Binance

BMT crypto soars nearly 30% a day after Binance listing

Published

2 days agoon

By

admin

Bubblemaps’ token, BMT crypto, has gone up by nearly 30% following its debut on Binance. Just a day prior, the token reached a new all-time high.

According to data from CoinGecko, the BubbleMaps token has gone up by 28.8% only a day after it was listed on Binance. Less than 24 hours ago, the token reached new heights when it bounded up by nearly 45% to a new all-time high of $0.3173.

At press time, the token is trading hands at $0.24 with a market cap of $62 million. Meanwhile, BMT crypto’s fully diluted valuation stands at $242 million.

According to the official announcement, Binance listed BMT crypto on its platform on March 18 at 15:00 UTC and opened trading for BMT paired with major tokens including USDT (USDT), USDC (USDC), BNB (BNB), FDUSD (FDUSD), and TRY. However, the crypto exchange warned users that it will applying the seed tag, considering the token is still fairly new to the market.

Despite having just listed on the crypto exchange yesterday, Binance has already claimed the top spot on Bubblemaps’ trading markets, contributing the largest share of the token’s trading volume at 23.47%. In the past 24 hours, as much as $131 million worth of BMT crypto has been processed on Binance.

In fact, Bubblemaps trading volume skyrocketed by 442.8% to a total of $562 million in the past 24 hours. This means that the token has experienced a significant rise in market activity since its Binance listing.

Launched on March 11, BMT is the native token for Bubblemaps. Bubblemaps is an on-chain analytics platform that provides users with blockchain data visualization for token analytics and NFT owenrship. BMT serves as its governance utility token, granting holders access to advanced analytical features on the platform.

During Bubblemaps’ token generation event for BMT, it received an overwhelming number of subscriptions, around 202,990 BNB, which is13,500% more than the project’s initial target.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

You may like

Pakistan Plans To Legalise Bitcoin And Crypto

‘This Is a Good Sign’: Crypto Analyst Says Bitcoin at a Key Inflection Point, Unveils Breakout Targets for BTC

Meteora shares two proposals on MET token allocation

Trump Aides Look To Reform USAID With Blockchain For ‘Transparency’: Report

Ethereum Price Eyes 50% Drop Amid Heavy ETH Whale Profit Booking

Polymarket is Over 90% Accurate in Predicting World Events: Research

Binance

Binance adds a new EUR market tier to its fiat liquidity provider program

Published

1 day agoon

March 20, 2025By

admin

Binance has updated its fiat trading market maker program by adding a new EUR market tier with a 1% minimum maker volume percentage.

According to a recent notice, the crypto exchange platform has introduced a second tier to its EUR markets in Binance’s Fiat Liquidity Provider Program. The EUR market will have two trading tiers instead of one starting from March 24, 2025 at 00:00 UTC.

The first tier will require Binance users to meet a weekly maker volume percentage of 0.5%. Meanwhile, the second tier will require users to meet a maker volume of 1%.

The maker volume percentage is the percentage of a user’s weekly trading volume of maker orders in a specific fiat market compared to the total maker trading volume in that market across the platform. This metric determines eligibility for various tiers within the program, each offering different fee rebates.

Based on the notice, liquidity providers will be reviewed on a weekly basis in accordance with the new program mechanism.

In addition to the new tier, the platform will also update its maker fee rebate rate for EUR markets. EUR tier 1 users will receive a maker fee rebate of -0.005%, while EUR tier 2 users will be subjected to a maker fee rebate of -0.010%.

Similar to the liquidity providers, maker fee rebates will be updated weekly, starting from April 1, 2025 at 00:00 UTC. Maker fee rebates will be distributed to liquidity providers based on spot trading performance during the previous week across the selected fiat markets.

With the new update, the EUR markets becomes the sixth fiat currency to receive a second trading tier. The other fiat markets with two tiers include BRL, ARS, MXN, COP, and JPY.

Earlier today, the Australian authorities have warned crypto traders of an ongoing fraud tactic where scammers would impersonate Binance representatives and contact victims with fake warnings, such as claims that their Binance accounts have been breached.

Source link

Binance

Binance’s USDT pair with Turkish lira sees largest amplitude since 2024 after key Erdogan rival detained

Published

1 day agoon

March 20, 2025By

admin

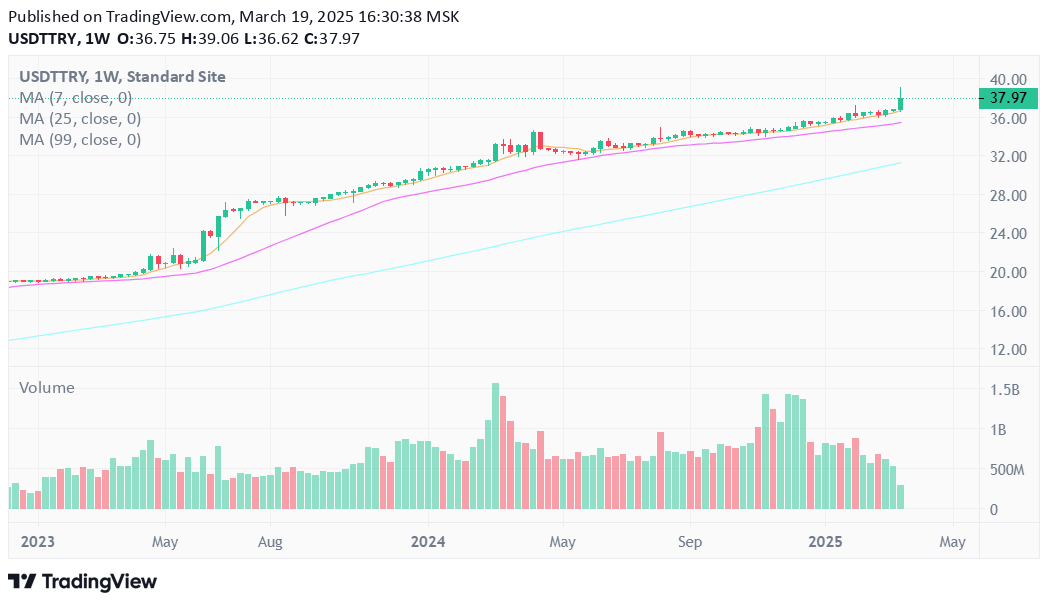

Binance’s USDT/TRY trading pair saw its highest volatility since April 2024 after Istanbul Mayor Ekrem Imamoglu, a key rival to President Tayyip Erdogan, was arrested.

Turkey’s arrest of Istanbul Mayor Ekrem İmamoğlu, a key political figure, and potential 2028 presidential candidate, sent shockwaves through the country’s markets — sparking a sharp drop in the lira and a rush into crypto.

Shortly after the news broke, the lira took a quick nosedive, hitting a new all-time low in one of its worst intraday moves ever. Binance‘s USDT/TRY trading pair also saw wild price swings, spiking 6.4% in volatilityl what appears to be the highest volatility level since April 2024.

BtcTurk and Paribu, two of Turkey‘s biggest crypto exchanges, also saw an influx of activity, with daily volumes jumping 23.4% and 18.8%, respectively, per CoinGecko data, as a lot of traders seemingly rushed to hedge against the lira’s instability, a trend that’s played out before during economic uncertainty in Turkey.

Meanwhile, Borsa Istanbul, the sole exchange entity of Turkey, got hammered. The BIST 100 index dropped nearly 6%, its worst day since 2023, while the banking sub-index plunged almost 10%, forcing a temporary trading halt.

Turkish central bank offloads billions to save lira

In response to the lira’s rapid depreciation, Turkish authorities intervened in the foreign exchange market. Bankers reportedly estimate that the central bank may have sold between $5 billion and $10 billion in FX reserves to stabilize the currency. Such interventions, while potentially calming short-term volatility, raise concerns about the sustainability of Turkey’s foreign reserves.

On Wednesday morning, March 19, Turkish authorities arrested İmamoğlu on allegations of terrorism links, a move the opposition Republican People’s Party decried as a “coup attempt.” İmamoğlu was poised to become the party’s presidential candidate in the upcoming president elections in 2028, making his arrest particularly consequential.

The state-run Anadolu Agency reported that prosecutors issued warrants for Istanbul Mayor Ekrem İmamoğlu and around 100 others, including his close aide Murat Ongun. Authorities also sealed off several roads in Istanbul and imposed a four-day ban on demonstrations, seemingly to deter protests.

In a statement to Reuters, Emma Sinclair-Webb, the Turkey director for Human Rights Watch, called the arrest a “blatant misuse of the justice system” and part of a “pattern of politically driven investigations” meant to weaken the opposition.

Social networks face outages

Following the arrest, users across Turkey reportedly experienced widespread access issues on major social media platforms, including X, Instagram, YouTube, and TikTok.

Confirmed: Live metrics show #Turkey has restricted access to multiple social media platforms including X, YouTube, Instagram and TikTok; the incident comes as Istanbul mayor Ekrem Imamoglu and dozens of others are detained in events described by the opposition as a “coup” pic.twitter.com/5ldegqQCH3

— NetBlocks (@netblocks) March 19, 2025

Later on, NetBlocks, a watchdog organization that monitors cybersecurity and the governance of the Internet, confirmed in an X post that Turkey restricted access to multiple social media platforms.

Shortly after the news broke, the Turkish lira experienced a sharp decline, plummeting to an all-time low of 42 to the U.S. dollar, registering a staggering 12.7% drop.

International reactions to İmamoğlu’s detention came quickly. Germany’s government reportedly described the move as a “serious setback for democracy” in Turkey, with Foreign Ministry spokesperson Sebastian Fischer stating that the arrest was part of a broader pattern of “intensified legal measures to put pressure” on İmamoğlu, Deutsche Welle reports.

The central bank recently made a step toward more traditional monetary policies, which many saw as a good way to help stabilize the economy and bring in foreign investment. But now, with all the political unpredictability going on, there seems to be a real concern that these efforts might fall apart, potentially making it harder to attract the foreign capital Turkey desperately needs for its economic recovery.

Source link

24/7 Cryptocurrency News

MUBARAK Coin Price Soars 22% Amid This Binance Announcement, What’s Next?

Published

4 days agoon

March 17, 2025By

admin

MUBARAK coin emerged as the latest hot buzz of the crypto sector, securing a prominent mark on traders’ and investors’ radars amid Binance founder CZ’s involvement in the meme coin. CZ recently hinted that he is Mubarak, a shilling cryptic move that sent shockwaves across the meme crypto industry. Now, with the crypto exchange titan itself revealing plans to launch a perpetual contract for the token, market sentiments over the crypto’s price prospects have turned highly bullish.

Notably, MUBARAK price is currently up 22% intraday in the wake of Changpeng Zhao spotlighting the token, further escorted by the CEX’s futures listing.

Mubarak Coin Gains Traction As It Secures Binance Listing

According to an official announcement dated March 17, Binance futures is launching a MUBARAKUSDT perpetual contract today at 13:30 UTC. The platform’s colossal user base remains primed to enjoy up to 25x leverage trading the new token.

This announcement by one of the top crypto exchanges ignited optimistic waves, paving the way for further investor interaction with the new asset. As market participants look to capitalize on emerging opportunities, a gush of money inflow into this meme token remains anticipated.

In turn, bullish market sentiments about MUBARAK coin’s price prevail across the broader market.

Is Binance’s CZ Mubarak?

CoinMarketCap’s data about this new token reveals that “CZ just subtly acknowledged that he’s Mubarak,” a cryptic move that sparked market discussions globally. On the other hand, a recent CoinGape report spotlights that CZ also bought $600 worth of the new meme coin, sparking a market frenzy.

When coupled with Binance’s futures listing, these developments add an extra layer of market optimism to the new token.

What’s More In The Listing Announcement?

Apart from enhanced trading support for MUBARAK coin, the crypto exchange behemoth unveiled Bubblemap’s (BMTUSDT) perpetual contract with up to 25x leverage. This announcement triggered 43% gains in the asset, reaching $0.1289, as indicated by the intraday trading chart.

MUBARAK Price Surges Over 20%

As of press time, MUBARAK price witnessed a 22% pump and exchanged hands at $0.09902. Notably, the coin hit an intraday peak of $0.1458, which was in sync with Binance’s announcement. Further, traders reacted positively to the abovementioned developments, as signaled by a 120% increase in the asset’s intraday trading volume to $165.45 million.

More Support From Binance?

Simultaneously, it’s noteworthy that in a previous announcement on Binance Alpha, the crypto exchange revealed support for the Mubarak coin. Binance Alpha is a platform featuring tokens that can be potentially considered for listings on the exchange moving ahead.

Overall, traders and investors anticipate potential gains in this newly launched token amid rising market demand and interest.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

1.5M Holders, 10M Blocks on Shibarium

Pakistan Plans To Legalise Bitcoin And Crypto

‘This Is a Good Sign’: Crypto Analyst Says Bitcoin at a Key Inflection Point, Unveils Breakout Targets for BTC

Meteora shares two proposals on MET token allocation

Trump Aides Look To Reform USAID With Blockchain For ‘Transparency’: Report

Ethereum Price Eyes 50% Drop Amid Heavy ETH Whale Profit Booking

Polymarket is Over 90% Accurate in Predicting World Events: Research

Bad news Bitcoin bulls, the long-hoped-for retail is already here: CryptoQuant

Top 6 Important Fed Decisions To Know After SEC Drops Ripple Lawsuit Appeal

Leaders In Adoption And Innovation

Trader Issues Urgent XRP Alert, Says the Top-Five Altcoin at Risk of Sharp Correction – Here’s His Target

This coin could see a $10b market cap and double-digit price before SHIB gains its 2021 mojo

Can a Meme Coin Fund the Future of Scientific Research?

Analyst Confirms XRP Price Is Still On Path To $130

Proof-of-Work Crypto Mining Doesn’t Trigger Securities Laws, SEC Says

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: