Bitcoin

Bitcoin UTXO Surpasses COVID 2020 Levels To New ATH

Published

3 months agoon

By

adminBitcoin’s consolidation below $68,000 extended throughout this week, with bulls holding steady above the $66,000 support level. Although the cryptocurrency hasn’t seen a significant push to the upside, its ability to avoid a deeper correction means that Bitcoin remains on track to end October on a bullish note.

Related Reading

In support of this outlook, a crypto analyst has highlighted an emerging trend in Bitcoin’s UTXO metric, which suggests a looming breakout in the crypto’s price.

UTXO In Loss Reaches Highest Point Ever

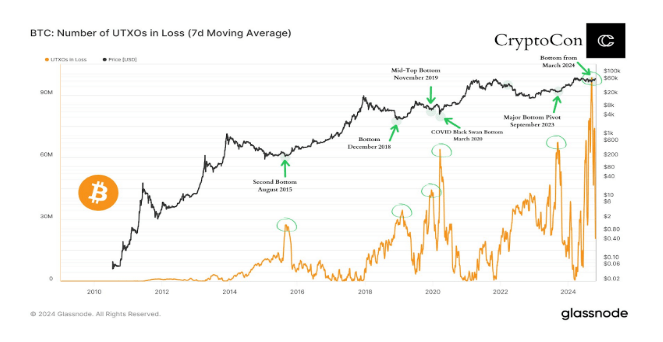

The number of Bitcoin UTXO in losses recently reached a new peak on September 11, 2024, surpassing levels last seen during the COVID-19 crash in 2020 and the September 2023 market bottom.

This metric, known as Unspent Transaction Output (UTXO), refers to the amount of Bitcoin that remains unspent in a Bitcoin wallet after a transaction. When UTXO is measured in loss, it reflects the number of Bitcoin holdings that would currently sell at a loss compared to the last transaction price from the Bitcoin wallet.

According to Glassnode data, the number of UTXO in losses spiked massively in September to surpass previous numbers, indicating that a significant portion of active Bitcoin addresses are underwater. However, while this may appear to signal bearish sentiment at first glance, history has shown this isn’t the case.

As pointed out by crypto analyst CryptoCon, major spikes in UTXO loss don’t come right before terrible price action, but they mostly come at the end of it. Keeping this trend in mind, the new peak in September most likely was an inflection point for Bitcoin’s price action for the rest of the year.

What Does This Mean For Bitcoin Price?

Past data reveals a consistent pattern: when UTXO in loss reaches extreme highs, Bitcoin’s price is often near a reversal. For instance, during the COVID-19 crash in March 2020, UTXO in loss spiked significantly, followed by a strong rally that led Bitcoin to new all-time highs in the following months.

The last time the UTXO in loss spiked massively was in September 2023, serving as the forerunner for the latest bull market cycle which kicked off in October 2023. This run culminated in a new all-time high for Bitcoin in March 2024, effectively showcasing spikes in the UTXO in loss as a signal of positive market momentum.

If history were to repeat itself, the September spike in the UTXO loss numbers could also signal a market bottom, which in turn opens up the stage for a rally in the rest of the year.

Related Reading

Interestingly, Bitcoin’s price action has been notably positive since this new peak in UTXO in loss. At the time, Bitcoin was trading around $57,000. Since then, it has experienced a considerable rally, inching closer to the $70,000 price level.

At the time of writing, Bitcoin is trading at $66,720.

Featured image from Pexels, chart from TradingView

Source link

You may like

Bitcoin

Genius Group buys $5m more in Bitcoin, totaling treasury to $35m

Published

5 hours agoon

January 10, 2025By

admin

Genius Group Limited has increased its Bitcoin Treasury to $35 million.

This purchase surpassed its milestone ahead of schedule in its ongoing effort to amass $120 million in Bitcoin holdings, according to a company release.

The latest purchase comes just two months after the Singapore-based, AI-powered education company announced its “Bitcoin-first” strategy in early November.

Genius Group added $5 million worth of Bitcoin (BTC) purchases, bringing its total holdings to 372 BTC at an average acquisition price of $94,047 per Bitcoin.

As of Jan. 9, the company’s Bitcoin Treasury was valued at $35 million, reflecting the current Bitcoin price of around $94,000.

With Genius Group’s market capitalization at $42 million, its BTC-to-price ratio stands at 83%.

Genius Group’s additional loan

To further grow its Bitcoin Treasury, Genius Group has increased its loan with Arch Lending from $10 million to $14 million, maintaining a loan-to-value ratio of 40%, according to the release.

The company is heavily leveraging crypto-backed loans to fund its reserves without selling Bitcoin, in line with its strategy of allocating 90% or more of its reserves to Bitcoin.

Genius Group, which integrates AI solutions into education, views Bitcoin as a key component of its financial strategy. CEO Roger Hamilton has compared the company’s approach that of other publicly traded firms that have adopted Bitcoin as a reserve asset, emphasizing its potential as a “store of value” in the digital economy.

The firm’s “Bitcoin-first” strategy aligns with its broader plans to incorporate blockchain technology into its AI-powered educational platforms. These plans include implementing on-chain certifications and reward systems using Bitcoin’s Lightning Network.

Source link

SAFE, the native token of Safe Wallet, surged 20% as Bithumb listed the token on its platform.

Safe (SAFE) rose to $1.10 on Jan. 10, marking a 20% surge from its monthly low of $0.924 while bringing its market cap to nearly $600 million at the time of writing.

The altcoin’s rally occurred in a high-volume environment. Its daily trading volume surged by 429%, climbing from $15 million early Thursday morning to over $80 million.

Despite the recent rally, the altcoin still holds significant growth potential, considering that SAFE’s price remains 69% below its all-time high of $3.56 in April last year.

SAFE rallied as Bithumb, a major South Korea-based crypto exchange, announced it would add a KRW trading pair for the SAFE token on Jan. 10, along with SONIC and AHT tokens.

A SAFE/KRW trading pair will allow direct trading between the SAFE token and the South Korean won, making it more accessible to a wider audience, particularly in the South Korean market.

Typically, a listing on a premier South Korean exchange such as Upbit or Bithumb results in a strong rally in the related token. One such instance was reported earlier in October last year when SAFE secured a listing on Upbit, leading to a 72% surge in just one day.

SAFE also rallied as a result of increased demand among its derivatives traders. According to CoinGlass, open interest for SAFE in the futures market surged by 151% over the past day, reaching $19.5 million, much higher than the $5.5 million recorded at the beginning of the year.

However, it’s important to note that rallies following exchange listings often face a reversal as investors sell their holdings to secure profits. Notably, data from CoinGlass shows that over $5.96 million SAFE was sent to centralized exchanges on Dec. 10, compared to the $5.65 million withdrawn.

Additionally, the weighted funding rate for SAFE at press time was -0.6690%, which means short sellers were dominating the market, with more traders betting on its price to dip lower.

Such levels also increase the possibility of a short squeeze if the price reverses upwards, potentially forcing short positions to close.

At press time, SAFE had wiped most of its gains, falling 7% from its daily high, and was trading at $1.01 per coin.

Source link

Bitcoin

Bitcoin Supercycle Incoming Amid Changing Market Conditions, According to Alex Krüger – But There’s a Catch

Published

12 hours agoon

January 10, 2025By

admin

Economist and trader Alex Krüger is leaning bullish on Bitcoin (BTC) even as the flagship crypto asset hovers around 14% below the all-time high.

In a new episode of the Unchained podcast, Krüger says that Bitcoin has more upside potential and is not even “remotely” close to the cycle top.

According to the economist and trader, the approval of spot Bitcoin exchange-traded funds (ETFs) in January of 2024 could result in the crypto king no longer following the usual four-year cycles that revolve around the halving.

“I think that what happened is the introduction of the ETF and the flows which are significant, they tie together and they make the correlation between risk and Bitcoin more sustainable. So that’s why I’m not thinking about a cycle top…

…at the same time market conditions for Bitcoin they are changing because the impact of the halving is lesser and we have ETFs now. So I am on the super cycle side of things.”

Krüger, however, says that a supercycle doesn’t mean that “we go up only.”

“It means that we have shorter [corrections]… for as long as equities do well and the economy does well, that may not be the same but they are usually the same. We have smaller drawdowns that last for shorter [periods of time].”

Bitcoin is trading at $93,134 at time of writing, around 10% below the 2025 high of about $102,000.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Meme Index raises $2M in 2 weeks

XRP Price Eyes Breakout: Bullish Pennant Points Upward

Pieter Wuille and Gregory Maxwell Receive The Finney Freedom Prize

Kenya Prepares to Legalize Cryptocurrencies in Policy Shift: Report

Genius Group buys $5m more in Bitcoin, totaling treasury to $35m

Why This AI Agent Crypto AIXBT is Up 55% Today?

Have Bitcoin ETFs Lived Up to the Hype?

Apostas basquete Brasil

SAFE rallies 20% on Bithumb listing

Solana, XRP, Litecoin, HBAR in 2025 With New SEC Chair?

Bitcoin Supercycle Incoming Amid Changing Market Conditions, According to Alex Krüger – But There’s a Catch

K-pop giant Cube Entertainment’s CEO under fire for misleading crypto investment guarantees

How a Crypto Trader Turned a 90% Loss Into a $2.5M Win?

Solana whales rapidly accumulate this viral altcoin dubbed the ‘next XRP’

Polymarket’s Customer Data Sought by U.S. CFTC Subpoena of Coinbase, Source Says

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Telegram users can send gifts to friends, TON fails to pump

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Crypto’s Big Trump Gamble Is Risky

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

A16z-backed Espresso announces mainnet launch of core product

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x