Bitcoin Payments

Chinese microchip company says it’s now accepting Bitcoin as payment

Published

5 months agoon

By

admin

Shares in China-based crypto mining chip designer Nano Labs rose slightly after announced it is now accepting Bitcoin as payment for its goods and services through a business account on Coinbase.

In a Nov. 11 statement, the Huangzhou-based crypto mining chip maker, which is listed on the Nasdaq, said the move was part of a “commitment to embracing the latest in financial technology” as demand increases for “digital currency transactions in the technology sector.”

Nano Labs said it was taking a “proactive stance in the evolving digital economy” as crypto “adoption continues to grow, particularly among businesses seeking efficient and secure cross-border transactions.”

According to Nano Labs, adopting Bitcoin (BTC) will provide “greater payment flexibility,” but it didn’t offer any details about whether it intends to keep the cryptocurrency on its balance sheet.

Following the announcement, shares in the Nasdaq-listed company rose 2.81% to $3.29.

Nano Labs’ share price saw a slight uptick after an announcement about accepting Bitcoin as a payment option. Source: Nasdaq

However, it hasn’t been enough to offset a share slump over the last month,which fell over 60% from a high of $8.33. It’s also nowhere near the all-time high of $96.20 set in July 2022, soon after the company was listed on the Nasdaq.

A growing number of companies are now accepting crypto as payment for some of their services.

Microsoft allows users of its Xbox store to pay in Bitcoin. McDonald’s adopted crypto as legal tender in its locations in El Salvador and Lugano, Switzerland.

The NBA franchise Dallas Mavericks also adopted Bitcoin as a payment option for club products and game tickets through BitPay.

China’s love-hate relationship with crypto

Beijing cracked down on crypto activities in May 2021, shutting down multiple mining firms and suspending crypto trading. However, authorities’ stance appears to have relaxed in recent times, despite an attempt to crack down on Tether in January.

In September, former Chinese finance minister Lou Jiwei urged China to closely examine advancements in crypto during a speech at the Sept. 28 Tsinghua Wudaokou Chief Economists Forum in Beijing.

Related: China still controls 55% of Bitcoin hashrate despite crypto ban

A few days earlier, a Shanghai Intermediate People’s Court in China recognized Bitcoin as a unique and non-replicable digital asset and acknowledged its scarcity and inherent value in a Sept. 25. report. Another Chinese court came to a similar conclusion on Sept. 1.

Earlier this year, Hong Kong’s financial regulator, the Securities and Futures Commission (SFC), also approved the first spot Bitcoin and Ether (ETH) ETFs on April 24.

Magazine: Real life yield farming: How tokenization is transforming lives in Africa

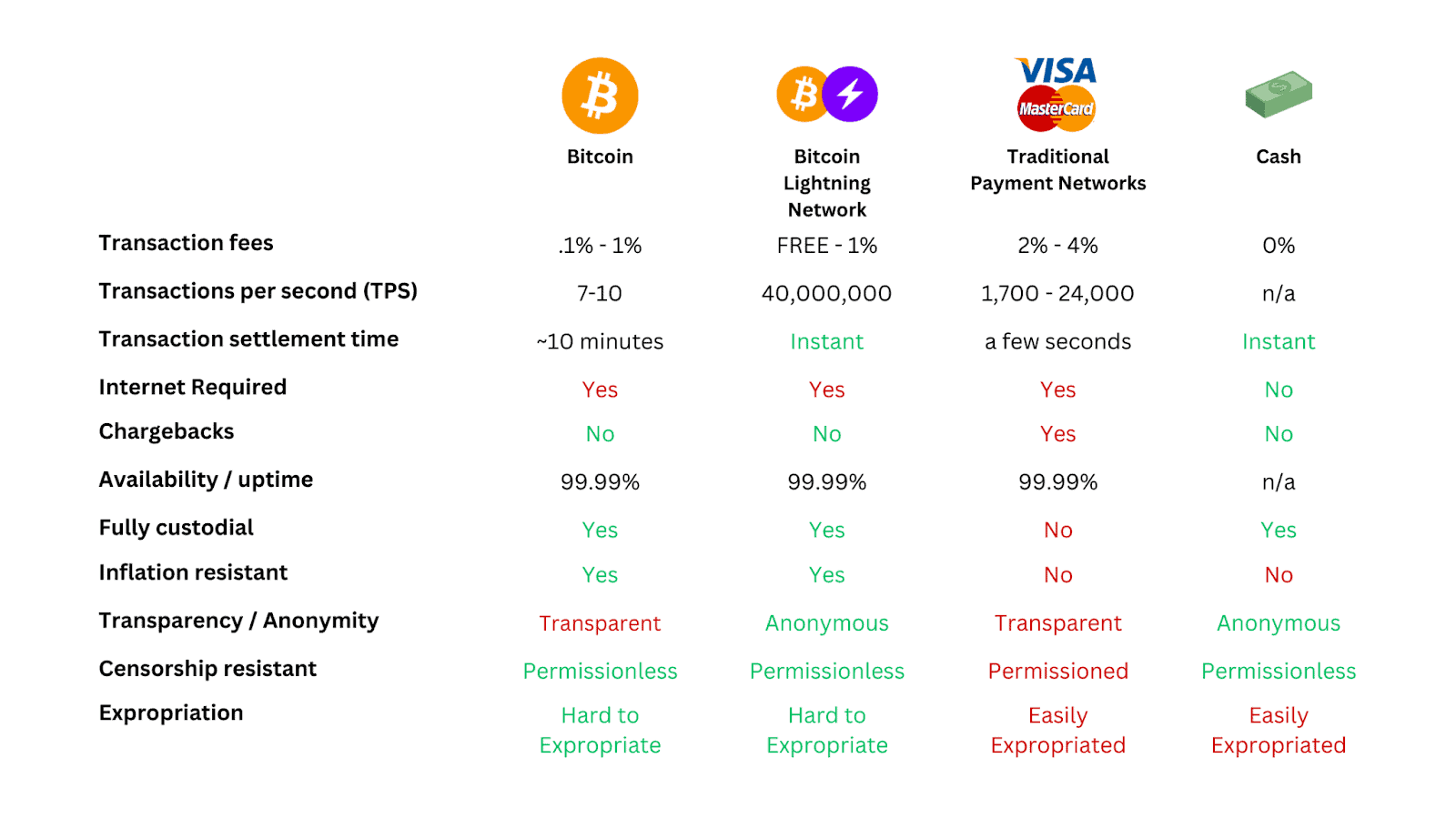

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown Athens Exchange Group eyes first onchain order book via Sui Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal AVAX Falls 2.1% as Nearly All Assets Trade Lower What is a VTuber, and how do you become one in 2025? Published on By Amid ongoing sanctions over the war in Ukraine, Russia has turned to bitcoin and other cryptocurrencies to facilitate some of its oil trade with major buyers China and India. According to a Reuters report, Russian oil companies and traders increasingly conduct transactions in bitcoin and crypto, allowing them to circumvent restrictions from Western nations. Sources say monthly trade volumes are already in the tens of millions of dollars. The mechanism involves Chinese or Indian buyers purchasing oil and depositing yuan or rupees into an offshore account owned by a middleman company. The middleman then converts the fiat currency into crypto and transfers it to an account in Russia, where it is exchanged into rubles. While crypto-based oil payments are still a fraction of Russia’s $192 billion total oil trade, the practice is growing as sanctions bite. The trend highlights the utility of bitcoin and crypto in enabling transaction settlement for sanctioned nations. Iran and Venezuela have adopted similar crypto strategies. Bitcoin and crypto’s censorship resistance allows value transfer beyond the reach of sanctions. In late 2024, Russia’s finance minister publicly endorsed using crypto in foreign trade. The Kremlin sees bitcoin and crypto as one of several effective strategies to overcome financial penalties imposed over the invasion of Ukraine. The Bank of Russia also recently proposed legalizing crypto investments for wealthy citizens. However, Russia’s oil trade still relies primarily on fiat currencies. President Donald Trump’s administration is debating whether to ease some restrictions to improve relations with Moscow. With the Ukraine conflict still unresolved, Russia’s pivot toward leveraging bitcoin and decentralized technologies appears to aim to reduce its reliance on traditional finance and dollar settlements. Other countries under U.S. sanctions are likely to be monitored closely. Published on By Bitcoin is often praised as a long-term savings technology, but its role as a medium of exchange is just as important—especially for businesses. From local cafés to large corporations, more merchants are considering bitcoin as a payment option, drawn by its low fees, fast transactions, and ability to reach a global, young and tech savvy customer base. This guide explores how local businesses can start accepting bitcoin, covering both the immediate benefits and long-term strategic advantages. As digital payments evolve, understanding Bitcoin’s potential isn’t just an option—it’s becoming essential for businesses looking to stay ahead. There are three main reasons for a small business to accept bitcoin: Some other benefits include: Every business, whether a cozy corner café or a sprawling enterprise, has its own unique needs when it comes to accepting payments. For that reason, it’s essential to understand how bitcoin could fit into your specific business: A café might find it perfectly suitable to use a simple mobile Bitcoin wallet for transactions, but larger businesses (or those seeking a polished and professional approach) might opt for a more comprehensive integration. Whatever your business size or aspirations, this guide is tailored to provide insights and steps to seamlessly incorporate bitcoin payments. Before we dive in, it’s important to learn about Bitcoin and why it should become a vital part of your business. It’s more than just another payment method; it’s a groundbreaking new currency and a powerful monetary network. Adopting Bitcoin won’t just expand your payment alternatives but could also lower operational expenses. The Bitcoin network is the world’s most secure computer network. It’s an unchangeable, censorship-resistant, immutable, global network of value which is beyond the purview of governments and conventional banking systems. Furthermore, it boasts a limited supply of twenty-one million coins — each divisible into smaller units, marking the advent of a genuinely limited and robust currency. Notably, bitcoin is a bearer asset, which means that those who hold bitcoin possess the actual asset, not just a debt or an IOU as is the case with fiat bank accounts. Read more >> What is Bitcoin & Why Does it Have Value Layer 1 (High security and settlement in minutes) Bitcoin’s base layer is a triple-entry ledger accounting system (timestamp server) where transactions are timestamped, irreversible, publicly verifiable, and secured by nodes and hash power. This makes it the most secure financial settlement network ever created. With settlement roughly every 10 minutes, Layer 1 is best suited for high-value transactions where instant finality isn’t required—such as buying a car, settling invoices, or large business payments. Layer 2 (Medium security, with settlement in seconds) The Lightning Network enables near-instant bitcoin transactions without compromising the security of the base layer. Operating as a second-layer protocol, it allows users to transact off-chain while remaining secured by Bitcoin’s triple-entry accounting system. When a channel is opened, funds are locked into the base chain, and from that point, transactions occur off-chain as state updates between channel participants—similar to an abacus keeping track of balances. The base chain remains unaware of these transactions until a channel is closed, at which point the net result is settled on-chain. With settlement speeds faster than Visa or Mastercard, Lightning is ideal for everyday payments in cafés, retail shops, and beyond. Now that we understand the layers, let’s talk about wallets. Accepting Bitcoin without proper security measures is counterproductive. Wallets function as digital safes for bitcoin, ensuring its security and facilitating transactions by generating Bitcoin addresses. Businesses transacting in Bitcoin should prioritize self-custody. While some might consider entrusting their bitcoin to third parties, it’s important to be aware of the associated risks. Should a third party mismanage your bitcoin or become insolvent, your business will lose its bitcoin; bitcoin held with a third party isn’t your bitcoin. Instead of relying on third parties, businesses should use a cryptographically secure Bitcoin wallet. Various wallets support both transaction layers, capable of generating unique Bitcoin addresses for transactions on either layer. Businesses should store bitcoin for the long term in a layer-1 hardware wallet or a multisig wallet. Sending bitcoin from a Lightning software wallet to a Bitcoin hardware wallet is relatively straightforward. We recommend keeping less than a month’s worth of bitcoin in a Lightning or hot wallet. When deciding on a payment solution for Bitcoin transactions, you should determine if a simple wallet is adequate or if it’s necessary to use a specialized payment app. Lightning wallets are primarily designed for personal use and not for commercial transactions. That said, some provide a light-touch POS solution and as such serve as an introductory tool for businesses to familiarize themselves with bitcoin payments. To proceed, simply download a Lightning wallet from the Android or App Store. We recommend upgrading from simple Lightning wallets should the amount of bitcoin received begin to grow, as basic wallets introduce a number of minor challenges that are easily overcome with a more customized solution. Specialized payment apps should be the preferred solution for local businesses as they provide a plethora of features necessary to run a business. Transaction with labeling: “2023-08-24: Coffee – Latte – $3 – Invoice #12345” Transaction without labeling: 2023-08-24 – XYZ123 – $3” Note: While payment processors don’t address the risks associated with zero-confirmation transactions, the Lightning network does. Accepting payments without network confirmations, known as “zeroconf,” can lead to potential double-spending issues. All that’s required is a mobile phone loaded with one of the following apps, which can be downloaded from the Google Play Store or the App Store. These setups can be enhanced by using a dedicated phone embedded in an NFC-enabled POS terminal, loaded with any of the necessary apps listed above. These terminals are better than using just a phone, as the customer can see clearly where to tap their phone or Bolt Card to pay for a transaction. Most legacy point-of-sale (POS) systems do not yet support native Bitcoin payments, as traditional payment processors remain heavily tied to the fiat banking system. However, some providers are beginning to experiment with Bitcoin integration, recognizing the growing demand from businesses and consumers. As demand increases, more traditional POS providers will likely integrate Bitcoin payments, but for now, merchants must use workarounds or hybrid setups to accept Bitcoin while still using their existing systems. Whether you’ve opted for a simple Lightning wallet, or a POS app, the process to accept payments is more or less the same. 1. Customer places an order: When a customer orders a coffee or any other item, tally the total cost in your local currency as you would for any other transaction. 2. Generate a Bitcoin invoice: Using your payment app, put in the total dollar amount of the order. The app will automatically convert this amount into its equivalent in bitcoin or satoshis (fractions of a Bitcoin) based on the current exchange rate. 3. Display the payment prompt: Once the invoice is generated, your app will display a QR code or activate an NFC instance for the customer to scan or tap with their phone. 4. Customer initiates payment: The customer will open their Lightning-enabled wallet app on their phone. They will then either: a. Scan the QR code displayed on your device, or b. Tap their phone against yours if both devices support NFC. c. Alternatively, if the customer has a Bold Card (Bitcoin NFC card), they can tap that against your device. 5. Payment verification: Once scanned or tapped, the customer’s wallet app will display the payment details, including the amount in bitcoin/satoshis and the merchant information (i.e., your café). The customer should verify that the amount and details are correct. 6. Customer approves the transaction: After verifying the payment details, the customer will be prompted to confirm and accept the transaction on their app. They’ll click or tap the “Accept” or “Confirm” button. 7. Transaction confirmation: Your payment app will instantly receive the payment and notify you of a successful transaction. The Lightning network ensures that this process is quick, often within seconds. Zaprite, CoinCorner Checkout, and Bitcoin Suisse Pay are services that allow anyone to create customized invoices that can be paid with bitcoin or even a bank transfer. The beauty of using such solutions is that the invoice can be issued in dollars, paid in dollars, and still be received in bitcoin. They need not ever know that bitcoin is being transacted; the payer need not even know the payee received bitcoin. For businesses with an online presence, integrating bitcoin payments can be seamless with solutions like Zaprite, BTCPay Server, OpenNode, Flash, CoinCorner Checkout, or Bitcoin Suisse Pay. Shopify also supports Bitcoin payments through third-party integrations like BTCPay Server, and OpenNode. Merchants using Shopify can easily add these payment processors to their stores, allowing customers to pay in Bitcoin while keeping checkout smooth and familiar. Like any new technology or system adopted by a business, proficiency is critical to leverage its full potential and ensure seamless integration into existing workflows. Stakeholders need to learn about Bitcoin, so as to not make uninformed or rash decisions about the business and its Bitcoin implementation. Meanwhile, staff members are at the forefront of daily operations, and their ability to manage Bitcoin transactions effectively will directly impact customer satisfaction and the company’s reputation. Simply put, adequate knowledge safeguards the company’s assets, maintains trust with its clientele, and guarantees that the decision to adopt bitcoin yields the desired advantages. Further, using a solution like Bitwage or CashApp, your staff can be paid in bitcoin, which may lead them to view the company as forward-thinking and progressive in nature. It may also give them the sense of having a vested interest in the business and value their work more. It’s critical to be aware of the tax implications and accounting requirements when dealing with bitcoin. Regularly consulting a financial advisor or accountant familiar with cryptocurrency can ensure compliance and proper reporting. In the USA, the Financial Accounting Standards Board (FASB) has allowed fair value accounting from 2024. So businesses based in the USA can mark their treasury up or down on their books accordingly. In most jurisdictions, taxation only applies when the asset is being sold. So a reasonable goal for most small businesses could be (at least in the early stages) to stack a small percentage of bitcoin that will appreciate in value over time. It’s important to keep a record of transactions so that capital gains can be calculated accurately in due course. Should a business have tight cash flows, then it would be useful to keep the volume of bitcoin received low, which can be done by setting up the payment app to receive payments mostly in dollars. Disclaimer: This article, including any advice and information contained herein, is provided for general informational purposes only and should not be construed as tax advice. Bitcoin Magazine and the author are not offering tax advice to readers. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Readers should consult their own tax advisor or accountant to understand the tax implications of their investments and financial decisions. Let everyone know you accept bitcoin. At the very least, display a sticker or sign at the checkout to signify that bitcoin is a valid payment method. Additionally, placing a sign on your shop’s window or exterior wall can attract the attention of passers by, especially Bitcoiners. Collaborate with local Bitcoin enthusiasts and join Bitcoin meetups to promote your services within the local Bitcoin community. Consider contacting local bloggers and/or media to create a local PR campaign, which would inform the broader community about this alternative payment option. Making payments in bitcoin more attractive than dollars would also be hugely advantageous to businesses, assuming the margins are not already too thin. A business that can build bitcoin reserves should benefit greatly from its long-term appreciation. The above image is a snapshot of BTC Map, 2024. Of course, you should add your business listing to Satmap and BTC Map, so that your business is noticeable to potential visitors from around the world. Bitcoin is young: Bitcoin is still in its nascent stages. Drawing parallels to the early days of business websites, it should be considered an addition to traditional payment systems, not a replacement. The benefit of accepting bitcoin early is better than having a business website in the ’90s. By receiving bitcoin and adding it to your company’s treasury, your business benefits from its price appreciation relative to traditional currencies. Companies like Newegg, Starbucks, Microsoft, Bed & Beyond, Tesla and much more recognize the benefits and accept payments. POS hardware solutions like Clover, Toast, and Square will integrate bitcoin in due course, if they haven’t already done so. Until then, the onus is upon small businesses to learn about bitcoin and implement a solid solution for their business. Price volatility: Bitcoin’s price can be volatile. However, with strategies like immediate conversion or fund splitting, businesses can mitigate potential risks. Security protocols: Adopting best practices for securing bitcoin assets and transactions is crucial to prevent potential breaches. Regulatory landscape and taxation: Staying updated with regulations and tax laws is essential to ensuring compliance. In most jurisdictions the taxing authorities treat bitcoin as an investment subject to capital gains tax. We recommend talking to your accountant or tax advisor on how tax would be applied to any bitcoin you receive. Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025 Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist Aptos Leverages Chainlink To Enhance Scalability and Data Access Bitcoin Could Rally to $80,000 on the Eve of US Elections Crypto’s Big Trump Gamble Is Risky Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Source link You may like

![]()

![]()

Bitcoin Payments

Russia Is Using Bitcoin And Crypto For Its Oil Trades With China And India

Source link Bitcoin Payments

How Local Businesses Can Use Bitcoin For Payments

I. Introduction

II. Benefits of Accepting Bitcoin for Small Businesses

III. Implementing Bitcoin in Business Operations

Step 1: Learn about Bitcoin

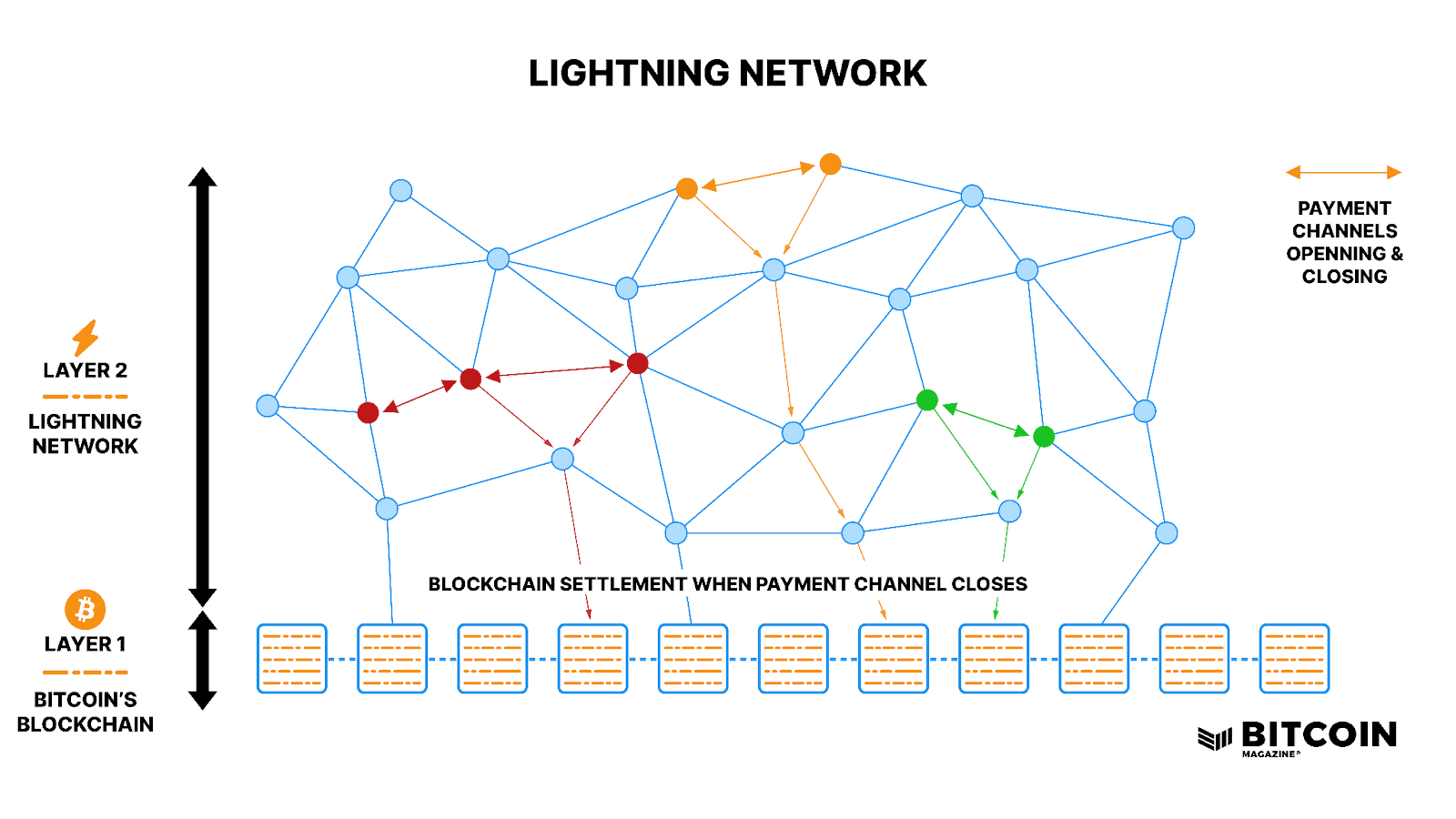

Step 2: Understand Transaction Layers

Step 3: Choose a Bitcoin Wallet

Step 4: Point of Sale (POS) Payment Solutions

Option 1: Use a Basic Lightning wallet

Option 2: Use a Bitcoin Point-of-Sale app

Option 3: Use an enterprise POS solution

Option 4: Are legacy POS solutions available?

Step 5: How to Process a Transaction

A. Brick and Mortar Payments

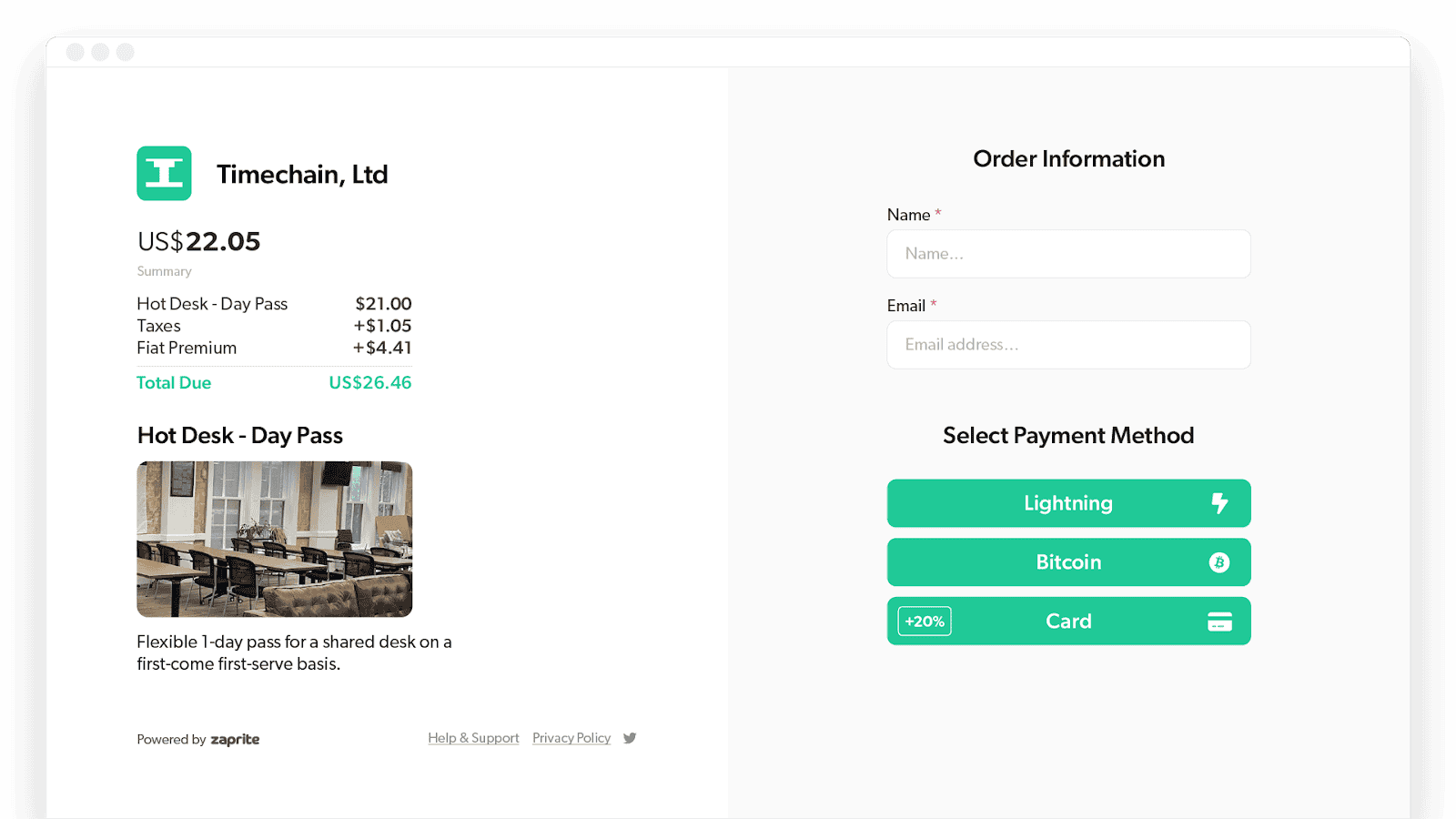

B. Invoicing

C. E-commerce Integration

Step 8: Educate Staff and Stakeholders

Step 9: Accounting and Tax Considerations

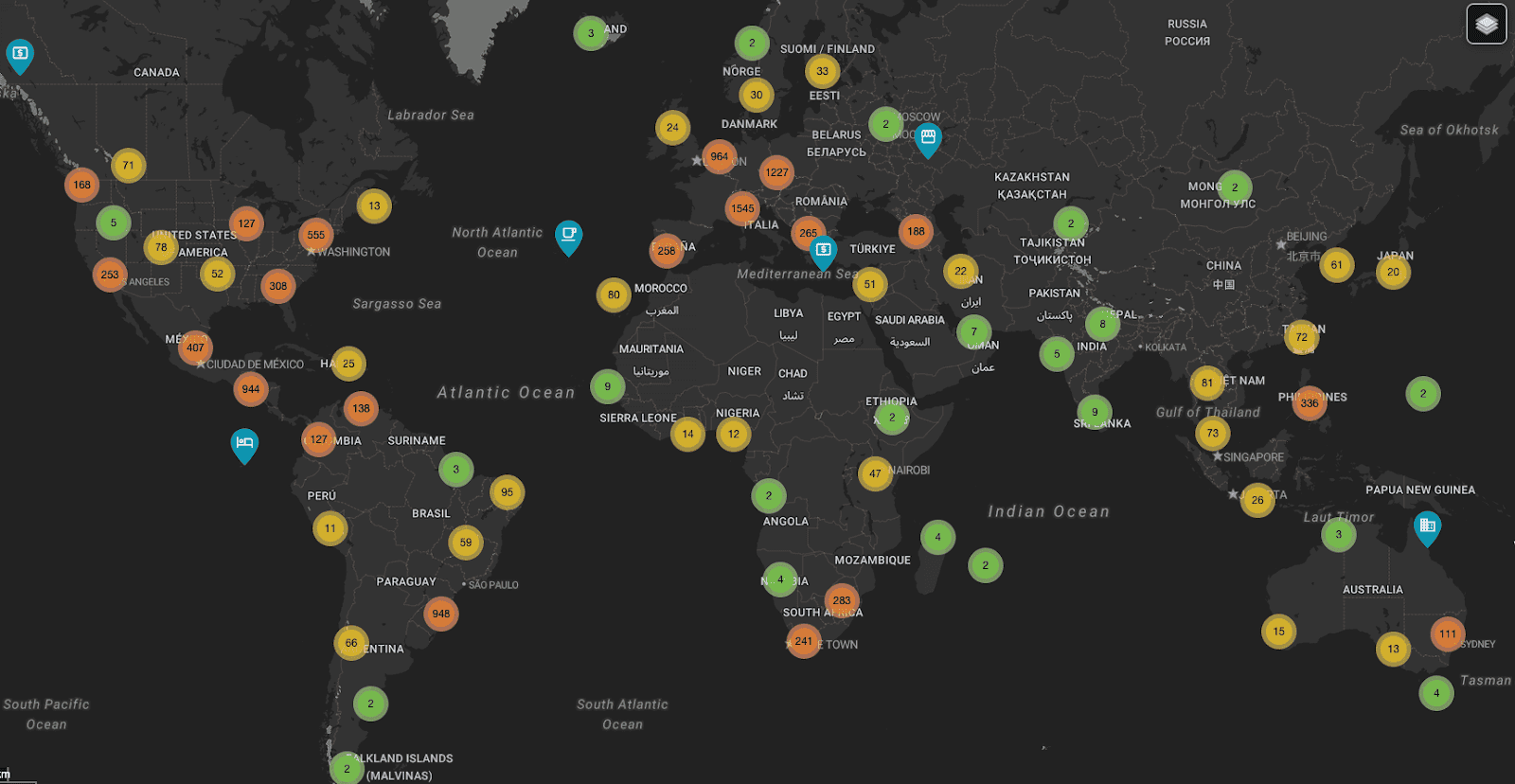

Step 10: Bitcoin Accepted Here

IV. Challenges and Considerations

Source link

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

![]()

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Coinbase Urges Australia to Vote for Crypto Progress in May

How High Would Pi Network Price Go If Pi Coin Adopts Transparency to Avoid Mantra Pitfalls

XRP’s ‘Rising Wedge’ Breakdown Puts Focus on $1.6 Price Support

China selling seized crypto to top up coffers as economy slows: Report

Ethereum Price Dips Again—Time to Panic or Opportunity to Buy?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending