24/7 Cryptocurrency News

Cardano Price Eyes $0.85 as Whales Scoop Up 240 Million ADA

Published

1 day agoon

By

admin

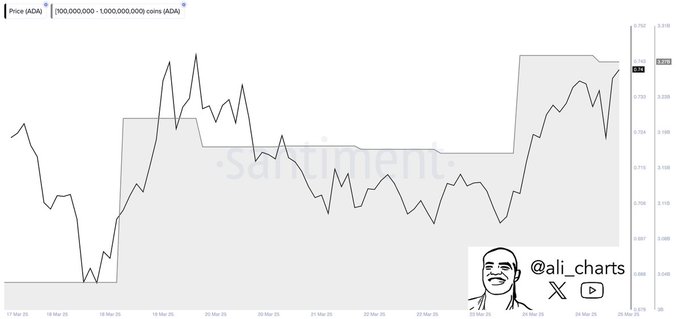

Cardano (ADA) continues to show signs of recovery, with whales significantly accumulating the token. Recently, whale addresses holding between 100 million and 1 billion ADA have purchased over 240 million ADA, worth approximately $175 million. This surge in whale activity suggests confidence in Cardano’s next performance, and the next key price target for ADA could be $0.85.

Whale Activity Supports ADA Price Recovery

Whales have been playing a significant role in the recent price movement of Cardano. In the last one week, the number of whale addresses is on a rise, and they have been accumulating ADA by buying it at higher volumes at a cheaper price. Such a move by the large investors means they have confidence in the asset in the long-run and an expectation of a change in trend, in this case a positive one.

The 240 million ADA purchased by whales serves as a strong indicator that large investors are positioning themselves for a future price increase.

Concurrently, based on the Mean Coin Age, long-term holders have not been selling the ADA tokens therefore they do not consider it a dump asset but rather a token with a massive rally potential. This could help contain the price support for ADA at higher levels and avoid sharp declines in the near term.

Cardano Price Struggles to Break Resistance

Nevertheless, the bullish indications from whale accumulation have been met with a pushback at $0.77 in price. In the previous weeks, ADA price has not managed to trade beyond this level, therefore, it cannot be considered a full recovery. Therefore, the $0.77 area represents the key level that will determine the formation of an uptrend since crossing a price higher than this level will unlock further buy signals.

There is a lack of consistent buying pressure in Cardano’s recent price action that hasn’t allowed ADA to break past significant resistance levels. However, the support from whales and long-term holders may help ADA price to avoid this situation. At press time, Cardano price was trading at $0.7476, a 1.20% rally from the intraday support of $0.7222.

If ADA price can cross above $0.77 then the next level of significant resistance may be $0.85 in order to pump for another round of higher price action.

Will ADA Price Soar To $5? Analyst Weighs In

Crypto analyst Javon Marks suggests that in accordance with the prior cycles it is possible to see the next move of ADA price towards the first level of the 1.272 Fibonacci extension, which in this case is $5.36. This target would signify over 6.8 times increase from the current position and more than 585% increase in the price rally.

In the shorter term, the 1.272 Fibonacci extension of the current base suggests a target of approximately $3.95. This target is in line with other past bullish runs that Cardano has exhibited where most of the movements occur after the formation of consolidation patterns.

Moreover, according to crypto analyst LLuciano_BTC, the Cardano price is showing signs of a bullish flag breakout after a period of consolidation. If the ADA price breaks above the descending resistance with strong volume, it could trigger a significant upside move, potentially toward $1.80.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

BTC in Stasis Below $88K as Trump Suggests Bigger Tariffs on EU, Canada

Dogecoin Price Eyes 10x Breakout After Elon Musk Ghibli Anime

XRP Price Rejected at Resistance—Are Bears Taking Control?

OpenAI expects to 3X revenue in 2025 but Chinese AI firms are heating up

‘Chart Is Still Broken’ – Crypto Analyst Predicts Sustained Downtrend for Altcoins Until This Takes Place

GameStop Announces $1.3 Billion Fundraising Plan To Purchase Bitcoin

24/7 Cryptocurrency News

Dogecoin Price Eyes 10x Breakout After Elon Musk Ghibli Anime

Published

40 minutes agoon

March 27, 2025By

admin

Dogecoin price has been showing major strength recently with more than 14% gains on the weekly chart and eyeing a potential breakout above $0.21, after which it can kickstart rally to $2 for another 10x gains. Furthermore, Elon Musk has once again teased DOGE, sharing a Ghibli Anime character of his from a famour scene from “The Lion King”.

Dogecoin Price Eyes A 10x Breakout Ahead

In the last 24 hours, the Dogecoin price has surged another 4%, moving to $0.205 with its market cap just touching $30 billion. Additionally, the daily trading volumes have surged more than 32%, crossing $2 billion showing a strong bullish sentiment aong traders.

Additionally, the Coinglass data shows that the DOGE futures open interest is also up 4%, moving above $2 billion, while the 24-hour liquidations have soared to $13.82 million. Popular crypto analyst CryptoELITES has cited the formation of a cup-and-handle chart pattern, wherein the DOGE price is on the move to complete the cup pattern. As a result, he expects the meme coin to register 10x gains from here onwards.

Some traders also expect the DOGE price rally to continue to $8 as the meme coin breaks past the three-month trendline.

DOGE SuperTrend Indicator

Crypto analyst Ali Martinez has highlighted a potential bullish phase for Dogecoin (DOGE) based on the SuperTrend indicator. According to Martinez, the popular meme coin could enter a significant upward trend if it manages to break through the critical resistance level of $0.21.

The SuperTrend indicator usually helps to identify trend reversals and potential breakout points. Thus, surpassing this key threshold of $0.21 Dogecoin price could signal renewed investor momentum for the meme coin.

Elon Musk Teases the DOGE Ghibli Anime

In a parody of the famous scene from Disney’s “The Lion King,” Elon Musk once again teases Dogecoin with the much popular Ghibli Anime character. Instead of a lion cub, the character is holding up a Shiba Inu dog – the mascot of the Dogecoin cryptocurrency.

Theme of the day pic.twitter.com/2ioG0StAxL

— Elon Musk (@elonmusk) March 26, 2025

The animated image is reminiscent of Studio Ghibli. The Ghibli Animes are seeing massive popularity recently, and Elon Musk jumping into the trend with DOGE, could provide further catalysts for the meme coin. Furthermore, the Dogecoin price prediction charts show a probable consolidation above $0.20 for the month of April.

- Shiba Inu Price Eyes 2x Gains As SHIB Burn Rate Shoots 60,000%

- Dogecoin Price Eyes 10x Breakout After Elon Musk Ghibli Anime

- Analyst Reveals How Much Bitcoin Is Needed for Retirement in the US

- Ethereum Price Eyes $10,000 Breakout Amid Supply Squeeze Worry

- Crypto Price Today: BTC, ETH, SOL, XRP, SHIB, DOGE, LINK, PEPE, ADA

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Expert Predicts XRP ETF Approval Is Only A ‘Matter Of Time’ As Approval Odds Soar

Published

9 hours agoon

March 26, 2025By

admin

The possibility of an XRP exchange-traded fund (ETF) gaining approval is quickly becoming a reality, with experts predicting it is now only a matter of time before the U.S. Securities and Exchange Commission (SEC) gives the green light. Following a significant boost in market confidence, betting platforms, like Polymarket, show an 87% chance that the SEC will approve an XRP ETF by the end of 2025.

Ripple SEC Case End Sparks Optimism for XRP ETF

A positive outlook about an XRP exchange-traded fund’s approval has emerged after Ripple won its recent court battle. Ripple’s victory against the SEC dismantled a major barrier that prevented financial institutions from adopting its cryptocurrency. The court settlement has raised investor trust in the SEC’s approval process for an XRP Exchange-Traded Fund (ETF) thus many investors now expect approval.

According to Nate Geraci the president of The ETF Store an XRP ETF approval seems destined to happen. He predicted asset managers like BlackRock and Fidelity would dominate the space while asserting that the approval process stood just a matter of time away from completion. Geraci explains that XRP’s rising market cap position as the third non-stablecoin cryptocurrency provides institutional investors with an appealing opportunity.

“With Ripple’s legal troubles now behind it, the path to an XRP ETF approval seems clearer than ever,” Geraci noted.

XRP Market Sentiment and Polymarket Data

An increasing number of market participants expect XRP ETF approval as shown by Polymarket’s statistical analysis. Polymarket data shows investors believe the SEC will approve a spot XRP ETF before the year ends with an 87% probability.

This indicates widespread belief that the regulatory hurdles for the cryptocurrency are nearly cleared.

The introduction of an XRP ETF could trigger increased institutional interest much in the same way Bitcoin and Ethereum ETFs gained investor attention. An XRP ETF’s market entry would help traditional investors view digital assets more favorably because Bitcoin and Ethereum already demonstrated successful ETF integration.

Major Financial Firms Exploring XRP ETF

Major financial institutions like BlackRock and Fidelity among others will be instrumental in creating an XRP Exchange-Traded Fund Analysts predict BlackRock will shift its focus from Bitcoin and Ethereum to XRP ETFs because the cryptocurrency exhibits strong institutional appeal.

BlackRock’s head of ETFs, Jay Jacobs, had earlier stated that altcoins like XRP and Solana are not currently on their agenda. However, experts argue that the growing market demand and regulatory developments around XRP could soon change BlackRock’s stance.

Large asset managers including Fidelity play crucial roles when it comes to this particular market segment. The regulatory approval of XRP ETFs by the SEC will allow these financial institutions to launch XRP-related products. Such high-profile firms’ participation will speed up both the adoption and institutional utilization of XRP within portfolios.

XRP Price Predictions Amid ETF Optimism

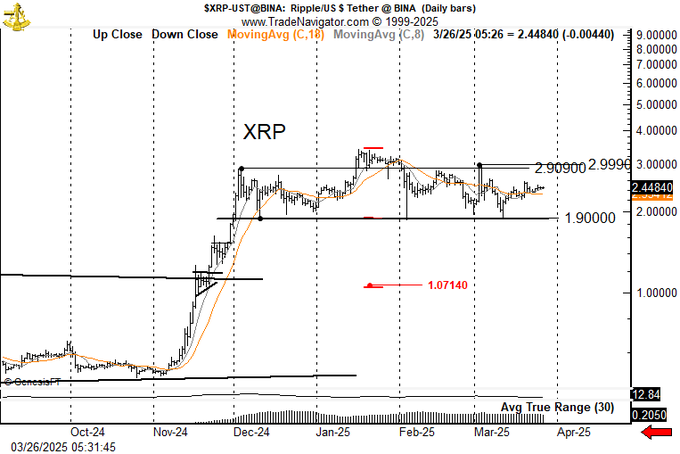

As the market anticipates the approval of an XRP ETF, different analysts have made bold price predictions for XRP. Renowned trader Peter Brandt has recently shared his technical analysis, highlighting a potential head and shoulders pattern in XRP’s price.

This pattern suggests that if XRP falls below a certain level, it could lead to significant losses, with a target price of around $1.07. However, Brandt also acknowledged that if the cryptocurrency stays above the $3 mark, shorting XRP could be risky.

On the other hand, cryptocurrency index fund manager Bitwise has offered a more optimistic price projection. Bitwise estimates that XRP could soar to as high as $29.32 by the end of the decade, assuming the cryptocurrency captures a meaningful share of the payments and tokenization sectors. In their “bull scenario,” Bitwise projects a price of $12.70 by 2030.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

South Korea Urges Google To Block 17 Unregistered Crypto Exchanges

Published

17 hours agoon

March 26, 2025By

admin

As South Korea continues to strengthen its crypto regulations, the Financial Intelligence Unit (FIU) has requested Google to block access to 17 unlicensed crypto exchanges. These unregistered virtual asset service providers (VASPs) include KuCoin, MEXC, Phemex, XT, CoinEx, BitMart, and Poloniex, among many others.

Reportedly, Google has responded positively to the FIU’s request. As a result, South Korean users will no longer be able to access these listed platforms, effective yesterday.

South Korea Tightens Regulations: Google Blocks 17 Crypto Exchanges

In a recent development, South Korea’s FIU has requested Google to block users from accessing 17 unlicensed crypto exchanges, including KuCoin, MEXC, Phemex, XT, CoinEx, BitMart, and Poloniex. As part of the move, Google blacklisted these platforms since yesterday.

Notably, South Korea’s decision to block access to these crypto exchanges comes amid growing concerns over crypto theft and money laundering activities. Recently, South Korea announced its potential regulatory revamp in a move to strengthen the country’s anti-money laundering rules.

Google Restricts Downloads and Updates

The Financial Services Commission (FSC) enlisted 22 unregistered platforms on March 26. In response to the South Korean financial regulator’s request, Google has blocked users’ access to the crypto exchanges that are deemed unregistered. In addition, the Google Play Store will not allow users to download or update the applications of these crypto exchanges.

Meanwhile, the FIU asserted that the financial watchdog is collaborating with Apple Korea and the Korea Communications Standards Commission (KCSC) to block both internet and App Store access to these exchange platforms.

Interestingly, the FSC believes that this strategic measure could help prevent money laundering activities involving crypto assets and potential future harm to local users. This move comes just a few days after the FIU launched a crackdown on these exchanges. It is alarming that KuCoin, one of the top crypto exchanges, is also facing intense scrutiny from FIU.

South Korea’s Crypto Regulations: What To Expect More?

Significantly, South Korean regulators mandate crypto exchanges to adhere to the country’s licensing rules before offering services. The restrictions apply to foreign platforms that cater to Korean users by offering Korean-language interfaces, conducting targeted marketing campaigns, or facilitating transactions in Korean won.

According to FIU’s official statement, the platforms that violate these laws could face up to five years in prison or fines of up to 50 million won (approximately $34,150).

South Korea vs United States: Crypto Regulatory Views

South Korea’s rigid crypto regulations come amidst the United States’ loosened norms under President Donald Trump. While South Korea is restricting access to crypto exchanges and tightening regulations, the US is dismissing prevailing crypto lawsuits.

This distinct regulatory trend highlights the two countries’ differing approaches to balancing innovation and investor protection in the rapidly evolving crypto market. The wider implications of these approaches remain differing with South Korea’s caution likely to influence Asian markets and the US’s permissiveness potentially shaping Western regulatory norms.

Nynu V Jamal

Nynu V Jamal is a passionate crypto journalist with three years of experience in blockchain, web3, and fintech spheres. She has established herself as a knowledgeable and engaging voice in the cryptocurrency and blockchain space. Her experience as an Assistant Professor in English Language and Literature has further added to her quest for crafting informative, well-researched, and accessible content.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

BTC in Stasis Below $88K as Trump Suggests Bigger Tariffs on EU, Canada

Dogecoin Price Eyes 10x Breakout After Elon Musk Ghibli Anime

XRP Price Rejected at Resistance—Are Bears Taking Control?

OpenAI expects to 3X revenue in 2025 but Chinese AI firms are heating up

‘Chart Is Still Broken’ – Crypto Analyst Predicts Sustained Downtrend for Altcoins Until This Takes Place

GameStop Announces $1.3 Billion Fundraising Plan To Purchase Bitcoin

Wyoming Governor Backs Away From State’s Failed Bitcoin Reserve Push

Priced at $0.20, this Solana competitor could be the next crypto to 20x

Why Are We Still Under the SEC’s Gun?

Expert Predicts XRP ETF Approval Is Only A ‘Matter Of Time’ As Approval Odds Soar

Analyst Unveils Extended XRP Price Target To $44, Reveals When To Take Profits

Would GameStop buying Bitcoin help BTC price hit $200K?

New SEC Chair Paul Atkins Holds $6,000,000 in Crypto-Related Investments – Here’s His Portfolio: Report

We’ve Turned A Generation Of Bitcoiners Into Digital Goldbugs

Solana DEX Raydium’s Pump.fun Alternative Is Going Live ‘Within a Week’

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: