Arthur Hayes

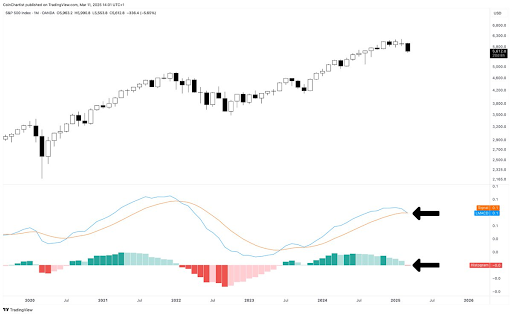

Bitcoin Price Risks Further Crash As S&P Monthly LMACD Turns Bearish, Why Bulls Have Only 20 Days

Published

2 months agoon

By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto analyst Tony Severino has warned that the Bitcoin price risks a further crash. This came as he revealed a critical technical indicator, which has turned bearish for the flagship crypto, although he noted that BTC bulls can still invalidate this current bearish setup.

Bitcoin Price At Risk Of Further Crash As S&P Monthly LMACD Turns Bearish

In an X post, Severino indicated that the Bitcoin price could crash further as the S&P 500 monthly LMACD has begun to cross bearish and the histogram has turned red. This development is significant as IntoTheBlock data shows that BTC and the stock market still have a strong positive price correlation.

Related Reading

The crypto analyst stated that BTC bulls can turn this bearish setup for the Bitcoin price in the next 20 days, as diverging would lead to a bullish setup instead. However, the Bulls’ failure to turn this around for Bitcoin could lead to a massive decline for the flagship crypto, worse than it has already witnessed.

Severino stated that a confirmation of this bearish setup at the end of the month could kick off a bear market or Black Swan type event similar to what happened when the last two crossovers occurred. It is worth mentioning that BTC has already crashed to as low as $76,000 recently, sparking concerns that the bear market might already be here.

However, crypto experts such as BitMEX co-founder Arthur Hayes have suggested that the bull market is still well in play for the Bitcoin price. Hayes noted that BTC has corrected around 30% from its current all-time high (ATH), which he remarked is normal in a bull run. The BitMEX founder predicts that the flagship crypto will rebound once the US Federal Reserve begins to ease its monetary policies.

BTC Still Looking Good Despite Recent Crash

Crypto analyst Kevin Capital has suggested that the Bitcoin price still looks good despite the recent crash. In his latest market update, he stated that BTC remains the best-looking chart and that everything is going according to plan for the flagship crypto. The analyst predicts that Bitcoin could still come down and test the range between $70,000 and $75,000, which he claims would still be completely fine.

Related Reading

Kevin Capital remarked that the Bitcoin price could remain afloat if it holds a key market structure and the 3-day MACD resets. He added that some decent macro data could help the flagship crypto stay above key support levels. The US CPI data will be released today, which could provide some relief for the market if it shows that inflation is slowing. The analyst is confident that one good inflation report and the FOMC can help turn the tides.

At the time of writing, the Bitcoin price is trading at around $81,860, up over 2% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Adobe Stock, chart from Tradingview.com

Source link

You may like

What is Base? The Ethereum Layer-2 Network Launched by Coinbase

Loopscale hacker in talks to return stolen crypto

Bitcoin (BTC) Yield Platform Coming From Coinbase (COIN), Aspen Digital

The Emerging Market For State Services Via Citizen X

XRP Price Shoots For 20% Surge To $2.51 Amid Pullback To Breakout Zone

Stocks edge higher ahead of big earnings week

Arthur Hayes

Arthur Hayes Says Bitcoin Primed To Benefit Amid Trade War, Deglobalization and US-China Decoupling – Here’s How

Published

2 days agoon

April 26, 2025By

admin

BitMEX founder Arthur Hayes says Bitcoin (BTC) will likely benefit from the ongoing trade war and a US-China decoupling.

In a new interview with the host of the Forward Guidance YouTube channel, Felix Jauvin, Hayes says governments around the world will likely have to print money to offset the impacts of the trade war, which has ignited massive Bitcoin rallies in the past.

“China’s not alone. It’s every major economy needs to print a bunch of money to basically cushion the effects of this attempted divorce, this decline in globalization. But at the end of the day, yeah, they’re going to print money – Bitcoin benefits.

Now the reciprocal of the current account deficit in the US is our financial account surplus. And so all these dollars that got earned, the trillions of dollars that got earned selling stuff to America, got recycled into Treasury bonds and stocks and Mag 7, all the big US tech stocks. So mathematically, if [US President Donald] Trump is serious about reducing the current account to zero, then foreigners have to sell stocks – period. It’s just math.

And then the question is, okay, well, can the US government survive financially if there’s a big decline in capital gains taxes because the market’s not going up? I don’t think so. Therefore, we get a printing money function and Bitcoin benefits. It finally decouples from tech because of the structural flows and what needs to happen from an affordability standpoint for the US government.”

While some in the crypto space suggest the market turmoil may prompt central banks to start accumulating Bitcoin to diversify their asset holdings, Hayes believes central banks will continue to turn to gold as a hedge, not the flagship crypto asset.

“I actually don’t think that they’re mentally prepared for that sort of leap. They understand gold. They’ve been trained in gold. They’ve read history books about gold.”

Bitcoin is trading for $94,832 at time of writing, up 1.2% in the last 24 hours.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Arthur Hayes

Déjà Boom—Arthur Hayes Says Bitcoin’s 2022 Rally Setup Is Back

Published

4 days agoon

April 24, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Arthur Hayes, the co-founder of BitMEX who now runs the family-office-style fund Maelstrom, believes the macro cocktail that ignited Bitcoin’s six-fold advance from late 2022 into early 2025 is being mixed again. Speaking on the “Forward Guidance” podcast just minutes after a market-soothing Trump press conference, Hayes said the present environment “feels like November 2022.”

Can Bitcoin Increase Sixfold Again?

In Hayes’s telling, the fulcrum of the next impulse is not the Federal Reserve but the US Treasury. “People forgot about the other side of the equation,” he argued. “Yellen printed two-and-a-half trillion dollars just by switching issuance to bills, and now Scott Bessent is talking about Treasury buybacks—another form of stealth quantitative easing that needs no input from the Fed.” Hayes cited his own arithmetic from the previous episode: between September 2022 and early 2025, Bitcoin rose roughly 6x while the Fed’s balance sheet was ostensibly shrinking, a move he attributes almost entirely to Treasury-engineered liquidity.

Related Reading

That dynamic, he contends, has returned. The Trump administration’s initial “maximalist” tariff schedule, announced in mid-April and aimed at slashing the US current-account deficit, triggered a brief but violent sell-off in bonds and equities before Trump began “concession after concession.” The rapid policy retreat, Hayes said, confirms that “the American financial system is so highly levered it couldn’t take one week” of trade hardball. To him, that single week exposed the political impossibility of fiscal retrenchment and made additional money creation inevitable. “They can call it whatever they want—just don’t call it QE—but it has the same effect: liquidity rises and Bitcoin benefits.”

Hayes’s decoupling thesis rests on arithmetic as much as narrative. If tariffs do trim the current-account gap, the mirror-image financial-account surplus must also fall, reducing foreign demand for US mega cap stocks.

“Mathematically, if Trump is serious, foreigners have to sell stocks. Period,” he said. In that world, Bitcoin’s flows are driven not by equity beta but by a global scramble for neutral stores of value amid escalating currency and trade friction. He expects “US-tech exceptionalism” to fade just as Bitcoin’s structural bid strengthens.

Related Reading

The former BitMEX chief also sees a latent tail-risk in Japan. A stronger yen, encouraged by Washington to help weaken the dollar, could force Japanese investors to unwind enormous USD carry trades, dumping Treasuries and pushing yields toward levels that would “corner the Fed into covert curve control.”

Any volatility spike of that kind, Hayes noted, historically elicits a rapid-fire response from the Federal Reserve—even if it arrives cloaked as a new alphabet facility rather than outright bond-buying. “Every time bond-market volatility spikes, the Fed does something,” he remarked. “It might not be QE in the traditional form, but it leads to the same outcome.”

Throughout the hour-long conversation Hayes returned to November 2022 as the template. Back then, markets were reeling from the aftermath of FTX and bond yields were surging, yet Bitcoin began a relentless grind upward as the Treasury tapped the reverse-repo basin for fresh cash. Today, he sees an echo: “This feels like November 2022,” he told host Felix Jauvin. “Shit’s going up.”

While Hayes stopped short of naming a price target, the implication was clear. In 2022–25 the stealth-liquidity wave took Bitcoin from roughly $16,000 to above $100,000. With Besson’s buyback machinery “ready to go” and political appetite for austerity already exhausted, Hayes says the stage is set for a sequel.

At press time, BTC traded at $92,559.

Featured image created with DALL.E, chart from TradingView.com

Source link

24/7 Cryptocurrency News

Arthur Hayes Predicts 70% Bitcoin Dominance as BTC Whales Hit Peak Accumulation

Published

3 weeks agoon

April 7, 2025By

admin

Bitcoin bull and former BitMEX CEO Arthur Hayes has shared that Bitcoin’s dominance in the cryptocurrency market will continue to rise.

Hayes revealed in a recent tweet that he has been avoiding altcoin investments despite their decreasing prices.

Arthur Hayes Predicts Bitcoin Dominance Increase

Arthur Hayes has taken a clear stance on the current market situation. He is actively adding to his Bitcoin position while avoiding altcoin investments. Hayes also spoke about a potential interest rate cut in the U.S. and explained how it could happen in one of his recent tweets.

In his recent tweet, the former BitMEX CEO stated: “Been nibbling on $BTC all day, and shall continue. Shitcoins are getting in our strike zone but I think #bitcoin dominance keeps zooming towards 70%.”

Been nibbling on $BTC all day, and shall continue. Shitcoins are getting in our strike zone but I think #bitcoin dominance keeps zooming towards 70%. So we are not gorging at the shitcoin supermarket. Remember, money printing is the only answer they have.

— Arthur Hayes (@CryptoHayes) April 7, 2025

Arthur Hayes specifically pointed to monetary policy as the driving factor behind his bullish Bitcoin outlook. He added: “So we are not gorging at the shitcoin supermarket. Remember, money printing is the only answer they have.” This comment suggests Hayes believes central bank policies will continue to favor Bitcoin as a hedge against inflation and currency devaluation.

The 70% dominance target is a substantial increase from Bitcoin’s current market share. Such a shift would imply major capital flows from altcoins back into Bitcoin.

Whale Accumulation Reaches Peak Levels

On-chain analytics firm Glassnode has identified a pattern of Bitcoin accumulation among the largest holders. According to their data, Bitcoin whales holding more than 10,000 BTC reached a nearly perfect accumulation score of approximately 1.0 at the month’s turn. This means that there is intense buying activity over a 15-day period.

Whales holding >10K $BTC briefly hit a perfect accumulation score (~1.0) at the turn of the month, reflecting intense 15-day buying. The score has since eased to ~0.65, still signaling steady accumulation.

Meanwhile, cohorts from <1 $BTC up to 100 $BTC have intensified their… https://t.co/cEo3F7Paid pic.twitter.com/7udA7G8nSM— glassnode (@glassnode) April 7, 2025

While this peak accumulation score has since moderated to around 0.65, it still shows continued steady buying from these major market participants. This level of whale accumulation stands in stark contrast to the behavior of smaller Bitcoin holders.

Glassnode noted: “Meanwhile, cohorts from <1 $BTC up to 100 $BTC have intensified their distribution, all trending toward 0.1–0.2. A clear and widening divergence between small and large holders.”

This difference in behavior between large and small holders often precedes major market movements. Historically, periods where whales accumulate while retail sells have preceded bullish phases in the Bitcoin market cycle.

Bitcoin Establishes support at $74,000

Bitcoin price appears to have established a support level around $74,000, according to data shared by Glassnode. Their analysis comes at a time when Bitcoin and altcoins have lost double-digit value in the last 24 hours.

The data shows this price point aligns with “the first major supply cluster below $80K – over 50K $BTC at $74.2K.” This supply zone is primarily composed of investors who were active in the market for approximately five months.

The strength of this support level will be important for Bitcoin’s short-term price action as the market moves through its current volatility. If this support holds, it could be a foundation for a potential recovery toward previous highs.

OKX partner Ted has highlighted a key technical level that could decide Bitcoin’s next directional move. “BTC is trying to reclaim the weekly 50-EMA level. This has acted as a bull/bear line for BTC,” Ted noted on X.

$BTC is trying to reclaim the weekly 50-EMA level.

This has acted as a bull/bear line for BTC.

If BTC fails to reclaim it, expect a correction towards $69K-$70K (2021 highs), and even the $67K (Saylor average entry) level could be retested.

In case BTC reclaims this level, a… pic.twitter.com/CtsyZ7q3FH

— Ted (@TedPillows) April 7, 2025

According to his analysis, failure to reclaim this moving average could trigger further downside. He mentioned potential correction targets at “$69K-$70K (2021 highs) and even the $67K (Saylor average entry) level.” Conversely, successfully reclaiming the 50-EMA could spark a “relief rally.”

Ted’s analysis also comes at a time when the crypto liquidations breached $600 million and Bitcoin fell below the important $80,000 level.

Vignesh Karunanidhi

Vignesh Karunanidhi is a seasoned crypto journalist with nearly 7 years of experience in the cryptocurrency industry. He has contributed to numerous publications, including WatcherGuru, BeInCrypto, Milkroad, and authored over 10,000 articles

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

What is Base? The Ethereum Layer-2 Network Launched by Coinbase

Loopscale hacker in talks to return stolen crypto

Bitcoin (BTC) Yield Platform Coming From Coinbase (COIN), Aspen Digital

The Emerging Market For State Services Via Citizen X

XRP Price Shoots For 20% Surge To $2.51 Amid Pullback To Breakout Zone

Stocks edge higher ahead of big earnings week

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin6 months ago

Bitcoin6 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

✓ Share: