$100

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Published

5 months agoon

By

admin

What an enormous day it has been today.

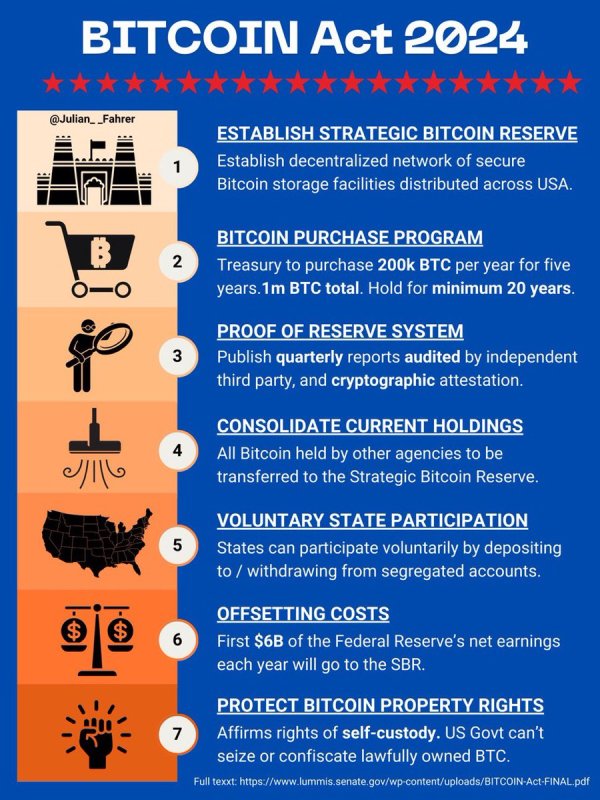

Gary Gensler officially announced that he is stepping down from his position as Chairman of the Securities and Exchange Commission (SEC), and minutes later, Reuters reported that Donald Trump’s “crypto council” is expected to “establish Trump’s promised bitcoin reserve.” A bitcoin reserve, that would see the United States purchase 200,000 bitcoin per year, for five years until it has bought 1,000,000 bitcoin.

Right after both of those, Bitcoin continued its upward momentum and broke $99,000, with $100,000 feeling like it can happen at any second now.

It is hard to contain my bullishness thinking about the United States purchasing 200,000 BTC per year. They essentially have to compete with everyone else in the world who is also accumulating bitcoin and attempting to front run them. There are only 21 million bitcoin and that is a LOT of demand.

To put this into context, so far this year the US spot bitcoin ETFs have accumulated a combined total of over 1 million BTC. At the time of launch the price was ~$44,000 and now bitcoin is practically at $100,000. And that’s all ETFs combined. Imagine what will happen when just one entity wants to buy a total of 1 million coins, having to compete with everyone else accumulating large amounts as well?

I mean MicroStrategy literally just completed another $3 BILLION raise to buy more bitcoin, and will continue raising until it purchases $42 billion more in bitcoin. The United States are most likely going to be purchasing their coins (if this legislation is officially signed into law) at very high prices. The demand is insane and only rising in the foreseeable future.

With two months left to go until Trump officially takes office, it remains to be seen if this bill becomes law, but at the moment things are looking really good. As Senator Cynthia Lummis stated, “This is our Louisiana Purchase moment!” and would be an absolutely historic moment for Bitcoin, Bitcoiners, and the future financial dominance of the United States of America.

This is the solution.

This is the answer.

This is our Louisiana Purchase moment!#Bitcoin2024 pic.twitter.com/RNEiLaB16U

— Senator Cynthia Lummis (@SenLummis) July 27, 2024

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

The moment Bitcoiners around the world have been waiting for is finally here: Bitcoin has hit the monumental $100,000 mark, and Michael Saylor is throwing the Party of the Century to celebrate!

What started as a dream and a meme has now become a reality, as Michael Saylor, a legendary advocate for Bitcoin and Executive Chairman of MicroStrategy, is hosting the most epic New Year’s Eve celebration to mark this historic occasion.

Bitcoin Magazine is thrilled to announce that we are streaming live from the event in Miami Beach, bringing the excitement of Saylor’s $100K Bitcoin party straight to your screens. From 7:00 PM EST, join us on the Bitcoin Magazine News Desk, hosted by Pete Rizzo.

The Party has been hyped for years and is set to deliver on all fronts. Your favourite Bitcoiners and podcasters will attend, including the man of the hour, Michael Saylor, Preston Pysh, American Hodl, Peter McCormack, and other Bitcoin legends. Expect lively and fun discussions as Bitcoiners come together to ring in 2025.

This exclusive live stream will give you front-row access to the celebration as we welcome a new year—and a new era for Bitcoin.

Catch the Bitcoin Magazine News Desk live stream on X and YouTube starting today, December 31, 2024, at 7:00 PM EST.

Source link

Bitcoin’s price is down over 10% from its all-time high and its critics are taking victory laps this week as bitcoin has plummeted all the way back to… $97,000.

It is still practically almost $100,000 for a single bitcoin. It is crazy to me to think that the “dip” is back to just under that important milestone, and really shows how far this asset has come over the last 15, going on 16 years.

Year-to-date, bitcoin is up over 128%. And by historical trends, it is entering into its third year of rising in price before having a large correction. So this tells me that bitcoin isn’t done pumping yet, it’s just taking a breather before its next leg up.

#Bitcoin should continue pumping through next year, based on historical trends

How high will BTC rise in 2025?

pic.twitter.com/VFX6jNgvvP

— Bitcoin Magazine (@BitcoinMagazine) December 13, 2024

HODLing bitcoin can be scary at times for new Bitcoiners. This asset is volatile both ways – which is great when it’s pumping but it makes people rethink their lives when it’s dumping. If you are new and bought the local top of $108,000 and are panicking, take it from me, someone who has been in Bitcoin for almost eight years now – you’re going to be fine.

This is a healthy pull back and the only thing you should be worried about is stacking more bitcoin today than you had yesterday.

It is more important to learn the fundamentals of Bitcoin and understand this new asset class than to worry about what the price of bitcoin does on a day to day basis. Bitcoin is a wild beast and will have downturns just as hard as it swings up. This volatility, even the downturns, are a good thing for many reasons – it creates opportunities. Especially for new bitcoiners to take advantage of stacking bitcoin at cheaper prices than when they originally got in.

Whenever you’re in doubt, it’s always important to zoom out and see the trajectory that bitcoin is on. Bitcoin has two possible scenarios it will experience:

1.) Bitcoin will fail and go to $0.

2.) Bitcoin will succeed and reach a price range in the millions and beyond.

I think Bitcoin has proven itself that it will not fail, so option number 1 here is not on the table. Meaning option number 2 is what is more likely to happen.

And if option number 2 is going to happen, then well, you should stack more bitcoin on every downturn.

When in doubt, zoom out.

HODL

pic.twitter.com/mr61ppIn3Y

— Nikolaus Hoffman (@NikolausHoff) December 20, 2024

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

$100

Bitcoin Officially Hits $100,000 For The First Time Ever

Published

5 months agoon

December 5, 2024By

admin

When Bitcoin was first launched by Satoshi Nakamoto, there was no price. It was literally worth $0.

The price of bitcoin first broke over $100 in April of 2013 and was captured on film as it rose to an all time high of $111. Later that year in December, BTC rose dramatically higher hitting a new all time high over $1,000.

Reacting to #Bitcoin reaching an ATH of $111 back in 2013

pic.twitter.com/qkBfdNJyjA

— Bitcoin Magazine (@BitcoinMagazine) February 11, 2024

Four years later, Bitcoin rose to $10,000 and beyond in November during the infamous bull market of 2017.

Our front page is looking pretty sweet right about now!

#Bitcoin pic.twitter.com/ug77yZoPW1

— Bitcoin Magazine (@BitcoinMagazine) November 29, 2017

Now, today we are at a historic time in history. December 4, 2024, will forever go down in history as the day the price of bitcoin rose above $100,000 for the first time.

BREAKING: #BITCOIN HITS $100,000 FOR FIRST TIME EVER!https://t.co/XwdsvLUycN

— Bitcoin Magazine (@BitcoinMagazine) December 5, 2024

The next logical target for Bitcoin is another 10x away — $1,000,000.

It is now no longer a question of if Bitcoin will achieve this, but when. When it comes to Bitcoin as a store of value, it has won. It’s off to the races from here, any price action is now possible. And one can only assume that going from $100,000 to $1,000,000 is going to be a lot easier than going from $0 to $100,000.

During this rise to $100,000, Bitcoin has cemented itself as a legitimate asset, and everyone who has taken any meaningful amount of time to research and understand it is buying more.

Everyday people around the world have adopted it for savings, payments, and financial privacy, nation states have adopted it as legal tender and are passing very pro-Bitcoin legislation, and now Wall Street firms are joining in. For someone who has been around for 7 years in the Bitcoin world, it feels unreal.

Congratulations to all the bitcoin holders, old and new, on achieving this milestone. For those who have been HODLing through the bear markets, educating themselves on why Bitcoin is so important, accumulating BTC and ignoring the FUD, and onboarding new Bitcoiners — I salute you. You deserve this and all the gains that have been made on this journey.

This was not easy, you did not get lucky. It takes conviction and strength to be able to buy and hold this extremely volatile asset long term. Enjoy this moment with your friends and family, and here’s to a new era of Bitcoin — the grind towards $1,000,000.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Ethereum community members propose new fee structure for the app layer

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje