ADA

Can Cardano Price Revisit ATH in 2025?

Published

3 months agoon

By

admin

Cardano (ADA) price has been navigating a downward trajectory since hitting its peak price of $1.30 earlier in the year. Despite a modest uptick during the Christmas season, the persistent bearish pattern has led investors to reconsider their stakes in ADA. The cryptocurrency’s continued presence in a descending channel raises questions about its potential to reach new highs in 2025.

How Cardano Price Can Hit ATH in 2025

Cardano price is projected to achieve a new all-time high (ATH) by 2025, based on a technical analysis chart. The chart delineates a potential head and shoulders pattern, indicating a bullish reversal could propel ADA’s price beyond previous records.

The analysis pinpoints several critical zones and trajectory paths that ADA might follow in the coming years. Initially, the currency faces a substantial support zone around $0.567. If this level holds, it could form the base for a potential surge. According to the chart, after touching this support, the top altcoin might ascend to test higher resistance levels.

Experts suggest that a significant rise could occur post-2024, following the completion of the right shoulder of the pattern. This movement aligns with a projected trendline that sees ADA gradually climbing, potentially peaking at $3.09, which would surpass its former ATH.

The pattern analysis on the chart highlights a drop of approximately 7.75% from the neckline of the head and shoulders pattern. Such retracements are common in bullish reversals, often seen as consolidation before a strong upward movement.

ADA Price Analysis

Cardano price has seen a recent dip below the critical $1 threshold after briefly peaking earlier this month amidst a wider bullish trend in the crypto market. Despite this setback, there’s potential for ADA to rebound by 20% come January 2025, possibly reaching the $1.20 level.

If the momentum continue, a surge to $3.10 is conceivable, replicating its 2021 performance. Conversely, a bearish turn could push its value below $0.80.

Currently, the ADA price trading value has decreased by 1%, sitting at $0.8612. Nonetheless, there’s a noticeable 50% increase in market volume, now at $891 million. This uptick indicates a growing interest in Cardano, even amid price fluctuations.

In conclusion, while the Cardano price journey back to its ATH by 2025 faces significant challenges, the potential for a bullish reversal remains. Continued support and market interest could indeed set the stage for ADA to reach new heights.

Frequently Asked Questions (FAQs)

It’s a chart formation that predicts a bullish reversal by outlining three peaks, the middle one being the highest.

Cardano’s significant support zone is around $0.567, which could form the base for a potential price surge.

Projections suggest Cardano could reach a new ATH by 2025, following a bullish pattern completion.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Police Arrest Four Teens Over Amouranth Home Invasion, Attempted Bitcoin Theft

MUBARAK Coin Price Soars 22% Amid This Binance Announcement, What’s Next?

Michael Saylor’s MSTR Purchases 130 Additional BTC

Michael Saylor’s Strategy makes smallest Bitcoin purchase on record

Bitcoin To $10 Million? Experts Predict Explosive Growth By 2035

Dormant whale sends 300 BTC to FalconX as Bitcoin nears $84k CME gap

ADA

Analyst Says Crypto Whales Loading Up on Ethereum, Accumulating $815,514,345 in ETH in Just Five Days

Published

16 hours agoon

March 17, 2025By

admin

A crypto analyst says deep-pocketed investors are snapping up the top layer-1 platform Ethereum (ETH) amid the marketwide digital asset correction.

Trader Ali Martinez tells his 132,900 followers on the social media platform X that whales gobbled up more than $815.514 million worth of ETH in less than a week.

“Whales have bought more than 420,000 Ethereum ETH in [five days]!”

Martinez is also keeping a close watch on Ethereum’s In/Out of the Money Around Price (IOMAP) metric – which classifies crypto addresses as either profiting, breaking even, or losing money – to determine support and resistance levels for ETH.

According to Martinez, ETH is currently trading in a narrow range between stiff support and resistance zones.

“Ethereum ETH key levels to watch! On-chain data reveals $1,870 as the strongest support and $2,050 as its toughest resistance!”

At time of writing, ETH is trading for $1,941.

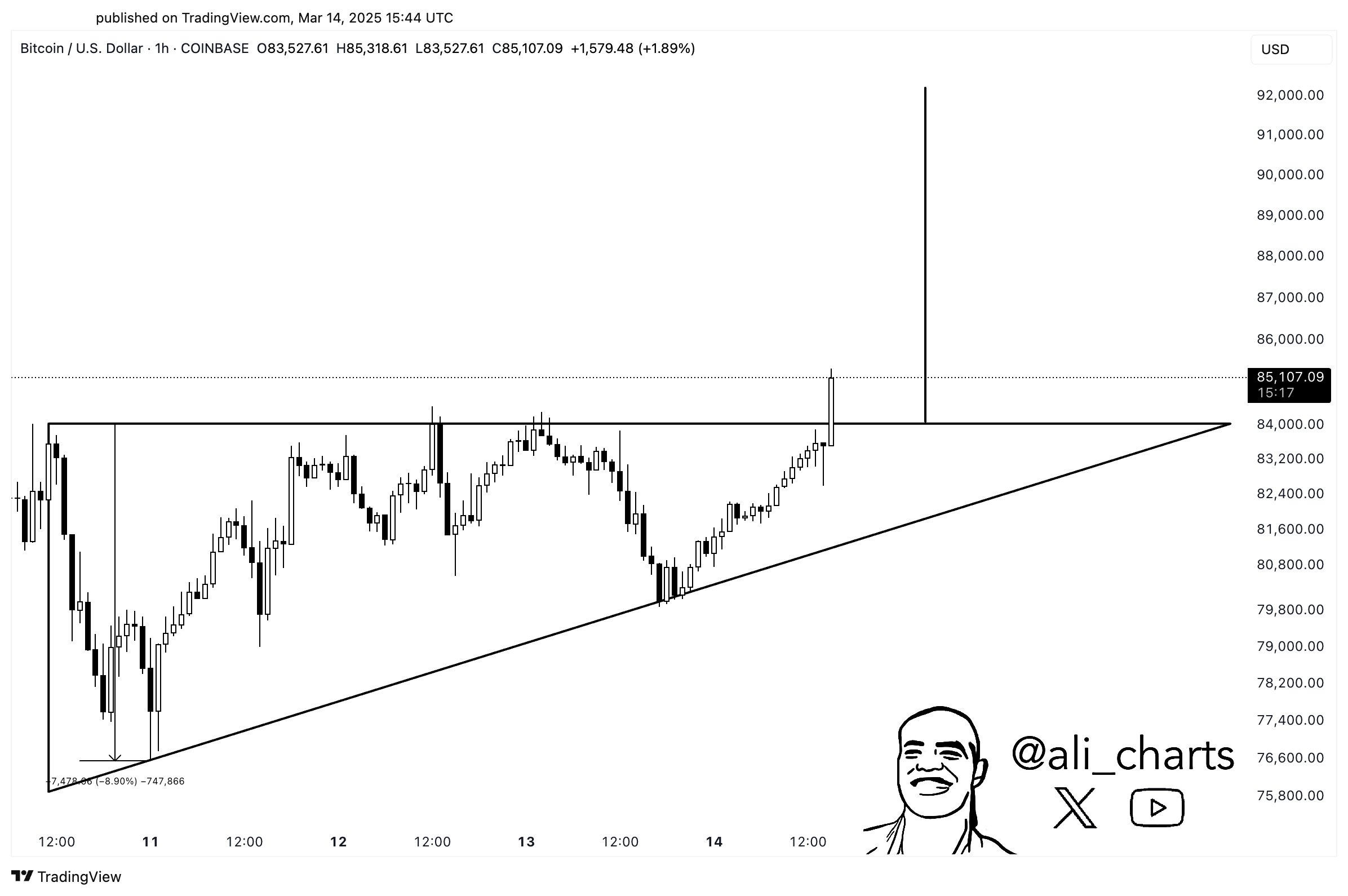

Turning to Bitcoin (BTC), the trader believes that the crypto king is poised to witness tactical rallies after breaching the horizontal resistance of an ascending triangle pattern.

“Bitcoin BTC is breaking out! The target is $90,000 as long as the $84,000 support holds.”

An ascending triangle pattern may be considered a bullish reversal structure if the asset soars above its horizontal resistance.

At time of writing, Bitcoin is trading for $84,288.

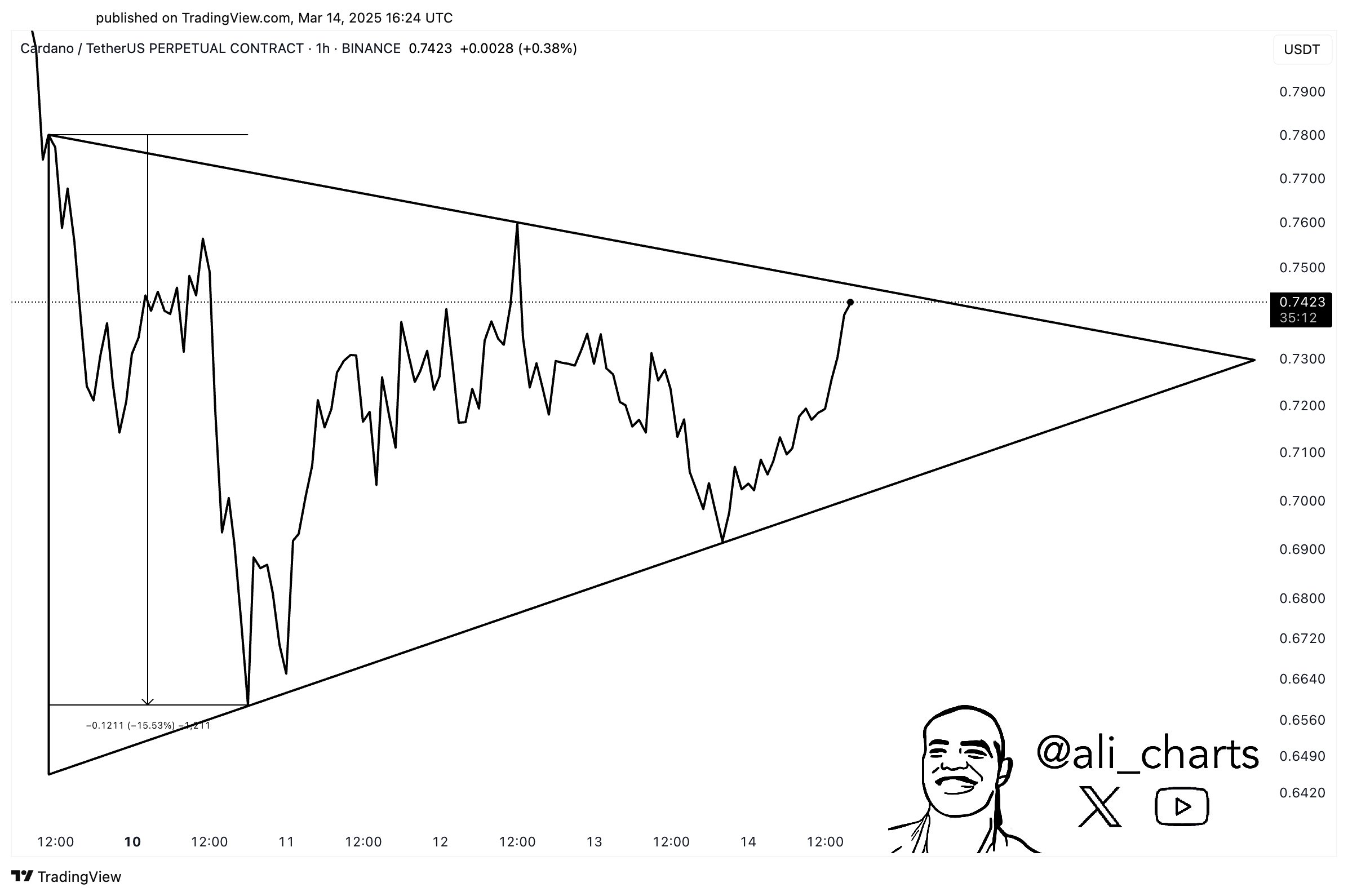

Turning to Ethereum rival Cardano, the analyst predicts rallies for ADA if the altcoin takes out the diagonal resistance of a triangle pattern at around $0.75.

“Cardano ADA is about to break free! Busting out of this triangle will trigger a 15% price move.”

A triangle is typically viewed as a consolidation pattern as it signals a potential breakout in either direction. The asset is considered bullish if the price moves above the diagonal resistance and bearish if it tumbles below the diagonal trend line.

At time of writing, ADA is worth $0.744.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

ADA

Cardano Bulls Eye $10 Target – Analyst Reveals Key Levels To Break

Published

1 week agoon

March 9, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Cardano (ADA) has been caught in massive volatility and extreme price swings, making it one of the most unpredictable assets in the crypto market. Following US President Donald Trump’s announcement of a US Strategic Crypto Reserve, which included Cardano, ADA’s price skyrocketed over 80% in less than a day, fueling speculation about its long-term role in institutional adoption.

Related Reading

However, the excitement was short-lived, as negative macroeconomic sentiment and fears surrounding global trade wars triggered a sharp 35% decline within just two days. As uncertainty grips the financial markets, traders remain cautious about whether ADA can regain momentum or if more downside is ahead.

Despite the recent sell-off, top analyst Ali Martinez shared a technical analysis suggesting that Cardano remains positioned for a potential surge toward $10. According to his insights, bulls must reclaim key technical levels for a strong recovery, with ADA still showing bullish potential despite short-term weakness.

With Cardano’s price action at a critical point, the coming days will be crucial in determining its next move. If bulls can stabilize ADA above key support, the potential for another explosive rally remains on the table.

Cardano Could Start A Massive Move

Cardano (ADA) has been overperforming compared to the broader crypto market over the past week, showing relative strength despite ongoing volatility. However, price action remains confined within a range that first began forming in November 2024, preventing a clear breakout in either direction.

Related Reading

If bulls can hold the current levels, ADA could soon attempt a push above multi-year highs, setting the stage for a significant bullish move. However, analysts remain cautious as prices are still low, and investor sentiment remains fearful amid macroeconomic uncertainty and trade war tensions. Many traders are waiting for confirmation of a breakout, as momentum has yet to fully shift in favor of the bulls.

Martinez’s technical analysis on X reveals that Cardano is still positioned for a potential surge toward $10. According to Martinez, for this bullish scenario to unfold, ADA must maintain support above $0.80 while successfully breaking through the key $1.20 resistance level. These price points serve as crucial pivot zones, and their validation or failure will likely determine Cardano’s short-term trend.

The next trading sessions will be crucial, as a break above $1.20 could trigger a strong upward move, while failure to hold above $0.80 could lead to further downside risk. With ADA currently at a pivotal moment, traders are closely monitoring price action to gauge whether bulls can regain control or if continued consolidation is ahead.

Price Action Details: Technical Analysis

Cardano (ADA) is currently trading at $0.80 after failing to hold above the key $1 level. Despite recent strong performance compared to the broader market, ADA has struggled to maintain bullish momentum, leaving traders uncertain about its next move.

For bulls to regain control, ADA must reclaim the $1 mark and push above the critical $1.17 resistance level. A break and hold above this zone could trigger a massive rally, potentially sending Cardano to multi-year highs. Such a move would signal renewed buying interest, boosting confidence among investors and traders who are watching ADA’s long-term potential.

Related Reading

However, failure to break above $1 and hold the crucial $0.80 support level could expose Cardano to further downside risk. A breakdown below $0.80 would likely send ADA into lower demand zones, extending its consolidation phase and delaying any significant recovery.

Featured image from Dall-E, chart from TradingView

Source link

ADA

CZ Weighs In On Altcoins Performance As Crypto Market Retraces

Published

1 week agoon

March 8, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Binance co-founder Changpeng Zhao has suggested that the highly anticipated Altseason isn’t here yet as most altcoins continue bleeding, while some market watchers consider the worst might be over soon.

Related Reading

CZ Says There’s No Altseason Yet

On Friday, Changpeng Zhao, also known as CZ, responded to an X user asking when the Altseason will happen. The Binance founder pointed out the price tracking and market data website CoinMarketCap (CMC), which recently added an “Altcoin Season Index.”

CZ highlighted that “of the top 100 altcoins,” very few have outperformed Bitcoin (BTC) in the past three months, suggesting that the Altseason won’t happen yet.

As the website states, the CMC Altcoin Season Index page “provides real-time insights into whether the cryptocurrency market is currently in Altcoin Season,” based on the performance of the top 100 altcoins against the flagship crypto over the past 90 days.

Under this metric, an Altseason is in if 75% of the top 100 altcoins outperform BTC during the established period. To CZ, “This is a tough ranking system,” as he considers that 50 would be a good score for Altcoins.

The CMC index page shows a score of 14/100, with only 14 altcoins outperforming BTC since early December. Some of the tokens in this list include Monero (XRM), Hyperliquid (HYPE), Pi (PI), Mantra (OM), Berachain (BERA), and the official Trump memecoin (TRUMP).

Leading cryptocurrencies of 2024, like SUI and Solana (SOL), show 37% to 41% price decreases in the past 90 days. Meanwhile, memecoin sensations like dogwifhat (WIF), PEPE, FLOKI, and BONK have bled between 70% and 80% during this period.

Analyst Michaël van de Poppe also noted that altcoins have had an overall negative performance on higher timeframes despite some recent price rallies. “Massive green day on some Altcoins, they are up 2%! Then, you zoom out, and you zoom out, and you zoom out,” he asserted.

Altcoins Bottom Could Be Near

Altcoin Sherpa stated that altcoins were in “about the same or worse” positions during the Summer 2024 retrace, pointing out that “things were also pretty bleak overall and then we saw some strong bounces in August.” However, he noted that, unlike last year, the market doesn’t have a “Trump Pump coming.”

Recently, some of the top cryptocurrencies saw a significant price increase after US President Donald Trump announced a strategic reserve that would include SOL, XRP, Cardano (ADA), Ethereum (ETH), and BTC.

Nonetheless, after the March 6 executive order establishing a Strategic Bitcoin Reserve and a “Digital Asset Stockpile,” the White House AI and Crypto Czar, David Sacks, clarified that the previously named altcoins were used as references for the most valuable tokens in the market.

Sherpa considers that the market’s bottom is close, but “we still also probably have the chop period to get through” before any substantial recovery.

On the contrary, some industry figures have also commented on altcoins’ overall performance this cycle, suggesting that the Altseason already started but will be different from previous cycles.

Related Reading

Recently, CryptoQuant’s founder and CEO, Ki Young Ju, stated that the Altseason had begun. He affirmed there will not be a direct Bitcoin-to-altcoins rotation this cycle, as BTC dominance isn’t the key metric that defines it.

To the CEO, trading volume is the metric that defines it this time. Ju also pointed out that this will be a very selective and challenging altseason, with only a few altcoins with strong narratives expected to thrive.

Featured Image from Unsplash.com, Chart from TradingView.com

Source link

Police Arrest Four Teens Over Amouranth Home Invasion, Attempted Bitcoin Theft

MUBARAK Coin Price Soars 22% Amid This Binance Announcement, What’s Next?

Michael Saylor’s MSTR Purchases 130 Additional BTC

Michael Saylor’s Strategy makes smallest Bitcoin purchase on record

Bitcoin To $10 Million? Experts Predict Explosive Growth By 2035

Dormant whale sends 300 BTC to FalconX as Bitcoin nears $84k CME gap

Bitcoin Flashing Bullish Reversal Signal Amid Waning Sell-Pressure, According to Crypto Strategist

Bitcoin Price Mirrors Gold’s 1970 Rally – A Six-Figure BTC Target of $250k Next?

OKX Pauses DEX Aggregator to Address Security Concerns

Trump’s second ex-wife calls for end of prosecution against Roger Ver

SEC Commissioner Hester Peirce on the New Crypto Task Force

Solana Hits 400B Transactions, Nearly $1T in 5 Years

640,000 Chainlink (LINK) Withdrawn From Exchanges In 24 Hours – Bullish Accumulation?

Traders eye $2.80 Rally As Ripple Files New Trademark

Analyst Says Crypto Whales Loading Up on Ethereum, Accumulating $815,514,345 in ETH in Just Five Days

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

A16z-backed Espresso announces mainnet launch of core product

Has The Bitcoin Price Already Peaked?

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: