Mining

Bitfarms stock dips despite $110m acquisition

Published

1 month agoon

By

admin

Canadian Bitcoin miner Bitfarms has finalized the acquisition of Stronghold Digital Mining, marking the largest-ever merger between two publicly listed Bitcoin mining companies.

According to a press release published on March 17, Bitfarms has completed the all-stock acquisition of Stronghold Digital Mining. The merger was approved on Feb. 28, with 99.6% of votes cast voting in favor, representing about 54.5% of Stronghold’s outstanding shares.

Bitfarms acquired Stronghold through a stock-for-stock merger, with Stronghold shareholders receiving 2.52 Bitfarms shares for each Stronghold share they owned. Nearly 60 million Bitfarms shares and over 10.5 million warrants were issued as part of the deal. Stronghold’s stock was removed from Nasdaq and stopped trading.

Bitfarms’ stock opened higher Monday morning but lost any buying momentum and was trading lower by around 1% during the early afternoon session.

Details of the acquisition

With Stronghold now fully integrated into Bitfarms, the mining giant has expanded its energy capacity to 623 megawatts — including existing power generation and grid import capacity in Pennsylvania.

Additionally, Bitfarms now manages nearly 1 more Exahash of computing power, bringing its total to 18 Exahash. A previous agreement where Stronghold hosted miners for others is now being used for Bitfarms’ direct mining operations.

Bitfarms also sees potential to convert two Stronghold power sites into large-scale AI and computing hubs, with plans to partner with industry players to develop these facilities.

“With Stronghold’s portfolio of power assets, combined with our operational expertise and balance sheet strength, we are well positioned to create long-term value for our shareholders by executing on our US strategy and developing an HPC/AI business geared for scale, ” said Ben Gagnon, Chief Executive Officer of Bitfarms.

In addition to increasing its power assets, the acquisition has boosted Bitfarms’ share of the North American energy market from 6% to 80%.

Source link

You may like

From Booze to Barbells: Exercise May Offset Risks of College Partying

Ethereum Foundation shuffles leadership, splits board and management

Bitcoin Price (BTC) Retakes $95K Level After Early U.S. Decline

A New Risk For The Industry?

Justin Sun Bets Big On JUST Token, Sees 100x Potential

Worldcoin price prediction | What’s next for WLD price?

A groundbreaking study from the Cambridge Centre for Alternative Finance (CCAF) claims that the United States now dominates Bitcoin mining, controlling as much as 75.4% of the global hashing power. “The U.S. has solidified its position as the largest global mining hub (75.4% of reported activity),” the CCAF reports, based on a survey of 49 mining firms representing nearly half the Bitcoin network’s hashrate.

This concentration, equating to roughly 600 exahashes per second (EH/s) of the global 796 EH/s, raises a pressing concern: Is Bitcoin mining becoming dangerously centralized in the U.S., and what risks does this pose for the emerging asset’s future?

Howard Lutnick, U.S. Secretary of Commerce and former CEO of Cantor Fitzgerald, recently shared insights into the Trump administration’s vision to position the U.S. as a Bitcoin superpower. “It’s like gold. To me. It’s a commodity,” Lutnick said in an interview with Frank Corva of Bitcoin Magazine, highlighting Bitcoin’s fixed supply of 21 million coins. He outlined plans to “turbocharge” U.S. mining through the Commerce Department’s Investment Accelerator, which streamlines permits for miners to build off-grid power plants. “You can build your own power plant next to [your data center]. I mean, think about that for a second,” he said.

This pro-business stance has fueled America’s mining boom, but the CCAF’s findings suggest a downside: centralization. For years, Bitcoiners worried about China’s dominance, which peaked at 65–75% of global hashrate before its June 2021 mining ban. “In 2019, China dominated global Bitcoin mining, accounting for 65–75% of the total Bitcoin network,” a 2025 Nature Communications study notes. When China banned mining, hashrate dispersed globally, with many operations relocating to the U.S., drawn to states with abundant energy and favorable policies. This shift caused a 50% market correction but paved the way for a 130% rise toward the end of the year, demonstrating the market’s resilience.

While China’s historical hashrate concentration never led to network abuse, it was a constant concern. Now, with the U.S. holding 75% of hashrate, similar risks emerge. The Trump administration is Bitcoin-friendly, but a future administration could turn hostile, leveraging centralized hashrate to control the network. Unlike China’s ban, a future U.S. government might try to regulate or manipulate mining, using executive powers like sanctions to censor transactions — a threat amplified by mining’s concentration.

The U.S.’s federal structure offers a potential safeguard. The division of powers between states and the federal government could enable resistance to federal overreach. In states with significant mining activity, officials and the public might argue that manipulating the industry harms Bitcoin’s value, impacting investors. Such resistance could preserve the network’s integrity.

The weakening of the U.S. monetary sanctions regime might play to our advantage. Following the 2022 seizure of Russian treasuries, nations misaligned with U.S. policy have reduced U.S. bond purchases, undermining the fiat rails abused in sanctions. The Trump administration is shifting toward tariffs to control goods rather than money flows, potentially reducing the threat of monetary censorship. This pivot buys Bitcoin time, as centralized hashrate may be a soft target for federal intervention.

Nevertheless, American Bitcoiners must stay proactive. Deepening Bitcoin adoption to embed it widely in the economy and throughout the world could deter censorship, as attacks on the network would harm personal wealth, spurring backlash. History also shows miners adapt when displaced — China’s ban proved that — but governments learn. A future U.S. administration might not ban mining but seek to control it, exploiting centralization.

The Bitcoin industry faces a critical juncture. With as much as 75.4% of hashrate in the U.S., even low estimates of 50% present a centralization risk that looms large. Should we diversify globally or lean into America’s mining dominance? As Lutnick’s vision unfolds, Bitcoiners must ensure this sovereign money remains resilient, regardless of who holds power.

Source link

austin

The Premier Developer-Centric Bitcoin Event Returns To Austin

Published

2 weeks agoon

April 17, 2025By

admin

Austin, TX – bitcoin++, the premier developer-focused Bitcoin event, returns to Austin from May 7-9, 2025. This highly anticipated conference brings together Bitcoin engineers, researchers, and innovators for an immersive three-day experience of technical workshops, cutting-edge talks, and in-depth discussions on Bitcoin development.

bitcoin++ mempools and mining edition offers an unparalleled opportunity for developers to deepen their expertise, collaborate with industry leaders, and engage with the latest advancements in Bitcoin mining. Whether you’re a seasoned Bitcoin developer or just beginning your journey, this event provides a unique environment to refine your skills and expand your network.

Who is Coming:Leading Bitcoin developers and engineers

● Researchers pushing the boundaries of Bitcoin scalability and security

● Innovators and builders exploring mempool dynamics and mining efficiency

● Enthusiasts looking to deepen their technical knowledge

What to Expect at bitcoin++ mempools and mining edition:

● Technical Workshops – Hands-on sessions led by top Bitcoin developers and engineers.

● Expert-Led Talks – In-depth discussions on the latest Bitcoin research, protocol updates,

and emerging technologies.

● Developer Networking – Connect with like-minded professionals passionate about

building the future of Bitcoin.

● Hacker-Friendly Environment – A collaborative space designed to foster innovation and

experimentation.

Bitcoin++ events have become a cornerstone for technical Bitcoin education, attracting some of the brightest minds in the space. The upcoming Austin edition promises an agenda packed with high-caliber content designed specifically for those who are serious about Bitcoin development.

Registration is now open, with limited spots available. To learn more and secure your ticket, visit https://btcpp.dev/conf/atx25.

For sponsorship inquiries, media requests, or additional information, please contact

[email protected]

About Bitcoin++

Bitcoin++ is a series of developer-first conferences designed to provide hands-on technical education and deep dives into Bitcoin’s evolving ecosystem. Through high-quality programming and interactive experiences, Bitcoin++ empowers developers to contribute meaningfully to the future of Bitcoin.

