chainlink

Chainlink Is In The Middle Of A Bullish Breakout – Analyst Sets $50 Target

Published

2 months agoon

By

admin

Chainlink (LINK) is navigating a turbulent market phase, recently experiencing an 11% decline after reaching a local high of $27 yesterday. This pullback reflects the heightened volatility sweeping through the cryptocurrency market, particularly affecting altcoins. Many altcoins, including Chainlink, are facing sharp declines and aggressive price swings as traders respond to uncertain conditions and Bitcoin’s consolidation near all-time highs.

Related Reading

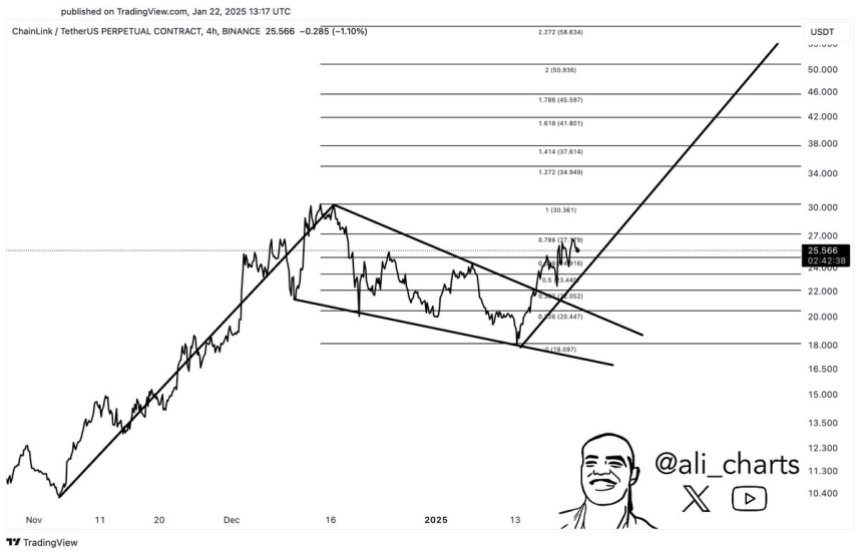

Despite the recent dip, optimism remains among analysts and investors. Top analyst Ali Martinez shared a technical analysis on X, highlighting a bullish perspective for Chainlink. According to Martinez, LINK is currently in the midst of a bullish breakout that, if sustained, could propel the price toward a $50 target. This long-term outlook offers hope for those concerned about the recent retracement, positioning Chainlink as a potential standout in the altcoin market.

As volatility continues to dominate, Chainlink’s ability to navigate these conditions and hold above key levels will be crucial for its bullish trajectory. With analysts pointing to the potential for significant upside, the market is closely watching LINK’s price action in anticipation of its next move. The coming days will reveal whether Chainlink can capitalize on its current setup and emerge as a leader in the altcoin space.

Chainlink Prepares For A Breakout

Chainlink (LINK) has emerged as a bullish standout amid a volatile crypto market, displaying resilience and strength even as altcoins face aggressive selling pressure and uncertainty. With its price maintaining a clear bullish structure, Chainlink appears poised for another upward move, signaling confidence among investors despite broader market turbulence.

Renowned crypto analyst Ali Martinez recently shared a technical analysis on X, highlighting Chainlink’s strong position. According to Martinez, LINK is currently in the midst of a bullish breakout, with a target set at $50. This optimistic projection is supported by the token’s ability to consolidate above critical demand levels, further reinforcing its bullish outlook.

Beyond the technicals, Chainlink’s strong fundamentals add to its appeal. As a pioneer in Oracle blockchain technology, Chainlink continues to cement its leadership in the Real-World Assets (RWA) sector. Its cutting-edge solutions, which enable seamless data integration between blockchains and traditional systems, have garnered widespread adoption and positioned Chainlink as an indispensable part of the decentralized finance ecosystem.

Related Reading

As Chainlink consolidates its gains and prepares for the next leg higher, all eyes are on its ability to maintain its structure and capitalize on its bullish momentum. With both technical and fundamental indicators aligning, LINK is well-positioned to weather market volatility and lead the altcoin recovery. Investors are watching closely as Chainlink continues to set itself apart in the evolving crypto landscape, with its $50 target representing a potential milestone in its ongoing growth.

LINK Holding Strong Above Key Level

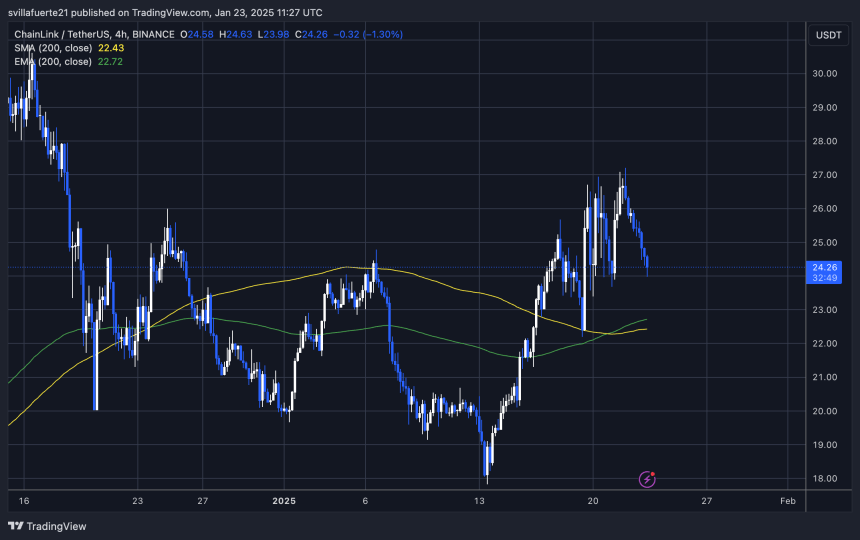

Chainlink (LINK) is currently trading at $24.26, a pivotal level that has transitioned from a stubborn resistance to a strong support zone. This shift marks a significant milestone for LINK, as the $24 level had acted as a supply zone for weeks. Now holding firmly as support, it signals that bulls have regained control, setting the stage for a potential surge.

The price action suggests that LINK is building momentum to break above the $27 mark, a critical level that could trigger a more explosive rally. With the broader market facing uncertainty and heightened volatility, LINK’s ability to maintain key demand zones showcases its relative strength and investor confidence.

This bullish setup positions Chainlink as a standout performer among altcoins, as it continues to weather market turbulence. If bulls can maintain control and push above $27 with conviction, the next rally could propel LINK into higher targets, potentially sparking renewed interest and activity in the altcoin market.

Related Reading

As traders closely monitor these developments, Chainlink’s resilience at the $24.26 level underscores its potential for significant upside. The coming days will be crucial in determining whether LINK can sustain its bullish structure and capitalize on this opportunity to lead the market higher.

Featured image from Dall-E, chart from TradingView

Source link

You may like

World Liberty Financial-Labeled Tokens Spark Speculation of Trump-Backed Project’s Stablecoin Launch

Brad Garlinghouse Discusses Ripple’s Future, Crypto Legislation & Blockchain Technology As Lawsuit Ends

Analyst Sets Dogecoin Next Target As Ascending Triangle Forms

Crypto exchange Kraken exploring $1B raise ahead of IPO: Report

Bitcoin and Stock Market Rally Hard as White House Narrows Scope of Tariffs

Tabit Insurance Raises $40 Million Bitcoin-Funded Insurance Facility

Altcoins

Analyst Says Bitcoin Primed for ‘Party Time’ if BTC Breaks Above Critical Level, Updates Outlook on Chainlink

Published

5 days agoon

March 20, 2025By

admin

Crypto strategist Michaël van de Poppe says Bitcoin (BTC) may take off on a series of rallies if it can break through a key resistance level in the coming days.

The analyst tells his 782,000 followers on the social media platform X that Bitcoin needs to flip $84,500 into support this week in order to regain bullish momentum.

However, he warns if Bitcoin fails to break through $84,500, the flagship crypto asset may collapse in price.

“I really want to see some momentum on Bitcoin. If it doesn’t happen this week and we’ll break sub $82,000, likely we’ll see some new lows. Break $84,500 equals party time.”

Looking at his chart, the analyst says if Bitcoin fails to reclaim $84,500 as support this week, there are two likely outcomes.

“Two scenarios, as Bitcoin faces crucial resistance here:

- Reject and find a higher low [around $82,000].

- Reject and double-bottom retest [in the $70,000 range] before moving higher.”

Bitcoin is trading for $87,315 at time of writing, up 5.7% in the last 24 hours.

Next up, the analyst says that the decentralized oracle network Chainlink may be printing a double-bottom pattern against Bitcoin (LINK/BTC) on the weekly chart.

A double-bottom pattern is typically considered a bullish reversal pattern as buyers step in to create a price floor for an asset.

“LINK doing a double bottom test and back to the range low. Weekly firing up nicely. Things are heating up the right way.”

Based on the trader’s chart, he seems to predict that LINK/BTC will soar to as high as 0.000795 BTC worth $68.39.

LINK/BTC is trading for 0.0001719 BTC ($14.92) at time of writing, up nearly 2% in the last 24 hours.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

chainlink

640,000 Chainlink (LINK) Withdrawn From Exchanges In 24 Hours – Bullish Accumulation?

Published

1 week agoon

March 17, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Chainlink (LINK) is currently trading below crucial resistance levels, which could trigger a strong rally if bulls manage to reclaim them. However, volatility and uncertainty have dominated the market since the start of the month, keeping LINK’s price action unstable.

Related Reading

The token has seen wild price swings, moving from $17 down to $13, briefly rebounding to $16, and then collapsing to a low of $11.8. Bulls are now fighting to push LINK back above the $15 mark, but momentum remains weak, and the market appears to be consolidating around current levels.

Despite this uncertainty, on-chain data is showing promising signs. Metrics from Santiment reveal that 640,000 LINK were pulled off exchanges in the last 24 hours, which is typically a bullish signal. Large withdrawals from exchanges often indicate long-term accumulation, as investors move their holdings into private wallets instead of keeping them available for immediate selling.

With exchange outflows rising, traders are watching closely to see if LINK can break through resistance levels and confirm a shift toward bullish momentum. The next few trading sessions will be key in determining whether LINK can recover or if further consolidation is ahead.

Uncertainty Looms As Investors Watch For A Breakout

Chainlink is currently holding above the $13.5 mark, struggling to reclaim higher levels as selling pressure and market uncertainty persist. Despite its recent recovery attempts, LINK remains stuck below key resistance, making investors cautious about its short-term direction.

Analysts and traders are concerned about a potential drop below the current range, as on-chain metrics suggest a distribution phase may be unfolding. If LINK fails to hold its support zone, it could see renewed selling pressure, sending the price toward lower demand levels.

However, not all signals are bearish. Crypto expert Ali Martinez shared Santiment data on X, revealing that 640,000 LINK were pulled off exchanges in the last 24 hours. This is often seen as a bullish indicator, as large investors typically withdraw their holdings from exchanges when they anticipate higher prices in the future.

When whales and long-term holders accumulate, it reduces selling pressure on the market and strengthens price stability. If LINK manages to break key resistance levels, this accumulation trend could set the stage for a strong recovery rally.

Related Reading

For now, bulls must defend the $13.5 support and push LINK above the $15 mark to confirm a bullish trend reversal. The next few days will be critical as investors watch for a breakout or further downside movement.

Chainlink Bulls Defend Key Support Levels

Chainlink (LINK) is currently trading at $14, facing resistance at the $15 level as bulls struggle to reclaim higher ground. The market remains under pressure, and LINK must hold current levels to avoid a deeper correction.

For a recovery rally to take shape, bulls need to defend the $13 support zone and build momentum toward a breakout above $15. If LINK successfully pushes past this resistance, the next major target is the $17 level, where it must reclaim the 200-day moving average (MA) and the exponential moving average (EMA) to confirm a bullish trend reversal.

However, if LINK fails to hold its current support levels, selling pressure could intensify, driving the price toward the $10 range or even lower levels. This would put LINK in a deeper downtrend, making a short-term recovery more difficult.

Related Reading

With market conditions still uncertain, the next few trading sessions will be crucial in determining whether LINK can stabilize and recover or face further downside risks. Bulls must step in soon to regain control and push prices back into an uptrend.

Featured image from Dall-E, chart from TradingView

Source link

Celestia

Market Cap of Top Five Stablecoins Surges to New All-Time High of $204,700,000,000, According to Analyst

Published

2 weeks agoon

March 11, 2025By

admin

A closely followed analyst says that the total market cap of the five largest stablecoins has reached heights never seen before.

Crypto trader Ali Martinez tells his 131,400 followers on the social media platform X that the top five dollar-pegged crypto assets by market cap have a total valuation of $204.7 billion.

The five largest stablecoins in the market include Tether’s USDT, Circle’s USDC, USDS, Ethena’s USDe and DAI, according to data from CoinGecko.

A soaring stablecoin market cap suggests more buying power on the sidelines. It may also suggest that investors are unloading their crypto assets in favor of dollar-pegged coins.

Looking at Ethena (ENA), a decentralized protocol designed to provide a crypto-based alternative to the traditional banking system, Martinez says the altcoin is flashing a bullish signal based on the Tom DeMark Sequential indicator.

Traders use the TD Sequential Indicator to predict potential trend reversals for tokens based on the closing prices of their 13 previous bars or candles.

“Ethena ENA is flashing bullish signals! A buy signal from the TD Sequential indicator on the weekly chart, combined with a hammer candlestick at key support, suggests a strong rebound could be ahead.”

A hammer candlestick pattern is typically viewed as a bullish reversal signal with the candle wick indicating demand.

At time of writing, ENA is trading for $0.44.

The trader adds that the decentralized oracle network Chainlink (LINK) and the modular blockchain Celestia (TIA) are also showing signs of a potential rebound based on the TD Sequential indicator.

At time of writing, LINK is worth $14.30 and TIA is trading for $3.11.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Natalia Siiatovskaia/Tithi Luadthong

Source link

World Liberty Financial-Labeled Tokens Spark Speculation of Trump-Backed Project’s Stablecoin Launch

Brad Garlinghouse Discusses Ripple’s Future, Crypto Legislation & Blockchain Technology As Lawsuit Ends

Analyst Sets Dogecoin Next Target As Ascending Triangle Forms

Crypto exchange Kraken exploring $1B raise ahead of IPO: Report

Bitcoin and Stock Market Rally Hard as White House Narrows Scope of Tariffs

Tabit Insurance Raises $40 Million Bitcoin-Funded Insurance Facility

Strategy’s Bitcoin Holdings Cross 500,000 BTC After Stock Sales

PwC Italy, SKChain to launch self-sovereign EU digital ID

PwC Italy, SKChain Advisors to Build Blockchain-Based EU Digital Identity Product

Bitcoin Price Set To Explode as Global Liquidity Z Score Flashes Buy Signal

Crypto Braces For April 2 — The Most Crucial Day Of The Year

DYDX shoots up 10% as buybacks get a quarter of protocol revenue

$7,000,000 Up for Grabs As Feds Tell Crypto Fraud Victims To Come Recover Their Money

Berachain rolls out next phase of proof-of-liquidity system

White House to Scale Back Tariffs, Bitcoin Gains on Eased Economic Jitters

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x