority of which are produced in China.

And this will be largely beneficial for the health of the Bitcoin mining ecosystem.

As Troy Cross eloquently explained in “The Future OF Bitcoin Mining Is Distributed”, if one country controls too much of the Bitcoin hashrate, Bitcoin’s censorship resistance — one of its core value propositions — is put at risk.

In the article, Cross highlighted that if the majority of the Bitcoin network’s hashrate is not only produced in the U.S. but produced by American public mining companies, the U.S. government has more leverage to mandate that these companies only mine OFAC-compliant blocks.

For those who believe that these companies would push back or simply not follow such orders, please note that Marathon Digital Holdings, the largest publicly-traded Bitcoin mining company in the U.S., has already proven that it’s willing to comply with OFAC regulations.

The Bitcoin network has a higher likelihood of maintaining its censorship resistance when the hashrate is distributed globally.

As Cross mentioned in a recent interview (below), Bitcoin differs from other emerging technologies in that it does not benefit from one country controlling most of the industry around it.

He acknowledges that this isn’t necessarily intuitive, and that the notion may be confusing to the likes of those who are behind President Trump when he declares that he wants “all bitcoin made in the U.S.A.”

With the Bitcoin network, it’s best for countries to control a sizable portion of the network but not more than 50% of it.

And as Cross mentioned in the interview above, he believes that the U.S. may already control more than 50% of the hashrate.

However, this trend may now begin to reverse in the wake of China’s tariff increase on the U.S., because it will now be cheaper for the competitors of public U.S.-based Bitcoin miners to obtain ASICs than it will be for these companies.

So, while the escalating tariff war may be incredibly anxiety-inducing on a number of levels, consider taking some solace in the fact that it may be good for Bitcoin.

Source link

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Coinbase Urges Australia to Vote for Crypto Progress in May

How High Would Pi Network Price Go If Pi Coin Adopts Transparency to Avoid Mantra Pitfalls

XRP’s ‘Rising Wedge’ Breakdown Puts Focus on $1.6 Price Support

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x