Bitcoin

Brian Armstrong Says Crypto To Usher In New Phase of Capitalism and Economic Freedom

Published

2 months agoon

By

admin

Coinbase founder and CEO Brian Armstrong believes that crypto is paramount to unleashing a new wave of economic freedom across the globe.

In a long thread on the social media platform X, Armstrong says global economic freedom is on the decline but crypto can spark the reversal of the trend.

Zooming in on the US, the Coinbase chief executive highlights that economic repression has led to a decaying standard of living with the American dream looking unachievable for most.

“Crypto can unleash the next chapter of capitalism: the age of economic freedom.

Coinbase’s core thesis is that greater adoption and usage of crypto will increase economic freedom. This is based on the promise of crypto to create a global economy, powered by tech and people rather than governments, where anyone with an internet connection can participate, property rights are enforced, and money preserves its value. This isn’t a dream. Crypto is already creating more economic freedom for real people TODAY.”

To drive economic freedom, Armstrong says leaders and policymakers should pass crypto-friendly laws.

“Crypto is a new, unique technology that should not be governed by antiquated laws. Policymakers should be focused on developing clear, forward-looking regulatory frameworks that cultivate this innovation rather than pushing it offshore – or they risk getting left behind.”

Armstrong also says economic freedom will blossom in countries that establish a strategic Bitcoin (BTC) reserve.

“It [Bitcoin] is the best-performing asset class since inception and solidifying itself as a hedge against inflation. The next global arms race will be in the digital economy, not space. Bitcoin could be as foundational to the global economy as gold and will become central to national security in a world where holdings of Bitcoin can shift the balance of power among nation-states. Governments will race to build strategic Bitcoin reserves, securing and uplifting their national economies while those without will lose their footing in the digital age.”

The Coinbase CEO adds that leaders and policymakers should focus on making their government more efficient and support the establishment of special economic zones for builders to experiment with big ideas.

“World leaders and policymakers: it’s time to embrace crypto + techno-optimism to accelerate economic freedom and human progress.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Bitcoin Exchange Whale Ratio Hits New 2025 High — BTC Price At Risk?

Having The Bitcoin Privacy Discussion With Politicians Will Be Difficult — Please Help

$4,750,000 Guaranteed Income Program To Distribute Cash to Citizens Across One US State

Key factors why Ripple could soon skyrocket like it did in 2024

This Week in Bitcoin: Volatility Rises as ETFs Rebound and SEC Gives OK to Mining

Will ETH ETF Net Outflow Exceed $20 Million?

Bitcoin

Bitcoin Exchange Whale Ratio Hits New 2025 High — BTC Price At Risk?

Published

2 hours agoon

March 22, 2025By

admin

Opeyemi is a proficient writer and enthusiast in the exciting and unique cryptocurrency realm. While the digital asset industry was not his first choice, he has remained absolutely drawn since making a foray into the space over two years. Now, Opeyemi takes pride in creating unique pieces unraveling the complexities of blockchain technology and sharing insights on the latest trends in the world of cryptocurrencies.

Opeyemi savors his attraction to the crypto market, which explains why he spends the better parts of his day looking through different price charts. “Looking” is a rather simple way to describe analyzing and interpreting various price patterns and chart formations. However, it appears that is not Opeyemi’s favorite part – in fact, far from it.

Being able to connect what happens on a price chart to on-chain movements and blockchain activities is what keeps Opeyemi ticking. “This emphasizes the intricacies of blockchain technology and the cryptocurrency market,” he would say. Most importantly, Opeyemi thinks of any market insights as the gospel, while recognizing that he is only a messenger.

When he is not clicking away at his keyboard, Opeyemi is most definitely listening to music, playing games, reading a book, or scrolling through X. He likes to think he is not loyal to a particular genre of music, which can be true on many days. However, the fast-rising Afrobeats genre is a staple in Opeyemi’s Spotify Daily Mix.

Meanwhile, Opeyemi is a voracious reader who enjoys a wide category of books – ranging from science fiction, fantasy, and historical, to even romance. He believes that authors like George R. R. Martin and J. K.

Rowling are the greatest of all time when it comes to putting pen to paper. Opeyemi believes his reading of the Harry Potter series twice is proof of that.

Indeed, Opeyemi enjoys spending most of his time within the four walls of his home. However, he also sometimes finds solace in the company of his friends at a bar, a restaurant, or even on a stroll. In essence, Opeyemi’s ambivert (haha! been searching for an opportunity to use the word to describe myself) nature makes him a social chameleon who is able to quickly adapt to different settings.

Opeyemi recognizes the need to constantly develop oneself in order to stay afloat in a competitive and ever-evolving market like crypto. For this reason, he is always in learning mode, ready to pick up the slightest lesson from every situation. Opeyemi is efficient and likes to deliver all that is required of him in time – he believes that “whatever is worth doing at all is worth doing well.” Hence, you will always find him striving to be better.

Ultimately, Opeyemi is a good writer and an even better person who is trying to shed light on an exciting world phenomenon – cryptocurrency. He goes to bed every day with a smile of satisfaction on his face, knowing that he has done his bit of the holy assignment – spreading the crypto gospel to the rest of the world.

Source link

Bitcoin

Net Taker Volume on Binance Hits Yearly High Amid Bitcoin Price Consolidation

Published

10 hours agoon

March 22, 2025By

admin

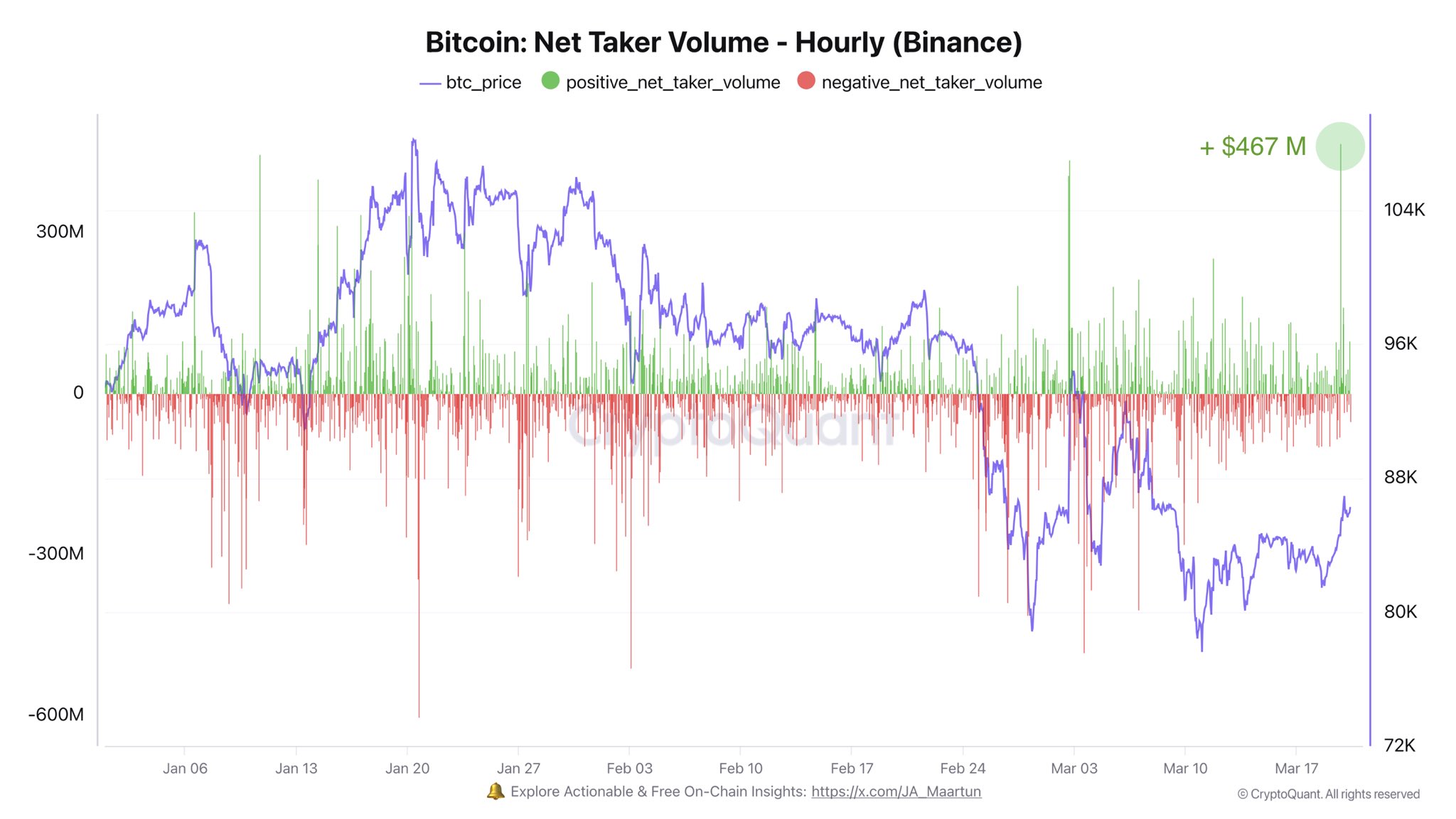

Bitcoin continues to trade just below the $84,000 mark, reflecting a broader slowdown in upward momentum. Despite attempts to reclaim higher levels, the cryptocurrency has remained under the $90,000 mark for over two weeks.

This current range-bound activity comes nearly two months after Bitcoin touched its all-time high in January, indicating a period of uncertainty as traders assess macroeconomic conditions and upcoming Federal Reserve policy decisions.

In the midst of the stagnation from BTC’s price, on-chain data is offering contrasting signals on where the market might be headed next. Analysts have pointed to fluctuations in buying and selling pressure on major exchanges, particularly Binance, as key indicators of short-term market sentiment.

Surge in Binance Net Taker Volume

CryptoQuant analyst Darkfost recently highlighted a notable spike in net taker volume on Binance, the world’s largest centralized crypto exchange. According to Darkfost, net taker volume surged by $467 million in a single hour—marking the highest level recorded in 2025 so far.

This metric, which measures the difference between aggressive market buys and sells, is often used to gauge the immediate sentiment of active traders. A positive value indicates stronger buying activity and has historically signaled short-term bullishness.

Darkfost emphasized that this uptick in taker volume occurred just prior to the recent FOMC meeting, suggesting that some traders may be positioning for favorable policy outcomes.

While the data only reflects an hourly time frame and may not imply long-term directional change, the movement could signal a broader shift in sentiment among active participants, especially given Binance’s influential position in global crypto markets.

Buying pressure from Binance traders might be back.

— Binance is the CeX with the highest trading volume, making it particularly relevant for data analysis. —

The net taker volume is a powerful metric for gauging trader sentiment, as it measures the volume of market buys and… pic.twitter.com/enI1VMAixf

— Darkfost (@Darkfost_Coc) March 20, 2025

Bitcoin Whale Activity Returns as Exchange Ratios Spike

Meanwhile, another CryptoQuant analyst, EgyHash, provided a more cautious interpretation of recent activity. According to his analysis, the Bitcoin Exchange Whale Ratio—defined as the share of total exchange inflows coming from the top 10 largest addresses—has surged to its highest point in over a year.

This ratio is closely monitored because spikes often precede increased selling pressure, especially when large holders move funds to exchanges. While not a definitive indicator of immediate liquidation, the rise in whale-driven deposits suggests that some major players may be preparing for reallocation or profit-taking.

Combined with stagnant price action, this metric implies that Bitcoin’s current price level may be approaching a decision point, where the market direction will be determined by the balance between new demand and potential supply from large holders.

Featured image created with DALL-E, Chart from TradingView

Source link

Bitcoin

Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

Published

12 hours agoon

March 22, 2025By

admin

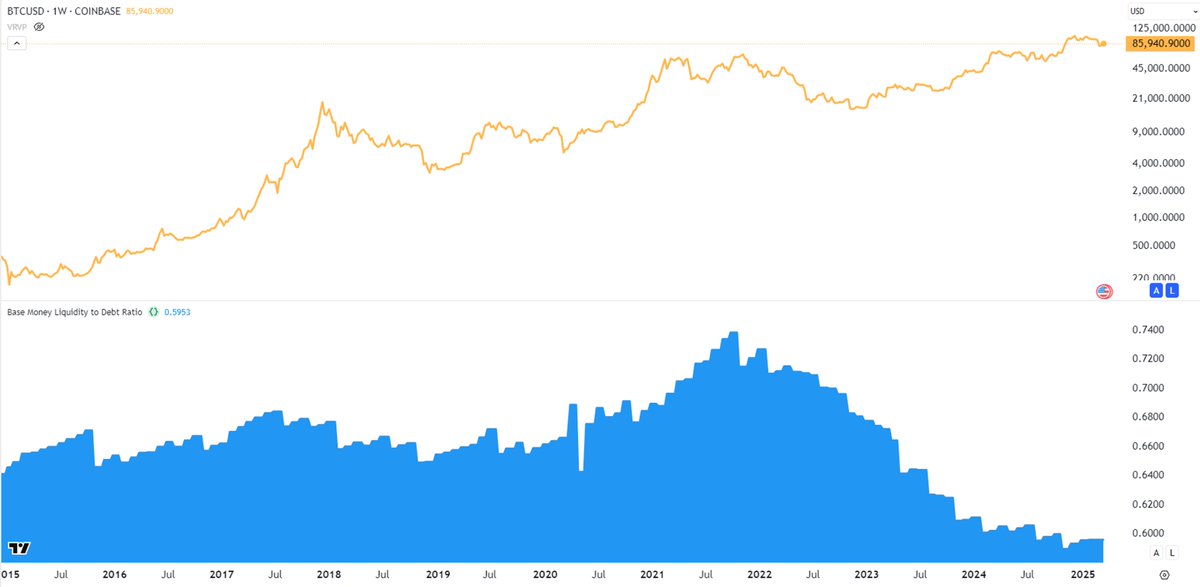

Real Vision’s chief crypto analyst says that Bitcoin (BTC) may soon print a series of rallies as macroeconomic conditions could ease later this year.

In a new thread, crypto strategist Jamie Coutts tells his 37,300 followers on the social media platform X that market liquidity is expected to increase in the second half of 2025, which may pump Bitcoin.

“The bottom line, though, is that if Bitcoin can rally through the worst liquidity withdrawal in decades, it’s primed for more significant moves as conditions ease through the rest of the year. Watch the blue line [Base Money Liquidity to Debt Ratio] begin to tick higher in 2H (second half) of the year.”

In addition to predicting money supply will increase faster than US debt, he also predicts that Bitcoin adoption will increase among US banks and sovereign wealth funds, helping to increase the value of the flagship crypto asset.

“More likely, base money outpaces government debt growth. What happens if base money expands faster than U.S. debt growth? In some reality, that might steady the ship and dampen the fear fueling Bitcoin adoption. But, in my view, that only hits the margins.

Meanwhile, deeper Bitcoin integration at both sovereign and banking levels is inevitable. Ultimately, US structural deficits are not changing. The US government will need to find new and inventive ways to ensure there is a bid for their debt.”

Bitcoin is trading for $84,090 at time of writing, flat on the day.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin Exchange Whale Ratio Hits New 2025 High — BTC Price At Risk?

Having The Bitcoin Privacy Discussion With Politicians Will Be Difficult — Please Help

$4,750,000 Guaranteed Income Program To Distribute Cash to Citizens Across One US State

Key factors why Ripple could soon skyrocket like it did in 2024

This Week in Bitcoin: Volatility Rises as ETFs Rebound and SEC Gives OK to Mining

Will ETH ETF Net Outflow Exceed $20 Million?

The SEC Resets Its Crypto Relationship

Will new US SEC rules bring crypto companies onshore?

Net Taker Volume on Binance Hits Yearly High Amid Bitcoin Price Consolidation

Eric Trump Joins Metaplanet’s Board Of Advisers

Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

Themes ETFs exec on new 2X Coinbase fund: ‘We believe as the Bitcoin tide rises, it will lift all crypto boats’

Ethena’s USDe Stablecoin Sales Blocked by German Regulator Over ‘Serious Deficiencies’

Is Ethena Price At Risk? Market Maker Offloads $10M ENA Raising Concerns

Coinbase Could Be Near Multi-Billion Dollar Deal for Deribit: Bloomberg

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x