Bitcoin++ events have become a cornerstone for technical Bitcoin education, attracting some of the brightest minds in the space. The upcoming Austin edition promises an agenda packed with high-caliber content designed specifically for those who are serious about Bitcoin development.

Contact

Source link

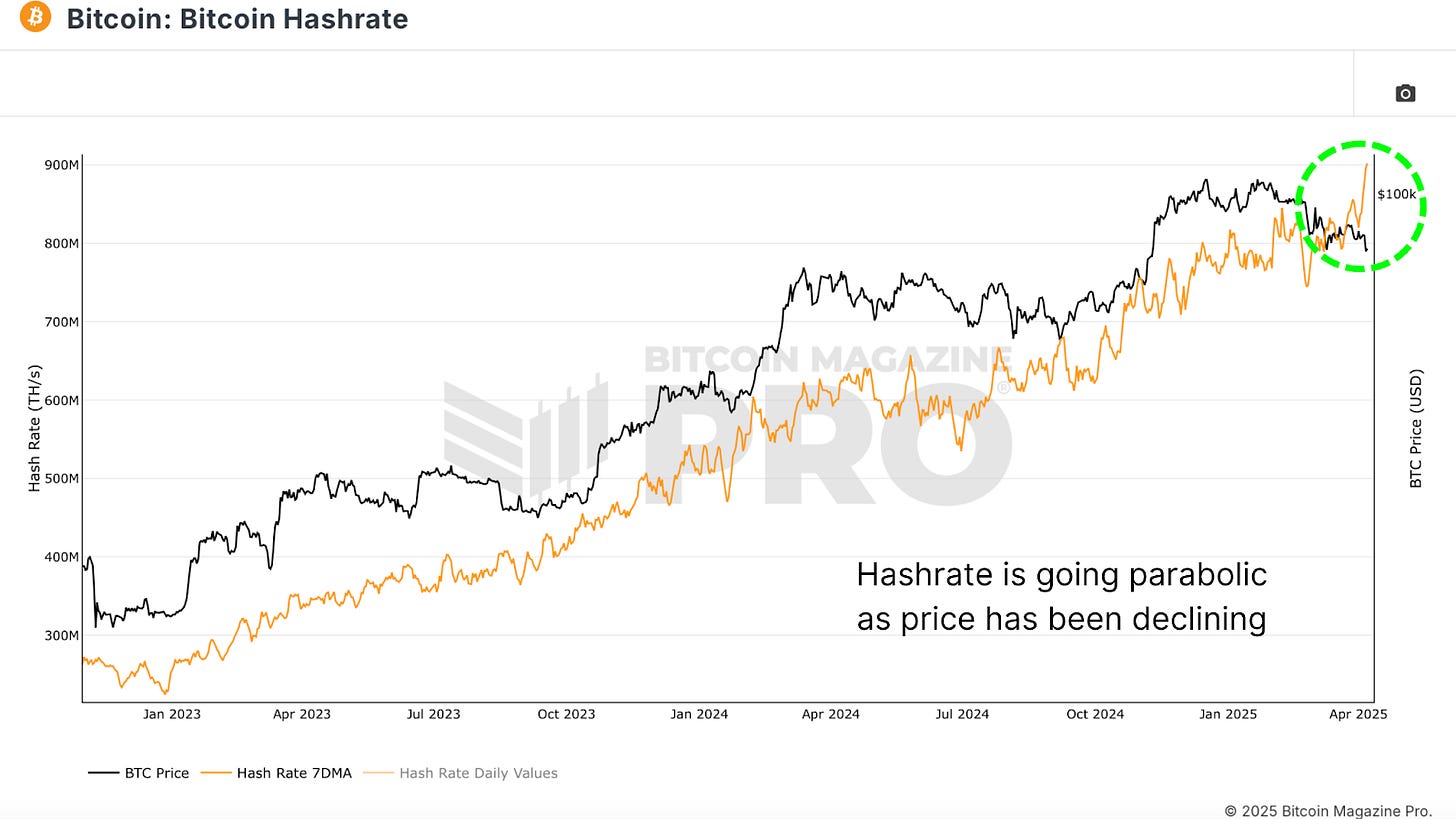

With all the current bearish sentiment and macroeconomic uncertainty swirling around both Bitcoin and the broader global economy, it might come as a surprise to see miners as bullish as ever. In this article, we’ll unpack the data that suggests Bitcoin miners are not just staying the course, they’re accelerating, doubling down at a time when many are pulling back. What exactly do they know that the broader market might be missing?

For a more in-depth look into this topic, check out a recent YouTube video here:

Why Bitcoin Miners Are Doubling Down Right Now

Bitcoin Hash Rate Going Parabolic

Despite Bitcoin’s recent price underperformance, the Bitcoin Hashrate has been going absolutely vertical, breaking all-time highs with seemingly no regard for macro headwinds or sluggish price action. Typically, hash rate is tightly correlated with BTC price; when price drops sharply or remains stagnant, hash rate tends to plateau or decline due to economic pressure on miners.

Yet now, in the face of heightened global tariffs, economic slowdown, and a consolidating BTC price, hash rate is accelerating. Historically, this level of divergence between hash rate and price has been rare and often significant.

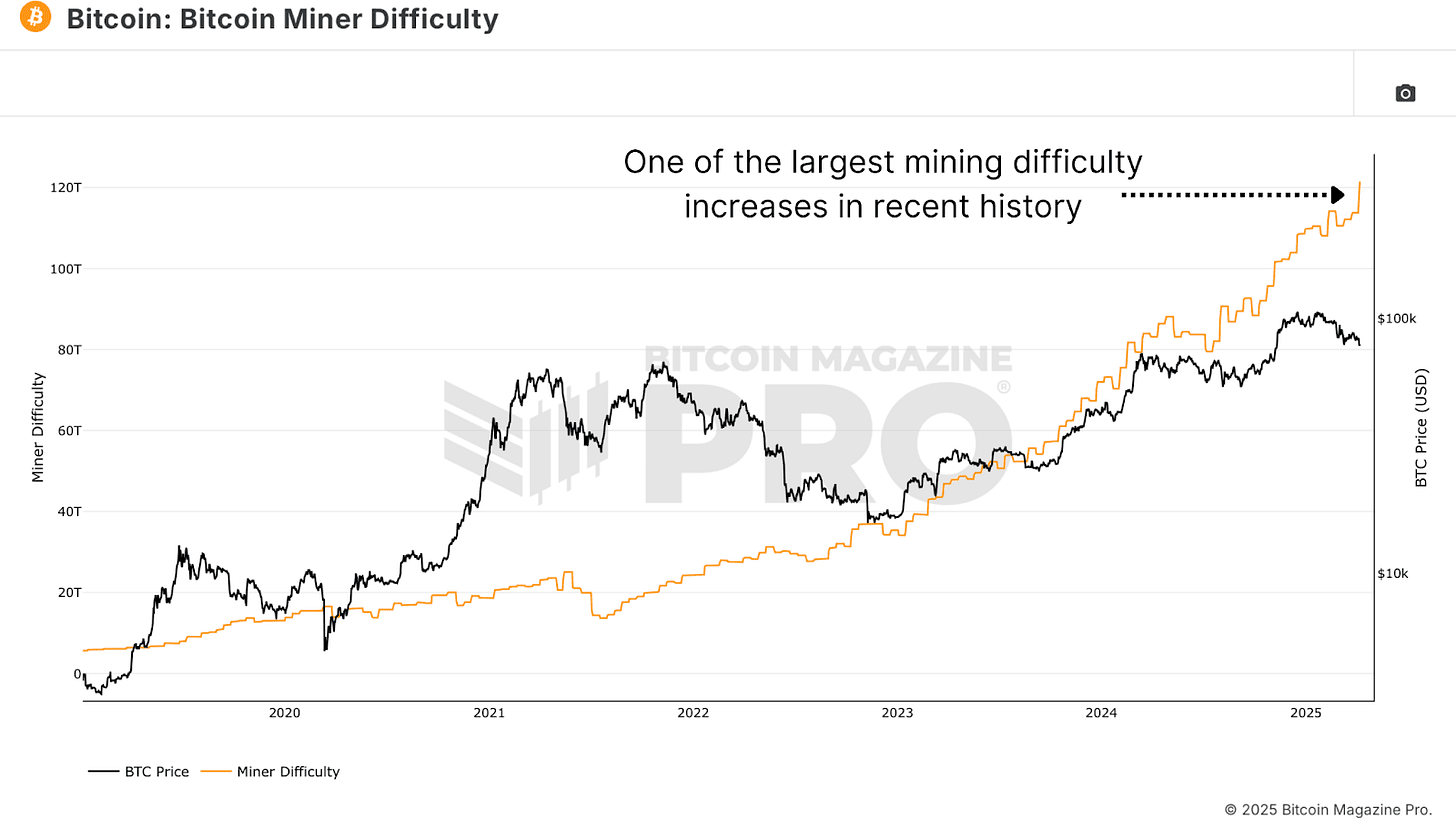

Bitcoin Miner Difficulty, a close cousin to hash rate, just saw one of its largest single adjustments upward in history. This metric, which auto-adjusts to keep Bitcoin’s block timing consistent, only increases when more computational power floods the network. A difficulty spike of this magnitude, especially when paired with poor price performance, is nearly unprecedented.

Again, this suggests that miners are investing heavily in infrastructure and resources, even when BTC price does not appear to support the decision in the short term.

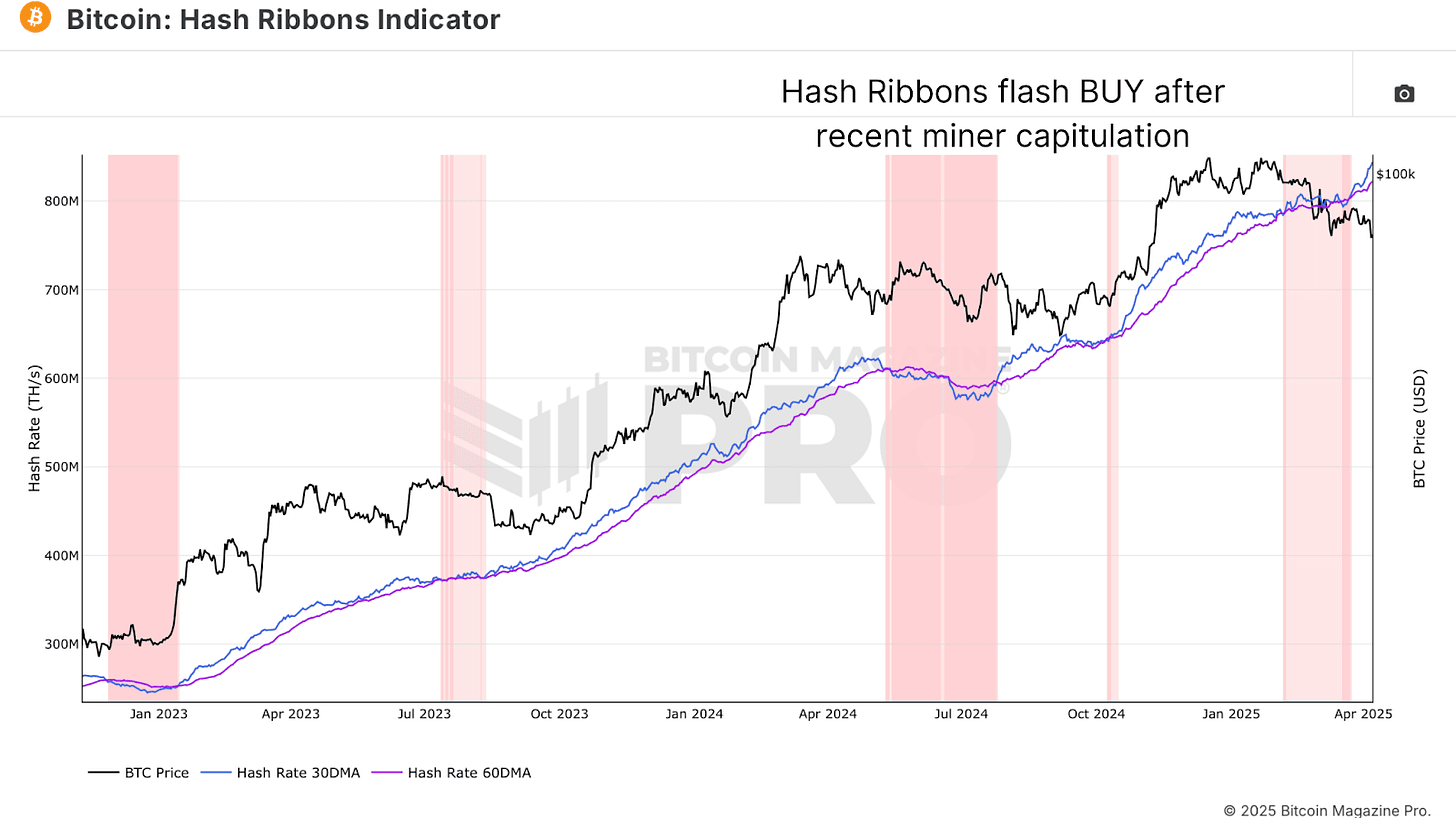

Adding further intrigue, the Hash Ribbons Indicator, a blend of short and long-term hash rate moving averages, recently flashed a classic Bitcoin buy signal.

When the 30-day moving average (blue line) crosses back above the 60-day (purple line), it signals the end of miner capitulation and the beginning of renewed miner strength. Visually, the background of the chart shifts from red to white when this crossover occurs. This has often marked powerful inflection points for BTC price.

What’s striking this time around is how aggressively the 30-day moving average is surging away from the 60-day. This is not just a modest recovery, it’s a statement from miners that they are betting heavily on the future.

The Tariff Factor

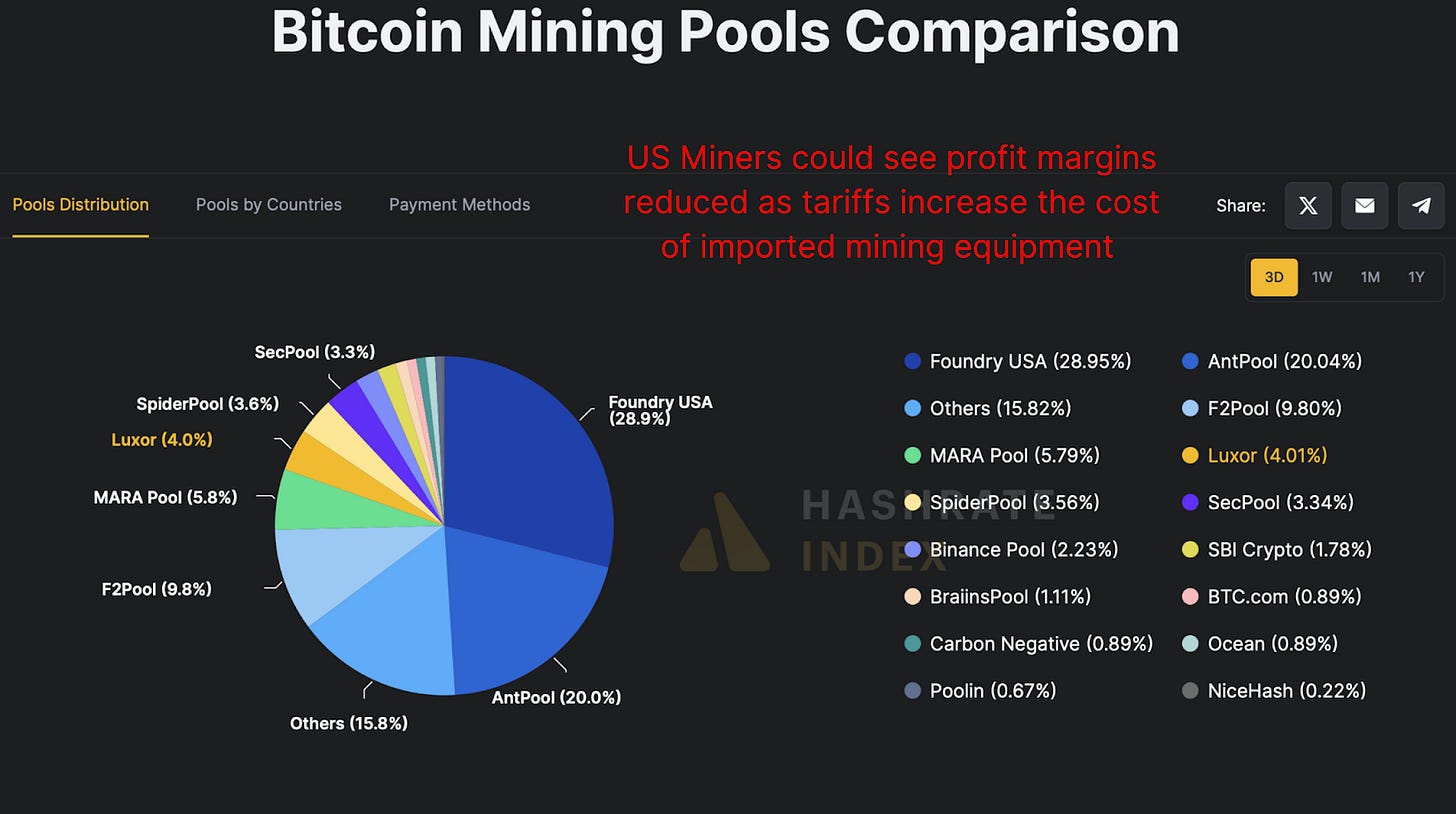

So, what’s fueling this miner frenzy? One plausible explanation is that miners, especially U.S.-based ones, are trying to front-run the impact of looming tariffs. Bitmain, the dominant producer of mining equipment, is now in the crosshairs of trade policies that could see equipment prices surge by 30–50%, potentially to even over 100%!

Given that over 40% of Bitcoin’s hash rate is controlled by U.S.-based pools like Foundry USA, Mara Pool, and Luxor, any cost increase would drastically reduce profit margins. Miners may be aggressively scaling now while hardware is still (relatively) cheap and available.

Bitcoin Miners Keep Mining

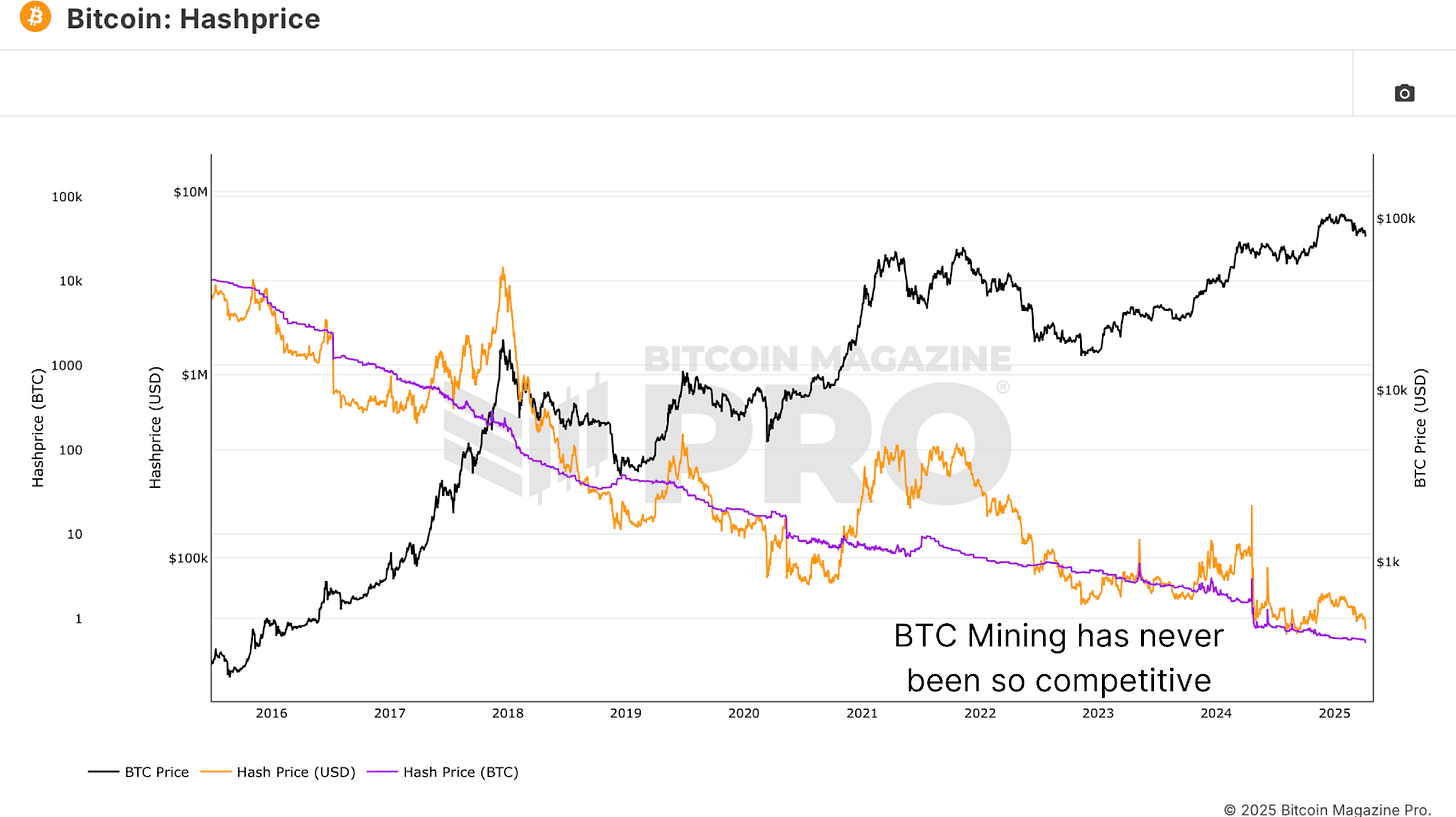

Hashprice, the BTC-denominated revenue per terahash of computational power, is at historical lows. In other words, it’s never been less profitable in BTC terms to operate a Bitcoin miner on a per-terahash basis. Typically, we see hash price increase toward the tail-end of bear markets, as competition fades and weaker players exit the space.

But that’s not happening here. Despite terrible profitability, miners are not only staying online, they’re deploying more hash power. This could imply one of two things; either miners are racing against deteriorating margins to front-load BTC accumulation, or, more optimistically, they have strong conviction in Bitcoin’s future profitability and are buying the dip aggressively.

Bitcoin Miners Conclusion

So, what’s really happening? Either miners are desperately front-running hardware costs, or, more likely, they’re signaling one of the strongest collective votes of confidence in the future of Bitcoin we’ve seen in recent memory. We’ll continue tracking these metrics in future updates to see whether this miner conviction is proven right.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

From Booze to Barbells: Exercise May Offset Risks of College Partying

Ethereum Foundation shuffles leadership, splits board and management

Bitcoin Price (BTC) Retakes $95K Level After Early U.S. Decline

A New Risk For The Industry?

Justin Sun Bets Big On JUST Token, Sees 100x Potential

Worldcoin price prediction | What’s next for WLD price?

Bitcoin Is About To Begin Outperforming Gold, Says InvestAnswers – Here’s His Timeline

Bloomberg Analyst Confirms No Set Launch Date for ProShares XRP ETFs

What is Base? The Ethereum Layer-2 Network Launched by Coinbase

Loopscale hacker in talks to return stolen crypto

Bitcoin (BTC) Yield Platform Coming From Coinbase (COIN), Aspen Digital

The Emerging Market For State Services Via Citizen X

XRP Price Shoots For 20% Surge To $2.51 Amid Pullback To Breakout Zone

Stocks edge higher ahead of big earnings week

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Bitcoin6 months ago

Bitcoin6 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals