business

Coinbase Targets USDT Stablecoin Rival Tether With an $86 Billion ‘Stretch Goal’ for USDC

Published

2 months agoon

By

admin

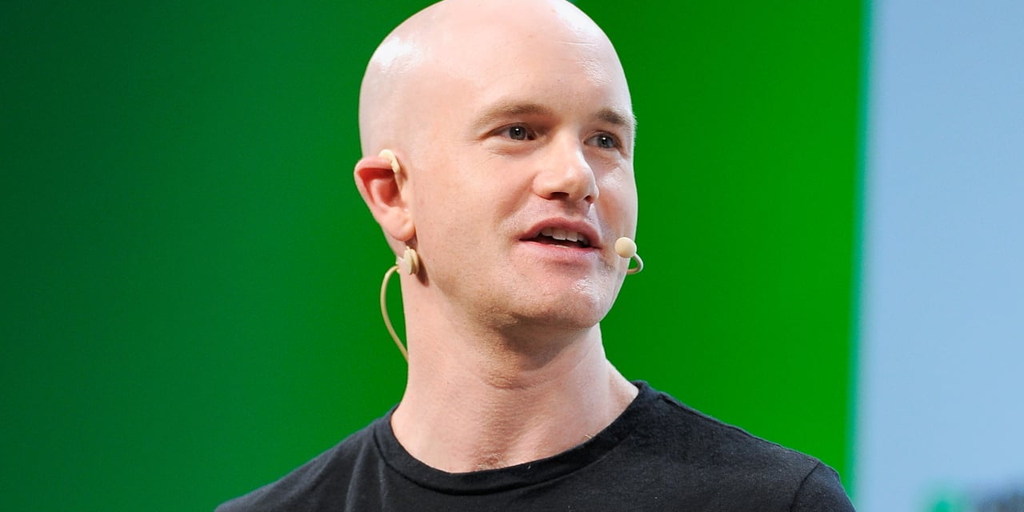

Coinbase CEO Brian Armstrong said Thursday that the crypto heavyweight is taking off its gloves for a renewed fight in the stablecoin ring.

During the company’s fourth-quarter earnings call, Armstrong said the firm will aim to challenge Tether’s position as the industry’s reigning stablecoin issuer. The ultimate goal is to make Circle’s USDC the world’s “number one dollar stablecoin.”

Armstrong characterized this new aim as a “stretch goal,” signaling it represents an ambitious yet potentially achievable feat, which will nonetheless push Coinbase outside its comfort zone.

As the second largest stablecoin, USDC’s market cap stands at $56 billion after hitting an all-time high last week. Still, that leaves a lot of ground for USDC to cover as it works to overtake Tether. As of this writing, USDT currently accounts for a hulking 60% of the stablecoin market at $142 billion market capitalization, per CoinGecko.

Because stablecoins are designed to maintain a 1:1 peg with another currency, in this case the U.S. dollar, the market capitalization tends to be a reliable indicator of issuance.

Coinbase CFO Alesia Haas contextualized Armstrong’s bold call on Thursday. “I think it’s important to note that we hope to achieve this over the next few years,” she said.

The high bar for Coinbase comes after its stronger-than-expected fourth quarter was marked by $1.3 billion in profits. Meanwhile, stablecoin legislation appears to be gaining momentum on Capitol Hill, after years of quibbling among lawmakers.’

Sen. Tim Scott (R-SC), Senate Banking Committee Chairman, has already pledged that legislation covering stablecoins will be passed within the first 100 days of President Donald Trump’s term.

That bill, dubbed the GENIUS Act, would create a pathway to legality for issuers of U.S. dollar-backed stablecoins. That would include sharing monthly audits on the health of the fiat reserves backing their products, according to a draft of the bill seen by Decrypt.

Since lawmakers may end up modifying the stablecoin bill before it can be passed through both chambers of Congress and signed into law by Trump, how sweeping stablecoin legislation could ultimately impact USDC, USDT, or any stablecoin remains unclear.

Can legislation help?

Hours before Coinbase’s earnings, JP Morgan analysts posited that Tether may be forced to change the structure of the dollar-equivalent reserves backing USDT.

In its most recent attestation report, Tether said those reserves consist mostly of cash and cash equivalents and other short-term deposits, including assets like U.S. Treasuries and money market funds, which account for 82% of Tether’s reserves.

For years, Tether has sporadically and then more regularly published attestation reports about the reserves that back its stablecoin. But accountants and competitors alike have been quick to point out that none of those financial statements have been audited.

While audits seek to uncover risks and potential compliance issues by gathering data, attestations are typically used to authenticate how truthful data is.

But it is worth pointing out that, as of this writing, Circle also has never published an audited report on the reserves backing USDC. Like Tether, the company publishes attestations about the “highly liquid fiat reserves” backing USDC and EUROC, its Euro-backed equivalent.

JP Morgan posited that Tether may have to sell a significant sum of “non-compliant” assets in its reserve, like Bitcoin and any remaining commercial paper, if it wants to comply with new U.S. rules.

A Tether spokesperson pushed back against JP Morgan’s suggestion, telling Decrypt that $20 billion in “other very liquid assets” had been overlooked by the Wall Street titan, along with “more than $1.2 billion in profits per quarter” from holding swathes of government debt.

Notably, Tether may also fall outside the stablecoin bill’s scope; the company recently relocated its business from the British Virgin Islands to El Salvador.

“If stablecoin regulation passes in the U.S., I do think it will disproportionately help USDC gain market share,” Bitwise Senior Investment Strategist Juan Leon told Decrypt. “But will that be enough to surpass USDT?”

USDC would have to become the predominately used stablecoin in developed markets for it to have a chance at surpassing USDT, Leon said. USDC is less likely to be able to displace USDT’s dominance in emerging markets, he added.

Former SEC Chair Gary Gensler once referred to stablecoins as “poker chips” used in decentralized finance, or DeFi, as a common way for traders to easily park funds and lock in gains. Remittances and payments represent real-world use cases, while the use of stablecoins in money laundering and sanctions evasion has also drawn controversy.

‘Accelerating’

On-chain activity involving stablecoins is largely concentrated on networks that support smart contracts, like Ethereum and Solana. But Armstrong said growing USDC’s footprint on the Ethereum scaling network Base—which Coinbase itself created and launched—is key, along with fostering commercial partnerships.

“We think USDC has a network effect behind it, and the compliant approach that they’ve taken, I think, is going to be really defensible long term,” Armstrong said, referring to Circle.

“We’ll be accelerating the market cap growth of USDC with more partnerships, and leaning into new use cases like adding payments support across our product suite,” he continued.

Stablecoin revenue totaled $224 million in Coinbase’s fourth quarter, falling $20 million from the previous quarter and representing just 9.4% of the company’s total sales.

In its shareholder letter, Coinbase described USDC as “the fastest growing ‘major’ stablecoin in 2024,” while pointing to $12 billion in on-chain USDC payments that the exchange facilitated.

Coinbase is taking an offensive approach to growing USDC now. But during the bear market in 2023, when trading volumes lagged, the company saw stablecoin revenue bolster its subscriptions and services segment.

In fact, subscriptions and services revenue temporarily surpassed transaction revenue as Coinbase’s main money maker, totaling $334 million and $289 million, respectively, in the third quarter of 2023.

In August of that year, Circle said Coinbase had taken an equity stake in the firm. Both companies agreed to shelve a “self-governance consortium” to better hone their alignment.

Circle and Tether did not immediately respond to requests for comment from Decrypt.

Edited by Stacy Elliott

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

XRP Price Shoots For 20% Surge To $2.51 Amid Pullback To Breakout Zone

Stocks edge higher ahead of big earnings week

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

business

Strategy Boosts Bitcoin Holdings Above $47 Billion With Latest Buy

Published

7 days agoon

April 21, 2025By

admin

In brief

- Strategy purchased 6,500 Bitcoin last week, padding its corporate coffers by $556 million.

- Tysons, Virginia-based Strategy (formerly MicroStrategy) now owns 538,000 Bitcoin worth $47.2 billion.

- Strategy said the acquisition was made using proceeds from two recent equity offerings.

Strategy, formerly known as MicroStrategy, purchased 6,500 Bitcoin last week, padding its corporate coffers by $556 million, according to a Securities and Exchange Commission filing.

The Tysons, Virginia-based firm now owns 538,000 Bitcoin worth $47.2 billion following Bitcoin’s climb above $88,000 on Sunday, according to crypto data provider CoinGecko. The software firm said it scooped the asset up for an average price of $84,800 last week.

Strategy said the acquisition was made using proceeds from two recent equity offerings: the firm received $548 million in proceeds by issuing Class A common shares, while Strategy also gained $8 million from the sale of its so-called perpetual “STRK” preferred stock.

Uncertainty surrounding U.S. President Donald Trump’s trade war has weighed on risk assets in recent weeks, as economists pencil in slower growth and higher costs for consumers in the U.S., yet Strategy has bought Bitcoin fairly consistently since mid-March. Over the past six Mondays, Strategy has said that it bought Bitcoin on five of them.

The size of Strategy’s recent Bitcoin purchases has varied, however. After buying $11 million worth of Bitcoin in mid-March, it spent $1.9 billion on Bitcoin two weeks later, per Saylor Tracker.

Strategy’s shares were recently trading at about $322, up 1.6% on the day, according to Nasdaq. The stock changed hands as high as $328 during pre-market trading on Monday but plunged as low as $317 after the opening bell.

On Sunday, Strategy co-founder and Executive Chairman Michael Saylor noted on X, formerly Twitter, that the company isn’t a niche option for gaining exposure to Bitcoin’s price anymore.

Based on public data, 13,000 institutions hold Strategy’s stock directly, along with 814,000 accounts tied to retail investors, he said. In addition, Saylor said 55 million investors have “indirect exposure through ETFs, mutual funds, pensions, and insurance portfolios.

Strategy was added to the Nasdaq 100 in December, a milestone placing it within the coveted ranks of tech giants like Apple and Meta. The company may also join the S&P 500 one day, but Strategy’s lack of consistent profits is currently a barrier, based on inclusion criteria.

Edited by James Rubin

Editor’s note: This story was updated to ensure pricing consistency throughout.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

business

Strategy Buys More Bitcoin as Tariff Exemptions Send Tech Stocks Soaring

Published

2 weeks agoon

April 14, 2025By

admin

Strategy, formerly known as MicroStrategy, acquired around 3,450 Bitcoin worth $286 million last week, the company said in a Securities and Exchange Commission filing.

Unveiling a Bitcoin purchase for the third straight Monday, the Tysons, Virginia-based firm now owns 531,644 Bitcoin worth $45.2 billion, based on the asset’s current price.Strategy paid an average price of $82,600 per Bitcoin last week, it added.

Strategy, which has shifted its focus from software development to become a Bitcoin treasury, said it meanwhile sold one million Class A common shares through an at-the-money offering program unveiled in October. Under the initiative, Strategy said it can still issue an additional $2 billion worth of common shares, alongside swaths of preferred perpetual stock.

Strategy’s shares rose 4% on Monday to around $312, as the tech-heavy Nasdaq surged 1.5%, adding on to last week’s recovery after the White House said smartphones and computers would be exempt from sweeping levies, including 125% taxes on Chinese goods, per Nasdaq.

Monday’s price action represents a dramatic turnaround after investors navigated outsized uncertainty last week, including a disclosure from Strategy that it may ultimately need to sell Bitcoin to meet its financial obligations. Amid tariff-linked concerns, Strategy’s shares fell as low as $236, or around 32% below their opening on Monday.

“No Tariffs on Orange Dots,” Strategy co-founder and Executive Chairman Michael Saylor said on X, formerly Twitter, on Sunday, referring to the way Bitcoin buys look on Saylor Tracker.

The price of Bitcoin was recently changing hands around $85 on Monday, showing a roughly 8.3% increase of the past week, according to CoinGecko. Over the past month, it’s virtually flat.

Strategy has become the world’s largest corporate holder of Bitcoin since it began accumulating the asset in 2020. Over time, as it has embraced its role as a Bitcoin treasury firm, Strategy has issued billions of dollars in debt to buy more Bitcoin than it could otherwise.

The Nasdaq-listed firm’s 531,600 Bitcoin tower over the next largest corporate holder, Bitcoin miner Marathon Digital, which is around 47,500 Bitcoin, according to Bitcoin Treasures. As of this writing, Strategy’s stash accounted for more than 2.5% of Bitcoin total supply.

The Tokyo-based investment firm Metaplanet, which began buying Bitcoin last May, said on X on Monday that it had recently bought 319 Bitcoin worth $27 million. The company said in an update that it now holds 4,525 Bitcoin worth around $385 million.

Among publicly traded companies, MetaPlanet is currently the 10th largest Bitcoin holder, according to Bitcoin Treasuries.

Edited by James Rubin

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

business

Japan’s Metaplanet Buys Another $26M in Bitcoin Amid Tariff Market Uncertainty

Published

2 weeks agoon

April 14, 2025By

admin

Metaplanet, the Tokyo-listed firm dubbed “Asia’s MicroStrategy,” has boosted its Bitcoin holdings with a fresh 3.78 billion yen ($26.3 million) purchase amid growing tension over U.S. trade tariffs.

The company said it acquired 319 BTC at an average price of 12,849,780 yen ($82,549) per coin, bringing its total holdings to 4,525 BTC. Metaplanet plans to boost its Bitcoin holdings by 470%, targeting a total of 10,000 BTC by year-end.

The timing of the purchase comes as digital assets falter under geopolitical pressure. Bitcoin dropped more than 2% on Sunday during Asia trading hours, sliding to $83,482 as investors digested conflicting signals from Washington over the direction of U.S. trade policy toward China.

Traditional markets remained resilient despite a flurry of comments from the Trump administration regarding new tariffs on Chinese electronics. Nasdaq 100 futures rose over 1% in early trading, while S&P 500 futures climbed 0.7%.

While smartphones and semiconductors were temporarily excluded from a proposed 10% “reciprocal” tariff, President Trump clarified late Sunday on Truth Social that the same products will remain subject to a separate 20% national security levy.

Commerce Secretary Howard Lutnick said further sector-specific tariffs are expected within the next two months.

By Monday, 1 a.m. ET, Bitcoin was up just 0.4% over the last 24 hours, trading at $84,990, according to CoinGecko. Ether was up 1.8% to $1,638 over the same period. The top ten cryptocurrencies by market cap have all posted slight gains or no change.

Metaplanet has leaned heavily into Bitcoin as its core treasury asset. Last month, the company appointed Eric Trump, son of the U.S. president, to its newly formed Strategic Advisory Board, citing his “business expertise and passion for Bitcoin.”

Metaplanet is positioning itself in the mold of Michael Saylor’s Strategy, whose aggressive Bitcoin accumulation strategy has influenced a growing number of publicly listed firms to follow suit.

At the same time, the Trump administration has launched two separate initiatives: a Strategic Bitcoin Reserve, funded by seized BTC and held as a permanent national asset, and a U.S. Digital Asset Stockpile, which includes other confiscated crypto with potential for liquidation or strategic use.

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

XRP Price Shoots For 20% Surge To $2.51 Amid Pullback To Breakout Zone

Stocks edge higher ahead of big earnings week

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin6 months ago

Bitcoin6 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines