China

China May Be On the Verge of Ending Its Bitcoin Ban

Published

4 months agoon

By

admin

Look, I think it’s only a matter of time before China pulls a complete 180 on its Bitcoin ban. Yes, they outlawed trading and mining back in 2021, but honestly, a lot has changed since then — especially this year. Bitcoin’s momentum globally has been insane.

We’ve seen US President-Elect Donald Trump calling to stockpile Bitcoin; Bitcoin ETFs get approved, Fed Chair Jerome Powell calling Bitcoin “digital gold,” Larry Fink flipping pro-Bitcoin, and even Putin saying nice things about it. With all of this happening, I wouldn’t be shocked if China has already started quietly stacking sats (buying bitcoin).

Here’s why I think that: China doesn’t like to announce what it’s doing beforehand — it’s just not how they operate. Former Binance CEO CZ talked about this recently at the Bitcoin MENA conference in Abu Dhabi, saying that while the US loves to make big public statements about upcoming policies (like Trump announcing Bitcoin plans to court voters), Asian countries prefer to move in silence.

And let’s not forget China doesn’t have elections. They don’t need to win over public opinion like Trump does. If they’re making moves with Bitcoin, they’ll do it quietly — and we’ll find out when they’re ready to make it official.

Now, with Trump’s big push for Bitcoin and crypto, I can’t see China sitting on the sidelines for too long. This is turning into a global race, and if China wants to stay competitive, they can’t afford to miss the Bitcoin train. My gut tells me they’re already planning to unban Bitcoin and crypto — and I wouldn’t be surprised if it happens as early as Q1 next year, especially if Trump takes office.

Another big hint? Hong Kong. China has a long history of using Hong Kong as a sandbox to test things before rolling them out on the mainland. And this year, we’ve seen Hong Kong make major moves — approving Bitcoin and crypto ETFs and greenlighting more crypto exchanges. Let’s be real: this isn’t a coincidence. They are planning to eliminate crypto taxes for institutions. I think China is watching carefully, and these are early steps toward a broader shift.

In my opinion, China has likely been quietly accumulating bitcoin all along. When the time is right, they’ll unban it — and not just to compete with the US, but to lead. Watch this space. I think it’s going to happen much sooner than most people expect.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Bitcoin

Gold Rush Or Bitcoin Boom? China Buys Big, BTC Price Follows

Published

6 days agoon

April 21, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

China has added five tonnes of gold to its reserves in under a month as part of an increasing aggressive purchase of the precious metal. Bitcoin continues to stand firm above the $87,000 level despite recent market fluctuations.

Related Reading

PBOC Gold Accumulation Up As Bitcoin Price Soars

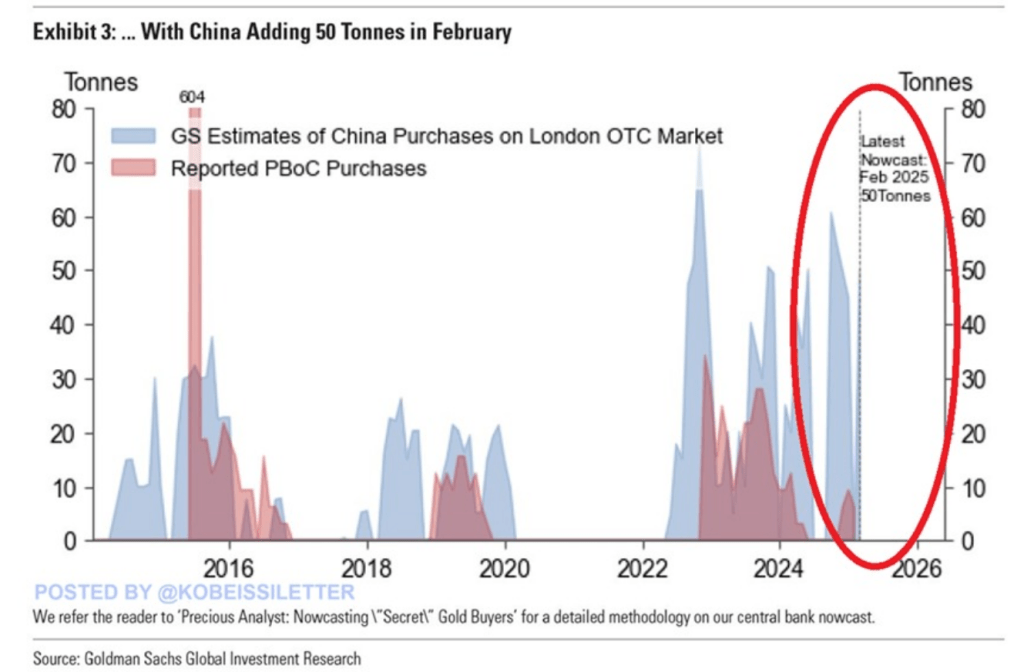

According to the Kobeissi Letter in posting messages on X, the People’s Bank of China has been abruptly accumulating gold. It has acquired five tonnes over the last month. This has taken place amid uncertainty in global markets from the rift caused by persistent tensions in trade along US-China fronts.

Bitcoin traders seem to witness this, as the price of the crypto holds strong at $87,280, with scanty negative macronews in the background. Merely four days ago, cryptocurrencies fell back after US President Donald Trump proclaimed a 245% import tax on Chinese items. The quick recovery has surprised many market observers.

BREAKING: China’s central bank increased its gold holdings by 5 tonnes in March, posting their 5th consecutive monthly purchase.

This brings total China’s gold reserves to a record 2,292 tonnes.

Chinese gold holdings now reflect 6.5% of its total official reserve assets.… pic.twitter.com/LuwiBvnirn

— The Kobeissi Letter (@KobeissiLetter) April 20, 2025

Whale Wallets Indicate Growing Appetite For Bitcoin

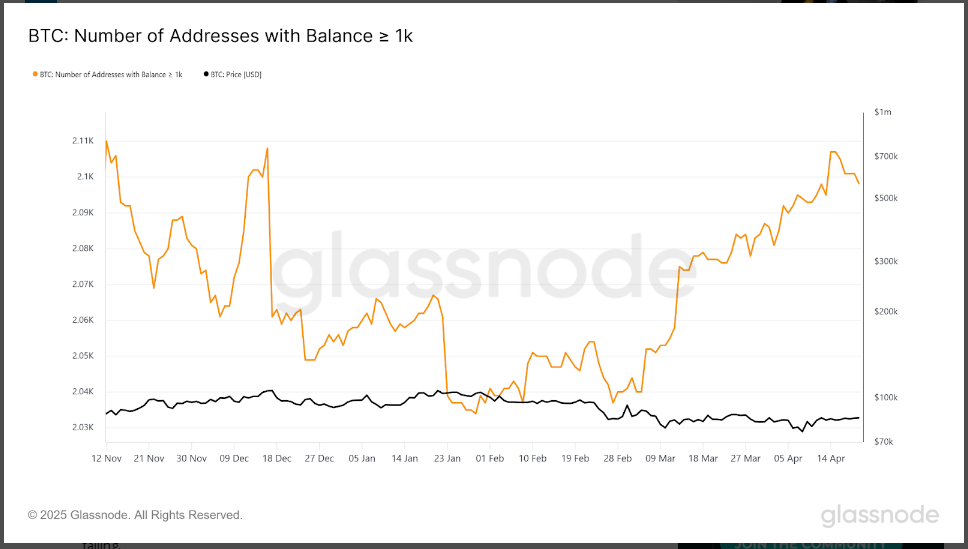

Statistics by Glassnode indicate a steep increase in addresses containing over 1,000 Bitcoin. More than 60 new “whale” wallets have entered the market since early March.

The number of such large Bitcoin addresses has increased from 2,030 in late February to 2,100 as of April 15, which is the highest in four months. The boost indicates large investors are purchasing more Bitcoin despite changing market conditions.

Others say the strength of Bitcoin lies in its increased popularity as an inflation hedge, akin to gold. This theory has become more widely accepted as China seems to be steering away from US dollar-denominated assets.

Gold Prices Hit New Records As Trade Tensions Mount

Prices of gold have surged to $3,401, up by close to $100 over only a week. The rise comes as institutions, dominated by China, raise their gold stockpiles.

The ongoing tariff war between the US and China has driven investors towards traditional safe-haven assets. Bitcoin is also seen to be gaining from this same trend, with some investors seeing it as a contemporary option for gold in times of uncertainty.

Mixed Signals From ETF Flows And Market Analysts

Not everything is rosy for Bitcoin. Reports disclose that nearly $5 billion has exited Bitcoin ETFs since their aggregate flow hit all-time highs. In spite of this outflow, Bitcoin’s price has remained extremely stable.

Related Reading

There are also contradictory reports regarding China’s position on Bitcoin. While there are rumors that China may be accumulating a Strategic Bitcoin Reserve, other reports say the nation sold 15,000 BTC on offshore exchanges.

The cryptocurrency’s ability to maintain its price despite these mixed signals has caught the attention of traders worldwide. As US-China economic tensions continue, investors are watching both gold and Bitcoin as potential safe havens in an increasingly unstable global market.

Featured image from GEPL Capital, chart from TradingView

Source link

Bessent

Why The Bond Market Matters More Than Ever For U.S. Foreign Policy

Published

2 weeks agoon

April 13, 2025By

admin

Scott Bessent’s Bond Strategy: The U.S. Ten-Year, Foreign Policy & the New Monetary Order

Experts from the Bitcoin Policy Institute unpack why the 10-year Treasury yield is central to Donald Trump’s policy ambitions and U.S. Treasury Secretary Scott Bessent’s economic strategy.

Featuring Bitcoin Policy Institute Executive Director Matthew Pines, Head of Policy Zack Shapiro and Growth Associate Zack Cohen.

They explore how bond market dynamics affect U.S. interest payments, trade policy, and the feasibility of industrial onshoring. As America confronts growing debt burdens and fiscal constraints, understanding the yield curve becomes critical for navigating the future of U.S. monetary policy and Bitcoin’s role within it.

From Episode #1 of The Bitcoin Policy Hour: “Wargaming the Mar-a-Lago Accord: Tariffs, Bitcoin and Stablecoins“.

Source link

24/7 Cryptocurrency News

Crypto Market Rebounds As Donald Trump Exempts Tech From Tariffs On China

Published

2 weeks agoon

April 12, 2025By

admin

The crypto market, led by Bitcoin, has rebounded following Donald Trump’s decision to exempt tech products from tariffs he has imposed on China and other countries. Market participants see this as a positive amid the ongoing trade war between the US and China.

Crypto Market Rebounds As Donald Trump Exempts Tech Products From Tariffs

The crypto market has surged following Donald Trump’s move to exempt tech products from reciprocal tariffs imposed on China and other countries. According to a CNBC report, the US president has exempted phones, computers, and chips from the new tariffs.

The Bitcoin price surged past the $85,000 market following this report, with other altcoins also recording significant gains. This development is undoubtedly bullish for the market as it reduces the severity of the tariffs that Trump imposed on almost all countries earlier this month.

Moreover, this represents a big win for the stock market, with companies like Apple the biggest beneficiaries of this exemption. As such, it is normal for the crypto market to rebound alongside, given Bitcoin’s correlation with stocks.

Meanwhile, this move could also mark the beginning of the end of the ongoing trade war between the US and China. As CoinGape reported, China yesterday announced a 125% tariff on US imports following the latter’s decision to impose 145% tariffs on Chinese goods.

Trump already mentioned that he is looking forward to making a deal with China, which is also positive for the market. Bitcoin and altcoins could witness another massive rally once that happens.

Correctional Phase Could Soon Be Over

In a recent X post, crypto analyst Kevin Capital suggested that the correctional phase could soon be over for the crypto market. He noted that this phase has so far gone according to plan. However, he warned that there is still a lot of work to be done.

The analyst believes it is important for the Bitcoin price to clear the $89,000 level before market participants start feeling good. He added that the macro side also needs to line up for things to start looking really good for the market.

The macro side looks to be progressing well as the Federal Reserve recently revealed plans to provide liquidity if necessary. Meanwhile, the latest CPI and PPI inflation data came in lower than expectations, which could also motivate the Fed to start easing monetary policies.

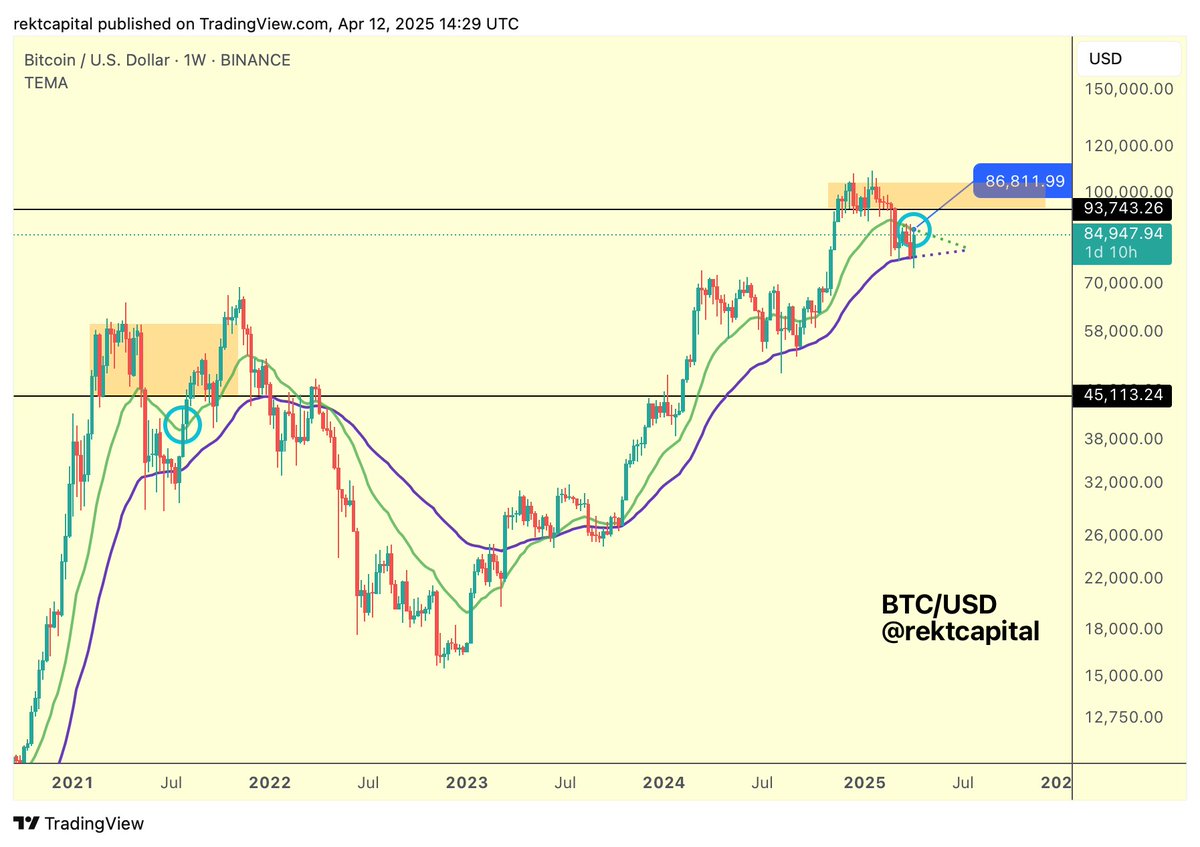

Crypto analyst Rekt Capital warned that Bitcoin isn’t there yet. He stated that it would be momentous to weekly close above $86,000, as this would potentially set BTC up for a repeat of a mid-2021 breakout. However, the flagship crypto is still away from the bullish weekly close of $86,811.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across several topics and niches. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover, a traveler and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Bitcoin Post-Halving Price Performance Is the Worst on Record. Why?

Expert Predicts Start Date For Pi Network Price Pump

GameFi Tokens Show Signs of Life After Gala Games, White House Tie-Up

Bitcoin trades at ‘40% discount’ as spot BTC ETF buying soars to $3B in one week

Bitcoin Continues To Flow Out Of Major Exchanges — Supply Squeeze Soon?

BlackRock’s Bitcoin ETF Sees $643 Million Inflows

DePIN Altcoin Outpaces Crypto Market and Skyrockets by Nearly 44% Following High-Profile Exchange Listing

Solaxy, BTC bull token, and Pepeto gaining momentum as leading 2025 presale tokens

Australian Radio Station Used AI DJ For Months Before Being Discovered

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

✓ Share: