Bitwise

Bitwise CEO predicts Trump administration to boost crypto mergers

Published

2 months agoon

By

admin

Hunter Horsley links corporate power consolidation to crypto demand.

The CEO of Bitwise Asset Management, Hunter Horsley, has suggested that the economic policies of the Trump administration could have a major impact on the cryptocurrency sector.

In a recent tweet, Horsley noted that the potential deregulation of mergers and acquisitions could allow major companies like Google or Amazon to expand even further through strategic acquisitions. M&As refer to the consolidation of companies, either through the merging of businesses or the purchase of one company by another. This process often helps corporations achieve economies of scale, expand market share, or acquire critical assets.

Trump administration may unfreeze M&A.

Large corporates — mag 7, etc — may finally be able to wield their market cap. Amazon could buy Instacart. Google could buy Uber. etc etc

The big may get bigger, and the middle may shrink.

If that happens, I think it will accelerate…

— Hunter Horsley (@HHorsley) January 5, 2025

Horsley argued that this concentration of power could drive the adoption of decentralized systems, aligning with the core tenet of cryptocurrency: the skepticism toward centralized organizations. He believes that as large corporations gain more control, the demand for cryptocurrencies—designed to offer an alternative to such institutions—could grow.

Corporate behemoths like Google and Amazon are becoming increasingly interested in blockchain technology and digital assets as they look for ways to enter the crypto markets. One example of a blockchain-related service that Amazon Web Services has introduced is Amazon Managed Blockchain, which enables companies to create and oversee scalable blockchain networks. With this action, Amazon establishes itself as a major force in the expanding enterprise blockchain market.

By establishing strategic alliances with prominent blockchain initiatives and participating in campaigns to incorporate blockchain technology into its cloud infrastructure, Google has also increased its presence in the cryptocurrency sector. Blockchain-as-a-service is now available on Google Cloud, allowing companies to create and implement decentralized apps.

These initiatives demonstrate how major companies are using blockchain technology to diversify their business models while leveraging traditional M&As to expand their reach, thereby further driving the adoption of decentralized systems.

Horsley’s statement comes amid a major rebound in the cryptocurrency market, following Donald Trump’s recent re-election. Trump’s victory has been welcomed by many in the cryptocurrency industry, given his pro-business stance and policies that are seen as supportive of digital assets and blockchain technology. These policies have fueled a bullish trend in the market, with experts attributing much of the surge to a more favorable regulatory approach under Trump’s administration.

Since Trump’s election win, the cryptocurrency market has seen notable growth, with the biggest example being Bitcoin which surged from approximately $69,000 on Nov. 8, 2024, to over $100,000 in early December.

This increase has been largely driven by political shifts and the anticipation of loosened regulations, which experts believe will create a more conducive environment for digital assets.

Experts also believe this rise is driven by the political shift and the potential loosening of regulations, which may create a more favorable environment for digital assets.

Horsley is the CEO of Bitwise, an investment firm that has exclusively focused on cryptocurrency investments for the past seven years. The company offers a range of products including crypto-focused funds, ETFs, and others, designed to provide investors exposure to the crypto and Web3 markets.

According to Horsley, the influence of major market players—along with regulatory changes—could shape the future of both digital assets and traditional financial systems in 2025, making this an exciting time for both M&A activity and the cryptocurrency sector.

Source link

You may like

Analyst Says Crypto Whales Loading Up on Ethereum, Accumulating $815,514,345 in ETH in Just Five Days

Bitcoin landfill man loses appeal, says he has one ‘last legal option’

Filmmakers Bet on Web3 to Fix Hollywood Film Financing

Mr. Wonderful says the crypto cowboy era is over. Really?

TON Token Surges 20% as Telegram Founder Recovers Passport From French Authorities

Can Bitcoin Reach $100K After the Upcoming US Fed Decision?

Bitcoin

Why Bitcoin Wins No Matter The Outcome Of Trump’s Trade War

Published

1 month agoon

February 5, 2025By

admin

In an escalation of global economic friction, President Trump’s imposed tariffs have roiled financial markets this week, cutting across both equities, Bitcoin and cryptocurrencies. Yet a new memo from Bitwise Asset Management suggests that these headwinds might ultimately propel Bitcoin to new heights—regardless of whether Trump’s strategy succeeds or fails.

At the beginning of the week, the crypto market witnessed a severe sell-off. Bitcoin declined by about 5%, while Ethereum and XRP suffered even sharper losses—17% and 18%, respectively. The immediate catalyst was Trump’s imposition of a 25% tariff on most imports from Canada and Mexico, as well as a 10% tariff on China. In retaliation, those trading partners announced countermeasures of their own.

Related Reading

The US dollar reacted by jumping more than 1% against major currencies. That, combined with lingering weekend illiquidity in crypto markets, triggered a wave of forced liquidations as leveraged traders sold into the downdraft. According to Bitwise Chief Investment Officer Matt Hougan, as much as $10 billion in leveraged positions was wiped out in what he described as “the largest liquidation event in crypto’s history.”

Despite the dramatic price action, Bitwise’s Head of Alpha Strategies, Jeffrey Park, remains optimistic about Bitcoin’s trajectory. He points to two guiding ideas that shape his bullish thesis: the ‘Triffin Dilemma’ and President Trump’s broader aim to restructure America’s trade dynamics.

The Triffin Dilemma highlights the conflict between a currency serving as a global reserve—generating consistent demand and overvaluation—and the need to run persistent trade deficits to supply enough currency abroad. While this status allows the US to borrow cheaply, it also puts sustained pressure on domestic manufacturing and exports.

“Trump wants to get rid of the negatives, but keep the positives,” Park explains, suggesting that tariffs may be a negotiating tool to compel other nations to the table—reminiscent of the 1985 Plaza Accord, which devalued the dollar in coordination with other major economies.

The Two Scenarios: Bitcoin Wins, Fiat Loses

Park argues that Bitcoin stands to benefit under two distinct outcomes of Trump’s current trade policy:

Scenario 1: Trump Succeeds in Weakening the Dollar (While Keeping Rates Low)

If Trump can maneuver a multilateral agreement—akin to a ‘Plaza Accord 2.0’—to reduce the dollar’s overvaluation without boosting long-term interest rates, risk appetite among US investors could surge. In this environment, a non-sovereign asset like Bitcoin, free from capital controls and dilution, would likely attract additional inflows. Meanwhile, other nations grappling with the fallout of a weaker dollar might deploy fiscal and monetary stimulus to support their economies, potentially driving even more capital toward alternative assets like Bitcoin.

Related Reading

“If Trump can bully his way into the position, there’s no asset better positioned than bitcoin. Lower rates will spark the risk appetite of US investors, sending prices high. Abroad, countries will face weakened economies, and will turn to classic economic stimulus to compensate, leading again to higher bitcoin prices,” Park argues.

Scenario 2: A Prolonged Trade War And Massive Money Printing

If Trump fails to secure a broad-based deal and the trade war grinds on, global economic weakness would almost certainly invite extensive monetary stimulus from central banks. Historically, such large-scale liquidity injections have been bullish for Bitcoin, as investors seek deflationary and decentralized assets insulated from central bank policies

“And what if he fails? What if, instead, we get a sustained tariff war? Our high-conviction view is the resulting economic weakness will lead to money printing on a scale larger than we’ve ever seen. And historically, such stimulus has been extraordinarily good for bitcoin,” Park says..

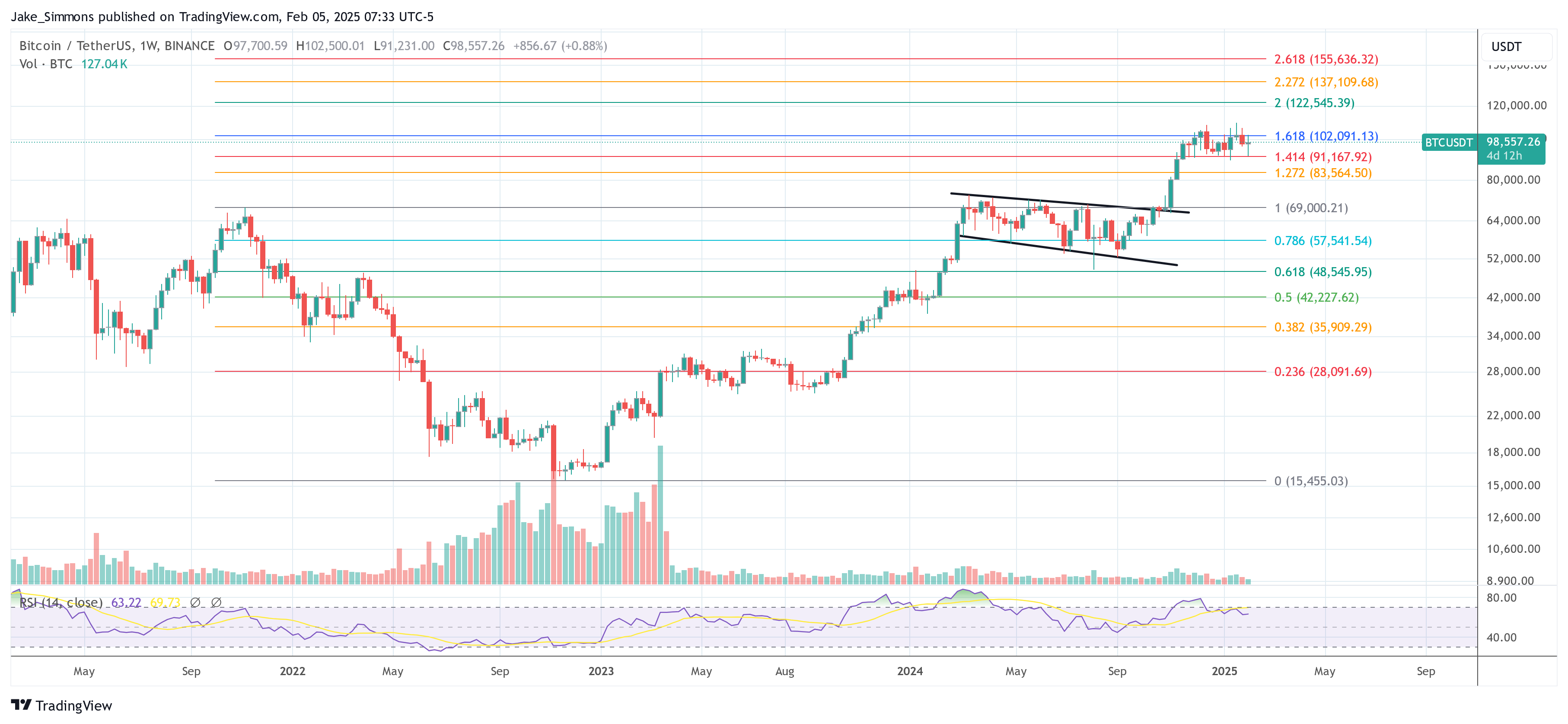

At press time, BTC traded at $98,557.

Featured image created with DALL.E, chart from TradingView.com

Source link

Bitcoin

Bitwise Predicts ‘Violent’ Surge Amid Trump’s Tariffs

Published

1 month agoon

February 3, 2025By

admin

The Bitcoin price sank by more than 13.5% over the weekend, dropping as low as $91,201 on Binance. The sell-off followed US President Donald Trump’s announcement of new trade tariffs. The administration levied a 25% tariff on most imports from Canada and Mexico, added a 10% tax on Chinese goods, and imposed a 10% tariff on Canadian energy resources.

While market observers typically view such aggressive moves as a negative for risk assets, one prominent voice at Bitwise Invest sees a wildly different scenario, predicting that these tariffs could fuel a “violent” long-term rally in Bitcoin.

Why Tariffs May Supercharge Bitcoin

Jeff Park, Head of Alpha Strategies at Bitwise Invest, argues that these tariffs cannot be understood simply as a response to trade imbalances but should be viewed against the broader backdrop of the so-called Triffin dilemma. In Park’s words, “The US wants to keep its ability to borrow cheaply, but rid its structural overvaluation and constant trade deficits—enter tariffs.”

Related Reading

He suggests that, by using tariffs as a bargaining chip, the White House is looking to create a new multi-lateral agreement—akin to a “Plaza Accord 2.0”—aimed at weakening the US dollar. This would potentially oblige foreign governments to reduce their US dollar reserves or to hold longer-duration Treasuries, thereby keeping yields low without officially enacting yield curve control.

Park also ties this strategy to the president’s personal incentives. He believes Trump’s “#1 goal” is to drive down the 10-year Treasury yield, in part because cheaper long-term financing would benefit real estate markets. According to Park, such a push for lower yields dovetails with a deliberate move to weaken the dollar—two conditions that, in his view, create a perfect environment for Bitcoin to flourish.

“The asset to own therefore is Bitcoin. In a world of weaker dollar and weaker US rates, something broken pundits will tell you is impossible (because they can’t model statecraft), risk assets in the US will fly through the roof beyond your wildest imagination, for it is likely a giant tax cut will have to accompany the higher costs borne by the loss of comparative advantage,” Park writes.

His thesis is that the “online and onchain” nature of today’s economy will funnel frustrated citizens across the globe toward alternative stores of value—namely Bitcoin. He believes both sides of any prolonged tariff war will discover that BTC offers a refuge from the fallout, leading to what he describes as a much higher price trajectory.

Related Reading

“So while both sides of the trade imbalance equation will want Bitcoin for two different reasons, the end result is the same: higher, violently faster—for we are at war. TLDR: You simply have not yet grasped how amazing a sustained tariff war is going to be for Bitcoin in the long run,” Park claims.

Tariffs As A Risk Asset Drag

Not all analysts share Park’s optimism. Alex Krüger, an economist and trader from Argentina, disagrees with the notion that tariffs of this magnitude inherently favor Bitcoin. He warned that “Bitcoin is mainly a risk asset.”

He added: Tariffs this aggressive are very negative for risk assets. And the economy will take a hit. The tariffs announced are considerably worse than what was expected by the market, as gradual tariffs or delayed implementation were seen as alternatives. So the S&P futures will open deeply in the red tonight and flush.”

In Krüger’s view, Bitcoin remains a high-beta asset often correlated with equity markets. When a major macro shock—like a sudden hike in tariffs—hits, investors typically rotate into safe havens rather than riskier holdings such as stocks or cryptocurrencies. He pointed out that the sell-off in crypto over the weekend might be explained by the market reacting to an “unexpectedly harsh” tariff announcement.

“The hope for crypto is that it has already dropped a lot in anticipation,” Krüger observed, hinting that digital assets may find a local bottom if the initial shock has been fully absorbed. However, he emphasized the persistent uncertainty ahead, including the possibility of retaliation by targeted nations. A swift resolution to the trade dispute could trigger a bounce, whereas an escalation could deepen market jitters.

Krüger also cautioned that the Federal Reserve might turn hawkish if tariffs stoke inflation—an outcome that rarely bodes well for high-growth or risk-prone assets. Still, he hasn’t ruled out fresh all-time highs in equities later this year:

“I still don’t think the cycle top is in, and expect equity indices to print ATHs later in the year. But the probability of being wrong has increased. Particularly on the latter. As I said a week ago, I’ve taken my long-term hat off. This is a traders’ market.”

At press time, BTC traded at $94,000.

Featured image created with DALL.E, chart from TradingView.com

Source link

Bitcoin

Will Trump’s Executive Order Break Bitcoin’s Four-Year Market Cycle?

Published

1 month agoon

January 31, 2025By

admin

The Bitcoin market has long been defined by its seemingly immutable four-year cycle, a pattern of three years of surging prices followed by a sharp correction. However, a seismic shift in policy from Washington, led by former President Donald Trump, may shatter this cycle and usher in a new era of prolonged growth for the cryptocurrency industry.

Matt Hougan, Chief Investment Officer at Bitwise Asset Management, recently posed an intriguing question: Can Trump’s Executive Order break crypto’s four-year cycle? His answer, though nuanced, leans towards an emphatic yes.

The Four-Year Cycle: A Recap

Hougan clarifies his personal belief that the four-year Bitcoin market cycle is not driven by Bitcoin’s halving events. He states, “People try to link it to bitcoin’s quadrennial ‘halving,’ but those halvings are misaligned with the cycle, having occurred in 2016, 2020, and 2024.”

Bitcoin’s four-year cycle has been historically driven by a mix of investor sentiment, technological breakthroughs, and market dynamics. Typically, a bull run emerges following a significant catalyst—be it infrastructure improvements or institutional adoption—which attracts new capital and fuels speculation. Over time, leverage accumulates, excesses emerge, and a major event—such as regulatory crackdowns or financial fraud—triggers a brutal correction.

This pattern has played out repeatedly: from the early days of Mt. Gox’s implosion in 2014 to the ICO boom and bust of 2017-2018, and most recently, the deleveraging crisis of 2022 with the collapse of FTX and Three Arrows Capital. Yet, every winter has been followed by an even stronger resurgence, culminating in Bitcoin’s latest bull run spurred by the mainstream adoption of Bitcoin ETFs in 2024.

Related: Nasdaq Proposes In-Kind Redemptions for BlackRock’s Bitcoin ETF

The Executive Order: A Game Changer

The fundamental question Hougan explores is whether Trump’s recent Executive Order, which prioritizes the development of the digital asset ecosystem in the U.S., will disrupt the established cycle. The order, which outlines a clear regulatory framework and even envisions a national digital asset stockpile, represents the most bullish stance on Bitcoin from any sitting or former U.S. president.

The implications are profound:

- Regulatory Clarity: By eliminating legal uncertainty, the EO paves the way for institutional capital to flow into Bitcoin at an unprecedented scale.

- Wall Street Integration: With the SEC and financial regulators now pro-crypto, major banks can enter the space, offering Bitcoin custody, lending, and structured products to their clients.

- Government Adoption: The concept of a national digital asset stockpile hints at a future where the U.S. Treasury could hold Bitcoin as a reserve asset, solidifying its status as digital gold.

These developments will not play out overnight, but their cumulative effect could fundamentally alter Bitcoin’s market dynamics. Unlike previous cycles that were driven by speculative retail euphoria, this shift is underpinned by institutional adoption and regulatory endorsement—a far more stable foundation.

Related: Why Hundreds of Companies Will Buy Bitcoin in 2025

The End of Crypto Winters?

If history were to repeat itself, Bitcoin would continue its ascent through 2025 before facing a significant pullback in 2026. However, Hougan suggests this time may be different. While he acknowledges the risk of speculative excess and leverage-driven bubbles, he argues that the sheer scale of institutional adoption will prevent the kind of prolonged bear markets seen in the past.

This is a crucial distinction. In previous cycles, Bitcoin lacked a strong base of value-oriented investors. Today, with ETFs making it easier for pensions, hedge funds, and sovereign wealth funds to allocate to Bitcoin, the asset is no longer solely dependent on retail enthusiasm. The result? Corrections may still occur, but they will likely be shallower and shorter-lived.

What Comes Next?

Bitcoin has already crossed the $100,000 mark, and projections from industry leaders, including BlackRock CEO Larry Fink, suggest it could reach $700,000 in the coming years. If Trump’s policies accelerate institutional adoption, the typical four-year pattern could be replaced by a more traditional asset-class growth trajectory—akin to how gold responded to the end of the gold standard in the 1970s.

Related: BlackRock CEO Larry Fink Forecasts $700K Bitcoin Price Amid Inflation Worries

While risks remain—including unforeseen regulatory reversals and excessive leverage—the direction of travel is clear: Bitcoin is becoming a mainstream financial asset. If the four-year cycle was driven by Bitcoin’s infancy and speculative nature, its maturation may render such cycles obsolete.

Conclusion

For over a decade, investors have used the four-year cycle as a roadmap for Bitcoin’s market movements. But Trump’s Executive Order could be the defining moment that disrupts this pattern, replacing it with a more sustained and institutionally-driven growth phase. As Wall Street, corporations, and even governments increasingly embrace Bitcoin, the question is no longer if crypto winter will come in 2026—but rather if it will come at all.

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Readers are encouraged to conduct thorough independent research before making investment decisions.

Source link

Analyst Says Crypto Whales Loading Up on Ethereum, Accumulating $815,514,345 in ETH in Just Five Days

Bitcoin landfill man loses appeal, says he has one ‘last legal option’

Filmmakers Bet on Web3 to Fix Hollywood Film Financing

Mr. Wonderful says the crypto cowboy era is over. Really?

TON Token Surges 20% as Telegram Founder Recovers Passport From French Authorities

Can Bitcoin Reach $100K After the Upcoming US Fed Decision?

XRP Must Close Above This Level For Bullish Breakout: Analyst

Bitcoin reclaims $80K zone as BNB, TON, GT, ATOM hint at altcoin season

Stock Market To Witness Rallies in Next One to Two Weeks, Predicts Wall Street’s Cantor Fitzgerald – Here’s Why

Cryptocurrencies to watch this week: Binance Coin, Cronos, ZetaChain

What is Milady? The Edgy Ethereum NFT Community With Vitalik Buterin’s Support

Can Pi Network Price Triple if Binance Listing is Approved Before March 2025 Ends?

Gold ETFs Inflow Takes Over BTC ETFs Amid Historic Rally

Toncoin in ‘great entry zone’ as Pavel Durov’s France exit fuels TON price rally

XRP $15 Breakout? Not A Far-Fetched Idea—Analysis

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x