Bitcoin

Crypto Analyst Issues Ethereum Alert, Predicts ‘One Final Shakeout’ for ETH – Here Are His Targets

Published

3 months agoon

By

admin

A cryptocurrency analyst and trader is saying that Ethereum (ETH) is primed to fall to levels last recorded in late 2023.

The analyst pseudonymously known as Capo tells his 104,092 Telegram subscribers that Ethereum could fall by over 26% from the current level.

“Ethereum has been ranging between $2,000 and $2,800 for two months. It appears to be an accumulation range. However, as mentioned in recent days, it is likely that we will see one final shakeout before an expansion, to $1,800 – $2,000 (the spring phase of the accumulation schematic).”

Ethereum is trading at $2,430 at time of writing.

According to the pseudonymous analyst, an Ethereum collapse could lead to altcoins plummeting, consequently increasing the chances of a proper altcoin season kicking off down the road.

“If that potential shakeout occurs, altcoins should dump 20% – 40%, a ‘capitulation candle’ similar to the Covid crash. Don’t get scared if that happens. It would probably be one of the best buying opportunities in months.”

Turning to Bitcoin (BTC), Capo says the recovery of the flagship crypto asset to above $60,000 earlier this week after pulling back to under $59,000 appears to be a “dead cat bounce.” A dead cat bounce is an uptick in the price of an asset after a downtrend which gives a false sense of a rally but then is followed by another leg down.

Says Capo,

“First move done.

Now we should see a local top formation around here and bearish continuation this week.”

Bitcoin is trading at $62,275 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/liorigo

Generated Image: DALLE-2

Source link

You may like

XRP meme coin PHNIX pumps 50%; UFD shows a similar pump

U.S. Enforcement Chief Behind CFTC Crypto Cases Exits Before Trump Arrives

DOGE Positions surge $310M ahead of Trump Inauguration

Bitcoin Price To $140,000 Or $67,000? Analyst Weighs In On Interesting BTC Setup

5 low-cap coins aiming for potential life-changing gains

$175M Staking to spark $3,300 Breakout?

Ali Martinez

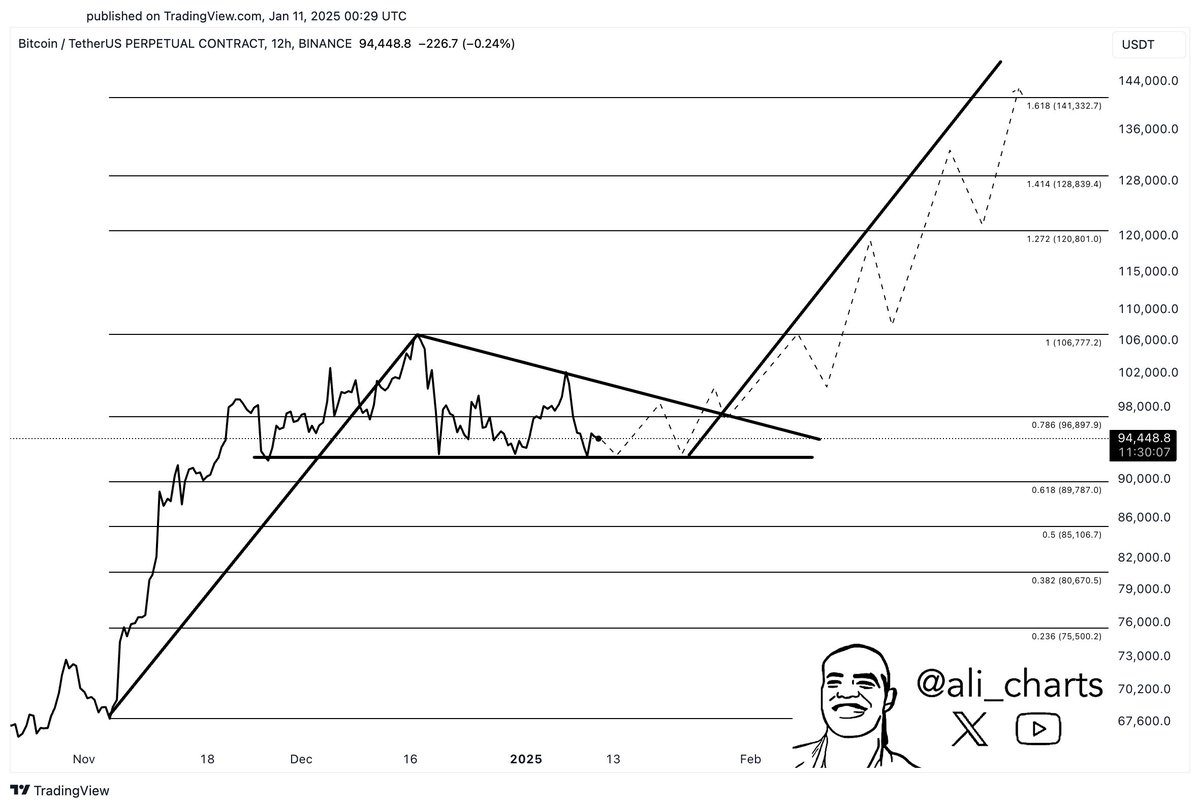

Bitcoin Price To $140,000 Or $67,000? Analyst Weighs In On Interesting BTC Setup

Published

6 hours agoon

January 12, 2025By

admin

After an unexpected bearish plot twist in the past week, the Bitcoin price action has been pretty quiet over the weekend, with BTC barely holding above the $94,000 level. The premier cryptocurrency briefly slipped beneath this price mark on Saturday, January 11, before traveling to as high as $94,870.

Interestingly, a top analyst on the social media platform X has put forward an interesting analysis of the Bitcoin price, suggesting that the market leader might be at a pivotal juncture. Could a bullish breakout be on the cards for the price of BTC or is a deep correction the more likely scenario?

Bitcoin’s Performance In The Next Few Weeks

In a recent post on X, popular crypto analyst Ali Martinez weighed in on the trajectory of the Bitcoin price over the next few weeks. According to the market pundit, the flagship cryptocurrency is currently set up such that it could see a move higher to $140,000 or a pullback to around $67,000.

Related Reading

These projections are based on the formation of two patterns, namely the head-and-shoulders and the bull pennant, on the BTC 12-hour price chart. The pennant pattern is marked by a price upswing (the flagpole) followed by a consolidation range with converging trend lines (the pennant), while the head-and-shoulders formation (as the name suggests) is characterized by three distinct price highs, including a higher “head” between two lower “shoulders.”

The pennant chart formation often serves as a bullish continuation pattern, suggesting the persistence of an upward price trend. The head-and-shoulders pattern, on the other hand, typically indicates a potential bearish reversal, signaling a shift from an uptrend to a downtrend.

As seen in the chart above, the Bitcoin price is yet to break beneath the neckline of the head-and-shoulders pattern, which often serves as confirmation for the trend reversal. If the premier cryptocurrency breaks the neckline situated at around $93,000, its price could plunge to as low as $67,000.

However, Martinez pointed out that the next target could be higher if the Bitcoin price holds above the neckline and breaks out of the bull pennant pattern. If this occurs, a bullish surge to around $140,000 could be on the cards for the price of the market leader. This would represent an almost 50% rally from the current price point.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $94,600, reflecting no significant change in the past 24 hours. According to CoinGecko data, the premier cryptocurrency is down by nearly 4% in the last seven days.

Related Reading

.Featured image from iStock, chart from TradingView

Source link

Bitcoin

Why High Net-Worth Investors Are Super Bullish on Bitcoin Right Now

Published

18 hours agoon

January 12, 2025By

admin

As bitcoin (BTC) wobbles around the $90,000-$95,000 area, down more than 10% from its all-time high touched a bit less than four weeks ago, a contrast is growing between traders — whose technical analysis tools show the top cryptocurrency may be due for another plunge — and long-term investors who believe the bull run is nowhere near done.

That’s according to David Siemer, CEO of Wave Digital Assets, a firm that provides asset management services to funds and high net-worth individuals in the crypto space. The company counts Charles Hoskinson, the CEO of the firm behind Cardano, as one of its clients.

“In 14 years of owning bitcoin, I’ve never seen a dichotomy like this,” Siemer told CoinDesk in an interview. “The traders are all worried and nervous and hedged, fully neutral or worse. And the long-term people are all super bullish.”

“There’s a really good chance we’ll go to $200,000 [per bitcoin] this year,” Siemer said. “Do I think we’ll see $1 million dollars per coin in my lifetime? Sure. Not soon, you know, not in the next year. … The smart, more connected people that I know are also really bullish. More is going to happen in the next six months than most people realize.”

Top of the list of developments for the year to come is that numerous jurisdictions — including the U.S., Russia, Singapore, the United Arab Emirates, South Korea, Japan, the Philippines and some European nations — are looking to take big steps in crypto’s favor, according to Siemer. (Wave runs crypto educational programs for various branches of the U.S. government, like the Internal Revenue Service or U.S. Marshals Service, as well as other executive bodies across the globe; in fact, government practices is the firm’s fastest growing business.)

These steps, whichever form they take, will likely have positive knock-on effects on some of these countries’ private sectors, Siemer said. “[Japan or Singapore], those are societies where they actually trust and rely on their governments. If their government says it’s okay, it’s actually really okay. It’s different from the U.S. where we think our guys are idiots.”

What is spurring such sudden interest in the crypto industry? The tremendous success of the U.S. spot bitcoin exchange-traded funds (ETFs), for one, is forcing financial institutions worldwide to think of ways to compete. That means spinning up exotic new products, like multi-token yield funds, to make up for the liquidity that was sucked away by BlackRock’s IBIT.

“The ETFs launched in America and they absolutely devastated all the bitcoin ETPs around the world,” Siemer said. “All of them had these terrible products, charging 1.5%. All of those guys got crushed.” Regulators, for their part, will tend to be supportive, Siemer said. For example, the European Union could end up producing a friendlier version of the Markets in Crypto-Assets Regulation (MiCA).

The chances of seeing new strategic bitcoin reserves is also high, Siemer said. “Even if the U.S. doesn’t do a reserve, at least several other countries probably will,” he added. Not that he’s bearish on prospects in the U.S. Wave, he said, is currently in talks with seven different states that are considering the matter of creating a reserve, Texas, Ohio and Wyoming among them.

What about the federal government? Siemer put the odds at slightly better than 50-50, in part thanks to the nearly $19 billion worth of bitcoin it already owns.

“That’s a decent start on a bitcoin reserve,” Siemer said. “All they have to do is not sell it. It’s a lot more palatable to the tax base than buying, you know, $10 billion worth of bitcoin.”

Source link

Altcoins

$7,000 Ethereum In Sight? Expert Breaks Down The Potential Path

Published

22 hours agoon

January 11, 2025By

admin

There is a reason for Ethereum fans to be optimistic, as expert analysis suggests that the cryptocurrency is going to touch the skies in the coming months. As Bitcoin has just crossed $94,000, Ethereum also shows signs of life and bounces back from its recent low and hints at the possibility of price explosion.

Related Reading

A Quick Look At The Patterns

Well-known crypto analyst Ali Martinez has found a bullish reversal pattern that can potentially take the price of Ethereum into much higher value. Trading at $3,281 at the moment, Ethereum has slipped below the middle line of its rising channel and has traders spooked.

But Martinez is one who thinks if Ethereum could just retest the lower boundary at $2,800 and rebound, it will likely launch into a bullish trend. This rebound may eventually set the stage for Ethereum to reach between $6,000 and $7,000.

If #Ethereum $ETH is following an ascending parallel channel, a dip to the lower boundary at $2,800 could act as a launchpad for a move toward $6,000. pic.twitter.com/uYP6BW3DZh

— Ali (@ali_charts) January 10, 2025

Market Sentiment & Challenges

Even though these are all good signs, the mood in the futures market right now is not clear. Open interest in Ethereum has gone down by 1.25%, which shows that some buyers are becoming more cautious.

The long-to-short number is still less than 1, which means that traders are betting against Ethereum instead of for it. Also, funding rates have gone down a lot, which shows that people are less interested in taking leveraged long bets.

Although short-term sentiment may be negative, long-term holders may see attractive entry points at current prices. Due to their inherent volatility, cryptocurrencies require constant vigilance and awareness of market trends.

Key Resistance Levels

All eyes will be on Ethereum’s performance and whether it can overcome important resistance thresholds as we advance into 2025. Several elements determine whether one may achieve $6,000 or even $7,000: market conditions, investor mood, and more general economic impact.

At the time of writing, Ether was trading at $3,274, down 0.9% and 9.9% in the daily and weekly timeframes, data from Coingecko shows.

Related Reading

Ether Price Forecast

Ether (ETH) is likely to start an ascent in the next seven days; its present price sits 56% below the projected value for next month. This recovery can draw more trading activity and fits the optimistic trends in the market.

Ether is expected to rise by a solid 93% in six months and 94% in three months, according to predictions by CoinCheckup. Though market volatility still has great importance to take into account, a one-year forecast reveals an impressive 180% increase, demonstrating great development potential.

Featured image from Getty Images, chart from TradingView

Source link

XRP meme coin PHNIX pumps 50%; UFD shows a similar pump

U.S. Enforcement Chief Behind CFTC Crypto Cases Exits Before Trump Arrives

DOGE Positions surge $310M ahead of Trump Inauguration

Bitcoin Price To $140,000 Or $67,000? Analyst Weighs In On Interesting BTC Setup

5 low-cap coins aiming for potential life-changing gains

$175M Staking to spark $3,300 Breakout?

Crypto Surging Higher Than Expected As Asset Class Now in ‘Fundamentally Different Game’: Investor Ryan Watkins

Shareholder pokes Meta to fill corporate treasury with BTC

Do Kwon’s Terra Trial Set for 2026—Here’s What You Need to Know

Where To Invest Before January Ends?

Why High Net-Worth Investors Are Super Bullish on Bitcoin Right Now

This new token targets 1,200x growth and could topple SUI and ADA

Expert Predicts SEC To Approve XRP And Solana ETF This Year

$7,000 Ethereum In Sight? Expert Breaks Down The Potential Path

$190m raised, OG Labs secures capital

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Telegram users can send gifts to friends, TON fails to pump

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

A16z-backed Espresso announces mainnet launch of core product

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x