Binance

Bitcoin Open Interest Crashes By $4.5 Billion In One Weekend, Spells Doom For Bulls

Published

3 months agoon

By

admin

Bitcoin open interest crashed by billions in one weekend, painting a bearish outlook for the flagship crypto and spells doom for BTC bulls. Despite this setback, crypto analysts have provided some optimism with their analysis, which hints at a bullish reversal soon enough.

Bitcoin’s Open Interest Crashes By $4.5 Billion Over The Weekend

Coinglass data shows that Bitcoin’s open interest crashed by $4.5 billion over the weekend, dropping from $65 billion to $61.5 billion. This came following the liquidations that occurred due to the BTC price crash. Further data from Coinglass shows that over $2 billion has been wiped out from the Bitcoin market in the last 24 hours.

Related Reading

Bitcoin bulls took the most hit, as $1.88 billion in long positions was liquidated during this period, leading to a crash in BTC’s open interest. This paints a bearish outlook for the flagship crypto and puts the bulls in danger as the bears look to be firmly in control. For context, Bitcoin dropped from above $100,000 to as low as $92,000 over the weekend.

This Bitcoin price crash occurred after US President Donald Trump announced a 25% tariff on imports from Mexico and Canada and a 10% tariff on goods from China. Mexico and Canada have retaliated by imposing tariffs on goods from the US, while China has also hinted about imposing a tariff on US goods.

Bitcoin’s open interest looks unlikely to recover in the short term as market participants could choose to stay out of the market due to economic uncertainty. This occurrence spells doom for Bitcoin bulls as the flagship crypto could drop lower if there are no buyers to defend BTC at these levels.

Some Positive For Bitcoin Amid Open Interest Crash

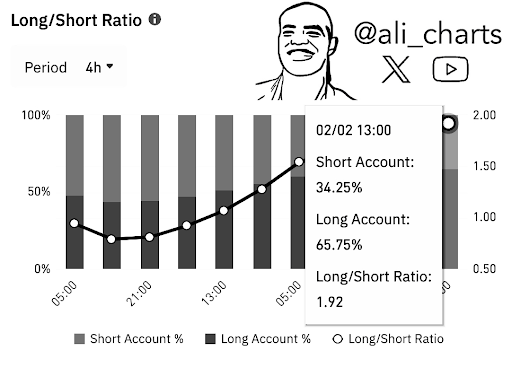

In an X post, crypto analyst Ali Martinez revealed that 65.75% of Binance traders with open Bitcoin futures positions are betting on the upside. This is bullish for the BTC price as these traders have a track record of being right most of the time. As such, the flagship crypto could rebound from its current price level.

In an X post, crypto analyst Titan of Crypto stated that the broader trend for the Bitcoin price is still upward. This came as he revealed that BTC is establishing a new range between $104,400 and $93,600. The crypto analyst remarked that the short-term direction remains uncertain until this range breaks. However, in the long term, Titan of Crypto is confident that the broader trend is still upward.

Related Reading

Meanwhile, renowned author and finance expert Robert Kiyosaki suggested that this wasn’t a time to panic as this was an opportunity to buy Bitcoin on sale before it rallies further to the upside.

At the time of writing, the Bitcoin price is trading at around $94,000, down over 6% in the last 24 hours, according to data from CoinMarketCap.

Featured image from iStock, chart from Tradingview.com

Source link

You may like

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

24/7 Cryptocurrency News

Is Binance Thinking to List PI Coin? New Update Fuel Speculations

Published

2 days agoon

April 26, 2025By

admin

Leading digital asset exchange Binance recently released listing guidelines that have stirred the crypto community, especially supporters of Pi Coin. Following the exchange outlining more straightforward criteria for future listings, market participants are speculating on a potential onboarding of PI coin on the world’s biggest crypto platform.

Binance Reveals New Listing Standards

In its most recent statement, Binance announced changes to how it lists new tokens. The exchange has introduced a more structured process. It carefully evaluates the quality of each project and monitors the token’s market performance.

According to the update, the digital asset exchange broke down its listing process into three main paths: Alpha, Futures, and Spot listings. Each path includes thorough evaluations of topics ranging from user adoption and tokenomics to technical security and trading volume.

For new projects, Binance Alpha offers early exposure before a complete listing. Projects must prove strong fundamentals, including a defined user base, real-world use, and a sound business model. The crypto exchange also checks token distribution, ensuring tokens are not held mainly by insiders.

It is worth noting that technical checks are done to avoid risks like bugs or past security issues. Teams are also checked for background and compliance issues, like sanctions or financial irregularities.

Meanwhile, circulating projects that already trade on other platforms must show healthy trading volume and stable price movements. Binance also looks at liquidity, market cap, and the overall investor interest before moving such tokens into Futures or Spot listings.

These straightforward guidelines now make it easier for projects to prepare and aim for listing on the platform.

Does Pi Coin Have a Chance Now?

It is worth noting that earlier this year, Binance held a community vote where 86% of nearly 295,000 participants favored Pi getting listed. While this was not a formal listing, it showed strong community support.

CoinGape also reported that crypto expert Dr. Altcoin shared news about Pi. Pi resumed trading on BitMart after a one-month pause, which, according to the update, was due to KYB concerns.

Pi’s return to BitMart suggests that the project might be moving towards full compliance.

This, along with a loyal community and growing interest in the token, could strengthen its case for meeting Binance’s standards. It is crucial for trading activity, compliance, and user adoption.

Price Outlook and Market Sentiment

CoinMarketCap data shows that Pi Coin was trading at $0.6470 at the time of writing, down 0.52% in the last 24 hours.

The coin has had trouble staying above the $1 mark amid recent market uncertainty. However, it has started showing signs of stabilizing as more people are paying attention to Pi now.

In line with the Binance exchange and other related updates, CoinGape reported that Grok3 believes this PI could reach $5 by 2026, with a bull case projection of $20 by 2030.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Binance

Binance Advising Multiple Governments On Strategic Bitcoin Reserve

Published

1 week agoon

April 20, 2025By

admin

Financial Times reports that bitcoin and crypto exchange Binance is advising several countries on creating their own bitcoin and crypto regulations and establishing national strategic bitcoin reserves.

Binance CEO Richard Teng revealed that multiple governments seek the exchange’s guidance on establishing strategic bitcoin reserves and crafting digital asset policies following recent U.S. moves toward creating a national bitcoin stockpile.

“We have actually received quite a number of approaches by a few governments and sovereign wealth funds on the establishment of their own crypto reserves,” Teng said in an interview with the Financial Times. While declining to name specific countries, he noted that the United States is “way ahead” in developing strategic bitcoin frameworks.

The development comes as nations worldwide reassess their approach to Bitcoin following former U.S. President Donald Trump’s executive order to establish a Strategic Bitcoin Reserve using confiscated assets from criminal and civil proceedings.

Teng, who assumed leadership of Binance after founder Changpeng Zhao stepped down, said that many countries have approached Binance to “[help] them with formulating their regulatory framework to govern crypto.”

The exchange’s advisory role significantly evolves its relationship with regulators. Previously known for its “no headquarters” approach, Binance is considering establishing a global base as it takes on a more formal role in shaping national bitcoin and crypto policies.

Countries like Pakistan and Kyrgyzstan have already partnered with Binance on crypto regulation, though neither has officially announced plans for bitcoin reserves. The exchange’s expanding influence in policy formation reflects the growing acceptance of Bitcoin as a potential strategic asset by sovereign entities.

Market observers note this development could signal a broader shift in how governments view bitcoin and crypto.

The advisory initiative comes as Binance works to reshape its image following recent regulatory challenges. The exchange has strengthened its compliance frameworks and proactively engaged with regulators worldwide.

The trend toward national bitcoin reserves could significantly affect the bitcoin’s global adoption and price stability. As more countries consider holding bitcoin as a strategic asset, the market may see reduced volatility and increased institutional participation.

Binance’s role in advising governments marks a new chapter in the bitcoin and crypto industry’s maturation as these assets increasingly become part of national strategic planning. The development suggests a potential shift in how countries approach monetary sovereignty in the digital age.

Source link

Amazon

Binance, KuCoin face interruptions due to ‘large-scale outage’ in Amazon’s data center

Published

2 weeks agoon

April 15, 2025By

admin

Cryptocurrency exchanges Binance, KuCoin alerted users about temporary interruptions that may result in partial execution of trading orders.

Binance, one of the world’s largest cryptocurrency exchanges, said it had temporarily paused withdrawals due to technical issues linked to its cloud service provider. In an X post on Tuesday, the trading platform said it’s “aware of an issue impacting some services on the Binance platform due to a temporary network interruption in the AWS data center.”

We are aware of an issue impacting some services on the #Binance platform due to a temporary network interruption in the AWS data center.

Some orders are still successful, but some are failing. If users failed, they may keep retrying.Our team is working closely with AWS to…

— Binance (@binance) April 15, 2025

The company suggested that the outage may not be affecting all users as the interruption may only affect trading activity for some users. “Some orders are still successful, but some are failing. If users failed, they may keep retrying,” the exchange said.

While the nature of the outage wasn’t disclosed, Binance said its team is working with Amazon Web Services to fix the problem. To limit risk during the outage, the exchange said had it decided to suspend withdrawals “to keep safe.”

It’s not clear how many users are affected. As of press time, Binance said that “all services are starting to recover and resume,” adding that withdrawals “have also reopened.”

“We will continue to monitor to ensure that all operations run smoothly. Thank you for your patience and understanding.”

Binance

Another crypto exchange KuCoin took to X to say that it is also experiencing disruptions due to the same AWS issue. In a notice to users, KuCoin said that due to a “large-scale network outage with AWS services, our platform is currently experiencing temporary disruptions.” The exchange added that its technical team is “working on a fix,” reassuring users that their assets “remain secure and all data is intact.”

Source link

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin6 months ago

Bitcoin6 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

✓ Share: