News

Bitcoin to $180K? Expect a 30% correction, VanEck warns

Published

6 months agoon

By

admin

VanEck’s head of digital asset research, Matthew Sigel, has outlined a detailed forecast for the cryptocurrency market through 2025.

Sigel predicted Friday that Bitcoin (BTC) will reach $180,000 in the first quarter before experiencing a correction. The analysis projects Ethereum (ETH) reaching beyond $6,000, while coins like Solana (SOL) and Sui (SUI) could achieve $500 and $10, respectively.

Sigel anticipates this initial peak will be followed by a market correction, with Bitcoin pulling back 30% and altcoins experiencing deeper declines of up to 60% during the summer months.

To identify potential market tops, Sigel highlights several key indicators for investors to monitor. The research points to sustained high funding rates as a crucial signal.

He noted that when traders consistently pay funding rates above 10% for three months or longer to bet on Bitcoin price increases, it typically indicates excessive speculation in the market.

The analysis also emphasizes the importance of tracking unrealized profits among Bitcoin holders. When a large proportion of holders maintain paper gains with a profit-to-cost ratio exceeding 70%, it often signals market euphoria.

Bitcoin’s market dominance serves as another critical indicator. Sigel warns that a drop below 40% could signal excessive speculation in altcoins, typical of late-cycle market behavior.

The research attributes current market momentum largely to Donald Trump’s election victory and his administration’s projected appointments. The anticipated crypto-friendly leadership team, including JD Vance as VP and Paul Atkins as SEC Chair, suggests a shift from previous restrictive policies toward a framework that positions Bitcoin as a strategic asset.

Following the summer correction, Sigel forecasts a market recovery in fall 2025. Major cryptocurrencies will likely reclaim their previous all-time highs by year-end.

This projection assumes continued institutional adoption and supportive regulatory developments under the new administration.

This market outlook provides investors with specific price targets and warning signals to monitor, while acknowledging the impact of political developments on the crypto market.

Source link

You may like

Ethereum Price Headed For Crash To $2,000 With Current Price Action

Tokenized funds hit $5.7B, scaling fast — Moody’s

Authorities Warn of Phony Text Messages Phishing for Sensitive Information, Telling Victims Their Bank Account Is at Risk

Tether invests in Chilean crypto exchange Orionx

MARA Hits Record-High Bitcoin Production in May

Retail investors no longer FOMO into BTC, altcoins

Hacks & Breaches

Authorities Warn of Phony Text Messages Phishing for Sensitive Information, Telling Victims Their Bank Account Is at Risk

Published

4 hours agoon

June 3, 2025By

admin

Authorities in a town in Tennessee are warning residents about a new texting scam that has been impersonating local banks.

The Shelbyville Police Department says the scam texts have been circulating through the local community.

“Several citizens have reported receiving messages claiming to be from local banks, urging them to click a suspicious link. DO NOT click any links or provide personal information.

These texts are not legitimate and are designed to steal your sensitive information. Below is an example of the text. If you receive one of these messages, delete it immediately and contact your bank directly if you have concerns.”

In a similar vein, Suffolk County Executive Ed Romaine warned last month that a crew of con artists had been calling seniors on Long Island and pretending to be their banks.

The fraudsters tell the seniors that their bank accounts are under attack and that their credit and debit cards have malfunctioned. The scammers subsequently offer to pick the cards up from the victims and attempt to lure them to reveal their PINs, Romaine explained.

“And guess what? Then they go to the ATM machine and steal their money. And this happened to a number of seniors.”

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Latin America

Tether invests in Chilean crypto exchange Orionx

Published

4 hours agoon

June 3, 2025By

admin

Tether continues to expand its global presence and support for cryptocurrency adoption, with the stablecoin giant’s latest move being a strategic investment in Chile-based crypto exchange Orionx.

Tether, the issuer of leading stablecoin Tether (USDT), announced its investment in the Chilean Chilean digital assets and infrastructure company on June 3, 2025. According to details, the investment is part of Orionx’s series A funding round, which Tether led.

Orionx has operations across Latin America, offering its crypto cross-border payments solution in Chile, Peru, Mexico and Colombia. The funding will allow the platform to consolidate its operations in the region, Tether noted in a blog post.

The company will also use the capital injection to scale its stablecoin-powered infrastructure, targeting further adoption of its solution for remittances, treasury services and payment collection across LATAM. Orionx will also target the region’s huge number of unbanked adults, with this key given LATAM users received almost $415 billion in crypto between July 2023 and June 2024.

“By closing Orionx’s series A round, we are not only supporting a high-impact company but also advancing our broader vision of making stablecoin-powered financial tools accessible to underserved communities across the region,” said Paolo Ardoino, chief executive officer of Tether.

Investment in Orionx adds to Tether’s other notable strategic moves, including the USDT issuer’s backing of self-custodial crypto wallet Zengo in February 2025.

A couple of months later, in April, Tether invested in Fizen Limited, a fintech company focused on digital payments and crypto self-custody wallets. The deals aim at supporting Tether’s quest to enhance global stablecoin adoption, including in regions with high numbers of unbanked and underserved populations.

Orionx will support this initiative via the Tether collaboration, said Joel Vainstein, CEO of Orionx.

“Having Tether, the undisputed global leader in stablecoins, by our side will allow us to accelerate this path with digital, flexible, and scalable solutions,” Vainstein.

Source link

AI Market Insights

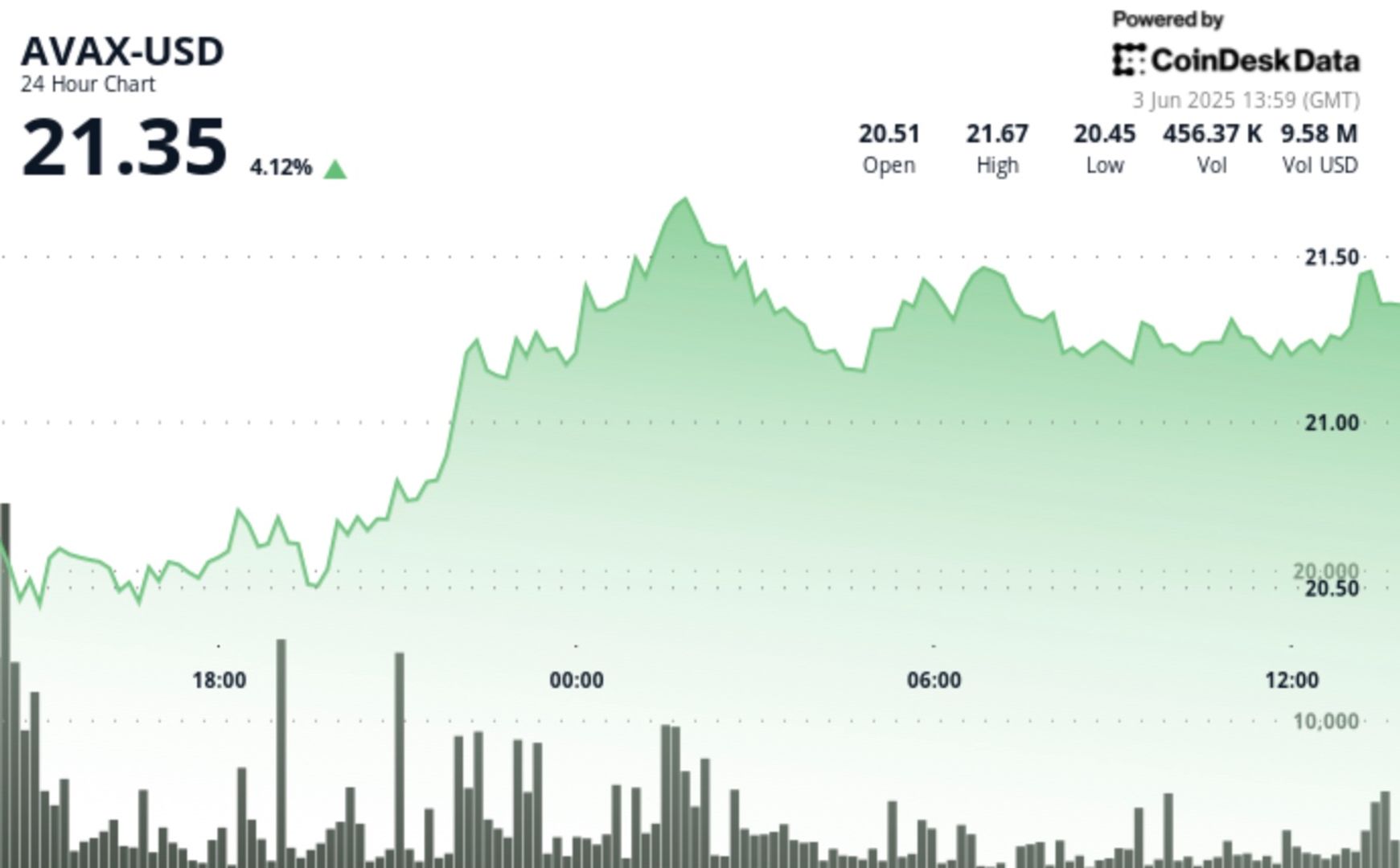

AVAX Rises 3.8% on Strong Volume, Breaking Key Resistance Levels

Published

8 hours agoon

June 3, 2025By

admin

AVAX broke through key resistance levels on high volume, establishing new support zones around $21.30 as traders navigate complex market conditions influenced by international trade disputes and monetary policy speculation.

Technical Analysis

• AVAX climbed from $20.52 to $21.31, representing a 3.8% gain with a total range of $1.28 (6.2%).

• Price formed a clear uptrend with higher lows and higher highs, breaking through key resistance at $20.90.

• Exceptionally high volume (1.33M) confirmed the breakout.

• Strong support established at $21.15 following the surge.

• Most significant price movement occurred when AVAX surged past the $21.00 psychological level.

• Pronounced correction saw price drop 5.8% on the highest volume spike (40,669).

• Decreasing volume suggests consolidation after volatile price action.

Source link

Ethereum Price Headed For Crash To $2,000 With Current Price Action

Tokenized funds hit $5.7B, scaling fast — Moody’s

Authorities Warn of Phony Text Messages Phishing for Sensitive Information, Telling Victims Their Bank Account Is at Risk

Tether invests in Chilean crypto exchange Orionx

MARA Hits Record-High Bitcoin Production in May

Retail investors no longer FOMO into BTC, altcoins

AVAX Rises 3.8% on Strong Volume, Breaking Key Resistance Levels

K33 begins Bitcoin buying with 10 BTC purchase for treasury strategy

Why $107,500 And $103,500 Are The Levels To Watch

Pakistan Proposes New Crypto Regulations

Japanese Bitcoin Hoarder Metplanet Adds $115,600,000 Worth of BTC As Stock Surpasses 263% Gains on the Year

Bitcoin traders anticipate decline, watch $100K

Ethereum Foundation Restructures R&D Division, Plans ‘Rethink’ on Design and Development

Here’s why Sophon crypto rallied over 40% today

BCB Strikes Deal with SocGen–FORGE to Distribute Euro-Pegged Stablecoin EURCV

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Pi Network coin to $10? 4 catalysts that may make it possible

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Blockchain groups challenge new broker reporting rule

Xmas Altcoin Rally Insights by BNM Agent I

Trending

24/7 Cryptocurrency News7 months ago

24/7 Cryptocurrency News7 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Markets3 months ago

Markets3 months agoPi Network coin to $10? 4 catalysts that may make it possible

Ripple Price3 months ago

Ripple Price3 months ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Bitcoin5 months ago

Bitcoin5 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin7 months ago

Bitcoin7 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion7 months ago

Opinion7 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin4 months ago

Bitcoin4 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines