America

Buying Greenland Would Be A Huge Boost to US Bitcoin Mining

Published

2 months agoon

By

admin

In less than two weeks, the United States will have a new administration in office, but there’s already much debate about President-elect Donald Trump and his policies.

One of the most controversial — his expressed interest in purchasing Greenland for strategic, economic and political reasons.

Trump claims that buying Greenland would be vital to U.S. national security, both for monitoring and defense purposes given its location near Canada and Russia, as well as its energy.

On that note, Greenland is of interest given its vast amount of natural resources in hydropower, wind power, geothermal energy, and rare earth minerals. This is particularly interesting from a Bitcoin perspective, especially given Greenland’s cold climate and lack of Bitcoin mining there currently now presents an entirely new opportunity for the country.

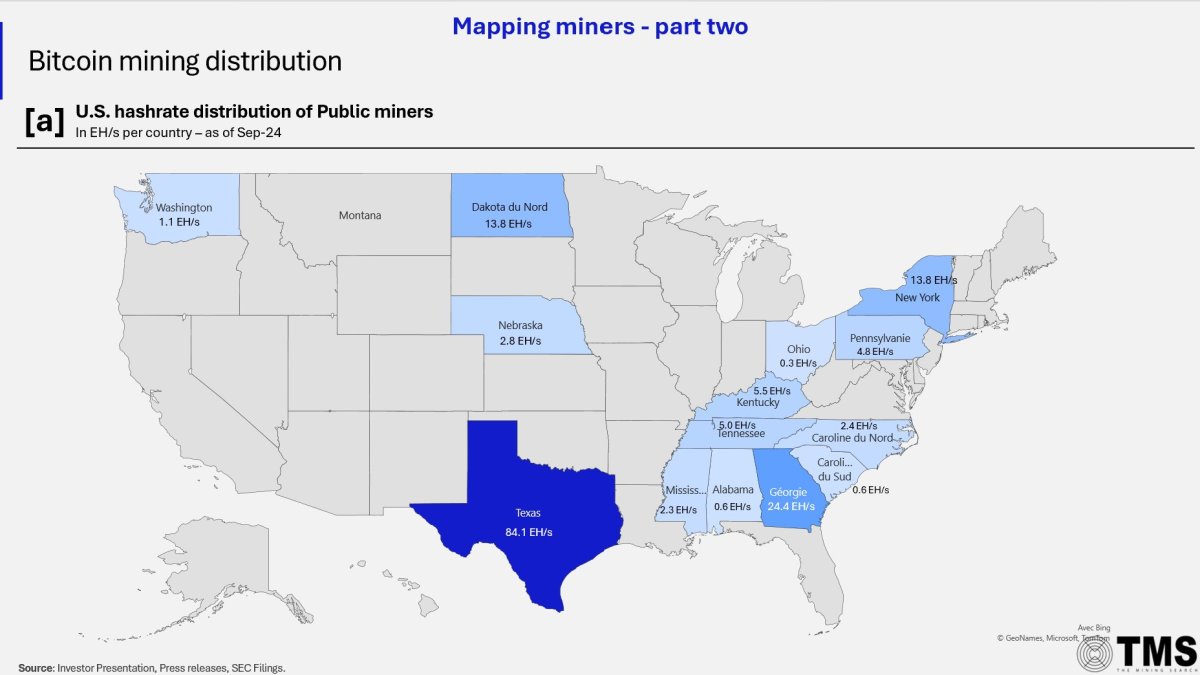

The majority of American Bitcoin mining today is done in the states of Texas, Georgia, New York and North Dakota. Purchasing Greenland could give the United States the opportunity to mine in more favorable conditions and further increase and decentralize the hashrate of Bitcoin.

This could also be a strategic play for America, considering Russia’s Vladimir Putin had signed a law to legalize Bitcoin mining in August of 2024 and stated in 2022 that the country has “some competitive advantages” in Bitcoin mining given its cold climate.

With Donald Trump’s ongoing support of American Bitcoin miners and expressed interest in leading in this industry before competing countries embrace it — this gives Trump the opportunity to drastically expand U.S. dominance in Bitcoin mining under favorable conditions.

This wouldn’t just be a win for America, but Greenland would also benefit from it as well. Greenland is highly dependent on the Danish government for financial support, and Bitcoin mining could offer an alternative economic avenue. Greenland would then have the full support of the United States government to utilize their natural and untapped resources to mine Bitcoin and get anything else they need support in. Greenland would then be able to create more jobs to build the needed infrastructure to run these operations and bring in additional revenue from the mined bitcoin. And as the price of Bitcoin goes up, that only makes the mined BTC and mining operations all the more valuable. Seems like a win-win to me.

Trump is very eager to acquire Greenland and make it a U.S. territory. If he does, it could be a massive boost for Bitcoin as well.

BREAKING: President Trump just announced that he will place massive tariffs on Denmark if they don't immediately relinquish all control of Greenland.

"We need Greenland for national security purposes."

LET THE 3D CHESS COMMENCE! pic.twitter.com/mZaqY3V2Y6

— George (@BehizyTweets) January 7, 2025

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

CryptoQuant CEO Sounds The Alarm

South Korea Dismisses Establishing Strategic Bitcoin Reserve

TokenPicks Launches Reward System to Incentivize Crypto Education

Ethereum leadership now eyes Solana-style growth, Dragonfly’s Qureshi says

SEC’s Uyeda Signals Possible Revisions to Crypto Custody Rule

Mubarak Meme Coin Trader Turns $232 Into $1.1 Million, Here’s How

America

President Trump Has Got A Bold Vision For Bitcoin In America

Published

2 months agoon

January 17, 2025By

admin

With his return to the presidency, Donald Trump has positioned himself as a key figure in the Bitcoin conversation. His keynote at Bitcoin 2024 laid out ambitious plans for integrating Bitcoin into the U.S. economy, making him the first U.S. president to openly champion the cryptocurrency in such a way. As his second term begins, the Bitcoin community is eager to see how his promises will evolve into concrete policies, with hopes of a friendlier regulatory environment and a more secure, innovative financial system.

The Promises

Trump’s speech at Bitcoin 2024 highlighted a series of initiatives aimed at embracing Bitcoin and blockchain technology:

- Ending the “anti-crypto stance” from previous administrations, with a commitment to revising the approach to regulation.

- Establishing a Presidential Crypto Advisory Council to shape the national strategy for Bitcoin and blockchain innovation.

- Rejecting the idea of a Central Bank Digital Currency (CBDC).

- Securing and holding government-owned bitcoin, with plans to create a strategic stockpile.

- Freeing Ross Ulbricht, the founder of the Silk Road online marketplace, who has been imprisoned since 2013.

- The removal of SEC Chairman Gary Gensler.

While Trump’s commitment to Bitcoin is undeniably encouraging for the community, translating ambitious promises into effective policy presents a challenging path forward. His call for removing SEC Chairman Gary Gensler resonated with Bitcoin advocates, many of whom blamed Gensler for restrictive policies. Although it’s unclear if Trump’s influence played a role, Gensler’s announcement of his November departure signals a changing regulatory tide. Trump’s proposal to establish a Crypto Advisory Council holds potential, but its success will depend on bipartisan cooperation and a clear, actionable mandate. Without these elements, it risks becoming a hollow political gesture. Additionally, his opposition to a Central Bank Digital Currency (CBDC) aligns well with privacy advocates and decentralization proponents, and there does seem to be support from within the Republican party for this policy. In regards to Ross Ulbricht, President Trump has many avenues to explore, from a commuted sentence to a presidential pardon. Whether it happens “day one” or within the early days of Trump’s second term, Ulbricht’s freedom is on the horizon.

As with any sweeping political vision, enthusiasm must be tempered with pragmatism. Turning promises into actionable policies takes time, especially within the labyrinth of established financial systems. Regulatory reforms move slowly, often hindered by entrenched interests and complex legislative processes. Nonetheless, Trump’s vocal advocacy of Bitcoin marks a cultural shift in American politics. Even if not every initiative reaches full fruition, his presidency could significantly alter public perceptions and policy discourse surrounding Bitcoin, embedding the cryptocurrency deeper into the national conversation.

Should political inertia or opposition delay progress, the Bitcoin community has tools to remain proactive and engaged. Active participation in shaping policy will be key—advocating for legislative clarity and innovation-friendly frameworks can help ensure Bitcoin’s potential is realized. Keeping a vigilant eye on regulatory shifts, including how Trump’s administration addresses existing SEC cases and cryptocurrency classifications, will also be crucial. Flexibility and readiness to accept incremental progress could yield meaningful wins, especially in resisting CBDCs and strengthening the government’s bitcoin holdings strategy.

Ultimately, Trump’s pro-Bitcoin stance represents a historic pivot toward integrating Bitcoin into U.S. governance. While challenges and delays are inevitable, the presence of a Bitcoin advocate in the White House offers unprecedented opportunities. The next few years will test whether America can truly become a beacon for Bitcoin innovation or whether political realities will slow the revolution. Either way, Bitcoin now has a powerful ally at the highest level of government—a hopeful signal for its future trajectory in the United States and beyond.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

America

Michael Saylor's Trump Meeting Is Turbo Bullish for Bitcoin

Published

2 months agoon

January 3, 2025By

admin

Last night, President-elect Donald Trump’s son, Eric Trump, posted a photo of himself at Mar-a-Lago with MicroStrategy Executive Chairman Michael Saylor with the caption, “Two friends, one passion: Bitcoin.”

This is so unbelievably bullish — let me explain.

For the last four years, under the Biden-Harris administration with total Democrat control, the U.S. government did their best to terrorize this industry and attack us. The overwhelming majority of the Democrat party did not support Bitcoin and followed Elizabeth Warren’s lead on demonizing the industry and its participants. They weaponized the justice system to arrest Bitcoiners, tried to tax our unrealized gains, stopped pro-Bitcoin legislation from being signed into law, de-banked industry participants via Operation Chokepoint 2.0, refused to support Bitcoin in any meaningful way, and so much more.

They were truly anti-Bitcoin. If Kamala Harris had won the presidential election, their reign of terror on Bitcoin would have continued for at least four more years. But now, the Democrats’ war on Bitcoin in America is finally coming to an end. And a new administration is coming in — and they love Bitcoin.

Donald Trump is not even officially in office yet, and his family is already inviting Michael Saylor to his estate in Mar-a-Lago to discuss Bitcoin further. This isn’t the first time he’s done something like this either, like in 2024 when Trump invited American Bitcoin mining giants there to learn more about the industry and what he needs to do to best support them.

It is important to note that just two weeks ago, Saylor said on Bloomberg that he would be open to advising Donald Trump on Bitcoin. And now with him being at Mar-a-Lago, I think it is safe to speculate that something big might be brewing here.

The Trumps understand Bitcoin and continue to show their support for the asset and industry. Eric Trump recently gave a great speech at the Bitcoin MENA Conference in Abu Dhabi, explaining the characteristics that make Bitcoin an invaluable asset while also sharing his family’s personal experience being de-banked, and how Bitcoin protects individuals from being cancelled. Donald Trump Jr. made an appearance at the Bitcoin 2024 Conference in, along with his father, and showed lots of support for this asset and industry.

Donald Trump has committed to releasing Bitcoiners (Ross Ulbricht) from prison, sign pro-Bitcoin legislation into law, work with the industry to help us thrive, end Operation Chokepoint 2.0, appointed an official Crypto Czar, said “Bitcoin and crypto will skyrocket like never before” under his administration, and so much more.

Even if you’re not a fan of Trump, you have to acknowledge and give him and his family credit for the good work they’re doing to make a regulatory friendly environment for this industry to thrive in. Imagine all this industry can accomplish over the next four years being supported by the President, allowing us the room to innovate and build without fear of being harassed and demonized by our own government. I would say the sky is the limit but it’s even better than that.

Four years is a long time, especially in this industry. Lots can happen during that time and I am incredibly bullish on the future of Bitcoin in America under this incoming Trump administration.

Michael Saylor: "Bitcoin is on the menu at Mar-a-Lago."

AMERICA IS EMBRACING #BITCOIN LIKE NEVER BEFORE

pic.twitter.com/7c2NJG7Kzd

— Nikolaus Hoffman (@NikolausHoff) January 3, 2025

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

CryptoQuant CEO Sounds The Alarm

South Korea Dismisses Establishing Strategic Bitcoin Reserve

TokenPicks Launches Reward System to Incentivize Crypto Education

Ethereum leadership now eyes Solana-style growth, Dragonfly’s Qureshi says

SEC’s Uyeda Signals Possible Revisions to Crypto Custody Rule

Mubarak Meme Coin Trader Turns $232 Into $1.1 Million, Here’s How

Solana Protected Gender Identity Before Panning It in Anti-Queer Ad

Musk says he found ‘magic money computers’ printing money ‘out of thin air’

XRP To Triple Digits? Analyst Confident In $100 Price Goal

What Are They And What Do They Do?

Trader Predicts Crypto Rallies Amid Expectations of Fed Monetary Policy Shift – But There’s a Catch

Solana’s 5th birthday highlights explosive growth and trading activity: Mercuryo

Trump, Associates Net $390 Million Payday From World Liberty Token Sale

Bitcoin Price Eyes $200,000 Breakout If This History Aligns

Gold-Backed Tokens Outperform as ‘Bond King’ Gundlach Sees Precious Metal Hit $4,000

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x