Bitcoin

Bitcoin race intensifies as leaders address reserve urgency

Published

3 days agoon

By

admin

On March 20, investor and entrepreneur Anthony Pompliano stated on Fox News, “There’s a global race going on–Russia, Abu Dhabi, El Salvador, Bhutan–all these other countries are trying to buy Bitcoin… the same way that there was a space race there’s now a Bitcoin race.”

The idea of a Bitcoin “race” is now a reality as world leaders actively discuss the urgency of either establishing digital asset reserves or embracing cryptocurrency as legal tender.

El Salvador, in 2021, became the first country to make Bitcoin legal tender, purchasing over 2,000 Bitcoin as part of a national reserve to foster financial inclusion and economic growth. The move has been both celebrated and criticized due to Bitcoin’s volatility. Similarly, in 2022, the Central African Republic became the second country to adopt Bitcoin, viewing the cryptocurrency as a tool to improve economic development and financial inclusion in one of the world’s least developed nations.

Both countries’ actions reflect growing interest in Bitcoin as an alternative financial strategy. It’s hard-capped at 21 million, and in 10 years, most of it will be mined.

The theory is that the countries considering Bitcoin a valuable reserve asset will strive to establish as much ownership of the total BTC supply as possible.

Proponents believe scarcity and growing demand will drive Bitcoin’s value, making large BTC holders influential.

What Saylor says…

One of the most prominent Bitcoin evangelists, Michael Saylor, said that 78% of the U.S. was bought for $40 million at some point. The former CEO of MicroStrategy referred to various land acquisitions, such as the Louisiana Purchase of 1803 to illustrate why the U.S. government should buy Bitcoin now when it’s “cheap.”

In a recent speech, Saylor called the next decade “a digital gold rush” and compared Bitcoin to the Manhattan Project, dubbing it “digital energy.”

“Today, Bitcoin represents the digital capital network, controlling 99% of power within the cryptocurrency ecosystem,” he said. “The U.S. government recognizes only Bitcoin as legitimate digital capital. To secure the future of cyberspace and maintain global financial dominance, America must adopt Bitcoin strategically. Only Bitcoin—and U.S. Treasuries—have the liquidity and global trust required to serve as reliable reserve assets worldwide.”

No wonder Saylor has been vocally supportive of government officials pushing to increase the U.S.’s BTC stockpile.

President Donald Trump, Republican Sen. Cynthia Lummis, and Bo Hines, the Executive Director of the President’s Council of Advisors on Digital Assets, have all expressed a desire to increase the U.S.’s Bitcoin reserve.

Like Saylor, Pompliano (among the most vocal crypto advocates in the U.S.) considers the Trump administration’s focus on Bitcoin dominance important.

Speaking about the future price of Bitcoin, Pompliano said during a Fox News appearance that he doesn’t know when BTC will hit one million. However, he is seemingly confident that, like gold, its value will increase from where it currently is today.

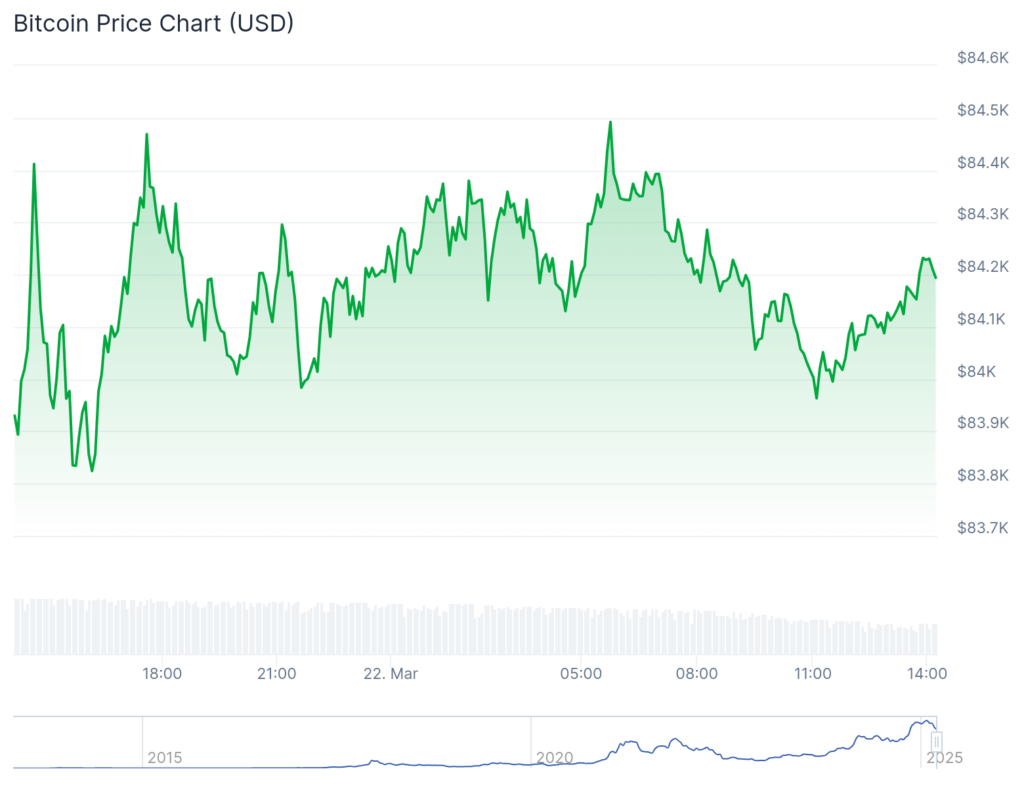

At last check, Bitcoin is trading at just above $84,000.

“I think people are drastically underestimating how maniacal they are going to be about buying Bitcoin,” Pompliano said. “Everyone thinks it’s cute that they put 200,000 Bitcoin over here and now we have this reserve — they are going to continue to buy Bitcoin.”

Who participates in the Bitcoin race?

Apart from the U.S., Pompliano named Russia, El Salvador, Bhutan, and the United Arab Emirates. Indeed, all of these countries reportedly have Bitcoin holdings, but not necessarily all of them explicitly expressed their desire to buy more.

It is not quite clear how much crypto Russia holds. However, it is known that Russia has large-scale mining operations while local companies use crypto for international trade and dodging Western sanctions.

Pompliano neglected to mention several leading Bitcoin holders, including China, which is the second biggest BTC owner after the U.S.

The United Kingdom and Ukraine currently follow China, according to BitBo’s Bitcoin Treasuries page.

All these countries have different strategies:

- North Korea’s hackers steal hundreds of millions of dollars worth of crypto from crypto exchanges.

- The UK holds crypto, seized while dismantling a high-scale money-laundering operation.

- Ukraine became a notable Bitcoin holder through donations made after the intensification of the Russian-Ukrainian conflict in 2022.

- The U.S. intends to confiscate Bitcoin and crypto assets from criminal cases. It’s worth noting that many individual states are exploring the creation of local-level reserves.

More than that, some corporations, most notably Strategy (previously MicroStrategy) and asset manager BlackRock, are among the world’s biggest Bitcoin holders, capable of competing with leading nations in terms of Bitcoin dominance. Both firms own or manage around 500,000 Bitcoins (over 2% of the total supply). As of March 2025, no country holds even half that amount.

Many countries are opting out

European countries have been cautious and innovative in their interactions with blockchain solutions. For instance, Estonia is one of the world’s pioneers in adopting blockchain for elections and healthcare data management. However, the EU countries take a conservative stance when it comes to crypto reserves. High volatility and low liquidity are the main reasons for rejecting Bitcoin’s reserve establishment.

Similar reasons are cited by Switzerland, South Korea, Japan, and other countries that seem unbothered by America’s passion for winning in the Bitcoin musical chairs game. Germany went so far to sell thousands of Bitcoin.

Germany sold all their #Bitcoin at $54,000.

If they had waited, they could have made an extra $990 million.

Losers

pic.twitter.com/2G8iRFhzn9

— Crypto Rover (@rovercrc) November 6, 2024

Crypto.news asked Genius Group, a company using Bitcoin as a corporate reserve, how they time the market.

“As fundamental believers in the long-term potential of Bitcoin, we don’t try to time the market, but rather buy and hold with the intention of never selling,” a spokesperson responded.

Let’s assume the so-called Bitcoin race exists, as Pompliano described it. If we compare it to space or the Manhattan Project, we must ask ourselves: Were the countries that didn’t have spacecraft or atomic weapons in the 20th century left with nothing?

Source link

You may like

Tokenized Treasuries Hit $5B Milestone as Fidelity Investments Touts RWA Potential as Collateral

Cardano Price Eyes $0.85 as Whales Scoop Up 240 Million ADA

Dogecoin Price Mirroring This 2017 Pattern Suggests That A Rise To $4 Could Happen

SEC closes investigation into Immutable nearly 5 months after Wells notice

Solana Rises As BlackRock Brings Its $1,700,000,000 Tokenized Treasury Fund to Ethereum Rival’s Chain

BlackRock Launches Bitcoin ETP In Europe

Altcoin

XRP Breakout On Hold? Financial Expert Reveals What’s Missing

Published

12 hours agoon

March 25, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP remains stuck around the $2 level, with experts issuing warnings of restricted near-term growth prospects. According to recent analysis, the digital currency is going through a phase of uncommon stability that has investors speculating about its next step.

Related Reading

Investor Sentiment Dampens Market Momentum

According to financial commentator Austin Hilton, millions of crypto traders have withdrawn from active participation. The market is stuck in neutral, as traders are simply waiting for a big event to set things into motion. The volumes of trade have been above $4 billion at peak levels, but the price itself remains virtually unchanged.

Summer Slowdown Impacts Crypto Trading

Analysts cite seasonal patterns as the major reason for XRP’s current behavior. Hilton describes how summer months usually experience lower trading volumes, with investors more inclined to engage in private activities than respond to market activity. This pattern might continue until July, possibly maintaining XRP’s price relatively stable.

A realistic XRP price prediction!

– Lets talk about the resistance levels for $XRP

– Also, discussed are the support levels that you need to know about

– What you need to know about your XRP holdings – so that you can navigate what is going on right now pic.twitter.com/h9kxG3a0Ex— Austin Hilton (@austinahilton) March 23, 2025

Price Barriers Create Market Challenges

Technical analysis indicates key price levels for XRP. Resistance levels are found at $2.61 and $2.81, while support levels are at $2.22 and $2.31. Experts caution that in the absence of heavy buy pressure, the cryptocurrency might not be able to overcome these levels. Currently, XRP is trading at $2.44, with a modest 0.04% gain over the last 24 hours.

XRP market cap currently at $141 billion. Chart: TradingView.com

Long-Term Outlook Remains Hopeful

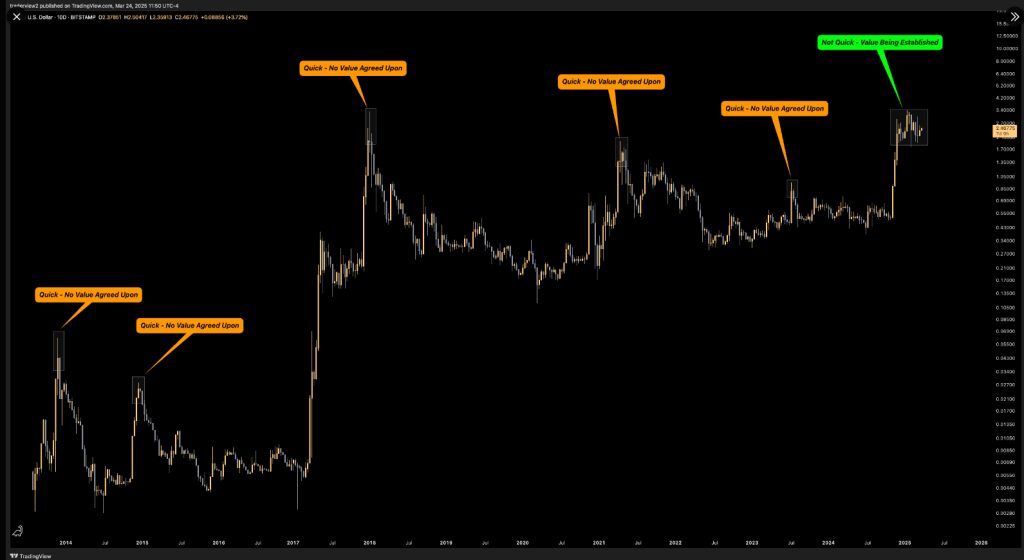

Despite current market challenges, some experts remain optimistic. Market analyst Dom suggests the current price consolidation might indicate a strong foundation for future growth. Unlike previous market cycles where XRP experienced rapid price spikes and drops, the current stability suggests a more measured approach.

There’s one reason I will be pretty surprised if $XRP does not go higher this year, read along –

Every time $XRP has historically put in a multi month or year top, it did it quickly (as shown below)

Essentially, it never showed any mid term acceptance at those higher… pic.twitter.com/RahjM2xHwz

— Dom (@traderview2) March 24, 2025

A number of possible catalysts are on the horizon, such as developments in XRP ETF products, continued action in the SEC vs. Ripple case, and possible reserve disclosures. As of yet, however, none of these events have caused major market activity.

Related Reading

Institutional investors remain quietly accumulating digital assets, creating yet another level of sophistication to the current market dynamics. Hilton advises not to anticipate extreme price increases in the near term, highlighting that there needs to be a major positive event for drastic change.

As the cryptocurrency market keeps growing, XRP investors are warned to keep close watch on the market conditions. The fourth quarter could see things pick up once again, but for the meantime, patience seems to be the main approach for those who possess the cryptocurrency.

Featured image from Gemini Imagen, chart from TradingView

Source link

Ali Martinez

Analyst Sets Dogecoin Next Target As Ascending Triangle Forms

Published

1 day agoon

March 24, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto analyst CobraVanguard has revealed the next price target for Dogecoin as an ascending triangle forms for the foremost meme coin. A rally to this price target could pave the way for the new highs, especially with the crypto market looking to be in rebound mode.

Next Target For Dogecoin As Ascending Triangle Forms

In a TradingView post, CobraVanguard set $0.197 as the next target for the Dogecoin price with an ascending triangle forming. He noted that this ascending triangle indicates a potential price increase. The analyst added that it is anticipated that the price could rise, aligning with the projected price movement of AB=CD.

Related Reading

Meanwhile, CobraVanguard warned that it is crucial to wait for the triangle to break before taking any action. His accompanying chart showed that Dogecoin needs to break above $0.177 to confirm a break above the ascending triangle. A break above that target would then lead to a rally to the $0.197 target.

Dogecoin already looks to be in rebound mode at the moment, alongside Bitcoin, which is nearing the $90,000 mark again. The foremost meme coin is nearing the $0.177 target for a break above the ascending triangle. As crypto analyst Kevin Capital suggested, DOGE will likely rally as long as BTC is in bullish territory.

Crypto traders are also betting on a Dogecoin rally to the upside. Crypto analyst Ali Martinez revealed that 76.26% of traders with open DOGE positions on Binance futures are leaning bullish. This is particularly bullish because Binance traders have a good track record of being right most of the time. In another X post, Martinez revealed that whales bought over 120 million DOGE last week, which is also bullish for the foremost meme coin.

DOGE’s Market Structure Has Shifted

In an X post, crypto analyst Trader Tardigrade revealed that Dogecoin’s market structure has shifted. This came as he noted that Dogecoin is recovering from an ascending triangle, forming higher highs and higher lows from lower highs and lower lows.

Related Reading

Based on this, the analyst affirmed that Dogecoin had shifted the market structure from a downtrend to an uptrend on the hourly chart since it just formed the second higher high. His accompanying chart showed that DOGE is eyeing a rally to $0.177 as it continues to form higher highs.

Martinez raised the possibility of the Dogecoin price rallying to as high as $4 or even $20 in the long term. He stated that if DOGE holds above the $0.16 support at the lower boundary of an ascending channel, history suggests that it could rebound toward the mid-range at $4 or upper range at around $20.

At the time of writing, the Dogecoin price is trading at around $0.174, up over 3% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Pexels, chart from Tradingview.com

Source link

Bitcoin

Bitcoin and Stock Market Rally Hard as White House Narrows Scope of Tariffs

Published

1 day agoon

March 24, 2025By

admin

Digital assets and equities are soaring on the weekly open amid renewed optimism stemming from the White House taking a softer tone on tariffs.

While tariff threats initially sparked one of the worst stock market drawdowns in recent memory, reports are now suggesting that President Trump’s aggressive trade negotiations may be in the process of a smooth resolution.

Citing “US officials familiar with the matter,” Bloomberg reports that Trump’s reciprocal tariffs may be more targeted than initially anticipated, with some countries being exempt, and some sector-specific levies being delayed by the White House.

The Wall Street Journal reported similar information.

All major stock indices opened the week well into the green, while Bitcoin (BTC) is up 3% on the day and is now up 15% from its 2025 low near $76,500.

Said Tobin Marcus of Wolfe Research in a note seen by CNBC,

“Omitting the sectoral tariffs from the April 2nd package significantly reduces both its aggregate scale and the maximum rate on targeted sectors, given that all of Trump’s tariffs to date have been designed to stack… The ceiling for reciprocal tariffs on April 2 remains dramatic, and we still expect a negative market reaction, but the scale won’t be as severe and the sectoral impacts won’t be as concentrated.”

However, in a post on Truth Social, President Trump announced that “secondary tariffs” would be placed on Venezuela and any country that purchases oil and/or gas from the country. Trump cited numerous reasons, including “the fact that Venezuela has purposefully and deceitfully sent to the United States, undercover, tens of thousands of high level, and other, criminals, many of whom are murderers and people of a very violent nature.”

At time of writing, BTC is trading at $88,013.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Tokenized Treasuries Hit $5B Milestone as Fidelity Investments Touts RWA Potential as Collateral

Cardano Price Eyes $0.85 as Whales Scoop Up 240 Million ADA

Dogecoin Price Mirroring This 2017 Pattern Suggests That A Rise To $4 Could Happen

SEC closes investigation into Immutable nearly 5 months after Wells notice

Solana Rises As BlackRock Brings Its $1,700,000,000 Tokenized Treasury Fund to Ethereum Rival’s Chain

BlackRock Launches Bitcoin ETP In Europe

Crypto holds on to Gains, US may reverse Biden BTC sales, Tesla leads bounce

Cardano price could surge to $2 as whale purchases rise

Bitcoin Cash (BCH) Falls 1.9%, Leading Index Lower

Analyst Sets ‘Conservative’ XRP Price Target At $15, What’s Next?

XRP Breakout On Hold? Financial Expert Reveals What’s Missing

Pump.fun’s new DEX reaches $1B volume a week after launch

Economist Alex Krüger Says Markets Could Rally ‘Fast and Furiously’ if President Trump Does This

Democrats Propose More Bad Bitcoin And Crypto Regulation

Circle Deepens Japan Commitment as SBI Group Prepares USDC Launch

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x