Altcoin

Crypto Analyst Predicts XRP Price Could Touch $15 Easily If This Happens

Published

3 months agoon

By

admin

A well-known crypto analyst, Crypto Beast, has made a bold prediction about XRP future price trajectory, suggesting that it could reach $15 with ease under specific conditions. This interesting outlook comes amidst a consolidation of prices, which is now looking to regain momentum above $3.

Banks Adopting XRP Could Send It To $15

Bitcoin was created to disrupt the traditional financial industry and compete with the existing global financial system. While many other early cryptocurrencies like Ethereum and Litecoin also built upon this premise, XRP took another approach. Its creators developed it as a solution for fast and efficient cross-border transactions, aiming to complement the existing financial infrastructure rather than replace it.

Related Reading

Despite its intended role in improving financial transactions, XRP has faced years of price struggles, with long periods of decline over multiple years overshadowing its utility. This lackluster growth led many traders to lose faith, with some dismissing it as a dying asset. Interestingly, despite regulatory challenges and market downturns, the asset remained one of the top-ranking cryptocurrencies by market capitalization throughout this period.

However, recent price rallies have breathed life into XRP. Particularly, this rally has seen the value of XRP grow massively since November 2024 and is now the third largest crypto in terms of market cap. This has seen sentiment around the altcoin shifting into a more optimistic direction, with some crypto analysts who doubted before now revealing bullish price targets for its price.

One of these analysts is Crypto Beast, who recently shared a $15 price prediction for XRP. Speaking to his over 560,000 followers on social media platform X, Crypto Beast stated that XRP’s price could surge to $15 if banks worldwide fully integrate the token into their systems.

Is $15 A Pipe Dream Or A Realistic Target

There is a valid question of whether XRP can realistically trade at $15 given its tokenomics. As of now, XRP has a total supply of 99.9 billion tokens, with 57.7 billion coins currently in circulation. Its market capitalization stands at $177.6 billion, while its fully diluted valuation is around $307.8 billion. If XRP were to reach $15, its market cap would need to grow to approximately $865.5 billion, assuming no significant increase in circulating supply. This would also push its fully diluted valuation close to $1.5 trillion.

Related Reading

Such a surge would place XRP ahead of Ethereum in market cap rankings and within striking distance of Bitcoin. On the surface, this might seem like a challenging milestone, but it could become feasible if the asset gains widespread adoption in cross-border payments and replaces current methods like SWIFT. Consequently, the token’s demand will increase significantly, driving sustained price growth.

According to Changelly, the XRP price can reach the $15 target sometime around 2033. At the time of writing, the altcoin is trading at $3.08.

Featured image from Adobe Stock, chart from Tradingview.com

Source link

You may like

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Altcoin

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Published

9 hours agoon

April 27, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

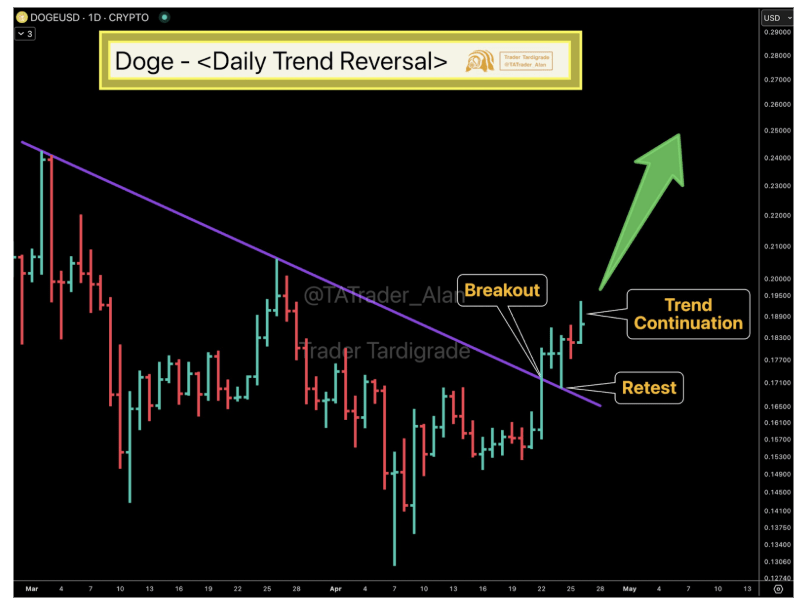

Dogecoin’s price is entering a new bullish phase after months of decline. Technical analysis of the daily candlestick timeframe chart shows that the popular meme cryptocurrency is flashing a trend reversal, hinting at a significant shift from bearish to bullish momentum.

Analyst Flags Daily Trend Reversal On Dogecoin Chart

A prominent crypto analyst known as Trader Tardigrade has highlighted a confirmed trend reversal for Dogecoin. In a post on X (formerly Twitter) this week, he pointed out that DOGE’s daily chart has flipped from a downtrend to an uptrend. This claim is reinforced by a technical analysis of Dogecoin’s price action.

Related Reading

Dogecoin’s price recently broke above a descending trendline that had defined its downtrend for several weeks. This breakout occurred on April 22, when Dogecoin closed above $0.165 on the daily candlestick timeframe. This breakout was the first step indicating the coin was escaping its bearish trajectory.

Shortly after breaching the downward sloping resistance line, Dogecoin’s price pulled back between April 23 and April 24 to retest the same trendline, but this time from above. Importantly, the former resistance trendline held strong as a new support level during the retest. Following that successful test, Dogecoin resumed its upward climb, marking the continuation of the new uptrend.

This pattern of breakout, retest, continuation is a classic technical confirmation of a trend reversal. The successful retest of this trendline gives more confidence that the bullish shift is real and not a false signal.

Image From X: Trader Tardigrade

Bullish Target: $0.25 By Early May

With the daily trend now pointing upward, the focus is now on how far this new uptrend could carry Dogecoin. According to Trader Tardigrade’s analysis, Dogecoin could continue climbing in the coming days, potentially crossing the quarter-dollar mark very soon. As indicated on the chart he shared by Trader Tardigrade, the next Dogecoin price target is around $0.25 by the first week of May.

If achieved, a rise to $0.25 would be a significant milestone, considering Dogecoin has been stuck in a downtrend for over 10 weeks. As such, a break to $0.25 would mark Dogecoin’s highest price since late February and a robust recovery from its recent lows around the $0.14 to $0.15 range. Such a move would also represent roughly a 51% gain from the breakout level of $0.165.

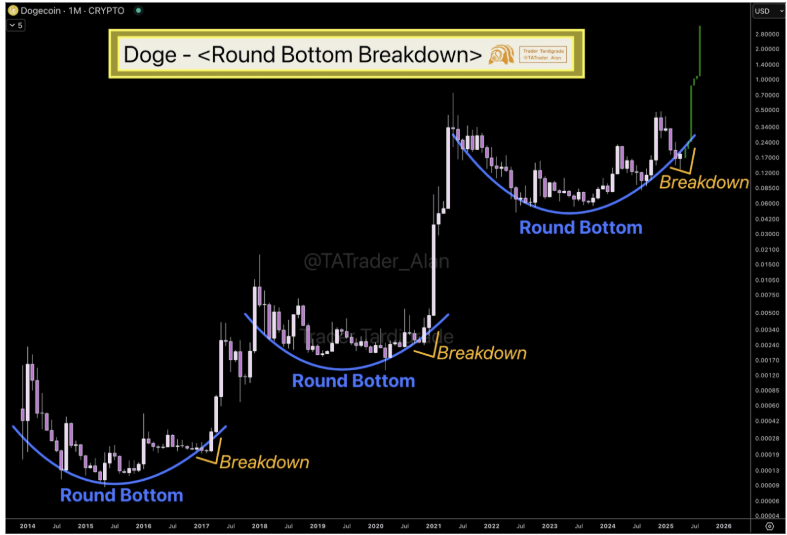

However, $0.25 is only the target in the short term. In a separate analysis, Trader Tardigrade pointed to Dogecoin’s long-term chart, highlighting a round bottom formation. The accompanying chart shows that in previous cycles, Dogecoin’s price formed a rounded bottom before entering explosive upward trends. This repeated pattern, now visible again on the monthly timeframe, signals that Dogecoin may be on the verge of another significant breakout. The long-term price target in this case is $2.8.

Image From X: Trader Tardigrade

Related Reading

At the time of writing, Dogecoin is trading at $0.18.

Featured image from Unsplash, chart from TradingView

Source link

Altcoin

TAO price action shifts hints at 200% rally potential, but one key confirmation remains

Published

2 days agoon

April 25, 2025By

admin

TAO has recently shown signs of breaking free from its extended bearish market structure with a decisive impulse move. While this shift is promising, if a higher low is established at a key confluence zone, TAO could be setting up for a potential 200% rally toward the previous range high.

Over the past several weeks, Bittensor (TAO) has been locked in a steady downtrend, consistently printing lower highs and lower lows. That pattern may now be changing. The recent impulsive move broke above a significant lower high, marking the first real break in TAO’s bearish structure. Now, price is hovering around a high-probability zone for continuation—provided buyers can confirm a valid higher low.

Key technical points

- TAO Breaks Bearish Market Structure: TAO has broken the most recent lower high, signaling a potential shift in trend for the first time since the range high.

- Testing the 0.618 Fibonacci and VWAP: Price is now testing the golden Fibonacci level, which aligns with the VWAP drawn from the top of the current downtrend, forming a crucial area of technical confluence.

- Point of Control (POC) as a Pivot Zone: If TAO confirms a higher low at this zone, where POC, VWAP, and 0.618 Fib all intersect, it increases the probability of a strong bullish impulse.

From a technical perspective, this current zone of interaction is highly significant for TAO. The confluence of key indicators, specifically the point of control, 0.618 Fibonacci level, and anchored VWAP, creates a strong area of interest. If buyers defend this level and TAO forms a higher low, the setup for a Wave 3 bullish impulse becomes far more likely. This would target the previous range high, equating to a projected 200% rally from the current zone.

Zooming out to the macro structure, TAO remains inside a large sideways range. The recent bounce from the range low shows clear signs of buyer activity, indicating demand at lower levels.

Should TAO begin consolidating above this confluence zone, form a bullish market structure, and show strong volume profile support, the odds of a full range rotation increase sharply.

What to expect in the coming price action

TAO is at a critical inflection point. If the higher low confirms at this confluence zone, the bullish case strengthens dramatically. A successful retest could spark a powerful continuation move, offering one of the clearest 200% setups in the current market structure.

Source link

Altcoin

Cointelegraph Bitcoin & Ethereum Blockchain News

Published

7 days agoon

April 21, 2025By

admin

Crypto, stocks and bonds: Are they the same?

When you dive into investing, you’ll find three frequently utilized investment options: Crypto is the risky thrill-seeker’s choice, stocks offer a middle ground with growth potential, and bonds are for those who prefer a steadier, more predictable path.

While both stocks and crypto offer growth potential, regulation makes stock market investments more structured and predictable, and crypto aims for decentralization and remains less regulated.

Crypto

Cryptocurrency is a digital currency built on blockchain technology, a decentralized, transparent and secure system that records all transactions. No entity, such as a bank, directly controls it. Crypto is known for massive swings — big gains (and losses) can happen fast, making it exciting for those who want to play the high-risk game.

Although cryptocurrency has been available for a while, its adoption has surged in recent years, gaining traction among retail investors, institutions and even some governments. Cryptocurrency is not universally regulated and can be accessed through various channels, including crypto exchanges, brokers, ATMs and fintech apps.

Stocks

Stocks represent ownership in a company — when you buy a stock, you’re purchasing a share of that business. If the company performs well and earns profits, shareholders may benefit through dividends and capital gains. On the flip side, poor performance or negative market sentiment can lead to losses.

Stocks are typically regulated by government agencies, such as the US Securities and Exchange Commission, making them generally less risky than cryptocurrencies. However, they are still influenced by factors such as company performance, market conditions, economic trends and global events — making them potentially volatile.

You can purchase stocks through traditional stock exchanges (like the NYSE or Nasdaq) or online brokerage platforms.

Bonds

Bonds are essentially loans that investors give to governments or companies. In exchange, the issuer pays regular interest over a set period and returns the full loan amount — known as the principal — when the bond reaches its maturity date, which can range from a few months to 30 years.

Bonds are often considered less volatile than stocks, making them a popular choice for conservative investors. However, they are not without risks. Rising interest rates can lower a bond’s market value, inflation can erode purchasing power, and corporate bonds carry the risk of default if the issuer experiences financial trouble.

The trade-off for this relative stability is usually lower returns, which may not appeal to those seeking high-growth investments. Bonds are regulated financial instruments and can typically be purchased through brokers or directly from government agencies.

Is crypto more profitable compared to stocks and bonds?

While crypto can offer diversification benefits, its relationship with traditional assets is complex and evolving.

For instance, in 2024, Bitcoin (BTC), the most popular cryptocurrency, demonstrated remarkable profitability, achieving a 121% return and outperforming traditional assets like the Nasdaq 100, which gained 25.6%, and the S&P 500, which rose by 25%. Gold also saw a significant increase of 26.7%, while US large-cap stocks experienced a 24.9% gain.

Bonds, on the other hand, offered a more modest return: The 10-year US Treasury bond, known for its fixed interest payments, ended the year with a yield of approximately 4.57%.

Historically, Bitcoin has exhibited a low correlation with the S&P 500, averaging 0.17 over the past decade. However, this correlation has fluctuated, reaching as high as 0.75 before declining toward zero in early 2025, indicating periods of both alignment and independence from traditional markets.

Tariff fallout: Which is more profitable now — Crypto, stocks or bonds?

The tariffs introduced by US President Donald Trump on April 2, 2025, have had an unprecedented impact on both traditional and crypto markets. But the effects have followed the above pattern consistently — stocks experienced a sharp price reduction.

According to the Guardian, the Nasdaq Composite entered a bear market by the close of trading on April 3, falling more than 20% below its most recent peak on Dec. 16, 2024. In the meantime, European indexes such as the FTSE 100 fell over 11%, and the S&P 500 dropped at least 12% since the introduction of tariffs.

Crypto had an even stronger downturn, which was once seen as a hedge against market volatility but has not been immune. Bitcoin’s price dropped by over 6% and Ether’s (ETH) by more than 12% within 24 hours of the tariff announcement, as global markets reacted with fear. The unpredictability of tariff policies contributes to market jitters, affecting all asset classes, from stocks to bonds and crypto, in unique ways.

Bonds have experienced only a small return rate increase, given that a higher return means a lower price for a bond. According to CNBC, in response to President Trump’s tariff announcements, global bond yields sharply dropped as investors sought safe havens amid stock market turmoil. For example, Germany’s 10-year bond yield fell from 2.72% to below 2.6%, and US Treasury yields also hit their lowest levels in months, signaling heightened demand for government debt, though economists warn this rally may not be sustainable if inflation concerns persist.

Trading and investing in crypto, stocks and bonds: What sets them apart?

All asset classes — crypto vs. traditional investments — involve identifying patterns, but the timeframes, dynamics and tactics differ significantly.

Crypto and stock trading share similar patterns, like sensitivity to macroeconomic trends and

technical patterns, but their market structures contrast sharply. Stock markets operate within set hours, such as the NYSE’s hours of 9:30 am–4:30 pm ET, while crypto markets run 24/7. Bonds are typically traded during regular market hours, similar to stocks, but the exact trading hours can depend on the type of bond, such as Treasurys or corporate issues.

Crypto trading involves pairs using common tokens like Bitcoin or Ether as base currencies, while stocks are typically bought with fiat, and bonds are traded in fixed denominations, often with a minimum investment threshold. Liquidity issues can affect all three: Crypto can face challenges with small-cap tokens, stocks with micro-cap companies and bonds with less-traded long-term or corporate issues.

Timeframes for market patterns highlight further distinctions. Crypto market patterns thrive on short-term volatility, demanding rapid decisions and frequent trades, while stock patterns often track longer-term trends tied to company performance and broader economic cycles. Bonds move the slowest, with price shifts driven primarily by interest rates, and offer stable, predictable patterns.

Price drivers also set them apart. Crypto values hinge on market trends, adoption and utility; stocks rely on company fundamentals, research and earnings; and bonds depend on interest rate movements and issuer creditworthiness, prioritizing stability over growth.

Entry barrier to crypto, stocks and bonds

Stock issuance is governed by company laws, blockchain protocols with hard caps control crypto supply, and bonds are issued based on creditworthiness.

To invest in stocks and bonds, you generally need to be at least 18 years old and have a brokerage account to invest in the stock and bond markets. Some stocks may require a higher income or level of experience, while most stocks only allow accredited or wealthy investors to participate.

Buying stocks and bonds means going through regulated brokers and exchanges. Crypto, on the other hand, lets you jump in with just a wallet — no intermediary, no paperwork. Centralized crypto exchanges require Know Your Customer (KYC) verification, but decentralized platforms let you trade freely with only your private keys.

Did you know? Stocks represent company equity with dividends; crypto represents digital assets with varying uses; and bonds are loans offering fixed-interest payments.

Regulatory differences between crypto, stocks and bonds

While stocks and bonds follow strict rules, crypto is still figuring things out, making buying, selling, holding and taxes a whole different experience.

In most countries, investing in stocks and bonds is legal and regulated. Still, some governments, like North Korea and Cuba, impose strict restrictions or outright bans on private investment in these assets. Crypto faces a patchwork of regulations worldwide, ranging from full bans in countries like China and Egypt to partial restrictions in places like India, where regulations limit banking support but don’t outlaw trading. Meanwhile, crypto-friendly nations like El Salvador embrace digital assets with clear legal frameworks and government support.

Holding stocks and bonds is straightforward. The shares sit safely with a brokerage, and bonds pay you interest at fixed intervals. Holding crypto, however, comes with risks. You can self-custody in a wallet, but if you lose your private keys, your funds are gone forever. If you keep crypto on an exchange, there’s always a risk of hacks or platform failures.

Taxes add another layer of complexity. Stocks and bonds typically fall under capital gains and dividend tax rules, with clear guidelines based on how long you’ve held them. Crypto tax laws vary widely by country. Some countries treat it like property, others like a commodity, and a few don’t tax it at all. Keeping track of every transaction is crucial, as even swapping one crypto for another can be taxable.

Crypto vs. stocks vs. bonds: Which one should you buy in 2025?

Choosing between crypto, stocks and bonds in 2025 depends on your personality, risk appetite and financial goals.

If you love the adrenaline and believe in the future of decentralized finance (DeFi), then a crypto-focused portfolio might be for you. For example, a high-risk, high-reward portfolio could be 70% crypto, 20% stocks and 10% bonds.

If you prefer a more structured approach but still want growth, stocks balance risk and return. A portfolio, for instance, with 60% stocks, 30% crypto and 10% bonds could give exposure to innovation while keeping things grounded.

For those who sleep better knowing their money is safe, bonds provide stability. For example, a conservative mix could contain 70% bonds, 20% stocks and just 10% crypto, ensuring steady returns with a taste of market excitement.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Source link

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Ethereum community members propose new fee structure for the app layer

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje