Altcoin

Coinbase Sees Rising Altcoin Interest, Traders Set For Big Moves

Published

2 months agoon

By

admin

A popular cryptocurrency exchange platform foresees an outsized market rally for altcoins in the upcoming weeks after Donald Trump assumes the US presidency on January 20. A Coinbase analysis urged crypto traders to start positioning themselves in the altcoin space as a potential huge rally concerning altcoins is on the horizon.

Related Reading

Coinbase Reports Rise Of Altcoins

Coinbase crypto exchange suggested that the upcoming massive market rally for altcoins could be on the way and might happen in the succeeding weeks after Trump returns to the White House.

The crypto exchange released its latest weekly market commentary which provided its insights on Trump’s upcoming inauguration and its impact on the cryptocurrency landscape, saying that although the incoming American president is pro-crypto, it might take a while before “all planned crypto-related policies on the agenda” will be fully implemented.

However, Coinbase analysts noted that after Trump’s inauguration on January 20, they are expecting a surge in altcoins since, they believe, the digital asset space is preparing for a massive altcoin rally.

The crypto exchange’s report stated that crypto traders might be strategically positioning themselves to fuel another growth spurt for altcoins under the Trump administration.

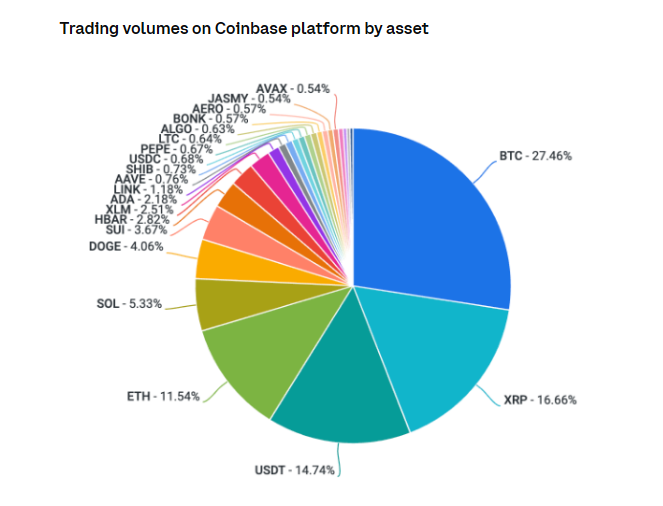

According to Coinbase, the latest surge in altcoins is driven by a slight drop in the dominance of Bitcoin.

“The drop in BTC dominance from 58.5% to its support level of 57.3% during the inflation print relief rally on January 15 suggests to us that traders may be positioning for an outsized altcoin market rally on the back of positive catalysts for risk assets and crypto,” Coinbase explained in the report.

BTC’s Fading Dominance

A crypto analyst observed that the dominance of the world’s most popular cryptocurrency, Bitcoin, could be slightly dipping, a circumstance that allowed the latest altcoin pump.

“Importantly for the long tail, $BTC dominance has been slowly fading since late November ’24 – fireworks if that continues,” VC firm Placeholder partner and former ARK Invest crypto lead Chris Burniske said.

Importantly for the long tail, $BTC dominance has been slowly fading since late November ’24 – fireworks if that continues. pic.twitter.com/PyBWTwT8os

— Chris Burniske (@cburniske) January 17, 2025

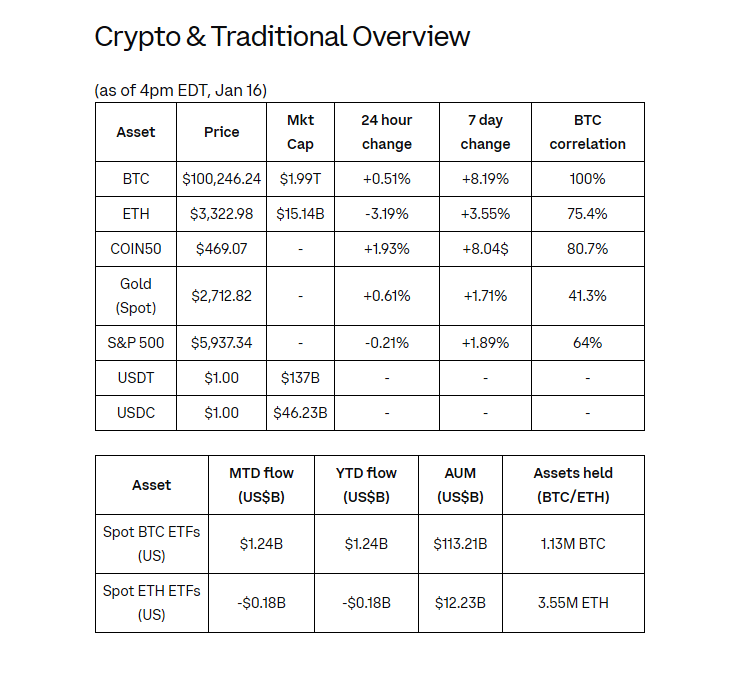

In its insight report, Coinbase provided a possible price scenario for Bitcoin through the Deribit options contracts.

“The max paint point for Deribit BTC options expiring on January 31 and February 28, 2025 is $94K and $98K respectively. However, this drops to $80K for the March 28 expiry. While not a pure prediction of future price action, the max paint point suggests possible biases in market positioning by market makers and options sellers who may be hedging their liabilities,” the crypto exchange analysts said in the weekly commentary.

Related Reading

Stablecoin Inflows A Cue

Crypto analysts observed that stablecoins posted strong inflows, which Coinbase analysts David Duong and David Han suggested as an indicator that a bullish market could happen to altcoin.

The analysts added that a big chunk of stablecoins’ strong capital inflows went to altcoins while Bitcoin and Ethereum recorded outflows.

“Stablecoin supply – perhaps the most clear proxy for capital flows to these long tail assets in our view – increased by $1.3B last week, a continuation of trends we’ve observed over the past two months,” the Coinbase report said.

Coinbase also noted that BTC had a net outflow of $457 million while ETH’s net outflow was at $206 million.

Featured image from Pexels, chart from TradingView

Source link

You may like

Authorities Target Crypto Scammers Posing as Binance in Australia

Why Is Solana Price Up 6% Today?

Ripple CEO Confident of XRP Being Included in U.S. Strategic Reserve, Says IPO is 'Possible'

Bitnomial drops SEC lawsuit ahead of XRP futures launch in the US

BIGGER THAN ORDINALS. MORE THAN ART

Leading Shiba Inu Rival Flashing Bullish Signals Hinting at Price Reversal, According to Santiment

Altcoin

Ethereum To $4,000? Standard Chartered Lowers Expectations

Published

1 day agoon

March 19, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum, like the broader crypto market, has experienced a sharp drop in price in recent weeks. From a high of $3,352 at the start of 2025, Ether now trades around $1,800 and $1,900, reflecting a sharp drop to the world’s second-biggest crypto by market cap. Looking at Ether’s bigger picture, it’s down 47% from last year’s value.

Related Reading

If we go by the latest analyses and observations from commentators, Ether’s price correction will likely be extended. The altcoin is facing a huge bearish wave, with plenty of market factors undermining its price performance.

One significant factor is Standard Chartered’s recent decision to cut its price prediction by 60%, confirming market expectations.

News: Standard Chartered slashes ETH price target!

The bank cuts its 2025 ETH forecast from $10K to $4K, blaming Layer-2 networks like Base, which they say has drained $50B from Ethereum’s market value.#Ethereum #ETH #Crypto #Layer2 #Base #Blockchain

— Andres Meneses (@andreswifitv) March 17, 2025

Ethereum Faces A Descending Channel

Ethereum is currently in a price slump, and many experts expect a much deeper dive in the next few weeks. Ether’s price is currently floating above the $1,900 level as it continues its bearish price movements.

Analysts use the MACD indicator to verify and confirm the asset’s bearish sentiment. Also, the asset’s moving averages suggest a neutral trend and possible price consolidation.

Ethereum (ETH) remains in the correction zone today, trading around $1,874. The price continues to move in a descending channel, indicating a possible continuation of consolidation. Moving averages confirm the neutral trend: the price is holding below the 50-day and 200-day MA,… pic.twitter.com/R3vNqFBDkZ

— LVelarde (@0xvelarde) March 17, 2025

According to a crypto user named “LVelarde,” Ether’s price continues to follow the descending channel, suggesting price consolidation. The asset’s price is consolidating below its 5-day and 200-day moving averages, with traders looking for possible rejection or breakout. Since it fell below $2k, sentiments have been generally bearish, with many questioning its future price trends.

Standard Chartered Cuts Price Estimates For Ethereum

Even some of the biggest banks, like Standard Chartered Bank, are lowering their expectations of Ethereum. From a high of $10,000, the bank is reducing its price target to just $4,000, explaining that the Layer 2s are impacting its bottom line.

The bank added that changes and improvements to the blockchain affected its overall value, like its shift to the proof-of-stake and scaling roadmap.

Standard Chartered used Coinbase’s Base Layer 2 as an example, suggesting that the project has cost Ethereum $50 billion from its market cap. According to Geoff Kendrick, Standard Chartered analyst, Ethereum’s losses will continue as Base’s dominance in the industry continues.

Kendrick calls this the blockchain’s “midlife crisis”, adding that Ethereum’s chain has become a commodity with its Layer 2 framework.

Related Reading

Things Ethereum Can Do To Address Its Slide

According to Kendrick, Ethereum can address its downturn in two ways. First, it can leverage its security-based dominance in the context of the tokenization of real-world assets (RWA). If Ethereum focuses on security, it can maintain its 80% market share.

Second, it can charge taxes for its Layer 2s, but it’s highly unlikely. Kendrick expects Ethereum to continue its underperformance in the short term.

Featured image from Bloomberg, chart from TradingView

Source link

Altcoin

XRP To Triple Digits? Analyst Confident In $100 Price Goal

Published

2 days agoon

March 18, 2025By

admin

As one of the top-performing digital assets in the 4Q of 2024, it’s only natural that Ripple’s XRP attracts attention from its detractors and bullish supporters. The bearish sentiment has been wearing down the asset in the last few weeks, pushing the altcoin to as low as $1.96 last March 11th, the lowest in its three-month chart.

XRP has been highly volatile this month, trading between $2.30 and $2.47, still down by 1.6% from its previous month’s price.

The sentiment is still bearish, but for some crypto analysts like Captain, XRP is set to increase, with $100 as its realistic target. Egrag Crypto, on the other hand, offers a more conservative estimate, saying that XRP can reach double digits this cycle.

#XRP 100$ Realistic Target For This Bullrun

pic.twitter.com/lh403ilBjJ

— XRP CAPTAIN (@UniverseTwenty) March 15, 2025

Analyst Sets $100 As ‘Realistic’ Target

In a recent Twitter/X post, XRP Captain (@UniverseTwenty) shared that $100 is Ripple’s realistic target this cycle. The post has now received dozens of replies, but it leaves more questions than answers. For example, the crypto analyst failed to identify the timeframe for this surge or the factors or events that can trigger this surge.

XRP Captain’s latest tweet comes just as Egrag Crypto (@egragcrypto) added his thoughts on the coin’s direction. In the Twitter/X thread, Egrag Crypto boldly claims that XRP will hit double digits this cycle and surge to triple digits next.

#XRP = Thread (1/7) #XRP: Double Digits This Cycle, Triple Digits Next!

The thread below about #XRP was shared in the Subscribers section on February 12, 2025.

We’ve built together the Full Elliot Wave Count to assess our next Targets:

Take an in-depth look at it!

… pic.twitter.com/NKv00Y5MZD

— EGRAG CRYPTO (@egragcrypto) March 12, 2025

To justify his predictions for the short term, Egrag Crypto used his “Just Do It” chart. He explained that the measured wave or cup pattern movement has formed within the arc, then added that the potential to this movement is $13.

Will XRP Break Past $300?

Ripple has a few bullish supporters right now, with crypto commentator Dark Defender adding his thoughts on the asset’s latest performance. According to Dark Defender, XRP can surge to $333 if it duplicates its impressive performance during the 2017 bull run.

Dark Defender’s arguments and predictions for XRP received plenty of criticism. Some argue that XRP will not achieve this market price due to its market cap. Based on the current circulating tokens, XRP’s market cap will hit $1.6 trillion if its price just hits $280. Dark Defender shot down this argument and added that a crypto market cap doesn’t matter and is “just an illusion.”

Featured image from Pexels, chart from TradingView

Source link

Altcoin

XRP Must Close Above This Level For Bullish Breakout: Analyst

Published

4 days agoon

March 16, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP has struggled to gain momentum, with its price caught in a downtrend since the beginning of March. Although XRP has managed to push up in the past five days after reaching a low of $1.93 on March 11, it has yet to fully recoup its losses in the first week of the month.

Related Reading

The altcoin’s long-term prospects are still on bullish speculation, but its short-term price action has frustrated traders looking for signs of a breakout. Amid this stagnation, crypto analyst Egrag Crypto has outlined specific price levels that could determine whether XRP finally reverses its course.

Analyst Identifies $2.65 As Key Level Before XRP Can Challenge $3.00

Egrag Crypto, a long-time bullish advocate for XRP, recently took to social media platform X to outline key price levels that could determine the cryptocurrency’s next significant move. He identified $2.65 as the first critical threshold the coin must reclaim to sustain meaningful bullish momentum. However, the analyst expressed concern over XRP’s repeated tests of lower boundaries, which is in reference to the recent bottom at $1.93.

According to the analyst, the frequent retests of this support level are a double-edged sword. While multiple touches on resistance can eventually trigger a breakout, repeated tests of support weaken its integrity, increasing the likelihood of a breakdown. He likened this pattern to knocking on a door that would eventually open or break. He highlighted six instances of XRP retesting this zone since December 2024 on a 12-hour candlestick chart, warning that prolonged weakness could pave the way for further downside.

For the crypto to escape this cycle and shift into bullish territory, Egrag emphasized the importance of a strong close above $3.00, not just a brief move past it. This level has served as the upper resistance trendline for the past two weeks and has been a barrier to any sustained uptrend. Failure to break and hold above $3.00 could cause continued correction in the short term and keep XRP trapped in its current range.

However, the analyst believes XRP’s chances of reaching $3.00, considering the current price action, are slim without securing a close above $2.65.

Image From X: EGRAG CRYPTO

What’s Next For XRP After $3?

March has been particularly bearish for XRP, with sellers maintaining control as it failed to reclaim lost ground. However, if XRP bulls manage to close above $3 before the end of the month, it will open up the door for the resumption of a price rally. With this in mind, Egrag set an initial target of $4.80, placing XRP at new all-time highs.

Related Reading

Interestingly, this target is modest compared to the analyst’s more ambitious long-term projections. Egrag has previously predicted that XRP could surge to $110 in the long term. At the time of writing, XRP is trading at $2.37 and is still 26.5% away from reaching $3.

Featured image from Crypto Logos, chart from TradingView

Source link

Authorities Target Crypto Scammers Posing as Binance in Australia

Why Is Solana Price Up 6% Today?

Ripple CEO Confident of XRP Being Included in U.S. Strategic Reserve, Says IPO is 'Possible'

Bitnomial drops SEC lawsuit ahead of XRP futures launch in the US

Bitcoin Long-Term Holder Net Position Turns Green For The First Time In 2025

BIGGER THAN ORDINALS. MORE THAN ART

Leading Shiba Inu Rival Flashing Bullish Signals Hinting at Price Reversal, According to Santiment

Binance’s USDT pair with Turkish lira sees largest amplitude since 2024 after key Erdogan rival detained

Treasury Expands Financial Surveillance of Cash Transactions—What About Crypto?

Bitcoin Price Eyes 90K rally at Blackrock-led ETFs Buy $512M BTC 3-Days before US Fed Decision

Bitcoin Reclaims $85k and Stocks Head Higher Despite Analysts Warning of Pain Ahead

Trump to speak at Digital Asset Summit: Report

Bitcoin’s Road To $1M? Expect A ‘Dip Then Rip,’ Bitwise CIO Says

How Bitcoin ETFs And Mining Innovations Are Reshaping BTC Price Cycles

Bitcoin Hoarder Metaplanet Issues Fresh Bonds To Increase Holdings to 3,200 BTC

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x