chainlink

Chainlink (LINK), UBS Asset Management, Swift Complete Pilot to Bridge Tokenized Funds With TradFi Payment Rails

Published

6 months agoon

By

admin

The project, completed as part of the Monetary Authority of Singapore’s (MAS) Project Guardian, showcased how Swift’s infrastructure can facilitate off-chain cash settlements for tokenized funds. It also demonstrates how tokenization and blockchain can work to improve, not replace, Swift, which connects over 11,500 financial institutions in more than 200 countries.

Source link

You may like

Justin Sun Bets Big On JUST Token, Sees 100x Potential

Worldcoin price prediction | What’s next for WLD price?

Bitcoin Is About To Begin Outperforming Gold, Says InvestAnswers – Here’s His Timeline

Bloomberg Analyst Confirms No Set Launch Date for ProShares XRP ETFs

What is Base? The Ethereum Layer-2 Network Launched by Coinbase

Loopscale hacker in talks to return stolen crypto

Ali Martinez

Chainlink Price Continues To Hover Around $12.5 — Levels To Watch

Published

1 week agoon

April 19, 2025By

admin

Opeyemi is a proficient writer and enthusiast in the exciting and unique cryptocurrency realm. While the digital asset industry was not his first choice, he has remained absolutely drawn since making a foray into the space over two years. Now, Opeyemi takes pride in creating unique pieces unraveling the complexities of blockchain technology and sharing insights on the latest trends in the world of cryptocurrencies.

Opeyemi savors his attraction to the crypto market, which explains why he spends the better parts of his day looking through different price charts. “Looking” is a rather simple way to describe analyzing and interpreting various price patterns and chart formations. However, it appears that is not Opeyemi’s favorite part – in fact, far from it.

Being able to connect what happens on a price chart to on-chain movements and blockchain activities is what keeps Opeyemi ticking. “This emphasizes the intricacies of blockchain technology and the cryptocurrency market,” he would say. Most importantly, Opeyemi thinks of any market insights as the gospel, while recognizing that he is only a messenger.

When he is not clicking away at his keyboard, Opeyemi is most definitely listening to music, playing games, reading a book, or scrolling through X. He likes to think he is not loyal to a particular genre of music, which can be true on many days. However, the fast-rising Afrobeats genre is a staple in Opeyemi’s Spotify Daily Mix.

Meanwhile, Opeyemi is a voracious reader who enjoys a wide category of books – ranging from science fiction, fantasy, and historical, to even romance. He believes that authors like George R. R. Martin and J. K.

Rowling are the greatest of all time when it comes to putting pen to paper. Opeyemi believes his reading of the Harry Potter series twice is proof of that.

Indeed, Opeyemi enjoys spending most of his time within the four walls of his home. However, he also sometimes finds solace in the company of his friends at a bar, a restaurant, or even on a stroll. In essence, Opeyemi’s ambivert (haha! been searching for an opportunity to use the word to describe myself) nature makes him a social chameleon who is able to quickly adapt to different settings.

Opeyemi recognizes the need to constantly develop oneself in order to stay afloat in a competitive and ever-evolving market like crypto. For this reason, he is always in learning mode, ready to pick up the slightest lesson from every situation. Opeyemi is efficient and likes to deliver all that is required of him in time – he believes that “whatever is worth doing at all is worth doing well.” Hence, you will always find him striving to be better.

Ultimately, Opeyemi is a good writer and an even better person who is trying to shed light on an exciting world phenomenon – cryptocurrency. He goes to bed every day with a smile of satisfaction on his face, knowing that he has done his bit of the holy assignment – spreading the crypto gospel to the rest of the world.

Source link

Ali Martinez

Chainlink (LINK) Targets Rebound To $19 — But Only If This Key Support Holds

Published

3 weeks agoon

April 6, 2025By

admin

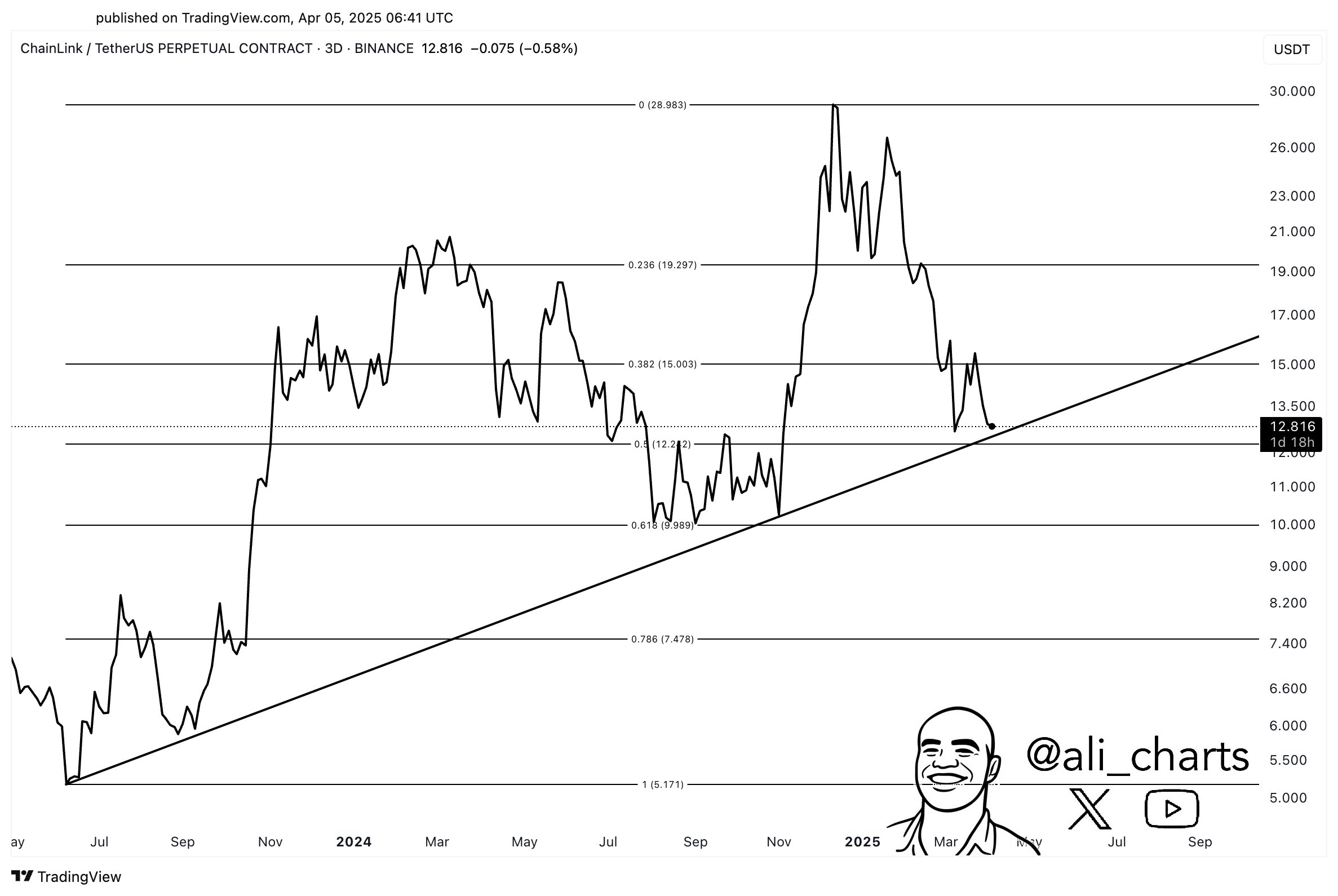

Despite a widespread weekly gain in the crypto market, Chainlink (LINK) remains under significant bearish pressure printing losses across multiple time frames. Since hitting a local price peak of $29.28 in December, the altcoin has slipped into a downtrend losing over 56% since then. Amid this negative performance, top crypto analyst Ali Martinez postulates LINK could soon experience some short-term price gain.

LINK Recovery Depends On Critical Trendline Support

In a recent post on X, Martinez shares a positive technical outlook on LINK hinting the altcoin is likely to experience an upswing. This price forecast is based on a crucial ascending trendline that has acted as price support since mid-2023, ensuring a consistent formation of higher lows and higher highs.

Based on the trading chart by Martinez, Chainlink is currently heading for a retest with the identified trendline near the 0.5 Fibonacci retracement level at $12.00. If LINK bulls can induce a sufficient surge in demand at this level, the following price bounce could ignite a bullish reversal. Looking at historical price patterns, such a price rally could drive Chainlink’s price to around $19, which represents the next resistance zone.

In the presence of robust buying pressure, the altcoin could even rise as high as $30 suggesting a potential 147% price increase on current market prices. On the other hand, a failure to stay above $12.00 would cause an initial price decline to around $10.00, with the potential to trade as low as $5.00.

Chainlink Integrated Into PayPal’s Ecosystem

In other news, prominent American payment platform PayPal Holdings has announced the inclusion of Chainlink in its crypto offerings. In a statement released on April 4, PayPal stated that users will now be able to buy, hold, send, and receive Chainlink and Solana (SOL) on both their PayPal and Venmo wallets.

This development marks a significant step in the mainstream integration of LINK which is crucial to driving token demand in the future. In addition to both tokens, PayPal also offers users access to Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH).

At press time, LINK continues to trade at $12.91 reflecting a 0.62% decline in the past 24 hours. On larger time frames, the token maintains a bearish form with losses of 5.03% and 21.81% in the past seven and thirty days respectively.

According to data from Coincodex, investor sentiments in the LINK market remain highly bearish with a Fear & Greed Index of 26 signaling near-extreme fear. However, the analysts at this firm foresee a price rebound similar to Martinez’s with a forecast of $15.32 in five days and $17.46 in a month.

Source link

Avalanche (Avax)

Cryptocurrencies to Sell Fast if Bitcoin Price Plunges Below $80K

Published

4 weeks agoon

March 30, 2025By

admin

Bitcoin price tumbled towards the $82,000 mark on Sunday, March 30. IntoTheBlock data shows DOGE, Chainlink, and AVAX exhibited high correlation to BTC price action in the last 30 days. Could these tokens be among the top cryptocurrencies to sell if BTC plunges below the $80,000 mark?

Bitcoin Price Tumbles Below $82,000 as Trump’s SEC Chair Nominee Faces Scrutiny

Bitcoin (BTC) market sell-off continued on Saturday, as it closed the week with three consecutive days in losses.

After a positive start to the week, Trump’s tariffs and controversy surrounding the approval of SEC-chair nominee Paul Atkins sent bearish tailwinds across Bitcoin markets over the last three days.

Last Thursday, members of the US Congress raised issues related to “conflict of interests” as Paul Atkins’ confirmation hearing began.

Concerns that a less crypto-friendly SEC chair could replace Atkins further accelerating sell-offs across the global cryptocurrency markets, as evidenced by the Bitcoin price 5.7% decline observed since Friday.

As seen above, BTC price plunged as low as $81,645 on Saturday, before bulls battled back to reclaim the $82,500 level at press time.

However, rising trading volume bars accompanying the downward price action over the last three days suggest bulls will require a strong catalyst to generate sufficient momentum for a major rebound.

Chainlink, DOGE, and Avalanche at Risk – Cryptocurrencies to Sell if BTC Drops Below $80,000

Bitcoin price plunged 5.73% lower than the weekly $87,500 local top recorded on Friday. As prices dropped toward $81,200 on Saturday, bulls stepped in to avert cascading leverage liquidations looming at the $80,000 psychological support level.

However, BTC traders were not the only ones relieved to see prices back above $82,500. According to on-chain data culled from IntoTheBlock, DOGE, Chainlink, and AVAX exhibited high correlation to BTC price action in the last 30 days.

This shows that these assets have often moved in the same direction as BTC.

The correlation matrix highlights a strong relationship between Bitcoin (BTC) and Chainlink (LINK), Dogecoin (DOGE), and Avalanche (AVAX) over the past 30 days. Specifically, LINK (0.93), DOGE (0.80), and AVAX (0.79) exhibit high positive correlations with BTC, meaning their price movements largely mirror Bitcoin’s trajectory.

If BTC plunges below $80,000, these altcoins could experience intensified sell-offs as traders attempt to hedge against further losses. Given their historically high correlation, a sustained BTC price downtrend could drag these cryptocurrencies to sell significantly lower, triggering margin calls and forced liquidations in leveraged positions.

Strategic traders may consider reducing exposure to these assets or implementing stop-loss orders if BTC continues struggling for traction.

If Bitcoin fails to reclaim key resistance levels, a broader market downturn could push these correlated altcoins into deeper losses, reinforcing a bearish outlook. For traders looking to manage risk, these could be among the top cryptocurrencies to sell in a volatile market.

Frequently Asked Questions (FAQs)

Bitcoin’s price is declining due to market sell-offs, rising liquidation risks, and uncertainty surrounding Trump’s SEC chair nominee, Paul Atkins.

These altcoins have a high correlation with Bitcoin, meaning they often move in the same direction, making them vulnerable when BTC tumbles

A break below $80,000 could trigger further sell-offs in correlated altcoins, leading to margin calls and increased liquidation risks.

ibrahim

Crypto analyst covering derivatives markets, macro trends, technical analysis, and DeFi. His works feature in-depth market insights, price forecasts, and institutional-grade research on digital assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Justin Sun Bets Big On JUST Token, Sees 100x Potential

Worldcoin price prediction | What’s next for WLD price?

Bitcoin Is About To Begin Outperforming Gold, Says InvestAnswers – Here’s His Timeline

Bloomberg Analyst Confirms No Set Launch Date for ProShares XRP ETFs

What is Base? The Ethereum Layer-2 Network Launched by Coinbase

Loopscale hacker in talks to return stolen crypto

Bitcoin (BTC) Yield Platform Coming From Coinbase (COIN), Aspen Digital

The Emerging Market For State Services Via Citizen X

XRP Price Shoots For 20% Surge To $2.51 Amid Pullback To Breakout Zone

Stocks edge higher ahead of big earnings week

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin6 months ago

Bitcoin6 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

✓ Share: